Professional Documents

Culture Documents

Total Job Cost

Total Job Cost

Uploaded by

Cyruss MeranoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Total Job Cost

Total Job Cost

Uploaded by

Cyruss MeranoCopyright:

Available Formats

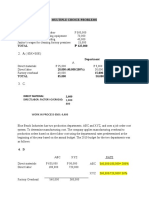

1.

If the direct labor cost method is used in applying factory overhead and the predetermined rate

is 100%, what amount should be charged to Job 2010 for factory overhead? Assume that direct

materials used totaled $5,000 and that the direct labor cost totaled $3,200.

GIVEN:

DIRECT MATERIAL = $5,000

DIRECT LABOR = $3,200

FACTORY OVERHEAD = (100% OF $3200) = $3,200

SOLUTION:

𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇 𝐽𝐽𝐽𝐽𝐽𝐽 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 = 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷 𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 + 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷 𝐿𝐿𝐿𝐿𝐿𝐿𝐿𝐿𝐿𝐿 + 𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴 𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂

𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇 𝐽𝐽𝑂𝑂𝑂𝑂 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 = $5,000 + $3,200 + $3,200

𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇 𝐽𝐽𝐽𝐽𝐽𝐽 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 = $11,400

2. If direct labor hour method is used in applying factory overhead and the predetermined rate is

$10 an hour, what amount should be charged to Job 2010 for factory overhead? Assume that the

direct materials used totaled $5,000, the direct labor cost total $3,200, and the number of direct

labor hours totaled 250.

GIVEN:

DIRECT MATERIAL = $5,000

DIRECT LABOR = $3,200

FACTORY OVERHEAD = (250 HOURS X $10) = $2,500

SOLUTION:

𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇 𝐽𝐽𝐽𝐽𝐽𝐽 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 = 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷 𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 + 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷 𝐿𝐿𝐿𝐿𝐿𝐿𝐿𝐿𝐿𝐿 + 𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴 𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂

𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇 𝐽𝐽𝐽𝐽𝐽𝐽 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 = $5,000 + $3,200 + $2,500

𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇 𝐽𝐽𝐽𝐽𝐽𝐽 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 = $10,700

3. If the machine hour method is used in applying factory overhead and the predetermined rate is

$12.50 an hour, what amount should be charged to Job 2010 for factory overhead? Assume that

the direct materials used totaled $5,000, the direct cost totaled $3,200, the direct labor hours were

250 hours, and the machine hours were 295 hours.

GIVEN:

DIRECT MATERIAL = $5,000

DIRECT LABOR = $3,200

FACTORY OVERHEAD = (295 HOURS X $12.50) = $3,687.50

SOLUTION:

𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇 𝐽𝐽𝐽𝐽𝐽𝐽 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 = 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷 𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 + 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷 𝐿𝐿𝐿𝐿𝐿𝐿𝐿𝐿𝐿𝐿 + 𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴 𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂

𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇 𝐽𝐽𝐽𝐽𝐽𝐽 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 = $5,000 + $3,200 + $3,687.50

𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇 𝐽𝐽𝐽𝐽𝐽𝐽 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 = $11,887.50

You might also like

- CH4 Test Bank (Problems)Document11 pagesCH4 Test Bank (Problems)ABC DEFNo ratings yet

- Soal Job Costing 14 Maret 2021Document5 pagesSoal Job Costing 14 Maret 2021Sugata SNo ratings yet

- Reviewer Cost PrelimsDocument10 pagesReviewer Cost PrelimsClarence John G. BelzaNo ratings yet

- Productivity Class ExamplesDocument5 pagesProductivity Class ExamplesWilly K. Ng'etich80% (5)

- Chapter 3 Test AccountingDocument2 pagesChapter 3 Test AccountingitonemodNo ratings yet

- Problems SolvingDocument4 pagesProblems SolvingAhmed RaeisiNo ratings yet

- Managerial Accounting Homework 1.3Document5 pagesManagerial Accounting Homework 1.3OvidiaNo ratings yet

- Section 5Document2 pagesSection 5Wael chehataNo ratings yet

- Assignment 1Document4 pagesAssignment 1Rahul ARNo ratings yet

- PANDIT PURNAJUARA - TUGAS CASE 3 - BLEMBA 67 WEEKEND - Financial Report and ControlDocument5 pagesPANDIT PURNAJUARA - TUGAS CASE 3 - BLEMBA 67 WEEKEND - Financial Report and ControlPandit PurnajuaraNo ratings yet

- Cost AccountingDocument4 pagesCost AccountingRoselyn LumbaoNo ratings yet

- Job Order Costing SystemDocument1 pageJob Order Costing SystemDesiree FrancoNo ratings yet

- Tugas 1 Akuntansi ManagerDocument9 pagesTugas 1 Akuntansi ManagerPutri RahmalyaNo ratings yet

- Ch.2 - Job CostingDocument26 pagesCh.2 - Job Costingahmedgalalabdalbaath2003No ratings yet

- Cost AccountingDocument2 pagesCost AccountingVerediana MbilangoNo ratings yet

- P 6 + 4 + 8 18 Different Models.: 5 300 000 2000,, / / Ker HR Yr HR WorDocument3 pagesP 6 + 4 + 8 18 Different Models.: 5 300 000 2000,, / / Ker HR Yr HR WorIlhamNo ratings yet

- Hence, Correct Answer Is $10,178Document1 pageHence, Correct Answer Is $10,178MohitNo ratings yet

- Jawaban Tugas Akmen TM 6 - DwitiaraDocument2 pagesJawaban Tugas Akmen TM 6 - DwitiaraDwi Tiara PutriNo ratings yet

- (W5) Tutorial Answer Chapter 3 JOCDocument4 pages(W5) Tutorial Answer Chapter 3 JOCMUHAMMAD ADAM MOHD DEFIHAZRINo ratings yet

- Incentive Exercises Topic 5 - 0Document8 pagesIncentive Exercises Topic 5 - 0ScribdTranslationsNo ratings yet

- Chapter 3-Exercises-Managerial AccountingDocument3 pagesChapter 3-Exercises-Managerial AccountingSheila Mae LiraNo ratings yet

- Assignment Question AccDocument5 pagesAssignment Question AccruqayyahqaisaraNo ratings yet

- Nandinisingh - Managerial Accounting - BDocument4 pagesNandinisingh - Managerial Accounting - Btanya.goyalNo ratings yet

- Selection in Resent Economy Solved Supplementary ProblemsDocument3 pagesSelection in Resent Economy Solved Supplementary ProblemsRonielManzanoEsperidionNo ratings yet

- Ppce Unit-5Document21 pagesPpce Unit-5Jackson ..No ratings yet

- Job Costing 2440011362 Rogger SeptryaDocument5 pagesJob Costing 2440011362 Rogger SeptryaRogger SeptryaNo ratings yet

- Cost Accounting Practice Quiz Chap 3-4Document7 pagesCost Accounting Practice Quiz Chap 3-4Adeline DelveyNo ratings yet

- Tutorial Unit 5Document6 pagesTutorial Unit 5Mukoya edward EdwardNo ratings yet

- Compensation Problem ExcersizeDocument9 pagesCompensation Problem ExcersizesephNo ratings yet

- Assignment #2 DM&DL L Variance With SolutionDocument9 pagesAssignment #2 DM&DL L Variance With SolutionJeannet LagcoNo ratings yet

- Operationmanagementproblems 131216134550 Phpapp02Document86 pagesOperationmanagementproblems 131216134550 Phpapp02Mai LinhNo ratings yet

- 08 Selection of Present EconomyDocument15 pages08 Selection of Present EconomyMitch TechsNo ratings yet

- Pom Review QaDocument38 pagesPom Review QaShijaAbihudKabola100% (1)

- EFAAC CMA Session4,5,6 CostingSystemDocument73 pagesEFAAC CMA Session4,5,6 CostingSystemankitadeyarun1997No ratings yet

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNo ratings yet

- Overhead Math and SolutionDocument3 pagesOverhead Math and SolutionRajibNo ratings yet

- Job Order CostingDocument51 pagesJob Order CostingKenneth TallmanNo ratings yet

- Akutansi Biaya 3 BaruDocument3 pagesAkutansi Biaya 3 Baruulfania eka0% (1)

- Cost and Management Accounting AssessmentDocument6 pagesCost and Management Accounting Assessmentsumanrock9040No ratings yet

- Standard Costing Quiz 2Document2 pagesStandard Costing Quiz 2Shafni DulnuanNo ratings yet

- Valerio Cost Account 3Document3 pagesValerio Cost Account 3Laurence Garcia LaurenteNo ratings yet

- Assignment (Page203) - Jamvy Fernandez - BSA2.1 - CY2Document2 pagesAssignment (Page203) - Jamvy Fernandez - BSA2.1 - CY2Jamvy Jose FernandezNo ratings yet

- B.3. Forecasting Techniques Essay 1Document7 pagesB.3. Forecasting Techniques Essay 1Kondreddi SakuNo ratings yet

- Lec06a Labour and Material CostsDocument21 pagesLec06a Labour and Material CostsShazamNo ratings yet

- CH 5 ExcelDocument37 pagesCH 5 ExcelssdsNo ratings yet

- Solutions-Chapter 2Document5 pagesSolutions-Chapter 2Saurabh SinghNo ratings yet

- 7811-6, 7 - Productivity PMDocument5 pages7811-6, 7 - Productivity PMfarahNo ratings yet

- Sample Productivity ProblemsDocument5 pagesSample Productivity ProblemsCassia MontiNo ratings yet

- University of Finance and MarketingDocument8 pagesUniversity of Finance and MarketingQuế Phương NguyễnNo ratings yet

- 2021 Answer Chapter 5Document15 pages2021 Answer Chapter 5prettyjessyNo ratings yet

- Athena LTD SolutionDocument4 pagesAthena LTD Solutionsurbhiaggarwal13No ratings yet

- ABC ProblemsDocument2 pagesABC Problemsxenon cloudNo ratings yet

- Costassign JoDocument4 pagesCostassign Jokishi8mempinNo ratings yet

- Lecture 7 - Practice Answer - March 31, 2019 - 3pm To 6pmDocument5 pagesLecture 7 - Practice Answer - March 31, 2019 - 3pm To 6pmBhunesh KumarNo ratings yet

- Paper8 Solution PDFDocument19 pagesPaper8 Solution PDFronakNo ratings yet

- Problem Set 2 With Solution - Cost Concept & Design ProcessDocument5 pagesProblem Set 2 With Solution - Cost Concept & Design ProcessNoel So jr100% (1)

- Ch09 TB Hoggetta8eDocument14 pagesCh09 TB Hoggetta8eAlex Schuldiner100% (1)

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 24Document15 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 24Mr. JalilNo ratings yet

- Laboratory Exercises in Astronomy: Solutions and AnswersFrom EverandLaboratory Exercises in Astronomy: Solutions and AnswersNo ratings yet

- Fig. 5.1Document1 pageFig. 5.1Cyruss MeranoNo ratings yet

- Fig. 2A.2Document1 pageFig. 2A.2Cyruss MeranoNo ratings yet

- Fig. S2.1.1Document1 pageFig. S2.1.1Cyruss MeranoNo ratings yet

- Fig. 2.3Document1 pageFig. 2.3Cyruss MeranoNo ratings yet

- Fig. 2A.3Document1 pageFig. 2A.3Cyruss MeranoNo ratings yet

- Fig. 2A.1Document1 pageFig. 2A.1Cyruss MeranoNo ratings yet

- Fig. 2.5Document1 pageFig. 2.5Cyruss MeranoNo ratings yet

- Fig. 2.4Document1 pageFig. 2.4Cyruss MeranoNo ratings yet

- Fig. 2.6Document1 pageFig. 2.6Cyruss MeranoNo ratings yet

- Principles of Microeconomics, 8e (Case/Fair) Chapter 6: Household Behavior and Consumer ChoiceDocument66 pagesPrinciples of Microeconomics, 8e (Case/Fair) Chapter 6: Household Behavior and Consumer ChoiceCyruss MeranoNo ratings yet

- Fig. 2.1Document1 pageFig. 2.1Cyruss MeranoNo ratings yet

- Activity 8 NomenclatureDocument2 pagesActivity 8 NomenclatureCyruss MeranoNo ratings yet

- Fig. 2.2Document1 pageFig. 2.2Cyruss MeranoNo ratings yet

- Solution:: Indirect Labor Hours Indirect Labor CostDocument1 pageSolution:: Indirect Labor Hours Indirect Labor CostCyruss MeranoNo ratings yet

- Summary Measures: DF SS MS F P-ValueDocument3 pagesSummary Measures: DF SS MS F P-ValueCyruss MeranoNo ratings yet

- Probability 9.21.2019Document20 pagesProbability 9.21.2019Cyruss MeranoNo ratings yet

- Matter ExcerciseDocument3 pagesMatter ExcerciseCyruss MeranoNo ratings yet