Professional Documents

Culture Documents

Chapter 2 Handfffout PDF

Chapter 2 Handfffout PDF

Uploaded by

dodoCopyright:

Available Formats

You might also like

- Hon. Caesar R. Dulay Bureau of Internal Revenue: CommissionerDocument4 pagesHon. Caesar R. Dulay Bureau of Internal Revenue: CommissionerPatrice Noelle Ramirez91% (11)

- Section 8.1 Review Questions (Page 275)Document65 pagesSection 8.1 Review Questions (Page 275)CJ Ngo100% (13)

- Dentist Chart of AccountDocument4 pagesDentist Chart of AccountrajawhbNo ratings yet

- Bank Guarantee Swift Mt760 Sample 2Document1 pageBank Guarantee Swift Mt760 Sample 2Божидар Денев100% (1)

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearDirector GGINo ratings yet

- Homework Chapter 2Document9 pagesHomework Chapter 2Thạch TrâmNo ratings yet

- Journal TransactionsDocument3 pagesJournal TransactionsFaye Garlitos100% (1)

- Gazetted Officer's Certificate/Annexure For PAN CardDocument1 pageGazetted Officer's Certificate/Annexure For PAN CardJeherul Bhuyan100% (5)

- General Journal, General Ledger and Trial Balance TemplateDocument14 pagesGeneral Journal, General Ledger and Trial Balance TemplateAnoop VgNo ratings yet

- Chapter 2: Financing Company Operations Practice Questions Vienna LTD General JournalDocument8 pagesChapter 2: Financing Company Operations Practice Questions Vienna LTD General Journalsyed rahmanNo ratings yet

- Afdf 3333Document8 pagesAfdf 3333DaddyNo ratings yet

- 02 - GROUP Soì Ì 1 - TEST GROUP NO.1Document15 pages02 - GROUP Soì Ì 1 - TEST GROUP NO.1My NguyenNo ratings yet

- SE10210Document3 pagesSE10210syed rahmanNo ratings yet

- Seminar Outline 8Document15 pagesSeminar Outline 8cccqNo ratings yet

- Outline - AC2101 Seminar 4-5 FA Outline - Revised - StudentsDocument35 pagesOutline - AC2101 Seminar 4-5 FA Outline - Revised - StudentsC.TangibleNo ratings yet

- General Ledger Account FormatDocument9 pagesGeneral Ledger Account FormatGideon BouroNo ratings yet

- E20.10 A) Webb Corp. Pension WorksheetDocument2 pagesE20.10 A) Webb Corp. Pension WorksheetLộc Nguyễn NhưNo ratings yet

- E20.10 A) Webb Corp. Pension WorksheetDocument2 pagesE20.10 A) Webb Corp. Pension WorksheetLộc Nguyễn NhưNo ratings yet

- 2023 August PART-4 MEMODocument10 pages2023 August PART-4 MEMOwomaninlaw911No ratings yet

- W 12 Receivables2344Document8 pagesW 12 Receivables2344DaddyNo ratings yet

- Acc AliabatDocument3 pagesAcc AliabatNUR AUNI DIYANA MOHD ROZALINo ratings yet

- Assessment Task - Tutorial Questions Assignment Unit Code: HA3011 Question 1 Answer (A It Costed $860,000 To Acquire The Machine. (B)Document7 pagesAssessment Task - Tutorial Questions Assignment Unit Code: HA3011 Question 1 Answer (A It Costed $860,000 To Acquire The Machine. (B)Jaydeep KushwahaNo ratings yet

- Chapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsDocument53 pagesChapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsMercy GamingNo ratings yet

- AF210 Unit 3 Tutorial Suggested SolutionsDocument5 pagesAF210 Unit 3 Tutorial Suggested SolutionsChand DivneshNo ratings yet

- Ak Lpd&bank Group 5Document30 pagesAk Lpd&bank Group 5Tata Intan Tamara100% (1)

- Kunci Jawaban Latihan Soal Chapter 01 - Current Liabilities, Provisions, and ContigenciesDocument2 pagesKunci Jawaban Latihan Soal Chapter 01 - Current Liabilities, Provisions, and ContigenciesHilma Nahla SawalyaNo ratings yet

- Solution Ultimate Sample Paper 2Document7 pagesSolution Ultimate Sample Paper 2Nitin KumarNo ratings yet

- I. Cases Case 12-16: Tully Corporation 30-Nov-10Document5 pagesI. Cases Case 12-16: Tully Corporation 30-Nov-10Tio SuyantoNo ratings yet

- Assignment 4 AnswersDocument5 pagesAssignment 4 AnswersĐào Huệ ChiNo ratings yet

- Tugas Akuntansi DasarDocument7 pagesTugas Akuntansi DasarJabbar aqwanNo ratings yet

- Soft Byte Company Journal Book: Date Description Ref. Debit (TK.) Credit (TK.)Document1 pageSoft Byte Company Journal Book: Date Description Ref. Debit (TK.) Credit (TK.)Siam FarhanNo ratings yet

- Soal Uts AkunDocument9 pagesSoal Uts AkunshasafebriantyNo ratings yet

- Jawaban Soal Yg Dikerjakan Chapter 17Document1 pageJawaban Soal Yg Dikerjakan Chapter 17CaratmelonaNo ratings yet

- T2 - ABFA1153 (Extra)Document2 pagesT2 - ABFA1153 (Extra)LOO YU HUANGNo ratings yet

- Chapter 1 - Recording Business TransactionDocument14 pagesChapter 1 - Recording Business TransactionThủy NguyễnNo ratings yet

- Ans 3 Assignment 2Document10 pagesAns 3 Assignment 2Swati PorwalNo ratings yet

- Jawaban 10 - Accounting For PensionDocument2 pagesJawaban 10 - Accounting For PensionBie SapuluhNo ratings yet

- Question A: Adjusting Entries in The Books of G Inc. Adjusting Journal Entries Sr. No. Particulars/Accounts Title Debit $ Credit $Document7 pagesQuestion A: Adjusting Entries in The Books of G Inc. Adjusting Journal Entries Sr. No. Particulars/Accounts Title Debit $ Credit $Talha Iftekhar KhanNo ratings yet

- Ffa TT3Document8 pagesFfa TT3Uyen NguyenNo ratings yet

- AF210 Q2.3 Corrected SolutionDocument1 pageAF210 Q2.3 Corrected SolutionChand DivneshNo ratings yet

- Assignment 2: Journal Entry & Ledger PostingDocument3 pagesAssignment 2: Journal Entry & Ledger PostingATBNo ratings yet

- Hsslive Xii Acc 3 Admission of A Partner KeyDocument8 pagesHsslive Xii Acc 3 Admission of A Partner KeyShinu ShinadNo ratings yet

- Ch2 The Recording Process ACC101Document15 pagesCh2 The Recording Process ACC101Muhammad KridliNo ratings yet

- Acc Formula PNS CycleDocument19 pagesAcc Formula PNS CycleJING RONG GOHNo ratings yet

- Acc 108 - AssignmentDocument3 pagesAcc 108 - AssignmentjoelgodfreyjpNo ratings yet

- Class Exercises - Reporting LiabilitiesDocument4 pagesClass Exercises - Reporting LiabilitiesShiftussy Enjoyer (JoniXx)No ratings yet

- Chapter 9 and Revision For ExamDocument19 pagesChapter 9 and Revision For ExamThanh UyênNo ratings yet

- DK Goal 6Document52 pagesDK Goal 6sahiltiwariii225No ratings yet

- Activity Acctg 1Document4 pagesActivity Acctg 1Elmeerajh JudavarNo ratings yet

- Name: Nguyen Thi Tien Tien: InstructionsDocument20 pagesName: Nguyen Thi Tien Tien: InstructionsChery Tiên TiênNo ratings yet

- TM 5 AKM 3 Ananda Dika M. 164Document4 pagesTM 5 AKM 3 Ananda Dika M. 164Bam BamNo ratings yet

- T Accounts and TB by Riffat JabeenDocument4 pagesT Accounts and TB by Riffat JabeenAbie AsifNo ratings yet

- Accounting-Bonus Issue and Right-Issue-1653399117076303Document17 pagesAccounting-Bonus Issue and Right-Issue-1653399117076303Badhrinath ShanmugamNo ratings yet

- Order 2547577Document8 pagesOrder 2547577KashémNo ratings yet

- PA-HW Chap3 + 4Document8 pagesPA-HW Chap3 + 4Hà Anh ĐỗNo ratings yet

- Tugas Pertemuan 11Document4 pagesTugas Pertemuan 11Hana NadhifaNo ratings yet

- Accounting Problem 1Document12 pagesAccounting Problem 1Reynaldo BurgosNo ratings yet

- Fundamentals of Accounting - Seatwork # 1Document3 pagesFundamentals of Accounting - Seatwork # 1ollem mark mamatoNo ratings yet

- Chapter 8 Cash BookDocument1 pageChapter 8 Cash BookMuhammad Zain BakhtawarNo ratings yet

- Financial & Managerial Accounting - JunXianDocument5 pagesFinancial & Managerial Accounting - JunXianhashtagjxNo ratings yet

- Accounts Class 12Document167 pagesAccounts Class 12Utkarsh Navandar100% (1)

- Luton Inc ExerciseDocument3 pagesLuton Inc ExerciseHue PhamNo ratings yet

- Book 1Document6 pagesBook 1Jane VillanuevaNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- Laboratory 6 ReportDocument3 pagesLaboratory 6 ReportdodoNo ratings yet

- Laboratory 6 ReportDocument3 pagesLaboratory 6 ReportdodoNo ratings yet

- CTH 225 CA01 Foundations of Critical Thinking: NothingDocument3 pagesCTH 225 CA01 Foundations of Critical Thinking: NothingdodoNo ratings yet

- What Does It Mean To Annotate A Text?Document2 pagesWhat Does It Mean To Annotate A Text?dodoNo ratings yet

- Project Budget: Program Title: Afterschool Sports Program at Boston CollegeDocument2 pagesProject Budget: Program Title: Afterschool Sports Program at Boston CollegedodoNo ratings yet

- Report Due November 9, 2019.: Please Enable Editing Before Filling Out This Report!Document3 pagesReport Due November 9, 2019.: Please Enable Editing Before Filling Out This Report!dodoNo ratings yet

- (DOC) Mt. Everest Simulation - Personal Reflection - Lukmon Sumola - Academia - Edu.Document12 pages(DOC) Mt. Everest Simulation - Personal Reflection - Lukmon Sumola - Academia - Edu.dodoNo ratings yet

- Risk Management Matrix Template: Name ObjectiveDocument3 pagesRisk Management Matrix Template: Name ObjectivedodoNo ratings yet

- 2019 TaxReturn PDFDocument23 pages2019 TaxReturn PDFalhajikura2252No ratings yet

- FTFCS 2023-04-14 1681510273125 PDFDocument17 pagesFTFCS 2023-04-14 1681510273125 PDFIvel RhaenNo ratings yet

- LNKD Invoice 5193804546Document2 pagesLNKD Invoice 5193804546avanti zoneNo ratings yet

- Annex C RR 11-2018Document1 pageAnnex C RR 11-2018Alyk CalionNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearKumari KhushbooNo ratings yet

- Income Taxes (IAS 12)Document15 pagesIncome Taxes (IAS 12)Mahir RahmanNo ratings yet

- Occupied House Property: Computation of Income From A SelfDocument34 pagesOccupied House Property: Computation of Income From A SelfVarun SinghviNo ratings yet

- Transaction Type of Transaction Effect Journal EntryDocument4 pagesTransaction Type of Transaction Effect Journal EntryDonabelle MarimonNo ratings yet

- Us 1099 2022Document4 pagesUs 1099 2022mks12No ratings yet

- MODULE 10 - Audit of Current Liabilities With DiscussionDocument130 pagesMODULE 10 - Audit of Current Liabilities With DiscussionDonise Ronadel SantosNo ratings yet

- Bradley, We'Ve Received Your Income-Based Repayment (Ibr) Plan Application From Studentaid - GovDocument2 pagesBradley, We'Ve Received Your Income-Based Repayment (Ibr) Plan Application From Studentaid - Govborn2dive 9702No ratings yet

- Income Taxation Finals Quiz 2Document7 pagesIncome Taxation Finals Quiz 2Jericho DupayaNo ratings yet

- Gov. Ron DeSantis Financial DisclosureDocument4 pagesGov. Ron DeSantis Financial DisclosureSkyler SwisherNo ratings yet

- Assessment of Individual's Income Tax in India: January 2018Document4 pagesAssessment of Individual's Income Tax in India: January 2018Jai VermaNo ratings yet

- Amendments To IFRS 2 'Share-Based Payment'Document1 pageAmendments To IFRS 2 'Share-Based Payment'Rizshelle D. AlarconNo ratings yet

- Course Outline Tax II - Karim Final SY 2223 PG1-2v2Document4 pagesCourse Outline Tax II - Karim Final SY 2223 PG1-2v2Lucifer MorningstarNo ratings yet

- On October 1, 2019, Helen Kennedy Opened An Advertising AgencyDocument7 pagesOn October 1, 2019, Helen Kennedy Opened An Advertising AgencyMakenson MillienNo ratings yet

- Budget Template and Samples GuideDocument5 pagesBudget Template and Samples GuidebelijobNo ratings yet

- Pay Bill of Gazzetted OfficerDocument1 pagePay Bill of Gazzetted OfficerPita 1No ratings yet

- Tax Invoice #29Q72Z: Date Ref Tour Pax Gross NettDocument1 pageTax Invoice #29Q72Z: Date Ref Tour Pax Gross NettKiran PNo ratings yet

- Income TaxDocument85 pagesIncome TaxvicsNo ratings yet

- Deceased Person, Trust and SettlementDocument12 pagesDeceased Person, Trust and SettlementLee HansNo ratings yet

- Darma Solusi Period 31 October 2015: NO Account Title Unadjusted Trial BalanceDocument9 pagesDarma Solusi Period 31 October 2015: NO Account Title Unadjusted Trial BalanceAlma SiwiNo ratings yet

- Income Taxation IndividualDocument6 pagesIncome Taxation IndividualJessa BeloyNo ratings yet

- Aspects of TaxationDocument1 pageAspects of TaxationJuvie AnNo ratings yet

Chapter 2 Handfffout PDF

Chapter 2 Handfffout PDF

Uploaded by

dodoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 2 Handfffout PDF

Chapter 2 Handfffout PDF

Uploaded by

dodoCopyright:

Available Formats

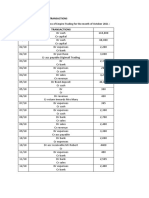

Chapter 2 Handout

Record the following adjusting entries for the month ended October 31, 2015:

1 Company purchased additional supplies totaling $6,200 on credit. Office supplies totaling $3,000 at 10/1/15, $2,400 remained at 10/31/15.

2 The Company paid for a two year property insurance policy on 10/1/15 with a total premium of $48,000.

3 Monthly depreciation for warehouse racking is $150. The equipment was purchased with an original cost of $12,600 on 10/1/15.

4 The Company receives a deposit for a contratcing job to take place in October and November for $15,000. Half of work is completed in October.

5 The Company reviews the month-end billing run and discovers that unbilled jobs for revenue earned totaled $7,500.

6 Invoices sent by advertising consultants totaling $25,000 are received the first week of November, but relate to services performed in October.

7 The Company pays salaries every other Monday for the two week period ending the prior Friday. Salaries paid on November 10 cover October 25th through November 7th.

Assuming the period includes five business days in October and the payroll for the period was $12,500.

8 Commissions are paid to sales personnel based on 2% of monthly gross revenue. Revenue for October was $1,000,000

9 Company lends money to a customer of $5,000 on October 1. Interest will be 6% annually.

Date Account Title and Explanation Debit Credit

1 10/1/15 Dr. Prepaid supplies $ 6,200

Cr. Accounts Payable $ 6,200

10/31/15 Dr. Supply expense $ 6,800

Cr. Prepaid supplies $ 6,800

2 10/1/15 Dr. Prepaid insurance $ 48,000

Cr. Cash $ 48,000

10/31/15 Dr. Insurance expense $ 2,000

Cr. Prepaid Insurance $ 2,000

3 10/1/15 Dr. Equipment $ 12,600

Cr. Accounts Payable $ 12,600

10/31/15 Dr. Depreciation expense $ 150

Cr. Accumulated Depreciation $ 150

4 10/31/15 Dr. Cash $ 15,000

Cr. Service revenue $ 15,000

Dr. Service Revenue $ 7,500

Cr. Unearned Revenue $ 7,500

5 10/31/15 Dr. Unbilled receivable (Accounts receivable) $ 7,500

Cr. Revenue $ 7,500

6 10/31/15 Dr. Consulting expense $ 25,000

Cr. Consulting Payable $ 25,000

7 10/31/15 Dr. Salary expense $ 6,250

Cr. Salaries Payable $ 6,250

8 10/31/15 Dr. Commission expense $ 20,000

Cr. Comissions Payable $ 20,000

9 10/31/15 Dr. Note receivable $ 5,000

Cr. Cash $ 5,000

Dr. Interest Receivable $ 25

Cr. Interest Income $ 25

You might also like

- Hon. Caesar R. Dulay Bureau of Internal Revenue: CommissionerDocument4 pagesHon. Caesar R. Dulay Bureau of Internal Revenue: CommissionerPatrice Noelle Ramirez91% (11)

- Section 8.1 Review Questions (Page 275)Document65 pagesSection 8.1 Review Questions (Page 275)CJ Ngo100% (13)

- Dentist Chart of AccountDocument4 pagesDentist Chart of AccountrajawhbNo ratings yet

- Bank Guarantee Swift Mt760 Sample 2Document1 pageBank Guarantee Swift Mt760 Sample 2Божидар Денев100% (1)

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearDirector GGINo ratings yet

- Homework Chapter 2Document9 pagesHomework Chapter 2Thạch TrâmNo ratings yet

- Journal TransactionsDocument3 pagesJournal TransactionsFaye Garlitos100% (1)

- Gazetted Officer's Certificate/Annexure For PAN CardDocument1 pageGazetted Officer's Certificate/Annexure For PAN CardJeherul Bhuyan100% (5)

- General Journal, General Ledger and Trial Balance TemplateDocument14 pagesGeneral Journal, General Ledger and Trial Balance TemplateAnoop VgNo ratings yet

- Chapter 2: Financing Company Operations Practice Questions Vienna LTD General JournalDocument8 pagesChapter 2: Financing Company Operations Practice Questions Vienna LTD General Journalsyed rahmanNo ratings yet

- Afdf 3333Document8 pagesAfdf 3333DaddyNo ratings yet

- 02 - GROUP Soì Ì 1 - TEST GROUP NO.1Document15 pages02 - GROUP Soì Ì 1 - TEST GROUP NO.1My NguyenNo ratings yet

- SE10210Document3 pagesSE10210syed rahmanNo ratings yet

- Seminar Outline 8Document15 pagesSeminar Outline 8cccqNo ratings yet

- Outline - AC2101 Seminar 4-5 FA Outline - Revised - StudentsDocument35 pagesOutline - AC2101 Seminar 4-5 FA Outline - Revised - StudentsC.TangibleNo ratings yet

- General Ledger Account FormatDocument9 pagesGeneral Ledger Account FormatGideon BouroNo ratings yet

- E20.10 A) Webb Corp. Pension WorksheetDocument2 pagesE20.10 A) Webb Corp. Pension WorksheetLộc Nguyễn NhưNo ratings yet

- E20.10 A) Webb Corp. Pension WorksheetDocument2 pagesE20.10 A) Webb Corp. Pension WorksheetLộc Nguyễn NhưNo ratings yet

- 2023 August PART-4 MEMODocument10 pages2023 August PART-4 MEMOwomaninlaw911No ratings yet

- W 12 Receivables2344Document8 pagesW 12 Receivables2344DaddyNo ratings yet

- Acc AliabatDocument3 pagesAcc AliabatNUR AUNI DIYANA MOHD ROZALINo ratings yet

- Assessment Task - Tutorial Questions Assignment Unit Code: HA3011 Question 1 Answer (A It Costed $860,000 To Acquire The Machine. (B)Document7 pagesAssessment Task - Tutorial Questions Assignment Unit Code: HA3011 Question 1 Answer (A It Costed $860,000 To Acquire The Machine. (B)Jaydeep KushwahaNo ratings yet

- Chapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsDocument53 pagesChapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsMercy GamingNo ratings yet

- AF210 Unit 3 Tutorial Suggested SolutionsDocument5 pagesAF210 Unit 3 Tutorial Suggested SolutionsChand DivneshNo ratings yet

- Ak Lpd&bank Group 5Document30 pagesAk Lpd&bank Group 5Tata Intan Tamara100% (1)

- Kunci Jawaban Latihan Soal Chapter 01 - Current Liabilities, Provisions, and ContigenciesDocument2 pagesKunci Jawaban Latihan Soal Chapter 01 - Current Liabilities, Provisions, and ContigenciesHilma Nahla SawalyaNo ratings yet

- Solution Ultimate Sample Paper 2Document7 pagesSolution Ultimate Sample Paper 2Nitin KumarNo ratings yet

- I. Cases Case 12-16: Tully Corporation 30-Nov-10Document5 pagesI. Cases Case 12-16: Tully Corporation 30-Nov-10Tio SuyantoNo ratings yet

- Assignment 4 AnswersDocument5 pagesAssignment 4 AnswersĐào Huệ ChiNo ratings yet

- Tugas Akuntansi DasarDocument7 pagesTugas Akuntansi DasarJabbar aqwanNo ratings yet

- Soft Byte Company Journal Book: Date Description Ref. Debit (TK.) Credit (TK.)Document1 pageSoft Byte Company Journal Book: Date Description Ref. Debit (TK.) Credit (TK.)Siam FarhanNo ratings yet

- Soal Uts AkunDocument9 pagesSoal Uts AkunshasafebriantyNo ratings yet

- Jawaban Soal Yg Dikerjakan Chapter 17Document1 pageJawaban Soal Yg Dikerjakan Chapter 17CaratmelonaNo ratings yet

- T2 - ABFA1153 (Extra)Document2 pagesT2 - ABFA1153 (Extra)LOO YU HUANGNo ratings yet

- Chapter 1 - Recording Business TransactionDocument14 pagesChapter 1 - Recording Business TransactionThủy NguyễnNo ratings yet

- Ans 3 Assignment 2Document10 pagesAns 3 Assignment 2Swati PorwalNo ratings yet

- Jawaban 10 - Accounting For PensionDocument2 pagesJawaban 10 - Accounting For PensionBie SapuluhNo ratings yet

- Question A: Adjusting Entries in The Books of G Inc. Adjusting Journal Entries Sr. No. Particulars/Accounts Title Debit $ Credit $Document7 pagesQuestion A: Adjusting Entries in The Books of G Inc. Adjusting Journal Entries Sr. No. Particulars/Accounts Title Debit $ Credit $Talha Iftekhar KhanNo ratings yet

- Ffa TT3Document8 pagesFfa TT3Uyen NguyenNo ratings yet

- AF210 Q2.3 Corrected SolutionDocument1 pageAF210 Q2.3 Corrected SolutionChand DivneshNo ratings yet

- Assignment 2: Journal Entry & Ledger PostingDocument3 pagesAssignment 2: Journal Entry & Ledger PostingATBNo ratings yet

- Hsslive Xii Acc 3 Admission of A Partner KeyDocument8 pagesHsslive Xii Acc 3 Admission of A Partner KeyShinu ShinadNo ratings yet

- Ch2 The Recording Process ACC101Document15 pagesCh2 The Recording Process ACC101Muhammad KridliNo ratings yet

- Acc Formula PNS CycleDocument19 pagesAcc Formula PNS CycleJING RONG GOHNo ratings yet

- Acc 108 - AssignmentDocument3 pagesAcc 108 - AssignmentjoelgodfreyjpNo ratings yet

- Class Exercises - Reporting LiabilitiesDocument4 pagesClass Exercises - Reporting LiabilitiesShiftussy Enjoyer (JoniXx)No ratings yet

- Chapter 9 and Revision For ExamDocument19 pagesChapter 9 and Revision For ExamThanh UyênNo ratings yet

- DK Goal 6Document52 pagesDK Goal 6sahiltiwariii225No ratings yet

- Activity Acctg 1Document4 pagesActivity Acctg 1Elmeerajh JudavarNo ratings yet

- Name: Nguyen Thi Tien Tien: InstructionsDocument20 pagesName: Nguyen Thi Tien Tien: InstructionsChery Tiên TiênNo ratings yet

- TM 5 AKM 3 Ananda Dika M. 164Document4 pagesTM 5 AKM 3 Ananda Dika M. 164Bam BamNo ratings yet

- T Accounts and TB by Riffat JabeenDocument4 pagesT Accounts and TB by Riffat JabeenAbie AsifNo ratings yet

- Accounting-Bonus Issue and Right-Issue-1653399117076303Document17 pagesAccounting-Bonus Issue and Right-Issue-1653399117076303Badhrinath ShanmugamNo ratings yet

- Order 2547577Document8 pagesOrder 2547577KashémNo ratings yet

- PA-HW Chap3 + 4Document8 pagesPA-HW Chap3 + 4Hà Anh ĐỗNo ratings yet

- Tugas Pertemuan 11Document4 pagesTugas Pertemuan 11Hana NadhifaNo ratings yet

- Accounting Problem 1Document12 pagesAccounting Problem 1Reynaldo BurgosNo ratings yet

- Fundamentals of Accounting - Seatwork # 1Document3 pagesFundamentals of Accounting - Seatwork # 1ollem mark mamatoNo ratings yet

- Chapter 8 Cash BookDocument1 pageChapter 8 Cash BookMuhammad Zain BakhtawarNo ratings yet

- Financial & Managerial Accounting - JunXianDocument5 pagesFinancial & Managerial Accounting - JunXianhashtagjxNo ratings yet

- Accounts Class 12Document167 pagesAccounts Class 12Utkarsh Navandar100% (1)

- Luton Inc ExerciseDocument3 pagesLuton Inc ExerciseHue PhamNo ratings yet

- Book 1Document6 pagesBook 1Jane VillanuevaNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- Laboratory 6 ReportDocument3 pagesLaboratory 6 ReportdodoNo ratings yet

- Laboratory 6 ReportDocument3 pagesLaboratory 6 ReportdodoNo ratings yet

- CTH 225 CA01 Foundations of Critical Thinking: NothingDocument3 pagesCTH 225 CA01 Foundations of Critical Thinking: NothingdodoNo ratings yet

- What Does It Mean To Annotate A Text?Document2 pagesWhat Does It Mean To Annotate A Text?dodoNo ratings yet

- Project Budget: Program Title: Afterschool Sports Program at Boston CollegeDocument2 pagesProject Budget: Program Title: Afterschool Sports Program at Boston CollegedodoNo ratings yet

- Report Due November 9, 2019.: Please Enable Editing Before Filling Out This Report!Document3 pagesReport Due November 9, 2019.: Please Enable Editing Before Filling Out This Report!dodoNo ratings yet

- (DOC) Mt. Everest Simulation - Personal Reflection - Lukmon Sumola - Academia - Edu.Document12 pages(DOC) Mt. Everest Simulation - Personal Reflection - Lukmon Sumola - Academia - Edu.dodoNo ratings yet

- Risk Management Matrix Template: Name ObjectiveDocument3 pagesRisk Management Matrix Template: Name ObjectivedodoNo ratings yet

- 2019 TaxReturn PDFDocument23 pages2019 TaxReturn PDFalhajikura2252No ratings yet

- FTFCS 2023-04-14 1681510273125 PDFDocument17 pagesFTFCS 2023-04-14 1681510273125 PDFIvel RhaenNo ratings yet

- LNKD Invoice 5193804546Document2 pagesLNKD Invoice 5193804546avanti zoneNo ratings yet

- Annex C RR 11-2018Document1 pageAnnex C RR 11-2018Alyk CalionNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearKumari KhushbooNo ratings yet

- Income Taxes (IAS 12)Document15 pagesIncome Taxes (IAS 12)Mahir RahmanNo ratings yet

- Occupied House Property: Computation of Income From A SelfDocument34 pagesOccupied House Property: Computation of Income From A SelfVarun SinghviNo ratings yet

- Transaction Type of Transaction Effect Journal EntryDocument4 pagesTransaction Type of Transaction Effect Journal EntryDonabelle MarimonNo ratings yet

- Us 1099 2022Document4 pagesUs 1099 2022mks12No ratings yet

- MODULE 10 - Audit of Current Liabilities With DiscussionDocument130 pagesMODULE 10 - Audit of Current Liabilities With DiscussionDonise Ronadel SantosNo ratings yet

- Bradley, We'Ve Received Your Income-Based Repayment (Ibr) Plan Application From Studentaid - GovDocument2 pagesBradley, We'Ve Received Your Income-Based Repayment (Ibr) Plan Application From Studentaid - Govborn2dive 9702No ratings yet

- Income Taxation Finals Quiz 2Document7 pagesIncome Taxation Finals Quiz 2Jericho DupayaNo ratings yet

- Gov. Ron DeSantis Financial DisclosureDocument4 pagesGov. Ron DeSantis Financial DisclosureSkyler SwisherNo ratings yet

- Assessment of Individual's Income Tax in India: January 2018Document4 pagesAssessment of Individual's Income Tax in India: January 2018Jai VermaNo ratings yet

- Amendments To IFRS 2 'Share-Based Payment'Document1 pageAmendments To IFRS 2 'Share-Based Payment'Rizshelle D. AlarconNo ratings yet

- Course Outline Tax II - Karim Final SY 2223 PG1-2v2Document4 pagesCourse Outline Tax II - Karim Final SY 2223 PG1-2v2Lucifer MorningstarNo ratings yet

- On October 1, 2019, Helen Kennedy Opened An Advertising AgencyDocument7 pagesOn October 1, 2019, Helen Kennedy Opened An Advertising AgencyMakenson MillienNo ratings yet

- Budget Template and Samples GuideDocument5 pagesBudget Template and Samples GuidebelijobNo ratings yet

- Pay Bill of Gazzetted OfficerDocument1 pagePay Bill of Gazzetted OfficerPita 1No ratings yet

- Tax Invoice #29Q72Z: Date Ref Tour Pax Gross NettDocument1 pageTax Invoice #29Q72Z: Date Ref Tour Pax Gross NettKiran PNo ratings yet

- Income TaxDocument85 pagesIncome TaxvicsNo ratings yet

- Deceased Person, Trust and SettlementDocument12 pagesDeceased Person, Trust and SettlementLee HansNo ratings yet

- Darma Solusi Period 31 October 2015: NO Account Title Unadjusted Trial BalanceDocument9 pagesDarma Solusi Period 31 October 2015: NO Account Title Unadjusted Trial BalanceAlma SiwiNo ratings yet

- Income Taxation IndividualDocument6 pagesIncome Taxation IndividualJessa BeloyNo ratings yet

- Aspects of TaxationDocument1 pageAspects of TaxationJuvie AnNo ratings yet