Professional Documents

Culture Documents

Write Up

Write Up

Uploaded by

nehaaa780 ratings0% found this document useful (0 votes)

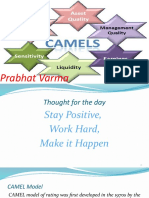

10 views2 pagesThe document outlines the CAMELS approach for evaluating the financial performance and risk profile of banks. It describes the six components of CAMELS - Capital Adequacy, Asset Quality, Management, Earnings, Liquidity, and Sensitivity to Market Risk. Various metrics are listed under each component to measure factors like capital levels, asset quality, management efficiency, profitability, liquidity position, and interest rate risk. The objectives, limitations, and rating symbols of the CAMELS framework are also defined.

Original Description:

Original Title

write up

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the CAMELS approach for evaluating the financial performance and risk profile of banks. It describes the six components of CAMELS - Capital Adequacy, Asset Quality, Management, Earnings, Liquidity, and Sensitivity to Market Risk. Various metrics are listed under each component to measure factors like capital levels, asset quality, management efficiency, profitability, liquidity position, and interest rate risk. The objectives, limitations, and rating symbols of the CAMELS framework are also defined.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views2 pagesWrite Up

Write Up

Uploaded by

nehaaa78The document outlines the CAMELS approach for evaluating the financial performance and risk profile of banks. It describes the six components of CAMELS - Capital Adequacy, Asset Quality, Management, Earnings, Liquidity, and Sensitivity to Market Risk. Various metrics are listed under each component to measure factors like capital levels, asset quality, management efficiency, profitability, liquidity position, and interest rate risk. The objectives, limitations, and rating symbols of the CAMELS framework are also defined.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

CAMELS APPROACH-

1. Capital Adequacy Ratio is calculated through-

1. Debt Equity ratio

2. Advances to total Asset ratio

3. Government securities to Total Investment ratio

2. Asset quality- we calculate

1. Net NPA to Net Advances

2. total NPA growth rate.

Net Non Performing assets is the Gross NPA minus gross provision made, unrealised

interest and unadjusted credit balances with regard to various NPA accounts.

3. Management Quality parameter is evaluated by calculating-

o Market Value to Equity Capital

o Total Advances to Total Deposits

o Business/Employee (cr)

o Profit/Employee(cr)

4. Earning Quality is calculated by-

1. Operating profits by Average working funds

2. Net Profit to Average Assets

3. Interest income to Total Income

4. Non Interest income to Total Income

5. Dividend Payout Ratio

6. Return on Asset

5. Liquidity Parameter is judged by-

1. Liquid assets to Total Assets

2. Liquid assets to Total deposits

3. Government Security to Total Security

4. Approved Security to Total Security

5. Liquidity Asset to Demand Deposit

6. Sensitivity to market risk is calculated by-

Interest rate risk basics

An institution might lose liquidity if its credit rating falls, it experiences sudden unexpected cash

outflows, or some other event causes counterparties to avoid trading with or lending to the

institution. A firm is also exposed to liquidity risk if markets on which it depends are subject to

loss of liquidity.

Objectives set before-

- To understand the financial performance of the banks.

To describe the CAMELS model of ranking, banking institutions, so as to analyze the

comparative of various banks.

To analyze the banks performance through CAMEL model and give suggestion for

improvement if necessary.

Understand qualitative as well as quantitative factors for evaluating financial institutions

Identify various risks faced by financial institutions

Analyze financial institutions and assign overall ratings.

To do an in-depth analysis of the model.

To analyze 3 banks to get the desired results by using CAMELS as a tool of measuring

performance.

To study loan procedure of Bank of India and Banking scenario.

Limitations of the work done before-

The study was limited to three banks only.

Time and resource constrains.

The method discussed pertains only to banks though it can be used for performance

evaluation of other financial institutions.

The study was completely done on the basis of ratios calculated from the balance sheets.

It was not possible to get a personal interview with the top management employees of all

banks under study.

Rating Symbols-

A- Bank is sound in every respect

B- Bank is fundamentally sound but with moderate weaknesses

C- Financial, operational or compliance weaknesses that give cause for supervisory concern.

D- serious or immoderate finance, operational and managerial weaknesses that could impair

future viability

E- Critical financial weaknesses and there is high possibility of failure in the near future.

You might also like

- Instant Download Ebook PDF Ethics in Marketing International Cases and Perspectives 2nd Edition PDF ScribdDocument29 pagesInstant Download Ebook PDF Ethics in Marketing International Cases and Perspectives 2nd Edition PDF Scribdchester.whelan111100% (52)

- Neimen Marcus Retail Pricing - AshlynGravesDocument42 pagesNeimen Marcus Retail Pricing - AshlynGravesAshlyn GravesNo ratings yet

- RJR Nabisco - Case QuestionsDocument2 pagesRJR Nabisco - Case QuestionsJorge SmithNo ratings yet

- CAMELS and PEARLS Applied To Financial Management of Commercial Bank in VietnamDocument44 pagesCAMELS and PEARLS Applied To Financial Management of Commercial Bank in VietnamDan LinhNo ratings yet

- Chapter 5 and 6 Business QuestionsDocument10 pagesChapter 5 and 6 Business QuestionsHibah AamirNo ratings yet

- Uml Diagrams of Hospital ManagmentsDocument34 pagesUml Diagrams of Hospital Managmentsshakir54491% (68)

- CAMELS ApproachDocument12 pagesCAMELS ApproachAreeb AsifNo ratings yet

- Camels Model of Performance Evaluation of Banks: By, Tripura, Sishira.P, S.Neha, Mythili.MDocument30 pagesCamels Model of Performance Evaluation of Banks: By, Tripura, Sishira.P, S.Neha, Mythili.MMythili MadapatiNo ratings yet

- Final ProjectDocument90 pagesFinal ProjectdgpatNo ratings yet

- Chapter 06Document25 pagesChapter 06Farjana Hossain DharaNo ratings yet

- Bank Performance Measurement & Analysis & PCADocument46 pagesBank Performance Measurement & Analysis & PCAVenkatsubramanian R IyerNo ratings yet

- This Study Resource Was: Ms-11: Long Term Equity FinancingDocument4 pagesThis Study Resource Was: Ms-11: Long Term Equity FinancingKathleen Lucas0% (1)

- Day 2 Slides (Rev)Document48 pagesDay 2 Slides (Rev)AHMAD RANANo ratings yet

- CCRA Training Session 11Document21 pagesCCRA Training Session 11VISHAL PATILNo ratings yet

- Day 2 Slides (Rev)Document48 pagesDay 2 Slides (Rev)AHMAD RANANo ratings yet

- Financial Statements AnalysisDocument58 pagesFinancial Statements AnalysisenkeltvrelseNo ratings yet

- CAMELDocument30 pagesCAMELnguyentrinh.03032003No ratings yet

- 1437-Khansa Tallat-Finance-Summary of The ChaptersDocument12 pages1437-Khansa Tallat-Finance-Summary of The Chapterswasif sardarNo ratings yet

- ALM PPT FinalDocument49 pagesALM PPT FinalNishant SinhaNo ratings yet

- Camel 1Document7 pagesCamel 1Papa PappaNo ratings yet

- Financial Ratio Analysis IDocument12 pagesFinancial Ratio Analysis IManvi Jain0% (1)

- Corporate Finance Assignment 1 July To Sep BatchDocument9 pagesCorporate Finance Assignment 1 July To Sep BatchMadhu Patil G TNo ratings yet

- A Study On CAMEL Concept of The Co Operative Bank SoceityDocument31 pagesA Study On CAMEL Concept of The Co Operative Bank SoceityJustin AyersNo ratings yet

- 3.0. Performance Measurement of Banking SectorDocument15 pages3.0. Performance Measurement of Banking SectorFarzana Akter 28No ratings yet

- (FMDFINA) Bridging Blaze FMDFINA ReviewerDocument24 pages(FMDFINA) Bridging Blaze FMDFINA Reviewerseokyung2021No ratings yet

- R53 Global BaselIII v1 1Document16 pagesR53 Global BaselIII v1 1douglasNo ratings yet

- Ratio Analysis (1) .Doc 1Document24 pagesRatio Analysis (1) .Doc 1Priya SinghNo ratings yet

- Finance Question BankDocument10 pagesFinance Question BankSameer WableNo ratings yet

- CAMELS Rating SystemDocument55 pagesCAMELS Rating Systemsyedasiftanveer100% (8)

- Disclosure Requirements For BanksDocument19 pagesDisclosure Requirements For Banksmunna tamangNo ratings yet

- Report On BanksDocument12 pagesReport On BanksDeepNo ratings yet

- Ratio Analysis of Bank Al Habib Limited, Habib Metropolitan Bank Limited and J.S Bank Limited For Financial Year 2013, 2014 and 2015Document11 pagesRatio Analysis of Bank Al Habib Limited, Habib Metropolitan Bank Limited and J.S Bank Limited For Financial Year 2013, 2014 and 2015Mubarak HussainNo ratings yet

- Risk Management: Capital Management & Profit PlanningDocument25 pagesRisk Management: Capital Management & Profit Planningharry2learnNo ratings yet

- Aashi Gupta (FE1702) - Prakhar Sikka (FE1730)Document12 pagesAashi Gupta (FE1702) - Prakhar Sikka (FE1730)Suprabha GambhirNo ratings yet

- Comparative Analysis of Prism Cement LTD With JK Cement LTDDocument57 pagesComparative Analysis of Prism Cement LTD With JK Cement LTDRajudimple100% (1)

- Components of Assets & Liabilities in Bank'S Balance SheetDocument7 pagesComponents of Assets & Liabilities in Bank'S Balance SheetAnonymous nx6TUjNP4No ratings yet

- Financial Statement AnalysisDocument69 pagesFinancial Statement AnalysisSrinivasa raoNo ratings yet

- Camel Analysis Framework-BankDocument27 pagesCamel Analysis Framework-BankAmnaNo ratings yet

- Commercial Banking Assignment: Dhruti Bhatia Roll No: 062 Specialization-Finance MMS - 2020Document8 pagesCommercial Banking Assignment: Dhruti Bhatia Roll No: 062 Specialization-Finance MMS - 2020Dhruti BhatiaNo ratings yet

- Equity Research Interview Questions and AnswersDocument22 pagesEquity Research Interview Questions and AnswersHarsh JainNo ratings yet

- 06 Camel AnalysisDocument37 pages06 Camel Analysissachinp patilNo ratings yet

- Camel Framework in Banks - Indian ScenarioDocument3 pagesCamel Framework in Banks - Indian Scenarioanjusawlani86No ratings yet

- Bank LendingDocument25 pagesBank Lendingnguyen16023No ratings yet

- PARTIAL - A STUDY ON FINANCIAL PERFORMANCE OF Bescal (2015-2019) With Table of Contents-6Document47 pagesPARTIAL - A STUDY ON FINANCIAL PERFORMANCE OF Bescal (2015-2019) With Table of Contents-6gopi chowdaryNo ratings yet

- Assessment of Financial Condition: A Case Study of Saudi Construction CompaniesDocument9 pagesAssessment of Financial Condition: A Case Study of Saudi Construction Companiesفرفشه اضحك بجدNo ratings yet

- FIN441 Assignment 2Document4 pagesFIN441 Assignment 2MahiraNo ratings yet

- A Study of Performance Evaluation OF Top 6 Indian BanksDocument12 pagesA Study of Performance Evaluation OF Top 6 Indian BanksKeval PatelNo ratings yet

- Commercial Bank ManagementDocument4 pagesCommercial Bank ManagementFat PandaNo ratings yet

- M&A Questions and Answers: Q1a. Why Business Fails? Enumerate The Symptoms of Business Failure? AnswerDocument55 pagesM&A Questions and Answers: Q1a. Why Business Fails? Enumerate The Symptoms of Business Failure? Answervrn1985No ratings yet

- Ratio AnalysisDocument3 pagesRatio AnalysisAman ChaudharyNo ratings yet

- Final Part Stress Test On Pubali BankDocument17 pagesFinal Part Stress Test On Pubali BankShah Naoaj ShahedNo ratings yet

- International Financial Statement Analysis: ResumeDocument8 pagesInternational Financial Statement Analysis: ResumeQhu Luph CmuanyaNo ratings yet

- Fs 2018Document126 pagesFs 2018Thiyagu SubramanianNo ratings yet

- What Is FinanceDocument6 pagesWhat Is FinanceMiral Sandipbhai MehtaNo ratings yet

- BASLE II A Simplified ExplanationDocument5 pagesBASLE II A Simplified ExplanationmanaskaushikNo ratings yet

- Executive SummaryDocument56 pagesExecutive SummaryMurali Balaji M CNo ratings yet

- Performance Evaluation of A Bank (CBM)Document34 pagesPerformance Evaluation of A Bank (CBM)Vineeth MudaliyarNo ratings yet

- Reading 31 Slides - Private Company ValuationDocument57 pagesReading 31 Slides - Private Company ValuationtamannaakterNo ratings yet

- Chapter TWO FM I1Document65 pagesChapter TWO FM I1Embassy and NGO jobsNo ratings yet

- Risk ManagementDocument20 pagesRisk Managementuco bankNo ratings yet

- Q1 Explain What Is CAMELS Framework Used in Banking AnalysisDocument2 pagesQ1 Explain What Is CAMELS Framework Used in Banking Analysisshubham ghodkeNo ratings yet

- Comparative Analysis of Prism Cement LTD With JK Cement LTDDocument56 pagesComparative Analysis of Prism Cement LTD With JK Cement LTDBhushan NagalkarNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Shoes Bill MohitDocument2 pagesShoes Bill MohitmohitNo ratings yet

- Chinese Pharmaceutical Expo SmoothingDocument5 pagesChinese Pharmaceutical Expo SmoothingGreggi RizkyNo ratings yet

- Kumar Printing & Textile: K. Fialok TrendzDocument1 pageKumar Printing & Textile: K. Fialok TrendzRajkumarsinghNo ratings yet

- IWMP IDC - Inception Report - ENG - Clean - V4 - FINAL - 20230630 EbDocument71 pagesIWMP IDC - Inception Report - ENG - Clean - V4 - FINAL - 20230630 EbCastleKGNo ratings yet

- MGT 212 AssignmentDocument5 pagesMGT 212 AssignmentTamzid Islam SanvyNo ratings yet

- Science Club by LawsDocument5 pagesScience Club by LawsMarjorie Baya BidlanNo ratings yet

- ENT 300 UITM Samarahan 2Document70 pagesENT 300 UITM Samarahan 2anon_585151197No ratings yet

- Business Ethics and Social Responsibility Module 2 Grade 11 QTR 2Document19 pagesBusiness Ethics and Social Responsibility Module 2 Grade 11 QTR 2Justin AmorantoNo ratings yet

- Accounting Theory 2Document2 pagesAccounting Theory 2Glenda TaniaNo ratings yet

- Chapter 7 - Monitoring and Controlling The ProjectDocument41 pagesChapter 7 - Monitoring and Controlling The ProjectAung Khaing MinNo ratings yet

- 2 Belgian Overseas Chartering vs. Phil. First Insurance, 383 SCRA 23Document24 pages2 Belgian Overseas Chartering vs. Phil. First Insurance, 383 SCRA 23blessaraynesNo ratings yet

- 2018 11 ADF Digital Issue LoDocument84 pages2018 11 ADF Digital Issue LoIkram AbdennouriNo ratings yet

- KI0220666ENN enDocument1 pageKI0220666ENN entsai robertNo ratings yet

- Examdays PrivateJobs - Wipro-Elite-NLTH-Aptitude-Questions & AnswersDocument41 pagesExamdays PrivateJobs - Wipro-Elite-NLTH-Aptitude-Questions & AnswersKEEP CALM studiosNo ratings yet

- US FDA 483 To Qualgen LLCDocument10 pagesUS FDA 483 To Qualgen LLCvijay narayanNo ratings yet

- Labour Law CaseDocument15 pagesLabour Law CaseHrishika Netam100% (1)

- History of Pharmaceutical Development in Nepal: Review ArticleDocument8 pagesHistory of Pharmaceutical Development in Nepal: Review ArticleDinesh Kumar YadavNo ratings yet

- Analyses of The Financial Statements: Dr. Rakesh Kumar SharmaDocument33 pagesAnalyses of The Financial Statements: Dr. Rakesh Kumar Sharmarakeshsharmarv3577No ratings yet

- Mas 10 Exercises For UploadDocument5 pagesMas 10 Exercises For UploadChristine Joy Duterte RemorozaNo ratings yet

- BAPI - It Is Nothing, But A FM Which Is Used To Load The Data Into SAP System. The Data May Be From TheDocument2 pagesBAPI - It Is Nothing, But A FM Which Is Used To Load The Data Into SAP System. The Data May Be From ThejovanaNo ratings yet

- Coffee Shop Business PlanDocument21 pagesCoffee Shop Business PlanCherry PieNo ratings yet

- FYP - Recruitment and Selection FibremarxDocument57 pagesFYP - Recruitment and Selection FibremarxPrateek GoyalNo ratings yet

- Case Analysis - Natureview FarmDocument11 pagesCase Analysis - Natureview Farmayush singla100% (1)

- (Labor Rev) Day OneDocument130 pages(Labor Rev) Day OneAnyaNo ratings yet

- What Is A Tangible Asset Comparison To Non-Tangible AssetsDocument7 pagesWhat Is A Tangible Asset Comparison To Non-Tangible AssetshieutlbkreportNo ratings yet