Professional Documents

Culture Documents

Divisors 1

Divisors 1

Uploaded by

Sriram PattaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Divisors 1

Divisors 1

Uploaded by

Sriram PattaCopyright:

Available Formats

Divisors@multiples.

com

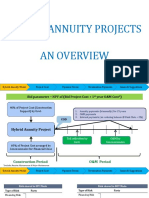

Multiples: Valuing ILF Real Estate Private Ltd

Inherent Strengths of the business model:

Benefits of the Deal structure:

For a project valued at `900 million, the cost of the land bank is `750 million.

This makes the project particularly attractive as this high collateral value

reduces the default risks, thereby reducing cost of capital.

The IRR of the project based accounting for the dividend payments and equity

buy backs is 21%. The realization multiple of the project is 2.95 for the Private

Equity Investor. Both multiples look strong given the context of the project.

Idiosyncratic Benefits:

Project location is unique and there is no contiguous plot of land in close

proximity of the city. Competition gets limited to a few players and thus the

planned 7% increase in selling price can be sustained.

High promoter equity (37.5%) adds credibility to the sustenance of the project,

in terms of the commitment of the promoter to the project.

Risks Involved

Internal accruals & its implications

20 20 20 20 20 20 20 20

10 11 12 13 14 15 16 17

72 31 35 62 93 24 15 21

Total Outflow 5 9 2 3 2 30 79 61

Inflows from 11 46 93 18 26 23 18

sales of units 42 3 0 8 35 39 93 49

Construction activities are almost entirely funded by cash inflows from advance

sales. Sales over the 7 years are sensitive to market conditions and will influence

the working capital management. Current valuation assumes a 400% y-o-y

increase in sales for 2012, whereas the y-o-y increase is only 40-60% in other

years.

External Risks

Regulatory risks in terms of building plan approvals, layout approvals, and NOC

can delay construction in the tightly knit construction plan. Additionally there

could be selling pressures created by delays in the upcoming amenities in the

surrounding ecosystem.

Reasonability of Assumptions in the existing Valuation

Construction Cost assumptions: The project assumes construction costs to rise at an

effective annual rate of 9.2% (5% increase in the construction material costs and 4%

in cost-overruns), which is quite reasonable if not cautious.

Divisors@multiples.com

Given the size of the project, 40 lakh sq.ft, at least 2.5% of the Super-Built-Up

area should be developed into commercial space to generate an additional

revenue stream. Considering a selling price of INR 3000/sq.ft . For the

commercial space, we can expect additional revenues of about INR 50 million.

Working Capital management is a potential issue given the assumptions about

the absorption rates. Might need lead to short-term borrowings at a higher cost

of capital to fulfill obligations. A better model would probably be to stagger the

construction over a 4-year period, with 25% completion target every year. This

would reduce the dependence on cash flow from sales.

Sensitivity Analysis: Cash Available to Equity Holders

(Change from base case as per the model)

Selling Price

(20.0%) (10.0%) 0.0% 10.0% 20.0%

CostConstruction

(20.0%) 3,198.5 3,815.2 4,431.9 5,048.6 5,665.3

(10.0%) 2,973.3 3,590.0 4,206.7 4,823.4 5,440.0

0.0% 2,748.0 3,364.7 3,981.4 4,598.1 5,214.8

10.0% 2,522.8 3,139.5 3,756.2 4,372.8 4,989.5

20.0% 2,297.5 2,914.2 3,530.9 4,147.6 4,764.3

Other Considerations

Price Checks Vicinity Development Opportunity Costs Developer Reputation

Verify the authenticity of Due considerations should This deal should be The developer’s credibility

the land price, by looking at be given to the existing compared with the other is imperative and the fund

data for the last registered residential projects and deal proposals the Fund has should perform extensive

land deal in the vicinity of future developments received in the last month background checks

the project from the (including commercial, to understand the regarding the reputation of

Registrar. The selling price residential and opportunity cost of this the developer from the

should be evaluated with infrastructure activities) deal. perspective of its customers

those of comparable within a 5 km radius. and partners.

existing projects nearby.

Recommendations

The assumptions taken by the developer seem fair in most instances, if not

conservative. The developer’s commitment is clearly highlighted by its investment in

the project at an early stage. Some further investigation needs to be undertaken to

understand the premium value and prospects of the location as claimed by the

developer. Although it would have been preferable to invest in this project once the

work had started, as that would help circumvent some of the risks, the project seems

profitable at this stage and presents a strong proposition for investments.

You might also like

- Aerocomp Inc Case Study Week 7Document5 pagesAerocomp Inc Case Study Week 7Aguntuk Shawon100% (4)

- Air Compressor 132KW ZR 3 Atlas Copco ManualDocument27 pagesAir Compressor 132KW ZR 3 Atlas Copco ManualM Uzair Shaikh67% (3)

- Leave FormDocument1 pageLeave FormOspen Noah Sithole100% (1)

- New Heritage Doll Company Capital BudgetDocument27 pagesNew Heritage Doll Company Capital BudgetCarlos100% (1)

- IREF V 6 Pager Brochure - X UnitsDocument6 pagesIREF V 6 Pager Brochure - X UnitsPushpa DeviNo ratings yet

- Unit 39 Sales Management Assignment BriefDocument4 pagesUnit 39 Sales Management Assignment BriefKhushbu VarmaNo ratings yet

- Viability and Financial Assessment ReportDocument53 pagesViability and Financial Assessment ReportHazim Zakaria100% (2)

- New Heritage Doll (NHD) : Figure 1: The Current ProcessDocument2 pagesNew Heritage Doll (NHD) : Figure 1: The Current Processrath3477100% (4)

- Objectives of Project Finance ModelsDocument86 pagesObjectives of Project Finance ModelsAlavaro Jaramillo100% (1)

- 3rd Quarter Summative Test in CCS For Week 1 - 2 Grade10Document1 page3rd Quarter Summative Test in CCS For Week 1 - 2 Grade10heidee carpio100% (1)

- Developer'S Budget: Qs 435 Construction ECONOMICS IIDocument19 pagesDeveloper'S Budget: Qs 435 Construction ECONOMICS IIGithu RobertNo ratings yet

- Issue 44 - July 2020Document5 pagesIssue 44 - July 2020Ace DanishNo ratings yet

- Cama302 Main Exam Memo 2019Document14 pagesCama302 Main Exam Memo 2019lusandasithembeloNo ratings yet

- Ch9 Project SelectionDocument39 pagesCh9 Project SelectionHuỳnh Ngọc ThắmNo ratings yet

- Proposed SolutionsDocument8 pagesProposed Solutionsheyy1731No ratings yet

- Smaliraza 3343 18861 2 Corporate Finance-Lecture 3Document9 pagesSmaliraza 3343 18861 2 Corporate Finance-Lecture 3Sadia AbidNo ratings yet

- Case Study Presentation-Greenfield Project: Sub-Group-5Document7 pagesCase Study Presentation-Greenfield Project: Sub-Group-5mohammad mustafaNo ratings yet

- Colliers Manila Q2 2022 Residential JB 07282022 BO Edits 2Document5 pagesColliers Manila Q2 2022 Residential JB 07282022 BO Edits 2Geodel CuarteroNo ratings yet

- DELLFY10 Q2 Earnings PresentationDocument23 pagesDELLFY10 Q2 Earnings PresentationwagnebNo ratings yet

- Sansera Engineering Limited ReportDocument8 pagesSansera Engineering Limited Reportarjun aNo ratings yet

- The Mountain View Case Study - OR Final Project - Group 4 PDFDocument9 pagesThe Mountain View Case Study - OR Final Project - Group 4 PDFakhilendra pandeyNo ratings yet

- Colliers Korean Real Estate Market Trend 2023Document15 pagesColliers Korean Real Estate Market Trend 2023Neha GaurNo ratings yet

- FMTII Session 4&5 Capital BudgetingDocument56 pagesFMTII Session 4&5 Capital Budgetingbhushankankariya5No ratings yet

- Hogwart HTL ReportDocument7 pagesHogwart HTL ReportterahongmarkNo ratings yet

- 20PT31 Cf-IiDocument4 pages20PT31 Cf-IiSakthivelayudham BhyramNo ratings yet

- IREF V 6 Pager Brochure - Regular UnitsDocument6 pagesIREF V 6 Pager Brochure - Regular UnitsPushpa DeviNo ratings yet

- Feasibility Report ABC ConstructionDocument84 pagesFeasibility Report ABC ConstructionHasnainImranNo ratings yet

- Exam - CPS&C (Spring 2024) PGD Batch 3Document2 pagesExam - CPS&C (Spring 2024) PGD Batch 3AbdulNo ratings yet

- MBALN-622 - Midterm Examination BriefDocument6 pagesMBALN-622 - Midterm Examination BriefwebsternhidzaNo ratings yet

- Approaches To Calculating Project Hurdle Rates PDFDocument16 pagesApproaches To Calculating Project Hurdle Rates PDFSudipta ChatterjeeNo ratings yet

- Multipurpose MallDocument90 pagesMultipurpose MallkidanemariamNo ratings yet

- Financing and ValuationDocument6 pagesFinancing and ValuationGauri TyagiNo ratings yet

- CRISILs Rating Criteria For Real Estate DevelopersDocument11 pagesCRISILs Rating Criteria For Real Estate DevelopersTay MonNo ratings yet

- WACCDocument32 pagesWACChari.shankar24No ratings yet

- Indian Institute of Management TiruchirappalliDocument3 pagesIndian Institute of Management TiruchirappalliSachin BalahediNo ratings yet

- Evaluation ReportDocument30 pagesEvaluation Reportpragi patelNo ratings yet

- Colliers Manila Q4 2022 Residential v1Document4 pagesColliers Manila Q4 2022 Residential v1slingNo ratings yet

- Smart Construction ReportDocument22 pagesSmart Construction Reportsamyak jainNo ratings yet

- DB Toys-Case StudyDocument16 pagesDB Toys-Case StudyNitin ShankarNo ratings yet

- Final Review QuestionsDocument2 pagesFinal Review QuestionshatanoloveNo ratings yet

- Group B Assignment 3Document16 pagesGroup B Assignment 3Ashok SaikiaNo ratings yet

- KW 01-The Importance of Requirements ManagementDocument15 pagesKW 01-The Importance of Requirements ManagementLuiz CruzNo ratings yet

- Savills Residential Development MarginsDocument13 pagesSavills Residential Development Marginsraymond1066No ratings yet

- Estimating Cash Flows: L RamprasathDocument4 pagesEstimating Cash Flows: L RamprasathMayank RanjanNo ratings yet

- Financing Strategy For Project by Developing MS Excel Based Financial ModelDocument17 pagesFinancing Strategy For Project by Developing MS Excel Based Financial ModelMeghna GoradiaNo ratings yet

- Pinhome CaseDocument3 pagesPinhome CaseDean ErlanggaNo ratings yet

- Project Assumptions - Project Feasibility StudyDocument7 pagesProject Assumptions - Project Feasibility StudyKeziah ReveNo ratings yet

- Ublmxs-15-2 - Online Exam - JanDocument5 pagesUblmxs-15-2 - Online Exam - JanJennifer AshworthNo ratings yet

- Solution Manual For Analysis For Financial Management 12th EditionDocument21 pagesSolution Manual For Analysis For Financial Management 12th Editionmissitcantaboc6sp100% (46)

- Full Download Solution Manual For Analysis For Financial Management 12th Edition PDF Full ChapterDocument36 pagesFull Download Solution Manual For Analysis For Financial Management 12th Edition PDF Full Chapterbuoyala6sjff100% (21)

- Colliers Manila Q3 2022 Residential v2Document4 pagesColliers Manila Q3 2022 Residential v2bhandari_raviNo ratings yet

- Ham - 16062017Document17 pagesHam - 16062017sumit pamecha100% (1)

- 02 - Abdul Qodir - 3H AKM - Value Chain Analysis and Balanced Scorecard of Construction Company RevisionDocument12 pages02 - Abdul Qodir - 3H AKM - Value Chain Analysis and Balanced Scorecard of Construction Company Revisionabdul qodirNo ratings yet

- Construction Cost Guide Book India-2021: Project & Development Services, IndiaDocument23 pagesConstruction Cost Guide Book India-2021: Project & Development Services, Indiaalim shaikhNo ratings yet

- Project EvaluationDocument23 pagesProject EvaluationDebasish PattanaikNo ratings yet

- CFI5102201412 Advanced Corporate Financial StrategyDocument5 pagesCFI5102201412 Advanced Corporate Financial StrategyFungai MukundiwaNo ratings yet

- Chapter 8-Capital Budgeting Process and Decision Criteria: Multiple ChoiceDocument14 pagesChapter 8-Capital Budgeting Process and Decision Criteria: Multiple ChoiceLJaneNo ratings yet

- Indicative Solution: October 2009 ExaminationDocument11 pagesIndicative Solution: October 2009 ExaminationYogeshAgrawalNo ratings yet

- Presentation-on-Project-Selection NeDocument31 pagesPresentation-on-Project-Selection NeSridhar ChebroluNo ratings yet

- Fly Ash Brick Project: Feasibility Study Using CVP AnalysisDocument20 pagesFly Ash Brick Project: Feasibility Study Using CVP Analysissantiago gonzalez0% (1)

- Mohan's Task-3Document5 pagesMohan's Task-3Pampana Bala Sai Saroj RamNo ratings yet

- FMID Group 2 - Financial Modelling and Project EvalutaionDocument17 pagesFMID Group 2 - Financial Modelling and Project EvalutaionAkash MittalNo ratings yet

- Contract Strategies for Major Projects: Mastering the Most Difficult Element of Project ManagementFrom EverandContract Strategies for Major Projects: Mastering the Most Difficult Element of Project ManagementNo ratings yet

- Wealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment PropertiesFrom EverandWealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment PropertiesNo ratings yet

- Resume Oussama CHERAIBIDocument2 pagesResume Oussama CHERAIBIOussama CheraibiNo ratings yet

- Wallstreetjournal 20160121 The Wall Street JournalDocument54 pagesWallstreetjournal 20160121 The Wall Street JournalstefanoNo ratings yet

- Know Your Client (Kyc) Application Form (For Individuals) : F I R S T N A M E M I D D L E N A M E L A S T N A M EDocument12 pagesKnow Your Client (Kyc) Application Form (For Individuals) : F I R S T N A M E M I D D L E N A M E L A S T N A M ESskNo ratings yet

- Macroeconomics - Notes 12thDocument28 pagesMacroeconomics - Notes 12thReddyNo ratings yet

- 4 Citizen's Charter San Carlos City 2019 1st EditionDocument274 pages4 Citizen's Charter San Carlos City 2019 1st EditionAntonio V. RanqueNo ratings yet

- SAP Ariba Procurement OverviewDocument2 pagesSAP Ariba Procurement OverviewpilgraNo ratings yet

- Financial Markets and InstitutionsDocument31 pagesFinancial Markets and Institutionsqueen estevesNo ratings yet

- The Value of GBSDocument22 pagesThe Value of GBSDana MilitaruNo ratings yet

- FAR MODULE 3 The Accounting EquationDocument3 pagesFAR MODULE 3 The Accounting EquationKatherine MagpantayNo ratings yet

- QuestionsDocument2 pagesQuestionsEl AgricheNo ratings yet

- 01.09.22 - 66130005113501R - Home Depot - CarwashDocument2 pages01.09.22 - 66130005113501R - Home Depot - CarwashjleonardomendozaNo ratings yet

- Topic I Introduction To CreditDocument4 pagesTopic I Introduction To CreditLemon OwNo ratings yet

- CSR of InfosysDocument40 pagesCSR of Infosysmahalaxmi agrawalNo ratings yet

- Itc FinalDocument32 pagesItc FinalbuntysaunakNo ratings yet

- TYPES OF ADVERTISING CLassification of AdvertisingDocument127 pagesTYPES OF ADVERTISING CLassification of AdvertisingTejaswi PundhirNo ratings yet

- All Fields Are Mandatory: The Branch Head Axis Bank LTDDocument3 pagesAll Fields Are Mandatory: The Branch Head Axis Bank LTDHarpreet0gjgkbkv KaurNo ratings yet

- Sesi 13 The New Mandate For HCM RoleDocument55 pagesSesi 13 The New Mandate For HCM RoleAndika MervinandaNo ratings yet

- Castrol AR2017 Frontend MDA Final Low Res File Min PDFDocument137 pagesCastrol AR2017 Frontend MDA Final Low Res File Min PDFSrinivasan Krishnan 1828543No ratings yet

- How To Price Assignment PhotographyDocument9 pagesHow To Price Assignment PhotographyBarry RobinsonNo ratings yet

- PDF DocumentDocument6 pagesPDF DocumentJai Sam DanielNo ratings yet

- Immersion Partner LetterDocument4 pagesImmersion Partner LetterEian SalvidasNo ratings yet

- NewProd2 PDFDocument71 pagesNewProd2 PDFMelissa IsaacNo ratings yet

- 4 IFRS 16 LeasesDocument26 pages4 IFRS 16 Leasespesse0% (1)

- Devi Ahilya University, Indore: SynopsisDocument10 pagesDevi Ahilya University, Indore: SynopsisRubain KhanNo ratings yet

- Poniman, SE., M.S.A., Ak., CADocument10 pagesPoniman, SE., M.S.A., Ak., CAshelvira viraNo ratings yet

- Analysis and Critical Review of ICH Q8, Q9 and Q10 From A Generic Pharmaceutical Industry View PointDocument12 pagesAnalysis and Critical Review of ICH Q8, Q9 and Q10 From A Generic Pharmaceutical Industry View PointARMANDO JOSE RIVERO LAVERDENo ratings yet