Professional Documents

Culture Documents

Old Final Course Paper 8: Indirect Tax Laws (100 Marks) : Section-Wise and Skill-Wise Weightage of Marks

Old Final Course Paper 8: Indirect Tax Laws (100 Marks) : Section-Wise and Skill-Wise Weightage of Marks

Uploaded by

Raghav TibdewalCopyright:

Available Formats

You might also like

- Demand Proof of Undertaking - Agreement With Child Support AgencyDocument4 pagesDemand Proof of Undertaking - Agreement With Child Support AgencyLamario StillwellNo ratings yet

- Internship ReportDocument1 pageInternship ReportMohameth HisamNo ratings yet

- Sample SalnDocument3 pagesSample SalnAN NANo ratings yet

- In The Court of Appeal of The State of CaliforniaDocument9 pagesIn The Court of Appeal of The State of CaliforniaCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasNo ratings yet

- 53975bos43334finalold p8Document2 pages53975bos43334finalold p8eswarmaddipatla2003No ratings yet

- CA Final Customs and Advanced Indirect Taxation and Int TaxDocument3 pagesCA Final Customs and Advanced Indirect Taxation and Int Taxyoyoabhi189No ratings yet

- Indirect Tax GSTDocument1 pageIndirect Tax GSTHemantsinh ParmarNo ratings yet

- Indirect Tax CustomsDocument1 pageIndirect Tax CustomsHemantsinh ParmarNo ratings yet

- Study Guidelines For May 2022 Examination: Final (New Course) Paper 8: Indirect Tax LawsDocument2 pagesStudy Guidelines For May 2022 Examination: Final (New Course) Paper 8: Indirect Tax Lawsparam.ginniNo ratings yet

- Study Guidelines For November 2022 Examination: Final Paper 8: Indirect Tax LawsDocument2 pagesStudy Guidelines For November 2022 Examination: Final Paper 8: Indirect Tax Lawsruhi MalviyaNo ratings yet

- Ca Final NotesDocument2 pagesCa Final NotesShantanuNo ratings yet

- Paper 4 Law WeightageDocument3 pagesPaper 4 Law Weightageexactincometax11No ratings yet

- Levy of and Exemptions From Customs Duty: After Studying This Chapter, You Would Be Able ToDocument56 pagesLevy of and Exemptions From Customs Duty: After Studying This Chapter, You Would Be Able ToNeha raiNo ratings yet

- Weightage Inter CADocument30 pagesWeightage Inter CAadityatiwari122006No ratings yet

- Introduction To Custom DutyDocument8 pagesIntroduction To Custom DutySnigdha DubeyNo ratings yet

- 53973bos43334iipc P4aDocument1 page53973bos43334iipc P4agadiyasiddhi0No ratings yet

- LLM Corporate Law SyllabusDocument10 pagesLLM Corporate Law SyllabusCorpsons MgtNo ratings yet

- GrammerDocument9 pagesGrammerrishabhmehta2008No ratings yet

- Levy of and Exemptions From Customs Duty: After Studying This Chapter, You Would Be Able ToDocument51 pagesLevy of and Exemptions From Customs Duty: After Studying This Chapter, You Would Be Able ToAkshay SeshaNo ratings yet

- Question PaperDocument3 pagesQuestion PaperAida AmalNo ratings yet

- Intermediate Examination Syllabus 2016 Paper 11: Indirect Taxation (ITX)Document12 pagesIntermediate Examination Syllabus 2016 Paper 11: Indirect Taxation (ITX)AnjaliNo ratings yet

- Introduction To Customs: Lakhan (A026) Vishesh (A030) Pranav Rai (A034) Rohan Soni (A050)Document25 pagesIntroduction To Customs: Lakhan (A026) Vishesh (A030) Pranav Rai (A034) Rohan Soni (A050)Lakhan KodiyatarNo ratings yet

- 57148bos46296 PDFDocument66 pages57148bos46296 PDFshris1No ratings yet

- DT New WeightsDocument3 pagesDT New WeightsSach SahuNo ratings yet

- 2008-04-21 - Trade Policy Review - Report by The Secretariat On ST Kitts & Nevis Rev1 (WTTPRS190KNAR1)Document49 pages2008-04-21 - Trade Policy Review - Report by The Secretariat On ST Kitts & Nevis Rev1 (WTTPRS190KNAR1)Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- Weightages of CA Inter Group - 1Document35 pagesWeightages of CA Inter Group - 1Rohit PaulNo ratings yet

- Revised RAE 27aug19Document13 pagesRevised RAE 27aug19DorthyNo ratings yet

- 76831bos61899 FinalDocument27 pages76831bos61899 FinalShailesh BapnaNo ratings yet

- Competition Law in India: ResearchDocument78 pagesCompetition Law in India: ResearchSamriddhiNo ratings yet

- ICAI WeightageDocument27 pagesICAI Weightagemrpstaff00007No ratings yet

- Overview of Customs Functions Under Customs Act, 1962 - Taxguru - inDocument2 pagesOverview of Customs Functions Under Customs Act, 1962 - Taxguru - inSuhani RathiNo ratings yet

- Paper I Management in Government Including Constitutional and Financial Management Framework (Without Books)Document13 pagesPaper I Management in Government Including Constitutional and Financial Management Framework (Without Books)প্রীতম সেনNo ratings yet

- Wco Self Assessment Checklist For Framework (Publication)Document18 pagesWco Self Assessment Checklist For Framework (Publication)mindiaNo ratings yet

- Detail SyllabusDocument1 pageDetail SyllabusJyoti Sankar BairagiNo ratings yet

- 05 Days Advanced Certificate Course On Import Export Management and Goods & Service Tax (GST)Document6 pages05 Days Advanced Certificate Course On Import Export Management and Goods & Service Tax (GST)SWAYAMBHU GROUPNo ratings yet

- 2010-09-29 - Trade Policy Review - Report by The Secretariat On Belize (WTTPRS238)Document7 pages2010-09-29 - Trade Policy Review - Report by The Secretariat On Belize (WTTPRS238)Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- Trade Policy Review Report by The Secretariat Barbados RevisionDocument9 pagesTrade Policy Review Report by The Secretariat Barbados RevisionOffice of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- GSTDocument194 pagesGSTMadhu kumarNo ratings yet

- Manual On Financial and Banking StatisticsDocument2 pagesManual On Financial and Banking StatisticsI MNo ratings yet

- 13 - Tax Law - Customs Law - 271219Document25 pages13 - Tax Law - Customs Law - 271219Sushil BansalNo ratings yet

- 2004-06-14 - Trade Policy Review - Report by The Secretariat On Belize (WTTPRS134-0)Document8 pages2004-06-14 - Trade Policy Review - Report by The Secretariat On Belize (WTTPRS134-0)Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- 76830bos61899 InterDocument35 pages76830bos61899 InterShailesh BapnaNo ratings yet

- Reference Layout of KYC Circular - RBIDocument6 pagesReference Layout of KYC Circular - RBIBhaskar GarimellaNo ratings yet

- Chap 2Document17 pagesChap 2Kiệt Lê Hoàng TuấnNo ratings yet

- FR Suggested May 2018Document31 pagesFR Suggested May 2018Rahul NandurkarNo ratings yet

- SAS Part-1 SyllabusDocument7 pagesSAS Part-1 Syllabusnagarjuna_upsc100% (1)

- FR PDFDocument2 pagesFR PDFBlastoiseNo ratings yet

- 2005-03-09 - Trade Policy Review - Report by The Secretariat On Jamaica Rev1. (WTTPRS139R1-0)Document9 pages2005-03-09 - Trade Policy Review - Report by The Secretariat On Jamaica Rev1. (WTTPRS139R1-0)Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- GST Scanner by DG SirDocument41 pagesGST Scanner by DG SirvishnuvermaNo ratings yet

- Intermediate Examination Syllabus 2016 Paper 7: Direct Taxation (DTX)Document21 pagesIntermediate Examination Syllabus 2016 Paper 7: Direct Taxation (DTX)Bharat ThackerNo ratings yet

- The Federal Value Added Tax Act, 2010: Chapter-I PRELIMINARYDocument53 pagesThe Federal Value Added Tax Act, 2010: Chapter-I PRELIMINARYWaqas ShafiqueNo ratings yet

- ACCT 4410 Taxation: Preparation Stage - Get Ready To Master The Subject MattersDocument21 pagesACCT 4410 Taxation: Preparation Stage - Get Ready To Master The Subject MattersElaine LingxNo ratings yet

- Ar EnglishDocument154 pagesAr EnglishAdeeb HusnainNo ratings yet

- Trade Policy Review Report by The Secretariat Guyana RevisionDocument10 pagesTrade Policy Review Report by The Secretariat Guyana RevisionOffice of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- 2003-10-07 - Trade Policy Review - Report by The Secretariat On Haiti Rev1. (WTTPRS99R1-0)Document11 pages2003-10-07 - Trade Policy Review - Report by The Secretariat On Haiti Rev1. (WTTPRS99R1-0)Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- The Federal Value Added Tax Act, 2010: Chapter-I PRELIMINARYDocument53 pagesThe Federal Value Added Tax Act, 2010: Chapter-I PRELIMINARYMuhammad AzamNo ratings yet

- Orld Rade Rganization: Trade Policy Review Chile Report by The SecretariatDocument9 pagesOrld Rade Rganization: Trade Policy Review Chile Report by The Secretariatishantkumararora7123No ratings yet

- Competition Law in IndiaDocument78 pagesCompetition Law in IndiaBusiness Law Group CUSBNo ratings yet

- Financial Reporting & Financial Statement Analysis Paper - Dse 6.1A FM - 80 Group - A (5x3 15)Document5 pagesFinancial Reporting & Financial Statement Analysis Paper - Dse 6.1A FM - 80 Group - A (5x3 15)tanmoy sardarNo ratings yet

- 74860bos60513 m2 cp1 p2 UnlockedDocument100 pages74860bos60513 m2 cp1 p2 Unlockedmohit kumarNo ratings yet

- East African Community Customs Management Act, 2004 (Revised 2021)Document177 pagesEast African Community Customs Management Act, 2004 (Revised 2021)Victor WahomeNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Information Technology Outsourcing Transactions: Process, Strategies, and ContractsFrom EverandInformation Technology Outsourcing Transactions: Process, Strategies, and ContractsNo ratings yet

- Esi August ExtensionDocument1 pageEsi August ExtensionRaghav TibdewalNo ratings yet

- Series 2 ADocument15 pagesSeries 2 ARaghav TibdewalNo ratings yet

- GST 11 Aug 2017Document2 pagesGST 11 Aug 2017Raghav TibdewalNo ratings yet

- GST 06 Jan 2018Document7 pagesGST 06 Jan 2018Raghav TibdewalNo ratings yet

- GST 29 July 2017Document1 pageGST 29 July 2017Raghav TibdewalNo ratings yet

- Customs Laws 02 Dec 2017Document2 pagesCustoms Laws 02 Dec 2017Raghav TibdewalNo ratings yet

- GST 27 NOV 2017 Class 1Document3 pagesGST 27 NOV 2017 Class 1Raghav TibdewalNo ratings yet

- Icai 3Document14 pagesIcai 3Raghav TibdewalNo ratings yet

- Chapter 9 Input Tax CreditDocument24 pagesChapter 9 Input Tax CreditRaghav TibdewalNo ratings yet

- Disa QB For e AssessmentDocument47 pagesDisa QB For e AssessmentRaghav TibdewalNo ratings yet

- G.R. No. 206294Document10 pagesG.R. No. 206294Anonymous KgPX1oCfrNo ratings yet

- NUPIC Doc 1 Bylaw June 2023 Revision 3 PDFDocument16 pagesNUPIC Doc 1 Bylaw June 2023 Revision 3 PDFVeronica BajañaNo ratings yet

- 66 Central Bank v. CloribelDocument3 pages66 Central Bank v. CloribelYaneeza MacapadoNo ratings yet

- Subject Matter JurisdictionDocument3 pagesSubject Matter JurisdictionPhil100% (8)

- Parent Consent To Guardian - Waiver of ServiceDocument1 pageParent Consent To Guardian - Waiver of ServiceToniaNivisonFoxNo ratings yet

- Alexis v. McDonald's Corp., 1st Cir. (1995)Document100 pagesAlexis v. McDonald's Corp., 1st Cir. (1995)Scribd Government DocsNo ratings yet

- Chapter 2 Oblicon ReviewerDocument7 pagesChapter 2 Oblicon ReviewerPetrelle RodrigoNo ratings yet

- People v. Lol-Lo (Art. 123)Document7 pagesPeople v. Lol-Lo (Art. 123)monagbayaniNo ratings yet

- Estrella Vs ComElecDocument8 pagesEstrella Vs ComElecJohnday MartirezNo ratings yet

- History and Evolution of Competition LawDocument18 pagesHistory and Evolution of Competition LawShubhankar ThakurNo ratings yet

- Performance Securing Declaration 2021Document2 pagesPerformance Securing Declaration 2021Mike Francis F GubuanNo ratings yet

- LaGrand CaseDocument2 pagesLaGrand CaseRose de Dios100% (1)

- Contract Jesse 23 Nov ORCHEDocument1 pageContract Jesse 23 Nov ORCHEJesse Perez0% (1)

- GR No. 213394. April 6, 2016 Spouses Emmanuel D. Pacquiao and Jinkee J. Pacquiao, Petitioners, vs. Court of Tax Appeals & Commission of Internal Revenue FactsDocument4 pagesGR No. 213394. April 6, 2016 Spouses Emmanuel D. Pacquiao and Jinkee J. Pacquiao, Petitioners, vs. Court of Tax Appeals & Commission of Internal Revenue FactsMay HumiwatNo ratings yet

- Rodrigues and The Outer Islands: Conditions of Service Specific To Mauritian OfficersDocument6 pagesRodrigues and The Outer Islands: Conditions of Service Specific To Mauritian OfficersKrishna OodhorahNo ratings yet

- General Power of AttorneyDocument2 pagesGeneral Power of AttorneySai PastranaNo ratings yet

- Nigeria Current Affairs Latest Questions and Answers PDF Free Download (1960 Till Date)Document123 pagesNigeria Current Affairs Latest Questions and Answers PDF Free Download (1960 Till Date)Deborah Omobolanle OlalekanNo ratings yet

- Appointment Reciept MADHUDocument3 pagesAppointment Reciept MADHUakash agarwalNo ratings yet

- Architect Delhi Urban Art CommissionDocument2 pagesArchitect Delhi Urban Art CommissionshahimabduNo ratings yet

- AASTHA HOSPITALITY Joining FormDocument5 pagesAASTHA HOSPITALITY Joining FormPoojaDesaiNo ratings yet

- International ConventionDocument3 pagesInternational ConventionOlga SîrbuNo ratings yet

- SAINT MARY CRUSADE TO ALLEVIATE POVERTY OF BRETHREN FOUNDATION, INC vs. HON. TEODORO T. RIELDocument2 pagesSAINT MARY CRUSADE TO ALLEVIATE POVERTY OF BRETHREN FOUNDATION, INC vs. HON. TEODORO T. RIELgemmaNo ratings yet

- Week4 Federal ConstitutionDocument18 pagesWeek4 Federal ConstitutionfariyiinNo ratings yet

- BOOK TWO - Crimes and Penalties TITLE ONE - Crimes Against National Security and The Law of The Nations CHAPTER ONE - Crimes Against National Security SECTION 1 - Treason and EspionageDocument2 pagesBOOK TWO - Crimes and Penalties TITLE ONE - Crimes Against National Security and The Law of The Nations CHAPTER ONE - Crimes Against National Security SECTION 1 - Treason and EspionageAP CruzNo ratings yet

- Authorization Letter 3000Document4 pagesAuthorization Letter 3000padayonnursingNo ratings yet

- Defective Products: Online ContentDocument67 pagesDefective Products: Online ContentEljabriNo ratings yet

- CONSTITUTIONDocument31 pagesCONSTITUTIONpcbranch.copNo ratings yet

Old Final Course Paper 8: Indirect Tax Laws (100 Marks) : Section-Wise and Skill-Wise Weightage of Marks

Old Final Course Paper 8: Indirect Tax Laws (100 Marks) : Section-Wise and Skill-Wise Weightage of Marks

Uploaded by

Raghav TibdewalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Old Final Course Paper 8: Indirect Tax Laws (100 Marks) : Section-Wise and Skill-Wise Weightage of Marks

Old Final Course Paper 8: Indirect Tax Laws (100 Marks) : Section-Wise and Skill-Wise Weightage of Marks

Uploaded by

Raghav TibdewalCopyright:

Available Formats

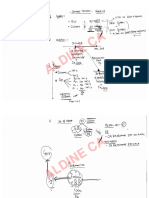

Section-wise and skill-wise weightage of marks

Old Final Course Paper 8: Indirect Tax Laws (100 marks)

Part-I: Goods and Services Tax (75 Marks)

Level I Level II Level III

Comprehension Analysis & Evaluation &

SECTION WEIGHTAGE Sl. No. CONTENT AREA & Knowledge Application Synthesis

10%-30% 40%-70% 20%-30%

I. 25%-35% 1.(ii) Levy and collection of CGST and IGST – Application of CGST/IGST

law; Concept of supply including composite and mixed supplies,

inter-State supply, intra-State supply, supplies in territorial waters;

Charge of tax; Exemption from tax; Composition levy

1.(vii) Reverse charge

1.(iii) Place of supply

1.(iv) Time and Value of supply

1.(v) Input tax credit

© The Institute of Chartered Accountants of India

II. 20%-30% 1.(vi) Computation of GST liability

III. 10%-30% 1.(vii) Procedures under GST – All procedures including registration, tax

invoice, credit and debit notes, electronic way bill, accounts and

records, returns, payment of tax, refund, job-work

1.(viii) Provisions relating to electronic commerce

1.(ix) Liability to pay in certain cases

IV. 10%-25% 1.(xii) Demand and Recovery

1.(xiii) Offences and Penalties

1.(xiv) Advance Ruling

1.(xv) Appeals and Revision

V. 5%-10% 1.(i) Constitutional aspects

1.(x) Administration of GST; Assessment and Audit

1.(xi) Inspection, Search, Seizure and Arrest

1.(xvi) Other provisions

© The Institute of Chartered Accountants of India

Part-II: Customs & FTP (25 Marks)

Level I Level II Level III

SECTION WEIGHTAGE Sl. No. CONTENT AREA Comprehension Analysis & Evaluation &

& Knowledge Application Synthesis

20%-40% 40%-70% 10%-20%

I. 20% - 40% 1.(ii) Levy of and exemptions from customs duties – All provisions

including application of customs law, taxable event, charge of

customs duty, exceptions to levy of customs duty, exemption from

custom duty

1.(iii) Types of customs duties

1.(iv) Valuation of imported and export goods

II. 40% - 70% 1.(vi) Import and Export Procedures – All import and export

procedures including special procedures relating to baggage,

goods imported or exported by post, stores

1.(viii) Warehousing

1.(ix) Drawback

1.(x) Demand and Recovery; Refund

1.(xi) Provisions relating to prohibited goods, notified goods, specified

goods, illegal importation/exportation of goods

1.(xii) Searches, seizure and arrest; Offences; Penalties; Confiscation

and Prosecution

© The Institute of Chartered Accountants of India

1.(xiii) Appeals and Revision; Advance Rulings; Settlement Commission

Foreign Trade Policy

2.(iii) Basic concepts relating to export promotion schemes provided

under FTP

III. 10% - 20% 1.(i) Introduction to customs law including Constitutional aspects

1.(iv) Classification of imported and export goods

1.(v) Officers of Customs; Appointment of customs ports, airports etc.

1.(vii) Provisions relating to coastal goods and vessels carrying coastal

goods

1.(xiv) Other provisions

Foreign Trade Policy

2.(i) Introduction to FTP – legislation governing FTP, salient features of

an FTP, administration of FTP, contents of FTP and other related

provisions

2.(ii) Basic concepts relating to import and export of goods

© The Institute of Chartered Accountants of India

You might also like

- Demand Proof of Undertaking - Agreement With Child Support AgencyDocument4 pagesDemand Proof of Undertaking - Agreement With Child Support AgencyLamario StillwellNo ratings yet

- Internship ReportDocument1 pageInternship ReportMohameth HisamNo ratings yet

- Sample SalnDocument3 pagesSample SalnAN NANo ratings yet

- In The Court of Appeal of The State of CaliforniaDocument9 pagesIn The Court of Appeal of The State of CaliforniaCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasNo ratings yet

- 53975bos43334finalold p8Document2 pages53975bos43334finalold p8eswarmaddipatla2003No ratings yet

- CA Final Customs and Advanced Indirect Taxation and Int TaxDocument3 pagesCA Final Customs and Advanced Indirect Taxation and Int Taxyoyoabhi189No ratings yet

- Indirect Tax GSTDocument1 pageIndirect Tax GSTHemantsinh ParmarNo ratings yet

- Indirect Tax CustomsDocument1 pageIndirect Tax CustomsHemantsinh ParmarNo ratings yet

- Study Guidelines For May 2022 Examination: Final (New Course) Paper 8: Indirect Tax LawsDocument2 pagesStudy Guidelines For May 2022 Examination: Final (New Course) Paper 8: Indirect Tax Lawsparam.ginniNo ratings yet

- Study Guidelines For November 2022 Examination: Final Paper 8: Indirect Tax LawsDocument2 pagesStudy Guidelines For November 2022 Examination: Final Paper 8: Indirect Tax Lawsruhi MalviyaNo ratings yet

- Ca Final NotesDocument2 pagesCa Final NotesShantanuNo ratings yet

- Paper 4 Law WeightageDocument3 pagesPaper 4 Law Weightageexactincometax11No ratings yet

- Levy of and Exemptions From Customs Duty: After Studying This Chapter, You Would Be Able ToDocument56 pagesLevy of and Exemptions From Customs Duty: After Studying This Chapter, You Would Be Able ToNeha raiNo ratings yet

- Weightage Inter CADocument30 pagesWeightage Inter CAadityatiwari122006No ratings yet

- Introduction To Custom DutyDocument8 pagesIntroduction To Custom DutySnigdha DubeyNo ratings yet

- 53973bos43334iipc P4aDocument1 page53973bos43334iipc P4agadiyasiddhi0No ratings yet

- LLM Corporate Law SyllabusDocument10 pagesLLM Corporate Law SyllabusCorpsons MgtNo ratings yet

- GrammerDocument9 pagesGrammerrishabhmehta2008No ratings yet

- Levy of and Exemptions From Customs Duty: After Studying This Chapter, You Would Be Able ToDocument51 pagesLevy of and Exemptions From Customs Duty: After Studying This Chapter, You Would Be Able ToAkshay SeshaNo ratings yet

- Question PaperDocument3 pagesQuestion PaperAida AmalNo ratings yet

- Intermediate Examination Syllabus 2016 Paper 11: Indirect Taxation (ITX)Document12 pagesIntermediate Examination Syllabus 2016 Paper 11: Indirect Taxation (ITX)AnjaliNo ratings yet

- Introduction To Customs: Lakhan (A026) Vishesh (A030) Pranav Rai (A034) Rohan Soni (A050)Document25 pagesIntroduction To Customs: Lakhan (A026) Vishesh (A030) Pranav Rai (A034) Rohan Soni (A050)Lakhan KodiyatarNo ratings yet

- 57148bos46296 PDFDocument66 pages57148bos46296 PDFshris1No ratings yet

- DT New WeightsDocument3 pagesDT New WeightsSach SahuNo ratings yet

- 2008-04-21 - Trade Policy Review - Report by The Secretariat On ST Kitts & Nevis Rev1 (WTTPRS190KNAR1)Document49 pages2008-04-21 - Trade Policy Review - Report by The Secretariat On ST Kitts & Nevis Rev1 (WTTPRS190KNAR1)Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- Weightages of CA Inter Group - 1Document35 pagesWeightages of CA Inter Group - 1Rohit PaulNo ratings yet

- Revised RAE 27aug19Document13 pagesRevised RAE 27aug19DorthyNo ratings yet

- 76831bos61899 FinalDocument27 pages76831bos61899 FinalShailesh BapnaNo ratings yet

- Competition Law in India: ResearchDocument78 pagesCompetition Law in India: ResearchSamriddhiNo ratings yet

- ICAI WeightageDocument27 pagesICAI Weightagemrpstaff00007No ratings yet

- Overview of Customs Functions Under Customs Act, 1962 - Taxguru - inDocument2 pagesOverview of Customs Functions Under Customs Act, 1962 - Taxguru - inSuhani RathiNo ratings yet

- Paper I Management in Government Including Constitutional and Financial Management Framework (Without Books)Document13 pagesPaper I Management in Government Including Constitutional and Financial Management Framework (Without Books)প্রীতম সেনNo ratings yet

- Wco Self Assessment Checklist For Framework (Publication)Document18 pagesWco Self Assessment Checklist For Framework (Publication)mindiaNo ratings yet

- Detail SyllabusDocument1 pageDetail SyllabusJyoti Sankar BairagiNo ratings yet

- 05 Days Advanced Certificate Course On Import Export Management and Goods & Service Tax (GST)Document6 pages05 Days Advanced Certificate Course On Import Export Management and Goods & Service Tax (GST)SWAYAMBHU GROUPNo ratings yet

- 2010-09-29 - Trade Policy Review - Report by The Secretariat On Belize (WTTPRS238)Document7 pages2010-09-29 - Trade Policy Review - Report by The Secretariat On Belize (WTTPRS238)Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- Trade Policy Review Report by The Secretariat Barbados RevisionDocument9 pagesTrade Policy Review Report by The Secretariat Barbados RevisionOffice of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- GSTDocument194 pagesGSTMadhu kumarNo ratings yet

- Manual On Financial and Banking StatisticsDocument2 pagesManual On Financial and Banking StatisticsI MNo ratings yet

- 13 - Tax Law - Customs Law - 271219Document25 pages13 - Tax Law - Customs Law - 271219Sushil BansalNo ratings yet

- 2004-06-14 - Trade Policy Review - Report by The Secretariat On Belize (WTTPRS134-0)Document8 pages2004-06-14 - Trade Policy Review - Report by The Secretariat On Belize (WTTPRS134-0)Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- 76830bos61899 InterDocument35 pages76830bos61899 InterShailesh BapnaNo ratings yet

- Reference Layout of KYC Circular - RBIDocument6 pagesReference Layout of KYC Circular - RBIBhaskar GarimellaNo ratings yet

- Chap 2Document17 pagesChap 2Kiệt Lê Hoàng TuấnNo ratings yet

- FR Suggested May 2018Document31 pagesFR Suggested May 2018Rahul NandurkarNo ratings yet

- SAS Part-1 SyllabusDocument7 pagesSAS Part-1 Syllabusnagarjuna_upsc100% (1)

- FR PDFDocument2 pagesFR PDFBlastoiseNo ratings yet

- 2005-03-09 - Trade Policy Review - Report by The Secretariat On Jamaica Rev1. (WTTPRS139R1-0)Document9 pages2005-03-09 - Trade Policy Review - Report by The Secretariat On Jamaica Rev1. (WTTPRS139R1-0)Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- GST Scanner by DG SirDocument41 pagesGST Scanner by DG SirvishnuvermaNo ratings yet

- Intermediate Examination Syllabus 2016 Paper 7: Direct Taxation (DTX)Document21 pagesIntermediate Examination Syllabus 2016 Paper 7: Direct Taxation (DTX)Bharat ThackerNo ratings yet

- The Federal Value Added Tax Act, 2010: Chapter-I PRELIMINARYDocument53 pagesThe Federal Value Added Tax Act, 2010: Chapter-I PRELIMINARYWaqas ShafiqueNo ratings yet

- ACCT 4410 Taxation: Preparation Stage - Get Ready To Master The Subject MattersDocument21 pagesACCT 4410 Taxation: Preparation Stage - Get Ready To Master The Subject MattersElaine LingxNo ratings yet

- Ar EnglishDocument154 pagesAr EnglishAdeeb HusnainNo ratings yet

- Trade Policy Review Report by The Secretariat Guyana RevisionDocument10 pagesTrade Policy Review Report by The Secretariat Guyana RevisionOffice of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- 2003-10-07 - Trade Policy Review - Report by The Secretariat On Haiti Rev1. (WTTPRS99R1-0)Document11 pages2003-10-07 - Trade Policy Review - Report by The Secretariat On Haiti Rev1. (WTTPRS99R1-0)Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- The Federal Value Added Tax Act, 2010: Chapter-I PRELIMINARYDocument53 pagesThe Federal Value Added Tax Act, 2010: Chapter-I PRELIMINARYMuhammad AzamNo ratings yet

- Orld Rade Rganization: Trade Policy Review Chile Report by The SecretariatDocument9 pagesOrld Rade Rganization: Trade Policy Review Chile Report by The Secretariatishantkumararora7123No ratings yet

- Competition Law in IndiaDocument78 pagesCompetition Law in IndiaBusiness Law Group CUSBNo ratings yet

- Financial Reporting & Financial Statement Analysis Paper - Dse 6.1A FM - 80 Group - A (5x3 15)Document5 pagesFinancial Reporting & Financial Statement Analysis Paper - Dse 6.1A FM - 80 Group - A (5x3 15)tanmoy sardarNo ratings yet

- 74860bos60513 m2 cp1 p2 UnlockedDocument100 pages74860bos60513 m2 cp1 p2 Unlockedmohit kumarNo ratings yet

- East African Community Customs Management Act, 2004 (Revised 2021)Document177 pagesEast African Community Customs Management Act, 2004 (Revised 2021)Victor WahomeNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Information Technology Outsourcing Transactions: Process, Strategies, and ContractsFrom EverandInformation Technology Outsourcing Transactions: Process, Strategies, and ContractsNo ratings yet

- Esi August ExtensionDocument1 pageEsi August ExtensionRaghav TibdewalNo ratings yet

- Series 2 ADocument15 pagesSeries 2 ARaghav TibdewalNo ratings yet

- GST 11 Aug 2017Document2 pagesGST 11 Aug 2017Raghav TibdewalNo ratings yet

- GST 06 Jan 2018Document7 pagesGST 06 Jan 2018Raghav TibdewalNo ratings yet

- GST 29 July 2017Document1 pageGST 29 July 2017Raghav TibdewalNo ratings yet

- Customs Laws 02 Dec 2017Document2 pagesCustoms Laws 02 Dec 2017Raghav TibdewalNo ratings yet

- GST 27 NOV 2017 Class 1Document3 pagesGST 27 NOV 2017 Class 1Raghav TibdewalNo ratings yet

- Icai 3Document14 pagesIcai 3Raghav TibdewalNo ratings yet

- Chapter 9 Input Tax CreditDocument24 pagesChapter 9 Input Tax CreditRaghav TibdewalNo ratings yet

- Disa QB For e AssessmentDocument47 pagesDisa QB For e AssessmentRaghav TibdewalNo ratings yet

- G.R. No. 206294Document10 pagesG.R. No. 206294Anonymous KgPX1oCfrNo ratings yet

- NUPIC Doc 1 Bylaw June 2023 Revision 3 PDFDocument16 pagesNUPIC Doc 1 Bylaw June 2023 Revision 3 PDFVeronica BajañaNo ratings yet

- 66 Central Bank v. CloribelDocument3 pages66 Central Bank v. CloribelYaneeza MacapadoNo ratings yet

- Subject Matter JurisdictionDocument3 pagesSubject Matter JurisdictionPhil100% (8)

- Parent Consent To Guardian - Waiver of ServiceDocument1 pageParent Consent To Guardian - Waiver of ServiceToniaNivisonFoxNo ratings yet

- Alexis v. McDonald's Corp., 1st Cir. (1995)Document100 pagesAlexis v. McDonald's Corp., 1st Cir. (1995)Scribd Government DocsNo ratings yet

- Chapter 2 Oblicon ReviewerDocument7 pagesChapter 2 Oblicon ReviewerPetrelle RodrigoNo ratings yet

- People v. Lol-Lo (Art. 123)Document7 pagesPeople v. Lol-Lo (Art. 123)monagbayaniNo ratings yet

- Estrella Vs ComElecDocument8 pagesEstrella Vs ComElecJohnday MartirezNo ratings yet

- History and Evolution of Competition LawDocument18 pagesHistory and Evolution of Competition LawShubhankar ThakurNo ratings yet

- Performance Securing Declaration 2021Document2 pagesPerformance Securing Declaration 2021Mike Francis F GubuanNo ratings yet

- LaGrand CaseDocument2 pagesLaGrand CaseRose de Dios100% (1)

- Contract Jesse 23 Nov ORCHEDocument1 pageContract Jesse 23 Nov ORCHEJesse Perez0% (1)

- GR No. 213394. April 6, 2016 Spouses Emmanuel D. Pacquiao and Jinkee J. Pacquiao, Petitioners, vs. Court of Tax Appeals & Commission of Internal Revenue FactsDocument4 pagesGR No. 213394. April 6, 2016 Spouses Emmanuel D. Pacquiao and Jinkee J. Pacquiao, Petitioners, vs. Court of Tax Appeals & Commission of Internal Revenue FactsMay HumiwatNo ratings yet

- Rodrigues and The Outer Islands: Conditions of Service Specific To Mauritian OfficersDocument6 pagesRodrigues and The Outer Islands: Conditions of Service Specific To Mauritian OfficersKrishna OodhorahNo ratings yet

- General Power of AttorneyDocument2 pagesGeneral Power of AttorneySai PastranaNo ratings yet

- Nigeria Current Affairs Latest Questions and Answers PDF Free Download (1960 Till Date)Document123 pagesNigeria Current Affairs Latest Questions and Answers PDF Free Download (1960 Till Date)Deborah Omobolanle OlalekanNo ratings yet

- Appointment Reciept MADHUDocument3 pagesAppointment Reciept MADHUakash agarwalNo ratings yet

- Architect Delhi Urban Art CommissionDocument2 pagesArchitect Delhi Urban Art CommissionshahimabduNo ratings yet

- AASTHA HOSPITALITY Joining FormDocument5 pagesAASTHA HOSPITALITY Joining FormPoojaDesaiNo ratings yet

- International ConventionDocument3 pagesInternational ConventionOlga SîrbuNo ratings yet

- SAINT MARY CRUSADE TO ALLEVIATE POVERTY OF BRETHREN FOUNDATION, INC vs. HON. TEODORO T. RIELDocument2 pagesSAINT MARY CRUSADE TO ALLEVIATE POVERTY OF BRETHREN FOUNDATION, INC vs. HON. TEODORO T. RIELgemmaNo ratings yet

- Week4 Federal ConstitutionDocument18 pagesWeek4 Federal ConstitutionfariyiinNo ratings yet

- BOOK TWO - Crimes and Penalties TITLE ONE - Crimes Against National Security and The Law of The Nations CHAPTER ONE - Crimes Against National Security SECTION 1 - Treason and EspionageDocument2 pagesBOOK TWO - Crimes and Penalties TITLE ONE - Crimes Against National Security and The Law of The Nations CHAPTER ONE - Crimes Against National Security SECTION 1 - Treason and EspionageAP CruzNo ratings yet

- Authorization Letter 3000Document4 pagesAuthorization Letter 3000padayonnursingNo ratings yet

- Defective Products: Online ContentDocument67 pagesDefective Products: Online ContentEljabriNo ratings yet

- CONSTITUTIONDocument31 pagesCONSTITUTIONpcbranch.copNo ratings yet