Professional Documents

Culture Documents

The Story So Far: Prices of

The Story So Far: Prices of

Uploaded by

deepakOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Story So Far: Prices of

The Story So Far: Prices of

Uploaded by

deepakCopyright:

Available Formats

Why are oil prices in negative terrain?

Sellers have to pay buyers to get rid of their crude, an unprecedented situation

Raghuvir Srinivasan contango trades in the oil off� the British coast and is

market. What do they the accepted benchmark for

The story so far: Prices of mean? this part of the world. The

West Texas Intermediate market that it serves is con-

(WTI), the American bench- Simply put, contango kicks siderably larger than that of

mark for crude oil, fell to less in when prices of a commod- the United States and de-

than zero in Monday’s trade. ity in the futures market are mand is, therefore, higher.

The price of a barrel of WTI considerably higher for de- Transporting oil from the

fell to minus, yes, that’s liveries many months later, U.S. to Asia is not economi-

right, minus $37.63 a barrel. compared to prices for im- cal thus limiting the scope

What this means is that sell- mediate delivery. For in- for the WTI grade. Refi�neries

ers have to pay buyers to get stance, while May oil futures in Europe are confi�gured for

rid of their crude! This is un- are negative and June is at Brent rather than WTI. Pric-

precedented in the oil mar- BACKGROUNDER $20.43 a barrel, November es of Brent are therefore al-

ket, even accounting for its futures for the same grade of ways higher than that of

notoriety for being volatile. oil ended at a hefty $31.66 a WTI. Importantly, unlike

So, speculators who did not barrel on Monday. Contango WTI futures on NYMEX,

Why did prices fall like this? want to take delivery in May trades happen when traders Brent futures traded in Lon-

proceeded to unwind their anticipate a surge or rise in don can be settled by cash

We need to understand a bit “positions,” leading to the demand and value the com- when the contract expires.

of oil market and trading dy- massive fall in prices. modity higher for the future. In other words, a trader who

namics here. WTI oil is trad- It could be that these were has bought oil for May deliv-

ed as futures contracts in the fi�nancial speculators who So, why can’t traders buy ery is not forced to take

NYMEX (New York Mercan- never take physical delivery cheap oil now and store physical delivery of the oil

tile Exchange) where traders and hence closed their con- them for release in future but can settle the contract in

buy and sell monthly futures tracts. Or, these could also when demand and prices cash. This big diff�erence bet-

such as, for instance, May fu- be delivery-based traders rise? ween WTI and Brent has en-

tures, June futures and so backing out as the bottom sured that Brent futures will

on. The sellers of such fu- has fallen off� demand for oil. That’s exactly what traders not crash like that of WTI.

tures will have to deliver a In reality, it would be a com- are now doing. Such a prac-

barrel of crude oil at the con- bination of both categories tice became famous during How is India benefi�ting from

tracted price in the contract- of traders. The bottomline, Iraq’s invasion of Kuwait in this price crash?

ed month just as buyers will though, is that prices fell as 1990 when a trader took

have to take delivery at the demand for oil is falling and massive positions at cheap In two ways. First, the oil im-

contracted date. the world, especially Ameri- prices ahead of the invasion port bill will fall sharply this

As with all trading in com- ca, is running out of storage and sold them when prices fi�scal year, giving tremen-

modities, there’s a huge space. rose after the invasion. Oil dous relief to the govern-

speculative participation in was stored in tankers fl�oat- ment on the external ac-

oil futures trading too. So May WTI futures prices ing on the sea and unloaded count front. With

speculators buy and sell con- went negative but June at considerably higher pric- merchandise exports from

tracts with no intention of futures prices are still at es. Traders are doing the India badly hit due to the

taking delivery (in the case $20.43 a barrel. Why? same now. Year-long hiring lockdown in the West, fo-

of buyers) or off�ering deliv- contracts for VLCC (very reign exchange earnings are

ery (in the case of sellers) of This could be due to two rea- large crude carriers) that can under pressure. With oil

the physical oil, on the con- sons. Traders expect de- store up to 2 million barrels prices falling and foreign ex-

tracted date. These specula- mand to recover by June as of oil are soaring through the change outgo reducing, the

tors have to unwind their lockdowns are lifted across roof. According to a report in pressure on the current ac-

“positions” on the contract the world and economic ac- the Wall Street Journal, count balance is off�. In fact,

expiry date. If they fail to do tivity resumes. Second, trad- VLCC hiring charges for we may be looking at a posi-

so, they will have to take ers also expect that storage year-long contracts are now tive balance in the current

physical delivery of the space may be created as ex- at $72,500 a day, compared account if global economic

crude oil on the contracted isting inventory is drawn to $30,500 a day a year ago. recovery is quick and our ex-

date. down. America is also talk- ports recover. Second, India

What happened on Mon- ing of adding to their strateg- The prices of Brent grade is quietly building up its stra-

day was that speculators ic storage by taking advan- are still at $20.58 a barrel tegic reserves, taking advan-

who had taken large bets on tage of the low prices. This for May futures. What’s the tage of the cheap prices. In-

May futures began to un- could create demand for oil. reason for the diff�erence? dia has a capacity to hold

wind their “positions”. This Finally, contract expiry for over 39 million barrels of oil

was because the futures con- June contracts is still a few Brent oil has traditionally qu- at its strategic reserves in Vi-

tracts are set to expire today, weeks away, giving specula- oted higher than WTI with sakhapatnam, Mangalore

Tuesday. Those not intend- tors that much more time to the gulf being about $6-7 a and Padur, near Udupi.

ing to take physical delivery speculate. barrel between the two. These are underground salt

have to square off� their con- Brent is a superior grade caverns converted and built

tracts before the expiry date. Market reports talk about produced in the North Sea to store crude oil.

You might also like

- FGE - Weekly Oil Market and Refining Update - 1 November 2021Document21 pagesFGE - Weekly Oil Market and Refining Update - 1 November 2021Marlow Touch RugbyNo ratings yet

- Info 1Document28 pagesInfo 1Veejay Soriano Cuevas0% (1)

- Detailed Lesson PlanDocument10 pagesDetailed Lesson Plancess100% (5)

- Investing in Oil, in A Crisis: Covid-19 - Impacts On Oil Futures and EtpsDocument8 pagesInvesting in Oil, in A Crisis: Covid-19 - Impacts On Oil Futures and EtpsSandesh Tukaram GhandatNo ratings yet

- Oil and Gas Trading and Risk ManagementDocument11 pagesOil and Gas Trading and Risk ManagementSalaton KanyaareNo ratings yet

- Unravelling The Oil Engima - Past, Present and Future by RMDocument4 pagesUnravelling The Oil Engima - Past, Present and Future by RMKaitlyn KorellNo ratings yet

- Light Sweet Crude Oil (WTI) Futures and Options: How The World AdvancesDocument16 pagesLight Sweet Crude Oil (WTI) Futures and Options: How The World AdvancesDark CygnusNo ratings yet

- ABN Amro 2019 OilDocument5 pagesABN Amro 2019 OilK MNo ratings yet

- ICE Crude OilDocument10 pagesICE Crude Oilenyi25No ratings yet

- How Oil Market WorksDocument4 pagesHow Oil Market WorksPaco BaGaNo ratings yet

- Trading Wti and Brent 101Document7 pagesTrading Wti and Brent 101venkateswarant0% (1)

- Oil Price FallDocument1 pageOil Price FalldeepakNo ratings yet

- Intermodal Weekly Market Report 3rd February 2015, Week 5Document9 pagesIntermodal Weekly Market Report 3rd February 2015, Week 5Budi PrayitnoNo ratings yet

- Opr 20181205Document32 pagesOpr 20181205rojovies24No ratings yet

- Special Report On Crude OilDocument8 pagesSpecial Report On Crude OilDeepakNo ratings yet

- Russian Oil - UralsDocument1 pageRussian Oil - UralsKhalidNo ratings yet

- Oil Market Prices - AONG WebsiteDocument4 pagesOil Market Prices - AONG WebsiteRizwan FaridNo ratings yet

- FGE - Weekly Oil Market and Refining Update - 27 JuneDocument16 pagesFGE - Weekly Oil Market and Refining Update - 27 JunenoobcatcherNo ratings yet

- Petroleum: How Does Crude Oil Affect Gas Prices?Document5 pagesPetroleum: How Does Crude Oil Affect Gas Prices?SSLabNo ratings yet

- Crude PricingDocument15 pagesCrude PricingGirish1412No ratings yet

- Finance NotesDocument6 pagesFinance NotesGu Xin yuNo ratings yet

- Oil & Gas: Difficult Times..Document4 pagesOil & Gas: Difficult Times..Arvind MeenaNo ratings yet

- Ups and Downs of Oil Prices: Former Ambassador To UNDocument18 pagesUps and Downs of Oil Prices: Former Ambassador To UNmuki10No ratings yet

- Shamik Bhose September Crude Oil ReportDocument8 pagesShamik Bhose September Crude Oil ReportshamikbhoseNo ratings yet

- The Top 3 Oil Tanker Stocks Making A Lot of MoneyDocument2 pagesThe Top 3 Oil Tanker Stocks Making A Lot of MoneyIszahar AbdullahNo ratings yet

- Shun Patel ThesisDocument34 pagesShun Patel Thesisasdf324342No ratings yet

- Comparación Del PetroleoDocument24 pagesComparación Del PetroleoJuan Los NoblesNo ratings yet

- Crude Oil Forecast: Q2 2020: Christopher Vecchio, Cfa, Senior Strategist Rich Dvorak, AnalystDocument8 pagesCrude Oil Forecast: Q2 2020: Christopher Vecchio, Cfa, Senior Strategist Rich Dvorak, AnalystBob BlythNo ratings yet

- Oil Price DifferentialsDocument7 pagesOil Price DifferentialsRazor1011No ratings yet

- The Phenomenon of Negative Oil PricesDocument19 pagesThe Phenomenon of Negative Oil PricesAnikaEmaNo ratings yet

- The Edge - Why Oil Is Pushing Towards Us$100bblDocument3 pagesThe Edge - Why Oil Is Pushing Towards Us$100bblQuyet Doan TienNo ratings yet

- How Crude Become Negative!Document1 pageHow Crude Become Negative!Shaishav MistryNo ratings yet

- Oil Down But Not OutDocument40 pagesOil Down But Not OutJade WNo ratings yet

- Crude Oil ContractsDocument6 pagesCrude Oil ContractsRizwan FaridNo ratings yet

- Spe 1015 0004 Ogf PDFDocument2 pagesSpe 1015 0004 Ogf PDFWisnu ArdhiNo ratings yet

- EPS Oil Pricing - Draft - 05-08Document14 pagesEPS Oil Pricing - Draft - 05-08VISHNU GOPAL EPGDIBS 2021-22No ratings yet

- Oil Markets Have A Timing ProblemDocument2 pagesOil Markets Have A Timing ProblemAlbert LinNo ratings yet

- Oil Refineries in 2013: ST NDDocument2 pagesOil Refineries in 2013: ST NDGaryNo ratings yet

- Weekly Energy Review For November 5, 2014: Banking On Cheap Oil Prices Not EasyDocument17 pagesWeekly Energy Review For November 5, 2014: Banking On Cheap Oil Prices Not Easyd_stepien43098No ratings yet

- Oil Refineries in 2013: ST NDDocument2 pagesOil Refineries in 2013: ST NDxjyang01No ratings yet

- Crude PetroleumDocument6 pagesCrude PetroleumadadwNo ratings yet

- 0602PMDocument2 pages0602PMZerohedgeNo ratings yet

- Asrashaikh 16 16594 7 Article 3Document10 pagesAsrashaikh 16 16594 7 Article 3Syed Ali RehanNo ratings yet

- Crude OilDocument3 pagesCrude OilVaibhav KavthekarNo ratings yet

- Astenbeck Capital Letter July2015Document9 pagesAstenbeck Capital Letter July2015ZerohedgeNo ratings yet

- Exploring Seasonality in Crude Oil Prices For NYMEX - CL1! by Mintdotfinance - TradingViewDocument9 pagesExploring Seasonality in Crude Oil Prices For NYMEX - CL1! by Mintdotfinance - TradingViewOPTIONS TRADING20No ratings yet

- Oil Prices Term PaperDocument5 pagesOil Prices Term Papereeyjzkwgf100% (1)

- 2024 COMMODITIES PREVIEW Andy EditDocument13 pages2024 COMMODITIES PREVIEW Andy Editm0nsysNo ratings yet

- DerivativesDocument130 pagesDerivativesPavithran ChandarNo ratings yet

- Burse ArticolDocument4 pagesBurse ArticolMadalina MraNo ratings yet

- (20190123) RBC Counting BarrelsDocument8 pages(20190123) RBC Counting BarrelsGargarNo ratings yet

- Oil Prices Under Covid-19 Roles: University of Zakho College of Engineering Petroleum Engineering DepDocument19 pagesOil Prices Under Covid-19 Roles: University of Zakho College of Engineering Petroleum Engineering DepAhmed JafferNo ratings yet

- La Fluctuación ..... en InglesDocument18 pagesLa Fluctuación ..... en InglesMarcia Lizeth Valarezo YungaNo ratings yet

- Bloomberg Commodities Outlook Feb 2023 Edition 1676085352Document17 pagesBloomberg Commodities Outlook Feb 2023 Edition 1676085352q4r4kf7c5hNo ratings yet

- State of The US Oil and Gas IndustryDocument9 pagesState of The US Oil and Gas IndustryRodrigo GarcíaNo ratings yet

- The Dollar Will Be Finished As Reserve Currency Within The Next Five Years.Document5 pagesThe Dollar Will Be Finished As Reserve Currency Within The Next Five Years.scparcoNo ratings yet

- Intermodal Report Week 26 2021Document8 pagesIntermodal Report Week 26 2021Nguyen Le Thu HaNo ratings yet

- The New Economics of Oil: Sheikhs V ShaleDocument3 pagesThe New Economics of Oil: Sheikhs V Shaleahr slmNo ratings yet

- Fastmarkets Bulletin 23jul20Document36 pagesFastmarkets Bulletin 23jul20Sergio LopezNo ratings yet

- Canadian Oil Out LookDocument10 pagesCanadian Oil Out LookbblianceNo ratings yet

- Oil's Endless Bid: Taming the Unreliable Price of Oil to Secure Our EconomyFrom EverandOil's Endless Bid: Taming the Unreliable Price of Oil to Secure Our EconomyNo ratings yet

- Status of Import Substitute Potash ReserDocument10 pagesStatus of Import Substitute Potash ReserdeepakNo ratings yet

- 1561013442uptet P-1 17Document25 pages1561013442uptet P-1 17deepakNo ratings yet

- UP Assistant Teacher Exam Syllabus 2018Document2 pagesUP Assistant Teacher Exam Syllabus 2018deepakNo ratings yet

- Mekong Rive Comission Climate Change and Adaptation InitiativeDocument23 pagesMekong Rive Comission Climate Change and Adaptation InitiativedeepakNo ratings yet

- How Can Environmental Protection and Biodiversity Be Improved by Using Current Ecological TechnologiesDocument1 pageHow Can Environmental Protection and Biodiversity Be Improved by Using Current Ecological Technologiesdeepak100% (1)

- As Observer, India Could Learn From As Well As Support The Indian Ocean CommissionDocument1 pageAs Observer, India Could Learn From As Well As Support The Indian Ocean CommissiondeepakNo ratings yet

- 1561013338uptet 2016-IDocument10 pages1561013338uptet 2016-IdeepakNo ratings yet

- Oil Price FallDocument1 pageOil Price FalldeepakNo ratings yet

- Why Migrants Occupy Centre StageDocument1 pageWhy Migrants Occupy Centre StagedeepakNo ratings yet

- Biodiversity and SustainableDocument16 pagesBiodiversity and SustainabledeepakNo ratings yet

- How We Can Balance Conservation and Development - World Economic ForumDocument5 pagesHow We Can Balance Conservation and Development - World Economic ForumdeepakNo ratings yet

- Economics VocabularyDocument61 pagesEconomics VocabularydeepakNo ratings yet

- U.S.'s Moves To Resume Nuclear TestingDocument1 pageU.S.'s Moves To Resume Nuclear TestingdeepakNo ratings yet

- People Can Pose Queries and Get Answers On Twitter: Press Trust of IndiaDocument1 pagePeople Can Pose Queries and Get Answers On Twitter: Press Trust of IndiadeepakNo ratings yet

- ClimatechangeglossaryDocument6 pagesClimatechangeglossarydeepakNo ratings yet

- Atrificial IntelligencyDocument1 pageAtrificial IntelligencydeepakNo ratings yet

- Timeline of Ancient History: (Common Era Years in Astronomical Year Numbering)Document10 pagesTimeline of Ancient History: (Common Era Years in Astronomical Year Numbering)deepakNo ratings yet

- Indian History: Ancient India To Modern India ChronologyDocument3 pagesIndian History: Ancient India To Modern India ChronologydeepakNo ratings yet

- 978 1 4438 3890 0 SampleDocument30 pages978 1 4438 3890 0 SampledeepakNo ratings yet

- Gandhian Strategy-The Exclusive Mantra For Solving Problems in Modern Context - Articles On and by GandhiDocument7 pagesGandhian Strategy-The Exclusive Mantra For Solving Problems in Modern Context - Articles On and by GandhideepakNo ratings yet

- Suo Moto CognizanceDocument4 pagesSuo Moto CognizancedeepakNo ratings yet

- Coal Projects in India-2014: 300+ PagesDocument4 pagesCoal Projects in India-2014: 300+ PagesdeepakNo ratings yet

- Impact of COVID-19 On The World EconomyDocument9 pagesImpact of COVID-19 On The World EconomydeepakNo ratings yet

- Poaching, Not Coronavirus, Is The Bigger Threat, Says Tiger Expert - The HinduDocument3 pagesPoaching, Not Coronavirus, Is The Bigger Threat, Says Tiger Expert - The HindudeepakNo ratings yet

- 1974-5 Gibson Super 400CES PDFDocument6 pages1974-5 Gibson Super 400CES PDFBetoguitar777No ratings yet

- 1 - Pattent IDocument8 pages1 - Pattent IAmirNo ratings yet

- 79-Article Text-140-3-10-20170810Document5 pages79-Article Text-140-3-10-20170810Raihanah Fadhillah YulianiNo ratings yet

- Influence of Wood ModificationDocument11 pagesInfluence of Wood Modificationkulin_banNo ratings yet

- Nrfat Rev 2018Document225 pagesNrfat Rev 2018Diego VillaniaNo ratings yet

- Training Modules For Group B Officers & Group C Supervisors of S&T DepartmentDocument59 pagesTraining Modules For Group B Officers & Group C Supervisors of S&T DepartmentMayank TripathiNo ratings yet

- BEVAE-181 Sample PPR 2Document4 pagesBEVAE-181 Sample PPR 2saketsharmaytNo ratings yet

- MSDS Pozzolith® 100 XRDocument5 pagesMSDS Pozzolith® 100 XRakardosNo ratings yet

- Ship SizeDocument4 pagesShip SizeBaki PınarlıNo ratings yet

- Design and Prototype of Inline Seeder 2022 AAITDocument88 pagesDesign and Prototype of Inline Seeder 2022 AAITHailemariam Weldegebral0% (1)

- Betag 2014Document7 pagesBetag 2014MelmakPolytronNo ratings yet

- Isolated Bidirectional Full-Bridge DC-DC Converter With A Flyback SnubberDocument62 pagesIsolated Bidirectional Full-Bridge DC-DC Converter With A Flyback SnubberqwertyuiopNo ratings yet

- Figure 1 Concept of Structure and Function: Philippine-EagleDocument8 pagesFigure 1 Concept of Structure and Function: Philippine-EagleShekaina Faith Cuizon Lozada100% (2)

- Application of Passive Solar SystemDocument38 pagesApplication of Passive Solar SystemRam Krishna SinghNo ratings yet

- Presentation of Food Processing (FSSAI)Document32 pagesPresentation of Food Processing (FSSAI)Naincy Chhabra100% (1)

- Apour Pressure For Liquid Vapour Equilibrium: Antoine'S Equation Fitting (T in Kelvin and P in Kpa)Document2 pagesApour Pressure For Liquid Vapour Equilibrium: Antoine'S Equation Fitting (T in Kelvin and P in Kpa)makari66No ratings yet

- Czasy TabelkaDocument2 pagesCzasy TabelkaAnna UssNo ratings yet

- Food Recall and RecordDocument29 pagesFood Recall and RecordCitra DessyNo ratings yet

- Playground Arduino CC Code NewPingDocument11 pagesPlayground Arduino CC Code NewPingimglobaltraders100% (1)

- Skema Jawapan Instrumen Bi PTTS 2023Document9 pagesSkema Jawapan Instrumen Bi PTTS 2023Darina Chin AbdullahNo ratings yet

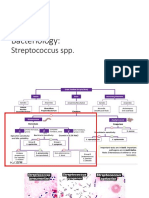

- MicroPara Lecture 6Document24 pagesMicroPara Lecture 6Pearl NoconNo ratings yet

- Soal USP BIG LMDocument56 pagesSoal USP BIG LMMoh. Aska FailandriNo ratings yet

- Forum Arduino CC T GRBL Lcdkeypad Shield 331250 6Document10 pagesForum Arduino CC T GRBL Lcdkeypad Shield 331250 6David duranNo ratings yet

- Wastage of Food in Indian WeddingsDocument9 pagesWastage of Food in Indian WeddingsThe United IndianNo ratings yet

- 4 WD SystemDocument126 pages4 WD SystemSantiago Morales100% (1)

- Lucent Technologies CaseDocument9 pagesLucent Technologies CaseShrivathsan KSNo ratings yet

- HomeAwayJamalMahjoub WSTEXTDocument11 pagesHomeAwayJamalMahjoub WSTEXTVanDesignsNo ratings yet

- Digit ProblemDocument4 pagesDigit ProblemKimo KenoNo ratings yet