Professional Documents

Culture Documents

Institute of Management Technology: Centre For Distance Learning

Institute of Management Technology: Centre For Distance Learning

Uploaded by

abhimani5472Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Institute of Management Technology: Centre For Distance Learning

Institute of Management Technology: Centre For Distance Learning

Uploaded by

abhimani5472Copyright:

Available Formats

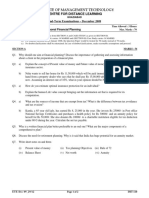

INSTITUTE OF MANAGEMENT TECHNOLOGY

CENTRE FOR DISTANCE LEARNING

GHAZIABAD

End-Term Examinations – December 2009

Subject Code : IMT-07 Time Allowed : 3 Hours

Subject Name: Working Capital Management Max. Marks : 70

Notes: (a) Answer any FOUR questions from SECTION-A and CASE STUDY as given in SECTION-B.

Each Question (SECTION-A) carries 14 MARKS and (SECTION-B) Case Study carries 14 MARKS.

(b) For students enrolled before January 2008, the Question Paper would be treated for 50 marks instead of 70 marks.

(c) No doubts/clarifications shall be entertained. In case of doubts/clarifications, make reasonable assumptions and proceed.

SECTION-A MARKS : 56

1. Define working capital and distinguish between permanent and temporary working capital. What do you understand by

‘positive’ and ‘negative’ working capital? Explain with suitable examples.

2. What do you understand by working capital management? Enumerate the dangers of deficiency and surplus in working

capital.

3. Any good inventory policy followed by an organization must balance the requirements of two opposing and conflicting

demands. What are these? What, according to you, should be the ingredients of a good inventory policy?

4. From the following particulars calculate the (i) re-order point, and (ii) the EOQ:

Annual demand: 26,000 units @ Rs. 9 per unit.

The firm can purchase it at Rs.6.15 per unit.

Carrying cost is 20% of the inventory value.

Fixed cost is Rs. 1,000 per order.

Lead time: 4 weeks

Sales will be made evenly over the period.

Safety stock may be assumed to be 1,000 units.

Taking inflation factor of 10 percent, (iii) determine the EOQ.

5. What do you understand by “float”? Enumerate the various kinds of float. Explain their role in cash management.

6. ‘Credit terms to debtors can be relaxed so long as additional cost of investment does not exceed the additional

contribution’. – Examine the statement.

7. Discuss various methods of working out the maximum permissible level of bank borrowings as suggested by Tandon

Committee. In the wake of freedom given to the individual bank by the RBI recently in matters relating to working capital

financing, are the Tandon Committee recommendations relevant today? Discuss briefly.

SECTION-B (Case Study) MARKS : 14

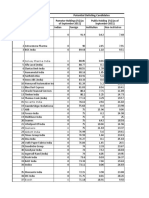

ABC Co. starts manufacture in April, 2009. The prime cost for one unit is expected to be Rs. 200 (Rs 8for materials and Rs. 120

for labour).

In addition, variable expenses per unit are expected to be Rs. 40 and fixed expenses per month will be Rs. 15,00,000.

Payment for materials is to be made in the month following the purchase.

One-third of sales will be for cash, and the rest on credit to be settled in the following month.

Expenses are payable in the month in which they are incurred.

Selling price is Rs. 400 per unit.

The number of units manufactured and sold are expected to be as under:

April 9,000 units

May 12,000 units

June 18,000 units

July 21,000 units

Aug 21,000 units

Sept 24,000 units

Prepare the Cash Budget for April to September, 2009 ignoring the question of stocks.

ETE-Dec 09_23/12 Page 1 of 1 IMT-07

You might also like

- Sample Exam Paper With Answers PDFDocument6 pagesSample Exam Paper With Answers PDFabhimani5472100% (1)

- Grow Management Consultants Pty LTD Profit and Loss Statement July 17 To June 18Document2 pagesGrow Management Consultants Pty LTD Profit and Loss Statement July 17 To June 18Hussnain ShahNo ratings yet

- Ininstitute of Management Technology: Centre For Distance LearningDocument2 pagesIninstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- MS 4 Previous Year Question Papers by IgnouassignmentguruDocument84 pagesMS 4 Previous Year Question Papers by IgnouassignmentguruRani AgarwalNo ratings yet

- Annexure of WCMDocument5 pagesAnnexure of WCMRupa PuneaNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityMehul VarmaNo ratings yet

- BBA 221 MANAGERIAL ACCOUNTING Set 1Document6 pagesBBA 221 MANAGERIAL ACCOUNTING Set 1Lawrence jnr MwapeNo ratings yet

- 2019 7010 2c Cost and Management AccountingDocument4 pages2019 7010 2c Cost and Management AccountingNdichou AbitNo ratings yet

- Accounting For Management: Total No. of Questions 17Document2 pagesAccounting For Management: Total No. of Questions 17vikramvsuNo ratings yet

- MCS 035 NotesDocument7 pagesMCS 035 NotesAshikNo ratings yet

- 1ST Ass QuestionsDocument6 pages1ST Ass QuestionsAbbas WazeerNo ratings yet

- Financial ManagementDocument3 pagesFinancial ManagementMRRYNIMAVATNo ratings yet

- QBDocument34 pagesQBAadeel NooraniNo ratings yet

- Gujarat Technological UniversityDocument4 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- FM 02Document3 pagesFM 02Sudhan RNo ratings yet

- 8568Document9 pages8568unsaarshadNo ratings yet

- 3rd Sem Cost AccountingDocument3 pages3rd Sem Cost AccountingkapilchandanNo ratings yet

- Mba Summer 2019Document4 pagesMba Summer 2019Dhruvi PatelNo ratings yet

- aee4376ab1391d10d58eb95b219aec45.docDocument11 pagesaee4376ab1391d10d58eb95b219aec45.docAmna EhsanNo ratings yet

- 4201 (Previous Year Questions)Document13 pages4201 (Previous Year Questions)Tanjid MahadyNo ratings yet

- FM II QB Final May 2020 PDFDocument12 pagesFM II QB Final May 2020 PDFJuhi JethaniNo ratings yet

- 0462Document4 pages0462tinuNo ratings yet

- BComDocument3 pagesBComChristy jamesNo ratings yet

- Working Capital ManagementDocument5 pagesWorking Capital ManagementDiya MukherjeeNo ratings yet

- Bcom 5 Sem Cost Accounting 1 22100106 Jan 2022Document4 pagesBcom 5 Sem Cost Accounting 1 22100106 Jan 2022Internet 223No ratings yet

- 7010 P3 - QuestionDocument4 pages7010 P3 - QuestionrollinpeguyNo ratings yet

- Acf 318 M 2018Document4 pagesAcf 318 M 2018Bulelwa HarrisNo ratings yet

- MBG-206 2019-20Document4 pagesMBG-206 2019-20senthil.jpin8830No ratings yet

- FMDocument18 pagesFMPriyanka DashNo ratings yet

- FIN 302 Exam 2016Document3 pagesFIN 302 Exam 2016Ricardo Elmo DianeNo ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- 5555Document9 pages5555arsalanssgNo ratings yet

- 820003Document3 pages820003Minaz VhoraNo ratings yet

- Bchcr410 CIADocument4 pagesBchcr410 CIA15Nabil ImtiazNo ratings yet

- 1044 Question PaperDocument2 pages1044 Question PaperPacific TigerNo ratings yet

- Group Assignment FAR Semester 2 2020Document4 pagesGroup Assignment FAR Semester 2 2020Shamimi ShahNo ratings yet

- 72 Elective 1 Advance Financial Management Repeaters Prior To 2014 15Document4 pages72 Elective 1 Advance Financial Management Repeaters Prior To 2014 15premium info2222No ratings yet

- Bcom 5 Sem Cost Accounting 1 20100106 Feb 2020Document4 pagesBcom 5 Sem Cost Accounting 1 20100106 Feb 2020sandrabiju7510No ratings yet

- Mefa Question BankDocument6 pagesMefa Question BankShaik ZubayrNo ratings yet

- Gujarat Technological University: InstructionsDocument3 pagesGujarat Technological University: InstructionssanketchauhanNo ratings yet

- MEFA Important QuestionsDocument14 pagesMEFA Important Questionstulasinad123No ratings yet

- Question Paper UEIM007 Financial ManagementDocument2 pagesQuestion Paper UEIM007 Financial ManagementPratik RathaurNo ratings yet

- Acc406 - Q - Set 1 - Sesi 1 July 2020Document12 pagesAcc406 - Q - Set 1 - Sesi 1 July 2020NABILA NADHIRAH ROSLANNo ratings yet

- Maf201 Test 2 Jan 2023 QDocument5 pagesMaf201 Test 2 Jan 2023 Qediza adhaNo ratings yet

- M 2012 June PDFDocument21 pagesM 2012 June PDFMoses LukNo ratings yet

- IMT-07 - Working Capital Management - Need Solution - Ur Call/Email Away - 9582940966/ambrish@gypr - In/getmyprojectready@Document3 pagesIMT-07 - Working Capital Management - Need Solution - Ur Call/Email Away - 9582940966/ambrish@gypr - In/getmyprojectready@Ambrish (gYpr.in)No ratings yet

- Question Paper Code:: Reg. No.Document26 pagesQuestion Paper Code:: Reg. No.Khanal NilambarNo ratings yet

- MEFA Most Important QuestionsDocument15 pagesMEFA Most Important Questionsapi-26548538100% (5)

- P1.PROO - .L Question CMA September 2022 ExaminationDocument7 pagesP1.PROO - .L Question CMA September 2022 ExaminationS.M.A AwalNo ratings yet

- 820003Document2 pages820003komalbhadani77No ratings yet

- UntitledDocument5 pagesUntitledbetty KemNo ratings yet

- KL Business Finance May Jun 2017Document2 pagesKL Business Finance May Jun 2017Tanvir PrantoNo ratings yet

- AssignmentsDocument7 pagesAssignmentspratikshakurhade04No ratings yet

- Question PaperDocument3 pagesQuestion PaperAmbrishNo ratings yet

- Costing English Question 31.12.2020Document6 pagesCosting English Question 31.12.2020mayoogha1407No ratings yet

- AAO Paper 1 2022Document5 pagesAAO Paper 1 2022Baskar ANgadeNo ratings yet

- Mefa by Aarya Sri+ Imp Qustns (Uandistar - Org)Document202 pagesMefa by Aarya Sri+ Imp Qustns (Uandistar - Org)Srilekha KadiyalaNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItFrom EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNo ratings yet

- Delisting Candidates111Document6 pagesDelisting Candidates111abhimani5472No ratings yet

- Sample 168 PDFDocument26 pagesSample 168 PDFabhimani5472No ratings yet

- We Create Stock Market ProfessionalsDocument12 pagesWe Create Stock Market Professionalsabhimani5472No ratings yet

- Accredited Finance For Non-Financial Managers: Chartered Management Institute'S SyllabusDocument2 pagesAccredited Finance For Non-Financial Managers: Chartered Management Institute'S Syllabusabhimani5472No ratings yet

- Topic: Finance For Non Finance Executives FACULTY: Mr. J N MamtoraDocument3 pagesTopic: Finance For Non Finance Executives FACULTY: Mr. J N Mamtoraabhimani5472No ratings yet

- Finance - For Non-Finance - ExecutivesDocument4 pagesFinance - For Non-Finance - Executivesabhimani5472No ratings yet

- Finance For Non-Finance Managers: SCDL: Obj Ect IveDocument5 pagesFinance For Non-Finance Managers: SCDL: Obj Ect Iveabhimani5472No ratings yet

- Finance For Non-Finance Personnel 2011Document4 pagesFinance For Non-Finance Personnel 2011abhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Finance Question PaperDocument2 pagesFinance Question Paperabhimani5472No ratings yet

- Corporate Finance Practice QuestionsDocument11 pagesCorporate Finance Practice Questionsabhimani5472No ratings yet

- International Finance - Dec 09Document1 pageInternational Finance - Dec 09abhimani5472No ratings yet

- Ininstitute of Management Technology: Centre For Distance LearningDocument2 pagesIninstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Financial Planning - Dec 09Document2 pagesFinancial Planning - Dec 09abhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument1 pageInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument1 pageInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Week 1 Notes: Financial MarketingDocument6 pagesWeek 1 Notes: Financial MarketingPulkit AggarwalNo ratings yet

- Finance Interview QuestionsDocument14 pagesFinance Interview QuestionsVivek SequeiraNo ratings yet

- Nepal Income Tax Slab Rates 2077-78 (2020-21), Provisions and Concessions For IndividualsDocument7 pagesNepal Income Tax Slab Rates 2077-78 (2020-21), Provisions and Concessions For IndividualsSajjal GhimireNo ratings yet

- Delta Capital - Investor Presentation - 2017-01-16 - v3Document24 pagesDelta Capital - Investor Presentation - 2017-01-16 - v3Jim MacaoNo ratings yet

- Segments of Axis BankDocument54 pagesSegments of Axis BankFaheem QaziNo ratings yet

- Theories Accounting ProcessDocument5 pagesTheories Accounting Processshella vienNo ratings yet

- Suggested Answer CAP III June 2018 PDFDocument155 pagesSuggested Answer CAP III June 2018 PDFRajani Shrestha0% (1)

- SDM Business StandardDocument21 pagesSDM Business Standard9662856026No ratings yet

- ComMgt ch02 Reward SystemDocument24 pagesComMgt ch02 Reward SystemFarhana MituNo ratings yet

- Council Response 15 Sept 2014 RedactDocument4 pagesCouncil Response 15 Sept 2014 RedactGotnitNo ratings yet

- Nature of Tax ExemptionDocument2 pagesNature of Tax ExemptionLeah Mariz RocaNo ratings yet

- Reviewer ObliconDocument16 pagesReviewer ObliconchacharancharanNo ratings yet

- Laporan Keuangan PT KoyakiDocument2 pagesLaporan Keuangan PT Koyakinurul azizahNo ratings yet

- Sec 2.7 - Empirical RuleDocument11 pagesSec 2.7 - Empirical RuleSiinozuko MasentseNo ratings yet

- Registration Form: A. Training Schedule (Cidb CCD Points)Document1 pageRegistration Form: A. Training Schedule (Cidb CCD Points)Amyfarhana91No ratings yet

- Cori Preftakes Cash Flow Analysis ToolDocument6 pagesCori Preftakes Cash Flow Analysis ToolcpreftakesNo ratings yet

- Earnings Power - Hewitt HeisermanDocument14 pagesEarnings Power - Hewitt HeisermanSivakumar GanesanNo ratings yet

- ISYE 220 HW1 Q'sDocument1 pageISYE 220 HW1 Q'sAlex LopezNo ratings yet

- Aguinaldo Industries Vs CIRDocument5 pagesAguinaldo Industries Vs CIRMonaVargasNo ratings yet

- Sterling Bank PLC 2010 Annual Report & AccountsDocument125 pagesSterling Bank PLC 2010 Annual Report & AccountsSterling Bank PLC100% (1)

- 15 Complete Lesson On TallyDocument73 pages15 Complete Lesson On TallyRavi ShastriNo ratings yet

- RR 12-99 Rules On Assessments PDFDocument19 pagesRR 12-99 Rules On Assessments PDFJeremeh PenarejoNo ratings yet

- A Study of Derivative Market SIP FINALDocument104 pagesA Study of Derivative Market SIP FINALAanchal Vardhani100% (1)

- Lease AccountingDocument10 pagesLease AccountingXeanne Gloria100% (2)

- 2020 03 27 Ljubisa Matic TIAA Transfer of Funds Confirmation StatmentDocument3 pages2020 03 27 Ljubisa Matic TIAA Transfer of Funds Confirmation StatmentLjubiNo ratings yet

- Contest Basic AccountingDocument9 pagesContest Basic AccountingJin Hee MarasiganNo ratings yet

- NZX Ecoya Media ReleaseDocument4 pagesNZX Ecoya Media ReleaseAlphatrader.co.nzNo ratings yet

- Summary of The General Provisions Law and Tax ProceduresDocument7 pagesSummary of The General Provisions Law and Tax ProceduresAndhika Bella PrawitasariNo ratings yet

- Ratio Analysis of Financial Statements (Emperador Co.)Document5 pagesRatio Analysis of Financial Statements (Emperador Co.)Bibble panpanNo ratings yet