Professional Documents

Culture Documents

Bumi Serpong Damai: Solid Marketing Sales Achievement

Bumi Serpong Damai: Solid Marketing Sales Achievement

Uploaded by

owen.rijantoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bumi Serpong Damai: Solid Marketing Sales Achievement

Bumi Serpong Damai: Solid Marketing Sales Achievement

Uploaded by

owen.rijantoCopyright:

Available Formats

14 February 2018

Bumi Serpong Damai (BSDE IJ)

Company Update

BUY (Unchanged)

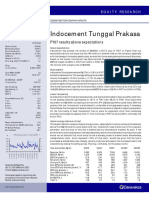

Stock Data Solid marketing sales achievement

Target price (Rp) Rp2,400

Marketing sales growing grew by 16% in FY17 in line with guidance.

Prior TP (Rp) Rp2,400

Shareprice (Rp) Rp1,785 Management is guiding for flat marketing sales in FY18.

Upside/downside (%) +34.5 Target recurring income of 20-25% in the next 5 years.

Equity | Indonesia | Property

Sharesoutstanding (m) 19,246 Maintain Buy with unchanged TP of Rp2,400.

Marketcap. (US$ m) 2,517

Free float (%) 38.9 FY17 marketing sales accounts for 104/100% of our/company’s target.

Avg. 6m dailyT/O (US$ m) 1.9 BSDE booked marketing sales of Rp7.2tn (+16% yoy) in FY17, which is came in

line with our/company’s forecast. The marketing sales were mainly supported by

Price Performance BSD commercial land plot sales of Rp1.6tn and Rp1.4tn to local conglomerate and

3M 6M 12M China Fortune Development, respectively. Commercial sales accounts for 50% of

Absolute (%) 6.9 -1.7 -5.6 FY17 total marketing sales, while residential sales and JV sales accounts for 39%

and 12%, respectively. Residential sales in BSD City contribute for 18% of FY17

Relative to JCI (%) -1.8 -13.3 -28.3

marketing sales, which was 40% below internal target and showing negative

52w high/low (Rp) 1,910 - 1,560

growth of 48% yoy. BSDE alleged that most of the residential sales are still

130

dominated by houses and apartment below Rp2bn.

125

120

115 Expect flat FY18 marketing sales, with 22% achievement as of mid Feb.

110 BSDE targets flat marketing sales of Rp7.2tn in FY18, however they are expecting

105

100 higher contribution from the residential sales of 51% (FY17: 39%). BSDE is

95

90 targeting marketing sales of Rp1.9tn (+43% yoy) from BSD City in FY18 as the

85 company is still confident with BSD city’s growth which is still enjoying high

80

growth in ASP (±20% yoy) supported by infrastructure development in the area,

Oct-17

Oct-17

Mar-17

Mar-17

May-17

May-17

Jun-17

Jul-17

Jul-17

Jan-18

Apr-17

Aug-17

Sep-17

Nov-17

Dec-17

Dec-17

Feb-17

Feb-18

mostly Serpong-Balaraja toll road. As of mid February, BSDE has booked

BSDE-Rebase JCI Index-Rebase

marketing sales of Rp1.6tn, cumulating to 22% of FY18 target. There are several

Major Shareholders notable sales in early 2018, which came from commercial lot sales of Rp600bn,

Paraga Arta Mida 26.6% Klaska Residence of Rp400bn and Jedi Cluster of Rp280bn.

Ekacentra Usahamaju 25.0%

To increase recurring income portion to 20-25% (FY17: 18%). As the

Public 38.9% company experienced slow sales during sluggish property condition in 2014-2017,

Estimate Change; Vs. Consensus BSDE plans to increase their recurring income portion in the next 5 years. In

2017 2018 2017, company managed to acquire two investment properties, namely Sinarmas

Latest EPS (Rp) 148.8 155.3 MSIG Tower (68k NLA) and Bakrie Tower (17k NLA). Sinarmas MSIG Tower and

Bakrie tower currently has 40% and 23% occupancy rates, representing total

Vs. Prior EPS (%) 0.0 0.0

yield of 4.2%. We forecast both building will have occupancy rate of 80% by 2019

Vs. Consensus (%) (2.7) 3.9

which represent yield of 7.6% These investment properties will help expand

Source: Bloomberg BSDE’s ROE to 8.7% in FY19 (vs. prior investment 8.5%).

Maintain Buy on BSDE with TP of Rp2,400. We continue to like BSDE due to

its resilient marketing sales in FY18. Despite sluggish property condition, BSDE

managed to book 16% growth in marketing sales (peers: 13%). We maintain our

Buy call on BSDE with TP of Rp2,400. BSDE is currently trades at 66% discount to

our estimate RNAV or 11.5x FY18F PE.

Year To 31 Dec 2015A 2016A 2017F 2018F 2019F

Revenue (RpBn) 6,210 6,522 8,094 8,452 8,737

EBITDA (RpBn) 3,018 2,965 3,880 4,046 4,205

EBITDA Growth (%) 10.9 (1.7) 30.8 4.3 3.9

Net Profit (RpBn) 2,139 1,796 2,865 2,988 3,027

EPS (Rp) 111 93 149 155 157

EPS Growth (%) (44.0) (16.0) 59.5 4.3 1.3

Net Gearing (%) 8.2 16.1 4.2 1.0 (0.7)

PER (x) 16.1 19.1 12.0 11.5 11.3

Joey Faustian PBV (x) 1.6 1.4 1.2 1.0 0.9

PT Indo Premier Sekuritas Dividend Yield (%) 0.3 0.8 0.5 1.7 1.7

joey.faustian@ipc.co.id EV/EBITDA (x) 12.0 13.0 9.2 8.6 8.1

+62 21 5793 1168 Source: BSDE, IndoPremier Share Price Closing as of : 13-February-2018

Refer to Important disclosures in the last page of this report

BSDE Company Update

Fig. 1: Marketing Sales trend 2013-2018F Fig. 2: Revenue Breakdown 2014-2019F

(Rp bn) Recurring income Property sales

7,600 100%

7,354 18% 18% 19% 17%

7,400 90% 20% 22%

7,225 7,200

7,200 80%

7,000 70%

6,758

6,800 60%

6,600 6,507 50%

6,400 40% 82% 82% 81% 83% 80% 78%

6,252

6,200 30%

6,000 20%

5,800 10%

5,600 0%

2013A 2014A 2015A 2016A 2017A 2018F 2014A 2015A 2016A 2017A 2018F 2019F

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 3: Gross Profit trend 2014-2019F Fig. 4: Operating Profit trend 2014-2019F

Operating profit Operating margin

Gross profit Gross margin

(Rp bn) (Rp bn)

7,000 74.7% 75% 4,500 47.5% 48.0%

74.2%

75% 4,000 46.7%

6,000 47.0%

73.5% 74% 46.1% 46.1%

3,500 45.9%

5,000 73.1% 74% 46.0%

72.9% 3,000

73%

4,000 2,500 45.0%

73%

3,000 71.8% 2,000 43.5% 44.0%

72%

1,500

2,000 72% 43.0%

71% 1,000

1,000 42.0%

71% 500

- 70% - 41.0%

2014A 2015A 2016A 2017F 2018F 2019F 2014A 2015A 2016A 2017F 2018F 2019F

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 5: Net Profit trend 2014-2019F Fig. 6: Quarterly Marketing Sales growth 1Q12-4Q17

Net profit Net margin

(Rp bn)

41%

4,500 80.0%

35% 34%

68.0% 34%

4,000 33%

70.0% 32% 32%

31%

3,500 29% 28%

60.0% 27%

3,000 24% 24%

50.0% 22%

22% 21%

2,500 19%

34.5% 35.4% 35.4% 34.6% 40.0%

19%

17%

2,000 27.5% 14% 18%

30.0%

1,500 12%

13%

20.0%

1,000 7%

500 10.0%

- 0.0%

1Q12 3Q12 1Q13 3Q13 1Q14 3Q14 1Q15 3Q15 1Q16 3Q16 1Q17 3Q17

2014A 2015A 2016A 2017F 2018F 2019F

Source: Company, IndoPremier Source: Company, IndoPremier

Refer to Important disclosures in the last page of this report 2

BSDE Company Update

Year To 31 Dec (RpBn) 2015A 2016A 2017F 2018F 2019F

Income Statement

Net Revenue 6,210 6,522 8,094 8,452 8,737

Cost of Sales (1,572) (1,840) (2,195) (2,276) (2,312)

Gross Profit 4,638 4,681 5,900 6,176 6,425

SG&A Expenses (1,737) (1,846) (2,165) (2,297) (2,400)

Operating Profit 2,901 2,835 3,734 3,879 4,025

Net Interest (324) (390) (387) (109) (154)

Forex Gain (Loss) 139 (116) 0 0 0

Others-Net 0 96 307 52 51

Pre-Tax Income 2,715 2,425 3,655 3,822 3,922

Income Tax (364) (387) (405) (433) (488)

Minorities (212) (241) (385) (402) (407)

Net Income 2,139 1,796 2,865 2,988 3,027

Balance Sheet

Cash & Equivalent 6,793 4,181 7,383 6,405 7,486

Receivable 168 422 524 547 565

Inventory 6,548 7,441 6,985 7,398 7,483

Other Current Assets 4,179 5,240 6,408 6,272 6,705

Total Current Assets 17,688 17,284 21,299 20,621 22,240

Fixed Assets - Net 12,675 14,900 17,255 20,572 23,865

Goodwill 9 9 9 9 9

Non Current Assets 5,650 6,098 6,098 6,098 6,098

Total Assets 36,022 38,292 44,662 47,300 52,211

ST Loans 1,897 377 377 377 1,377

Payable 317 261 0 215 212

Other Payables 4,050 4,454 6,750 7,050 7,290

Current Portion of LT Loans 158 577 1,783 469 1,093

Total Current Liab. 6,422 5,669 9,133 8,111 9,971

Long Term Loans 5,869 6,527 5,879 5,410 4,317

Other LT Liab. 1,634 1,576 937 959 977

Total Liabilities 13,925 13,772 15,949 14,480 15,265

Equity 8,122 8,168 8,168 8,168 8,168

Retained Earnings 10,728 12,412 15,097 17,513 19,942

Minority Interest 3,247 3,772 5,447 7,139 8,836

Total SHE + Minority Int. 22,097 24,353 28,713 32,820 36,946

Total Liabilities & Equity 36,022 38,125 44,662 47,300 52,211

Source: BSDE, IndoPremier

Refer to Important disclosures in the last page of this report 3

BSDE Company Update

Year to 31 Dec 2015A 2016A 2017F 2018F 2019F

Cash Flow

Net Income (Excl.Extraordinary&Min.Int) 2,351 2,038 3,250 3,390 3,434

Depr. & Amortization 196 225 286 319 355

Changes in Working Capital (2,503) (1,777) 1,540 (68) (270)

Others 121 85 (183) (326) (181)

Cash Flow From Operating 165 571 4,892 3,315 3,338

Capital Expenditure (6,924) (2,899) (2,640) (3,635) (3,648)

Others 5,068 293 320 405 400

Cash Flow From Investing (1,856) (2,605) (2,320) (3,231) (3,249)

Loans 3,618 (445) 558 (1,783) 531

Equity 1,771 12 0 0 0

Dividends (94) (289) (180) (573) (598)

Others (197) (160) 393 1,256 1,212

Cash Flow From Financing 5,098 (881) 772 (1,099) 1,146

Changes in Cash 3,406 (2,916) 3,344 (1,015) 1,235

Financial Ratios

Gross Margin (%) 74.7 71.8 72.9 73.1 73.5

Operating Margin (%) 46.7 43.5 46.1 45.9 46.1

Pre-Tax Margin (%) 43.7 37.2 45.1 45.2 44.9

Net Margin (%) 34.5 27.5 35.4 35.4 34.6

ROA (%) 6.7 4.8 6.9 6.5 6.1

ROE (%) 10.5 7.7 10.8 9.7 8.7

ROIC (%) 10.3 7.4 10.5 10.5 10.1

Acct. Receivables TO (days) 9.0 16.5 21.3 23.1 23.2

Acct. Receivables - Other TO (days) 0.0 0.0 0.0 0.0 0.0

Inventory TO (days) 0.3 0.3 0.3 0.3 0.3

Payable TO (days) 55.1 57.3 40.2 35.1 33.7

Acct. Payables - Other TO (days) 0.0 0.0 0.0 0.0 0.0

Debt to Equity (%) 35.9 30.7 28.0 19.1 18.4

Interest Coverage Ratio (x) 0.2 0.2 0.2 0.1 0.1

Net Gearing (%) 8.2 16.1 4.2 1.0 (0.7)

Source: BSDE, IndoPremier

Refer to Important disclosures in the last page of this report 4

Head Office

PT INDO PREMIER SEKURITAS

Wisma GKBI 7/F Suite 718

Jl. Jend. Sudirman No.28

Jakarta 10210 - Indonesia

p +62.21.5793.1168

f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period

HOLD : Expected total return between -10% and 10% within a 12-month period

SELL : Expected total return of -10% or worse within a 12-month period

ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analysts personal views about any and all of the subject securities or issuers; and no part of the

research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS

This research is based on information obtained from sources believed to be reliable, but we do not make any representation or warranty nor accept any

responsibility or liability as to its accuracy, completeness or correctness. Opinions expressed are subject to change without notice. This document is prepared for

general circulation. Any recommendations contained in this document does not have regard to the specific investment objectives, financial situation and the

particular needs of any specific addressee. This document is not and should not be construed as an offer or a solicitation of an offer to purchase or subscribe or

sell any securities. PT. Indo Premier Sekuritas or its affiliates may seek or will seek investment banking or other business relationships with the companies in this

report.

You might also like

- CruzJoaquin - ACCCOB1 - Chapter 1 Review of The Accounting CycleDocument37 pagesCruzJoaquin - ACCCOB1 - Chapter 1 Review of The Accounting CycleInigo CruzNo ratings yet

- Chapter 1 Partnership Formation Test BanksDocument49 pagesChapter 1 Partnership Formation Test BanksLizza Marie Casidsid90% (20)

- Raymond Initiating CoverageDocument20 pagesRaymond Initiating Coveragenarayanan_rNo ratings yet

- MGMT 026 Connect Chapter 3 Homework HQ PDFDocument28 pagesMGMT 026 Connect Chapter 3 Homework HQ PDFKailash KumarNo ratings yet

- Indo Premier BISI - A Good Start This YearDocument6 pagesIndo Premier BISI - A Good Start This YearKPH BaliNo ratings yet

- Wijaya Karya: Healthiest Balance Sheet Among PeersDocument6 pagesWijaya Karya: Healthiest Balance Sheet Among PeersmidiakbaraNo ratings yet

- Intp 080318Document3 pagesIntp 080318Cristiano DonzaghiNo ratings yet

- Indo Premier RALS - Stronger Lebaran 2018 SalesDocument5 pagesIndo Premier RALS - Stronger Lebaran 2018 SalesTanjung YanugrohoNo ratings yet

- United Tractors BUY: Another Upgrade On Strong ResultsDocument6 pagesUnited Tractors BUY: Another Upgrade On Strong ResultsbenuNo ratings yet

- Industrial Estate: Strong Sales To Drive Sector's ReratingDocument3 pagesIndustrial Estate: Strong Sales To Drive Sector's ReratingRamdha Dien AzkaNo ratings yet

- Initiating Coverage Report On Future Lifestyle FashionDocument54 pagesInitiating Coverage Report On Future Lifestyle Fashionsujay85No ratings yet

- BUY Avenue Supermarts: Strong Result Maintain Our Investment ThesisDocument9 pagesBUY Avenue Supermarts: Strong Result Maintain Our Investment ThesisjigarchhatrolaNo ratings yet

- Market ResearchDocument1 pageMarket ResearchShielaMarie MalanoNo ratings yet

- Mps LTD: Moderate Topline Growth, Margins Impacted Due To Stronger RupeeDocument6 pagesMps LTD: Moderate Topline Growth, Margins Impacted Due To Stronger RupeeAbhijit TripathiNo ratings yet

- Sun Pharma: Promising Specialty PipelineDocument8 pagesSun Pharma: Promising Specialty PipelineDinesh ChoudharyNo ratings yet

- Sun Pharmaceuticals: Price: INR 508 Target Price: INR 604Document4 pagesSun Pharmaceuticals: Price: INR 508 Target Price: INR 604Pooja MannaNo ratings yet

- India Infoline Limited (INDINF) : Next Delta Missing For Steep GrowthDocument24 pagesIndia Infoline Limited (INDINF) : Next Delta Missing For Steep Growthanu nitiNo ratings yet

- Pembangunan Perumahan: Better in TimeDocument13 pagesPembangunan Perumahan: Better in TimeadetyarahmawanNo ratings yet

- Jain Irrigation Systems LTD: AccumulateDocument6 pagesJain Irrigation Systems LTD: Accumulatesaran21No ratings yet

- Alembic Pharma - 4QFY19 - HDFC Sec-201905091034594285107Document10 pagesAlembic Pharma - 4QFY19 - HDFC Sec-201905091034594285107Ravikiran SuryanarayanamurthyNo ratings yet

- Vaibhav Global Research ReportDocument4 pagesVaibhav Global Research ReportVikrant SadanaNo ratings yet

- Avenue Supermarts LTD.: Margin Reset UnderwayDocument9 pagesAvenue Supermarts LTD.: Margin Reset UnderwayAshokNo ratings yet

- Icici Sec Berger PaintsDocument6 pagesIcici Sec Berger PaintsvenugopallNo ratings yet

- Apcotex Industries 230817 PDFDocument7 pagesApcotex Industries 230817 PDFADNo ratings yet

- 8 13 2007 (Pioneer In) PAGE Industries Q1FY08 - Pio00522Document7 pages8 13 2007 (Pioneer In) PAGE Industries Q1FY08 - Pio00522api-3740729No ratings yet

- Korea Investment & Sekuritas Indonesia CPIN - The Resilient IntegratorDocument8 pagesKorea Investment & Sekuritas Indonesia CPIN - The Resilient Integratorgo joNo ratings yet

- Research Report Maruti Suzuki Ltd.Document8 pagesResearch Report Maruti Suzuki Ltd.Harshavardhan pasupuletiNo ratings yet

- SML Isuzu LTD: Weak Quarter Due To Seasonality, Still Maintains GrowthDocument5 pagesSML Isuzu LTD: Weak Quarter Due To Seasonality, Still Maintains Growthamitnpatel1No ratings yet

- IP SILO Results Note 171101Document6 pagesIP SILO Results Note 171101gloridoroNo ratings yet

- Tanla Platform: Inline Performance With Strong Traction in Platform SegmentDocument7 pagesTanla Platform: Inline Performance With Strong Traction in Platform Segmentprateeksri10No ratings yet

- Centrum 4.6.18 CMP - 595 TP - 1070Document9 pagesCentrum 4.6.18 CMP - 595 TP - 1070jeetu16No ratings yet

- Cadila - Health Karvy 141119Document8 pagesCadila - Health Karvy 141119Harshit SinghNo ratings yet

- HDFC Sec Report On Vinati OrganicsDocument21 pagesHDFC Sec Report On Vinati Organicssujay85No ratings yet

- PP London Sumatra Indonesia: Equity ResearchDocument6 pagesPP London Sumatra Indonesia: Equity Researchkrisyanto krisyantoNo ratings yet

- Traders Club - Nov. 21Document5 pagesTraders Club - Nov. 21Peter ErnstNo ratings yet

- Axis Detailed Report - May 2020 PDFDocument118 pagesAxis Detailed Report - May 2020 PDFRohan AdlakhaNo ratings yet

- Ambit Insights - 07sept2017 StaffingDocument7 pagesAmbit Insights - 07sept2017 StaffinggreyistariNo ratings yet

- Sadbhav Engineering: Driving in The Right LaneDocument5 pagesSadbhav Engineering: Driving in The Right LanesuprabhattNo ratings yet

- Deepak Fertilizers & Petrochemicals Corporation: Result As Per Expectation, Project On TimeDocument4 pagesDeepak Fertilizers & Petrochemicals Corporation: Result As Per Expectation, Project On TimeNandan AcharyaNo ratings yet

- Supreme Industries: Margin Surprises PositivelyDocument12 pagesSupreme Industries: Margin Surprises Positivelysaran21No ratings yet

- Godrej Consumer Products Limited 44 QuarterUpdateDocument9 pagesGodrej Consumer Products Limited 44 QuarterUpdateKhushboo SharmaNo ratings yet

- Coverage Stock: S H Kelkar & Company LTD.: Flavour' of The Season Likely To Smell' SuccessDocument26 pagesCoverage Stock: S H Kelkar & Company LTD.: Flavour' of The Season Likely To Smell' SuccessMiteshNo ratings yet

- Embassy Office Parks REIT - Initiating Coverage - Axis Direct - 23!12!2019 - 14Document30 pagesEmbassy Office Parks REIT - Initiating Coverage - Axis Direct - 23!12!2019 - 14Yash ChhabraNo ratings yet

- Buyung Poetra Sembada: The Premium PlayerDocument24 pagesBuyung Poetra Sembada: The Premium PlayerFahlevie RNo ratings yet

- SMI OCBC Report (May17)Document4 pagesSMI OCBC Report (May17)Douglas LimNo ratings yet

- Li & Fung DB ReportDocument14 pagesLi & Fung DB ReportfwdnishantNo ratings yet

- On Track: Bison ConsolidatedDocument9 pagesOn Track: Bison ConsolidatedJOHN SKILLNo ratings yet

- Ciptadana Sekuritas ASRI - Growing Recurring IncomeDocument6 pagesCiptadana Sekuritas ASRI - Growing Recurring Incomebudi handokoNo ratings yet

- Gudang Garam: ASP Hikes Ahead of 2022F Excise Tax HikeDocument7 pagesGudang Garam: ASP Hikes Ahead of 2022F Excise Tax Hikemaradona ligaNo ratings yet

- Prada (1913 HK) : Rich in Valuation Plus Sluggish Growth AheadDocument8 pagesPrada (1913 HK) : Rich in Valuation Plus Sluggish Growth AheadKebun NagaNo ratings yet

- Bekasi Fajar Industrial EstateDocument7 pagesBekasi Fajar Industrial EstateOm OlerNo ratings yet

- PT Ciptadana Sekuritas BEST - First Time Land Sold in 3Q21 After Zero Sales Last YearDocument7 pagesPT Ciptadana Sekuritas BEST - First Time Land Sold in 3Q21 After Zero Sales Last Yearrisyad laochiNo ratings yet

- Natco Pharma: In-Line PAT On Strong Margin Stronger Q4 GuidanceDocument7 pagesNatco Pharma: In-Line PAT On Strong Margin Stronger Q4 GuidanceMridul TodiNo ratings yet

- Subscribe: Bharat Dynamics LTDDocument9 pagesSubscribe: Bharat Dynamics LTDkk4486No ratings yet

- Chartwatchers - Emerging Markets Huddle To Triumph Over VolatilityDocument29 pagesChartwatchers - Emerging Markets Huddle To Triumph Over VolatilityAnonymous Gh3QD7E5OzNo ratings yet

- UPL Company Update - 030520 - Emkay PDFDocument15 pagesUPL Company Update - 030520 - Emkay PDFshaikhsaadahmedNo ratings yet

- Jasa Marga: Equity ResearchDocument7 pagesJasa Marga: Equity ResearchKhorbina SiregarNo ratings yet

- Cummins - Q1FY16 Results Review 7aug15Document9 pagesCummins - Q1FY16 Results Review 7aug15HimanshuNo ratings yet

- Aegis Logistics: Volumes Inching Up Capacity Expansion Augurs Well BuyDocument6 pagesAegis Logistics: Volumes Inching Up Capacity Expansion Augurs Well BuynnsriniNo ratings yet

- Uflex LTD.: Better Times Ahead!Document5 pagesUflex LTD.: Better Times Ahead!MuskanNo ratings yet

- Unichem Lab (UNILAB) : On TrackDocument6 pagesUnichem Lab (UNILAB) : On Trackcos.secNo ratings yet

- Alembic Pharma LTD: Stock Price & Q4 Results of Alembic Pharma - HDFC SecuritiesDocument10 pagesAlembic Pharma LTD: Stock Price & Q4 Results of Alembic Pharma - HDFC SecuritiesHDFC SecuritiesNo ratings yet

- FAR Final Preboard QuestionaireDocument18 pagesFAR Final Preboard Questionaireyzhlansang.studentNo ratings yet

- SOCI - Financial Statements Per 31 Dec 2019Document127 pagesSOCI - Financial Statements Per 31 Dec 2019Jefri Formen PangaribuanNo ratings yet

- Assignment Help Guide SheetDocument11 pagesAssignment Help Guide SheetShakil KhanNo ratings yet

- Financial Statement Version-TPCODLDocument87 pagesFinancial Statement Version-TPCODLBiswajit GhoshNo ratings yet

- CH 1 - Kombinasi BisnisDocument29 pagesCH 1 - Kombinasi BisnisJulia Pratiwi ParhusipNo ratings yet

- Grace Fidelia - AKD (Pertemuan 11)Document6 pagesGrace Fidelia - AKD (Pertemuan 11)Grace FideliaNo ratings yet

- Addl Correction of TB Errors - 20200921 - 0002Document3 pagesAddl Correction of TB Errors - 20200921 - 0002Dalemma FranciscoNo ratings yet

- P2Document7 pagesP2Jomar VillenaNo ratings yet

- Mco 03 Block 02 1559781031Document112 pagesMco 03 Block 02 1559781031arushichananaNo ratings yet

- FR & Fsa Sem-6 GKJ (Final File) - 02!03!24 (Final)Document72 pagesFR & Fsa Sem-6 GKJ (Final File) - 02!03!24 (Final)bharatipaul42No ratings yet

- Financial Accounts Assingnment 3Document5 pagesFinancial Accounts Assingnment 3Zakarya KhanNo ratings yet

- Chapter 4Document35 pagesChapter 4Mohammad Mostafa MostafaNo ratings yet

- Buscom Midterm PDF FreeDocument29 pagesBuscom Midterm PDF FreeheyNo ratings yet

- 1st Quarter ExaminationDocument2 pages1st Quarter ExaminationMarilyn Nelmida TamayoNo ratings yet

- Choose One Answer To Each QuestionDocument5 pagesChoose One Answer To Each QuestionNguyễn Vũ Phương AnhNo ratings yet

- Afar h04 Hoba PDFDocument6 pagesAfar h04 Hoba PDFRae Steven SaculoNo ratings yet

- CH 06Document72 pagesCH 06api-307892902No ratings yet

- Period Close Exceptions Report 310323Document49 pagesPeriod Close Exceptions Report 310323mshadabalamNo ratings yet

- CH 5Document9 pagesCH 5landmarkconstructionpakistanNo ratings yet

- 09 Lecture Notes - Trust Accounts 2021Document16 pages09 Lecture Notes - Trust Accounts 2021Chamela MahiepalaNo ratings yet

- Double Entry Illustrative ProblemDocument7 pagesDouble Entry Illustrative ProblemYana JaureguiNo ratings yet

- Summer 2020 Exercise9bDocument3 pagesSummer 2020 Exercise9bMiko ArniñoNo ratings yet

- EOQ Problems Class NotesDocument18 pagesEOQ Problems Class NotesVikram KumarNo ratings yet

- Itr 2Q13Document0 pagesItr 2Q13Klabin_RINo ratings yet

- Practice 8: Business Combinations and Impairment Exercise 7.12 Impairment Loss For A CGU, Reversal of Impairment LossDocument7 pagesPractice 8: Business Combinations and Impairment Exercise 7.12 Impairment Loss For A CGU, Reversal of Impairment LossJingwen YangNo ratings yet

- Fund AccountingDocument43 pagesFund AccountingthisisghostactualNo ratings yet

- Financial Accounting Iii Sem: Multiple Choice Questions and AnswersDocument24 pagesFinancial Accounting Iii Sem: Multiple Choice Questions and AnswersRamya Gowda100% (1)