Professional Documents

Culture Documents

Airfreight 2100, Inc: Tax Compliance Review On Compensation Fiscal Year 2020

Airfreight 2100, Inc: Tax Compliance Review On Compensation Fiscal Year 2020

Uploaded by

175pau0 ratings0% found this document useful (0 votes)

7 views3 pages1. The company provided medical cash allowances to employees for their dependents' medical expenses but did not declare this in tax returns which could result in tax deficiencies.

2. Under Philippine tax laws, a medical cash allowance up to P1,500 per semester or P250 per month for dependents is tax exempt, as is actual medical assistance up to P10,000 annually.

3. The recommendation is for the company to set up a fund to pay health insurance premiums for employees to maximize benefits and minimize cash advances, while also allowing for potential tax reductions.

Original Description:

Original Title

Review on Compensation

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The company provided medical cash allowances to employees for their dependents' medical expenses but did not declare this in tax returns which could result in tax deficiencies.

2. Under Philippine tax laws, a medical cash allowance up to P1,500 per semester or P250 per month for dependents is tax exempt, as is actual medical assistance up to P10,000 annually.

3. The recommendation is for the company to set up a fund to pay health insurance premiums for employees to maximize benefits and minimize cash advances, while also allowing for potential tax reductions.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views3 pagesAirfreight 2100, Inc: Tax Compliance Review On Compensation Fiscal Year 2020

Airfreight 2100, Inc: Tax Compliance Review On Compensation Fiscal Year 2020

Uploaded by

175pau1. The company provided medical cash allowances to employees for their dependents' medical expenses but did not declare this in tax returns which could result in tax deficiencies.

2. Under Philippine tax laws, a medical cash allowance up to P1,500 per semester or P250 per month for dependents is tax exempt, as is actual medical assistance up to P10,000 annually.

3. The recommendation is for the company to set up a fund to pay health insurance premiums for employees to maximize benefits and minimize cash advances, while also allowing for potential tax reductions.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

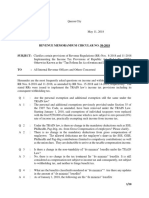

AIRFREIGHT 2100, INC

Tax Compliance Review on Compensation

Fiscal Year 2020

PRESENT CONDITIONS

1. MEDICAL CASH ALLOWANCE (DEPENDENTS OF EMPLOYEE)

Due to failure to fund PHILCARE, the Company reimbursed medical expenses incurred

by the employee and its dependent. Expenses incurred is subject to endorsement and

audit of the Clinic Dept. and Payable Dept.

Receipts issued is under the name of employee or its dependent

Company does'nt decl

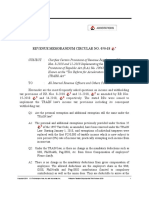

EXPOSURE/ SAVINGS ANALYSIS

Deficiency witholding tax or Under RR No. 11-18 Medical

disallowance of portion of cash allowance to dependents

salaries and wages for of employees, not exceeding

income tax purposes P1,500 per employee per

semester or P250 per month.

Actual medical assistance, e.g.

medical allowance to cover

medical and healthcare needs,

annual medical/executive

check-up, maternity assistance,

and routine consultations, not

exceeding P10,000.00 per annum

De minimis benefits in excess of

the threshold can still be exempt

as “other benefits,” together with

the employees’ 13th month pay,

but not to exceed P90,000

RECOMMENDATION MANAGEMENT RESPONSE

The Company must set a fund

to pay for the premium of

health cards of their employee

Pros:

1. Maximize the benefits that

can be received by our employee

and their dependent

2. Minimize personal cash

advances due to sickness

3. May claim input taxes to reduce

output taxes

You might also like

- Chapter 9 v2Document17 pagesChapter 9 v2Sheilamae Sernadilla GregorioNo ratings yet

- Fringe Benefit TaxDocument11 pagesFringe Benefit TaxJonard Godoy75% (4)

- Business Math Lesson1 Week 4Document6 pagesBusiness Math Lesson1 Week 4REBECCA BRIONESNo ratings yet

- Week 3 Fringe Benefits Part 2 2023Document30 pagesWeek 3 Fringe Benefits Part 2 2023Arellano Rhovic R.No ratings yet

- Chap 10-14: Compensation IncomeDocument44 pagesChap 10-14: Compensation IncomeArna Kaira Kjell DiestraNo ratings yet

- HRM9 Employee Benefits and CompensationDocument11 pagesHRM9 Employee Benefits and CompensationarantonizhaNo ratings yet

- MGT2Document23 pagesMGT2ramonay062223No ratings yet

- Midterm Lecture 2 Employee Benefits and ServicesDocument7 pagesMidterm Lecture 2 Employee Benefits and ServicesJohn LesterNo ratings yet

- Module 10 - Compensation IncomeDocument26 pagesModule 10 - Compensation IncomeJANELLE NUEZNo ratings yet

- MMMMDocument9 pagesMMMMABMachineryNo ratings yet

- Taxation - Direct and Indirect 2022Document10 pagesTaxation - Direct and Indirect 2022Sagar JindalNo ratings yet

- Module 10 Compensation Income.1Document22 pagesModule 10 Compensation Income.1Jeon KookieNo ratings yet

- Benefits and Services-HrmDocument27 pagesBenefits and Services-Hrmrizalleneangiela44No ratings yet

- Taxation - Direct & Indirect JUNE 2022Document10 pagesTaxation - Direct & Indirect JUNE 2022Rajni KumariNo ratings yet

- De Minimis BenefitsDocument1 pageDe Minimis BenefitsEduard RiparipNo ratings yet

- Compensation IncomeDocument3 pagesCompensation IncomePaula Jane Raby RicamaraNo ratings yet

- Unit 4 - Inclusions & Exclusions To Gross Comp IncomeDocument8 pagesUnit 4 - Inclusions & Exclusions To Gross Comp IncomeJoseph Anthony RomeroNo ratings yet

- De Minimis BenefitsDocument2 pagesDe Minimis BenefitsClaudine SumalinogNo ratings yet

- INTGR TAX 005 Compensation IncomeDocument5 pagesINTGR TAX 005 Compensation IncomeZatsumono YamamotoNo ratings yet

- Revenue Memorandum Circular No. 50-2018: Quezon CityDocument18 pagesRevenue Memorandum Circular No. 50-2018: Quezon CityKyleZapanta100% (1)

- De Minimis Benefits 2024Document1 pageDe Minimis Benefits 2024Love Heart BantilesNo ratings yet

- Topic-8_Compensation-Income BsBADocument13 pagesTopic-8_Compensation-Income BsBACherry IlaoNo ratings yet

- Fringe Benefit Tax PDFDocument9 pagesFringe Benefit Tax PDFLorraine TomasNo ratings yet

- CHAPTER 10 - IncomeTaxDocument3 pagesCHAPTER 10 - IncomeTaxVicente, Liza Mae C.No ratings yet

- Legal Opinion de MinimisDocument6 pagesLegal Opinion de MinimisjoyiveeongNo ratings yet

- Gross Income: Learning ObjectivesDocument12 pagesGross Income: Learning ObjectivesClaire BarbaNo ratings yet

- CHAPTER 8 Compensation Income (Module)Document6 pagesCHAPTER 8 Compensation Income (Module)Shane Mark CabiasaNo ratings yet

- M5-P1-Compensation Income-Students'Document49 pagesM5-P1-Compensation Income-Students'micaella pasion100% (1)

- Chapter 10 Compensation IncomeDocument4 pagesChapter 10 Compensation IncomeJason MablesNo ratings yet

- Fringe Benefits TaxDocument3 pagesFringe Benefits TaxGrace EspirituNo ratings yet

- Chapter 10 Compensation IncomeDocument65 pagesChapter 10 Compensation IncomeAnna Janinah100% (6)

- 12 - de Minimis BenefitsDocument2 pages12 - de Minimis BenefitsAllan SantosNo ratings yet

- 11 Tax Exempt de Minimis Benefits To EmployeesDocument2 pages11 Tax Exempt de Minimis Benefits To EmployeesAdrian Mark GomezNo ratings yet

- RMC No. 50-2018 WTWDocument21 pagesRMC No. 50-2018 WTWAris Basco DuroyNo ratings yet

- De Minimis Benefits Allowable AMOUNT (Per Employee) Excess (Taxable)Document1 pageDe Minimis Benefits Allowable AMOUNT (Per Employee) Excess (Taxable)temNo ratings yet

- Tax On Compensation Income: Activi TY SheetDocument14 pagesTax On Compensation Income: Activi TY SheetJudylyn SakitoNo ratings yet

- De Minimis BenefitsDocument2 pagesDe Minimis Benefitsinfp xadNo ratings yet

- Answer The Following:: Airon Marwyn P. Bendaña Bsais - Ii Inclusions and Exclusions of Gross IncomeDocument3 pagesAnswer The Following:: Airon Marwyn P. Bendaña Bsais - Ii Inclusions and Exclusions of Gross IncomeAiron BendañaNo ratings yet

- Chapter 3 Taxation Part 1Document28 pagesChapter 3 Taxation Part 1Alhysa Rosales CatapangNo ratings yet

- Additional P10,000 Nontaxable de Minimis Benefits Effective January 1, 2015Document1 pageAdditional P10,000 Nontaxable de Minimis Benefits Effective January 1, 2015Dennis VelasquezNo ratings yet

- Page 1Document14 pagesPage 1JohnNo ratings yet

- De Minimis BenefitsDocument3 pagesDe Minimis BenefitsanneNo ratings yet

- Chapter 3 Fringe & de Minimis BenefitsDocument6 pagesChapter 3 Fringe & de Minimis BenefitsNovelyn Hiso-anNo ratings yet

- BIR (Philippines) FBT Guidelines: Revenue Regulation 50-18Document16 pagesBIR (Philippines) FBT Guidelines: Revenue Regulation 50-18Cuayo JuicoNo ratings yet

- Special Treatment of Fringe BenefitsDocument20 pagesSpecial Treatment of Fringe BenefitsMartin EstreraNo ratings yet

- Gross IncomeDocument96 pagesGross IncomeJenilyn CalaraNo ratings yet

- Compensation Income and Fringe BenefitsDocument3 pagesCompensation Income and Fringe BenefitsAbigail VergaraNo ratings yet

- Tax Chapter 10, 11, 12Document13 pagesTax Chapter 10, 11, 12Sheraldine MendozaNo ratings yet

- Module 3.1 Fringe Benefits and de Minimis BenefitsDocument4 pagesModule 3.1 Fringe Benefits and de Minimis BenefitsGabs SolivenNo ratings yet

- Income Tax: Chapter Vi-A Deductions From Gross Total IncomeDocument20 pagesIncome Tax: Chapter Vi-A Deductions From Gross Total Incomesoumya256No ratings yet

- Topic 3 - Compensation IncomeDocument13 pagesTopic 3 - Compensation IncomeRoxanne DiazNo ratings yet

- De Minimis and FringeDocument1 pageDe Minimis and FringeAlicia Jane NavarroNo ratings yet

- Tax43-013-Compensation IncomeDocument22 pagesTax43-013-Compensation Incomelowi shooNo ratings yet

- Taxation Module 3 5Document57 pagesTaxation Module 3 5Ma VyNo ratings yet

- What Is TaxDocument5 pagesWhat Is TaxVenkatesh YerramsettiNo ratings yet

- Compensation Income and Fringe Benefit Tax. ReviewerDocument4 pagesCompensation Income and Fringe Benefit Tax. RevieweryzaNo ratings yet

- TXH 1706 Compensation Income FBTDocument12 pagesTXH 1706 Compensation Income FBTLouiseNo ratings yet

- Preparation of Legal OpinionDocument5 pagesPreparation of Legal OpinionNereus Sanaani CAñeda Jr.No ratings yet

- Pal Airline ConsoDocument132 pagesPal Airline Conso175pauNo ratings yet

- PALEX Airline Consolidation January 29, 2018Document52 pagesPALEX Airline Consolidation January 29, 2018175pauNo ratings yet

- List Provinces Philippines 68jDocument6 pagesList Provinces Philippines 68j175pauNo ratings yet

- Airline Conso (Blk-Space) January 29, 2018Document9 pagesAirline Conso (Blk-Space) January 29, 2018175pauNo ratings yet

- Cebpac Airline Conso January 29, 2018Document12 pagesCebpac Airline Conso January 29, 2018175pauNo ratings yet

- Ube Express, Inc.: Statement of AccountDocument12 pagesUbe Express, Inc.: Statement of Account175pauNo ratings yet

- AF2100 - Budget Template Per DeptDocument55 pagesAF2100 - Budget Template Per Dept175pauNo ratings yet

- 2307 New Template Ni PauDocument37 pages2307 New Template Ni Pau175pauNo ratings yet

- Bank Loans Ni PAUDocument18 pagesBank Loans Ni PAU175pauNo ratings yet

- Expense CoaDocument12 pagesExpense Coa175pauNo ratings yet

- Bullet Journaling Intro 2019 PDFDocument29 pagesBullet Journaling Intro 2019 PDF175pau100% (1)