Professional Documents

Culture Documents

Tutoring Services Transactions

Tutoring Services Transactions

Uploaded by

JayMoralesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tutoring Services Transactions

Tutoring Services Transactions

Uploaded by

JayMoralesCopyright:

Available Formats

MINI Completing the Accounting Cycle

PRACTICE for a Sole Proprietorship

SET 2

Fast Track TUTORING

Tutoring Service

SE RVIC E

Main Task

Set up the accounting records

▲

and complete the accounting Company Background:

cycle for Fast Track Tutoring Fast Track Tutoring Service is owned and

Service. managed by Jennifer Rachael. It has been

in business for one month. The business

Summary of Steps is organized as a sole proprietorship and

provides tutoring services in a number

Open general ledger accounts.

▲

of disciplines for students from pre-

Analyze, journalize, and post kindergarten through high school. The

▲

transactions. business earns revenue from tuition

charged for one-on-one instruction and

Reconcile the bank statement.

▲

special classes.

Journalize and post the bank Your Job Responsibilities: As the accounting clerk for this business,

▲

service charge. use the accounting stationery in your working papers to complete the

following activities.

Prepare a trial balance, a

▲

(1) Open a general ledger account for each account in the chart of

work sheet, and the financial accounts.

statements. (2) Analyze each business transaction.

Journalize and post the closing (3) Enter each business transaction in the general journal. Begin

▲

entries. on journal page 1.

(4) Post each journal entry to the appropriate accounts in the

Prepare a post-closing trial

▲

general ledger.

balance. (5) Reconcile the bank statement that was received on December

31. The statement is dated December 30. The checkbook

Why It’s Important has a current balance of $9,631. The bank statement shows

This project pulls together a balance of $9,844. The bank service charge is $15. These

▲

all of the concepts and checks are outstanding: Check 108, $183 and Check 109, $45.

procedures you have learned. There are no outstanding deposits.

(6) Make any necessary adjustments to the checkbook balance.

(7) Journalize and post the entry for the bank service charge.

(8) Prepare a trial balance and complete the work sheet.

(9) Prepare an income statement, a statement of changes in

owner’s equity, and a balance sheet.

(10) Journalize and post the closing entries.

(11) Prepare a post-closing trial balance.

Business Transactions: Fast Track Tutoring Service began

business operations on December 1 of this year.

304 Mini Practice Set 2

304-305_MPS02_868829.indd 304 4/6/06 5:52:40 PM

Fast Track Tutoring Service (continued)

Complete the project using: Manual Glencoe Peachtree Complete QuickBooks

OR OR

Working Papers Accounting Software Templates

SMART GUIDE

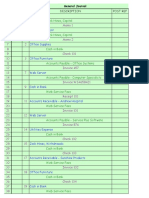

CHART OF ACCOUNTS

Step–by–Step Instructions:

Fast Track Tutoring Service

1. Select the problem set

ASSETS 305 Jennifer Rachael, Withdrawals for Fast Track Tutoring

310 Income Summary Service (MP–2).

101 Cash in Bank

2. Rename the company

110 Accts. Rec.—Carla DiSario REVENUE and set the system

120 Accts. Rec.—George McGarty date.

401 Group Lessons Fees

140 Office Supplies 3. Record all of the

405 Private Lessons Fees

150 Office Equipment transactions.

155 Instructional Equipment EXPENSES 4. Reconcile the bank

LIABILITIES 505 Maintenance Expense statement.

510 Miscellaneous Expense 5. Print a General Journal

210 Accts. Pay.—Educational Software report and proof your

515 Rent Expense

215 Accts. Pay.—T & N School Equip. work.

525 Utilities Expense

6. Print the Account

OWNER’S EQUITY

Reconciliation reports.

301 Jennifer Rachael, Capital 7. Print a General Ledger

and a Trial Balance.

8. Print the financial

statements.

Date Transactions 9. Close the fiscal year.

10. Print a post-closing

Dec. 1 Jennifer Rachael invested $25,000 in the business, Memo 1. trial balance.

11. Complete the Analyze

2 Bought a cash register (Office Equipment) for $525, Check 101.

activity and complete

2 Purchased $73 in office supplies, Check 102. the Audit Test.

12. End the session.

5 Purchased instructional computers for $13,924, Check 103.

5 Received $950 for private instruction, Receipt 1. QuickBooks

6 Bought $8,494 of instructional materials, Invoice 395, from PROBLEM GUIDE

Educational Software on account.

Step–by–Step Instructions:

8 Billed Carla DiSario for two group classes, $36, Invoice 101.

1. Restore the Mini

9 Wrote Check 104 for $850 for the December rent. Practice Set 2.QBB file.

2. Record all of the

10 Billed George McGarty $275 for special group classes, Invoice 102.

transactions.

10 Received Invoice 5495 for a $2,375 microcomputer system, for office 3. Reconcile the bank

use, bought on account from T & N School Equipment. statement.

4. Print a Detail

11 Prepared Receipt 2 for $695 for 20 private lessons given between Reconciliation report.

December 1 and December 10. 5. Print a Journal report.

6. Print the register for the

13 Received $36 from Carla DiSario on account, Receipt 3. Cash in Bank account.

14 Sent Check 105 for $200 to Educational Software on account. 7. Print a General Ledger.

8. Print a Trial Balance.

15 Wrote Check 106 for $750 to repaint two classrooms. 9. Print a Profit and Loss

report and Balance

18 Jennifer Rachael withdrew $500 for personal use, Check 107.

Sheet.

20 Sent Check 108 for the electric bill of $183. 10. Close the fiscal year.

11. Print a post-closing Trial

24 Issued Check 109 for $45 for stamps (Miscellaneous Expense). Balance.

12. Complete the Analyze

activity and the Audit

Analyze Identify the creditor to which Fast Track Tutoring Service Test.

owed the most money on December 31. 13. Back up your work.

Mini Practice Set 2 305

304-305_MPS02_868829.indd 305 4/6/06 5:52:47 PM

You might also like

- Web Sites Chart of AccountsDocument14 pagesWeb Sites Chart of AccountsJayMorales0% (2)

- Web Sites Chart of AccountsDocument14 pagesWeb Sites Chart of AccountsJayMorales0% (2)

- Principles of Marketing WEEK 6Document6 pagesPrinciples of Marketing WEEK 6JayMorales100% (1)

- Bpact Activity 5Document1 pageBpact Activity 5Cherry Ann OlasimanNo ratings yet

- Organization and ManagementDocument88 pagesOrganization and ManagementJayMorales100% (1)

- Fundamentals of Accountancy, Business and Management 2Document60 pagesFundamentals of Accountancy, Business and Management 2JayMoralesNo ratings yet

- Cash in Bank: Description Post RefDocument25 pagesCash in Bank: Description Post RefJayMoralesNo ratings yet

- Industry Analysis: Positioning The Firm Within The Specific EnvironmentDocument12 pagesIndustry Analysis: Positioning The Firm Within The Specific EnvironmentJann Aldrin Pula100% (1)

- FAR 1 Financial Accounting and Reporting Redesigning FormDocument6 pagesFAR 1 Financial Accounting and Reporting Redesigning FormJhane MarieNo ratings yet

- (Ebook PDF) (Ebook PDF) Bookkeeping and Accounting Essentials 2nd Edition All ChapterDocument43 pages(Ebook PDF) (Ebook PDF) Bookkeeping and Accounting Essentials 2nd Edition All Chaptertarkkuouanga100% (10)

- ebook download (eBook PDF) Bookkeeping and Accounting Essentials 2nd Edition all chapterDocument43 pagesebook download (eBook PDF) Bookkeeping and Accounting Essentials 2nd Edition all chapterhusejnseedor100% (4)

- Instant Download Ebook PDF Bookkeeping and Accounting Essentials 2nd Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Bookkeeping and Accounting Essentials 2nd Edition PDF Scribdmyrtis.donaldson459100% (51)

- ChapterDocument47 pagesChapteralfyomar79No ratings yet

- Chap 004Document39 pagesChap 004Ali SaloNo ratings yet

- Hca Blueprint SampleDocument11 pagesHca Blueprint Sampleapi-519919545No ratings yet

- Module PA 1 MGT 2023-2024 1Document47 pagesModule PA 1 MGT 2023-2024 1KingFaithNo ratings yet

- NetSuite Financial Management Training Data SheetDocument3 pagesNetSuite Financial Management Training Data Sheetallo hello100% (1)

- AP-115-Unit-4 RECORDING BUSINESS TRANSACTIONSDocument40 pagesAP-115-Unit-4 RECORDING BUSINESS TRANSACTIONSBebie Joy Urbano100% (1)

- Lecture 3 Part 1Document9 pagesLecture 3 Part 1BTS LOVERSNo ratings yet

- General Ledger Department: Introduction and Overview Definition: TheDocument29 pagesGeneral Ledger Department: Introduction and Overview Definition: Thekanwal1234No ratings yet

- Rolo Company - Comprehensive Accounting ProblemDocument29 pagesRolo Company - Comprehensive Accounting ProblemFaith SindanumNo ratings yet

- Consultancy Proposal: Michael MwanandimaiDocument11 pagesConsultancy Proposal: Michael Mwanandimaimichael mwanandimaiNo ratings yet

- PSA - Financial Accounting PDFDocument684 pagesPSA - Financial Accounting PDFMinhajul Haque Sajal100% (1)

- 1 - Bsa Workbook - Ps ServiceDocument121 pages1 - Bsa Workbook - Ps ServiceSakuraNo ratings yet

- A C T S: Saint Columban College Pagadian CityDocument9 pagesA C T S: Saint Columban College Pagadian CityglennNo ratings yet

- Guide in Accounting CycleDocument65 pagesGuide in Accounting CycleChristian Paul Villavert TuazonNo ratings yet

- Income - Used in Connection With The Inflow of AssetsDocument4 pagesIncome - Used in Connection With The Inflow of AssetsKimberly FloresNo ratings yet

- DLP Fabm 1Document2 pagesDLP Fabm 1Junar DesucatanNo ratings yet

- Fundamentals of Accountancy Business and Management 1 11 FourthDocument4 pagesFundamentals of Accountancy Business and Management 1 11 FourthPaulo Amposta CarpioNo ratings yet

- Shamshad Shaikh (Accountant) KSA GE Wup VVCCF CCDocument9 pagesShamshad Shaikh (Accountant) KSA GE Wup VVCCF CCftimum1No ratings yet

- B-Module Ii - Workshop (Job Analysis Questionnaire)Document5 pagesB-Module Ii - Workshop (Job Analysis Questionnaire)Desiree FrancoNo ratings yet

- 5.1 Worksheet AccountingDocument6 pages5.1 Worksheet AccountingClarissa Rivera VillalobosNo ratings yet

- Full Download PDF of Solution Manual For College Accounting Chapters 1-27 20th Edition All ChapterDocument28 pagesFull Download PDF of Solution Manual For College Accounting Chapters 1-27 20th Edition All Chapterbetiksxle23100% (4)

- Problem 7-7 QuickBooks Guide PDFDocument1 pageProblem 7-7 QuickBooks Guide PDFJoseph SalidoNo ratings yet

- FUNDAMENTALS OF ABM 1 Section 7Document13 pagesFUNDAMENTALS OF ABM 1 Section 7Allysa Kim RubisNo ratings yet

- Accounting Principles - Chapter 4Document8 pagesAccounting Principles - Chapter 4Duoth ChuolNo ratings yet

- AE112 Module 4Document30 pagesAE112 Module 4LIZA ROI CUSTODIONo ratings yet

- Hornbill Company ProfileDocument7 pagesHornbill Company ProfileMalay ThakerNo ratings yet

- Fundamentals of Abm 1 q2 Module 1 Week 1 3Document25 pagesFundamentals of Abm 1 q2 Module 1 Week 1 3sheilainojales07No ratings yet

- Course Outline Abbq 323a1 Computerized AccountingDocument4 pagesCourse Outline Abbq 323a1 Computerized AccountingNelson BruceNo ratings yet

- Topic 5 HI5001 - SolutionDocument5 pagesTopic 5 HI5001 - SolutionMd Jahid HossainNo ratings yet

- Curricullem Accounts and Budget Services Level IVDocument62 pagesCurricullem Accounts and Budget Services Level IVeliyas mohammedNo ratings yet

- Self-Paced Learning Module: Senior High SchoolDocument7 pagesSelf-Paced Learning Module: Senior High SchoolImee May Bianes BayonaNo ratings yet

- Comp Acctg Brochure PDFDocument2 pagesComp Acctg Brochure PDFDanielle WatsonNo ratings yet

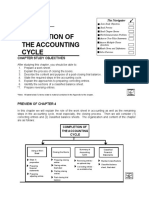

- 4 Ompletion of The Accounting Cycle: Chapter Study ObjectivesDocument23 pages4 Ompletion of The Accounting Cycle: Chapter Study ObjectivesyoantanNo ratings yet

- 4 Ompletion of The Accounting Cycle: Chapter Study ObjectivesDocument23 pages4 Ompletion of The Accounting Cycle: Chapter Study ObjectivesyoantanNo ratings yet

- Learning: Fundamentals of Accounting, Business and Management 1Document13 pagesLearning: Fundamentals of Accounting, Business and Management 1MTECH ASIANo ratings yet

- New SyllabusDocument4 pagesNew SyllabusSiya ChughNo ratings yet

- Month-End Guidance: The Financial Procedures ManualDocument12 pagesMonth-End Guidance: The Financial Procedures ManualSyed Ahsan Hussain XaidiNo ratings yet

- Quickbooks Guide: Step-By-Step InstructionsDocument1 pageQuickbooks Guide: Step-By-Step InstructionsJoseph SalidoNo ratings yet

- Information Sheet No. 1.3-3Document19 pagesInformation Sheet No. 1.3-3ggtxc7x2bkNo ratings yet

- Catibog-Activity 8-Transaction Processing and Financial ReportingDocument4 pagesCatibog-Activity 8-Transaction Processing and Financial ReportingMarynissa CatibogNo ratings yet

- DLP Fabm1Document2 pagesDLP Fabm1Junar DesucatanNo ratings yet

- Problem 13-9 QuickBooks Guide PDFDocument1 pageProblem 13-9 QuickBooks Guide PDFJoseph SalidoNo ratings yet

- Accounting Cycle For A Merchandising Business The Basic Accounting CycleDocument4 pagesAccounting Cycle For A Merchandising Business The Basic Accounting CycleEloizaMarieNo ratings yet

- Chapter 4 - Completing The Accounting CycleDocument2 pagesChapter 4 - Completing The Accounting CyclePárk Jigoo'sNo ratings yet

- Processing Bookkeeping Transactions Kaplankaplan Processing Bookkeeping TransactionsDocument25 pagesProcessing Bookkeeping Transactions Kaplankaplan Processing Bookkeeping TransactionsRanyaNo ratings yet

- Financial Acctg Reporting 1 Chapter 8Document9 pagesFinancial Acctg Reporting 1 Chapter 8Charise Jane ZullaNo ratings yet

- JVA-TRN - FI109 - Joint Venture Accounting v1.1Document83 pagesJVA-TRN - FI109 - Joint Venture Accounting v1.1James Anderson Luna SilvaNo ratings yet

- GGGDocument13 pagesGGGmuhammad07066893449No ratings yet

- Topic: Preparing Worksheet and Financial StatementsDocument30 pagesTopic: Preparing Worksheet and Financial StatementsSheikh Hassan Al-HadiNo ratings yet

- CH 4 EnglishDocument36 pagesCH 4 Englishshikha guptaNo ratings yet

- UG04 APP Week 5 A With Sound FinalDocument20 pagesUG04 APP Week 5 A With Sound FinalJaspal SinghNo ratings yet

- Chapter 3 - The Recording ProcessDocument36 pagesChapter 3 - The Recording ProcessRian Hanz AlbercaNo ratings yet

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesFrom EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesNo ratings yet

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerFrom EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerNo ratings yet

- Business Ethics Week 4Document2 pagesBusiness Ethics Week 4JayMoralesNo ratings yet

- Business Ethics Week 6Document4 pagesBusiness Ethics Week 6JayMoralesNo ratings yet

- Principles of Marketing WEEK 3 and 4Document6 pagesPrinciples of Marketing WEEK 3 and 4JayMoralesNo ratings yet

- 3IS Week 4Document3 pages3IS Week 4JayMoralesNo ratings yet

- Business Finance Week 4Document3 pagesBusiness Finance Week 4JayMoralesNo ratings yet

- FABM 2 Week 4Document3 pagesFABM 2 Week 4JayMoralesNo ratings yet

- Organization and Management Week 4Document3 pagesOrganization and Management Week 4JayMoralesNo ratings yet

- Practical Research 2 Week 4Document2 pagesPractical Research 2 Week 4JayMoralesNo ratings yet

- Principles of Marketing WEEK 1 and 2Document12 pagesPrinciples of Marketing WEEK 1 and 2JayMoralesNo ratings yet

- Principles of Marketing Q4 WEEK 1Document4 pagesPrinciples of Marketing Q4 WEEK 1JayMoralesNo ratings yet

- Media and Information LiteracyDocument105 pagesMedia and Information LiteracyJayMoralesNo ratings yet

- Tutoring ServicesDocument29 pagesTutoring ServicesJayMoralesNo ratings yet

- Introduction To PhilosophyDocument110 pagesIntroduction To PhilosophyJayMorales100% (1)

- PERPETUAL INVENTORY System TransactionDocument1 pagePERPETUAL INVENTORY System TransactionJayMorales100% (2)

- Web Sites TransactionsDocument2 pagesWeb Sites TransactionsJayMorales100% (1)

- Local Business EnvironmentDocument3 pagesLocal Business EnvironmentJayMoralesNo ratings yet

- Business FinanceDocument52 pagesBusiness FinanceJayMoralesNo ratings yet

- PDF of March 3, 2022 Webinar PresentationDocument30 pagesPDF of March 3, 2022 Webinar PresentationAhmed shabanNo ratings yet

- Port LogisticsDocument8 pagesPort LogisticsAnuradha Wasalamudali100% (1)

- Arun Kumar Shukla: Notable Attainments at HDB Financial Services LimitedDocument2 pagesArun Kumar Shukla: Notable Attainments at HDB Financial Services Limitedsaurabh kumar1No ratings yet

- TOT AgreementDocument138 pagesTOT Agreementchinnadurai33No ratings yet

- ICDE'2000: Jim Gray: Dennis TsichritzisDocument1 pageICDE'2000: Jim Gray: Dennis TsichritzisJuan KardNo ratings yet

- Fitness CenterDocument3 pagesFitness CenterKea Espere Sumile100% (2)

- Quality Standards PDFDocument20 pagesQuality Standards PDFmudassarhussainNo ratings yet

- Answer Sheet (Sagutang Papel) : ActivityDocument2 pagesAnswer Sheet (Sagutang Papel) : ActivityAngelica ParasNo ratings yet

- Module 1: Framework For Analysis and Valuation: Business ActivitiesDocument20 pagesModule 1: Framework For Analysis and Valuation: Business Activitiesarunvkumarindia1No ratings yet

- Soal Etika AuditDocument4 pagesSoal Etika AuditJudiono JoemanaNo ratings yet

- Sprint25a Rules November Start ENDocument7 pagesSprint25a Rules November Start ENsaraNo ratings yet

- Classification of Elements: Overheads - Accounting and ControlDocument11 pagesClassification of Elements: Overheads - Accounting and ControlAyushi GuptaNo ratings yet

- Hard Rock Café Location StrategyDocument3 pagesHard Rock Café Location Strategyfrankmarson100% (2)

- Commercial Banking System and Role of RBIDocument9 pagesCommercial Banking System and Role of RBIRishi exportsNo ratings yet

- Internship Project Report - Shweta - FinalDocument101 pagesInternship Project Report - Shweta - FinalshwetaNo ratings yet

- CSR in Specific or Various Industries: Kitex Garments LimitedDocument7 pagesCSR in Specific or Various Industries: Kitex Garments LimitedRiyaNo ratings yet

- Sukhwinder Kaur - Office ManagerDocument4 pagesSukhwinder Kaur - Office ManagerAbhishek aby5No ratings yet

- Quiz No. 1 Discount SeriesDocument2 pagesQuiz No. 1 Discount SeriesAngelicaHermoParas100% (1)

- Balance Sheet of Shakti PumpsDocument2 pagesBalance Sheet of Shakti PumpsAnonymous 3OudFL5xNo ratings yet

- How To Do Basic Transactions On HCMIS FEDocument9 pagesHow To Do Basic Transactions On HCMIS FEGada GudetaNo ratings yet

- Model Canevas 3Document10 pagesModel Canevas 3Hind Nia BenbrahimNo ratings yet

- Tax Drills Weeks 1-7 & DiagnosticDocument119 pagesTax Drills Weeks 1-7 & DiagnosticMitch MinglanaNo ratings yet

- Virtusa PDFDocument2 pagesVirtusa PDFAllu Vijay100% (1)

- InterfaceDocument11 pagesInterfacePougajendy Sadasivame100% (1)

- Ralph LaurenDocument11 pagesRalph LaurenAnushkaNo ratings yet

- Entrep 5Document5 pagesEntrep 5Kenth Godfrei DoctoleroNo ratings yet

- Pengakun II 1Document38 pagesPengakun II 1Cok Angga PutraNo ratings yet

- Single Entry SystemDocument15 pagesSingle Entry Systemmdhanjalah08No ratings yet

- Highest and Best Use Problems in Market ValueDocument3 pagesHighest and Best Use Problems in Market Valuedpkkd50% (2)