Professional Documents

Culture Documents

Goods & Services Tax: Zero Rated Supplies

Goods & Services Tax: Zero Rated Supplies

Uploaded by

Sundarachselvan SubramanianCopyright:

Available Formats

You might also like

- Law On Sales Agency & Credit Transactions (Reviewer)Document3 pagesLaw On Sales Agency & Credit Transactions (Reviewer)Yana100% (1)

- Dissolution of PartnershipDocument20 pagesDissolution of PartnershipChandrasekaran Iyer100% (4)

- Module 1 - Cash and Cash EquivalentsDocument16 pagesModule 1 - Cash and Cash EquivalentsJehPoy0% (1)

- Imports Under Gst02june2017Document2 pagesImports Under Gst02june2017shahruchirNo ratings yet

- 3rd Class Synopsis - Input Tax Credit (16.09.2022)Document26 pages3rd Class Synopsis - Input Tax Credit (16.09.2022)pronab sarkerNo ratings yet

- Zero Ratings of SupliesDocument2 pagesZero Ratings of SupliesDarsini KumarNo ratings yet

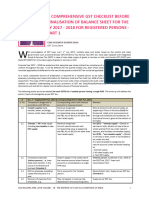

- A Comprehensive GST Checklist Before Finalisation of Balance Sheet For The Fy 2017 - 2018 For Registered PersonsDocument8 pagesA Comprehensive GST Checklist Before Finalisation of Balance Sheet For The Fy 2017 - 2018 For Registered Personsजयकरण शर्माNo ratings yet

- Chapter-5 (Input Tax Credit)Document30 pagesChapter-5 (Input Tax Credit)pronab sarkerNo ratings yet

- Refund of Unutilised Input Tax Credit (ITC) : (Goods and Services Tax)Document5 pagesRefund of Unutilised Input Tax Credit (ITC) : (Goods and Services Tax)dinesh kasnNo ratings yet

- Input Tax Credit: Cma Bibhudatta SarangiDocument3 pagesInput Tax Credit: Cma Bibhudatta SarangihanumanthaiahgowdaNo ratings yet

- 6 ItcDocument114 pages6 ItcRAUNAQ SHARMANo ratings yet

- Refund of Unutilised ItcDocument6 pagesRefund of Unutilised ItcgrameshchandraNo ratings yet

- 66519bos53752 cp6Document100 pages66519bos53752 cp6Aditya ThesiaNo ratings yet

- GST - Input Tax Credit - Edition 5Document17 pagesGST - Input Tax Credit - Edition 5Vineet PandeyNo ratings yet

- Input Tax CreditDocument10 pagesInput Tax CreditSme 2023No ratings yet

- Highlights of Budgetary Changes 2022 - VATDocument22 pagesHighlights of Budgetary Changes 2022 - VATRoyNo ratings yet

- Overview of Input Tax Credit: CMA Arindam GoswamiDocument4 pagesOverview of Input Tax Credit: CMA Arindam Goswamiharshadaphandge165No ratings yet

- Input Tax Credit Under GST by CA. Nagesh Jadhav PDFDocument22 pagesInput Tax Credit Under GST by CA. Nagesh Jadhav PDFLumita SinghNo ratings yet

- 3 Input TaxDocument23 pages3 Input TaxMobile LegendsNo ratings yet

- GST Input Tax Credit NotesDocument13 pagesGST Input Tax Credit Notesa_bc691973No ratings yet

- Imports of GST 07june2017 - DocumentDocument3 pagesImports of GST 07june2017 - DocumentinasapNo ratings yet

- Kjaefncl (Complete)Document42 pagesKjaefncl (Complete)Kenzo RodisNo ratings yet

- Budget 2021Document15 pagesBudget 2021RohitKumarDiwakarNo ratings yet

- 62329bos50452 cp8Document186 pages62329bos50452 cp8Pabitra Kumar PrustyNo ratings yet

- Important GST Amendments in Budget 2023 - Taxguru - in PDFDocument10 pagesImportant GST Amendments in Budget 2023 - Taxguru - in PDFPawan AswaniNo ratings yet

- GST and Exports: by Office of The Additional DGFT, HyderabadDocument18 pagesGST and Exports: by Office of The Additional DGFT, HyderabadjahnavireddysathiNo ratings yet

- 67767bos54359 cp8 PDFDocument193 pages67767bos54359 cp8 PDFvenuNo ratings yet

- Taxation Direct and Indirect NMIMS AssignmentDocument6 pagesTaxation Direct and Indirect NMIMS AssignmentN. Karthik UdupaNo ratings yet

- GST & Customs II Unit 1Document11 pagesGST & Customs II Unit 1GagandeepNo ratings yet

- 76220bos61590 cp7Document208 pages76220bos61590 cp7Sunil KumarNo ratings yet

- Refund of Un Utilised TaxDocument4 pagesRefund of Un Utilised TaxcahardikkachavaNo ratings yet

- Input Tax Credit-Cp8Document118 pagesInput Tax Credit-Cp8Shipra SonaliNo ratings yet

- Export of Services in GST RegimeDocument5 pagesExport of Services in GST RegimeNM JHANWAR & ASSOCIATESNo ratings yet

- CGST Act 16-21Document37 pagesCGST Act 16-21Dasari NareshNo ratings yet

- Input Tax Credit Under GSTDocument7 pagesInput Tax Credit Under GSTskumarcwacaNo ratings yet

- Process Flow To Submit Tax Regime4102023Document12 pagesProcess Flow To Submit Tax Regime4102023Gokul KrishNo ratings yet

- Tax HDocument15 pagesTax HDeepesh SinghNo ratings yet

- Deduction Allowed and Not Allowed Under The Head Income From Business PDFDocument6 pagesDeduction Allowed and Not Allowed Under The Head Income From Business PDFMuhammad sheran sattiNo ratings yet

- Chapter 3-GSTDocument14 pagesChapter 3-GSTPooja D AcharyaNo ratings yet

- 76442bos61715 cp15Document73 pages76442bos61715 cp15Uma SinghalNo ratings yet

- Implementing VAT in Your Business: E-ServicesDocument1 pageImplementing VAT in Your Business: E-ServicesSalman YousufNo ratings yet

- Returns PDFDocument109 pagesReturns PDFKrishna VamsiNo ratings yet

- Suraj Sir 1Document8 pagesSuraj Sir 1Avinash YadavNo ratings yet

- GST Educational Series 01082017Document1 pageGST Educational Series 01082017Sundarachselvan SubramanianNo ratings yet

- IDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesDocument27 pagesIDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesRonita DuttaNo ratings yet

- Input Tax Credit MechanismDocument3 pagesInput Tax Credit MechanismRutvik PandyaNo ratings yet

- Goods and Services Tax Council Standing Committee On Capacity Building and FacilitationDocument61 pagesGoods and Services Tax Council Standing Committee On Capacity Building and FacilitationJeyakar PrabakarNo ratings yet

- 07) CIR V Seagate Tech PhilsDocument3 pages07) CIR V Seagate Tech PhilsAlfonso Miguel LopezNo ratings yet

- Input Tax Credit (Itc) (Section 16) : Sem 5: Procedure and Levy Under Gstgoods and Service TaxDocument3 pagesInput Tax Credit (Itc) (Section 16) : Sem 5: Procedure and Levy Under Gstgoods and Service TaxmanjulaNo ratings yet

- S - Viii: Bba - LL.B (Hons) Corporate LawsDocument20 pagesS - Viii: Bba - LL.B (Hons) Corporate LawsSalonee NayakNo ratings yet

- NMIMS - Session 4 - Withholding Taxes TDS and TCS On Sale of Goods Software TaxationDocument49 pagesNMIMS - Session 4 - Withholding Taxes TDS and TCS On Sale of Goods Software TaxationSachin KandloorNo ratings yet

- TDS Under Section 194C: Press Releases Blog PostsDocument4 pagesTDS Under Section 194C: Press Releases Blog PostsBalu Mahendra SusarlaNo ratings yet

- GST Refund ProcessDocument5 pagesGST Refund ProcessG L SWAMYNo ratings yet

- PGBP Chapter - Ay 2021-22 (May & Nov 2021 Exam)Document130 pagesPGBP Chapter - Ay 2021-22 (May & Nov 2021 Exam)hgoyal1998No ratings yet

- Bos 32722 P 4Document37 pagesBos 32722 P 4CmaChanduNo ratings yet

- Zero Rated Supplies Under GST: CA Sachin Kumar JainDocument3 pagesZero Rated Supplies Under GST: CA Sachin Kumar Jainparam.ginniNo ratings yet

- Reverse Charge MechanismDocument3 pagesReverse Charge MechanismARJUNNo ratings yet

- Goods and Services Tax (GST) in India: Input Tax Credit (ITC)Document24 pagesGoods and Services Tax (GST) in India: Input Tax Credit (ITC)Noman AreebNo ratings yet

- 013 Terms and Phrases You Must Know Under GST - Part IIDocument3 pages013 Terms and Phrases You Must Know Under GST - Part II0amrevkapeed0No ratings yet

- Input Tax CreditDocument45 pagesInput Tax CreditGourav PareekNo ratings yet

- GST - V2 - May 2023Document326 pagesGST - V2 - May 2023FhfhhNo ratings yet

- WTS Dhruva VAT Handbook PDFDocument40 pagesWTS Dhruva VAT Handbook PDFFaraz AkhtarNo ratings yet

- Goods & Services Tax: Returns by Input Service DistributorDocument1 pageGoods & Services Tax: Returns by Input Service DistributorSundarachselvan SubramanianNo ratings yet

- Goods & Services Tax: Educational SeriesDocument1 pageGoods & Services Tax: Educational SeriesSundarachselvan SubramanianNo ratings yet

- Definitions Under Integrated Goods & Services Tax Act, 2017Document1 pageDefinitions Under Integrated Goods & Services Tax Act, 2017Sundarachselvan SubramanianNo ratings yet

- GST Educational Series 01082017Document1 pageGST Educational Series 01082017Sundarachselvan SubramanianNo ratings yet

- Goods & Services Tax: Understanding Schedule II (Part - I)Document1 pageGoods & Services Tax: Understanding Schedule II (Part - I)Sundarachselvan SubramanianNo ratings yet

- Goods & Services Tax: Educational SeriesDocument1 pageGoods & Services Tax: Educational SeriesSundarachselvan SubramanianNo ratings yet

- Financial Service: III SemDocument3 pagesFinancial Service: III SemSundarachselvan Subramanian0% (1)

- Security Analysis and Portfolio Management: Multiple Choice QuestionsDocument2 pagesSecurity Analysis and Portfolio Management: Multiple Choice QuestionsSundarachselvan SubramanianNo ratings yet

- KanWhizz Business Presentation 97Document17 pagesKanWhizz Business Presentation 97Satya Pal80% (5)

- Reserve Bank of India and Its Role in IndiaDocument11 pagesReserve Bank of India and Its Role in IndiaHarish Chandani100% (1)

- Bus Math Sample Problem in HandoutsDocument7 pagesBus Math Sample Problem in HandoutsAria & Kira CatzNo ratings yet

- Managerial Finance chp5Document13 pagesManagerial Finance chp5Linda Mohammad FarajNo ratings yet

- Western Mindanao Adventist Academy 7028 Dumingag, Zamboanga Del Sur, PhilippinesDocument9 pagesWestern Mindanao Adventist Academy 7028 Dumingag, Zamboanga Del Sur, PhilippinesJoyce Torres100% (1)

- Distinguish Between Revaluation Account and Realisation AccountDocument1 pageDistinguish Between Revaluation Account and Realisation AccountshabukrNo ratings yet

- OceanPay PDFDocument6 pagesOceanPay PDFKodar StickoNo ratings yet

- Accounting Principles: Second Canadian EditionDocument25 pagesAccounting Principles: Second Canadian EditionEshetieNo ratings yet

- Liquidity Risk and FIs' ManagementDocument16 pagesLiquidity Risk and FIs' ManagementJose Anibal Insfran PelozoNo ratings yet

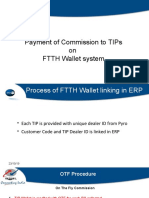

- FTTH Commission Payment ProcessDocument12 pagesFTTH Commission Payment ProcessVikrant PathakNo ratings yet

- 7case Digest Daguhoy Vs PonceDocument2 pages7case Digest Daguhoy Vs PonceJames ScoldNo ratings yet

- Employment Contract Sample Part Time and Full TimeDocument3 pagesEmployment Contract Sample Part Time and Full TimeAnonymous NiKZKWgKqNo ratings yet

- MCQ On Finals TaxesDocument7 pagesMCQ On Finals TaxesRandy ManzanoNo ratings yet

- Chapter 12 Exercise E12-7 SOLUTION Fall 2018Document2 pagesChapter 12 Exercise E12-7 SOLUTION Fall 2018Areeba QureshiNo ratings yet

- EXAMPLE OF INCOME STATEMENT Bella EnterpriseDocument2 pagesEXAMPLE OF INCOME STATEMENT Bella EnterprisemarivicNo ratings yet

- Chapter 10 and 11 HWDocument4 pagesChapter 10 and 11 HWkanielafinNo ratings yet

- Upbuild BookletDocument14 pagesUpbuild Bookletmrlee28No ratings yet

- Application Cum Form A2 For LRS Transactions - Revised - 28 - 03 - 2019Document5 pagesApplication Cum Form A2 For LRS Transactions - Revised - 28 - 03 - 2019Prabhu KnNo ratings yet

- TVM Practice Problems SolutionsDocument7 pagesTVM Practice Problems SolutionsAnne Bona100% (1)

- Loan Against Shares (LAS) AgreementDocument21 pagesLoan Against Shares (LAS) AgreementAshish ShahNo ratings yet

- 28 Pco Inc: Lecturer Resource Pack - QuestionsDocument2 pages28 Pco Inc: Lecturer Resource Pack - QuestionsCollen Takudzwa MuguyoNo ratings yet

- Nationwide Junior ISA Ts and CsDocument4 pagesNationwide Junior ISA Ts and CsSpartacus UkinNo ratings yet

- Seminar Outline 4Document16 pagesSeminar Outline 4cccqNo ratings yet

- Management & Organization of Stock Exchange - Mukesh CarpenterDocument22 pagesManagement & Organization of Stock Exchange - Mukesh CarpenterMukesh CarpenterNo ratings yet

- Chapter 17 Notes-Concepts, Homework Problems With AnswersDocument45 pagesChapter 17 Notes-Concepts, Homework Problems With Answersanilegna990% (2)

- R14 - UG - Wakala Musuwama PDFDocument30 pagesR14 - UG - Wakala Musuwama PDFSathya KumarNo ratings yet

- Incomes Chageable As Profits and Gains of Business and ProfessionDocument11 pagesIncomes Chageable As Profits and Gains of Business and ProfessionRishikesh KumarNo ratings yet

Goods & Services Tax: Zero Rated Supplies

Goods & Services Tax: Zero Rated Supplies

Uploaded by

Sundarachselvan SubramanianOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Goods & Services Tax: Zero Rated Supplies

Goods & Services Tax: Zero Rated Supplies

Uploaded by

Sundarachselvan SubramanianCopyright:

Available Formats

Goods & Services Tax Issue 46

Educational Series

PD & PP : GST : 46/2017 August 02, 2017

Zero Rated Supplies

Zero rated supplies mean Nil rated supplies. It means that the items specified under zero rated supplies will be

taxable but nil rate of tax will be levied on those items.

Section 16 of the IGST Act, 2017 specifies zero rated supplies as supplies of goods or services or both, namely:––

(a) export of goods or services or both; or

(b) supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit.

Zero Rated Supplies

Export

Supply to SEZ developer or SEZ Unit

Goods

Services

Input Tax Credit in Zero Rated Supplies.

Section 16(2) specifies that Input Tax Credit will be available on making zero rated supplies, notwithstanding that

such supply may be an exempt supply.

Refund Procedure

Subject to such conditions, safeguards and procedures, as may be prescribed:

can claim refund of

unutilised input tax

under Bond/ Letter of credit

Can supply Goods or undertaking , without

Services or both payment of integrated

tax

Registered

Person can claim refund of

such tax paid

on payment of

integrated tax

Disclaimer: This document developed for academic purposes only, is based on the information available in public domain. The Institute of Company Secretaries of India shall not be responsible for any loss or damage

caused due to any action taken on the basis of information contained in this document. Any person wishing to act on the basis of the information contained in this document should do so only after cross checking with

the original source.

Previous issues of Educational Series are available at https://www.icsi.edu/GSTEducationalSeries.aspx

You might also like

- Law On Sales Agency & Credit Transactions (Reviewer)Document3 pagesLaw On Sales Agency & Credit Transactions (Reviewer)Yana100% (1)

- Dissolution of PartnershipDocument20 pagesDissolution of PartnershipChandrasekaran Iyer100% (4)

- Module 1 - Cash and Cash EquivalentsDocument16 pagesModule 1 - Cash and Cash EquivalentsJehPoy0% (1)

- Imports Under Gst02june2017Document2 pagesImports Under Gst02june2017shahruchirNo ratings yet

- 3rd Class Synopsis - Input Tax Credit (16.09.2022)Document26 pages3rd Class Synopsis - Input Tax Credit (16.09.2022)pronab sarkerNo ratings yet

- Zero Ratings of SupliesDocument2 pagesZero Ratings of SupliesDarsini KumarNo ratings yet

- A Comprehensive GST Checklist Before Finalisation of Balance Sheet For The Fy 2017 - 2018 For Registered PersonsDocument8 pagesA Comprehensive GST Checklist Before Finalisation of Balance Sheet For The Fy 2017 - 2018 For Registered Personsजयकरण शर्माNo ratings yet

- Chapter-5 (Input Tax Credit)Document30 pagesChapter-5 (Input Tax Credit)pronab sarkerNo ratings yet

- Refund of Unutilised Input Tax Credit (ITC) : (Goods and Services Tax)Document5 pagesRefund of Unutilised Input Tax Credit (ITC) : (Goods and Services Tax)dinesh kasnNo ratings yet

- Input Tax Credit: Cma Bibhudatta SarangiDocument3 pagesInput Tax Credit: Cma Bibhudatta SarangihanumanthaiahgowdaNo ratings yet

- 6 ItcDocument114 pages6 ItcRAUNAQ SHARMANo ratings yet

- Refund of Unutilised ItcDocument6 pagesRefund of Unutilised ItcgrameshchandraNo ratings yet

- 66519bos53752 cp6Document100 pages66519bos53752 cp6Aditya ThesiaNo ratings yet

- GST - Input Tax Credit - Edition 5Document17 pagesGST - Input Tax Credit - Edition 5Vineet PandeyNo ratings yet

- Input Tax CreditDocument10 pagesInput Tax CreditSme 2023No ratings yet

- Highlights of Budgetary Changes 2022 - VATDocument22 pagesHighlights of Budgetary Changes 2022 - VATRoyNo ratings yet

- Overview of Input Tax Credit: CMA Arindam GoswamiDocument4 pagesOverview of Input Tax Credit: CMA Arindam Goswamiharshadaphandge165No ratings yet

- Input Tax Credit Under GST by CA. Nagesh Jadhav PDFDocument22 pagesInput Tax Credit Under GST by CA. Nagesh Jadhav PDFLumita SinghNo ratings yet

- 3 Input TaxDocument23 pages3 Input TaxMobile LegendsNo ratings yet

- GST Input Tax Credit NotesDocument13 pagesGST Input Tax Credit Notesa_bc691973No ratings yet

- Imports of GST 07june2017 - DocumentDocument3 pagesImports of GST 07june2017 - DocumentinasapNo ratings yet

- Kjaefncl (Complete)Document42 pagesKjaefncl (Complete)Kenzo RodisNo ratings yet

- Budget 2021Document15 pagesBudget 2021RohitKumarDiwakarNo ratings yet

- 62329bos50452 cp8Document186 pages62329bos50452 cp8Pabitra Kumar PrustyNo ratings yet

- Important GST Amendments in Budget 2023 - Taxguru - in PDFDocument10 pagesImportant GST Amendments in Budget 2023 - Taxguru - in PDFPawan AswaniNo ratings yet

- GST and Exports: by Office of The Additional DGFT, HyderabadDocument18 pagesGST and Exports: by Office of The Additional DGFT, HyderabadjahnavireddysathiNo ratings yet

- 67767bos54359 cp8 PDFDocument193 pages67767bos54359 cp8 PDFvenuNo ratings yet

- Taxation Direct and Indirect NMIMS AssignmentDocument6 pagesTaxation Direct and Indirect NMIMS AssignmentN. Karthik UdupaNo ratings yet

- GST & Customs II Unit 1Document11 pagesGST & Customs II Unit 1GagandeepNo ratings yet

- 76220bos61590 cp7Document208 pages76220bos61590 cp7Sunil KumarNo ratings yet

- Refund of Un Utilised TaxDocument4 pagesRefund of Un Utilised TaxcahardikkachavaNo ratings yet

- Input Tax Credit-Cp8Document118 pagesInput Tax Credit-Cp8Shipra SonaliNo ratings yet

- Export of Services in GST RegimeDocument5 pagesExport of Services in GST RegimeNM JHANWAR & ASSOCIATESNo ratings yet

- CGST Act 16-21Document37 pagesCGST Act 16-21Dasari NareshNo ratings yet

- Input Tax Credit Under GSTDocument7 pagesInput Tax Credit Under GSTskumarcwacaNo ratings yet

- Process Flow To Submit Tax Regime4102023Document12 pagesProcess Flow To Submit Tax Regime4102023Gokul KrishNo ratings yet

- Tax HDocument15 pagesTax HDeepesh SinghNo ratings yet

- Deduction Allowed and Not Allowed Under The Head Income From Business PDFDocument6 pagesDeduction Allowed and Not Allowed Under The Head Income From Business PDFMuhammad sheran sattiNo ratings yet

- Chapter 3-GSTDocument14 pagesChapter 3-GSTPooja D AcharyaNo ratings yet

- 76442bos61715 cp15Document73 pages76442bos61715 cp15Uma SinghalNo ratings yet

- Implementing VAT in Your Business: E-ServicesDocument1 pageImplementing VAT in Your Business: E-ServicesSalman YousufNo ratings yet

- Returns PDFDocument109 pagesReturns PDFKrishna VamsiNo ratings yet

- Suraj Sir 1Document8 pagesSuraj Sir 1Avinash YadavNo ratings yet

- GST Educational Series 01082017Document1 pageGST Educational Series 01082017Sundarachselvan SubramanianNo ratings yet

- IDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesDocument27 pagesIDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesRonita DuttaNo ratings yet

- Input Tax Credit MechanismDocument3 pagesInput Tax Credit MechanismRutvik PandyaNo ratings yet

- Goods and Services Tax Council Standing Committee On Capacity Building and FacilitationDocument61 pagesGoods and Services Tax Council Standing Committee On Capacity Building and FacilitationJeyakar PrabakarNo ratings yet

- 07) CIR V Seagate Tech PhilsDocument3 pages07) CIR V Seagate Tech PhilsAlfonso Miguel LopezNo ratings yet

- Input Tax Credit (Itc) (Section 16) : Sem 5: Procedure and Levy Under Gstgoods and Service TaxDocument3 pagesInput Tax Credit (Itc) (Section 16) : Sem 5: Procedure and Levy Under Gstgoods and Service TaxmanjulaNo ratings yet

- S - Viii: Bba - LL.B (Hons) Corporate LawsDocument20 pagesS - Viii: Bba - LL.B (Hons) Corporate LawsSalonee NayakNo ratings yet

- NMIMS - Session 4 - Withholding Taxes TDS and TCS On Sale of Goods Software TaxationDocument49 pagesNMIMS - Session 4 - Withholding Taxes TDS and TCS On Sale of Goods Software TaxationSachin KandloorNo ratings yet

- TDS Under Section 194C: Press Releases Blog PostsDocument4 pagesTDS Under Section 194C: Press Releases Blog PostsBalu Mahendra SusarlaNo ratings yet

- GST Refund ProcessDocument5 pagesGST Refund ProcessG L SWAMYNo ratings yet

- PGBP Chapter - Ay 2021-22 (May & Nov 2021 Exam)Document130 pagesPGBP Chapter - Ay 2021-22 (May & Nov 2021 Exam)hgoyal1998No ratings yet

- Bos 32722 P 4Document37 pagesBos 32722 P 4CmaChanduNo ratings yet

- Zero Rated Supplies Under GST: CA Sachin Kumar JainDocument3 pagesZero Rated Supplies Under GST: CA Sachin Kumar Jainparam.ginniNo ratings yet

- Reverse Charge MechanismDocument3 pagesReverse Charge MechanismARJUNNo ratings yet

- Goods and Services Tax (GST) in India: Input Tax Credit (ITC)Document24 pagesGoods and Services Tax (GST) in India: Input Tax Credit (ITC)Noman AreebNo ratings yet

- 013 Terms and Phrases You Must Know Under GST - Part IIDocument3 pages013 Terms and Phrases You Must Know Under GST - Part II0amrevkapeed0No ratings yet

- Input Tax CreditDocument45 pagesInput Tax CreditGourav PareekNo ratings yet

- GST - V2 - May 2023Document326 pagesGST - V2 - May 2023FhfhhNo ratings yet

- WTS Dhruva VAT Handbook PDFDocument40 pagesWTS Dhruva VAT Handbook PDFFaraz AkhtarNo ratings yet

- Goods & Services Tax: Returns by Input Service DistributorDocument1 pageGoods & Services Tax: Returns by Input Service DistributorSundarachselvan SubramanianNo ratings yet

- Goods & Services Tax: Educational SeriesDocument1 pageGoods & Services Tax: Educational SeriesSundarachselvan SubramanianNo ratings yet

- Definitions Under Integrated Goods & Services Tax Act, 2017Document1 pageDefinitions Under Integrated Goods & Services Tax Act, 2017Sundarachselvan SubramanianNo ratings yet

- GST Educational Series 01082017Document1 pageGST Educational Series 01082017Sundarachselvan SubramanianNo ratings yet

- Goods & Services Tax: Understanding Schedule II (Part - I)Document1 pageGoods & Services Tax: Understanding Schedule II (Part - I)Sundarachselvan SubramanianNo ratings yet

- Goods & Services Tax: Educational SeriesDocument1 pageGoods & Services Tax: Educational SeriesSundarachselvan SubramanianNo ratings yet

- Financial Service: III SemDocument3 pagesFinancial Service: III SemSundarachselvan Subramanian0% (1)

- Security Analysis and Portfolio Management: Multiple Choice QuestionsDocument2 pagesSecurity Analysis and Portfolio Management: Multiple Choice QuestionsSundarachselvan SubramanianNo ratings yet

- KanWhizz Business Presentation 97Document17 pagesKanWhizz Business Presentation 97Satya Pal80% (5)

- Reserve Bank of India and Its Role in IndiaDocument11 pagesReserve Bank of India and Its Role in IndiaHarish Chandani100% (1)

- Bus Math Sample Problem in HandoutsDocument7 pagesBus Math Sample Problem in HandoutsAria & Kira CatzNo ratings yet

- Managerial Finance chp5Document13 pagesManagerial Finance chp5Linda Mohammad FarajNo ratings yet

- Western Mindanao Adventist Academy 7028 Dumingag, Zamboanga Del Sur, PhilippinesDocument9 pagesWestern Mindanao Adventist Academy 7028 Dumingag, Zamboanga Del Sur, PhilippinesJoyce Torres100% (1)

- Distinguish Between Revaluation Account and Realisation AccountDocument1 pageDistinguish Between Revaluation Account and Realisation AccountshabukrNo ratings yet

- OceanPay PDFDocument6 pagesOceanPay PDFKodar StickoNo ratings yet

- Accounting Principles: Second Canadian EditionDocument25 pagesAccounting Principles: Second Canadian EditionEshetieNo ratings yet

- Liquidity Risk and FIs' ManagementDocument16 pagesLiquidity Risk and FIs' ManagementJose Anibal Insfran PelozoNo ratings yet

- FTTH Commission Payment ProcessDocument12 pagesFTTH Commission Payment ProcessVikrant PathakNo ratings yet

- 7case Digest Daguhoy Vs PonceDocument2 pages7case Digest Daguhoy Vs PonceJames ScoldNo ratings yet

- Employment Contract Sample Part Time and Full TimeDocument3 pagesEmployment Contract Sample Part Time and Full TimeAnonymous NiKZKWgKqNo ratings yet

- MCQ On Finals TaxesDocument7 pagesMCQ On Finals TaxesRandy ManzanoNo ratings yet

- Chapter 12 Exercise E12-7 SOLUTION Fall 2018Document2 pagesChapter 12 Exercise E12-7 SOLUTION Fall 2018Areeba QureshiNo ratings yet

- EXAMPLE OF INCOME STATEMENT Bella EnterpriseDocument2 pagesEXAMPLE OF INCOME STATEMENT Bella EnterprisemarivicNo ratings yet

- Chapter 10 and 11 HWDocument4 pagesChapter 10 and 11 HWkanielafinNo ratings yet

- Upbuild BookletDocument14 pagesUpbuild Bookletmrlee28No ratings yet

- Application Cum Form A2 For LRS Transactions - Revised - 28 - 03 - 2019Document5 pagesApplication Cum Form A2 For LRS Transactions - Revised - 28 - 03 - 2019Prabhu KnNo ratings yet

- TVM Practice Problems SolutionsDocument7 pagesTVM Practice Problems SolutionsAnne Bona100% (1)

- Loan Against Shares (LAS) AgreementDocument21 pagesLoan Against Shares (LAS) AgreementAshish ShahNo ratings yet

- 28 Pco Inc: Lecturer Resource Pack - QuestionsDocument2 pages28 Pco Inc: Lecturer Resource Pack - QuestionsCollen Takudzwa MuguyoNo ratings yet

- Nationwide Junior ISA Ts and CsDocument4 pagesNationwide Junior ISA Ts and CsSpartacus UkinNo ratings yet

- Seminar Outline 4Document16 pagesSeminar Outline 4cccqNo ratings yet

- Management & Organization of Stock Exchange - Mukesh CarpenterDocument22 pagesManagement & Organization of Stock Exchange - Mukesh CarpenterMukesh CarpenterNo ratings yet

- Chapter 17 Notes-Concepts, Homework Problems With AnswersDocument45 pagesChapter 17 Notes-Concepts, Homework Problems With Answersanilegna990% (2)

- R14 - UG - Wakala Musuwama PDFDocument30 pagesR14 - UG - Wakala Musuwama PDFSathya KumarNo ratings yet

- Incomes Chageable As Profits and Gains of Business and ProfessionDocument11 pagesIncomes Chageable As Profits and Gains of Business and ProfessionRishikesh KumarNo ratings yet