Professional Documents

Culture Documents

3) Worksheet

3) Worksheet

Uploaded by

CookiemonsterOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3) Worksheet

3) Worksheet

Uploaded by

CookiemonsterCopyright:

Available Formats

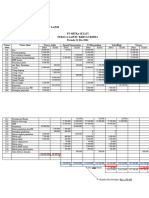

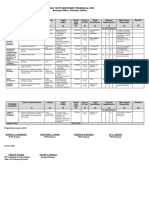

Dr. Nick Marasigan, M.D.

Worksheet

For the Month Ended October 30, 2019

Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet

No. Account Title Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

110 Cash 114,000 114,000 114,000

120 Accounts Receivable 204,000 204,000 204,000

130 Medical Supplies 56,000 b. 35,000 21,000 21,000

18,333.3

140 Prepaid Insurance 20,000 a. 1,666.67 3 18,333.33

150 Land 250,000 250,000 250,000

1,000,00 1,000,00

160 Medical Building 0 0 1,000,000

1c

165 Accumulated Depreciation - Medical Building . 5,000 5,000 5,000

170 Medical Equipment 465,000 465,000 465,000

2c

175 Accumulated Depreciation - Medical Equipment . 9,000 9,000 9,000

210 24% Notes Payable 400,000 400,000 400,000

1,200,00 1,200,00

220 20% Notes Payable 0 0 1,200,000

230 Accounts Payable 49,000 49,000 49,000

240 Salaries Payable e. 51,000 51,000 51,000

250 Interest Payable (20%) 1f. 20,000 20,000 20,000

250 Interest Payable (24%) 2f. 8,000 8,000 8,000

260 Unearned Research Revenues 90,000 d. 30,000 60,000 60,000

310 Marasigan, Capital 250,000 250,000 250,000

320 Marasigan, Withdrawals 200,000 200,000 200,000

330 Income Summary

410 Medical Revenues 434,000 434,000 434,000

420 Research Revenues d. 30,000 30,000 30,000

510 Salaries Expense 73,000 e. 51,000 124,000 124,000

520 Insurance Expense a. 1,666.67 1,666.67 1,666.67

530 Repairs Expense 23,000 23,000 23,000

540 Supplies Expense b. 35,000 35,000 35,000

550 Association Dues Expense 15,000 15,000 15,000

560 Telephone Expense 3,000 3,000 3,000

1c

570 Depreciation Expense - Bldg. . 5,000 5,000 5,000

2c

580 Depreciation Expense - Equipt. . 9,000 9,000 9,000

590 Interest Expense (20%) 1f. 20,000 20,000 20,000

590 Interest Expense (24%) 2f. 8,000 8,000 8,000

2,423,00 2,423,00 2,516,00 2,516,00 2,272,333.3

0 0 159,666.67 159,666.67 0 0 243,666.67 464,000 3 2,052,000

220,333.3

Profit 3 220,333.33

2,272,333.3

.464,000 464,000 3 2,272,333.33

You might also like

- Problem 01 Answer KeyDocument6 pagesProblem 01 Answer KeyAngelito Eclipse100% (5)

- Chapter 2-Statement of Financial Position: Problem 2-1 (AICPA Adapted)Document27 pagesChapter 2-Statement of Financial Position: Problem 2-1 (AICPA Adapted)Asi Cas Jav100% (1)

- People's Car Inc. vs. Commando Security Service Agency G.R. No. L-36840, May 22, 1973Document2 pagesPeople's Car Inc. vs. Commando Security Service Agency G.R. No. L-36840, May 22, 1973Lu Cas100% (2)

- Christine Sousa BagsDocument8 pagesChristine Sousa BagsKaila Clarisse Cortez100% (5)

- Acctg Problem 7Document4 pagesAcctg Problem 7Salvie Perez Utana57% (14)

- ACC 113 Activity 1 Answer KeyDocument7 pagesACC 113 Activity 1 Answer Keypia guiretNo ratings yet

- MODULE-5 Ac 5 inDocument14 pagesMODULE-5 Ac 5 inBlesh Macusi75% (4)

- Chapter 6Document10 pagesChapter 6SabNo ratings yet

- Accounting - Trial BalanceDocument1 pageAccounting - Trial Balancefranchesca.dejesus.educNo ratings yet

- Comprehensive ActivityDocument2 pagesComprehensive ActivitySofia Lynn Rico RebancosNo ratings yet

- Exercise 10Document10 pagesExercise 10dumpanonymouslyNo ratings yet

- Doctora (DR - Nickmarasigan) WorksheetDocument2 pagesDoctora (DR - Nickmarasigan) Worksheetkianna doctoraNo ratings yet

- Ily Abella Surveyors - WorksheetDocument2 pagesIly Abella Surveyors - WorksheetNeilan Jay FloresNo ratings yet

- ABC Company Worksheet For The Year Ended December 31, 2019Document1 pageABC Company Worksheet For The Year Ended December 31, 2019Rosemarie VillanuevaNo ratings yet

- Accounts Unadjusted Trial Balance Adjustments Ajusted Trial Balance Income Statement Balance Sheet Debit Credit Debit Credit DR CR DR CR DR CRDocument4 pagesAccounts Unadjusted Trial Balance Adjustments Ajusted Trial Balance Income Statement Balance Sheet Debit Credit Debit Credit DR CR DR CR DR CRGIDEON, JR. INESNo ratings yet

- N MarasiganDocument16 pagesN MarasiganMarikris Cadiente100% (1)

- YARADocument5 pagesYARAMischa Bianca BesmonteNo ratings yet

- P1 Day1 RM2020Document5 pagesP1 Day1 RM2020P De GuzmanNo ratings yet

- Bizcom Problem 3-2Document1 pageBizcom Problem 3-2kate trishaNo ratings yet

- Marasigan TransactionDocument20 pagesMarasigan TransactionE.D.J100% (2)

- Dr. Nick Marasigan AccountsDocument11 pagesDr. Nick Marasigan AccountsNicole SarmientoNo ratings yet

- Bizcom Problem 3-3Document1 pageBizcom Problem 3-3kate trishaNo ratings yet

- Free Trial PreFinals SolutionsDocument8 pagesFree Trial PreFinals Solutionsur.luna82997No ratings yet

- ULOa Let's Analyze Week 8 9Document4 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- Marasigan Medical Services - Ex 7Document4 pagesMarasigan Medical Services - Ex 7E.D.J100% (1)

- Group 1Document2 pagesGroup 1Niro MadlusNo ratings yet

- Principles of Accounting Problem 5Document7 pagesPrinciples of Accounting Problem 5Carlo AbrinaNo ratings yet

- Safari - 12 Aug 2019 at 1:00 PM PDFDocument1 pageSafari - 12 Aug 2019 at 1:00 PM PDFPauline BiancaNo ratings yet

- Vending Machines SolutionDocument6 pagesVending Machines SolutionizquierdofacturaNo ratings yet

- Exemplar Company - Fortunado PDFFDocument1 pageExemplar Company - Fortunado PDFFmitakumo uwuNo ratings yet

- Hcba 3103 Aug 2016 ExamDocument6 pagesHcba 3103 Aug 2016 ExamJane TalaiNo ratings yet

- Adjusted Trial BalanceDocument2 pagesAdjusted Trial BalanceJerrica Rama100% (1)

- EKO4 Marsya As - 12ipa3 - 16Document4 pagesEKO4 Marsya As - 12ipa3 - 16Marsya AlyssaNo ratings yet

- Accbp100 3rd Exam AnswersDocument8 pagesAccbp100 3rd Exam AnswersAlthea Marie OrtizNo ratings yet

- Answer To Sample Question 2Document3 pagesAnswer To Sample Question 2Farid AbbasovNo ratings yet

- FIN702: Corporate Financial Management 1 Tutorial 2: Financial Statement AnalysisDocument3 pagesFIN702: Corporate Financial Management 1 Tutorial 2: Financial Statement AnalysisBetcy RaetoraNo ratings yet

- Trial BalDocument1 pageTrial BalNikhil SharmaNo ratings yet

- Assignment - Basics of AccountingDocument1 pageAssignment - Basics of AccountingSamadhi KatagodaNo ratings yet

- Midterm Problem - DocmDocument2 pagesMidterm Problem - Docmpippen venegasNo ratings yet

- BA713 Financial Management Tutorial 2Document4 pagesBA713 Financial Management Tutorial 2Ten NineNo ratings yet

- Group 6 Drill WS & FSDocument12 pagesGroup 6 Drill WS & FSSheilla Dela Torre PaderangaNo ratings yet

- Rosalie Balhag CleanersDocument1 pageRosalie Balhag CleanersDominique Abrajano100% (1)

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- Chapter 8Document6 pagesChapter 8SabNo ratings yet

- Trial BalDocument1 pageTrial BalSun ShineNo ratings yet

- Acctg 153aDocument6 pagesAcctg 153aCHESTER JAN BOSONGNo ratings yet

- Finals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaDocument6 pagesFinals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaMica Mae CorreaNo ratings yet

- Itax Solutions Philippines Income Statement Working Paper No. of Client Ave. Rate Per Client Frequency /year 2023 449,000.00Document13 pagesItax Solutions Philippines Income Statement Working Paper No. of Client Ave. Rate Per Client Frequency /year 2023 449,000.00Rose CastilloNo ratings yet

- Afar Partnership LiquidationDocument42 pagesAfar Partnership LiquidationKrizia Mae Uzielle PeneroNo ratings yet

- PDF-Afar CompressDocument128 pagesPDF-Afar CompressCharisse VisteNo ratings yet

- Jawaban CH 5 - TM 11Document3 pagesJawaban CH 5 - TM 11ahmad shinigamiNo ratings yet

- J. P. Peralta Computer Clinic Worksheet For The Month Ended December 31, 2020Document2 pagesJ. P. Peralta Computer Clinic Worksheet For The Month Ended December 31, 2020Minjin lesner ManalansanNo ratings yet

- Accounting RefresherDocument2 pagesAccounting RefresherAlbert MorenoNo ratings yet

- General Balance Workshop..-4Document2 pagesGeneral Balance Workshop..-4ScribdTranslationsNo ratings yet

- Paw and Saw DownstreamDocument3 pagesPaw and Saw DownstreamLorie Roncal JimenezNo ratings yet

- AE 120 Group Activity AnswersDocument5 pagesAE 120 Group Activity AnswersRichard Rhamil Carganillo Garcia Jr.No ratings yet

- ShubhamTrial PDFDocument1 pageShubhamTrial PDFI am DannyHNo ratings yet

- Interpretation and Application of International Standards on AuditingFrom EverandInterpretation and Application of International Standards on AuditingNo ratings yet

- Wiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsRating: 2 out of 5 stars2/5 (2)

- Dr. Nick Marasigan, M.D. Income Statement For The Month Ended October 30, 2019Document1 pageDr. Nick Marasigan, M.D. Income Statement For The Month Ended October 30, 2019CookiemonsterNo ratings yet

- J-2 Adj and ClosingDocument1 pageJ-2 Adj and ClosingCookiemonsterNo ratings yet

- Date Account Title P.R. Debit Credit: Journal Entry 1Document1 pageDate Account Title P.R. Debit Credit: Journal Entry 1CookiemonsterNo ratings yet

- Human As Doer of An ActDocument4 pagesHuman As Doer of An ActCookiemonsterNo ratings yet

- Directing and LeadingDocument38 pagesDirecting and LeadingCookiemonsterNo ratings yet

- 19 Facts About AVOCADOSDocument2 pages19 Facts About AVOCADOSCookiemonsterNo ratings yet

- Date Activity Persons InvolvedDocument1 pageDate Activity Persons InvolvedCookiemonsterNo ratings yet

- AggressionDocument9 pagesAggressionapi-645961517No ratings yet

- Horsley PHDDocument221 pagesHorsley PHDmunsterhNo ratings yet

- Dayao v. ComelecDocument15 pagesDayao v. ComelecRichelle CartinNo ratings yet

- Leaflet Parenting A Baby 018months Domestic AbuseDocument2 pagesLeaflet Parenting A Baby 018months Domestic AbuseTazeen FatimaNo ratings yet

- 10 % SK Fund and Utilization Report 2018Document4 pages10 % SK Fund and Utilization Report 2018Virgo CayabaNo ratings yet

- Memorandum MODDocument21 pagesMemorandum MODrajeshd006100% (2)

- Maharashtra State Board of Secondary & Higher Secondary Education, PuneDocument14 pagesMaharashtra State Board of Secondary & Higher Secondary Education, PuneAjinkya DahivadeNo ratings yet

- Homeopathic Materia Medica Vol 1Document259 pagesHomeopathic Materia Medica Vol 1LotusGuy Hans100% (3)

- Affid Complaint 1Document3 pagesAffid Complaint 1Alimozaman DiamlaNo ratings yet

- Business Plan Review and AssessmentDocument12 pagesBusiness Plan Review and AssessmentKennelineNo ratings yet

- NuGate Group, LLC, A.S.B.C.A. (2016)Document1 pageNuGate Group, LLC, A.S.B.C.A. (2016)Scribd Government DocsNo ratings yet

- Legal Principles in Shipping Business 2014Document3 pagesLegal Principles in Shipping Business 2014MarvinNo ratings yet

- Reading and Writing 1 Q: Skills For Success Unit 2 Student Book Answer KeyDocument4 pagesReading and Writing 1 Q: Skills For Success Unit 2 Student Book Answer KeyMaria SuárezNo ratings yet

- College of Business Administration University of Pittsburgh BUSFIN 1030Document24 pagesCollege of Business Administration University of Pittsburgh BUSFIN 1030John P ReddenNo ratings yet

- MR 2018 5 e 9 BorszekiDocument38 pagesMR 2018 5 e 9 BorszekiborszekijNo ratings yet

- The GMO-Suicide Myth: Keith KloorDocument6 pagesThe GMO-Suicide Myth: Keith KloorNicholas GravesNo ratings yet

- Volume IV Batangas City Comprehensive Development Plan 2019 2025Document170 pagesVolume IV Batangas City Comprehensive Development Plan 2019 2025Aliza Marie PlacinoNo ratings yet

- 1Document16 pages1DiEly RANo ratings yet

- Q1 Mapeh - TosDocument2 pagesQ1 Mapeh - TosKenneth Roy MatuguinaNo ratings yet

- Icse Civics Lesson 1Document31 pagesIcse Civics Lesson 1Technical HacksNo ratings yet

- Fil-Estate Properties Vs Spouses Go (GR No 185798, 13 Jan 2014)Document3 pagesFil-Estate Properties Vs Spouses Go (GR No 185798, 13 Jan 2014)Wilfred MartinezNo ratings yet

- BofA - The EEMEA FX Strategist Higher Oil More EEMEA FX Weakness - 20230926Document19 pagesBofA - The EEMEA FX Strategist Higher Oil More EEMEA FX Weakness - 20230926Sofia Franco100% (1)

- Dev Studies Exam Paper PDFDocument27 pagesDev Studies Exam Paper PDFAndrew ArahaNo ratings yet

- Times Leader 06-13-2012Document46 pagesTimes Leader 06-13-2012The Times LeaderNo ratings yet

- Adv Hilal Khan Agreement - 034654Document3 pagesAdv Hilal Khan Agreement - 034654Hilal KhanNo ratings yet

- Data Center Cabling A Data Center - TIA-942 - PresentationDocument61 pagesData Center Cabling A Data Center - TIA-942 - PresentationGonzalo Prado100% (1)

- AffidavitsDocument36 pagesAffidavitsKarexa Skye LeganoNo ratings yet

- Update Data Karyawan - ShareDocument4 pagesUpdate Data Karyawan - SharedanangNo ratings yet

- Keells Super 2 PDFDocument64 pagesKeells Super 2 PDFPraveena vigneswaranNo ratings yet