Professional Documents

Culture Documents

Valmiki Shiksha Sadan H. S. S.: Sent Up Examination-2071

Valmiki Shiksha Sadan H. S. S.: Sent Up Examination-2071

Uploaded by

Rabindra Raj Bista0 ratings0% found this document useful (0 votes)

30 views3 pagesThis document contains information about transactions and financial statements for multiple businesses. It includes:

1) Journal entries for purchases, sales, expenses, and payments for a business for the month of Ashadh 2062.

2) A trial balance and additional financial information for a trading concern as of Chaitra 31, including adjustments needed for the adjusted trial balance.

3) Machinery account information for a company over four years, including purchases, disposals, depreciation, and year-end balances.

4) A summary of assets and liabilities for a sole proprietorship business using single-entry accounting for the year ending Chaitra 2054.

Original Description:

NEB Grade XI and XII Questions

Original Title

Accountancy_1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains information about transactions and financial statements for multiple businesses. It includes:

1) Journal entries for purchases, sales, expenses, and payments for a business for the month of Ashadh 2062.

2) A trial balance and additional financial information for a trading concern as of Chaitra 31, including adjustments needed for the adjusted trial balance.

3) Machinery account information for a company over four years, including purchases, disposals, depreciation, and year-end balances.

4) A summary of assets and liabilities for a sole proprietorship business using single-entry accounting for the year ending Chaitra 2054.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

30 views3 pagesValmiki Shiksha Sadan H. S. S.: Sent Up Examination-2071

Valmiki Shiksha Sadan H. S. S.: Sent Up Examination-2071

Uploaded by

Rabindra Raj BistaThis document contains information about transactions and financial statements for multiple businesses. It includes:

1) Journal entries for purchases, sales, expenses, and payments for a business for the month of Ashadh 2062.

2) A trial balance and additional financial information for a trading concern as of Chaitra 31, including adjustments needed for the adjusted trial balance.

3) Machinery account information for a company over four years, including purchases, disposals, depreciation, and year-end balances.

4) A summary of assets and liabilities for a sole proprietorship business using single-entry accounting for the year ending Chaitra 2054.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

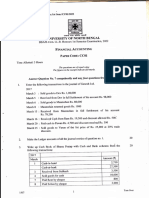

Sub.Code-112 Sub.

Code-112

Sub. Code : 124 Rs. 35000.

VALMIKI SHIKSHA SADAN H. S. Magh 22: Purchase from Rahul :

20 Tables of Rs 12000.

S. Required :

15 Chairs of Rs. 6000

(a) Purchase Book 2

Sent Up Examination-2071 b) Purchase Account 2

Subject: Principle's Accounting-I FM: 100 12. The following cash and Bank transaction are given.

Grade: XI Time: 3 hrs PM: 35 Jestha 1 : Cash in hand Rs. 7500 and Cash at Bank Rs. 15000.

Jestha 5 : Received cash from the debtors Rs. 95000 after deducting 5%

1. Give the meaning of Book Keeping in three to four effective sentences. 3 discount.

2. Explain the Money measurement concept. 2 Jestha 10 : Paid by cheque Rs. 2900 infullsettlement of Rs. 3000

3. Explain in short the features of Double entry system of Book Keeping. 3 Jestha 15 : Purchase goods for Rs. 45000 and paid Rs. 4000 in cash on the

4. Define Cheque and explain its type . 3 same date the Balance amount is also paid paid through cheque

5. Write any two points differentiating capital expenditure and revenue after receiving discount of Rs. 500.

expenditure. Jestha 20 : Cash deposited into Bank Rs. 2000.

6. Differentiate between Reserve and Provision with suitable example. 2 Required : Triple Column Cash Book. 5

7. Write any four features of government Accounting system. 2 13. Following information relating to a business were given to you on March 31.

8. Define Budget Sheet. Explain parts of Budget Sheet. 2 a) Debit side of Cash Book showed Bank balance Rs. 4800.

9. Give Accounting equation for the following transaction. b) Cheuqes issued prior to March 31 but not yet presented for payment

a) Started business with Cash Rs. 60000 and Bank Loan Rs. 30,000 Rs. 12500.

b) Rent Received Rs. 2000 and receivable Rs. 500 c) Cheque sent for collection of Rs. 6000 on March 15 has not yet been

d) Commission Received in Advance Rs. 1000 credited by Bank.

e) Amount withdrawn for domestic used Rs. 5000 d) Rs. 600 have wrongly been credited in the passbook by the Banker.

Required : Accounting equation 2 e) Interest of Rs. 350 collected and credited by the Bank.

10. Following transaction are given. f) Cheques of Rs. 5000, 6000 and 8000 were deposited into bank on

2062 Ashadh 1 Goods purchase of Rs. 70000. March 20 but cheque amounted to Rs. 5000 was not recorded in

2062 Ashadh 2 Goods purchase on credit from Ram of Rs. 30000. bank book till 31 March.

2062 Ashadh 5 Goods sold for Rs. 80000. Required : Bank Reconciliation Statement as on 31 st March. 6

2062 Ashadh 6 Goods withdrawn by proprietor for personal use Rs. 3000. 14. Give entry rectifying the following errors. 3

2062 Ashadh 7 Goods destroyed by fire of Rs. 5000 and claim admitted (a) A credit purchase of Rs. 8000 from Trade link has been recorded

by insurance company for Rs. 3000. as credit sales in the Book.

2062 Ashadh 8 Paid to Ram Rs. 29000 in full settlement of his Account. (b) General expenses of Rs. 10000 has been debited to commission

Required : a) Journal Entries 3 paid account.

b) Ram A/c 1 (c) Cash paid to Kumar Rs. 750 has been debited to his account by Rs.

11. Following Transactions of Rajesh Furniture are given. 570.

Magh 7: Purchase or credit from Raman 15. The following Trial Balance and adjustment of a trading concern on

10 Tables @ Rs. 500 each Chaitra 31 given to you.

30 Chairs @ Rs. 400 each. Trial balance

(Discount at 10%) Particular Debit Rs Credit

Magh 15: Purchase from Bimal on Cash. Drawing 12500

2 Amirahas @ Rs. 4000 each. Capital 160000

1 Sofa set @ Rs. 7000 each. Opening Stock 74400

Magh 20 : Purchase computer for office use from Hari on Credit

Carriage inward 12400 Total 190,000 190,000

Return inward 5000 Additional Information

Return to suppliers 7500 a) Outstanding wages. Rs. 3000.

Deposit with suppliers 18300 b) Depreciation on furniture to be provided at 10%.

Charges on sales 7000 c) Prepaid rent Rs. 2000.

Required : Adjusted Trial Balance

Rent Outstanding 1000

17. Rapti Company purchase a machine for Rs. 250,000 on 1 st July 2005.

Loan to Raju 10,000 Another machine was purchased at Rs. 200000 on 1 st January 2007. On

Interest on Loan 500 1st October 2007 the first machine became obsolete and disposed at a

Creditors 30,000 loss of Rs. 500. On the same date another new machine was purchased

Purchase 1130,000 for Rs. 100000. Company writes off depreciation on straight line method

Sales 1280,000 @10% p.a. Books of accounts are closed on 30th June each year.

Provision for Bad debt 12000 Required : Machinery Account for four year. 8

Debtors 60000 18. A trader who keeps his books of account on single entry system supplied

Goodwill 31000 to you the following summary of assets and liabilities of his business for

Advertisement 9500 the year ending Chaitra 2054. 4

Particular Amount Particular Amount

Bad debts 4000

Account Receivable 55000 Vehicle 20000

Discount allowed 3300

Stock Trade 30000 Cash at Bank 40000

Wages 7500

Sundry Creditors 60000 Furniture 25,000

Plant & Machinery 78000

Plant & Machinery 60000 Loan from Friends 10,000

Prepaid Insurance 2000

Goodwill written off. 5000 The Capital at the start of the Business considered cash of Rs. 10,000.

Bank balance of Rs. 50000 and trading goods Rs. 20,000. His monthly

Adjustment :

drawing was Rs. 600

a) Write off further Bad debts of Rs. 2000 and provision for bad debt 10% Additional Information :

b)Closing stock Rs. 188000. Depreciate plant and furniture by 10%. Bad debt Rs. 3000

c) Wages included Rs. 2000 paid for erection of plant. (a) Closing statement of affairs (b) Statement of profit and loss account

d)Depreciate plant by 10%. 19. Following transaction of Apolo colour Industry are given.

e)Prepaid Insurance expired Rs. 1500 Balance Sheet as on 1-1-2007

Required : (a) Trading Account Liabilities Rs. Assets Rs.

(b) Profit and loss a/c. Capital fund 125000 Machinery 12000

(c) Balance Sheet 4+6+5=15 O/S salaries 1000 Furniture 10000

16. An unadjusted Trial Balance of a concern is given below : 3 Advance Subscription 3000 Subscription due 2000

Particulars Debit Rs. Credit Rs. 10% Bank Loan 21000 Cash and Bank 18000

Bank 20,000 Total 150,000 Total 150,000

Purchase 46000 st

Receipt and Payment account on 31 Dec. 2008

Debtors 22000 Receipt Rs. Payment Rs.

Furniture 50,000 To Balance b/d 18000 By Salaries 20000

Salary 40,000 To Subscription : By Stationery 2500

Rent 12000 2007 2000 By Furniture 15000

Sales 90,000 2008 29000 By Repair 1500

Capital 60,000 To Sundry receipt 5000 By balance c/d 21000

Creditors 40,000 To Entrance fees 6000

Total 60,000 Total 60,000

Additional Information : 23. Following information are given.

(i) Depreciate on furniture @ 15% p.a. Budget Heads Annual Expenses up Expenses of

(ii) Half of the entrance fees are to be capitalized. (sub Head) Budget (Rs.) to Bhadra Aswin (Rs.)

(iii) Outstanding salaries Rs. 2000. (Rs.)

(iv) Subscription due for 2008 Rs. 4000 & 2009 for Rs. 5000. Salary 200000 80000 30000

Required : (i) Income and expenditure A/C 5 Allowances 10000 6000 1000

(ii) Balance sheet as on 31st December 2008. 5 Rent 50000 20000 4000

20. The following extracts are provided for the year ended 31 st De. Last year. Office supplies 50000 25000 4000

Description Debit Rs. Credit Rs. Furniture 70000 20000

Sundry Debtors 300000 Additional information

Provision for Bad debt 15000 Total revolving fund received Rs. 220,000

Bad debt 6000 Petty Cash fund Balance Rs. 1000

Additional information : Deposit from furniture suppliers Rs. 5000

a) Further Bad debts Rs. 15000. Required information : Statement of Expenditure. 6

b) Make a provision for doubtful debts at Rs. 4%.

Required : Provision for doubtful debts a/c 2

21. Following transaction of an operating office were given to you. The End

Falgun -4 : Received budget release order for actual expenditure of

previous month 80000 and bank order for Rs. 95000.

Falgun 19 : Furniture goods advance of Mr. Chaudhary Rs. 17000 has

been cleared against the bills for purchase of Rs. 19500 by

issuing cheque for balance amount.

Falgun 28 : Out of total salary of the months Rs. 33000 (including

government of Nepal contributors to P.F.) and allowances

of Rs. 1500 were distributed after deducting Rs. 6000 for

P.F. and Rs. 700 for income Tax .

Required : Journal Voucher 5

22. Following information are given to you.

Chaitra 1 : Balance at Bank Rs. 4000.

Chitra 5 : Receive Bank order for Rs. 60000 and budget relase order for

Rs. 52000

Chaitra 12 : Issued a cheque of Rs. 11400 in favour of the contractor for

road payment after deducting 5 % for deposit.

Chaitra 20 : Cheque issued for Ram Karki Rs. 30,000 advance for TADA.

Chaitra 25 : Issued cheque of Rs. 24000 for distribution of salary for the

month after deducting Rs. 6000 for PF and 3000 for PF loan.

Required : Posting in to Bank Cash Book. 5

You might also like

- Solution Manual For Operations and Supply Chain Management For Mbas 7th Edition Jack R Meredith Scott M ShaferDocument24 pagesSolution Manual For Operations and Supply Chain Management For Mbas 7th Edition Jack R Meredith Scott M ShaferFeliciaJohnsonjodeNo ratings yet

- Accounting From Incomplete Records For BookDocument21 pagesAccounting From Incomplete Records For BookbinuNo ratings yet

- EMEA Catafor Formulation BROCHURE - 2015 Copie 270934Document4 pagesEMEA Catafor Formulation BROCHURE - 2015 Copie 270934Duc NguyenNo ratings yet

- InterSchool Activity ScriptDocument7 pagesInterSchool Activity ScriptJessica Loren Leyco87% (15)

- Vesys Test Drive READMEDocument29 pagesVesys Test Drive READMEHota bNo ratings yet

- LHU8Q Olopr DaisyAcountXIDocument35 pagesLHU8Q Olopr DaisyAcountXIDido MuczNo ratings yet

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- Accountancy Three SetDocument10 pagesAccountancy Three Setrt6043663No ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Paper A1Document3 pagesTime Allowed: 3 Hours Max Marks: 100: Paper A1KashifNo ratings yet

- Exam Type Question of Accountancy, Class XiDocument3 pagesExam Type Question of Accountancy, Class Xirobinghimire100% (7)

- Accounts Paper Class 11 Sem 1 2019Document4 pagesAccounts Paper Class 11 Sem 1 2019samarthj.9390No ratings yet

- Fundamentals of Accounting 2021Document4 pagesFundamentals of Accounting 2021mariyabenny223No ratings yet

- (C) Prepare Suman Account With The Following Transactions:: I. Answer Any Two of The Following: 2 X 5 10Document3 pages(C) Prepare Suman Account With The Following Transactions:: I. Answer Any Two of The Following: 2 X 5 10M JEEVARATHNAM NAIDUNo ratings yet

- Faculty of Commerce: Code No. 10001Document4 pagesFaculty of Commerce: Code No. 10001Madasu BalnarsimhaNo ratings yet

- Class 11 Accounts Half Yearly SPDocument9 pagesClass 11 Accounts Half Yearly SPRakesh AgarwalNo ratings yet

- Delhi Pubic School, Nacharam Accountancy - Xi Question BankDocument9 pagesDelhi Pubic School, Nacharam Accountancy - Xi Question BanklasyaNo ratings yet

- Bba Bcom Ll.b-I-Fincncial Accounting CC01Document2 pagesBba Bcom Ll.b-I-Fincncial Accounting CC01vijay.s12usNo ratings yet

- Karnataka Ist PUC Accountcancy Sample Question Paper 4 PDFDocument4 pagesKarnataka Ist PUC Accountcancy Sample Question Paper 4 PDFNeha BaligaNo ratings yet

- Xi Accounting Set 4Document8 pagesXi Accounting Set 4aashirwad2076No ratings yet

- Xi Annual NewDocument5 pagesXi Annual NewPragadeshwar KarthikeyanNo ratings yet

- BCA & BSC (CS) Bussines Accounting I Internal QuestionDocument3 pagesBCA & BSC (CS) Bussines Accounting I Internal QuestionVignesh GopalNo ratings yet

- Xi Accounting Set 3Document6 pagesXi Accounting Set 3aashirwad2076No ratings yet

- Commerce First YearDocument7 pagesCommerce First Yearravulapallysona93No ratings yet

- Model Paper, Accountancy, XIDocument13 pagesModel Paper, Accountancy, XIanyaNo ratings yet

- Acc Xi Class Test-I 2022Document4 pagesAcc Xi Class Test-I 2022shaurya kapoorNo ratings yet

- Topic Wise Test Accounting From Incomplete RecordsDocument4 pagesTopic Wise Test Accounting From Incomplete RecordsChinmay GokhaleNo ratings yet

- Accounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationDocument5 pagesAccounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationRohan Chaugule0% (1)

- Account XIDocument2 pagesAccount XIDik EshNo ratings yet

- Vijayam Junior College:: Chittoor: Unior Mec Ii Terminal ExaminationsDocument2 pagesVijayam Junior College:: Chittoor: Unior Mec Ii Terminal ExaminationsM JEEVARATHNAM NAIDUNo ratings yet

- Accounting Send Up TestDocument3 pagesAccounting Send Up TestKashifNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- Class 11 Cbse Assighnment (New)Document3 pagesClass 11 Cbse Assighnment (New)carrotunchainedNo ratings yet

- Financial Accounting Unit 1Document7 pagesFinancial Accounting Unit 1MOAAZ AHMEDNo ratings yet

- June, 2004 Q.P JRDocument4 pagesJune, 2004 Q.P JRM JEEVARATHNAM NAIDUNo ratings yet

- Term 1 QP XI - Subjective Paper 40 MarksDocument3 pagesTerm 1 QP XI - Subjective Paper 40 MarksAditiNo ratings yet

- 11 QP Final (2021-22)Document4 pages11 QP Final (2021-22)Flick OPNo ratings yet

- Course Id 23324 CourseTitle Principals of Accounting and Costing-LABDocument4 pagesCourse Id 23324 CourseTitle Principals of Accounting and Costing-LABICIS CollegeNo ratings yet

- Module I Basic AccountingDocument11 pagesModule I Basic Accountingpaul amo100% (1)

- Problems On Journal, Ledger and Accounting EquationDocument11 pagesProblems On Journal, Ledger and Accounting EquationGopiNo ratings yet

- Nava Bharath National School Annur Annual Examination - 2021 AccountancyDocument5 pagesNava Bharath National School Annur Annual Examination - 2021 AccountancypranavNo ratings yet

- Accountancy XI. Raju Sir.1st TermDocument2 pagesAccountancy XI. Raju Sir.1st Termsuryarajaure554No ratings yet

- Fundamentals of Accounting Model Question PaperDocument3 pagesFundamentals of Accounting Model Question Paperabhishek509.pNo ratings yet

- I. Answer Any TWO of The Following Questions. 2 X 5 10Document3 pagesI. Answer Any TWO of The Following Questions. 2 X 5 10M JEEVARATHNAM NAIDUNo ratings yet

- Screenshot 2023-02-23 at 1.50.15 PMDocument18 pagesScreenshot 2023-02-23 at 1.50.15 PMnaveenmandla62No ratings yet

- Section "A" Very Short Answer Questions) (Attempt All Questions)Document5 pagesSection "A" Very Short Answer Questions) (Attempt All Questions)Ayusha TimalsinaNo ratings yet

- Journal TestDocument3 pagesJournal TestMenu GargNo ratings yet

- Xi Accountancy 80 Marks General InstructionsDocument5 pagesXi Accountancy 80 Marks General InstructionsJash ShahNo ratings yet

- Nov - 19 - Question and AnswersDocument15 pagesNov - 19 - Question and AnswersVidhi AgrawalNo ratings yet

- Dissolution + Single EntryDocument18 pagesDissolution + Single EntryOm JainNo ratings yet

- XI AccoutingDocument8 pagesXI AccoutingJaiswal BrotherNo ratings yet

- Ednovate CAF Accounts UT 1 QDocument3 pagesEdnovate CAF Accounts UT 1 QROCKYNo ratings yet

- March 2006 Q.P. JURDocument4 pagesMarch 2006 Q.P. JURM JEEVARATHNAM NAIDUNo ratings yet

- Jorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Document3 pagesJorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Abin DhakalNo ratings yet

- Fundamentals of Accounting 2019Document4 pagesFundamentals of Accounting 2019sreehari dineshNo ratings yet

- 11 AccDocument6 pages11 AccPushpinder KumarNo ratings yet

- Source Documents and Books of Original Entry QDocument6 pagesSource Documents and Books of Original Entry QMoses IngudiaNo ratings yet

- 2023 09 23 09 44Document7 pages2023 09 23 09 44Menu GargNo ratings yet

- (Final) Accountancy Class XiDocument4 pages(Final) Accountancy Class XiUmang AgarwalNo ratings yet

- Question 7Document2 pagesQuestion 7abhishek georgeNo ratings yet

- (Final) Accountancy Class XiDocument4 pages(Final) Accountancy Class XiUmang AgarwalNo ratings yet

- Interference of Light: Coherent SourcesDocument36 pagesInterference of Light: Coherent SourcesRabindra Raj BistaNo ratings yet

- Friction Part 1Document10 pagesFriction Part 1Rabindra Raj BistaNo ratings yet

- Quantum Phase TransitionDocument75 pagesQuantum Phase TransitionRabindra Raj BistaNo ratings yet

- Model Entrance Question (Science)Document5 pagesModel Entrance Question (Science)Rabindra Raj BistaNo ratings yet

- Valmiki Shiksha Sadan: Class Test 2077 Subject: Physics FM: 16 PM: 8 Time: 45 Min Set - 1Document2 pagesValmiki Shiksha Sadan: Class Test 2077 Subject: Physics FM: 16 PM: 8 Time: 45 Min Set - 1Rabindra Raj BistaNo ratings yet

- Model Physics XII 2nd Term 077Document4 pagesModel Physics XII 2nd Term 077Rabindra Raj BistaNo ratings yet

- p= E c hf fλ h λ λ= h p λ= h p - λ: Modern Physics By: Rabindra Raj Bista Short questions Quantization of EnergyDocument2 pagesp= E c hf fλ h λ λ= h p λ= h p - λ: Modern Physics By: Rabindra Raj Bista Short questions Quantization of EnergyRabindra Raj BistaNo ratings yet

- Auto 12x24 v2.7Document1,494 pagesAuto 12x24 v2.7Rabindra Raj BistaNo ratings yet

- Phy Practcal XI - Index 2077 - ValmikiDocument8 pagesPhy Practcal XI - Index 2077 - ValmikiRabindra Raj BistaNo ratings yet

- Balkumari Higher Sec. School: 2. Answer, in Brief, Any Two QuestionsDocument3 pagesBalkumari Higher Sec. School: 2. Answer, in Brief, Any Two QuestionsRabindra Raj BistaNo ratings yet

- BKHSS 1st Term 2067Document2 pagesBKHSS 1st Term 2067Rabindra Raj BistaNo ratings yet

- 5 Set Questions 2076Document9 pages5 Set Questions 2076Rabindra Raj BistaNo ratings yet

- Monthly Test (Bhadra - 070) Subject: Physics Class: 11 FM: 25 PM: 9 Time: 1 HR Set - IDocument2 pagesMonthly Test (Bhadra - 070) Subject: Physics Class: 11 FM: 25 PM: 9 Time: 1 HR Set - IRabindra Raj BistaNo ratings yet

- BMC B.SC. Sub CodeDocument2 pagesBMC B.SC. Sub CodeRabindra Raj BistaNo ratings yet

- VSS in ProspectusDocument3 pagesVSS in ProspectusRabindra Raj BistaNo ratings yet

- BMC B.SC. Sub CodeDocument2 pagesBMC B.SC. Sub CodeRabindra Raj BistaNo ratings yet

- Business PlanDocument55 pagesBusiness PlanRabindra Raj Bista100% (1)

- M. Sc. Physics First SemesterDocument4 pagesM. Sc. Physics First SemesterRabindra Raj BistaNo ratings yet

- You Need To Be Connected With Internet. You Should Have Gmail AccountDocument4 pagesYou Need To Be Connected With Internet. You Should Have Gmail AccountRabindra Raj BistaNo ratings yet

- Nursing Care at Home Business PlanDocument4 pagesNursing Care at Home Business PlanRabindra Raj BistaNo ratings yet

- Valmiki Shiksha Sadan H.S.S.: Second Term Examination - 2072 Subject: Chemistry FM: 75 Time: 3 Hrs PM: 27 Group 'A'Document2 pagesValmiki Shiksha Sadan H.S.S.: Second Term Examination - 2072 Subject: Chemistry FM: 75 Time: 3 Hrs PM: 27 Group 'A'Rabindra Raj BistaNo ratings yet

- Concrete Steel: ElasticityDocument2 pagesConcrete Steel: ElasticityRabindra Raj BistaNo ratings yet

- Physics XII 1st Term 075Document4 pagesPhysics XII 1st Term 075Rabindra Raj BistaNo ratings yet

- Kenya Supreme Court Justice Njoki Ndung'u's Dissenting VerdictDocument4 pagesKenya Supreme Court Justice Njoki Ndung'u's Dissenting VerdictThe Independent MagazineNo ratings yet

- PSR I455Document4 pagesPSR I455caronNo ratings yet

- Internship+Report-BUS498 8+Ishtiaque+Sarowar+Utsho+1912681630Document45 pagesInternship+Report-BUS498 8+Ishtiaque+Sarowar+Utsho+1912681630Fahrisah TazreeNo ratings yet

- Choosing An Ecommerce Platform GuideDocument40 pagesChoosing An Ecommerce Platform GuidejeetNo ratings yet

- Unity (Game Engine) - WikipediaDocument4 pagesUnity (Game Engine) - WikipediaRituraj TripathyNo ratings yet

- Indian Ports Community SystemDocument6 pagesIndian Ports Community Systempatil sNo ratings yet

- Nguyen Dai Duo NGDocument7 pagesNguyen Dai Duo NGtuan leNo ratings yet

- What Global Issues Have Emerged Because of Miscommunication DocxDocument10 pagesWhat Global Issues Have Emerged Because of Miscommunication DocxAvery SheperdNo ratings yet

- Alogrithm 02Document69 pagesAlogrithm 02Nebiyu Tefera ShiteNo ratings yet

- WALL STREET JOURNAL. CLASSROOM EDITION Chapter 14Document2 pagesWALL STREET JOURNAL. CLASSROOM EDITION Chapter 14Toby trittschlerNo ratings yet

- Analysis of GATE 2010Document25 pagesAnalysis of GATE 2010aloo_12345No ratings yet

- Budget Choux EkondjeDocument4 pagesBudget Choux EkondjePikol WeladjiNo ratings yet

- Perea RecommendationDocument1 pagePerea Recommendationapi-550296747No ratings yet

- A Flight Fare Prediction Using Machine LearningDocument8 pagesA Flight Fare Prediction Using Machine LearningIJRASETPublicationsNo ratings yet

- CTW320 Msy 00 El Abd 5002 01Document1 pageCTW320 Msy 00 El Abd 5002 01Jafffar MahasnehNo ratings yet

- Universal Pump Cart: No. PC200Document1 pageUniversal Pump Cart: No. PC200herbert madariagaNo ratings yet

- Monty 1510: Spare Parts List Tire ChangerDocument24 pagesMonty 1510: Spare Parts List Tire ChangerJonathan FullumNo ratings yet

- Omori Purple Background - Pesquisa GoogleDocument1 pageOmori Purple Background - Pesquisa Googleataide.leleo11No ratings yet

- Insolvency To Innovation: The Five-Year RecordDocument16 pagesInsolvency To Innovation: The Five-Year RecordGeorge RegneryNo ratings yet

- Technical Specification Wooden HousesDocument8 pagesTechnical Specification Wooden HousesNoor MohdNo ratings yet

- Compliance Check For Section 206AB & 206CCA - FAQsDocument7 pagesCompliance Check For Section 206AB & 206CCA - FAQsSushil KumarNo ratings yet

- 4183 17321 1 PBDocument12 pages4183 17321 1 PBUmiKulsumNo ratings yet

- Learning Contract ETHICSDocument2 pagesLearning Contract ETHICSBUAHIN JANNANo ratings yet

- ABMM2Document3 pagesABMM2QAISER IJAZNo ratings yet

- Rutgers University, Department of Electrical and Computer Engineering Abet Course Syllabus COURSE: 14:332:366Document3 pagesRutgers University, Department of Electrical and Computer Engineering Abet Course Syllabus COURSE: 14:332:366HUANG YINo ratings yet

- Ducati in Pursuit of MagicDocument16 pagesDucati in Pursuit of MagicJaideep ChauhanNo ratings yet