Professional Documents

Culture Documents

Cfas Chapter 16 4

Cfas Chapter 16 4

Uploaded by

Iana Jane BuronOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cfas Chapter 16 4

Cfas Chapter 16 4

Uploaded by

Iana Jane BuronCopyright:

Available Formats

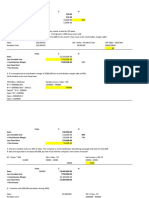

Atienza, Ron Carlos Miguel E.

BSA 1-3

PROBLEM 16-4

a. Deferred income approach

1. To record the acquisition of the equipment

Machinery 7,000,000

Cash 7,000,000

2. To record the government grant as deferred income:

Cash 1,000,000

Deferred grant income 1,000,000

3. To record annual depreciation

Depreciation 1,300,000

Accumulated depreciation 1,300,000

Cost of machinery 7,000,000

Residual value (500,000)

Depreciable amount 6,500,000

Annual Depreciation (6,500,000 / 5) 1,300,000

4. To recognize the income from government grant for the current year:

Deferred grant income 200,000

Grant income 200,000

(1,000,000 / 5)

b. Deduction from asset approach

1. To record the acquisition of the machinery:

Machinery 7,000,000

Cash 7,000,000

2. To record the government grant as a deduction from the cost of the asset:

Cash 1,000,000

Machinery 1,000,000

3. To record the annual depreciation

Depreciation 1,100,000

Accumulated depreciation 1,100,000

Acquisition cost 7,000,000

Government grant (1,000,000)

Net Cost 6,000,000

Residual value (500,000)

Depreciable amount 5,500,000

Annual depreciation (5,500,000 / 5) 1,100,000

You might also like

- Final Accountability Script Role PlayDocument5 pagesFinal Accountability Script Role PlaySherrie ann ConcepcionNo ratings yet

- Cortez Practice Set JanuaryDocument5 pagesCortez Practice Set JanuaryChristian LapidNo ratings yet

- Assign 1 Answer Valuation of Contributions of Partners Millan 2021Document4 pagesAssign 1 Answer Valuation of Contributions of Partners Millan 2021mhikeedelantarNo ratings yet

- Problem 7 - 22Document3 pagesProblem 7 - 22Jao FloresNo ratings yet

- Chap 013Document667 pagesChap 013Rhaine ArimaNo ratings yet

- Act. 3-9Document4 pagesAct. 3-9Fernando III PerezNo ratings yet

- Apply Your Knowledge: Case Study 1Document3 pagesApply Your Knowledge: Case Study 1Queen ValleNo ratings yet

- Accrued Liabilities: Problem 3-1 (AICPA Adapted)Document15 pagesAccrued Liabilities: Problem 3-1 (AICPA Adapted)Nila FranciaNo ratings yet

- Inter Branch Transactions: BC - BR 2 HOC Cash BC-BR 1 Cash HOCDocument4 pagesInter Branch Transactions: BC - BR 2 HOC Cash BC-BR 1 Cash HOCCarl Dhaniel Garcia SalenNo ratings yet

- Property, Plant and Equipment Problems 5-1 (Uy Company)Document14 pagesProperty, Plant and Equipment Problems 5-1 (Uy Company)NaSheeng100% (1)

- Group 1 - Chapter 16Document8 pagesGroup 1 - Chapter 16Cherie Soriano AnanayoNo ratings yet

- Flexible Company Debit Credit 2020Document1 pageFlexible Company Debit Credit 2020AnonnNo ratings yet

- Notes Payable and Debt Restructuring (Ruma, Jamaica)Document14 pagesNotes Payable and Debt Restructuring (Ruma, Jamaica)Jamaica RumaNo ratings yet

- Draft A90Document7 pagesDraft A90Jewel Mae MercadoNo ratings yet

- Capital Budgeting ExercisesDocument16 pagesCapital Budgeting ExercisesMhel EspanoNo ratings yet

- Case 3Document5 pagesCase 3Anna Marie Andal RanilloNo ratings yet

- Chapter 7 - Compound Financial Instrument (FAR6)Document5 pagesChapter 7 - Compound Financial Instrument (FAR6)Honeylet SigesmundoNo ratings yet

- Strategic Cost Accounting: MBA-First YearDocument99 pagesStrategic Cost Accounting: MBA-First YearNada YoussefNo ratings yet

- 03 Cost-Volume-Profit AnalysisDocument6 pages03 Cost-Volume-Profit Analysisrandomlungs121223No ratings yet

- Financial Accounting and Reporting April 2023 Final Preboard Examination Batch 93Document13 pagesFinancial Accounting and Reporting April 2023 Final Preboard Examination Batch 93norhainiNo ratings yet

- CAED101 - DE CASTRO - ACN1 - EOQ ActivityDocument1 pageCAED101 - DE CASTRO - ACN1 - EOQ ActivityIra Grace De CastroNo ratings yet

- Problem 4-29 To 31Document1 pageProblem 4-29 To 31maryaniNo ratings yet

- Employer Benefit - Part 2Document9 pagesEmployer Benefit - Part 2Julian Adam PagalNo ratings yet

- ch3 Not EditedDocument14 pagesch3 Not EditedDM MontefalcoNo ratings yet

- Fair Value Model: Home My Courses ACC211 - 6387 - 2021-2022 - 2NDSEM-SEM - CAE 5th To 8th Examinations/Assessments Final ExamDocument2 pagesFair Value Model: Home My Courses ACC211 - 6387 - 2021-2022 - 2NDSEM-SEM - CAE 5th To 8th Examinations/Assessments Final Examkaeya alberichNo ratings yet

- Name: Course & Yr: Schedule: Score: - : Subscribed and Paid-Up Shares Amou NTDocument3 pagesName: Course & Yr: Schedule: Score: - : Subscribed and Paid-Up Shares Amou NTYricaNo ratings yet

- Bond Valuation Exam 1Document2 pagesBond Valuation Exam 1Ronah Abigail BejocNo ratings yet

- Shareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)Document18 pagesShareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)nmdl123No ratings yet

- Ae 211 Solutions-PrelimDocument10 pagesAe 211 Solutions-PrelimNhel AlvaroNo ratings yet

- Chapter 5 - Adv Acc 1Document18 pagesChapter 5 - Adv Acc 1Maurice AgbayaniNo ratings yet

- CVP Analysis 2 Amp Ratios ExcelDocument53 pagesCVP Analysis 2 Amp Ratios ExcelSoahNo ratings yet

- 3rd ActivityDocument2 pages3rd Activitydar •No ratings yet

- Cash of Foregoing A Cash DiscountDocument3 pagesCash of Foregoing A Cash DiscountRNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Financial Assets at Fair Value (Investments) Basic ConceptsDocument2 pagesFinancial Assets at Fair Value (Investments) Basic ConceptsMonica Monica0% (1)

- Intermediate Accounting 2 CompressDocument84 pagesIntermediate Accounting 2 Compressngxbao0211suyaNo ratings yet

- Problem 5 and 6Document4 pagesProblem 5 and 6Lalaina EnriquezNo ratings yet

- Chapter 7Document18 pagesChapter 7Raven Vargas DayritNo ratings yet

- Chapter 5Document20 pagesChapter 5Clyette Anne Flores Borja100% (1)

- 1Document20 pages1Denver AcenasNo ratings yet

- Chap 5 Prob 1 3Document10 pagesChap 5 Prob 1 3Nyster Ann RebenitoNo ratings yet

- 2nd Sem 2021 Acctg 5a NCADocument7 pages2nd Sem 2021 Acctg 5a NCARUNEL J. PACOTNo ratings yet

- This Study Resource Was Shared Via: Solution 23-2 Answer DDocument5 pagesThis Study Resource Was Shared Via: Solution 23-2 Answer DDummy GoogleNo ratings yet

- CVP Analysis 2Document8 pagesCVP Analysis 2Gennelyn Grace PenaredondoNo ratings yet

- Chap16 ProblemsDocument20 pagesChap16 ProblemsYen YenNo ratings yet

- 4 Activity 5 PPEDocument9 pages4 Activity 5 PPEDaniella Mae ElipNo ratings yet

- COST Center (COST SBU) - Exercise 5 P. 507 Problem 4 p.512Document5 pagesCOST Center (COST SBU) - Exercise 5 P. 507 Problem 4 p.512RenNo ratings yet

- ACTG 431 QUIZ Week 2 Theory of Accounts Part 2 - FINANCIAL ASSET AT AMORTIZED COST QUIZDocument4 pagesACTG 431 QUIZ Week 2 Theory of Accounts Part 2 - FINANCIAL ASSET AT AMORTIZED COST QUIZMarilou Arcillas PanisalesNo ratings yet

- IA2 CH15A PROBLEMS (Vhinson)Document5 pagesIA2 CH15A PROBLEMS (Vhinson)sophomorefilesNo ratings yet

- 064 PDFDocument9 pages064 PDFWe WNo ratings yet

- Sol. Man. - Chapter 17 - Depletion of Mineral Resources - Ia Part 1BDocument3 pagesSol. Man. - Chapter 17 - Depletion of Mineral Resources - Ia Part 1BMahasia MANDIGANNo ratings yet

- Intacc Chapter 49-50Document17 pagesIntacc Chapter 49-50Cheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Problem 2 8Document6 pagesProblem 2 8Carl Jaime Dela CruzNo ratings yet

- Ia 2Document23 pagesIa 2Gelo OwssNo ratings yet

- (01I) Lower of Cost and NRVDocument3 pages(01I) Lower of Cost and NRVGabriel Adrian ObungenNo ratings yet

- Borrowing Cost Sample ProblemsDocument8 pagesBorrowing Cost Sample Problemslet me live in peaceNo ratings yet

- IA3 Chapter 22 29Document5 pagesIA3 Chapter 22 29ZicoNo ratings yet

- Qualifying Exam Review Financial Accounting & ReportingDocument21 pagesQualifying Exam Review Financial Accounting & ReportingClene DoconteNo ratings yet

- Solution Chapter 23 MilanDocument3 pagesSolution Chapter 23 MilanAngelica GaliciaNo ratings yet

- AE7 AssignmentDocument3 pagesAE7 AssignmentvhuusbcNo ratings yet

- Active Subject: Creditor/ Obligee: Passive Subject: Debtor/ ObligorDocument3 pagesActive Subject: Creditor/ Obligee: Passive Subject: Debtor/ ObligorIana Jane BuronNo ratings yet

- Questions Anti-Bullying Program Mentoring Program Community OutreachDocument2 pagesQuestions Anti-Bullying Program Mentoring Program Community OutreachIana Jane BuronNo ratings yet

- The Five Worst Mass ExtinctionsDocument1 pageThe Five Worst Mass ExtinctionsIana Jane BuronNo ratings yet

- SpeechDocument2 pagesSpeechIana Jane Buron100% (1)

- Ter/atomic and Molecular Properties/Intermolecular Forces/Van Der Waals ForcesDocument6 pagesTer/atomic and Molecular Properties/Intermolecular Forces/Van Der Waals ForcesIana Jane BuronNo ratings yet

- FSDJF KFHSDKLFHDSKLFHSDKFHSDL: Earthquake and Tsunami in Moro Gulf MinadanaoDocument4 pagesFSDJF KFHSDKLFHDSKLFHSDKFHSDL: Earthquake and Tsunami in Moro Gulf MinadanaoIana Jane BuronNo ratings yet

- Why We Should Not Go OutdoorsDocument1 pageWhy We Should Not Go OutdoorsIana Jane BuronNo ratings yet

- Intermediate Accounting 4: Investment PropertyDocument1 pageIntermediate Accounting 4: Investment PropertyIana Jane BuronNo ratings yet