Professional Documents

Culture Documents

Partnership Operation

Partnership Operation

Uploaded by

Cjhay MarcosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Operation

Partnership Operation

Uploaded by

Cjhay MarcosCopyright:

Available Formats

DATA CENTER COLLEGE OF THE PHILIPPINES

QUIZ #2

Partnership and Corporation Accounting

“Partnership Operations”

I. TRUE OR FALSE. Write TRUE if the statement is correct, otherwise, write FALSE.

1. The profits and losses shall be distributed conformity with the agreement.

2. When a loss is closed into partner’s capital accounts, income summary is credited.

3. Profit and losses are divided equally among the partners unless the partnership

agreement specifies otherwise.

4. The industrial partner is not liable for losses because he cannot withdraw the work or

labor already done by him.

5. When a profit or loss sharing agreement provides for salary and interest allowances to

the partners, these salary and interest allowances should be deducted from revenues in

arriving partnership profit.

6. The salary, interest and stated ratio method of allocation cannot be applied when loss

has occurred.

7. Bonus is allowed to partners only if there is profit, since bonus is based on profit.

8. In certain cases, when distribution of profit or losses involves salary and interest

allowances, some partners may receive an increase in equity and other may suffer a

decrease.

9. If the partnership agreement specifies a method for sharing profits, but not losses, then

losses are shared in the same proportion as profits.

10. The salary allocation to partners also appears as salaries expense on the partnership’s

income statement.

II. PROBLEM SOLVING. Solve the following independent problems. Show your solution in

good form.

1. Cjay and Marcos Partnership made a net income for the year of 42,000 before bonus.

Cjay and Marcos, the partners, agreed that Cjay is to receive a yearly bonus of 5% of the

net profiy after deducting the said bonus, and the balance will be divided in the ratio of

3:2 to Cjay and Marcos respectively. How much profit share will Cjay receive?

____________

2. Dante and Jerome invested their assets to form DJ Partnership on January 1, 2014. The

partnership reported net loss of 100,00 for the year ended December 31, 2014. The

partnership agreement provides the allocation of net income in the following order:

a. Interest on capital: 10,000 to Dante and 12,000 to Jerome

b. Dante is to be given monthly salaries of 8,000

c. Mark is to receive a bonus of 5% of net income after salaries and bonus

d. Any remaining balance is to be divided equally.

How much is Dante’s share in the net loss for the year? ____________

3. Partners Elpidio, Fortun anfd George have capital account balances at the beginning of

the year of 125,000, 136,000 and 95,000, respectively. They share net income and losses

as follows:

a. 7% interest on their beginning capital balances

b. Salary allowance of 10,000 to Elpidio; 12,000 to Fortun and 15,000 to George

c. 5% Bonus to George based on profit after bonus

d. The balance to be divided equally.

The partnership reported net income of 75,600 for the year, before interest, salaries

and bonus to partnership. How much will be the profit share of George in the net

income for the year? _________________

4. Lydia, Mae and Kathy formed a partnership on July 1, 2014. Upon formation, Lydia

contributed a total capital of 100,000, Mae contributed total capital of 200,000 while

Kathy contributed 200,000. After 6 months of operations, they earned a revenue of 125,

250 but incurred total expenses of 167, 820. The partners failed to agree on the division

of profit or loss. Based on this information. How much will be the share of Lydia in the

division of profit or loss? __________________

5. Carl and Chito are partners of CC Partnership. CC Partnership reported a net income of

88,000 for the year 2014. In the distribution of profit or loss, the partners agreed to

provide a total interest on capital of 24,000; total salaries of 20,000 and a 10% bonus to

Carl based on profit after salaries, interest and after bonus; and to divide the balance

equally. Compute for the amount of bonus to be given to Carl? _________________

6. Rebecca and Hannah are partners of RH Partnership. The partnership agreement

provide for the division of income as follows:

a. Interest on capital: 10,000 to Rebecca and 15,000 to Hannah

b. Hannah will be given salaries of 50,000 annually

c. Hannah will receive bonus of 10% of income before salaries, bonus and interest.

d. Balance will be divided equally.

The net income after deducting the salaries, interest and bonus is 303,000. How much is

the bonus given to Hannah? _______________

You might also like

- Chapter 7 - Assignment 2Document9 pagesChapter 7 - Assignment 2Gwen Stefani DaugdaugNo ratings yet

- HTH 367 Nur Alia Najihah Binti Asmadi (2020625872)Document26 pagesHTH 367 Nur Alia Najihah Binti Asmadi (2020625872)alia najihah100% (2)

- Training Program: Subject:: Final ProjectDocument6 pagesTraining Program: Subject:: Final ProjectSuraj Apex0% (1)

- Chapter 3 Case Part 2Document3 pagesChapter 3 Case Part 2graceNo ratings yet

- Problem 32 Retained Earnings ParcorDocument3 pagesProblem 32 Retained Earnings Parcornikki syNo ratings yet

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- Fundamentals of Accounting 1Document8 pagesFundamentals of Accounting 1Cjhay Marcos100% (1)

- Guide Questions For Chapter 2Document5 pagesGuide Questions For Chapter 2Kathleen Mangual0% (1)

- CAlAMBA AND SANTIAGO - TUGOTDocument2 pagesCAlAMBA AND SANTIAGO - TUGOTAndrea Tugot100% (1)

- Parcor Proj (Version 1)Document33 pagesParcor Proj (Version 1)Jwhll MaeNo ratings yet

- Far QuizDocument7 pagesFar QuizMeldred EcatNo ratings yet

- Acctg Problem 2-9Document4 pagesAcctg Problem 2-9Honeybunch before100% (1)

- Chapter 3 ParcorDocument6 pagesChapter 3 ParcorJwhll MaeNo ratings yet

- Solved The Partnership of Angel Investors Began Operations On January 1... - Course HeroDocument2 pagesSolved The Partnership of Angel Investors Began Operations On January 1... - Course HeroeannetiyabNo ratings yet

- Problem 20-23Document5 pagesProblem 20-23Teresa Pantallano DivinagraciaNo ratings yet

- Win Ballada Parcor Chapter 4 ProblemDocument2 pagesWin Ballada Parcor Chapter 4 ProblemKrngyxNo ratings yet

- UM Panabo College 6th Examination Accounting 2a Test I - Multiple Choice Theory. No Erasures AllowedDocument2 pagesUM Panabo College 6th Examination Accounting 2a Test I - Multiple Choice Theory. No Erasures AllowedJessa BeloyNo ratings yet

- Par CorDocument27 pagesPar CorPam LlanetaNo ratings yet

- Chapter 5 PartnershipDocument3 pagesChapter 5 PartnershipRose Ayson0% (1)

- Chapter 5 - Corporation - Share TransactionsDocument14 pagesChapter 5 - Corporation - Share Transactionslou-924No ratings yet

- Corp. Retained EarningsDocument9 pagesCorp. Retained EarningshsjhsNo ratings yet

- Chap 3 and 4 - ParcorDocument4 pagesChap 3 and 4 - ParcorAnne Gwynneth RadaNo ratings yet

- Assignment Bsma 1a April 6Document27 pagesAssignment Bsma 1a April 6Maeca Angela SerranoNo ratings yet

- ACFAR Partnership ExercisesDocument12 pagesACFAR Partnership ExercisesJhannamae PamugasNo ratings yet

- EXAM. MIDTERM. April 20, 2022Document15 pagesEXAM. MIDTERM. April 20, 2022Raziel Angelo AnsusNo ratings yet

- Baral, Malaluan, CastroDocument2 pagesBaral, Malaluan, CastroAndrea TugotNo ratings yet

- UntitledDocument4 pagesUntitledShevina Maghari shsnohsNo ratings yet

- CHAPTER 2 PartnershipDocument17 pagesCHAPTER 2 PartnershipLAZARO, Jaspher S.No ratings yet

- Parcor Proj (Version 1)Document45 pagesParcor Proj (Version 1)Jwhll MaeNo ratings yet

- Corporation Problems-1Document18 pagesCorporation Problems-1Avia Chelsy DeangNo ratings yet

- Problem 1:: Cash Avail For First Distribution: P65, 000 Less: Priority Creditors 50,000 Payment To Partners P15,000Document3 pagesProblem 1:: Cash Avail For First Distribution: P65, 000 Less: Priority Creditors 50,000 Payment To Partners P15,000Mitch Tokong MinglanaNo ratings yet

- Accounting Problem 16Document1 pageAccounting Problem 16sabbyveraNo ratings yet

- Chapter 3 ProblemshhhDocument15 pagesChapter 3 Problemshhhahmed arfanNo ratings yet

- Prefinal Review AcfarDocument8 pagesPrefinal Review AcfarBugoy CabasanNo ratings yet

- PARCOR - 2Nature-and-Formation-of-a-PartnershipDocument30 pagesPARCOR - 2Nature-and-Formation-of-a-PartnershipHarriane Mae GonzalesNo ratings yet

- Problem #9 Two Sole Proprietorship Form A PartnershipDocument3 pagesProblem #9 Two Sole Proprietorship Form A PartnershipNiño Rey LopezNo ratings yet

- Chapter 11 SampleDocument6 pagesChapter 11 SamplePattraniteNo ratings yet

- Problem 1: Lump Sum LiquidationDocument2 pagesProblem 1: Lump Sum LiquidationAina Aguirre100% (2)

- PROBLEM 13 Distribution of Profits or Losses Based On Partner's AgreementDocument1 pagePROBLEM 13 Distribution of Profits or Losses Based On Partner's AgreementRea PanganibanNo ratings yet

- Acctg 102 - True or False (Dissolution - Changes in Ownership) Flashcards - QuizletDocument4 pagesAcctg 102 - True or False (Dissolution - Changes in Ownership) Flashcards - QuizletBisag AsaNo ratings yet

- Chpter 1.problem 7.mullesDocument11 pagesChpter 1.problem 7.mullesKim OlimbaNo ratings yet

- BFARChapter 8Document19 pagesBFARChapter 8Herah SexyNo ratings yet

- MARVIN LISING Exercise 1 Installment Liquidation With Schedule of Safe PaymentsDocument5 pagesMARVIN LISING Exercise 1 Installment Liquidation With Schedule of Safe PaymentsMoon YoungheeNo ratings yet

- Partnership DissolutionDocument3 pagesPartnership DissolutionRoselyn Balik100% (1)

- Chapter 7 Angel Ann E. Orola Bsba HR1 1Document90 pagesChapter 7 Angel Ann E. Orola Bsba HR1 1Gwen Stefani DaugdaugNo ratings yet

- Vergil Joseph I. Literal, DBA, CPA: Page 1 of 3Document3 pagesVergil Joseph I. Literal, DBA, CPA: Page 1 of 3hsjhsNo ratings yet

- Delacruz Act1acctgDocument13 pagesDelacruz Act1acctghenry siyNo ratings yet

- Chapter 6 - Retained EarningsDocument30 pagesChapter 6 - Retained Earningslou-924No ratings yet

- BuenaventuraBSA1B Problems1 4 Pages 410 413Document37 pagesBuenaventuraBSA1B Problems1 4 Pages 410 413AnonnNo ratings yet

- Acfar1130 - Chapter 12 ProblemsDocument2 pagesAcfar1130 - Chapter 12 ProblemsMae BarsNo ratings yet

- Accounting Quizzes Answer KeyDocument11 pagesAccounting Quizzes Answer KeyRae SlaughterNo ratings yet

- Admission and Retirement of PartnersDocument3 pagesAdmission and Retirement of PartnersJohn Eric MacallaNo ratings yet

- Partnership Dissolution 3Document10 pagesPartnership Dissolution 3Jamaica RumaNo ratings yet

- Partnership LiquidationDocument9 pagesPartnership LiquidationPeter PiperNo ratings yet

- ActivityDocument9 pagesActivityKimberlie Jane GableNo ratings yet

- Module 1 JournalizingDocument6 pagesModule 1 JournalizingDianne CabilloNo ratings yet

- Theories of AccountingDocument4 pagesTheories of AccountingShanine BaylonNo ratings yet

- Stephanie Calamba and Allan Brillantes SolutionDocument6 pagesStephanie Calamba and Allan Brillantes SolutionGerald RamiloNo ratings yet

- Acp311 OperationDocument2 pagesAcp311 OperationAngeline Patac LumiguidNo ratings yet

- Chapter 8-Problem 6Document6 pagesChapter 8-Problem 6kakaoNo ratings yet

- C4 Partnership - Review - QuestionsDocument3 pagesC4 Partnership - Review - QuestionsJizelle BianaNo ratings yet

- True or FalseDocument8 pagesTrue or FalseKim OlimbaNo ratings yet

- Week 1, Module #2 - CommunicationDocument9 pagesWeek 1, Module #2 - CommunicationCjhay MarcosNo ratings yet

- Week 1, Module #1 - MotivationDocument7 pagesWeek 1, Module #1 - MotivationCjhay MarcosNo ratings yet

- Module #3 - Obligations of Employees and BusinessDocument4 pagesModule #3 - Obligations of Employees and BusinessCjhay MarcosNo ratings yet

- Globalisasyon TESTDocument11 pagesGlobalisasyon TESTCjhay MarcosNo ratings yet

- FM Quiz #3 SET 1Document2 pagesFM Quiz #3 SET 1Cjhay MarcosNo ratings yet

- Provincial Youth Business Convention 2018Document4 pagesProvincial Youth Business Convention 2018Cjhay MarcosNo ratings yet

- Week 2, Module #3 - Group Dynamics and Team BuildingDocument6 pagesWeek 2, Module #3 - Group Dynamics and Team BuildingCjhay Marcos100% (1)

- The Principles of Art (1938) That What An Artist Does To An Emotion Is Not To Induce It, But Express ItDocument2 pagesThe Principles of Art (1938) That What An Artist Does To An Emotion Is Not To Induce It, But Express ItCjhay MarcosNo ratings yet

- Financial MNGT Chapter IDocument33 pagesFinancial MNGT Chapter ICjhay MarcosNo ratings yet

- Nature of Financial ManagementDocument6 pagesNature of Financial ManagementCjhay MarcosNo ratings yet

- I Corinthians 14:40-Let All Things Be Done Decently in OrderDocument1 pageI Corinthians 14:40-Let All Things Be Done Decently in OrderCjhay MarcosNo ratings yet

- ResignationDocument1 pageResignationCjhay MarcosNo ratings yet

- Data Center College of The PhilippinesDocument1 pageData Center College of The PhilippinesCjhay MarcosNo ratings yet

- Data Center College of The PhilippinesDocument1 pageData Center College of The PhilippinesCjhay MarcosNo ratings yet

- NSTPDocument2 pagesNSTPCjhay MarcosNo ratings yet

- Presentation, Analysis and Interpretaion of DataDocument6 pagesPresentation, Analysis and Interpretaion of DataCjhay MarcosNo ratings yet

- Data Center College of The Philippines of Laoag City, IncDocument8 pagesData Center College of The Philippines of Laoag City, IncCjhay MarcosNo ratings yet

- Human Resource Management: Data Center College of The Philippines of Laoag City, IncDocument7 pagesHuman Resource Management: Data Center College of The Philippines of Laoag City, IncCjhay MarcosNo ratings yet

- Laoag City: DATA Center College of The PhilippinesDocument1 pageLaoag City: DATA Center College of The PhilippinesCjhay MarcosNo ratings yet

- Different Parts of A Business PlanDocument2 pagesDifferent Parts of A Business PlanCjhay MarcosNo ratings yet

- Types of Financial Decisions: Investment Decision, Financing Decision, Dividend Decision and Working Capital Management DecisionDocument4 pagesTypes of Financial Decisions: Investment Decision, Financing Decision, Dividend Decision and Working Capital Management DecisionCjhay MarcosNo ratings yet

- Ba 217 Financial Management Final ExamDocument3 pagesBa 217 Financial Management Final ExamCjhay MarcosNo ratings yet

- Quantitative Techniques and Analysis in BusinessDocument7 pagesQuantitative Techniques and Analysis in BusinessCjhay MarcosNo ratings yet

- Data Center College of The PhilippinesDocument1 pageData Center College of The PhilippinesCjhay MarcosNo ratings yet

- Data Center College of The PhilippinesDocument1 pageData Center College of The PhilippinesCjhay MarcosNo ratings yet

- HboDocument3 pagesHboCjhay MarcosNo ratings yet

- Data Center College of The Philippines of Laoag City, IncDocument8 pagesData Center College of The Philippines of Laoag City, IncCjhay MarcosNo ratings yet

- Proj ListDocument5 pagesProj ListY KarthikNo ratings yet

- Communication Plan Along With Implementation ProcedureDocument3 pagesCommunication Plan Along With Implementation Procedurenav randhawaNo ratings yet

- Chapter 1: The Nature of EntrepreneurshipDocument4 pagesChapter 1: The Nature of Entrepreneurshipbetsega shiferaNo ratings yet

- 5266financial ManagementDocument458 pages5266financial ManagementMd. Ferdowsur Rahman100% (2)

- SPE Introduction To E&P Petroleum Economics & Commercial: November 28, 2019 Lamé VerreDocument43 pagesSPE Introduction To E&P Petroleum Economics & Commercial: November 28, 2019 Lamé Verrejhon berez223344No ratings yet

- Prospectus (1) 1Document36 pagesProspectus (1) 1Rohit ChaudharyNo ratings yet

- Vietnam Merger Control Guide 2023 Fiingroup-Indochine-CounselDocument32 pagesVietnam Merger Control Guide 2023 Fiingroup-Indochine-CounselThuy Duong Pham LeNo ratings yet

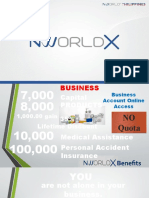

- NWORLDX MarketingDocument14 pagesNWORLDX MarketingRene DelovioNo ratings yet

- Scope of Cosultancy ServicesDocument4 pagesScope of Cosultancy ServiceshymerchmidtNo ratings yet

- Role of Judiciary in Policy Formulation in IndiaDocument3 pagesRole of Judiciary in Policy Formulation in IndiaPRIYANSHU KUMARNo ratings yet

- EJMCM - Volume 7 - Issue 8 - Pages 5820-5828Document9 pagesEJMCM - Volume 7 - Issue 8 - Pages 5820-5828jɨɲ๛ SђubђNo ratings yet

- Account Head of VertexDocument32 pagesAccount Head of Vertexripon_84No ratings yet

- How To Build An Activity Based Sales Strategy LevelElevenDocument14 pagesHow To Build An Activity Based Sales Strategy LevelElevenRogerNo ratings yet

- CeDerrick Mixon - ResumeDocument2 pagesCeDerrick Mixon - ResumeRonny PatelNo ratings yet

- CH 9.intl - Ind RelnDocument25 pagesCH 9.intl - Ind RelnAnoushkaNo ratings yet

- Calamity Loan Application FormDocument2 pagesCalamity Loan Application FormAsdfghjklNo ratings yet

- Principles of Mktg-Q4-Module-7Document27 pagesPrinciples of Mktg-Q4-Module-7Sharlyn Marie An Noble-Badillo100% (1)

- HP UocDocument159 pagesHP UocashokppnNo ratings yet

- Report of Project 2Document11 pagesReport of Project 2Hao YeNo ratings yet

- Test BankDocument36 pagesTest BankJaybie John Palco EralinoNo ratings yet

- Impact of GST On Hotel & Tourism IndustryDocument18 pagesImpact of GST On Hotel & Tourism Industryjogav10621No ratings yet

- Global Business in ContextDocument11 pagesGlobal Business in Contextvaibhavi sakhareliaNo ratings yet

- 分析建模技術的革新 Abaqus一條龍Document5 pages分析建模技術的革新 Abaqus一條龍Wheels CityNo ratings yet

- 1 Practice Exercise - Break Even PointDocument2 pages1 Practice Exercise - Break Even PointBhargav D.S.No ratings yet

- Plagiarism Report 1Document3 pagesPlagiarism Report 1Raiyan HaiderNo ratings yet

- Organization and Management Quarter 1: Module 3: The Firm and Its EnvironmentDocument3 pagesOrganization and Management Quarter 1: Module 3: The Firm and Its EnvironmentSean Andreson MabalacadNo ratings yet

- Historical Development of Banking System in IndiaDocument6 pagesHistorical Development of Banking System in IndiapiyushNo ratings yet

- Philippine Christian University - Dasmarinas Campus: Chapter 12: Introduction To Transfer TaxationDocument20 pagesPhilippine Christian University - Dasmarinas Campus: Chapter 12: Introduction To Transfer TaxationMichelle Esternon0% (1)