Professional Documents

Culture Documents

Anant Raj V Yes Bank

Anant Raj V Yes Bank

Uploaded by

Rishi SehgalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Anant Raj V Yes Bank

Anant Raj V Yes Bank

Uploaded by

Rishi SehgalCopyright:

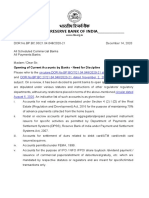

Available Formats

* IN THE HIGH COURT OF DELHI AT NEW DELHI

+ W.P.(C) URGENT 5/2020

ANANT RAJ LIMITED ….. Petitioner

Through: Mr. Saket Sikri, Mr. Nikhil Singhvi,

Mr. Mahesh Bansal and Mr. Dhruv

Khanna, Advocates.

versus

YES BANK LIMITED …..Respondent

Through: Mr.Ashwini Chawla, Advocate with

Mr. Navin Trivedi, Manager-Legal,

Yes Bank Ltd.

CORAM:

HON'BLE MR. JUSTICE SANJEEV SACHDEVA

ORDER

% 06.04.2020

1. The hearing was conducted through video conferencing.

2. Petitioner seeks a direction to respondent no. 1 – Yes Bank not

to take coercive/adverse steps as proposed in its e-mail dated

25.03.2020 and 27.03.2020 including but not limited to declaring the

account of the petitioner as a Non-PerformingAsset (NPA).

3. As per the petitioner, during the period 2010 – 2015, petitioner

had availed bank loan facility from the respondent bank to a tune of

Rs. 815 crores which has been paid in full. Thereafter between 2016 –

2018, respondent bank extended further loan facilities to the petitioner

vide several sanction letters.

W.P.(C) Urgent 5/2020 1

4. As per the petitioner, it had availed loan facilities to the tune of

Rs. 1570 crores out of which, petitioner has repaid about Rs. 1056

crores apart from interest running into hundreds of crores.

5. The case of the petitioner is that due to out-break of COVID-19

and spread of the same across the globe in December, 2019, economic

condition of the real estates industry was adversely affected. Petitioner

had been regularly servicing the loans in terms of the loan conditions

till 31.12.2019. It is stated that the instalment for repayment which

fell due on 01.01.2020, which is the subject matter of the present

petition, could not be paid by the petitioner because of adverse

economic conditions brought about by the effects of COVID-19

pandemic.

6. As per the respondent, in terms of the Income Recognition and

Asset Classification Guidelines (IRAC Guidelines) of the Reserve

Bank of India, if an instalment is overdue by a period of 30 days, the

borrower’s account is classified as Special Mention Account – 1

(SMA-1) and if the instalment is overdue by 60 days, the account is

classified as Special Mention Account – 2(SMA-2) and if the

instalment is overdue by a period of 90 days, the account is classified

as Non-performing Asset (NPA).

7. As per the respondent, since the instalment that was due on

01.01.2020 was not paid within 30 days, the account of the petitioner

W.P.(C) Urgent 5/2020 2

was classified as SMA-1 and thereafter since it was not paid within 60

days, the account was classified as SMA-2.

8. Further it is contended on behalf of the respondent that since

the instalment was not paid till 31.03.2020, the account of the

petitioner was liable to be classified as NPA.

9. It is submitted by learned counsel for the respondent that in

terms of the IRAC Guidelines, particularly paragraph 4.2.2banks have

to be put into place an automated system whereby the accounts are

classified automatically by the system in the event of default as

noticed hereinabove.

10. Learned counsel for the petitioner contends that in view of the

pandemic COVID-19, RBI has issued several guidelines and

advisories and brought into place regulatory polices to give benefit to

the borrowers to easethe financial crisis.

11. Learned counsel for the petitioner relies on the Statement of

Development Regulatory Policy dated 27.03.2020 wherein the object

of the said policy issued by the RBI stated is to inter-alia ease the

financial stress caused by COVID-19 disruptions by relaxing

repayment pressures and improving access to working capital and

further improving the functioning of markets in view of the high

volatility experienced with the onset and spread of the pandemic.

W.P.(C) Urgent 5/2020 3

12. Further reference is drawn to clause 5 of the Statement which

talks of moratorium on term of loan. Clause 5 reads as under:-

“5. Moratorium on term Loans

All commercial banks (including regional rural banks,

small finance banks and local area banks), co-operative

banks, all-India Financial Institutions, and NBFCs

including housing finance companies and micro-finance

institutions) („lending institutions‟) are being permitted

to allow moratorium of three months on payment of

instalments in respect of all term loans outstanding as on

March 1, 2020. Accordingly, the repayment schedule and

all subsequent due dates, as 1 also the tenure for such

loans, may be shifted across the board by three months.”

13. Learned counsel for the petitioner further submits that the

COVID -19 Regulatory Package issued by Reserve Bank of India on

27.03.2020,on account of COVID -19 Pandemic, provides for re-

scheduling of the payments – term loans and working capital facilities

and clause 2 thereof reads as under:-

“In respect of all term loans (including agricultural term

loans, retail and crop loans), all commercial banks

(including regional rural banks, small finance banks and

local area banks), co-operative banks, all-India

Financial Institutions, and NBFCs (including housing

finance companies) („lending institutions‟) are permitted

to grant a moratorium of three months on payment of all

instalments1 falling due between March 1, 2020 and May

31, 2020. The repayment schedule for such loans as also

the residual tenor, will be shifted across the board by

three months after the moratorium period. Interest shall

W.P.(C) Urgent 5/2020 4

continue to accrue on the outstanding portion of the term

loans during the moratorium period.”

14. Footnote 1 to the said clause provides that “Instalments will

include the following payments falling due from March 1, 2020 to

May 31, 2020: (i) principal and/or interest components; (ii) bullet

repayments; (iii) Equated Monthly instalments; (iv) credit card dues.”

15. The package also deals with the classification as Special

Mention Account and Non-performing Asset pursuant to the

economic fallout from COVID-19 and stipulates as under:-

“Classification as Special Mention Account (SMA)

and Non-Performing Asset(NPA)

5. Since the moratorium/deferment/recalculation of

the „drawing power‟ is beingprovided specifically to

enable the borrowers to tide over economic fallout from

COVID-19, the same will not be treated as concessionor

change in terms and conditions of loan agreements due

to financial difficultyof the borrower under paragraph 2

of the Annex to the Reserve Bank of India (Prudential

Framework for Resolution of Stressed Assets) Directions,

2019 dated,June 7, 2019 ("Prudential Framework").

Consequently, such a measure, by itself, shall not result

in asset classification downgrade.

6. The asset classification of term loans which are

granted relief as per paragraph 2 shall be determined on

the basis of revised due datesand the revised repayment

schedule. Similarly; working capital facilities where

relief it., provided as per paragraph 3 above, the SMA

and the out of order status shall be evaluated considering

the application of accumulated interest immediately after

the completion of the deferment period as well as the

W.P.(C) Urgent 5/2020 5

revised terms, as permitted in terms of paragraph 4

above.

7. The rescheduling of payments, including interest,

will not qualify as a default for the purposes of

supervisory reporting and reporting to Credit

Information Companies(CICs) by the lending institutions.

CICs shall ensure that the actions taken by lending

institutions pursuant to the above announcements do not

adversely impact the credit history of the beneficiaries.”

16. Learned counsel for the petitioner has also relied on Frequently

Asked Questions (FAQs) issued by the Ministry of Finance and

uploaded by Press Information Bureau particularly to Question No. 8.

Question – 8 reads as under:-

“QUESTION 8: What will be the impact of this relief by

RBI on borrowers as far as reporting of default is

concerned?

ANSWER: Any delay in payment leads to default and gets

reported to Credit Bureaus. For business loans of Rs. 5

Crores and above, the banks report the overdue position

to RBI also through CRILC. As a result of this relief

package, the overdue payments post 1stMarch 2020 will

not be reported to Credit Bureaus/CRILC for three

months. No penal interest or charges will be payable to

the banks. Similarly, SEBI has allowed that Credit Rating

Agencies (CRAs) may not consider the delay as default

by listed companies if the same is owing to lockdown

conditions arising due to COVID-19.”

17. Learned counsel for the respondent contends that RBI

guidelines and package are not applicable to the case of the petitioner,

W.P.(C) Urgent 5/2020 6

in as much as, the petitioner was already in default as on 01.03.2020

and the package is applicable only to those instalments which fall due

on 01.03.2020 and also only to those borrowers who were properly

servicing their account till 01.02.2020 and were not in default.

18. Reference is made by the learned counsel for the respondent to

a clarification issued by letter dated 31.03.2020 by the Chief General

Manager –in – charge Department of Regulation of the Reserve Bank

of India to the Chairman, Indian Banks Association, wherein it is

stated that if a borrower has been in default even before March 1,

2020, such default cannot be said to be as a result of economic fall

due pandemic and benefit of moratorium can be extended to such

borrower in respect of payment falling due during the period March 1,

2020 to May 31, 2020. However, payments overdue on or before

February 29, 2020 will attract current IRAC norms.

19. It is an admitted position of the Respondent that the Statement

on Development and Regulatory Policies issued by RBI on 27th

March, 2020 along with Regulatory Package issued on March 27,

2020 is applicable to the Respondent.

20. Reading of the Statement on Development and Regulatory

Policies issued by RBI on 27th March, 2020 along with Regulatory

Package issued on March 27, 2020 prima facie shows that the

intention of the RBI is to maintain status quo as on 01.03.2020 with

W.P.(C) Urgent 5/2020 7

regard to the all the instalments payment for which had to be made

post 01.03.2020 till 31.05.2020.

21. Paragraph 5 to 7 of the Regulatory Package with regard to

Classification of Accounts also indicates that the intention of RBI is to

maintain status quo with regard to the classification of accounts of the

borrowers as they existed as on 01.03.2020.

22. As per the contention of the learned counsel for the respondent,

prior to declaration of an account as NPA, the account has to go

through the process of declaration as SMA-1 and SMA-2.

23. If a borrower was duly servicing the account until 01.03.2020

and no instalment was overdue, the borrower’s account would have

been classified as a Standard Asset, i.e., there being no default, which

means that the account would not be classified as a SMA – 1 or SMA

– 2.

24. If an account is a standard account and not classified as SMA –

1- or SMA – 2, it would have to go through the process of SMA-1 and

SMA-2 prior to being declared as a non-performing asset.

25. If the Regulatory Package is applicable only to Standard Asset

accounts, there was no necessity for the RBI to refer to Classification

of an account as a Non-PerformingAsset (NPA) in its Regulatory

Package and RBI could have only referred to the change of

classification as a SMA.

W.P.(C) Urgent 5/2020 8

26. If the interpretation given by learned counsel for the respondent

were to be accepted, then an account which was classified as a

Standard Asset as on 29.02.2020, cannot become an NPApost

01.03.2020unless it goes through the process of SMA. Since the

account cannot be classified as SMA for instalments falling due post

01.03.2020, where was the question of stipulating a moratorium for

classification as a Non-Performing Asset (NPA).

27. The restriction on change in classification as mentioned in the

Regulatory Package shows that RBI has stipulated that the account

which has been classified as SMA-2 cannot further be classifiedas a

non-performing asset in case the instalment is not paid during the

moratorium period i.e. between 01.03.2020 and 31.05.2020 and status

quo qua the classification as SMA-2 shall have to be maintained.

28. The effect of the same would be that for a period of three

months there will be a moratorium from payment of that instalment.

However, stipulated interest and penal charges shall continue to

accrue on the outstanding payment even during the moratorium

period. If post the moratorium period borrower fails to pay the said

instalment, classification would then automatically change as per the

IRAC guidelines.

29. Prima facie, I am of the view that the classification of the

account of the petitioner as an NPA on 31.03.2020could not have

been done by the respondent. Accordingly, status quo ante is restored

W.P.(C) Urgent 5/2020 9

qua the classification of the account of petitioner and the account

classification as it stood on 01.03.2020 shall stand restored.

30. Mr. Saket Sikri, learned counsel appearing for petitioner under

instructions submits that petitioner without prejudice to its rights and

contentions shall make necessary arrangements and shall pay on or

before 25.04.2020, the instalment which fell due as on 01.01.2020

along with interest accrued thereon till the date of the payment

irrespective of the lockdown position.

31. The statement is taken on record. Petitioner shall pay on or

before 25.04.2020, the instalment which fell due as on 01.01.2020

along with interest accrued thereon till the date of the payment

irrespective of the lockdown position.

32. It is clarified that the payment would be without prejudice to

the rights and contentions of the parties.

33. List before the concerned Roster Bench on 04.05.2020.

34. The order be uploaded on the website forthwith.

35. Copy of the order be also forwarded to the counsels through

email.

SANJEEV SACHDEVA, J

APRIL 06, 2020/‘rs’

W.P.(C) Urgent 5/2020 10

You might also like

- Bajaj Finance Limited: Moratorium PolicyDocument5 pagesBajaj Finance Limited: Moratorium PolicyhariveerNo ratings yet

- The German Legal SystemDocument606 pagesThe German Legal SystemRishi Sehgal100% (2)

- BSBWRK510 Manage Employee RelationsDocument18 pagesBSBWRK510 Manage Employee RelationsKim Papa0% (1)

- Tvs Credit Policy On Emi MoratoriumDocument4 pagesTvs Credit Policy On Emi MoratoriumKumarNo ratings yet

- Lendingkart - Policy On EMI MoratoriumDocument4 pagesLendingkart - Policy On EMI MoratoriumShelly CouhanNo ratings yet

- COVID19 RegulatorypackageDocument4 pagesCOVID19 Regulatorypackagevikas bhanvraNo ratings yet

- Faqs On Covid-19 - Regulatory Package: 1. What Are The Relief Measures Provided in The Given Package?Document5 pagesFaqs On Covid-19 - Regulatory Package: 1. What Are The Relief Measures Provided in The Given Package?vikas bhanvraNo ratings yet

- Banks Policy On Covid Related Reschedulement of Dues PDFDocument6 pagesBanks Policy On Covid Related Reschedulement of Dues PDFYuva KonapalliNo ratings yet

- COVID19 RegulatorypackageDocument5 pagesCOVID19 RegulatorypackagedebasishNo ratings yet

- SUBJECT: Regulatory Measures and Reliefs Announced by RBI in View of Covid 19 - Bank's Policy For Implementation.-V 2.0Document7 pagesSUBJECT: Regulatory Measures and Reliefs Announced by RBI in View of Covid 19 - Bank's Policy For Implementation.-V 2.0Rishabh VachharNo ratings yet

- GIST OF CIRCULARS UPLDocument2 pagesGIST OF CIRCULARS UPLGagan Deep JangraNo ratings yet

- SBI EMI Moratorium FAQsDocument4 pagesSBI EMI Moratorium FAQsCNBCTV18 DigitalNo ratings yet

- Hướng Dẫn Giải Pháp Hỗ Trợ Khách Hàng Bị Ảnh Hưởng Bởi COVID 19 - VDocument27 pagesHướng Dẫn Giải Pháp Hỗ Trợ Khách Hàng Bị Ảnh Hưởng Bởi COVID 19 - VThoaNo ratings yet

- BSD Frequently Asked Questions No 2 of 2020 eDocument17 pagesBSD Frequently Asked Questions No 2 of 2020 eAda DeranaNo ratings yet

- Rbi MoratoriumDocument6 pagesRbi Moratoriumunwantedaccountno1No ratings yet

- Fa Q Son RestructuringDocument4 pagesFa Q Son RestructuringSoma ShekharNo ratings yet

- English Moratorium PolicyDocument3 pagesEnglish Moratorium PolicySanket SinghNo ratings yet

- Brief of The Case:: Writ Petition (C) No. 476 of 2020Document2 pagesBrief of The Case:: Writ Petition (C) No. 476 of 2020Sunita ParuiNo ratings yet

- Bayanihan To Recover As One ActDocument5 pagesBayanihan To Recover As One Acttravel cabanatuanNo ratings yet

- Frequently Asked QuestionsDocument5 pagesFrequently Asked QuestionskgvnktshNo ratings yet

- Addendum To Bank Audit Guidance NoteDocument6 pagesAddendum To Bank Audit Guidance Notebrat6No ratings yet

- Loan Information Sheet Mutual Aid QuickDocument4 pagesLoan Information Sheet Mutual Aid Quickdesmarais jean francoisNo ratings yet

- Bank - of - India - Vs - VVF - India - Limited - Defective FilingDocument25 pagesBank - of - India - Vs - VVF - India - Limited - Defective FilingAastha SinghNo ratings yet

- Frequently Asked Questions (Faqs)Document10 pagesFrequently Asked Questions (Faqs)chrstlllaoNo ratings yet

- Moratorium Clix Capital Services Pvt. Ltd.Document7 pagesMoratorium Clix Capital Services Pvt. Ltd.YogeshNo ratings yet

- ICICI Bank Moratorium FAQsDocument8 pagesICICI Bank Moratorium FAQsCNBCTV18 DigitalNo ratings yet

- AnnexureIIIDocument4 pagesAnnexureIIIKenedy KhumukchamNo ratings yet

- State Bank of India VS NAVJEEVAN TYRES PVT LTD NCLT MUMBAIDocument11 pagesState Bank of India VS NAVJEEVAN TYRES PVT LTD NCLT MUMBAISachika VijNo ratings yet

- 20200407-MC-015-2020 - GSIS Loan - MoratoriumDocument3 pages20200407-MC-015-2020 - GSIS Loan - MoratoriumPamNo ratings yet

- COVID-19 - Regulatory PackageDocument3 pagesCOVID-19 - Regulatory PackageUpananda PurohitNo ratings yet

- CURRENT Account Rbi RegulationsDocument3 pagesCURRENT Account Rbi RegulationsAneesNo ratings yet

- FAQs PDFDocument9 pagesFAQs PDFHumera FaizanNo ratings yet

- भारतीय �रजव� ब�क - - - - - - - - - - - - - - - - RESERVE BANK OF INDIA - - - - - - - - - - - - - - - -Document6 pagesभारतीय �रजव� ब�क - - - - - - - - - - - - - - - - RESERVE BANK OF INDIA - - - - - - - - - - - - - - - -praveen chokhaniNo ratings yet

- भारतीय �रजव� ब�क - - - - - - - - - - - - - - - - RESERVE BANK OF INDIA - - - - - - - - - - - - - - - -Document6 pagesभारतीय �रजव� ब�क - - - - - - - - - - - - - - - - RESERVE BANK OF INDIA - - - - - - - - - - - - - - - -praveen chokhaniNo ratings yet

- भारतीय �रजव� ब�क - - - - - - - - - - - - - - - - RESERVE BANK OF INDIA - - - - - - - - - - - - - - - -Document6 pagesभारतीय �रजव� ब�क - - - - - - - - - - - - - - - - RESERVE BANK OF INDIA - - - - - - - - - - - - - - - -praveen chokhaniNo ratings yet

- MQL Info SheetDocument3 pagesMQL Info Sheetdesmarais jean francoisNo ratings yet

- The Great Lockdown - Standstill On Asset Classification - Vinod Kothari ConsultantsDocument5 pagesThe Great Lockdown - Standstill On Asset Classification - Vinod Kothari ConsultantsVbs ReddyNo ratings yet

- RBI Circulars On COVIDDocument10 pagesRBI Circulars On COVIDASHWINNo ratings yet

- Banking OmbudsmanDocument5 pagesBanking OmbudsmanUdit ThakranNo ratings yet

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingDocument16 pagesU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseNo ratings yet

- Opt in TNC 310520 PDFDocument3 pagesOpt in TNC 310520 PDFvinayNo ratings yet

- Loan PolicyDocument5 pagesLoan PolicySoumya BanerjeeNo ratings yet

- Bajaj Moratorium Policy v1Document5 pagesBajaj Moratorium Policy v1Vilas_123No ratings yet

- 770 PDFDocument2 pages770 PDFanshulaNo ratings yet

- Tri LegalDocument4 pagesTri LegalShreyashkarNo ratings yet

- Sanction Letter INST5187568192559754 914871556872853Document10 pagesSanction Letter INST5187568192559754 914871556872853ManiNo ratings yet

- Policy For Lending To Micro and Small EnterprisesDocument8 pagesPolicy For Lending To Micro and Small Enterprisespatruni sureshkumarNo ratings yet

- One Time Restructuring Circular - RBI - 6th Aug'20Document16 pagesOne Time Restructuring Circular - RBI - 6th Aug'20Mr. UnknownNo ratings yet

- Memory Based Questions On Loans and AdvancesDocument4 pagesMemory Based Questions On Loans and AdvancesRadha KrishnaNo ratings yet

- Reserve Bank of IndiaDocument8 pagesReserve Bank of IndiaVasu Ram JayanthNo ratings yet

- COVID-19 - Withdrawal of Deferment Facility Provided On Payment of Loan Instalments / Interest On Working Capital Facility (Ies)Document2 pagesCOVID-19 - Withdrawal of Deferment Facility Provided On Payment of Loan Instalments / Interest On Working Capital Facility (Ies)Nagarjuna KandukuriNo ratings yet

- Key Highlights of 7 Bi-Monthly Monetary Policy 2019-20: IIBF Vision April 2020Document9 pagesKey Highlights of 7 Bi-Monthly Monetary Policy 2019-20: IIBF Vision April 2020go4ibibo 15No ratings yet

- Sanction Letter FAST8661165681156219 356627714819686Document8 pagesSanction Letter FAST8661165681156219 356627714819686Kuldip MajethiyaNo ratings yet

- Himalayan Reply CONTINUING (1) - 1Document13 pagesHimalayan Reply CONTINUING (1) - 1Gaurav KumarNo ratings yet

- Notice For Credit Card Holders On RBI's COVID-19 Relief: Page 1 of 4Document4 pagesNotice For Credit Card Holders On RBI's COVID-19 Relief: Page 1 of 4cr4satyajitNo ratings yet

- Volume XIV Issue 7 January 31, 2019: Banking RegulationDocument4 pagesVolume XIV Issue 7 January 31, 2019: Banking Regulationmy lifeNo ratings yet

- Study Material Officers 2016 PDFDocument135 pagesStudy Material Officers 2016 PDFSreedhar SrdNo ratings yet

- 14th KIMCC Brochure 2022Document21 pages14th KIMCC Brochure 2022Srinibash DashNo ratings yet

- Resolution Framework MsmeDocument81 pagesResolution Framework Msmesonyraj99No ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Agenda 21 For Sustainable Construction in Developing Countries - The Indian CaseDocument26 pagesAgenda 21 For Sustainable Construction in Developing Countries - The Indian CaseRishi SehgalNo ratings yet

- Sustainable Development Through The Roof - The CSR JournalDocument2 pagesSustainable Development Through The Roof - The CSR JournalRishi SehgalNo ratings yet

- Amended SCRADocument51 pagesAmended SCRARishi SehgalNo ratings yet

- Chatterjee-Mitra2017 Article CSRShouldContributeToTheNationDocument11 pagesChatterjee-Mitra2017 Article CSRShouldContributeToTheNationRishi SehgalNo ratings yet

- CSR in Singapore: What Is Corporate Social Responsibility (CSR) ?Document5 pagesCSR in Singapore: What Is Corporate Social Responsibility (CSR) ?Rishi SehgalNo ratings yet

- 13.isca Irjevs 2015 214Document9 pages13.isca Irjevs 2015 214Rishi SehgalNo ratings yet

- Rural Fairprice V IDBIDocument5 pagesRural Fairprice V IDBIRishi SehgalNo ratings yet

- Women & Law SynopsisDocument4 pagesWomen & Law SynopsisRishi SehgalNo ratings yet

- Forever Living ContractDocument2 pagesForever Living ContractRishi SehgalNo ratings yet

- Discussion Paper On Standard Essential Patent (SEPs)Document28 pagesDiscussion Paper On Standard Essential Patent (SEPs)Rishi SehgalNo ratings yet

- Vikram BakshiDocument134 pagesVikram BakshiRishi SehgalNo ratings yet

- The Battle of Forms - IndiaCorpLaw PDFDocument9 pagesThe Battle of Forms - IndiaCorpLaw PDFRishi SehgalNo ratings yet

- Law CommissionDocument240 pagesLaw CommissionRishi SehgalNo ratings yet

- Good Evening Ladies and GentlemenDocument1 pageGood Evening Ladies and GentlemenRishi SehgalNo ratings yet

- Battle of FormsDocument4 pagesBattle of FormsRishi SehgalNo ratings yet

- Two-Tier Arbitration in India: Supreme Court in Centrotrade V Hindustan Copper Ltd.Document14 pagesTwo-Tier Arbitration in India: Supreme Court in Centrotrade V Hindustan Copper Ltd.Rishi SehgalNo ratings yet

- Drafting, Pleading & Conveyance Project: D - R M L N L U - L, U PDocument25 pagesDrafting, Pleading & Conveyance Project: D - R M L N L U - L, U PRishi SehgalNo ratings yet

- Incoterms® Rules 2010 - ICC - International Chamber of CommerceDocument3 pagesIncoterms® Rules 2010 - ICC - International Chamber of CommerceRishi SehgalNo ratings yet

- Banking & Insurance Law Synopsis: D - R M L N L U - L, U PDocument4 pagesBanking & Insurance Law Synopsis: D - R M L N L U - L, U PRishi SehgalNo ratings yet

- Cyber Law Project: D - R M L N L U - L, U PDocument21 pagesCyber Law Project: D - R M L N L U - L, U PRishi SehgalNo ratings yet

- Special ContracrtDocument9 pagesSpecial ContracrtRishi SehgalNo ratings yet

- Dr. Ram Manohar Lohiya National Law University: Is Us Abandoning Rules Based Multilateral International Trading SystemDocument3 pagesDr. Ram Manohar Lohiya National Law University: Is Us Abandoning Rules Based Multilateral International Trading SystemRishi SehgalNo ratings yet

- Drafting, Pleading & Conveyance Synopsis: D - R M L N L U - L, U PDocument3 pagesDrafting, Pleading & Conveyance Synopsis: D - R M L N L U - L, U PRishi SehgalNo ratings yet

- B.R. RATHORE ARTICLE On Legal Regime For Trade Secret Protection in IndiaDocument14 pagesB.R. RATHORE ARTICLE On Legal Regime For Trade Secret Protection in IndiaRishi SehgalNo ratings yet

- IPC FinalDocument15 pagesIPC FinalRishi SehgalNo ratings yet

- Labour Law Project: D - R M L N L U - L, U PDocument20 pagesLabour Law Project: D - R M L N L U - L, U PRishi SehgalNo ratings yet

- Safety BeltsDocument18 pagesSafety BeltsBoddu ThirupathiNo ratings yet

- Suggested Answer CAP III December 2016Document122 pagesSuggested Answer CAP III December 2016Roshan PanditNo ratings yet

- RetailDocument11 pagesRetailvinit PatidarNo ratings yet

- Types of AgentsDocument5 pagesTypes of Agentsवैभव कौशिकNo ratings yet

- Systematic Literature Review Kepuasan Pelanggan Terhadap JasaDocument9 pagesSystematic Literature Review Kepuasan Pelanggan Terhadap JasaOlif pcyNo ratings yet

- Janata BankDocument89 pagesJanata BankabirNo ratings yet

- Organizational Behaviour in Sport 2017Document263 pagesOrganizational Behaviour in Sport 2017Güngör BoroNo ratings yet

- Module 2 Statement of Comprehensive IncomeDocument8 pagesModule 2 Statement of Comprehensive IncomeStella MarieNo ratings yet

- Unit 11 IncentivesDocument19 pagesUnit 11 Incentivessaravanan subbiahNo ratings yet

- Schedule of Fees & ChargesDocument9 pagesSchedule of Fees & ChargesJamesNo ratings yet

- UNIT 1 ASSIGNMENT Managerial AccountingDocument4 pagesUNIT 1 ASSIGNMENT Managerial AccountingKonanRogerKouakouNo ratings yet

- Soa University: Name: Gyanabrata Mohapatra Subject: Financial Derivetives AssignmentDocument10 pagesSoa University: Name: Gyanabrata Mohapatra Subject: Financial Derivetives Assignment87 gunjandasNo ratings yet

- Bayela QuotationDocument1 pageBayela QuotationNicholas MahwenyiyoNo ratings yet

- Hosking Post Collection Aug22Document50 pagesHosking Post Collection Aug22TimothyNgNo ratings yet

- FATF Annual Report 2022 2023.pdf - CoredownloadDocument60 pagesFATF Annual Report 2022 2023.pdf - CoredownloadmagnetmarxNo ratings yet

- Molykote® Longterm 2 Plus Datasheet EngDocument2 pagesMolykote® Longterm 2 Plus Datasheet EngAlaa HassanNo ratings yet

- Sitia Sparkle Co Purchases Its Raw Material From Africa Which Remains in Transit For Three WeeksDocument2 pagesSitia Sparkle Co Purchases Its Raw Material From Africa Which Remains in Transit For Three WeeksTashfeenNo ratings yet

- 1 - Business - Environment With ScanningDocument71 pages1 - Business - Environment With ScanningNavneet Nanda0% (1)

- Toyota CGS CSR ERM CoEDocument12 pagesToyota CGS CSR ERM CoEMelanie SamsonaNo ratings yet

- Ama Aia - Tax01-Final Exam-Casilla 2nd Sem Ay 2021-2022Document9 pagesAma Aia - Tax01-Final Exam-Casilla 2nd Sem Ay 2021-2022Meg CruzNo ratings yet

- 2022 Golf Sponsorship FlyerDocument2 pages2022 Golf Sponsorship FlyerNatalie TroianiNo ratings yet

- Salvatore's International Economics - 10 Edition Instructor's ManualDocument5 pagesSalvatore's International Economics - 10 Edition Instructor's Manualhoàng trương việtNo ratings yet

- Customer Relationship Management: Concepts and TechnologiesDocument49 pagesCustomer Relationship Management: Concepts and TechnologiesDr. Usman Yousaf100% (1)

- Module # Topics 4: Unit 4Document15 pagesModule # Topics 4: Unit 4ANNA MARY GINTORONo ratings yet

- Answers - Student Workbook - Unit 1 - Exploring Business - LA ADocument42 pagesAnswers - Student Workbook - Unit 1 - Exploring Business - LA Am.luuwisNo ratings yet

- Statement of Changes in Equity and The Balance SheetDocument19 pagesStatement of Changes in Equity and The Balance SheetJaspreet GillNo ratings yet

- Assignment1 - TRAVO - Ashraf Seif - G204 - TEDocument9 pagesAssignment1 - TRAVO - Ashraf Seif - G204 - TEAshraf Seif El-NasrNo ratings yet

- Apush Review: Henry Clay'S (Part of Key CONCEPT 4.2) : American SystemDocument9 pagesApush Review: Henry Clay'S (Part of Key CONCEPT 4.2) : American SystemNOT Low-brass-exeNo ratings yet

- Trading Chart GuideDocument6 pagesTrading Chart GuideRo ChelleNo ratings yet