Professional Documents

Culture Documents

Motor Vehicle Tax Calculatorforimportation

Motor Vehicle Tax Calculatorforimportation

Uploaded by

shan singh0 ratings0% found this document useful (0 votes)

12 views4 pagesThis document contains two matrices that outline the estimated duties and taxes to be paid on importing motor vehicles into the country. The first matrix is for vehicles under 4 years old, and lists customs duty, excise, and VAT rates based on the vehicle's cubic capacity (CC) and import value. The second matrix provides the same information for vehicles over 4 years old. No excise or VAT would be owed on vehicles valued at $0, but customs duty and excise taxes increase based on the vehicle's age, CC, and import value.

Original Description:

Original Title

MotorVehicleTaxCalculatorforimportation (1).xls

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains two matrices that outline the estimated duties and taxes to be paid on importing motor vehicles into the country. The first matrix is for vehicles under 4 years old, and lists customs duty, excise, and VAT rates based on the vehicle's cubic capacity (CC) and import value. The second matrix provides the same information for vehicles over 4 years old. No excise or VAT would be owed on vehicles valued at $0, but customs duty and excise taxes increase based on the vehicle's age, CC, and import value.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views4 pagesMotor Vehicle Tax Calculatorforimportation

Motor Vehicle Tax Calculatorforimportation

Uploaded by

shan singhThis document contains two matrices that outline the estimated duties and taxes to be paid on importing motor vehicles into the country. The first matrix is for vehicles under 4 years old, and lists customs duty, excise, and VAT rates based on the vehicle's cubic capacity (CC) and import value. The second matrix provides the same information for vehicles over 4 years old. No excise or VAT would be owed on vehicles valued at $0, but customs duty and excise taxes increase based on the vehicle's age, CC, and import value.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 4

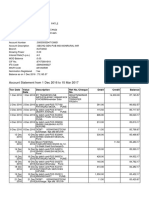

ESTIMATED APPLICABLE DUTIES AND TAXES TO BE PAID ON IMPORTATION

Matrix of Motor vehicle under 4 years old and Applicable Taxes

CIF US CC Customs Duty Excise VAT Customs Duty Payable

$0 0-1500 45% 0% 14% $0

$0 1501-1800 45% 10% 14% $0

$0 1801-2000 45% 10% 14% $0

$0 2001-3000 45% 110% 14% $0

$0 over 3000 45% 140% 14% $0

* AMOUNTS DISPLAYED ARE CALCULATED IN US DOLLARS

BE PAID ON IMPORTATION

Excise Tax Payable VAT Payable Total Taxes Payable

$0 $0 $0

$0 $0 $0

$0 $0 $0

$0 $0 $0

$0 $0 $0

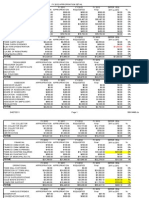

ESTIMATED APPLICABLE DUTIES AND TAXES TO BE P

Matrix of Motor Vehicles over 4 years old and Applicable Taxes

CIF US CC Customs Duty Excise VAT Customs Duty Payable

$0 0-1000 10% $4,200 0% $420

$0 1001-1500 10% $4,300 0% $430

$0 1501-1800 30% $6,000 0% $1,800

$0 1801-2000 30% $6,500 0% $1,950

$0 2001-3000 70% $13,500 0% $9,450

$0 over 3000 100% $14,500 0% $14,500

* AMOUNTS DISPLAYED ARE CALCULATED IN US DOLLARS

PLICABLE DUTIES AND TAXES TO BE PAID ON IMPORTATION

Excise Tax Payable VAT Payable Total Taxes Payable

$4,200 - $4,620

$4,300 - $4,730

$6,000 - $7,800

$6,500 - $8,450

$13,500 - $22,950

$14,500 - $29,000

You might also like

- Spectrum News: Service From 11/10/18 Through 12/09/18 Details On Following PagesDocument6 pagesSpectrum News: Service From 11/10/18 Through 12/09/18 Details On Following PagesRaul Delgado100% (1)

- SBI Account Statement 1-Dec-2016 To 15-Mar 2017Document4 pagesSBI Account Statement 1-Dec-2016 To 15-Mar 2017AnuAnuNo ratings yet

- How To Compute and Prepare The Quarterly Income Tax ReturnsDocument4 pagesHow To Compute and Prepare The Quarterly Income Tax ReturnsTwoo Phil100% (5)

- Effects of Financial Leverage: Model Produces Following OutputDocument1 pageEffects of Financial Leverage: Model Produces Following OutputArunNo ratings yet

- Motor Vehicle Tax Calculator For ImportationDocument2 pagesMotor Vehicle Tax Calculator For ImportationJulien ReddiNo ratings yet

- International Tax ComparisonsDocument23 pagesInternational Tax ComparisonsJahnavi BadlaniNo ratings yet

- Chapter 4 - TaxesDocument28 pagesChapter 4 - TaxesabandcNo ratings yet

- Computation of Income Tax FormatDocument12 pagesComputation of Income Tax FormatMADHAV JOSHINo ratings yet

- Taxes by The NumbersDocument2 pagesTaxes by The NumbersBrad StevensNo ratings yet

- TABL2751 Tax Rates 2021 - UpdatedDocument4 pagesTABL2751 Tax Rates 2021 - UpdatedPeper12345No ratings yet

- Essentials of Federal Income Taxation For Individuals and BusinessDocument860 pagesEssentials of Federal Income Taxation For Individuals and BusinessAbhisek chudalNo ratings yet

- ExtraTaxProblem-TY2020 Student - SUSANDocument6 pagesExtraTaxProblem-TY2020 Student - SUSANhhunter530No ratings yet

- Materi - INCOME TAX ACCOUNTING - 26march2021Document18 pagesMateri - INCOME TAX ACCOUNTING - 26march2021Septian Dwi AnggoroNo ratings yet

- Fed Individual Rate History Nominal PDFDocument68 pagesFed Individual Rate History Nominal PDFdracoplayrNo ratings yet

- Value Added TaxDocument56 pagesValue Added TaxMinh TragNo ratings yet

- General Ledger (Summary) 8/1/1974 To 9/30/1974Document1 pageGeneral Ledger (Summary) 8/1/1974 To 9/30/1974Andre TuukNo ratings yet

- General Ledger (Summary) 4/1/1974 To 4/30/1974Document1 pageGeneral Ledger (Summary) 4/1/1974 To 4/30/1974Andre TuukNo ratings yet

- Provided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDocument5 pagesProvided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDebolina DasNo ratings yet

- Taxes in Canada-Final 2010-4-07 Recovered)Document112 pagesTaxes in Canada-Final 2010-4-07 Recovered)DayarayanCanadaNo ratings yet

- 1904040010- Viêm Thị AnhDocument6 pages1904040010- Viêm Thị AnhAnh VânNo ratings yet

- FY2011 Clarksburg BudgetDocument6 pagesFY2011 Clarksburg BudgetiBerkshires.comNo ratings yet

- 17vs18taxbracket FinalDocument2 pages17vs18taxbracket Finalapi-426611448No ratings yet

- General Ledger (Summary) 4/1/1974 To 4/30/1974Document1 pageGeneral Ledger (Summary) 4/1/1974 To 4/30/1974Andre TuukNo ratings yet

- 1JUNIODocument4 pages1JUNIOsandralizeth.zunigaalonsoNo ratings yet

- Clarksburg Town Budget FY2013Document6 pagesClarksburg Town Budget FY2013iBerkshires.comNo ratings yet

- Income Tax Calculator FY 2024 25 Age Below 60 Years 1Document4 pagesIncome Tax Calculator FY 2024 25 Age Below 60 Years 1Kiran KumarNo ratings yet

- Taxes in Canada-Final 2011Document145 pagesTaxes in Canada-Final 2011Dayarayan CanadaNo ratings yet

- NZ Resident Tax Refund CalculatorDocument3 pagesNZ Resident Tax Refund CalculatorkwqczxrdwnNo ratings yet

- 2012 New Tax TableDocument1 page2012 New Tax TableHelen BennettNo ratings yet

- General Ledger (Summary) 9/1/1974 To 9/30/1974Document1 pageGeneral Ledger (Summary) 9/1/1974 To 9/30/1974Andre TuukNo ratings yet

- Jorg R. MenesesDocument3 pagesJorg R. MenesesKevin JugaoNo ratings yet

- Ator Property RecordsDocument2 pagesAtor Property RecordsErin LaviolaNo ratings yet

- Planilha de Simulacao de ImpostosDocument29 pagesPlanilha de Simulacao de ImpostosFernando Brindes Da HoraNo ratings yet

- R & D Converter: InputsDocument6 pagesR & D Converter: InputsKarthi KeyanNo ratings yet

- FM Homework6Document18 pagesFM Homework6subinamehtaNo ratings yet

- An Easy Way To Compute For Your Income Tax - JobStreetDocument3 pagesAn Easy Way To Compute For Your Income Tax - JobStreetVincent SuNo ratings yet

- TABL 2751 Tax Rates 2022Document4 pagesTABL 2751 Tax Rates 2022Crystal CheahNo ratings yet

- Business Start-Up Financial Plan 1Document6 pagesBusiness Start-Up Financial Plan 1Pubg MaxNo ratings yet

- PAYE Tax 2022 - Anand Chennai2LondonDocument34 pagesPAYE Tax 2022 - Anand Chennai2Londonpremkumar krishnanNo ratings yet

- Examples-On-Tax On TaxDocument16 pagesExamples-On-Tax On TaxDAO9No ratings yet

- General Ledger (Summary) 9/1/1974 To 9/30/1974Document1 pageGeneral Ledger (Summary) 9/1/1974 To 9/30/1974Andre TuukNo ratings yet

- FINC 721 Project 3Document6 pagesFINC 721 Project 3Sameer BhattaraiNo ratings yet

- Tax Reform For Acceleration and Inclusion Act - AnalysisDocument4 pagesTax Reform For Acceleration and Inclusion Act - AnalysisAlthea DumabokNo ratings yet

- Budget Summary Template USDocument1 pageBudget Summary Template USSachin KulkarniNo ratings yet

- Payroll Aggregated ReportDocument22 pagesPayroll Aggregated Reportplainnuts420No ratings yet

- Income Taxation PPT - pptx-1Document28 pagesIncome Taxation PPT - pptx-1Irfan AhmedNo ratings yet

- Costs of Homeownership: 2019 TCJA Inputs: Buy or Rent A House? Figure It Out With IRR - More Complex VersionDocument6 pagesCosts of Homeownership: 2019 TCJA Inputs: Buy or Rent A House? Figure It Out With IRR - More Complex VersionLogan WilsonNo ratings yet

- 2013 Tax Bracket CalculatorDocument1 page2013 Tax Bracket Calculatorsalauddin1979No ratings yet

- IC Contract Management Log 11242Document11 pagesIC Contract Management Log 11242brasilsedutorNo ratings yet

- Taxes in The UK vs. US - The Full Breakdown - Bright!Tax Expat Tax ServicesDocument14 pagesTaxes in The UK vs. US - The Full Breakdown - Bright!Tax Expat Tax ServicesvthreefriendsNo ratings yet

- Planilla de Sueldos Y Salarios: #Nombre Haber Básico Bono Antigüedad Total Ganado Fecha de Ingreso F-110 TotalDocument4 pagesPlanilla de Sueldos Y Salarios: #Nombre Haber Básico Bono Antigüedad Total Ganado Fecha de Ingreso F-110 TotalAnonymous cASDjraltHNo ratings yet

- Planilla de Sueldos Y Salarios: #Nombre Haber Básico Bono Antigüedad Total Ganado Fecha de Ingreso F-110 TotalDocument4 pagesPlanilla de Sueldos Y Salarios: #Nombre Haber Básico Bono Antigüedad Total Ganado Fecha de Ingreso F-110 TotalAnonymous cASDjraltHNo ratings yet

- Code Report Code NameDocument24 pagesCode Report Code NameLucy Marie RamirezNo ratings yet

- Millers' Tax Computati: Known ParametersDocument2 pagesMillers' Tax Computati: Known ParametersYadav_BaeNo ratings yet

- Home Buy Vs Rent Complex 2019 UpdateDocument6 pagesHome Buy Vs Rent Complex 2019 UpdateOthman Alaoui Mdaghri BenNo ratings yet

- Profit & Loss Statement - 2016/2017 (TTM) : Income/Sales Feb-16 Mar-16 Apr-16 May-16Document42 pagesProfit & Loss Statement - 2016/2017 (TTM) : Income/Sales Feb-16 Mar-16 Apr-16 May-16Anonymous EuIMcEFRqNNo ratings yet

- RetefuenteDocument270 pagesRetefuentejanna bejaranoNo ratings yet

- 2007 Tax RatesDocument3 pages2007 Tax RatesmobiletaxboysNo ratings yet

- 2017 Tax RatesDocument2 pages2017 Tax RatesMirta ZimmermanNo ratings yet

- 2023 Income Tax TablesDocument5 pages2023 Income Tax TablesKhushboo GuptaNo ratings yet

- Audit Module 1 - Variance Analysis TemplateDocument15 pagesAudit Module 1 - Variance Analysis TemplatelibinNo ratings yet

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet

- CIV 2201 Engineer's Design Report.Document73 pagesCIV 2201 Engineer's Design Report.shan singh100% (1)

- In This Part We Consider Only Steady Flow. For A Given Channel This Consists ofDocument8 pagesIn This Part We Consider Only Steady Flow. For A Given Channel This Consists ofshan singhNo ratings yet

- University of Guyana: Faculty of Engineering and TechnologyDocument19 pagesUniversity of Guyana: Faculty of Engineering and Technologyshan singhNo ratings yet

- Description Weight Grams (G) CM Blood Speckle Moisture Content Bruise Smell Broken Bone Rate Black Spots PRICE CifDocument1 pageDescription Weight Grams (G) CM Blood Speckle Moisture Content Bruise Smell Broken Bone Rate Black Spots PRICE Cifshan singhNo ratings yet

- 2019 Group 4: Entrepreneur ClassDocument14 pages2019 Group 4: Entrepreneur Classshan singhNo ratings yet

- Name: Oemawattie Khandai Next of Kin: Sham Singh Address: 23-26 Harkman's Lane N/A Health Facility: N.A.F.H.CDocument1 pageName: Oemawattie Khandai Next of Kin: Sham Singh Address: 23-26 Harkman's Lane N/A Health Facility: N.A.F.H.Cshan singhNo ratings yet

- Civil Life Verses Private Life PDFDocument1 pageCivil Life Verses Private Life PDFshan singhNo ratings yet

- Checklist: The Study of Earth ScienceDocument2 pagesChecklist: The Study of Earth Scienceshan singhNo ratings yet

- Research Paper Assignment: Topic and BibliographyDocument8 pagesResearch Paper Assignment: Topic and Bibliographyshan singhNo ratings yet

- Safety Precautions While Using Machines: Grinding StoneDocument10 pagesSafety Precautions While Using Machines: Grinding Stoneshan singhNo ratings yet

- Accentia Management Service LTDDocument2 pagesAccentia Management Service LTDshan singhNo ratings yet

- Assignment Overview: News Then and NowDocument2 pagesAssignment Overview: News Then and Nowshan singhNo ratings yet

- EEPGL General Contracting Services RFI 7.11.18Document10 pagesEEPGL General Contracting Services RFI 7.11.18shan singhNo ratings yet

- In-Country Operations Representative: Business ObjectiveDocument2 pagesIn-Country Operations Representative: Business Objectiveshan singhNo ratings yet

- Pod 7144600665Document1 pagePod 7144600665shan singhNo ratings yet

- Document 9 PDFDocument1 pageDocument 9 PDFshan singhNo ratings yet

- T24 Induction Business - TellerDocument63 pagesT24 Induction Business - TellerKrishna100% (2)

- Dominos Break Even AnalysisDocument3 pagesDominos Break Even AnalysiskipovoNo ratings yet

- Account Holder name:MD BILLAL HOSSAIN Address: House No 132 Road No 08, Andolbaria Chuadanga-7221, BangladeshDocument1 pageAccount Holder name:MD BILLAL HOSSAIN Address: House No 132 Road No 08, Andolbaria Chuadanga-7221, Bangladeshshohag ranaNo ratings yet

- DTEPDocument25 pagesDTEPpawan dhokaNo ratings yet

- TPR Guidelines 1.2 EDocument13 pagesTPR Guidelines 1.2 EhvalolaNo ratings yet

- Ticket For Bhimavaram-HyderabadDocument1 pageTicket For Bhimavaram-HyderabadVivek VarshithaNo ratings yet

- This Bill $166.62 Previous Balance - $110.61 Total: Tax Invoice For..Document6 pagesThis Bill $166.62 Previous Balance - $110.61 Total: Tax Invoice For..leanne11061962.lcNo ratings yet

- 2008 Spring Audit State Developments 2Document285 pages2008 Spring Audit State Developments 2rashidsfNo ratings yet

- ZB Online PaymentsDocument4 pagesZB Online PaymentsWayne Tawanda ChidawanyikaNo ratings yet

- ING Direct - Sommer - Orange EverydayDocument10 pagesING Direct - Sommer - Orange EverydaygeorgiinaNo ratings yet

- Profit and Loss Statement TemplateDocument3 pagesProfit and Loss Statement TemplateMervat AboureslanNo ratings yet

- 351711588Document3 pages351711588vasu_msa123No ratings yet

- (Original For Recipient) : Sl. No Description Unit Price Discount Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Original For Recipient) : Sl. No Description Unit Price Discount Qty Net Amount Tax Rate Tax Type Tax Amount Total Amountsrikanth121No ratings yet

- Government Suspense AccountsDocument63 pagesGovernment Suspense Accountsbharanivldv9No ratings yet

- Account StatementDocument4 pagesAccount StatementASHMIN BANUNo ratings yet

- Can Iranians Get Residency in Portugal in 2022 - 2023 - HQA VisaDocument2 pagesCan Iranians Get Residency in Portugal in 2022 - 2023 - HQA VisaRafael BaptistaNo ratings yet

- Work ExperienceDocument3 pagesWork ExperienceMarinel LadreraNo ratings yet

- FDD 47 DFBDocument1 pageFDD 47 DFBAmaryNo ratings yet

- Rules For Live and Silent Benifit AuctionDocument2 pagesRules For Live and Silent Benifit AuctionTofail AhmedNo ratings yet

- Tax Invoice: Chennai-600059 Gstin/Uin: 33BMOPM1236R1ZJ State Name: Tamil Nadu, Code: 33Document1 pageTax Invoice: Chennai-600059 Gstin/Uin: 33BMOPM1236R1ZJ State Name: Tamil Nadu, Code: 33Abhinaya JoNo ratings yet

- Law PM PDFDocument370 pagesLaw PM PDFLakshmanrao NayiniNo ratings yet

- LPBNG00031722172Document5 pagesLPBNG00031722172Ashok GNo ratings yet

- MCMQVKDocument2 pagesMCMQVKKarthikeya MandavaNo ratings yet

- ReportDocument3 pagesReportabdukarimu abdallahNo ratings yet

- 21.board of Assessment Appeals of Laguna vs. Cta, NwsaDocument1 page21.board of Assessment Appeals of Laguna vs. Cta, NwsaHappy KidNo ratings yet

- Tax On Corporation - NotesDocument9 pagesTax On Corporation - NotesMervidelleNo ratings yet

- Tutorial 8Document3 pagesTutorial 8Aaron Tan Wayne JieNo ratings yet