Professional Documents

Culture Documents

Three-Line Price Break Charts

Three-Line Price Break Charts

Uploaded by

indyanexpressOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Three-Line Price Break Charts

Three-Line Price Break Charts

Uploaded by

indyanexpressCopyright:

Available Formats

Three-Line Price

Break Charts

Private trader and President of a financial research and

development company, Suri Duddella goes beyond

Candlesticks to 3LPB to time the ‘reversal bar’ and confirm

a trend.

Introduction

T

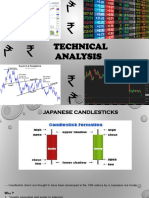

echnicians are always looking for ways the technical condition, the relationship of supply Construction Of 3LPB Chart

to recognize market direction and and demand, than any other known method,

market trends. Mostly technicians use which can be used for the purpose. Three-Line Break Charts are always constructed

technical indicators to detect signs of momentum based on closing prices. Many software programs

shift, rising/falling trends and market volatility for An Example of 3LPB Chart and websites have the capability of drawing

price projections. A price chart gives the visual “3LPB” charts. The construction of a 3LPB chart

display of the underlying strength and weakness Three-Line Break Charts defines the underlying starts from a base price (beginning of the chart

of a stock or commodity. A chart display coupled trend and considered as an adjunct to the data) and compare the base prices to the daily price

with trend-indicators, momentum indicators with candlestick charts. A basic understanding of closings.

support and resistance levels are essential in any “3LPB” is when there are three white successive

technician’s arsenal. candles, the major trend is up and when there are FIRST CANDLE (BASE CANDLE)

three black successive candles, the major trend is

Three-Line Break charts (3LPB) display a series down. The major reversal signals (based on the • A White candle is drawn if today’s price is

of vertical boxes that are based on changes in “3LPB” technique) are given when the turnaround higher than the base price; Or

prices. The 3LPB method entirely dispenses with lines (white to black or black to white) are formed. • A Black candle is drawn if today’s price is

the recording of the volume sales and time data. lower than the base price.

The other major charting techniques like Point

& Figure, Kagi and Renko Charts also ignore the SECOND CANDLE

passage of time and volume.

• Draw next WHITE candle (in the next

As Steve Nison describes in his “Beyond column) if today’s high is traded above the

Candlesticks” book, “The three-line break chart high of the first WHITE candle; Or

is a more subtle-form of point and figure charts • Draw next BLACK candle (in the next

where reversals are decided by the market and not column) if today’s low is traded below the

by the arbitrary rules. That means we can gear it low of the first BLACK candle.

to the strength and dynamism of the market”.

Why Chart Analysis?

The understanding of the effect of supply and

demand on any product or commodity or stocks

is necessary for successful investing. When

demand is greater than supply, prices move

upward. Should supply be greater than demand,

the prices are forced downward. When demand Figure 2

has absorbed all the supply at any given price, it

will begin to absorb the supply available at the THIRD CANDLE

next higher price at which offerings are available.

As the demand decreases, prices correspondingly • Draw a third WHITE candle (in the next

increase. Prices recede as a result of absence of column) if today’s high traded above (a new

demand or an oversupply. Figure 1 high) the previous two candles; Or

• Draw a third BLACK candle (in the next

The fluctuations of price changes, when plotted column) if today’s low traded below (a new

by means of the principles of any charting low) the previous two candles; Or

techniques like Bar Charts, Candlesticks, Kagi or • NO Candle will be drawn if the price is

Point and Figure, will more accurately indicate within the range of the first two candles.

Mediaedge Publishing Pte Ltd

Tampinese Central Post Office, P.O.Box 334, Soingapore 915212 www.chartpoint.biz

The next successive candles can be drawn using the Basic Rules Of “3LPB” Construction The first trading opportunity is provided (end of

THIRD CANDLE principle until a Three-Line Break March 2001) by the 3LPB full-range reversal bar

candle is formed. Also note that today’s prices should • A new Candle (BLACK or WHITE) can be ($49). This level also acts both as an entry into

trade entirely above or below previous candles high or

only added in the next column if today’s price the JNJ as well as support level. The Black reversal

low.

trades higher than previous WHITE candle’s bar formed in mid-June 2001 (around $57) closes

high or if today’s price trades lower than the long-trade. A second long position can be

previous BLACK candle. taken in late January 2002 after a successful test

of the trend-line and reversal of downtrend to the

• If three successive WHITE or BLACK upside (around $55). A downtrend followed by

candles are formed, the reversal CANDLE Black-Candle reversal and Trend-line breakout to

can be only drawn incase if today’s price is the downside confirms the end-of the up trend

traded above the high of all the previous (around $62).

three successive white candles high or if the

Figure 3 today’s price is traded below the low of all Example 2: (Microsoft Corporation)

the three successive black candles low.

Three-Line Break Candle (The Most Important

Candle) Trading With 3LPB Charts

The Three-Line Break Price Chart gets its name The Three-Line Price breaks indicate major trend

from this candle. If the price chart forms three changes. A trend change confirmation is generated

successive WHITE or BLACK candles, it when a reversal bar is formed. However, a trend

confirms a bullish (WHITE) and bearish confirmation bar could be late and substantial

(BLACK) trend. After forming a confirmed trend move to the upside or downside may have already

(by 3-successive same color candles), the reversal happened. A solution for this problem could be

is triggered only if the today’s price is traded below an intra-day trading signal for confirmation of the

the lowest of all prior three candles (in case of trend. But traders are comfortable to wait until a

BULLISH trend reversal) or if the today’s price is trend-confirmation is formed. The confirmation

traded above the highest of all prior three candles of the trend-reversal involves a tradeoff between

(in case of BEARISH reversal). risk and reward.

CASE A: THREE SUCCESSIVE WHITE Example 1: Johnson And Johnson (JNJ)

CANDLES

• Draw a WHITE Candle (in the next

column) if today’s high is above the THREE

WHITE CANDLES high; OR

• (REVERSAL CANDLE) Draw a BLACK

CANDLE (in the next column) if today’s

low is below the THREE WHITE

CANDLES low.

Figure 6

CASE B: THREE SUCCESSIVE BLACK

CANDLES

Example 2 presents 3LPB charts of Microsoft from

January 2001 to Aug. 2002. The 3LPB chart

• Draw a BLACK Candle (in the next column)

confirms a long-entry ($49) in January 2001 after

if today’s low is below the THREE BLACK

a WHITE bar reversal of previous downtrend.

CANDLES low; Or

Even though there was a temporary pullback in

• (REVERSAL CANDLE) Draw a WHITE

February 2001 to the entry level, there were no

CANDLE (in the next column) if today’s

signals from 3LPB chart to confirm the

high is above the THREE BLACK

downtrend. A major reversal and consolidation

CANDLES high.

region was signaled in the beginning of the May

2001. The line/bar charts would have kept the

investor in the trade without giving any sell signal

until late August during the consolidation region.

But 3LPB gave a sell signal in May 2001. Another

Figure 5: Johnson and Johnson long-entry signal was given in September 2001,

reaching previous reversal level ($50), acts as

Example 1 presents the chart of Johnson and support. A long-entry position was taken on 3LPB

Johnson (JNJ) from January 2001 to August reversal bar around $55 in September 2001. This

2002. The overall trend provided by the 3LPB trade was exited in late December 2001 on next

charts refine trading based on Trend-Line and “3LPB” reversal (downtrend) bar around $68.

Figure 4 Support/Resistance indicators.

Mediaedge Publishing Pte Ltd

Tampinese Central Post Office, P.O.Box 334, Soingapore 915212 www.chartpoint.biz

Chart Patterns / Support And Resistance

Most of the techniques that apply to conventional chart analysis can also be applied to Three Line

Price Break Charts. The chart patterns like ‘Double Tops’ and ‘Head and Shoulder’ can also be

applied. Support/Resistance and Trendlines can be drawn in 3LPB charts to confirm with the ‘Bar

Charts’ or ‘Candle Charts’.

Figure 7

CONCLUSION

Three-Line Price Break charts are mainly used to confirm the underlying trend, trend-reversals and

the balance of supply and demand. On many occasions “3LPB” charts show this ideal information

developing while conventional charts (Bar, Candle) show nothing more than a temporary halt in a

trend. Two important points to consider while using 3LPB are the timing of the ‘reversal bar’ and

‘confirmation’ of the trend. A Reversal bar is generated when three successive bullish (WHITE) or

bearish (BLACK) bars are formed and today’s price is traded below the lowest of all prior three

WHITE bars (in case of bearish reversal) and vice-versa. The drawback for 3LPB charts is a trend-

reversal bar could be late, as substantial move might have already happened. But many traders are

willing to wait for the trend-confirmation as it involves a trade-off between risk and reward. Traders

can also adjust the sensitivity of the 3LPB charts for 2, 5-Day Price Line break charts. Overall, 3LPB

charts are very valuable tool in addition to the conventional charts to any technician’s arsenal.

References

1. Steve Nison “Beyond Candlesticks” John Weily & Sons, Inc.

2. William Arnold “Three-Line Break Reversal”

3. Gary Wagner and Bradley M. “Using Candlesticks and Oscillators”

Suri Duddella is the President of siXer.cOm, inc., a Financial Research and Development Company specializing

in Web-Based Software Technologies and components for the financial markets. Suri Duddella’s website

(www.siXer.cOm) provides daily market/stock analysis, indicators, newsletter and a daily Gameplan for

active traders. Suri Duddella is also successful and private trader for the past 8 years using his proprietary

mathematical models/analysis. Duddella can be reached at suri@siXer.cOm.

Mediaedge Publishing Pte Ltd

Tampinese Central Post Office, P.O.Box 334, Soingapore 915212 www.chartpoint.biz

You might also like

- Technical+and+Graphical+Analysis+eBook+ +copy+Document52 pagesTechnical+and+Graphical+Analysis+eBook+ +copy+Achraf Semlali (centent)88% (33)

- Trading FaceDocument52 pagesTrading Facecryss savin92% (24)

- Al Brooks Setups 1Document17 pagesAl Brooks Setups 1Jayram Veliyath100% (19)

- Scalping is Fun! 2: Part 2: Practical examplesFrom EverandScalping is Fun! 2: Part 2: Practical examplesRating: 4.5 out of 5 stars4.5/5 (27)

- IQ School Price Action PDF BookDocument13 pagesIQ School Price Action PDF BookEx Traders0% (1)

- Binder1 PDFDocument493 pagesBinder1 PDFThe599499100% (4)

- Candlestick Patterns Analysis ToolboxDocument21 pagesCandlestick Patterns Analysis Toolboxpaolo100% (1)

- CANDLESTICK PATTERNS FOR ADVANCED PART 3 (cpfbp3) PDFDocument22 pagesCANDLESTICK PATTERNS FOR ADVANCED PART 3 (cpfbp3) PDFLenx Paul100% (1)

- Candlestick BookDocument20 pagesCandlestick Booktush100% (2)

- Alton Home Designs - SimondsDocument10 pagesAlton Home Designs - SimondsindyanexpressNo ratings yet

- Suri Duddella - 3 Line Price Break ChartsDocument3 pagesSuri Duddella - 3 Line Price Break ChartsDarkmatter DarkmatterrNo ratings yet

- Trend Following Systems & Time Neutral Charts. Vishal B Malkan, MFM, CMTDocument38 pagesTrend Following Systems & Time Neutral Charts. Vishal B Malkan, MFM, CMTChotu111No ratings yet

- CandlesticksDocument4 pagesCandlesticksVirendra Vaswani100% (1)

- The 5 Most Powerful Candlestick PatternsDocument1 pageThe 5 Most Powerful Candlestick PatternsHorneNo ratings yet

- Chart Pattern 2023 13 07 08 40 56Document50 pagesChart Pattern 2023 13 07 08 40 56CURIOUS KICKNo ratings yet

- Kaufman Short-Term Patterns - V39 - C01 - 168KAUFDocument13 pagesKaufman Short-Term Patterns - V39 - C01 - 168KAUFJoseph WestNo ratings yet

- Eight Best CandlesDocument4 pagesEight Best CandlesJonathan DominguezNo ratings yet

- Basics of Everything - by Lord of LordDocument18 pagesBasics of Everything - by Lord of LordBharath socialNo ratings yet

- Japanese Candlestick ChartingDocument15 pagesJapanese Candlestick ChartingAlex WongNo ratings yet

- 01-Futures Checklists-AllDocument13 pages01-Futures Checklists-AllEne OmedeNo ratings yet

- Bulls Eye Trading Academy - Basic Course1Document15 pagesBulls Eye Trading Academy - Basic Course1Sanjay DubeyNo ratings yet

- Day Trading StrategiesDocument10 pagesDay Trading StrategiessamNo ratings yet

- Candle Stick Pattern 2Document13 pagesCandle Stick Pattern 2edobor100% (1)

- Technical Analysis PresentationDocument73 pagesTechnical Analysis Presentationparvez ansari100% (1)

- Advanced Forex Breakouts Preview Peter July 2012Document92 pagesAdvanced Forex Breakouts Preview Peter July 2012aasdasdfNo ratings yet

- Candlestick Patterns (Ahmer Waqas)Document25 pagesCandlestick Patterns (Ahmer Waqas)ayubzulqarnain492No ratings yet

- Reversal PatternsDocument25 pagesReversal PatternsMunyaradzi Alka Musarurwa100% (3)

- Candlestick PatternsDocument12 pagesCandlestick PatternsSameer100% (2)

- Technical AnalysisDocument32 pagesTechnical AnalysisV SOUMITH REDDY-DM 20DM235No ratings yet

- Stock Market Trends: The Behaviour of A Chartist: by Enrico GrassiDocument36 pagesStock Market Trends: The Behaviour of A Chartist: by Enrico GrassiRam SriNo ratings yet

- D2 CandlesticksDocument15 pagesD2 Candlesticksmbbs anthemNo ratings yet

- What Is A Candlestick PatternDocument14 pagesWhat Is A Candlestick Patternknk333No ratings yet

- The 5 Most Powerful Candlestick Patterns (NUAN, GMCR) - InvestopediaDocument6 pagesThe 5 Most Powerful Candlestick Patterns (NUAN, GMCR) - InvestopediaMax Rene Velazquez GarciaNo ratings yet

- Ichimoku ChartingDocument14 pagesIchimoku ChartingdlmandaliaNo ratings yet

- Active Trader Heikin Ashi Charts by Tim Racette PDFDocument3 pagesActive Trader Heikin Ashi Charts by Tim Racette PDFm4k078100% (3)

- Candlepresentation3 110220224233 Phpapp02Document39 pagesCandlepresentation3 110220224233 Phpapp02thakur_neha20_903303No ratings yet

- Candlestick: Technical AnalysisDocument15 pagesCandlestick: Technical AnalysisHrushikesh S.K.100% (1)

- Technical Anls Part 2Document66 pagesTechnical Anls Part 2sujal JainNo ratings yet

- Introduction To CandlestickDocument28 pagesIntroduction To CandlestickAhmed Saeed AbdullahNo ratings yet

- Explain On Candle Stick Structure and PatternsDocument5 pagesExplain On Candle Stick Structure and PatternsSurjit KhomdramNo ratings yet

- Bearish Candle - Stick PatternDocument48 pagesBearish Candle - Stick Patternpdhamgaye49No ratings yet

- An Introduction To Japanese Candlestick ChartingDocument14 pagesAn Introduction To Japanese Candlestick ChartingRomelu MartialNo ratings yet

- Candlesticks BookDocument14 pagesCandlesticks BookLoose100% (1)

- Top 10 Candles That WorkDocument5 pagesTop 10 Candles That WorkSinyo Triadi0% (1)

- Ninjacators CandlestickPatternSpotter ManualDocument34 pagesNinjacators CandlestickPatternSpotter ManualiantraderNo ratings yet

- Hammer & Hanging Man - PrintedDocument16 pagesHammer & Hanging Man - PrintedMian Umar Rafiq0% (1)

- David Bowden 'Document2 pagesDavid Bowden 'sahil dhingraNo ratings yet

- Technical Analysis of Crypto AssetsDocument33 pagesTechnical Analysis of Crypto Assetskushagrabhushan0% (1)

- 17 CandlestickDocument6 pages17 CandlestickPaquiro2100% (3)

- Price Action Trading For Beginners EbookDocument67 pagesPrice Action Trading For Beginners EbookMAHEMOOD SHAHNo ratings yet

- International Finance Technical AnalysisDocument45 pagesInternational Finance Technical Analysislauraleon13No ratings yet

- The New High: New Low Index: Stock Market’s Best Leading IndicatorFrom EverandThe New High: New Low Index: Stock Market’s Best Leading IndicatorRating: 4 out of 5 stars4/5 (5)

- Summary of Steve Nison's Japanese Candlestick Charting TechniquesFrom EverandSummary of Steve Nison's Japanese Candlestick Charting TechniquesRating: 4 out of 5 stars4/5 (1)

- Gateway Home Design - SimondsDocument9 pagesGateway Home Design - SimondsindyanexpressNo ratings yet

- Barnard Home Design - SimondsDocument11 pagesBarnard Home Design - SimondsindyanexpressNo ratings yet

- Barakee: Welcome To Simonds How Can We Help You Today?Document6 pagesBarakee: Welcome To Simonds How Can We Help You Today?indyanexpressNo ratings yet

- Barossa - SimondsDocument6 pagesBarossa - SimondsindyanexpressNo ratings yet

- Allyn - SimondsDocument6 pagesAllyn - SimondsindyanexpressNo ratings yet

- Alpine - SimondsDocument6 pagesAlpine - SimondsindyanexpressNo ratings yet

- Warwick 34 Brochure Plan v2Document2 pagesWarwick 34 Brochure Plan v2indyanexpressNo ratings yet

- Alfred - SimondsDocument7 pagesAlfred - SimondsindyanexpressNo ratings yet

- Vaucluse Brochure Plan 2020Document4 pagesVaucluse Brochure Plan 2020indyanexpressNo ratings yet

- Sterling 25: Bedrooms Bathrooms GarageDocument3 pagesSterling 25: Bedrooms Bathrooms GarageindyanexpressNo ratings yet

- Montoria Grand 49 Brochure PlanDocument2 pagesMontoria Grand 49 Brochure PlanindyanexpressNo ratings yet

- Redcliffe 26: Bedrooms Bathrooms GarageDocument6 pagesRedcliffe 26: Bedrooms Bathrooms GarageindyanexpressNo ratings yet

- Rutherford 33: Bedrooms Bathrooms GarageDocument2 pagesRutherford 33: Bedrooms Bathrooms GarageindyanexpressNo ratings yet

- Sanctuary 42 Brochure Plans UpdatedDocument1 pageSanctuary 42 Brochure Plans UpdatedindyanexpressNo ratings yet

- Nallur Kantha Muruga PDFDocument1 pageNallur Kantha Muruga PDFindyanexpressNo ratings yet

- Provincial 24: Alfresco Ensuite Master SuiteDocument4 pagesProvincial 24: Alfresco Ensuite Master SuiteindyanexpressNo ratings yet

- Montpellier 51 Montpellier 51: Designed To Suit: Designed To SuitDocument2 pagesMontpellier 51 Montpellier 51: Designed To Suit: Designed To SuitindyanexpressNo ratings yet

- Piermont Brochure PlansDocument7 pagesPiermont Brochure PlansindyanexpressNo ratings yet

- Matisse Floorplans v3 PDFDocument8 pagesMatisse Floorplans v3 PDFindyanexpressNo ratings yet