Professional Documents

Culture Documents

Financial Planning - Dec 09

Financial Planning - Dec 09

Uploaded by

abhimani5472Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Planning - Dec 09

Financial Planning - Dec 09

Uploaded by

abhimani5472Copyright:

Available Formats

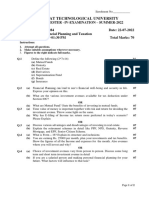

INSTITUTE OF MANAGEMENT TECHNOLOGY

CENTRE FOR DISTANCE LEARNING

GHAZIABAD

End-Term Examinations – December 2009

Subject Code : IMT-110 Time Allowed : 3 Hours

Subject Name: Basics of Personal Financial Planning Max. Marks : 70

Notes: (a) Answer any FOUR questions from SECTION-A and CASE STUDY as given in SECTION-B.

Each Question (SECTION-A) carries 14 MARKS and (SECTION-B) Case Study carries 14 MARKS.

(b) For students enrolled before January 2008, the Question Paper would be treated for 50 marks instead of 70 marks.

(c) No doubts/clarifications shall be entertained. In case of doubts/clarifications, make reasonable assumptions and proceed.

SECTION-A MARKS : 56

Q1. Why should one aim at financial planning? Discuss the importance of gathering and assessing information

about a client in the preparation of a financial plan.

Q2. a) Explain the concept of Present value of money and Future value of money and their uses in the

insurance sector.

b) Neha wants to sell her house for Rs 11,50,000 which will be paid immediately. She also has an offer in

hand from a property dealer who says that he shall pay Rs 15,00,000 after a period of three years from

now. Assuming an interest rate of 10%, what in your opinion should be Neha’s decision?

Q3. a) How do you estimate optimal insurance protection for an individual?

b) Explain the human Life value concept bringing out the information set that is required for its

computation.

Q4. a) What are the sources of income that are exempt from tax? What is the difference between tax avoidance

and tax evasion?

b) Kamla, a 65 year old lady, has earned Rs 8, 25,000 in the year. She invests Rs 25000/- in Post office

National Savings Certificates and purchases a health policy for Rs 30000/- and an annuity policy for

herself for Rs 50,000/. She also donates Rs 10000/- to a charitable institution eligible for tax deduction

under 80 G during the year. Calculate the net tax payable.

Q5. Why is a written financial plan better preferable to an oral one? What are the major components of a

comprehensive plan?

Q6. Discuss the need for retirement planning. Why is it said that India has huge potential for an annuity market.

Q7. Write short notes on and three-

(i) Present value of money (ii) Tax planning Objectives (iii) Rule of 72

(iv) Balance Sheet (v) Net worth (vi) Annuity

ETE-Dec 09_29/12 Page 1 of 2 IMT-110

SECTION-B (Case Study) MARKS : 14

Sunil was extremely excited about a prospect whom he had convinced to invest Rs. 1,00,000/- in a life insurance

product which he had to offer. When Sunil met the customer to collect the cheque, Rajesh informed him “Sunil, I

need your policy, but I don't have the money to pay”. Sunil was shocked that Rajesh, with a lifestyle of two cars, a

good flat in Mumbai, children studying in a good school and an income of 15,00,000/- p.a. could not pay Rs.

1,00,000/- as annual premium. The average saving ratio in India being 25% of income, here he was in front of a

prosperous customer who was not able to spare 6.5% into an investment.

Not one to give up hope, Sunil came out of the meeting determined to find out a solution because he was convinced

that a solution offered to Rajesh would add substantial value to Rajesh's life. Two days later he called Rajesh and

requested for another meeting suggesting that he could create a cash flow, which might provide the funds necessary

for the solution and needed certain data. Rajesh, realizing that Sunil's commitment to him, as a prospect was a

“Never before experience”, quickly consented. They met together and drew an analysis and were able to save out

the required amount of 1 lac. Further, they together assessed Rajesh’s need for children education , buying own

house in a decent colony in Delhi, marriage of children etc…. and drew out a need analysis on his insurance

requirement.

Questions

Q.1 How do you think they could together create a cash flow for Rajesh? How would you do it if in their position?

Q.2 How is a financial plan drawn? Can you enlist the benefits of drawing a financial plan?

Q.3 What is the role of Life Insurance products in personal financial planning of an individual?

Q.4 What in your opinion would be the insurance requirement for Rajesh in the given circumstances?

ETE-Dec 09_29/12 Page 2 of 2 IMT-110

You might also like

- Solution Manual For Principles of Risk Management and Insurance 13th Edition Rejda McNamara 0134082575 9780134082578Document36 pagesSolution Manual For Principles of Risk Management and Insurance 13th Edition Rejda McNamara 0134082575 9780134082578ericakaufmanctpkanfyms100% (29)

- ICICI Home Loans Project ReportDocument109 pagesICICI Home Loans Project ReportJohn Paul86% (21)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- p85 Form - HMRC - Leaving The UkDocument4 pagesp85 Form - HMRC - Leaving The Ukanthonyorourke813982No ratings yet

- Sample Exam Paper With Answers PDFDocument6 pagesSample Exam Paper With Answers PDFabhimani5472100% (1)

- Institute of Management Technology: Centre For Distance LearningDocument1 pageInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Class XI (Commerce) Holiday Home Work 2023-24Document9 pagesClass XI (Commerce) Holiday Home Work 2023-24Nivedan SainiNo ratings yet

- FMPSDocument2 pagesFMPSAman RenaNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityIsha KhannaNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityShyamsunder SinghNo ratings yet

- Acknowledgement: (Branch Head HDFC, Jaipur) For Giving Me An Opportunity ToDocument34 pagesAcknowledgement: (Branch Head HDFC, Jaipur) For Giving Me An Opportunity Toronypatel100% (5)

- Banking AwarenessDocument258 pagesBanking AwarenessDhanrajDarsenaNo ratings yet

- Gujarat Technological UnversityDocument2 pagesGujarat Technological UnversityKrutika Goyal100% (1)

- Class - Xii - Entrepreneurship - Sample Paper - Solved No.2 - 2018-19Document9 pagesClass - Xii - Entrepreneurship - Sample Paper - Solved No.2 - 2018-19Rishav BhattNo ratings yet

- FM PP 1 PDFDocument3 pagesFM PP 1 PDFRavichandraNo ratings yet

- Mba Summer 2022Document2 pagesMba Summer 2022Dhruvi PatelNo ratings yet

- Jaiib RBWM May 2023 Recollected Questions AnswersDocument9 pagesJaiib RBWM May 2023 Recollected Questions Answersprabhat.kr149No ratings yet

- Smu Mba AssignmentsDocument19 pagesSmu Mba AssignmentsProjectHelpForuNo ratings yet

- 2013Document6 pages2013blackmafia1297No ratings yet

- GNG Test 1Document10 pagesGNG Test 1Shivansh JaiswalNo ratings yet

- Credit Risk Management in HDFC BankDocument44 pagesCredit Risk Management in HDFC BankAyesha Mathur100% (2)

- Nov Dec3rd VTH Sem 2021 1Document33 pagesNov Dec3rd VTH Sem 2021 1progamerzbest07No ratings yet

- JaiibDocument105 pagesJaiibManikantha PattugaralaNo ratings yet

- 3rd Trimester Paper 2022Document9 pages3rd Trimester Paper 2022vaibhavrs22.pumbaNo ratings yet

- Adobe Scan 24-Jun-2024Document4 pagesAdobe Scan 24-Jun-2024trishala sharmaNo ratings yet

- Eco, B ST, Acc HHWDocument9 pagesEco, B ST, Acc HHWYug RajputNo ratings yet

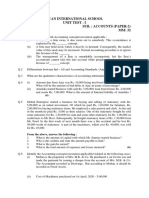

- Ryan International School Unit Test - I Class-Xi Sub.: Accounts (Paper-2) Time: 1 Hrs. MM: 32Document2 pagesRyan International School Unit Test - I Class-Xi Sub.: Accounts (Paper-2) Time: 1 Hrs. MM: 32RGN 11E 20 KHUSHI NAGARNo ratings yet

- Mba Winter 2018Document3 pagesMba Winter 2018fsdNo ratings yet

- Lotak Bank Finance LoanDocument11 pagesLotak Bank Finance LoanHarshal MohinkarNo ratings yet

- CA10 PB2 2022 AnswerKeyDocument7 pagesCA10 PB2 2022 AnswerKeyareet564No ratings yet

- Impact Evaluation of Prime Minister's Employment Generation ProgramDocument39 pagesImpact Evaluation of Prime Minister's Employment Generation ProgramDhruv JainNo ratings yet

- Sample Question CFPDocument15 pagesSample Question CFPapi-3814557100% (7)

- Isbm University Semester Examination, April-20Document2 pagesIsbm University Semester Examination, April-20Sidharth MIshraNo ratings yet

- ABM 118 Investment ManagementDocument114 pagesABM 118 Investment ManagementJulieto ZubradoNo ratings yet

- Module 1 CFP Mock TestDocument6 pagesModule 1 CFP Mock Testchitra_shresthaNo ratings yet

- BA Quiz PDF 25 June Copy 1Document6 pagesBA Quiz PDF 25 June Copy 1Rahul singhNo ratings yet

- MMPC 014Document6 pagesMMPC 014Pawan ShokeenNo ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument1 pageInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Final HDFC ProjectDocument45 pagesFinal HDFC ProjectAbhishek SainiNo ratings yet

- Bright Day School, Vadodara CBSE Unit - Vasna Academic Year: 2021 - 22 Term Test - I Subject: Economics (030) Date: 18/09/2021 STD: XII Time: 3 Hours Marks: 80Document4 pagesBright Day School, Vadodara CBSE Unit - Vasna Academic Year: 2021 - 22 Term Test - I Subject: Economics (030) Date: 18/09/2021 STD: XII Time: 3 Hours Marks: 80ADITYA SINGHNo ratings yet

- IBFS 2 Till 0807Document209 pagesIBFS 2 Till 0807neeraj_adorable4409No ratings yet

- Financial - Accounting - and - Analysis - Assignment - Dec - 2020 - NmPXMM5fmB COMPLETE PDFDocument5 pagesFinancial - Accounting - and - Analysis - Assignment - Dec - 2020 - NmPXMM5fmB COMPLETE PDFani2sysNo ratings yet

- Final Exam SemesterDocument1 pageFinal Exam SemesterPrashant BhatiaNo ratings yet

- Punjab College Bhimber: Mirpur University of Science and Technology (Bhimber Campus)Document2 pagesPunjab College Bhimber: Mirpur University of Science and Technology (Bhimber Campus)Hamza TariqNo ratings yet

- DEFIN542Document1 pageDEFIN542vincentalexanderanthonyNo ratings yet

- Iilm Academy of Higher Learning, Jaipur: ROLL NO. .. MBA BATCH . Time: 90 Minutes Max. Marks: 50Document2 pagesIilm Academy of Higher Learning, Jaipur: ROLL NO. .. MBA BATCH . Time: 90 Minutes Max. Marks: 50DrSwati BhargavaNo ratings yet

- I. Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10Document2 pagesI. Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10RavichandraNo ratings yet

- I. Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10Document2 pagesI. Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10RavichandraNo ratings yet

- ABACUS-Intro - To Buss - FinanceDocument1 pageABACUS-Intro - To Buss - FinanceAli AkbarNo ratings yet

- Nism 5 A - Mutual Fund Exam - Practice Test 6 - Copy - PDF (Secured) - Adobe ReaderDocument24 pagesNism 5 A - Mutual Fund Exam - Practice Test 6 - Copy - PDF (Secured) - Adobe ReaderNithin VarghzzNo ratings yet

- 1st Sem PapersDocument66 pages1st Sem PapersJanvi 86 sec.BNo ratings yet

- Ininstitute of Management Technology: Centre For Distance LearningDocument2 pagesIninstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- DMGT207 8Document1 pageDMGT207 8rjaggi0786No ratings yet

- MMPMC 014Document3 pagesMMPMC 014Ashvanee Kr. PathakNo ratings yet

- Strengthening India's Intergovernmental Fiscal Transfers: Learnings from the Asian ExperienceFrom EverandStrengthening India's Intergovernmental Fiscal Transfers: Learnings from the Asian ExperienceNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Innovative Infrastructure Financing through Value Capture in IndonesiaFrom EverandInnovative Infrastructure Financing through Value Capture in IndonesiaRating: 5 out of 5 stars5/5 (1)

- The Exciting World of Indian Mutual FundsFrom EverandThe Exciting World of Indian Mutual FundsRating: 5 out of 5 stars5/5 (1)

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItFrom EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNo ratings yet

- Human Capital Development in South Asia: Achievements, Prospects, and Policy ChallengesFrom EverandHuman Capital Development in South Asia: Achievements, Prospects, and Policy ChallengesNo ratings yet

- Human Capital Development in the People's Republic of China and India: Achievements, Prospects, and Policy ChallengesFrom EverandHuman Capital Development in the People's Republic of China and India: Achievements, Prospects, and Policy ChallengesNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- We Create Stock Market ProfessionalsDocument12 pagesWe Create Stock Market Professionalsabhimani5472No ratings yet

- Sample 168 PDFDocument26 pagesSample 168 PDFabhimani5472No ratings yet

- Topic: Finance For Non Finance Executives FACULTY: Mr. J N MamtoraDocument3 pagesTopic: Finance For Non Finance Executives FACULTY: Mr. J N Mamtoraabhimani5472No ratings yet

- Delisting Candidates111Document6 pagesDelisting Candidates111abhimani5472No ratings yet

- Finance For Non-Finance Managers: SCDL: Obj Ect IveDocument5 pagesFinance For Non-Finance Managers: SCDL: Obj Ect Iveabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Finance - For Non-Finance - ExecutivesDocument4 pagesFinance - For Non-Finance - Executivesabhimani5472No ratings yet

- Accredited Finance For Non-Financial Managers: Chartered Management Institute'S SyllabusDocument2 pagesAccredited Finance For Non-Financial Managers: Chartered Management Institute'S Syllabusabhimani5472No ratings yet

- Finance For Non-Finance Personnel 2011Document4 pagesFinance For Non-Finance Personnel 2011abhimani5472No ratings yet

- International Finance - Dec 09Document1 pageInternational Finance - Dec 09abhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument1 pageInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument1 pageInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Ininstitute of Management Technology: Centre For Distance LearningDocument2 pagesIninstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Finance Question PaperDocument2 pagesFinance Question Paperabhimani5472No ratings yet

- Corporate Finance Practice QuestionsDocument11 pagesCorporate Finance Practice Questionsabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument1 pageInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Frequently Asked Questions FAQs For BancassuranceDocument7 pagesFrequently Asked Questions FAQs For BancassuranceAzeem AnwarNo ratings yet

- Benefits of Milestone PlanDocument9 pagesBenefits of Milestone PlanASHIMA GUPTANo ratings yet

- Hitachi Solutions - ETIQA - Application Form (Signed)Document1 pageHitachi Solutions - ETIQA - Application Form (Signed)Bernard CasimiroNo ratings yet

- IA English Life QPDocument40 pagesIA English Life QPkb royal100% (1)

- India's Mega Online Education Hub For Class 9-12 Students, Engineers, Managers, Lawyers and DoctorsDocument31 pagesIndia's Mega Online Education Hub For Class 9-12 Students, Engineers, Managers, Lawyers and Doctorsanupathi mamatha deen dayalNo ratings yet

- Market Survey of Reliance Life InsuranceDocument27 pagesMarket Survey of Reliance Life InsuranceMaulikk PatelNo ratings yet

- Indiafirst: Policy Information SheetDocument2 pagesIndiafirst: Policy Information Sheetyash kavitaNo ratings yet

- Premium Paid Acknowledgement PDFDocument1 pagePremium Paid Acknowledgement PDFANAND BIRAJDARNo ratings yet

- 4 El Oriente Fabrica Vs PosadasDocument4 pages4 El Oriente Fabrica Vs PosadasAngelo ParaoNo ratings yet

- Loma 280Document72 pagesLoma 280Vishakha NaiduNo ratings yet

- PortfolioDocument8 pagesPortfolioM Umar MughalNo ratings yet

- Tan V. Ca GR NO. 48049 June 29, 1989 FactsDocument1 pageTan V. Ca GR NO. 48049 June 29, 1989 FactsFranzesca VinoyaNo ratings yet

- Aryan STRDocument21 pagesAryan STRChirag BhardwajNo ratings yet

- Handling Objection Sales Script: by Azri AminDocument58 pagesHandling Objection Sales Script: by Azri Aminkuya batokNo ratings yet

- The Catholic University of Eastern Africa A. M. E. C. E. A: Acs 301: Actuarial Mathematics IiDocument4 pagesThe Catholic University of Eastern Africa A. M. E. C. E. A: Acs 301: Actuarial Mathematics IiKimondo KingNo ratings yet

- Tata AIA Life Insurance Sampoorna Raksha Supreme TC 110N160V02Document54 pagesTata AIA Life Insurance Sampoorna Raksha Supreme TC 110N160V02Aman GuptaNo ratings yet

- b2b Marketing Project Report: Mico-Bosch Submitted To: Prof. v. SekharDocument33 pagesb2b Marketing Project Report: Mico-Bosch Submitted To: Prof. v. Sekharfine india50% (2)

- A Project Report On Risk Analysis and RiDocument42 pagesA Project Report On Risk Analysis and RiJyoti ShuklaNo ratings yet

- ART of Sunstone PresentationDocument17 pagesART of Sunstone PresentationMark TantongcoNo ratings yet

- fIVSecureAuthprotectedFIVImageViewerSourcePortalID E Service&SourceApplicID EDPM&RepositoryID 4&Document6 pagesfIVSecureAuthprotectedFIVImageViewerSourcePortalID E Service&SourceApplicID EDPM&RepositoryID 4&Bryan RuffNo ratings yet

- Group 7 - Organization and Management of Insurance CompanyDocument108 pagesGroup 7 - Organization and Management of Insurance CompanyAnn Tierra100% (1)

- High Water Mark PieceDocument2 pagesHigh Water Mark PiecedjdazedNo ratings yet

- Testbank Fim Từ A Đến Z Học Đi Quyên Sap Thi Final Roi Quyên chap 3Document18 pagesTestbank Fim Từ A Đến Z Học Đi Quyên Sap Thi Final Roi Quyên chap 3s3932168No ratings yet

- Common Questions TaxationDocument5 pagesCommon Questions TaxationChris TineNo ratings yet

- RMC 30-2008.PDF - Life and Non-Life InsuranceDocument5 pagesRMC 30-2008.PDF - Life and Non-Life InsuranceAbaNo ratings yet

- Factors Affecting The Demand For Life InsuranceDocument8 pagesFactors Affecting The Demand For Life Insurancearcherselevators100% (2)

- Literature ReviewDocument2 pagesLiterature Reviewpritheeka murthyNo ratings yet

- Philippine Christian University: Income Taxation (Midterm Exam)Document5 pagesPhilippine Christian University: Income Taxation (Midterm Exam)Michael Brian Torres100% (1)