Professional Documents

Culture Documents

Celernus Pivot Private Credit Fund Quarterly - Q12020

Celernus Pivot Private Credit Fund Quarterly - Q12020

Uploaded by

CGrantOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Celernus Pivot Private Credit Fund Quarterly - Q12020

Celernus Pivot Private Credit Fund Quarterly - Q12020

Uploaded by

CGrantCopyright:

Available Formats

March 31, 2020

*

Investment Objectives:

1.

2.

3.

Achieve high single-digit returns. Consistently.

Make variability of returns low. Lower than bonds. Way lower than

equities.

Generate uncorrelated returns to those of bond and equity markets.

2.10%

Quarter 1 2020

4. Help small and medium-sized businesses grow.

Equities and high yield bonds had

Fund Details 01How We’ve Performed double-digit losses over this period

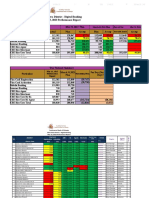

Manager: Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec YTD

Celernus Investment Partners

2020 0.77 0.64 0.67 2.10%

Inc. 2019 0.39 0.65 0.62 0.45 0.55 0.58 1.46 0.82 0.81 0.73 0.54 0.66 8.57%

Sub-Adviser: 2018 0.07 0.10 0.17%

Pivot Financial Services Inc.

Fund Status:

OM, Continuous Offering

02What’s Happening in the Fund?

Fund Structure:

Fund Statistics

Strong performance in a

Cumulative Return 11.04%

Mutual Fund Trust very difficult Q1

Sharpe Ratio 7.99

First Funding Date: environment

Nov 2018 Total Positive Months 17

Minimum Investment: $25,000 Total Down Months 0 Diversity of loan size

Advisory fee: 2.0% Maximum Loan Value $ 3,500,000

Minimum Loan Value $ 83,000 Average term of less than

Performance fee: 20%

Weighted Average Loan Value $ 2,134,000 one year provides good

High water mark: Permanent

Weighted Average Term 295 days liquidity

Subscriptions: Monthly

Number of Full Realized Exits 5

Redemptions: Quarterly (with Two exits in Q1 2020

Value of Full Realized Exits $ 6,261,700

90 days notice)

Auditor: KPMG LLP

Administrator:

Convexus Managed Services Inc.

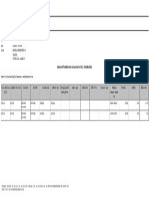

03Where We’re Allocating Capital

GICS Sub-Industry Facility Type Description

Legal Counsel: WeirFoulds LLP

Providing working capital to private equity

Eligible Accounts: Diversified Financial Services Bridge

investment company

RSP, RESP, RRIF, TFSA, Cash

Technology Hardware, Providing working capital to facilitate corporate

Bridge

Portfolio Manager: Storage and Peripherals transition

Christopher Grant, CFA Providing working capital to finance I.T.

Diversified Financial Services Term

Senior Partner infrastructure leases

Oil & Gas Equipment and Providing working capital to energy services

Bridge

Services supplier

Providing acquisition financing to investment

Diversified Financial Services Term

Contact Us advisory company

info@celernus.com Household Products and Term and A/R Providing working capital to manufacturer of home

289-863-1333 Manufacturing Factoring care products

1001 Champlain Avenue, Electronic Equipment &

Bridge

Providing tax-credit financing to internet-of-things

Suite 302 Instruments software and electronics designer

Burlington, Ontario Providing working capital to investment advisory

Diversified Financial Services Term

L7L 5Z4 company

www.celernus.com Providing tax-credit financing to visual-effects

Movies and Entertainment Bridge

company

04Navigating the Absurd Why Invest in CPPCF?

“Sweet Lincoln’s mullet!” – Ron Burgundy Strong Returns and Cash Flow

Relative to other fixed income vehicles, secured

Look, sometimes when you see the absurd, you need to say the absurd.

private commercial lending is expected to generate

Without a doubt, what we are seeing is patently absurd. superior returns that are closer to those provided by

In the final six weeks of Q1 2020, equity markets experienced: 1) an all-time equity indices over a market cycle

market high, 2) an entire bear market, and 3) a 20%+ rally qualifying a new Downside risk is nearer that of fixed income indices

bull market. Low Correlation to Equity and Bond Market Index

Returns

Over the same period, high yield bonds (HYG.US) sold off by 22% before

Secured private commercial lending arrangements

rallying 15%. Crude oil lost two-thirds of its value with no relief rally at all.

in the SME market tend to have low interest rate

Absurd. sensitivity

Returns are driven by the lending rates associated

In Q1 2020, the Celernus Pivot Private Credit Fund was able to maintain at with portfolio deals while downside risk is managed

least one foot in the land of the rational, posting a positive return of 2.10% – by accurate assessment of collateral value

equating to a rolling one-year return of 8.54%.

Portfolio Advantages

Among the highlights of the quarter was the welcoming back of a previous Incorporation of secured private commercial lending

client with an opportunity to provide credit intended to facilitate an reduces reliance on the equity risk premium to drive

important corporate transaction. portfolio returns

Price volatility is lower than that of publicly traded

Over this period, the fund also increased its exposure to technology fixed income securities because private lending

infrastructure lease contracts. We are pleased with these contracts because arrangements are priced at value rather than

they are backed by companies and institutions of very high credit quality. marked-to-public-market

Also of note was the repayment of one of the fund’s larger loans that had

been issued to a mortgage and real estate-oriented financial services

company. About Celernus

Finally, the fund received repayment of its first Scientific Research & Celernus Investment Partners manages investment

Experimental Development (SR&ED) –backed facility. We are constructive funds for high-net-worth individuals and institutions

on loans backed by SR&ED credit collateral because the counterparty to this

with a focus on active management of private credit

and real estate assets.

collateral is the Federal government. At present, the government is

particularly incented to expeditiously return money to job-creating Canadian Our goal is to generate attractive returns, with low

businesses (which in turn, pays back our loans). Because of this, we entered volatility, that exhibit minimal correlation to the

into a second SR&ED-backed loan during the quarter. returns of broad-based fixed income and equity indices.

Given the forced slowdown in worldwide economies, we are hyper-aware of Our funds include:

the need to maintain strong lines of communication with the fund’s current

Celernus Pivot Private Credit Fund CPPCF | CIP600A

borrowers. We are pleased with their competency and professionalism, as

well as the resiliency of the companies they lead. Celernus Mortgage and Income Trust CMIT |

CIP200A/B

During this period of uncertainty, we continue to allocate capital with deep

thought and care – doing our best to balance prudence with fortitude.

Celernus Absolute Growth Fund CAGF | CIP100A

Celernus Credit Opportunities Fund CCOF | CIP500A

All the while practicing social distancing!

DISCLAIMER

Information about the Celernus Pivot Private Credit Fund (the “Fund”) is not to be construed as a public offering of securities in any jurisdiction of Canada. This

Fund presentation is for information purposes only and does not constitute an offer to sell or a solicitation to buy any securities referred to herein. The offering

of units of the Fund is made pursuant to an Offering Memorandum and only to those investors in jurisdictions of Canada who meet certain eligibility or minimum

purchase requirements. Important information about the Fund, including a statement of the Fund’s fundamental investment objectives and risks, is contained in

the Offering Memorandum, a copy of which may be obtained from Celernus Investment Partners Inc. or by contacting your advisor. Please read the Offering

Memorandum carefully before investing. Unit values and investment returns will fluctuate. You are encouraged to speak with a tax advisor as any distributions

paid as a result of capital gains realized by the Fund and income and dividends earned by the Fund are taxable in the year they are paid to you. The Funds are not

guaranteed, their values change frequently and past performance may not be repeated. Past performance, or absence of historical performance in the case of a

new fund, does not guarantee future results. Unit value and investment returns will fluctuate and there is no assurance that a fund can maintain a specific net

asset value. All amounts herein are in Canadian dollars unless otherwise noted.

You might also like

- Examen 4: 5 Out of 5 PointsDocument5 pagesExamen 4: 5 Out of 5 PointsAngel L Rolon TorresNo ratings yet

- AL Debt Fund - One Pager - v3Document2 pagesAL Debt Fund - One Pager - v3kanikaNo ratings yet

- Creating Value For ShareholdersDocument8 pagesCreating Value For Shareholders18ITR028 Janaranjan ENo ratings yet

- Solvency Ratios Analysis: December 19, 2021 Present by Group 4Document16 pagesSolvency Ratios Analysis: December 19, 2021 Present by Group 4Phạm Tuấn HùngNo ratings yet

- ISec Digital Day September 2021Document105 pagesISec Digital Day September 2021Bhagwan BachaiNo ratings yet

- Home First Finance Company India LTD.: SubscribeDocument7 pagesHome First Finance Company India LTD.: SubscribeVanshajNo ratings yet

- Infrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDocument2 pagesInfrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundGaurangNo ratings yet

- Company Presentation MaterialsDocument30 pagesCompany Presentation MaterialsZhangZaoNo ratings yet

- BabeDocument16 pagesBabeNathan FellixNo ratings yet

- The Parts The Whole The Srei Story PDFDocument172 pagesThe Parts The Whole The Srei Story PDFyogesh wadikhayeNo ratings yet

- Bonitetno Porocilo - RS - ENDocument11 pagesBonitetno Porocilo - RS - ENAgit SipkaNo ratings yet

- Debt Product Suite - Upto 1 Yr - March 2023Document17 pagesDebt Product Suite - Upto 1 Yr - March 2023DeepakNo ratings yet

- 2q 2017 FactsheetDocument2 pages2q 2017 Factsheetbnr8jjtjnjNo ratings yet

- Fiera US Equity Segregated Fund - 2023 - SepDocument1 pageFiera US Equity Segregated Fund - 2023 - Sepsmartinvest2011No ratings yet

- Factsheet Moneysave P2P Malaysia MYBTF2108000567 Logistic B 11% 210818Document4 pagesFactsheet Moneysave P2P Malaysia MYBTF2108000567 Logistic B 11% 210818tioNo ratings yet

- Factoring: Market Research& Asia Market OverviewDocument17 pagesFactoring: Market Research& Asia Market OverviewtatianaNo ratings yet

- Stride Ventures Fund III Deck July 2023 - 230920 - 003934Document31 pagesStride Ventures Fund III Deck July 2023 - 230920 - 003934rajanaccNo ratings yet

- Kotak Bank Edel 220118Document19 pagesKotak Bank Edel 220118suprabhattNo ratings yet

- 2021 Year in Review: Mergers & AcquisitionsDocument43 pages2021 Year in Review: Mergers & AcquisitionsKevin ParkerNo ratings yet

- REL Fact Sheet 03-18Document2 pagesREL Fact Sheet 03-18Hannes Sternbeck FryxellNo ratings yet

- Vini 2000 Fobf PPT DocsDocument16 pagesVini 2000 Fobf PPT Docsh75017355No ratings yet

- Pmcf8 Midterm Part 2set A QuizDocument3 pagesPmcf8 Midterm Part 2set A QuizMaria Hannah GallanoNo ratings yet

- Bridging The Gap: Financing Projects: 19 February 2019Document21 pagesBridging The Gap: Financing Projects: 19 February 2019Joshua ArmeaNo ratings yet

- Quarterly M&A ReportDocument23 pagesQuarterly M&A ReportKevin ParkerNo ratings yet

- Investing and Financing Decisions and The Balance SheetDocument35 pagesInvesting and Financing Decisions and The Balance Sheetfmj6687No ratings yet

- H Strategic BondDocument2 pagesH Strategic BondDaniel GauciNo ratings yet

- IREF V 6 Pager Brochure - Regular UnitsDocument6 pagesIREF V 6 Pager Brochure - Regular UnitsPushpa DeviNo ratings yet

- Assured GuarantyDocument7 pagesAssured GuarantyJAINAM SHAHNo ratings yet

- Annual Report 2018 4 PDFDocument44 pagesAnnual Report 2018 4 PDFAnnie LamNo ratings yet

- Hdfc Corporate Bond FundDocument1 pageHdfc Corporate Bond FundMohammad Kausar Ali KhanNo ratings yet

- Home First Finance Company LTD IPO: Issue DetailsDocument8 pagesHome First Finance Company LTD IPO: Issue DetailstoonsagarNo ratings yet

- Financial Analysis of Vantage LTD and Dunhop LTDDocument23 pagesFinancial Analysis of Vantage LTD and Dunhop LTDAJ MNo ratings yet

- Publikasi - PT Hasjrat Multifinance 20082019 01092020Document1 pagePublikasi - PT Hasjrat Multifinance 20082019 01092020Imam M DarwisNo ratings yet

- Libby7ce PPT Ch09Document47 pagesLibby7ce PPT Ch09Moussa ElsayedNo ratings yet

- 712 Financial Reporting and Controls: Submitted By: Akash Narvaria 687082453Document13 pages712 Financial Reporting and Controls: Submitted By: Akash Narvaria 687082453AnarNo ratings yet

- Investment Banking TrendsDocument30 pagesInvestment Banking TrendsjezlinjacobNo ratings yet

- Small Steps Big ShiftsDocument117 pagesSmall Steps Big ShiftsRounak AgarwalNo ratings yet

- JT Express - Highlights of Draft IPO Prospectus - MW - June - 2023 c8jnqgDocument18 pagesJT Express - Highlights of Draft IPO Prospectus - MW - June - 2023 c8jnqgfkyqn9kp75No ratings yet

- Long Term Value CreationDocument3 pagesLong Term Value CreationSafety MarkNo ratings yet

- 1.financial Statment InterpretaionDocument7 pages1.financial Statment InterpretaionRana Ammar waheedNo ratings yet

- Central Depository Services: Stable Growth StoryDocument13 pagesCentral Depository Services: Stable Growth Storyrchawdhry123No ratings yet

- Course Name Course Code Student Name Student ID DateDocument7 pagesCourse Name Course Code Student Name Student ID Datemona asgharNo ratings yet

- Muthoot Finance LTD.: Business OverviewDocument5 pagesMuthoot Finance LTD.: Business OverviewAvinash ThakurNo ratings yet

- 01 EKK Infrastructure Private Limited December 2017 CRISIL RatingDocument4 pages01 EKK Infrastructure Private Limited December 2017 CRISIL RatingSivakumar VeerappanNo ratings yet

- 712-Ratio AnalysisDocument13 pages712-Ratio AnalysisAnarNo ratings yet

- 2Q 2019 Results Presentation: Indonesia's Premier Telecommunication Infrastructure CompanyDocument20 pages2Q 2019 Results Presentation: Indonesia's Premier Telecommunication Infrastructure CompanyRiska HariyadiNo ratings yet

- Dr. Abdul Razak's PE and VCDocument32 pagesDr. Abdul Razak's PE and VCMadhavi PulluruNo ratings yet

- Welspun Enterprises LTD - Investor Presentation - 2Document36 pagesWelspun Enterprises LTD - Investor Presentation - 2Dwijendra ChanumoluNo ratings yet

- IREDADocument8 pagesIREDAGorilla GondaNo ratings yet

- TaskDocument2 pagesTaskbhartisumbriasuryavanshiNo ratings yet

- The New Infrastructure:: A Real Asset Class EmergesDocument16 pagesThe New Infrastructure:: A Real Asset Class Emergesrsm97No ratings yet

- Session 2-2: Credit Risk Database (CRD) For SME Financial Inclusion by Lan Hoang NguyenDocument18 pagesSession 2-2: Credit Risk Database (CRD) For SME Financial Inclusion by Lan Hoang NguyenADBI EventsNo ratings yet

- Finc8019 S12Document27 pagesFinc8019 S12mcahya82No ratings yet

- ALFM Peso Bond FundDocument2 pagesALFM Peso Bond FundkimencinaNo ratings yet

- S2 PPTDocument12 pagesS2 PPTPUSHKAL AGGARWALNo ratings yet

- LC Accounting Q5 Part B Analysis - Lenders PerspectiveDocument7 pagesLC Accounting Q5 Part B Analysis - Lenders PerspectiveChloe KeaneNo ratings yet

- Reits in The Philippines: A Presentation To The Trading Participants of The Philippine Stock Exchange (PSE)Document27 pagesReits in The Philippines: A Presentation To The Trading Participants of The Philippine Stock Exchange (PSE)Ron FabiNo ratings yet

- 2020 12 December PublicDocument2 pages2020 12 December Publicsumit.bitsNo ratings yet

- Chapter 12 Assigned Question SOLUTIONSDocument61 pagesChapter 12 Assigned Question SOLUTIONSDang ThanhNo ratings yet

- Corporate Banking IndusInd Bank Investor Day 20221122Document26 pagesCorporate Banking IndusInd Bank Investor Day 20221122Ankit DhanukaNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- L13-16 MundellFlemingDocument50 pagesL13-16 MundellFlemingBHANU KUMARNo ratings yet

- PF Admin Charges Reduced To 0.5% From 1 June 2018 and EDLI Admin Charges Waived by EPFO - CA ClubDocument4 pagesPF Admin Charges Reduced To 0.5% From 1 June 2018 and EDLI Admin Charges Waived by EPFO - CA ClubNISHA SONARNo ratings yet

- Motilal Oswal 23rd Annual Wealth Creation Study - Detailed ReportDocument43 pagesMotilal Oswal 23rd Annual Wealth Creation Study - Detailed ReportRajeshPandeyNo ratings yet

- NEXT TFD Elder (1) 1Document13 pagesNEXT TFD Elder (1) 1Ruffabbey06No ratings yet

- Bst. Class Xii. Assgn.2013-14Document21 pagesBst. Class Xii. Assgn.2013-14puneetkhurana2007No ratings yet

- BoA - Deposit Form 05731Document2 pagesBoA - Deposit Form 05731Coy IngramNo ratings yet

- Airtel PDFDocument1 pageAirtel PDFShubham PandeyNo ratings yet

- Q1 2011 Return On Tangible Capital PDFDocument1 pageQ1 2011 Return On Tangible Capital PDFVenkat Sai Kumar KothalaNo ratings yet

- Investment Management SamplesDocument4 pagesInvestment Management SamplesMaximNo ratings yet

- Icici Bba ProjectDocument51 pagesIcici Bba ProjectHarsha GuptaNo ratings yet

- Chapter 7-Risk, Return, and The Capital Asset Pricing Model Percentage ReturnDocument10 pagesChapter 7-Risk, Return, and The Capital Asset Pricing Model Percentage ReturnRabinNo ratings yet

- Liberty Mills Limited: Audit ReportDocument41 pagesLiberty Mills Limited: Audit ReportAmad MughalNo ratings yet

- QQQ 2Document2 pagesQQQ 2Dominic angelNo ratings yet

- Midterm Answer KeyDocument10 pagesMidterm Answer KeyRebecca ParisiNo ratings yet

- Income From Other SourcesDocument7 pagesIncome From Other SourcessristiNo ratings yet

- Final Final BlackbookDocument105 pagesFinal Final BlackbookIsha PednekarNo ratings yet

- Finance - SBP ReportingDocument3 pagesFinance - SBP ReportingsxribedNo ratings yet

- 12th Commerce Secretarial PracticeDocument25 pages12th Commerce Secretarial PracticeAmandeep Singh MankuNo ratings yet

- Mar 23, 2023 DDD Digital Banking ReportDocument23 pagesMar 23, 2023 DDD Digital Banking ReportAschalew FikaduNo ratings yet

- SAMPLE EXAM 1aDocument12 pagesSAMPLE EXAM 1abasquesheep60% (5)

- 11.financing For Low Income Housing - Magnitude and Economics - Monitor GroupDocument24 pages11.financing For Low Income Housing - Magnitude and Economics - Monitor Groupalex.nogueira396No ratings yet

- 2024 Budget 12.5.23Document1 page2024 Budget 12.5.23Helen BennettNo ratings yet

- Lesson 1 - Introduction To LedgerDocument18 pagesLesson 1 - Introduction To LedgerNikhita MehraNo ratings yet

- Seminar QuestionsDocument2 pagesSeminar QuestionsjekaterinaNo ratings yet

- 02 S2 Special Topics in Mercantile LawDocument160 pages02 S2 Special Topics in Mercantile Lawsaeloun hrdNo ratings yet

- Ros Rof S1356148Document1 pageRos Rof S1356148Siddharth SatyarthiNo ratings yet

- UBS (Lux) Equity SICAV - All China: Fund Description Performance (Share Class P-Acc Basis USD, Net of Fees)Document2 pagesUBS (Lux) Equity SICAV - All China: Fund Description Performance (Share Class P-Acc Basis USD, Net of Fees)J. BangjakNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-3Document4 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-3Pramod VasudevNo ratings yet

- Ijm (India) Infrastructure Limited: Human Resource DepartmentDocument27 pagesIjm (India) Infrastructure Limited: Human Resource DepartmentDhanu ArunNo ratings yet