Professional Documents

Culture Documents

Sales: P1-,27A, OAO - 1LZB, O00 - )

Sales: P1-,27A, OAO - 1LZB, O00 - )

Uploaded by

Lovely Mae LariosaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sales: P1-,27A, OAO - 1LZB, O00 - )

Sales: P1-,27A, OAO - 1LZB, O00 - )

Uploaded by

Lovely Mae LariosaCopyright:

Available Formats

RgSA: The Rsiew Sdrool of Accounlancy hge a46 26

62. What is the adjusting journal entry to record the remaining unlocated difference between the

general ledger and the subsidiary ledger after consideration of all adjustments?

a. Accounts receivable P5,760

Bad debt expense P5,760

,b. Accounts receivable P5,760

Sales P5,760

C. Accounts receiv;rble P4,960

Sales P4,960

d.

Accounts receivable ?9,764

Bad debt expense P9,764

53. What is the accounts receivable balance on December 31, 2Ot4?

a. 793,20O c. 798,960

b. 79B,t6O d. 808,960

64. What is the required allowance for bad debt expense on December 31, 2014?

a, 19,457 c. 29,357

b. 19,857 d. 32,857

65. What ls the accounts receivable net of allowance for bad debts?

a. 774,143 c. 779,5O3

b.779,LO3 d. 779,903

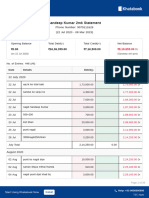

Pf,OTBLEM 21:

You ,are auditing the accounts receivable and the related allowance for bad debts account of Sayote

Inc. The control account of the aforementioned accounts had the following balances:

Accounts Receivable P1-,27A,OAO

Less: Allowance for bad debt _1LZB,O00_)

Net Book Value P1,192,000

Upon your investigation, you found out the following information:

3 ;-.e a:-.p,ei,1 s -3irrrdr -les [erm is n7'3O.

b. The allowance for bad debt account had the following details in the general ledger:

Allowance for Debts

July 31 Write off 24,OOOlJan. 1 Balance 30,ooo

Dec. 31 Provision 72,OAO

c. The subsidiary ledger balances of the company's accounts receivable as of December 31, 2014

contained the following information :

Debit Dalalces Credit !alanqgg

Under one month P540,O00 Kamote Co. P12,000

One to six months 552,000 Kutchay Corp. 21.000

Over slx months 22B,OOO Kalachuchi Inc. 27,OOA

P1,320,000 ___PggpQg_

Additional information

' The credit balance with Kamote Co. was for an overpayment from the customer. The

company delivered additional merchandise to Kamote Co. on January 3. 2O15 to cover such

overstatement.

' The credit balance of Kutchay Corp. was due to a posting error, the amount should have

been credited to Kutchara Corp for a 6O day outstanding receivable.

' The credit balance from Kalachuchi Inc. was a cash advance for a delivery to be made on

January 15, 2015.

d. It was estimated that 1 percent of accounts under one month is doubtful of collection while 2

percent of accounts one to six months are expected to require an allowance for doubtful of

collection. The accounts over six rnonths are analyzed as follows:

Defi nitely uncollecti ble P72,000

Doubtful (estimated to be 50o/o collectible) 36,0O0

Apparently good, but slow (estimated.to be 90o/o collectible) 120,000

Total _Ie?gpqq_

Required: Based on your audit, answer the following:

You might also like

- Standard Costing and Variance AnalysisDocument17 pagesStandard Costing and Variance AnalysisLovely Mae LariosaNo ratings yet

- Urdg 758Document33 pagesUrdg 758rupeshsingh1986No ratings yet

- ReceivablesDocument13 pagesReceivablesMikka100% (2)

- RecvbleDocument24 pagesRecvbleJoseph Salido100% (1)

- Audit of ReceivablesDocument29 pagesAudit of ReceivablesJoseph SalidoNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Representative Offices of Foreign Banks in CanadaDocument3 pagesRepresentative Offices of Foreign Banks in CanadaDhon Llabres100% (1)

- Hybrid FinancingDocument41 pagesHybrid Financingibong tiriritNo ratings yet

- Finals QuizDocument12 pagesFinals QuizLeslie Beltran ChiangNo ratings yet

- 03 Receivables PDFDocument13 pages03 Receivables PDFReyn Saplad PeralesNo ratings yet

- Receivables Problem 1: Account Is One To Six Months ClassificationDocument4 pagesReceivables Problem 1: Account Is One To Six Months ClassificationMary Grace NaragNo ratings yet

- 10.21.2017 Audit of ReceivablesDocument10 pages10.21.2017 Audit of ReceivablesPatOcampoNo ratings yet

- Audit of ReceivablesDocument3 pagesAudit of ReceivablesArlene Rose GonzaloNo ratings yet

- Finals - Receivables 2 Exercises WithoutDocument4 pagesFinals - Receivables 2 Exercises WithoutA.B AmpuanNo ratings yet

- Audit Ar With SolutionsDocument14 pagesAudit Ar With Solutionsbobo kaNo ratings yet

- Escorido Malfarta Accounts ReceivableDocument41 pagesEscorido Malfarta Accounts ReceivableAna Marie EscoridoNo ratings yet

- Receivables DiscussionDocument5 pagesReceivables DiscussionTrazy Jam BagsicNo ratings yet

- Audit of Receivables Pre-Assessment: Acctg35Document3 pagesAudit of Receivables Pre-Assessment: Acctg35Jeane Mae BooNo ratings yet

- Cup 1 FA 1 and FA 2Document16 pagesCup 1 FA 1 and FA 2Thony Danielle LabradorNo ratings yet

- Applied Auditing Audit of Receivables Problem 1: QuestionsDocument9 pagesApplied Auditing Audit of Receivables Problem 1: QuestionsPau SantosNo ratings yet

- 10.28.2017 MT (Audit of Receivables)Document7 pages10.28.2017 MT (Audit of Receivables)PatOcampo100% (1)

- Prelim CashDocument10 pagesPrelim CashMary Lynn Sta PriscaNo ratings yet

- Intacc ReceivablesDocument9 pagesIntacc Receivablesaugustokita5No ratings yet

- Audit of Accounting ReceivablesDocument9 pagesAudit of Accounting ReceivablesHelix HederaNo ratings yet

- Chapter 2 Audit of ReceivablesDocument33 pagesChapter 2 Audit of ReceivablesDominique Anne BenozaNo ratings yet

- Cordillera Career Development CollegeDocument12 pagesCordillera Career Development CollegeDonalyn BannagaoNo ratings yet

- QuizletDocument4 pagesQuizletKizzea Bianca GadotNo ratings yet

- Practice Problem 2 Cash ReconDocument5 pagesPractice Problem 2 Cash ReconKhyla DivinagraciaNo ratings yet

- AP - Loans & ReceivablesDocument11 pagesAP - Loans & ReceivablesDiane PascualNo ratings yet

- 6 Mock FAR Compre ExamDocument12 pages6 Mock FAR Compre ExamNatalia LimNo ratings yet

- ReceivablesDocument9 pagesReceivablesDiane Pascual0% (5)

- AP ReceivablesDocument13 pagesAP ReceivablesRegina Rebulado40% (5)

- AP Receivablesdocx PDF FreeDocument13 pagesAP Receivablesdocx PDF FreeAnn SaturayNo ratings yet

- AP - PreWeek - May 2022Document11 pagesAP - PreWeek - May 2022Miguel ManagoNo ratings yet

- 1Document13 pages1DesireeNo ratings yet

- Audit of Receivables Seatwork - Part 1 Solutions - Ooo-Problem 1Document6 pagesAudit of Receivables Seatwork - Part 1 Solutions - Ooo-Problem 1Aby ReedNo ratings yet

- Guerrero, Mariane Jean D. Page 1 of 4 Bsa 3: Auditing Problems Audit of Receivables Problem No. 1Document4 pagesGuerrero, Mariane Jean D. Page 1 of 4 Bsa 3: Auditing Problems Audit of Receivables Problem No. 1Mariane Jean GuerreroNo ratings yet

- Quiz # 11 Bank Reconciliation, Proof of Cash & AR - FinalDocument2 pagesQuiz # 11 Bank Reconciliation, Proof of Cash & AR - FinalDarren Jacob EspinaNo ratings yet

- Problem 5: QuestionsDocument6 pagesProblem 5: QuestionsTk KimNo ratings yet

- Lesson 2-ACCOUNTS RECEIVABLES-2021NADocument5 pagesLesson 2-ACCOUNTS RECEIVABLES-2021NAandreaNo ratings yet

- Accrued Income: College of Business Studies BS Accountancy Midterm ExaminationDocument4 pagesAccrued Income: College of Business Studies BS Accountancy Midterm ExaminationPineda, King Moises PangilinanNo ratings yet

- Auditing Problems: Audit of Cash and Cash Equivalents Problem No. 1Document21 pagesAuditing Problems: Audit of Cash and Cash Equivalents Problem No. 1ATLASNo ratings yet

- Quiz - Accounts ReceivableDocument3 pagesQuiz - Accounts ReceivableSamuel Bandibas0% (1)

- 2021 Prelim Exam Auditing Concepts and Applications 1Document15 pages2021 Prelim Exam Auditing Concepts and Applications 1moreNo ratings yet

- FAR Practice ProblemsDocument34 pagesFAR Practice ProblemsJhon Eljun Yuto EnopiaNo ratings yet

- ACT1104 Assignment 4Document5 pagesACT1104 Assignment 4cjorillosa2004No ratings yet

- Audit of Receivables ProblemsDocument9 pagesAudit of Receivables ProblemsMikaela JuanNo ratings yet

- Auditing Cup - 19 Rmyc Answer Key Elimination Round EasyDocument14 pagesAuditing Cup - 19 Rmyc Answer Key Elimination Round EasyFarhana GuiandalNo ratings yet

- CHAPTER 03 - Pg.4-6Document4 pagesCHAPTER 03 - Pg.4-6JabonJohnKennethNo ratings yet

- Audit of Receivables CaseDocument4 pagesAudit of Receivables CaseJohn Victor Mancilla MonzonNo ratings yet

- This Study Resource Was: Cash Flow - ProblemsDocument2 pagesThis Study Resource Was: Cash Flow - Problemsvenice cambryNo ratings yet

- S SdfafdafdafdafDocument8 pagesS SdfafdafdafdafMark Domingo MendozaNo ratings yet

- Problem 1: Finals - ReceivablesDocument4 pagesProblem 1: Finals - ReceivablesLeslie Beltran ChiangNo ratings yet

- Problem 7: QuestionsDocument4 pagesProblem 7: QuestionsTk KimNo ratings yet

- Audit of ReceivablesDocument9 pagesAudit of Receivablesmissy100% (2)

- Pre-Quali Examination - Level II - Cluster C AccountingDocument12 pagesPre-Quali Examination - Level II - Cluster C AccountingRobert CastilloNo ratings yet

- This Study Resource Was: AnswerDocument6 pagesThis Study Resource Was: AnswerKen SannNo ratings yet

- Single Entry Method and COE - AUD23Document4 pagesSingle Entry Method and COE - AUD23giofrancis.baledaNo ratings yet

- Drill 1 (15 Marks) : General Direction: Place On A Separate Sheet of Paper and Show Supporting Solutions in Good FormDocument3 pagesDrill 1 (15 Marks) : General Direction: Place On A Separate Sheet of Paper and Show Supporting Solutions in Good FormKaye GonxalesNo ratings yet

- AudithaccDocument3 pagesAudithaccTk KimNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- Itsaccountsreceivablestobplasof It: R Etrr/ F L (Document1 pageItsaccountsreceivablestobplasof It: R Etrr/ F L (Lovely Mae LariosaNo ratings yet

- P60, OO0 RM: Pto - OooDocument1 pageP60, OO0 RM: Pto - OooLovely Mae LariosaNo ratings yet

- The Review School No.: That orDocument1 pageThe Review School No.: That orLovely Mae LariosaNo ratings yet

- PSQC 1Document34 pagesPSQC 1Lovely Mae LariosaNo ratings yet

- Loo/O 37.: Profit ToDocument1 pageLoo/O 37.: Profit ToLovely Mae LariosaNo ratings yet

- Factory Overhead VarianceDocument8 pagesFactory Overhead VarianceLovely Mae LariosaNo ratings yet

- HO3 Pre Test 1Document3 pagesHO3 Pre Test 1Lovely Mae LariosaNo ratings yet

- MAS 2 - Standard CostingDocument13 pagesMAS 2 - Standard CostingLovely Mae Lariosa100% (1)

- Standard Costing and Variance AnalysisDocument17 pagesStandard Costing and Variance AnalysisLovely Mae Lariosa0% (1)

- STARBUCKS CORPORATION Financial RatiosDocument5 pagesSTARBUCKS CORPORATION Financial RatiosLovely Mae LariosaNo ratings yet

- Law Nego Pretest and Post TestDocument4 pagesLaw Nego Pretest and Post TestLovely Mae LariosaNo ratings yet

- Conversion CycleDocument44 pagesConversion CycleLovely Mae LariosaNo ratings yet

- Glosar NabavkiDocument20 pagesGlosar NabavkiSandra GlišićNo ratings yet

- Methods of Engineering Valuation - Lecture Material - DR MorakinyoDocument6 pagesMethods of Engineering Valuation - Lecture Material - DR MorakinyoEmmanuel OladeleNo ratings yet

- Percentage Speed Test: B-123-A MANGAL MARG, BAPU NAGAR JAIPUR (M) +919782519669Document4 pagesPercentage Speed Test: B-123-A MANGAL MARG, BAPU NAGAR JAIPUR (M) +919782519669piakapoorNo ratings yet

- Financial Accounting-An Overview: Course ObjectiveDocument6 pagesFinancial Accounting-An Overview: Course ObjectiveJohn DoeNo ratings yet

- SIX Swiss Exchange Swiss Leader Index (SLI) FactsheetDocument4 pagesSIX Swiss Exchange Swiss Leader Index (SLI) FactsheetjennabushNo ratings yet

- Automation, Manual & Computerised AccountingDocument16 pagesAutomation, Manual & Computerised AccountingAayush AnandNo ratings yet

- Aphermc Guidelines 2020-23 PDFDocument9 pagesAphermc Guidelines 2020-23 PDFSantoshHsotnasNo ratings yet

- Unpaid Seller: UNPAID SELLER: - (SEC.45) A Seller of Goods Is Deemed To Be An Unpaid SellerDocument3 pagesUnpaid Seller: UNPAID SELLER: - (SEC.45) A Seller of Goods Is Deemed To Be An Unpaid Sellerjerry zaidiNo ratings yet

- Fundamentals of Accounting 1Document8 pagesFundamentals of Accounting 1Kathleen MaynigoNo ratings yet

- Wei Peng Handbook-of-quantitative-finance-and-risk-management-2010-Chap 92Document17 pagesWei Peng Handbook-of-quantitative-finance-and-risk-management-2010-Chap 9220222991No ratings yet

- Forex Calendar at Forex FactoryDocument1 pageForex Calendar at Forex FactoryAnonymous TL6DhwK8mXNo ratings yet

- 04 Handout 1Document6 pages04 Handout 1Nhov CabralNo ratings yet

- F8 (AA) Kit - Que 81 Prancer ConstructionDocument2 pagesF8 (AA) Kit - Que 81 Prancer ConstructionChrisNo ratings yet

- Reading 22 Market-Based Valuation - Price and Enterprise Value MultiplesDocument50 pagesReading 22 Market-Based Valuation - Price and Enterprise Value Multiplestristan.riolsNo ratings yet

- Sapp - Deloitte Entrance TestDocument19 pagesSapp - Deloitte Entrance TestKim Ngan LeNo ratings yet

- Khatabook-Customer-Transactions-09 12 2023-04 45 01 PMDocument26 pagesKhatabook-Customer-Transactions-09 12 2023-04 45 01 PMPawan NayakNo ratings yet

- FM 211 Preparation of Journal EntriesDocument9 pagesFM 211 Preparation of Journal EntriesJuvy Jane DuarteNo ratings yet

- RBI Memorandum On DEAF SchemeDocument2 pagesRBI Memorandum On DEAF SchemeMoneylife FoundationNo ratings yet

- Chapter 6 BS 2 2PUCDocument20 pagesChapter 6 BS 2 2PUCVipin Mandyam KadubiNo ratings yet

- International Banking and FinanceDocument7 pagesInternational Banking and FinanceravikungwaniNo ratings yet

- Yield To Maturity (YTM) :: Answer To The Question No. 02Document13 pagesYield To Maturity (YTM) :: Answer To The Question No. 02nayna sharminNo ratings yet

- Comp50 Realgame Period 8Document24 pagesComp50 Realgame Period 8Nilesh JaiswalNo ratings yet

- Absorption Variable CostingDocument22 pagesAbsorption Variable CostingAaron ArellanoNo ratings yet

- Bri JunioDocument7 pagesBri JunioSinung Eko RaharjoNo ratings yet

- Gasbill 3429800000 201905 20190604131500Document1 pageGasbill 3429800000 201905 20190604131500Raza Production & FilmsNo ratings yet

- Guidlines For Project Practical Studies - BBADocument12 pagesGuidlines For Project Practical Studies - BBAShruti RAICHURANo ratings yet

- Law3 NotesDocument3 pagesLaw3 NotesLeon Genaro NaragaNo ratings yet