Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

14 viewsGroup Insurance Guidelines - 14.07.2005

Group Insurance Guidelines - 14.07.2005

Uploaded by

Khushboo BalaniCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Invisible Contracts PDFDocument584 pagesInvisible Contracts PDFNETER432100% (16)

- Autonomy PitchbookDocument23 pagesAutonomy PitchbookZerohedge100% (29)

- AAMI Car Renewal Account MPA006039747Document2 pagesAAMI Car Renewal Account MPA006039747RichieNo ratings yet

- Principles of Insurance Law with Case StudiesFrom EverandPrinciples of Insurance Law with Case StudiesRating: 5 out of 5 stars5/5 (1)

- Chapter 4: Regulation of Insurance Industry in UgandaDocument15 pagesChapter 4: Regulation of Insurance Industry in UgandaHarris YIG100% (1)

- Chapter 7Document22 pagesChapter 7anis abdNo ratings yet

- Insurance - A Brief Overview: Chapter-1Document58 pagesInsurance - A Brief Overview: Chapter-1Sreeja Sahadevan75% (4)

- CaseDocument7 pagesCasekrisNo ratings yet

- Notes of Town PlanningDocument12 pagesNotes of Town PlanningMuhammad Mudassir100% (2)

- Executive Summary: Administrative Management CollegeDocument70 pagesExecutive Summary: Administrative Management CollegeRavi Shankar SharmaNo ratings yet

- By Gaurav Insurance Law 2021Document24 pagesBy Gaurav Insurance Law 2021Gaurav KumarNo ratings yet

- TOPIC-IRDAI - Insurance Regulatory and Development Authority of IndiaDocument13 pagesTOPIC-IRDAI - Insurance Regulatory and Development Authority of IndiaTanisha GuptaNo ratings yet

- 3rd Footnotes Abstract and ConclusionDocument4 pages3rd Footnotes Abstract and ConclusionVarsha GuptaNo ratings yet

- IRDA ACT AssignmentDocument5 pagesIRDA ACT AssignmentSuraj ChandraNo ratings yet

- IRDA Project - Akanksha - LLMDocument9 pagesIRDA Project - Akanksha - LLMPULKIT KHANDELWALNo ratings yet

- Revised Guidelines On Stewardship Code For Insurers in IndiaDocument9 pagesRevised Guidelines On Stewardship Code For Insurers in IndiaKevalNo ratings yet

- NIA AssignmentDocument27 pagesNIA AssignmentAairah ZaidiNo ratings yet

- Takaful Act 1984 FINtakaful Act 1984Document17 pagesTakaful Act 1984 FINtakaful Act 1984Hafiz ShahriNo ratings yet

- Executive Summary 2-4Document71 pagesExecutive Summary 2-4Balram YadavNo ratings yet

- Takaful and IfsaDocument14 pagesTakaful and IfsaAfnan FaisalNo ratings yet

- IRDADocument2 pagesIRDAJIYA DOSHINo ratings yet

- HARSHUDocument22 pagesHARSHUvini2710No ratings yet

- Insurance Core Principles Updated November 2015Document396 pagesInsurance Core Principles Updated November 2015Roselyn MuromaNo ratings yet

- P6Document6 pagesP6pardeshikanchan07No ratings yet

- Insurance Regulatory and Development Authority of IndiaDocument6 pagesInsurance Regulatory and Development Authority of IndiaAkanksha PandeyNo ratings yet

- Kenya Micro Insurance Policy Paper11Document46 pagesKenya Micro Insurance Policy Paper11rzvendiya-1No ratings yet

- Insurance Commission CL2017 - 57Document8 pagesInsurance Commission CL2017 - 57atejNo ratings yet

- Insurance Core Principles Updated November 2017Document403 pagesInsurance Core Principles Updated November 2017Selim HanNo ratings yet

- Bfs - Unit V Short NotesDocument11 pagesBfs - Unit V Short NotesvelmuruganbNo ratings yet

- MF0018 Insurance and Risk ManagementDocument340 pagesMF0018 Insurance and Risk ManagementVihar Khadtare89% (9)

- Project On Web Based Application For Insurance ServicesDocument54 pagesProject On Web Based Application For Insurance ServicesNnamdi Chimaobi64% (11)

- Market Conduct For Insurance Companies and Intermediaries Ir Consul 18-07-0016Document13 pagesMarket Conduct For Insurance Companies and Intermediaries Ir Consul 18-07-0016NicquainCTNo ratings yet

- Learner Guide 242597Document28 pagesLearner Guide 242597palmalynchwatersNo ratings yet

- Insurance Regulatory and Development Authority (IRDA)Document4 pagesInsurance Regulatory and Development Authority (IRDA)Chandini KambapuNo ratings yet

- Insurance Regulatory and Development Authority IRDA Economics Study Material Amp NotesDocument3 pagesInsurance Regulatory and Development Authority IRDA Economics Study Material Amp NotesRaghav DhillonNo ratings yet

- Mgmt4104 Unit 2Document40 pagesMgmt4104 Unit 2Muskan KumariNo ratings yet

- Code of Ethnics - Life InsuranceDocument21 pagesCode of Ethnics - Life InsuranceWai Kit LeongNo ratings yet

- Executive SummaryDocument82 pagesExecutive SummaryDharmesh GuptaNo ratings yet

- 18-08-2004 Comments On Concept Paper On Micro-InsuranceDocument7 pages18-08-2004 Comments On Concept Paper On Micro-InsurancetusharNo ratings yet

- Accidental InsuranceDocument38 pagesAccidental InsuranceSohail ShaikhNo ratings yet

- Training and Development in BHARTI AXA Life InsuranceDocument75 pagesTraining and Development in BHARTI AXA Life Insuranceankitasachaan89No ratings yet

- The Project Study of ING Vysya Unit Linked As A Part of Financial Planning.Document63 pagesThe Project Study of ING Vysya Unit Linked As A Part of Financial Planning.Ankit JainNo ratings yet

- 06 - Chapter 1Document15 pages06 - Chapter 1gauravgaur4734No ratings yet

- Final ProjectDocument69 pagesFinal ProjectShareef SiddiquiNo ratings yet

- Insurance Law Notes RNDocument84 pagesInsurance Law Notes RNRudraksh NagarNo ratings yet

- Bajaj Finance Ritima KatiyarDocument102 pagesBajaj Finance Ritima KatiyarRidhima KatiyarNo ratings yet

- RAJUDocument15 pagesRAJULokeshNo ratings yet

- Insurance Regulatory Development Authority of India (IRDAI)Document13 pagesInsurance Regulatory Development Authority of India (IRDAI)Karthi KeyanNo ratings yet

- PIB - IRDA and Its RoleDocument11 pagesPIB - IRDA and Its Roleamittaneja28No ratings yet

- Role of Acturies in InsuranceDocument12 pagesRole of Acturies in InsurancePrajakta Kadam67% (3)

- Insurance Management AssignmentDocument9 pagesInsurance Management AssignmentRavindra SharmaNo ratings yet

- Lochan New Sip With Co - Profile ReportDocument57 pagesLochan New Sip With Co - Profile ReportAbhilash SahuNo ratings yet

- The Irda ActDocument3 pagesThe Irda ActAdeel RahmanNo ratings yet

- IRDADocument21 pagesIRDAJyoti SukhijaNo ratings yet

- SYLLABUS of Health InsuranceDocument10 pagesSYLLABUS of Health InsuranceSuchetana SenNo ratings yet

- Study of Mutual Models in Insurance - Report - 03 OctDocument53 pagesStudy of Mutual Models in Insurance - Report - 03 OctChandru JeyaramNo ratings yet

- Life Insurance Corporation of India: Submitted by Rahul SihagDocument41 pagesLife Insurance Corporation of India: Submitted by Rahul SihagSumit ChopraNo ratings yet

- ActuaryDocument5 pagesActuaryFreedNathanNo ratings yet

- Ankita STPDocument60 pagesAnkita STPAnkita PathakNo ratings yet

- Takaful Practices: As A Business OrganizationDocument30 pagesTakaful Practices: As A Business Organizationchao yangNo ratings yet

- All Adopted ICPs (Updated November 2018)Document356 pagesAll Adopted ICPs (Updated November 2018)Azman IsmailNo ratings yet

- Insurance, Regulations and Loss Prevention : Basic Rules for the Industry Insurance: Business strategy books, #5From EverandInsurance, Regulations and Loss Prevention : Basic Rules for the Industry Insurance: Business strategy books, #5No ratings yet

- Top Stocks Special Edition - Ethical, Sustainable, Responsible: A Sharebuyer's Guide to ESG for Leading Australian CompaniesFrom EverandTop Stocks Special Edition - Ethical, Sustainable, Responsible: A Sharebuyer's Guide to ESG for Leading Australian CompaniesNo ratings yet

- The Art of Asset Allocation: Principles and Investment Strategies for Any Market, Second EditionFrom EverandThe Art of Asset Allocation: Principles and Investment Strategies for Any Market, Second EditionRating: 3 out of 5 stars3/5 (4)

- National Law University, Jodhpur School of Insurance StudiesDocument52 pagesNational Law University, Jodhpur School of Insurance StudiesKhushboo BalaniNo ratings yet

- Motor Insurance: Ca A S Sisodia Ex DGM, Oriental InsuranceDocument55 pagesMotor Insurance: Ca A S Sisodia Ex DGM, Oriental InsuranceKhushboo BalaniNo ratings yet

- Liability and Aviation KhushbooDocument10 pagesLiability and Aviation KhushbooKhushboo BalaniNo ratings yet

- 03 Traditional Crop Insurance - Underwriting and ClaimsDocument20 pages03 Traditional Crop Insurance - Underwriting and ClaimsKhushboo BalaniNo ratings yet

- Add On Cover in Motor InsuranceDocument11 pagesAdd On Cover in Motor InsuranceKhushboo BalaniNo ratings yet

- FraudsDocument11 pagesFraudsKhushboo BalaniNo ratings yet

- RMS PDFDocument26 pagesRMS PDFKhushboo BalaniNo ratings yet

- Fraud ExampleDocument38 pagesFraud ExampleKhushboo BalaniNo ratings yet

- National Law University, Jodhpur School of Insurance StudiesDocument10 pagesNational Law University, Jodhpur School of Insurance StudiesKhushboo BalaniNo ratings yet

- Group Insurance Guidelines - 14.07.2005Document1 pageGroup Insurance Guidelines - 14.07.2005Khushboo BalaniNo ratings yet

- Frauds: Submitted By:-Khushboo Balani Rudraksh VaishnavDocument11 pagesFrauds: Submitted By:-Khushboo Balani Rudraksh VaishnavKhushboo BalaniNo ratings yet

- Khushboo Balani RMSDocument60 pagesKhushboo Balani RMSKhushboo BalaniNo ratings yet

- Non Proportional TreatiesDocument23 pagesNon Proportional TreatiesKhushboo Balani100% (1)

- Slide Audit ProcessDocument15 pagesSlide Audit Process黄勇添No ratings yet

- An Introduction To New Product Development (NPD)Document20 pagesAn Introduction To New Product Development (NPD)binder8640No ratings yet

- Direct and Indirect TaxesDocument14 pagesDirect and Indirect Taxeskratika singhNo ratings yet

- Reasons Why Smart Financing Is The Need of The HourDocument1 pageReasons Why Smart Financing Is The Need of The HourSaharsh NarangNo ratings yet

- RHP of OPL Octo 27 2019 P 278Document278 pagesRHP of OPL Octo 27 2019 P 278Rumana SharifNo ratings yet

- Strategic Management 2nd Edition Rothaermel Solutions ManualDocument25 pagesStrategic Management 2nd Edition Rothaermel Solutions ManualTracySnydereigtc100% (41)

- Global Business 4th Edition Mike Peng Test Bank 1Document21 pagesGlobal Business 4th Edition Mike Peng Test Bank 1ginalittlejxcboziedg100% (30)

- Introduction To Business AnalyticsDocument25 pagesIntroduction To Business AnalyticsPapeleriaphNo ratings yet

- 919020013783113Document1 page919020013783113Ankur SharmaNo ratings yet

- Welcome To TANGEDCO Online Application Filing Portal For New Service ConnectionDocument4 pagesWelcome To TANGEDCO Online Application Filing Portal For New Service Connectionsritha_87No ratings yet

- 1fec7e99ae37a49c1237227034d23848Document2 pages1fec7e99ae37a49c1237227034d23848vijayan pasupathinathNo ratings yet

- Swot Analysis of Hayleys Company LTD PDFDocument20 pagesSwot Analysis of Hayleys Company LTD PDFShehani WijayawardenaNo ratings yet

- Business PlanDocument24 pagesBusiness PlanRoanne Mae Canedo-PelorianaNo ratings yet

- CRM PresentationDocument16 pagesCRM PresentationNikita SabharwalNo ratings yet

- Joint Efficiency Factors For Seam-Welded Factory-Made Pipeline BendsDocument18 pagesJoint Efficiency Factors For Seam-Welded Factory-Made Pipeline Bendsmailmaverick8167No ratings yet

- Human Being in The Manmade WorldDocument1 pageHuman Being in The Manmade WorldAvipriyo KarNo ratings yet

- Architectural Design of Compute and Storage Clouds: Unit - IiiDocument13 pagesArchitectural Design of Compute and Storage Clouds: Unit - Iii0901IO201015 ANKIT PATELNo ratings yet

- L18 Managing Mass CommunicationsDocument31 pagesL18 Managing Mass CommunicationsAshish kumar ThapaNo ratings yet

- Return: Return What Is GST ReturnDocument3 pagesReturn: Return What Is GST ReturnNagarjuna ReddyNo ratings yet

- Oracle: Exam 1Z0-063Document157 pagesOracle: Exam 1Z0-063UdayanNo ratings yet

- Amazon SentenceDocument3 pagesAmazon SentencepratapreddychillaNo ratings yet

- 01 Apr 2023 To 26 Sep 2023-MinDocument28 pages01 Apr 2023 To 26 Sep 2023-MinRuloans VaishaliNo ratings yet

- Materi Digital Forensic Mada R Perdhana Seminar CitDocument19 pagesMateri Digital Forensic Mada R Perdhana Seminar CitVander DeckenNo ratings yet

- Class "A" Private Investigative Agency License Class "B" Security Agency License Class "R" Recovery Agency LicenseDocument24 pagesClass "A" Private Investigative Agency License Class "B" Security Agency License Class "R" Recovery Agency LicenseJohn RootNo ratings yet

- Nigel Slack Chapter 13 Supply Chain Planning and ControlDocument22 pagesNigel Slack Chapter 13 Supply Chain Planning and ControladisopNo ratings yet

Group Insurance Guidelines - 14.07.2005

Group Insurance Guidelines - 14.07.2005

Uploaded by

Khushboo Balani0 ratings0% found this document useful (0 votes)

14 views1 pageOriginal Title

Group Insurance Guidelines - 14.07.2005.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views1 pageGroup Insurance Guidelines - 14.07.2005

Group Insurance Guidelines - 14.07.2005

Uploaded by

Khushboo BalaniCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

4141 fg4q-ifft.

ITArpiul

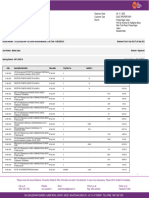

INSURANCE REGULATORY AND

da DEVELOPMENT AUTHORITY

Ref: 015/IRDA/Life/CircuIar/GI Guidelines/ 2005 14-Jul-05

Guidelines on Group Insurance Policies

Group Insurance constitutes an important activity of Insurance business and

the schemes offered by the insurance companies provide certain classes of

individuals, the advantage of a beneficial coverage at a moderate cost. The

tremendous growth of the economy and the consequential growth of the

organised sector lead the insurers to plara decisive role in designing various

group insurance schemes. Mast of the Group Insurance schemes pertain to

Employer - Employee groups, but Group Insurance is also being sold to

organisations where there is some commonality of interest. There are various

aspects that are connected with group insurance: e.g.: what shall constitute a

group': in the context of group insurance, the market conduct that is

supposed to be adopted by the insurers in canvassing group insurance

schemes and setting up administration standards for group schemes. With a

view to rationalize the approach to be adopted by insurers in dealing with

various groups the following guidelines are being issued under section 34 of

Insurance Act, 1938 to be adhered to by all the insurers,

A: Definition of a Group

1. A group should consist of persons who assemble together with a

commonality of purpose or engaging in a common economic activity

like employees of a company. Non-employer-employee groups, like

employee welfare associations, holders of credit cards issued by a

specific company, customers of a particular business where insurance

is offered as an add on benefit, borrowers of a bank, professional

associations or societies may also be treated as a group provided the

president/secretary/ manager/group organizer in his capacity as

organizer of the group has an authority from majority of the members

of the group to arrange insurance on their behalf or is doing so as part

of a necessary security for other matters such as a bank on the Life cif

borrowers. For employer - employee groups the scheme may be either

contributory or non contributory and there will be no limit to employer

contribution. Where an insurer is not clear whether a particular group

insurance proposal can qualify as per these guidelines, the insurer may

refer the matter to IRDA with facts of the case for clarification_

triiNtr nil?' I < i71 t

r 4

.141<- 500 004. Panshiam Bhavail, 3rd Floor_ Basheer Bagh Hyderabad - 5013 0n4

9 7 .

'7 -11 -1: 51-040-5582 0964. 5578 9768 e4wF:r : 91-040-5582 3334 Ph. 91-040.5582 0964 5578 9.768, Fax 91-040-5582 333

•-LIM irauth©vsnl.corn www Irclaindia.org E-mail irauth@vsnl.com Web www.irdaindia-.org

You might also like

- Invisible Contracts PDFDocument584 pagesInvisible Contracts PDFNETER432100% (16)

- Autonomy PitchbookDocument23 pagesAutonomy PitchbookZerohedge100% (29)

- AAMI Car Renewal Account MPA006039747Document2 pagesAAMI Car Renewal Account MPA006039747RichieNo ratings yet

- Principles of Insurance Law with Case StudiesFrom EverandPrinciples of Insurance Law with Case StudiesRating: 5 out of 5 stars5/5 (1)

- Chapter 4: Regulation of Insurance Industry in UgandaDocument15 pagesChapter 4: Regulation of Insurance Industry in UgandaHarris YIG100% (1)

- Chapter 7Document22 pagesChapter 7anis abdNo ratings yet

- Insurance - A Brief Overview: Chapter-1Document58 pagesInsurance - A Brief Overview: Chapter-1Sreeja Sahadevan75% (4)

- CaseDocument7 pagesCasekrisNo ratings yet

- Notes of Town PlanningDocument12 pagesNotes of Town PlanningMuhammad Mudassir100% (2)

- Executive Summary: Administrative Management CollegeDocument70 pagesExecutive Summary: Administrative Management CollegeRavi Shankar SharmaNo ratings yet

- By Gaurav Insurance Law 2021Document24 pagesBy Gaurav Insurance Law 2021Gaurav KumarNo ratings yet

- TOPIC-IRDAI - Insurance Regulatory and Development Authority of IndiaDocument13 pagesTOPIC-IRDAI - Insurance Regulatory and Development Authority of IndiaTanisha GuptaNo ratings yet

- 3rd Footnotes Abstract and ConclusionDocument4 pages3rd Footnotes Abstract and ConclusionVarsha GuptaNo ratings yet

- IRDA ACT AssignmentDocument5 pagesIRDA ACT AssignmentSuraj ChandraNo ratings yet

- IRDA Project - Akanksha - LLMDocument9 pagesIRDA Project - Akanksha - LLMPULKIT KHANDELWALNo ratings yet

- Revised Guidelines On Stewardship Code For Insurers in IndiaDocument9 pagesRevised Guidelines On Stewardship Code For Insurers in IndiaKevalNo ratings yet

- NIA AssignmentDocument27 pagesNIA AssignmentAairah ZaidiNo ratings yet

- Takaful Act 1984 FINtakaful Act 1984Document17 pagesTakaful Act 1984 FINtakaful Act 1984Hafiz ShahriNo ratings yet

- Executive Summary 2-4Document71 pagesExecutive Summary 2-4Balram YadavNo ratings yet

- Takaful and IfsaDocument14 pagesTakaful and IfsaAfnan FaisalNo ratings yet

- IRDADocument2 pagesIRDAJIYA DOSHINo ratings yet

- HARSHUDocument22 pagesHARSHUvini2710No ratings yet

- Insurance Core Principles Updated November 2015Document396 pagesInsurance Core Principles Updated November 2015Roselyn MuromaNo ratings yet

- P6Document6 pagesP6pardeshikanchan07No ratings yet

- Insurance Regulatory and Development Authority of IndiaDocument6 pagesInsurance Regulatory and Development Authority of IndiaAkanksha PandeyNo ratings yet

- Kenya Micro Insurance Policy Paper11Document46 pagesKenya Micro Insurance Policy Paper11rzvendiya-1No ratings yet

- Insurance Commission CL2017 - 57Document8 pagesInsurance Commission CL2017 - 57atejNo ratings yet

- Insurance Core Principles Updated November 2017Document403 pagesInsurance Core Principles Updated November 2017Selim HanNo ratings yet

- Bfs - Unit V Short NotesDocument11 pagesBfs - Unit V Short NotesvelmuruganbNo ratings yet

- MF0018 Insurance and Risk ManagementDocument340 pagesMF0018 Insurance and Risk ManagementVihar Khadtare89% (9)

- Project On Web Based Application For Insurance ServicesDocument54 pagesProject On Web Based Application For Insurance ServicesNnamdi Chimaobi64% (11)

- Market Conduct For Insurance Companies and Intermediaries Ir Consul 18-07-0016Document13 pagesMarket Conduct For Insurance Companies and Intermediaries Ir Consul 18-07-0016NicquainCTNo ratings yet

- Learner Guide 242597Document28 pagesLearner Guide 242597palmalynchwatersNo ratings yet

- Insurance Regulatory and Development Authority (IRDA)Document4 pagesInsurance Regulatory and Development Authority (IRDA)Chandini KambapuNo ratings yet

- Insurance Regulatory and Development Authority IRDA Economics Study Material Amp NotesDocument3 pagesInsurance Regulatory and Development Authority IRDA Economics Study Material Amp NotesRaghav DhillonNo ratings yet

- Mgmt4104 Unit 2Document40 pagesMgmt4104 Unit 2Muskan KumariNo ratings yet

- Code of Ethnics - Life InsuranceDocument21 pagesCode of Ethnics - Life InsuranceWai Kit LeongNo ratings yet

- Executive SummaryDocument82 pagesExecutive SummaryDharmesh GuptaNo ratings yet

- 18-08-2004 Comments On Concept Paper On Micro-InsuranceDocument7 pages18-08-2004 Comments On Concept Paper On Micro-InsurancetusharNo ratings yet

- Accidental InsuranceDocument38 pagesAccidental InsuranceSohail ShaikhNo ratings yet

- Training and Development in BHARTI AXA Life InsuranceDocument75 pagesTraining and Development in BHARTI AXA Life Insuranceankitasachaan89No ratings yet

- The Project Study of ING Vysya Unit Linked As A Part of Financial Planning.Document63 pagesThe Project Study of ING Vysya Unit Linked As A Part of Financial Planning.Ankit JainNo ratings yet

- 06 - Chapter 1Document15 pages06 - Chapter 1gauravgaur4734No ratings yet

- Final ProjectDocument69 pagesFinal ProjectShareef SiddiquiNo ratings yet

- Insurance Law Notes RNDocument84 pagesInsurance Law Notes RNRudraksh NagarNo ratings yet

- Bajaj Finance Ritima KatiyarDocument102 pagesBajaj Finance Ritima KatiyarRidhima KatiyarNo ratings yet

- RAJUDocument15 pagesRAJULokeshNo ratings yet

- Insurance Regulatory Development Authority of India (IRDAI)Document13 pagesInsurance Regulatory Development Authority of India (IRDAI)Karthi KeyanNo ratings yet

- PIB - IRDA and Its RoleDocument11 pagesPIB - IRDA and Its Roleamittaneja28No ratings yet

- Role of Acturies in InsuranceDocument12 pagesRole of Acturies in InsurancePrajakta Kadam67% (3)

- Insurance Management AssignmentDocument9 pagesInsurance Management AssignmentRavindra SharmaNo ratings yet

- Lochan New Sip With Co - Profile ReportDocument57 pagesLochan New Sip With Co - Profile ReportAbhilash SahuNo ratings yet

- The Irda ActDocument3 pagesThe Irda ActAdeel RahmanNo ratings yet

- IRDADocument21 pagesIRDAJyoti SukhijaNo ratings yet

- SYLLABUS of Health InsuranceDocument10 pagesSYLLABUS of Health InsuranceSuchetana SenNo ratings yet

- Study of Mutual Models in Insurance - Report - 03 OctDocument53 pagesStudy of Mutual Models in Insurance - Report - 03 OctChandru JeyaramNo ratings yet

- Life Insurance Corporation of India: Submitted by Rahul SihagDocument41 pagesLife Insurance Corporation of India: Submitted by Rahul SihagSumit ChopraNo ratings yet

- ActuaryDocument5 pagesActuaryFreedNathanNo ratings yet

- Ankita STPDocument60 pagesAnkita STPAnkita PathakNo ratings yet

- Takaful Practices: As A Business OrganizationDocument30 pagesTakaful Practices: As A Business Organizationchao yangNo ratings yet

- All Adopted ICPs (Updated November 2018)Document356 pagesAll Adopted ICPs (Updated November 2018)Azman IsmailNo ratings yet

- Insurance, Regulations and Loss Prevention : Basic Rules for the Industry Insurance: Business strategy books, #5From EverandInsurance, Regulations and Loss Prevention : Basic Rules for the Industry Insurance: Business strategy books, #5No ratings yet

- Top Stocks Special Edition - Ethical, Sustainable, Responsible: A Sharebuyer's Guide to ESG for Leading Australian CompaniesFrom EverandTop Stocks Special Edition - Ethical, Sustainable, Responsible: A Sharebuyer's Guide to ESG for Leading Australian CompaniesNo ratings yet

- The Art of Asset Allocation: Principles and Investment Strategies for Any Market, Second EditionFrom EverandThe Art of Asset Allocation: Principles and Investment Strategies for Any Market, Second EditionRating: 3 out of 5 stars3/5 (4)

- National Law University, Jodhpur School of Insurance StudiesDocument52 pagesNational Law University, Jodhpur School of Insurance StudiesKhushboo BalaniNo ratings yet

- Motor Insurance: Ca A S Sisodia Ex DGM, Oriental InsuranceDocument55 pagesMotor Insurance: Ca A S Sisodia Ex DGM, Oriental InsuranceKhushboo BalaniNo ratings yet

- Liability and Aviation KhushbooDocument10 pagesLiability and Aviation KhushbooKhushboo BalaniNo ratings yet

- 03 Traditional Crop Insurance - Underwriting and ClaimsDocument20 pages03 Traditional Crop Insurance - Underwriting and ClaimsKhushboo BalaniNo ratings yet

- Add On Cover in Motor InsuranceDocument11 pagesAdd On Cover in Motor InsuranceKhushboo BalaniNo ratings yet

- FraudsDocument11 pagesFraudsKhushboo BalaniNo ratings yet

- RMS PDFDocument26 pagesRMS PDFKhushboo BalaniNo ratings yet

- Fraud ExampleDocument38 pagesFraud ExampleKhushboo BalaniNo ratings yet

- National Law University, Jodhpur School of Insurance StudiesDocument10 pagesNational Law University, Jodhpur School of Insurance StudiesKhushboo BalaniNo ratings yet

- Group Insurance Guidelines - 14.07.2005Document1 pageGroup Insurance Guidelines - 14.07.2005Khushboo BalaniNo ratings yet

- Frauds: Submitted By:-Khushboo Balani Rudraksh VaishnavDocument11 pagesFrauds: Submitted By:-Khushboo Balani Rudraksh VaishnavKhushboo BalaniNo ratings yet

- Khushboo Balani RMSDocument60 pagesKhushboo Balani RMSKhushboo BalaniNo ratings yet

- Non Proportional TreatiesDocument23 pagesNon Proportional TreatiesKhushboo Balani100% (1)

- Slide Audit ProcessDocument15 pagesSlide Audit Process黄勇添No ratings yet

- An Introduction To New Product Development (NPD)Document20 pagesAn Introduction To New Product Development (NPD)binder8640No ratings yet

- Direct and Indirect TaxesDocument14 pagesDirect and Indirect Taxeskratika singhNo ratings yet

- Reasons Why Smart Financing Is The Need of The HourDocument1 pageReasons Why Smart Financing Is The Need of The HourSaharsh NarangNo ratings yet

- RHP of OPL Octo 27 2019 P 278Document278 pagesRHP of OPL Octo 27 2019 P 278Rumana SharifNo ratings yet

- Strategic Management 2nd Edition Rothaermel Solutions ManualDocument25 pagesStrategic Management 2nd Edition Rothaermel Solutions ManualTracySnydereigtc100% (41)

- Global Business 4th Edition Mike Peng Test Bank 1Document21 pagesGlobal Business 4th Edition Mike Peng Test Bank 1ginalittlejxcboziedg100% (30)

- Introduction To Business AnalyticsDocument25 pagesIntroduction To Business AnalyticsPapeleriaphNo ratings yet

- 919020013783113Document1 page919020013783113Ankur SharmaNo ratings yet

- Welcome To TANGEDCO Online Application Filing Portal For New Service ConnectionDocument4 pagesWelcome To TANGEDCO Online Application Filing Portal For New Service Connectionsritha_87No ratings yet

- 1fec7e99ae37a49c1237227034d23848Document2 pages1fec7e99ae37a49c1237227034d23848vijayan pasupathinathNo ratings yet

- Swot Analysis of Hayleys Company LTD PDFDocument20 pagesSwot Analysis of Hayleys Company LTD PDFShehani WijayawardenaNo ratings yet

- Business PlanDocument24 pagesBusiness PlanRoanne Mae Canedo-PelorianaNo ratings yet

- CRM PresentationDocument16 pagesCRM PresentationNikita SabharwalNo ratings yet

- Joint Efficiency Factors For Seam-Welded Factory-Made Pipeline BendsDocument18 pagesJoint Efficiency Factors For Seam-Welded Factory-Made Pipeline Bendsmailmaverick8167No ratings yet

- Human Being in The Manmade WorldDocument1 pageHuman Being in The Manmade WorldAvipriyo KarNo ratings yet

- Architectural Design of Compute and Storage Clouds: Unit - IiiDocument13 pagesArchitectural Design of Compute and Storage Clouds: Unit - Iii0901IO201015 ANKIT PATELNo ratings yet

- L18 Managing Mass CommunicationsDocument31 pagesL18 Managing Mass CommunicationsAshish kumar ThapaNo ratings yet

- Return: Return What Is GST ReturnDocument3 pagesReturn: Return What Is GST ReturnNagarjuna ReddyNo ratings yet

- Oracle: Exam 1Z0-063Document157 pagesOracle: Exam 1Z0-063UdayanNo ratings yet

- Amazon SentenceDocument3 pagesAmazon SentencepratapreddychillaNo ratings yet

- 01 Apr 2023 To 26 Sep 2023-MinDocument28 pages01 Apr 2023 To 26 Sep 2023-MinRuloans VaishaliNo ratings yet

- Materi Digital Forensic Mada R Perdhana Seminar CitDocument19 pagesMateri Digital Forensic Mada R Perdhana Seminar CitVander DeckenNo ratings yet

- Class "A" Private Investigative Agency License Class "B" Security Agency License Class "R" Recovery Agency LicenseDocument24 pagesClass "A" Private Investigative Agency License Class "B" Security Agency License Class "R" Recovery Agency LicenseJohn RootNo ratings yet

- Nigel Slack Chapter 13 Supply Chain Planning and ControlDocument22 pagesNigel Slack Chapter 13 Supply Chain Planning and ControladisopNo ratings yet