Professional Documents

Culture Documents

Costing An Overview of Cost and Management Accounting 1 PDF

Costing An Overview of Cost and Management Accounting 1 PDF

Uploaded by

keerthiCopyright:

Available Formats

You might also like

- To Costing: For SEBI Grade A ExamDocument24 pagesTo Costing: For SEBI Grade A ExamMBBS BackBencherNo ratings yet

- SEBI Grade A Free Study Material Accountancy Accounting Standards RFDocument15 pagesSEBI Grade A Free Study Material Accountancy Accounting Standards RFshiivam sharmaNo ratings yet

- Sebi Grade A 2020 Costing Cost Control AnalysisDocument28 pagesSebi Grade A 2020 Costing Cost Control AnalysisThabarak Shaikh100% (1)

- IPCC - FAST TRACK MATERIAL - 35e PDFDocument69 pagesIPCC - FAST TRACK MATERIAL - 35e PDFKunalKumarNo ratings yet

- Accenture MyConcerto AccelerateDocument4 pagesAccenture MyConcerto AccelerateMaryam TariqNo ratings yet

- SEM II Cost-Accounting Unit 1Document23 pagesSEM II Cost-Accounting Unit 1mahendrabpatelNo ratings yet

- Sebi Grade A 2020: Accountancy: Accounting For Share Capital TransactionsDocument13 pagesSebi Grade A 2020: Accountancy: Accounting For Share Capital Transactions45satishNo ratings yet

- Sebi Grade A 2020: Economics: Keynesian Approach To National IncomeDocument14 pagesSebi Grade A 2020: Economics: Keynesian Approach To National IncomeanjaliNo ratings yet

- SEBI Grade A 2020 Economics Demand Supply 1 PDFDocument9 pagesSEBI Grade A 2020 Economics Demand Supply 1 PDFanjaliNo ratings yet

- SEBI GRADE A 2020: ECONOMICS-Inflation & Phillips CurveDocument7 pagesSEBI GRADE A 2020: ECONOMICS-Inflation & Phillips CurveThabarak ShaikhNo ratings yet

- Keynesian Approach To National IncomeDocument17 pagesKeynesian Approach To National IncomeThabarak ShaikhNo ratings yet

- SEBI Grade A 2020 Monetary and Fiscal Policy 1Document11 pagesSEBI Grade A 2020 Monetary and Fiscal Policy 1anjaliNo ratings yet

- Sebi Grade A 2020: Economics-Consumption & Investment FunctionDocument11 pagesSebi Grade A 2020: Economics-Consumption & Investment FunctionThabarak ShaikhNo ratings yet

- Costing MCQ 2 PDFDocument11 pagesCosting MCQ 2 PDFSagar ShahNo ratings yet

- SEBI Grade A 2020 Companies Act Chapter XDocument8 pagesSEBI Grade A 2020 Companies Act Chapter Xnit07No ratings yet

- SEBI Grade A Free Study Material Commerce Accountancy Buy Back and ESOPDocument10 pagesSEBI Grade A Free Study Material Commerce Accountancy Buy Back and ESOPtejasreeNo ratings yet

- Sebi Grade A 2020: Economics: Determination of Output & EmploymentDocument7 pagesSebi Grade A 2020: Economics: Determination of Output & EmploymentThabarak ShaikhNo ratings yet

- SEBI Grade A Costing Lean System and Innovation PDFDocument17 pagesSEBI Grade A Costing Lean System and Innovation PDF45satish67% (3)

- SEBI Grade A 2020 Economics Balance of PaymentsDocument11 pagesSEBI Grade A 2020 Economics Balance of PaymentsThabarak ShaikhNo ratings yet

- Mock Numerical Questions: Model Test PaperDocument12 pagesMock Numerical Questions: Model Test PaperNaman JainNo ratings yet

- Sebi Grade A 2020: Economics: InflationDocument16 pagesSebi Grade A 2020: Economics: InflationThabarak ShaikhNo ratings yet

- Sebi Grade A 2020 Costing Methods of CostingDocument12 pagesSebi Grade A 2020 Costing Methods of Costing45satishNo ratings yet

- Sebi Grade A 2020: Economics-Business CyclesDocument12 pagesSebi Grade A 2020: Economics-Business CyclesThabarak ShaikhNo ratings yet

- National Income Concept MeasureDocument9 pagesNational Income Concept MeasureThabarak ShaikhNo ratings yet

- SEBI Grade A 2020: Commerce & Accountancy: Finacial Statements & Ratios Statement, Financial Statement Analysis & Ratio AnalysisDocument19 pagesSEBI Grade A 2020: Commerce & Accountancy: Finacial Statements & Ratios Statement, Financial Statement Analysis & Ratio Analysis45satishNo ratings yet

- Management 50 MCQs RBI SEBI - 2Document147 pagesManagement 50 MCQs RBI SEBI - 2rahafNo ratings yet

- Sebi Grade A 2020: Economics-Multiplier & AcceleratorDocument6 pagesSebi Grade A 2020: Economics-Multiplier & AcceleratorThabarak ShaikhNo ratings yet

- Company Law Share Capital & Debentures - Part 2: Important Mcqs - Chapter IvDocument29 pagesCompany Law Share Capital & Debentures - Part 2: Important Mcqs - Chapter IvamitNo ratings yet

- ValuationDocument23 pagesValuationishaNo ratings yet

- Cost Accounting SystemDocument64 pagesCost Accounting Systemaparna bingi0% (1)

- WWW - Edutap.co - In: Chapter IX of Companies Act - Accounts of CompanyDocument15 pagesWWW - Edutap.co - In: Chapter IX of Companies Act - Accounts of Companyraahul dubeyNo ratings yet

- SEBI Grade A Question Bank Paper 2Document116 pagesSEBI Grade A Question Bank Paper 2Prince SaviourNo ratings yet

- ADL 56 Cost & Management Accounting 2V3Document20 pagesADL 56 Cost & Management Accounting 2V3Deepesh100% (1)

- 6.2 Standard Costing & Variance Anlysis: Cost Accounting 341Document25 pages6.2 Standard Costing & Variance Anlysis: Cost Accounting 341sadhaya rajanNo ratings yet

- Chapter 04 Risk, Return, and The Portfolio TheoryDocument55 pagesChapter 04 Risk, Return, and The Portfolio TheoryAGNo ratings yet

- Company Law Appointment and Qualifications of Directors - Part 1Document28 pagesCompany Law Appointment and Qualifications of Directors - Part 1Vismit PariharNo ratings yet

- Process CostingDocument16 pagesProcess CostingPiyush Gupta100% (2)

- Cost Volume Profit Analysis & Absorption CostingDocument21 pagesCost Volume Profit Analysis & Absorption Costingvijaysavaliya0% (1)

- Alternative Sources of Finance - Private and SocialDocument13 pagesAlternative Sources of Finance - Private and SocialSkanda KumarNo ratings yet

- Accounting MCQ Sfile 3Document78 pagesAccounting MCQ Sfile 3Naeem Khan100% (1)

- Direct & Indirect Taxes and Sources of Revenue: Free E-BookDocument9 pagesDirect & Indirect Taxes and Sources of Revenue: Free E-BooknehaNo ratings yet

- 05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFDocument22 pages05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFsengpisalNo ratings yet

- Job Costing QuestionsDocument5 pagesJob Costing Questionsfaith olaNo ratings yet

- SEBI Grade A Mock Test PDFDocument31 pagesSEBI Grade A Mock Test PDFSnehashree SahooNo ratings yet

- Regulators-Sebi: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2Document12 pagesRegulators-Sebi: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2ramanNo ratings yet

- Assignment 1558529449 Sms PDFDocument16 pagesAssignment 1558529449 Sms PDFNextGen GamingNo ratings yet

- Lifo Fifo PDF NotesDocument38 pagesLifo Fifo PDF NotesBALAKUMARAN S 20MBA1061100% (2)

- CA Final AMA Theory Complete R6R7GKB0 PDFDocument143 pagesCA Final AMA Theory Complete R6R7GKB0 PDFjjNo ratings yet

- Costing Prob FinalsDocument52 pagesCosting Prob FinalsSiddhesh Khade100% (1)

- Company Law Declaration & Payment of Dividend: Important Mcqs - Chapter ViiiDocument35 pagesCompany Law Declaration & Payment of Dividend: Important Mcqs - Chapter ViiiVismit PariharNo ratings yet

- Budgeting and Variance AnalysisDocument43 pagesBudgeting and Variance AnalysisADITYAROOP PATHAKNo ratings yet

- Chapter 13Document19 pagesChapter 13prachi aroraNo ratings yet

- Cost Accounting Unit 1Document16 pagesCost Accounting Unit 1archana_anuragiNo ratings yet

- Additional Service Costing QuestionsDocument6 pagesAdditional Service Costing QuestionsSrushti AgarwalNo ratings yet

- Chapter 1: Accounting For Incomplete Records or Single Entry Exercise # 1Document12 pagesChapter 1: Accounting For Incomplete Records or Single Entry Exercise # 1amir0% (1)

- Cost Accounting, Job Costing & Batch CostingDocument10 pagesCost Accounting, Job Costing & Batch Costing✬ SHANZA MALIK ✬No ratings yet

- Shafiulhaq Kaoon's Assignment of Cost Accounting PDFDocument9 pagesShafiulhaq Kaoon's Assignment of Cost Accounting PDFShafiulhaq Kaoon QuraishiNo ratings yet

- Cost Accounting Importance and Advantages of Cost Accounting PapaDocument14 pagesCost Accounting Importance and Advantages of Cost Accounting PapaCruz MataNo ratings yet

- Hospital Cost AccountingDocument39 pagesHospital Cost AccountingIndu Randhawa Gill100% (1)

- Cost Assignment SEM 2 - Integrated-And-Non-Integrated-System-Of-AccountingDocument37 pagesCost Assignment SEM 2 - Integrated-And-Non-Integrated-System-Of-AccountingShubashPoojariNo ratings yet

- Brœâ¡F¿ Ò Brœâ¡F¿ Ò Brœâ¡F¿ Ò Brœâ¡F¿ ÒDocument7 pagesBrœâ¡F¿ Ò Brœâ¡F¿ Ò Brœâ¡F¿ Ò Brœâ¡F¿ ÒkeerthiNo ratings yet

- 1 - Page 1 - Page: TH TH THDocument17 pages1 - Page 1 - Page: TH TH THkeerthiNo ratings yet

- Syllabus For Paper 2 of Phase I in Information Technology StreamDocument2 pagesSyllabus For Paper 2 of Phase I in Information Technology StreamkeerthiNo ratings yet

- Environment and EcologyDocument1 pageEnvironment and EcologykeerthiNo ratings yet

- Tut Sheet7Document2 pagesTut Sheet7Ekta SharmaNo ratings yet

- Cost FM Sample PaperDocument6 pagesCost FM Sample PapercacmacsNo ratings yet

- 2018 Weekly CalendarDocument3 pages2018 Weekly CalendarFabian FebianoNo ratings yet

- Occupational StructureDocument3 pagesOccupational StructureEmirul FairuzNo ratings yet

- Oracle Read STATSPACK OutputDocument43 pagesOracle Read STATSPACK OutputRajNo ratings yet

- UpsDocument31 pagesUpsThuyaNo ratings yet

- Uji Chi SquareDocument5 pagesUji Chi Squareeldiya yuliSNo ratings yet

- Rope PDFDocument19 pagesRope PDFBenjamin van DierenNo ratings yet

- Biomedx Workshop AgendaDocument6 pagesBiomedx Workshop AgendabiomedxNo ratings yet

- ADM Marketing Module 4 Lesson 4 Promotional ToolsDocument20 pagesADM Marketing Module 4 Lesson 4 Promotional ToolsMariel Santos75% (8)

- Onco, TSG & CancerDocument8 pagesOnco, TSG & Cancersumera120488No ratings yet

- Practice Questions: Musculoskeletal SystemDocument4 pagesPractice Questions: Musculoskeletal SystemSali IqraNo ratings yet

- MTT Assay To Evaluate The Cytotoxic Potential of A DrugDocument5 pagesMTT Assay To Evaluate The Cytotoxic Potential of A DrugThanh KieuNo ratings yet

- SkillsDocument7 pagesSkillsRufus RajNo ratings yet

- The Strategy of Successful Total ProductDocument10 pagesThe Strategy of Successful Total ProductPham GHNo ratings yet

- The Little Book of Breaks 1840241519 PDFDocument61 pagesThe Little Book of Breaks 1840241519 PDFksrbhaskarNo ratings yet

- ScheduleDocument2 pagesScheduleJen NevalgaNo ratings yet

- Whittaker Dynamics 17Document442 pagesWhittaker Dynamics 17Mahmoud Ahmed 202201238No ratings yet

- ANSWERS For ExercisesDocument13 pagesANSWERS For ExercisesAlia HazwaniNo ratings yet

- Hayden Esterak Resume 1Document1 pageHayden Esterak Resume 1api-666885986No ratings yet

- Form Service A40gDocument1 pageForm Service A40gBrando ImanuelNo ratings yet

- Hot Cool 3 2012Document32 pagesHot Cool 3 2012thermosol5416No ratings yet

- Explosion Protection - E PDFDocument7 pagesExplosion Protection - E PDFAPCANo ratings yet

- Laboratorium Pengujian Teknik Sipil Universitas Bandar LampungDocument1 pageLaboratorium Pengujian Teknik Sipil Universitas Bandar LampungPanji OctaWirawanNo ratings yet

- Gcrouch@wsu - Edu Rmancini@wsu - Edu Andreakl@wsu - Edu: Groups/chem.345Document5 pagesGcrouch@wsu - Edu Rmancini@wsu - Edu Andreakl@wsu - Edu: Groups/chem.345Daniel McDermottNo ratings yet

- Machine Tool TestingDocument4 pagesMachine Tool Testingnm2007k100% (1)

- Worksheet Research-Title FINALDocument3 pagesWorksheet Research-Title FINALJierroe EvangelistaNo ratings yet

- Urushi ArtDocument24 pagesUrushi ArtGuadalupeCaravajalNo ratings yet

- Anesthetic Consideration in Thyroid SurgeryDocument36 pagesAnesthetic Consideration in Thyroid Surgerymaulina13No ratings yet

- Edc 2Document103 pagesEdc 2abhi_engg06No ratings yet

Costing An Overview of Cost and Management Accounting 1 PDF

Costing An Overview of Cost and Management Accounting 1 PDF

Uploaded by

keerthiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Costing An Overview of Cost and Management Accounting 1 PDF

Costing An Overview of Cost and Management Accounting 1 PDF

Uploaded by

keerthiCopyright:

Available Formats

SEBI GRADE A 2020: COSTING: OVERVIEW OF COST & MANAGEMENT ACCOUNTING

www.practicemock.com 1 info@practicemock.com 011-49032737

SEBI GRADE A 2020: COSTING: OVERVIEW OF COST & MANAGEMENT ACCOUNTING

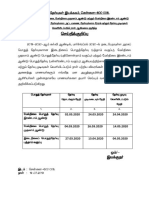

Table of Content

Table of Content ........................................................................................................... 2

Cost Accounting: ........................................................................................................... 3

Objectives of Cost Accounting: ..................................................................................................... 3

Importance of Cost Accounting: .................................................................................................... 3

Scope of Cost Accounting: ........................................................................................................... 4

Classification of Costs:................................................................................................................. 4

Management Accounting: ............................................................................................... 5

Features of Management Accounting: ............................................................................................ 5

Uses of Management Accounting: ................................................................................................. 5

Role of Management Accounting: .................................................................................................. 6

www.practicemock.com 2 info@practicemock.com 011-49032737

SEBI GRADE A 2020: COSTING: OVERVIEW OF COST & MANAGEMENT ACCOUNTING

Cost Accounting:

It is a form of accounting that aims to maximize profit by managing revenues and expenses. A measure in

monetary terms, it provides for the amount of resources required for the purpose of production of goods or

rendering of services. This type of data and report is used by managers to plan out the strategies around

the long-term profit and growth. In other words, it is the application of accounting and costing principles,

methods and techniques in the ascertainment of costs and the analysis of savings as compared with previous

experience or standards. The following are some of the basic principles and concepts of cost accounting:

1. Cost: It is defined as an expenditure (either actual or notional) incurred or attributable to a given

substance. It can also be defined as a resource that has or must be sacrificed in order to attain a

particular objective. For instance, to prepare a cup of tea, the amount to be incurred will be on elements

like material, labour, and other expenses. Hence, one can calculate the cost of production or cost of

service by ascertaining the resources used for the production or services

2. Costing: It is “the technique and process of ascertaining costs”. In other words, Costing refers to a

procedure involved in ascertaining the costs. Any business organization would like to ascertain the cost

and do this by following a scientific procedure. Hence, “Costing” is the steps which help the business to

find out the costs of products or services

3. Cost Accounting: This primarily deals with the collection and analysis of cost data for interpretation

and presentation for various problems of management.

4. Cost Accountancy: This can be defined as “the application of costing and cost accounting principles,

methods, and techniques to the science and art and practice of cost control and the ascertainment of

profitability as well as the presentation of information for the purpose of managerial decision making”.

Objectives of Cost Accounting:

The following are the main objectives of cost accounting:

1. It helps to analyze and classify all expenditures with reference to the cost of products and operations

2. To ascertain the cost of production on per unit, job, operations, process, department or service and

develop cost standard.

3. It helps in determining the selling price of the products or services, as it helps to ascertain the cost of

production on a scientific basis.

4. It enables management to make short-term decisions of various types, such as quotation of price to

special customers or during a slump, make or buy decision, assigning priorities to various products, etc.

5. Cost accounting helps in cost control and cost reduction.

6. It helps management identify any inefficiencies and the extent of various forms of waste, be it of

materials, time, and expense or in the use of machinery, equipment, and tools. These analyses can help

in taking remedial measures.

7. Provides data for periodical profit and loss accounts and balance sheets at various intervals, such as

weekly, monthly, quarterly, annually, or as per the wishes of the management during the financial year.

The data provided can be for whole business, departments or even individual products. It also helps to

explain the reasons for profit or loss revealed in total in the profit and loss account.

8. It provides actual cost data for comparison with the estimates and serves as a guide for future estimates

or quotations and to assist the management in their price-fixing policy.

Importance of Cost Accounting:

The importance of cost accounting tries to overcome the limitation of financial accounting as it can help

businesses to ascertain the cost of production and also avoid the possibility of waste at various stages of

the production cycle. Cost accounting is of importance not only to the management but also to creditors and

employees. The following are some of the advantages of cost accounting:

www.practicemock.com 3 info@practicemock.com 011-49032737

SEBI GRADE A 2020: COSTING: OVERVIEW OF COST & MANAGEMENT ACCOUNTING

1. Aid to management: Cost accounting helps management in the decision by providing them with

detailed costing information which enables them to maintain effective control over stores and inventory,

to increase the efficiency of the organization and to check wastage and losses. It also helps management

to fix the price of its products and services besides helping them make estimates for quoting for tenders.

Also, cost records provide costing data for comparisons which in turn helps the management in the

formulation of future lines of action

2. Aid to Creditors: Stakeholders such as investors, banks and other money lending institutions benefits

from an efficient system of costing as they can base their judgment about the profitability and future

prospects of the enterprise on the costing records

3. Aid to Employees: Employees look forward to an efficient cost system as they are benefited, through

continuous employment and higher remuneration by way of incentives, bonus plans, etc.

4. Importance to National Economy: An increase in production efficiency can lead to overall economic

development. Further cost control, elimination of wastages and inefficiencies led to the progress of the

industry and, in consequence of the nation as a whole.

Scope of Cost Accounting:

The following can be considered to be the scope of accounting:

1. Ascertainment of cost: This is one of the main functions of cost accounting and includes

2. the collection, analysis of expenses and measurement of production at different stages of manufacture.

The collection, analysis, and measurement require different methods of costing for different types of

products such as Historical costs, Standard costs, Process cost, Operation cost, etc. A cost can be

ascertained using the following two methods:

a. Post Costing, where the cost is ascertain based on actual information as recorded in financial

books

b. Continuous Costing, where the cost information is available as and when a particular activity or

a job is finished so that the entire cost of a particular job is available the moment it is completed

3. Cost control: Every business aims to control cost while increasing operating efficiency. Hence, they

analyze each item of cost in the light of the services or benefits obtained so that maximum utilization of

the money expended or it may be recovered. This can be done only by planning and using the standard

cost for each item and identifying deviations if any, so as to make remedial measures.

4. Proper matching of cost with revenue: In case of cost accounting, a manager may be required to

prepare daily, monthly or quarterly statements of cost and income data identified with the sale of that

period

5. Decision making: Cost accounting can help management in deciding between two or more alternatives.

For this, they can do a cost-benefit analysis, which can only be done through a good cost accounting

system.

Classification of Costs:

Costs can be classified on the following basis:

1. Nature of expense: Material, Labour, Expenses

2. Relation of Cost Centre traceability: Direct and Indirect

3. Functions/activities: Production; Administration, Research & Development and Selling and

Distribution

4. Behavior wise: Variable, Fixed, and Semi-variable

5. Management decision making: Marginal Cost, Differential Cost, Opportunity Cost, Replacement Cost,

Relevant Cost, Sunk Cost, Imputed Cost, Normal Cost, Abnormal cost, Avoidable Cost and Unavoidable

Cost

www.practicemock.com 4 info@practicemock.com 011-49032737

SEBI GRADE A 2020: COSTING: OVERVIEW OF COST & MANAGEMENT ACCOUNTING

6. Production Process: Batch Cost, Process Cost, Operation Cost, Operating Cost, Contract costs, Joint

Cost and By-product Cost

7. Time period: Historical Cost, Pre-determined Cost, Standard Cost, and Estimated Cost.

8. Relationship with accounting period: Capital and Revenue

Management Accounting:

The primary purpose of management accounting is to help management improve efficiency as it enables

management to determine the policy and formulate plans to achieve its desired objectives. Basically, it helps

the management in planning, controlling and analyzing the performance of the organization in order to

follow the path of continuous improvement. It borrows the principles and practices of financial accounting

and cost accounting in addition to other modern management techniques for the effective operation of a

company. Though there does exist some overlapping in various areas of cost and management accounting,

management accounting does have certain distinguishing features.

Features of Management Accounting:

The following are some of the features of management accounting:

1. It is derived from both financial accounting and cost accounting

2. It focuses on determining the policies and formulating plans in order to achieve management’s objectives

3. Makes corporate planning and strategy effective and meaningful

4. Concerned with short and long-range planning and uses techniques such as sensitivity analysis,

probability techniques, decision tree, ratio analysis, etc. for planning, control, and evaluation

5. It is futuristic in approach and predictive in nature

6. It cannot be installed without proper cost accounting

7. The reports generated by the management accounting systems are a quite helpful form the management

point of view

Uses of Management Accounting:

Management Accounting Information provides information for purposes like Measurements, Control and

Decision Making, which in turn generates vital information for the management. The following are the use

of information for each of the purposes.

1. Measurements: It focuses on the measurement of full costs, i.e. the total cost required for producing

goods or rendering services. These costs can be divided into Direct (i.e. cost that can be directly

identifiable or traceable to the products or services offered) or Indirect (i.e. those costs that are not

traceable to the products or services). Besides this, it also measures the other costs required to run

activities such as conducting a research project or running a welfare scheme.

2. Control: The Management Accounting information provides information to the management that can be

used for “Control”. Further, it is designed in such a way that the information is generated for every

“Responsibility Centre” (or the business unit/division responsible for its operations and performance). It

also helps to prepare a budget for each of the responsibility center and then compare the budgeted cost

with the actual cost.

3. Decision Making: The information generated by the management accounting information is useful in

making several decisions during the normal course of business. Those decisions can be Make vs Buy,

Accepting or rejecting of an Export Order, Fixing the selling price, Capital Expenditure decision, Product

Mix Optimization, etc. These decisions cannot be made unless the management accounting generates

the required information.

www.practicemock.com 5 info@practicemock.com 011-49032737

SEBI GRADE A 2020: COSTING: OVERVIEW OF COST & MANAGEMENT ACCOUNTING

Role of Management Accounting:

Management Accounting has a different set of roles to be performed when compared with financial

accounting or cost accounting. The following are some of the roles that a management accounting can

perform:

1. To implement the strategy by translating them into actions. The strategic planning and implementation

may include the followings:

a. decisions regarding the design of products,

b. services or processes,

c. research and development,

d. production,

e. marketing,

f. distribution,

g. customer services.

2. To perform supply chain analysis and efficiently perform activities in order to reduce costs and maintain

the quality and easy availability of the products.

3. Help management in taking business decisions.

4. To measure the performance of the business by comparing the budgeted with actuals.

www.practicemock.com 6 info@practicemock.com 011-49032737

You might also like

- To Costing: For SEBI Grade A ExamDocument24 pagesTo Costing: For SEBI Grade A ExamMBBS BackBencherNo ratings yet

- SEBI Grade A Free Study Material Accountancy Accounting Standards RFDocument15 pagesSEBI Grade A Free Study Material Accountancy Accounting Standards RFshiivam sharmaNo ratings yet

- Sebi Grade A 2020 Costing Cost Control AnalysisDocument28 pagesSebi Grade A 2020 Costing Cost Control AnalysisThabarak Shaikh100% (1)

- IPCC - FAST TRACK MATERIAL - 35e PDFDocument69 pagesIPCC - FAST TRACK MATERIAL - 35e PDFKunalKumarNo ratings yet

- Accenture MyConcerto AccelerateDocument4 pagesAccenture MyConcerto AccelerateMaryam TariqNo ratings yet

- SEM II Cost-Accounting Unit 1Document23 pagesSEM II Cost-Accounting Unit 1mahendrabpatelNo ratings yet

- Sebi Grade A 2020: Accountancy: Accounting For Share Capital TransactionsDocument13 pagesSebi Grade A 2020: Accountancy: Accounting For Share Capital Transactions45satishNo ratings yet

- Sebi Grade A 2020: Economics: Keynesian Approach To National IncomeDocument14 pagesSebi Grade A 2020: Economics: Keynesian Approach To National IncomeanjaliNo ratings yet

- SEBI Grade A 2020 Economics Demand Supply 1 PDFDocument9 pagesSEBI Grade A 2020 Economics Demand Supply 1 PDFanjaliNo ratings yet

- SEBI GRADE A 2020: ECONOMICS-Inflation & Phillips CurveDocument7 pagesSEBI GRADE A 2020: ECONOMICS-Inflation & Phillips CurveThabarak ShaikhNo ratings yet

- Keynesian Approach To National IncomeDocument17 pagesKeynesian Approach To National IncomeThabarak ShaikhNo ratings yet

- SEBI Grade A 2020 Monetary and Fiscal Policy 1Document11 pagesSEBI Grade A 2020 Monetary and Fiscal Policy 1anjaliNo ratings yet

- Sebi Grade A 2020: Economics-Consumption & Investment FunctionDocument11 pagesSebi Grade A 2020: Economics-Consumption & Investment FunctionThabarak ShaikhNo ratings yet

- Costing MCQ 2 PDFDocument11 pagesCosting MCQ 2 PDFSagar ShahNo ratings yet

- SEBI Grade A 2020 Companies Act Chapter XDocument8 pagesSEBI Grade A 2020 Companies Act Chapter Xnit07No ratings yet

- SEBI Grade A Free Study Material Commerce Accountancy Buy Back and ESOPDocument10 pagesSEBI Grade A Free Study Material Commerce Accountancy Buy Back and ESOPtejasreeNo ratings yet

- Sebi Grade A 2020: Economics: Determination of Output & EmploymentDocument7 pagesSebi Grade A 2020: Economics: Determination of Output & EmploymentThabarak ShaikhNo ratings yet

- SEBI Grade A Costing Lean System and Innovation PDFDocument17 pagesSEBI Grade A Costing Lean System and Innovation PDF45satish67% (3)

- SEBI Grade A 2020 Economics Balance of PaymentsDocument11 pagesSEBI Grade A 2020 Economics Balance of PaymentsThabarak ShaikhNo ratings yet

- Mock Numerical Questions: Model Test PaperDocument12 pagesMock Numerical Questions: Model Test PaperNaman JainNo ratings yet

- Sebi Grade A 2020: Economics: InflationDocument16 pagesSebi Grade A 2020: Economics: InflationThabarak ShaikhNo ratings yet

- Sebi Grade A 2020 Costing Methods of CostingDocument12 pagesSebi Grade A 2020 Costing Methods of Costing45satishNo ratings yet

- Sebi Grade A 2020: Economics-Business CyclesDocument12 pagesSebi Grade A 2020: Economics-Business CyclesThabarak ShaikhNo ratings yet

- National Income Concept MeasureDocument9 pagesNational Income Concept MeasureThabarak ShaikhNo ratings yet

- SEBI Grade A 2020: Commerce & Accountancy: Finacial Statements & Ratios Statement, Financial Statement Analysis & Ratio AnalysisDocument19 pagesSEBI Grade A 2020: Commerce & Accountancy: Finacial Statements & Ratios Statement, Financial Statement Analysis & Ratio Analysis45satishNo ratings yet

- Management 50 MCQs RBI SEBI - 2Document147 pagesManagement 50 MCQs RBI SEBI - 2rahafNo ratings yet

- Sebi Grade A 2020: Economics-Multiplier & AcceleratorDocument6 pagesSebi Grade A 2020: Economics-Multiplier & AcceleratorThabarak ShaikhNo ratings yet

- Company Law Share Capital & Debentures - Part 2: Important Mcqs - Chapter IvDocument29 pagesCompany Law Share Capital & Debentures - Part 2: Important Mcqs - Chapter IvamitNo ratings yet

- ValuationDocument23 pagesValuationishaNo ratings yet

- Cost Accounting SystemDocument64 pagesCost Accounting Systemaparna bingi0% (1)

- WWW - Edutap.co - In: Chapter IX of Companies Act - Accounts of CompanyDocument15 pagesWWW - Edutap.co - In: Chapter IX of Companies Act - Accounts of Companyraahul dubeyNo ratings yet

- SEBI Grade A Question Bank Paper 2Document116 pagesSEBI Grade A Question Bank Paper 2Prince SaviourNo ratings yet

- ADL 56 Cost & Management Accounting 2V3Document20 pagesADL 56 Cost & Management Accounting 2V3Deepesh100% (1)

- 6.2 Standard Costing & Variance Anlysis: Cost Accounting 341Document25 pages6.2 Standard Costing & Variance Anlysis: Cost Accounting 341sadhaya rajanNo ratings yet

- Chapter 04 Risk, Return, and The Portfolio TheoryDocument55 pagesChapter 04 Risk, Return, and The Portfolio TheoryAGNo ratings yet

- Company Law Appointment and Qualifications of Directors - Part 1Document28 pagesCompany Law Appointment and Qualifications of Directors - Part 1Vismit PariharNo ratings yet

- Process CostingDocument16 pagesProcess CostingPiyush Gupta100% (2)

- Cost Volume Profit Analysis & Absorption CostingDocument21 pagesCost Volume Profit Analysis & Absorption Costingvijaysavaliya0% (1)

- Alternative Sources of Finance - Private and SocialDocument13 pagesAlternative Sources of Finance - Private and SocialSkanda KumarNo ratings yet

- Accounting MCQ Sfile 3Document78 pagesAccounting MCQ Sfile 3Naeem Khan100% (1)

- Direct & Indirect Taxes and Sources of Revenue: Free E-BookDocument9 pagesDirect & Indirect Taxes and Sources of Revenue: Free E-BooknehaNo ratings yet

- 05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFDocument22 pages05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFsengpisalNo ratings yet

- Job Costing QuestionsDocument5 pagesJob Costing Questionsfaith olaNo ratings yet

- SEBI Grade A Mock Test PDFDocument31 pagesSEBI Grade A Mock Test PDFSnehashree SahooNo ratings yet

- Regulators-Sebi: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2Document12 pagesRegulators-Sebi: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2ramanNo ratings yet

- Assignment 1558529449 Sms PDFDocument16 pagesAssignment 1558529449 Sms PDFNextGen GamingNo ratings yet

- Lifo Fifo PDF NotesDocument38 pagesLifo Fifo PDF NotesBALAKUMARAN S 20MBA1061100% (2)

- CA Final AMA Theory Complete R6R7GKB0 PDFDocument143 pagesCA Final AMA Theory Complete R6R7GKB0 PDFjjNo ratings yet

- Costing Prob FinalsDocument52 pagesCosting Prob FinalsSiddhesh Khade100% (1)

- Company Law Declaration & Payment of Dividend: Important Mcqs - Chapter ViiiDocument35 pagesCompany Law Declaration & Payment of Dividend: Important Mcqs - Chapter ViiiVismit PariharNo ratings yet

- Budgeting and Variance AnalysisDocument43 pagesBudgeting and Variance AnalysisADITYAROOP PATHAKNo ratings yet

- Chapter 13Document19 pagesChapter 13prachi aroraNo ratings yet

- Cost Accounting Unit 1Document16 pagesCost Accounting Unit 1archana_anuragiNo ratings yet

- Additional Service Costing QuestionsDocument6 pagesAdditional Service Costing QuestionsSrushti AgarwalNo ratings yet

- Chapter 1: Accounting For Incomplete Records or Single Entry Exercise # 1Document12 pagesChapter 1: Accounting For Incomplete Records or Single Entry Exercise # 1amir0% (1)

- Cost Accounting, Job Costing & Batch CostingDocument10 pagesCost Accounting, Job Costing & Batch Costing✬ SHANZA MALIK ✬No ratings yet

- Shafiulhaq Kaoon's Assignment of Cost Accounting PDFDocument9 pagesShafiulhaq Kaoon's Assignment of Cost Accounting PDFShafiulhaq Kaoon QuraishiNo ratings yet

- Cost Accounting Importance and Advantages of Cost Accounting PapaDocument14 pagesCost Accounting Importance and Advantages of Cost Accounting PapaCruz MataNo ratings yet

- Hospital Cost AccountingDocument39 pagesHospital Cost AccountingIndu Randhawa Gill100% (1)

- Cost Assignment SEM 2 - Integrated-And-Non-Integrated-System-Of-AccountingDocument37 pagesCost Assignment SEM 2 - Integrated-And-Non-Integrated-System-Of-AccountingShubashPoojariNo ratings yet

- Brœâ¡F¿ Ò Brœâ¡F¿ Ò Brœâ¡F¿ Ò Brœâ¡F¿ ÒDocument7 pagesBrœâ¡F¿ Ò Brœâ¡F¿ Ò Brœâ¡F¿ Ò Brœâ¡F¿ ÒkeerthiNo ratings yet

- 1 - Page 1 - Page: TH TH THDocument17 pages1 - Page 1 - Page: TH TH THkeerthiNo ratings yet

- Syllabus For Paper 2 of Phase I in Information Technology StreamDocument2 pagesSyllabus For Paper 2 of Phase I in Information Technology StreamkeerthiNo ratings yet

- Environment and EcologyDocument1 pageEnvironment and EcologykeerthiNo ratings yet

- Tut Sheet7Document2 pagesTut Sheet7Ekta SharmaNo ratings yet

- Cost FM Sample PaperDocument6 pagesCost FM Sample PapercacmacsNo ratings yet

- 2018 Weekly CalendarDocument3 pages2018 Weekly CalendarFabian FebianoNo ratings yet

- Occupational StructureDocument3 pagesOccupational StructureEmirul FairuzNo ratings yet

- Oracle Read STATSPACK OutputDocument43 pagesOracle Read STATSPACK OutputRajNo ratings yet

- UpsDocument31 pagesUpsThuyaNo ratings yet

- Uji Chi SquareDocument5 pagesUji Chi Squareeldiya yuliSNo ratings yet

- Rope PDFDocument19 pagesRope PDFBenjamin van DierenNo ratings yet

- Biomedx Workshop AgendaDocument6 pagesBiomedx Workshop AgendabiomedxNo ratings yet

- ADM Marketing Module 4 Lesson 4 Promotional ToolsDocument20 pagesADM Marketing Module 4 Lesson 4 Promotional ToolsMariel Santos75% (8)

- Onco, TSG & CancerDocument8 pagesOnco, TSG & Cancersumera120488No ratings yet

- Practice Questions: Musculoskeletal SystemDocument4 pagesPractice Questions: Musculoskeletal SystemSali IqraNo ratings yet

- MTT Assay To Evaluate The Cytotoxic Potential of A DrugDocument5 pagesMTT Assay To Evaluate The Cytotoxic Potential of A DrugThanh KieuNo ratings yet

- SkillsDocument7 pagesSkillsRufus RajNo ratings yet

- The Strategy of Successful Total ProductDocument10 pagesThe Strategy of Successful Total ProductPham GHNo ratings yet

- The Little Book of Breaks 1840241519 PDFDocument61 pagesThe Little Book of Breaks 1840241519 PDFksrbhaskarNo ratings yet

- ScheduleDocument2 pagesScheduleJen NevalgaNo ratings yet

- Whittaker Dynamics 17Document442 pagesWhittaker Dynamics 17Mahmoud Ahmed 202201238No ratings yet

- ANSWERS For ExercisesDocument13 pagesANSWERS For ExercisesAlia HazwaniNo ratings yet

- Hayden Esterak Resume 1Document1 pageHayden Esterak Resume 1api-666885986No ratings yet

- Form Service A40gDocument1 pageForm Service A40gBrando ImanuelNo ratings yet

- Hot Cool 3 2012Document32 pagesHot Cool 3 2012thermosol5416No ratings yet

- Explosion Protection - E PDFDocument7 pagesExplosion Protection - E PDFAPCANo ratings yet

- Laboratorium Pengujian Teknik Sipil Universitas Bandar LampungDocument1 pageLaboratorium Pengujian Teknik Sipil Universitas Bandar LampungPanji OctaWirawanNo ratings yet

- Gcrouch@wsu - Edu Rmancini@wsu - Edu Andreakl@wsu - Edu: Groups/chem.345Document5 pagesGcrouch@wsu - Edu Rmancini@wsu - Edu Andreakl@wsu - Edu: Groups/chem.345Daniel McDermottNo ratings yet

- Machine Tool TestingDocument4 pagesMachine Tool Testingnm2007k100% (1)

- Worksheet Research-Title FINALDocument3 pagesWorksheet Research-Title FINALJierroe EvangelistaNo ratings yet

- Urushi ArtDocument24 pagesUrushi ArtGuadalupeCaravajalNo ratings yet

- Anesthetic Consideration in Thyroid SurgeryDocument36 pagesAnesthetic Consideration in Thyroid Surgerymaulina13No ratings yet

- Edc 2Document103 pagesEdc 2abhi_engg06No ratings yet