Professional Documents

Culture Documents

Agnes Monica Herman - 130318123 - KP C - Tugas Akl 1 Week 8 PDF

Agnes Monica Herman - 130318123 - KP C - Tugas Akl 1 Week 8 PDF

Uploaded by

Agnes HermanCopyright:

Available Formats

You might also like

- Nurul Aryani - AKL1 - QUIZ 4 - SOAL 1Document1 pageNurul Aryani - AKL1 - QUIZ 4 - SOAL 1Nurul AryaniNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- 87549654Document3 pages87549654Joel Christian Mascariña100% (1)

- Jan Carlzon - Case AnalysisDocument2 pagesJan Carlzon - Case AnalysisDaniyalNo ratings yet

- Market Positioning of White Cement and Wall PuttyDocument70 pagesMarket Positioning of White Cement and Wall PuttyKunal Kore100% (9)

- Suit For Partition & Permanent Injunction-1118Document3 pagesSuit For Partition & Permanent Injunction-1118sagar100% (4)

- FinACt 5 Foreign Currency TransactionsDocument2 pagesFinACt 5 Foreign Currency TransactionsBedynz Mark Pimentel100% (2)

- Problem 9-4: Name: Section: ScoreDocument5 pagesProblem 9-4: Name: Section: ScoreMohd ZuhairNo ratings yet

- KasdanPiutang 4B Kelompok1Document11 pagesKasdanPiutang 4B Kelompok1Estin TasyaNo ratings yet

- 23 Administrative Officer Interview Questions & Answers: Order ID: 0081249Document12 pages23 Administrative Officer Interview Questions & Answers: Order ID: 0081249JenniferNo ratings yet

- Hull OFOD9e MultipleChoice Questions and Answers Ch10 PDFDocument6 pagesHull OFOD9e MultipleChoice Questions and Answers Ch10 PDFfawefwaeNo ratings yet

- MG 514 C Service ManualDocument100 pagesMG 514 C Service ManualMahmoud Yosri100% (3)

- Tugas 12 AKL 2 - Lidia Ayu Lestari - 21043043Document7 pagesTugas 12 AKL 2 - Lidia Ayu Lestari - 21043043Lidya Ayu LestariNo ratings yet

- Forex Practice Questions Set 2 Sec B Non IcaiDocument5 pagesForex Practice Questions Set 2 Sec B Non IcaiChandu ChandanaNo ratings yet

- Akuntansi Account ReceivableDocument8 pagesAkuntansi Account Receivablem habiburrahman55No ratings yet

- Acg5205 Solutions Ch.11 - Christensen 12eDocument8 pagesAcg5205 Solutions Ch.11 - Christensen 12eRyan NguyenNo ratings yet

- UTS Ak 1 Genap 2029-2020Document3 pagesUTS Ak 1 Genap 2029-2020Dominica ViolitaNo ratings yet

- Tax Homework Chapter 4Document7 pagesTax Homework Chapter 4RosShanique ColebyNo ratings yet

- 683sol04 PDFDocument46 pages683sol04 PDFJonah MoyoNo ratings yet

- Kunci Kuis AKL 2Document9 pagesKunci Kuis AKL 2Ilham Dwi NoviantoNo ratings yet

- Kelompok 1 (Intan)Document14 pagesKelompok 1 (Intan)Amanda VeronikaNo ratings yet

- Answers To Extra QuestionsDocument8 pagesAnswers To Extra QuestionsHashani KumarasingheNo ratings yet

- AKM Week 3Document4 pagesAKM Week 3ELSA SYAFIRA ANANTANo ratings yet

- Assignment 2: Journal Entry & Ledger PostingDocument3 pagesAssignment 2: Journal Entry & Ledger PostingATBNo ratings yet

- Tabular AnalysisDocument3 pagesTabular Analysissilva yunizaNo ratings yet

- Acct 4010 Ch2-Handout-SolutionDocument4 pagesAcct 4010 Ch2-Handout-Solutionlokyee801mikiNo ratings yet

- (IFA 8) - Rendy Filiang - 1402210324Document15 pages(IFA 8) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- Lecture 8 (Chapter7) - International Arbitrage and Interest Rate ParityDocument39 pagesLecture 8 (Chapter7) - International Arbitrage and Interest Rate ParityTivinesh MorganNo ratings yet

- MCQ With AnswersDocument27 pagesMCQ With AnswersAnonymous qi4PZkNo ratings yet

- HW 7Document2 pagesHW 7Mishalm96No ratings yet

- The Role of Working Capital: Bordenk@unk - EduDocument7 pagesThe Role of Working Capital: Bordenk@unk - EduAntonio FrancoNo ratings yet

- Solution - Quiz - Partnership Formation and OperationDocument6 pagesSolution - Quiz - Partnership Formation and Operationvivien velezNo ratings yet

- 3er. SET DE EJERCICIOSDocument3 pages3er. SET DE EJERCICIOSCesar CameyNo ratings yet

- Act Stock Equity JournalDocument2 pagesAct Stock Equity Journalkevin phillipsNo ratings yet

- SOLUTION MANUAL Akm 1 PDFDocument4 pagesSOLUTION MANUAL Akm 1 PDFRizka khairunnisaNo ratings yet

- This Study Resource Was: Multiple Choice QuestionsDocument8 pagesThis Study Resource Was: Multiple Choice QuestionsPamela SantosNo ratings yet

- Hisyam Ramadhan 2201751543: 90% Parent Share 10% NCI Share 100% Total ValueDocument2 pagesHisyam Ramadhan 2201751543: 90% Parent Share 10% NCI Share 100% Total ValueYuda Fadhil CuyNo ratings yet

- Huỳnh Hiếu Hậu 2000002356 Accounting PrinciplesDocument4 pagesHuỳnh Hiếu Hậu 2000002356 Accounting PrinciplesTuấn DươngNo ratings yet

- Soal 1 A. Time Co Laporan Rekonsiliasi Bank Per 31 Januari Cash Balance Per Bank Statement $ 3,660.20Document6 pagesSoal 1 A. Time Co Laporan Rekonsiliasi Bank Per 31 Januari Cash Balance Per Bank Statement $ 3,660.20meifangNo ratings yet

- Quiz Adv Acc 2Document3 pagesQuiz Adv Acc 2georgius gabrielNo ratings yet

- TB 1 PA 2 - Meliza Angelina - 43219010134Document5 pagesTB 1 PA 2 - Meliza Angelina - 43219010134Meliza AngelinaNo ratings yet

- BUSI 2001 - Intermediate Accounting 1 Assignment 2 - Notes Receivable, Inventories Solution Problem 1Document2 pagesBUSI 2001 - Intermediate Accounting 1 Assignment 2 - Notes Receivable, Inventories Solution Problem 1Kate BNo ratings yet

- BUSI 2001 - Intermediate Accounting 1 Assignment 2 - Notes Receivable, Inventories Solution Problem 1Document2 pagesBUSI 2001 - Intermediate Accounting 1 Assignment 2 - Notes Receivable, Inventories Solution Problem 1Kate BNo ratings yet

- Tugas Bab 6 Jawaban P 6-3Document2 pagesTugas Bab 6 Jawaban P 6-3Syahirul AlimNo ratings yet

- Lat 7 Knight&lesserDocument5 pagesLat 7 Knight&lesserNadratul Hasanah LubisNo ratings yet

- Plantilla Tarea 1 1 ACCO 3150 4mjjDocument5 pagesPlantilla Tarea 1 1 ACCO 3150 4mjjcrispyy turonNo ratings yet

- Assessment Task - Tutorial Questions Assignment Unit Code: HA3011 Question 1 Answer (A It Costed $860,000 To Acquire The Machine. (B)Document7 pagesAssessment Task - Tutorial Questions Assignment Unit Code: HA3011 Question 1 Answer (A It Costed $860,000 To Acquire The Machine. (B)Jaydeep KushwahaNo ratings yet

- Akl Kelompok 4Document15 pagesAkl Kelompok 4Sry WahyuniNo ratings yet

- Solutions To ProblemsDocument4 pagesSolutions To ProblemslorraineNo ratings yet

- Feed Back Kuis Akl Praktikum (Uts)Document5 pagesFeed Back Kuis Akl Praktikum (Uts)KiwidNo ratings yet

- JAWABAN CHAPTER 17 - INVESTMENTS (Revisi)Document3 pagesJAWABAN CHAPTER 17 - INVESTMENTS (Revisi)CaratmelonaNo ratings yet

- November December 2014 $ 1.080.000 July-October 650.000 January-June 420.000 Prior To 1/1/16 150.000 $2.300.000Document4 pagesNovember December 2014 $ 1.080.000 July-October 650.000 January-June 420.000 Prior To 1/1/16 150.000 $2.300.000Yudhi MahendraNo ratings yet

- Problem 1 2 IAADocument1 pageProblem 1 2 IAAJUARE MaxineNo ratings yet

- Answers To Concepts Review and Critical Thinking QuestionsDocument6 pagesAnswers To Concepts Review and Critical Thinking QuestionsHimanshu KatheriaNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- Triangular Arbitrage ExamplesDocument1 pageTriangular Arbitrage ExamplesCarolina67% (6)

- PR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Document15 pagesPR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Satrio Saja67% (3)

- Chapter 2: Fund AccountingDocument13 pagesChapter 2: Fund AccountingPhượng TrầnNo ratings yet

- Sample Mid Term Exam QuestionsDocument15 pagesSample Mid Term Exam QuestionsThat kid 246No ratings yet

- Dwnload Full Cfin 3 3rd Edition Besley Solutions Manual PDFDocument35 pagesDwnload Full Cfin 3 3rd Edition Besley Solutions Manual PDFbrandihansenjoqll2100% (18)

- Acc 550 Week 4 HomeworkDocument7 pagesAcc 550 Week 4 Homeworkjoannapsmith33No ratings yet

- Chapter 2Document3 pagesChapter 2Ikramul HaqueNo ratings yet

- FM II Assignment 12 SolutionDocument3 pagesFM II Assignment 12 SolutionSinpaoNo ratings yet

- Modul Per 6 - Derivative and Foreign CurrencyDocument3 pagesModul Per 6 - Derivative and Foreign Currencyelisha nhataellinaNo ratings yet

- Corporate Finance Canadian 7th Edition Ross Solutions ManualDocument25 pagesCorporate Finance Canadian 7th Edition Ross Solutions ManualToniSmithmozr100% (65)

- Jawaban Soal 1: Date Keterangan DR CR Acc. Name RP Acc. Name RPDocument4 pagesJawaban Soal 1: Date Keterangan DR CR Acc. Name RP Acc. Name RPsilvia indahsariNo ratings yet

- Gulu University Private Admissions 2015/2016Document9 pagesGulu University Private Admissions 2015/2016The Campus Times100% (2)

- Theoretical Issues of Industry Structure Applied To The Building and Construction IndustryDocument10 pagesTheoretical Issues of Industry Structure Applied To The Building and Construction IndustryRonald Glenn RosadaNo ratings yet

- Literature ReviewDocument3 pagesLiterature ReviewRohan SharmaNo ratings yet

- Windows10 Commercial ComparisonDocument1 pageWindows10 Commercial ComparisoncetelecNo ratings yet

- Early History: Bacardi Is A Family-ControlledDocument13 pagesEarly History: Bacardi Is A Family-ControlledpinkiinsanNo ratings yet

- DHL Express: Money-Back Guarantee Terms and ConditionsDocument2 pagesDHL Express: Money-Back Guarantee Terms and ConditionsMopiNo ratings yet

- Industrial Engineering by S K Mondal (Marinenotes - Blogspot.com)Document318 pagesIndustrial Engineering by S K Mondal (Marinenotes - Blogspot.com)Abilasha VediappanNo ratings yet

- Kengyew ResumeDocument4 pagesKengyew ResumeKengyew ThamNo ratings yet

- Marketing Management Question Bank For MidDocument5 pagesMarketing Management Question Bank For Middynamo vjNo ratings yet

- Toyota Important TTTTDocument1 pageToyota Important TTTTArmin AmiriNo ratings yet

- 051 PELINO Secretary of Finance v. Oro MauraDocument2 pages051 PELINO Secretary of Finance v. Oro MauraIriz BelenoNo ratings yet

- (2-1) Time Value of Money - Single Cash FlowDocument19 pages(2-1) Time Value of Money - Single Cash Flowsaleemm_2No ratings yet

- Financial Statement Elements of Hotel DepartmentDocument4 pagesFinancial Statement Elements of Hotel DepartmentsarasatiwanamiNo ratings yet

- Murphy USA - Tobacco Compliance Audit: Key ObjectivesDocument2 pagesMurphy USA - Tobacco Compliance Audit: Key ObjectivesDucks TeeNo ratings yet

- Research Paper AkanshaDocument15 pagesResearch Paper AkanshaAkansha BhargavaNo ratings yet

- Bs#982371 - Antipolo City Hall Oct2021Document3 pagesBs#982371 - Antipolo City Hall Oct2021Perla EscresaNo ratings yet

- The Most Frequently Used Transaction Codes Are As FollowsDocument15 pagesThe Most Frequently Used Transaction Codes Are As FollowsJitender DalalNo ratings yet

- Mission of Pepsico BD: Transcom Beverage LTDDocument30 pagesMission of Pepsico BD: Transcom Beverage LTDBISHAASH বিশ্বাসNo ratings yet

- Gear Machine ManualDocument20 pagesGear Machine ManualRuchira Chanda Indu100% (1)

- Contract To SellDocument12 pagesContract To SellowenNo ratings yet

- UDS - Dex G 20 40 80 - 130324 Rev 04 - ENDocument1 pageUDS - Dex G 20 40 80 - 130324 Rev 04 - ENThanh Song PHANNo ratings yet

- One Time Debit Mandate Form NACH / Auto Debit: Mutual FundsDocument2 pagesOne Time Debit Mandate Form NACH / Auto Debit: Mutual FundsNothing NothingNo ratings yet

- SQM Question BankDocument25 pagesSQM Question BankkingraajaNo ratings yet

- DAR GuidelinesfortheProcessingofLandUseConversionDocument6 pagesDAR GuidelinesfortheProcessingofLandUseConversionMaricar Badiola CuervoNo ratings yet

Agnes Monica Herman - 130318123 - KP C - Tugas Akl 1 Week 8 PDF

Agnes Monica Herman - 130318123 - KP C - Tugas Akl 1 Week 8 PDF

Uploaded by

Agnes HermanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Agnes Monica Herman - 130318123 - KP C - Tugas Akl 1 Week 8 PDF

Agnes Monica Herman - 130318123 - KP C - Tugas Akl 1 Week 8 PDF

Uploaded by

Agnes HermanCopyright:

Available Formats

Agnes Monica Herman Tugas Week 8

130318123 Akuntansi Keuangan Lanjutan I

KP B P 12 – 4

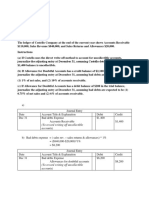

1. Determine the net exchange gain or loss that should be reflected in Lin’s income statement for

2016 from year – end exchange adjustments.

Answer :

Account Receivable Closing Balance Gain/Loss

U.S. Dollars $ 28.500 -

Swedish Krona (20.000 x $ 0.52) $ 10.400 ($ 1.400)

British Pounds (25.000 x $ 1.65) $ 41.250 $ 250

Account Receivable Loss ($ 1.150)

Account Payable Closing Balance Gain/Loss

U.S. Dollars $ 6.850 -

Canadian Dollars (10.000 x $ 0.70) $ 7.000 $ 600

British Pounds (15.000 x $ 1.65) $ 24.750 ($ 300)

Account Payable Gain $ 300

Net Exchange Loss = $ 1.150 - $ 300 = $ 850

2. Determine the amount at which the accounts receivable and accounts payable should be

included in Lin’s December 31, 2016, balance sheet.

Answer :

Account Receivable = $ 81.300 - $ 1.150 = $ 80.150

Account Payable = $ 38.900 - $ 300 = $ 38.600

3. Prepare journal entries to record collection of the receivables in 2017 when the spot rates for

Swedish Krona and British pounds are $0.55 and $1.63, respectively.

Answer :

a. Cash $ 28.500

Account Receivable – U.S $ 28.500

b. Cash (20.000 x $ 0.55) $ 11.000

Foreign Exchange Gain $ 600

Account Receivable – Swedish $ 10.400

c. Cash (25.000 x $ 1.63) $ 40.750

Foreign Exchange Loss $ 500

Account Receivable – British $ 41.250

4. Prepare journal entries to record settlement of the accounts payable in 2017 when the spot

rates for Canadian dollars and British pounds are $0.69 and $1.62, respectively.

Answer :

a. Account Payable – U.S $ 6.850

Cash $ 6.850

b. Account Payable – Canadian $ 7.000

Foreign Exchange Gain $ 100

Cash (10.000 x $ 0.69) $ 6.900

c. Account Payable – British $ 24.750

Foreign Exchange Gain $ 450

Cash (15.000 x $ 1.62) $ 24.300

You might also like

- Nurul Aryani - AKL1 - QUIZ 4 - SOAL 1Document1 pageNurul Aryani - AKL1 - QUIZ 4 - SOAL 1Nurul AryaniNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- 87549654Document3 pages87549654Joel Christian Mascariña100% (1)

- Jan Carlzon - Case AnalysisDocument2 pagesJan Carlzon - Case AnalysisDaniyalNo ratings yet

- Market Positioning of White Cement and Wall PuttyDocument70 pagesMarket Positioning of White Cement and Wall PuttyKunal Kore100% (9)

- Suit For Partition & Permanent Injunction-1118Document3 pagesSuit For Partition & Permanent Injunction-1118sagar100% (4)

- FinACt 5 Foreign Currency TransactionsDocument2 pagesFinACt 5 Foreign Currency TransactionsBedynz Mark Pimentel100% (2)

- Problem 9-4: Name: Section: ScoreDocument5 pagesProblem 9-4: Name: Section: ScoreMohd ZuhairNo ratings yet

- KasdanPiutang 4B Kelompok1Document11 pagesKasdanPiutang 4B Kelompok1Estin TasyaNo ratings yet

- 23 Administrative Officer Interview Questions & Answers: Order ID: 0081249Document12 pages23 Administrative Officer Interview Questions & Answers: Order ID: 0081249JenniferNo ratings yet

- Hull OFOD9e MultipleChoice Questions and Answers Ch10 PDFDocument6 pagesHull OFOD9e MultipleChoice Questions and Answers Ch10 PDFfawefwaeNo ratings yet

- MG 514 C Service ManualDocument100 pagesMG 514 C Service ManualMahmoud Yosri100% (3)

- Tugas 12 AKL 2 - Lidia Ayu Lestari - 21043043Document7 pagesTugas 12 AKL 2 - Lidia Ayu Lestari - 21043043Lidya Ayu LestariNo ratings yet

- Forex Practice Questions Set 2 Sec B Non IcaiDocument5 pagesForex Practice Questions Set 2 Sec B Non IcaiChandu ChandanaNo ratings yet

- Akuntansi Account ReceivableDocument8 pagesAkuntansi Account Receivablem habiburrahman55No ratings yet

- Acg5205 Solutions Ch.11 - Christensen 12eDocument8 pagesAcg5205 Solutions Ch.11 - Christensen 12eRyan NguyenNo ratings yet

- UTS Ak 1 Genap 2029-2020Document3 pagesUTS Ak 1 Genap 2029-2020Dominica ViolitaNo ratings yet

- Tax Homework Chapter 4Document7 pagesTax Homework Chapter 4RosShanique ColebyNo ratings yet

- 683sol04 PDFDocument46 pages683sol04 PDFJonah MoyoNo ratings yet

- Kunci Kuis AKL 2Document9 pagesKunci Kuis AKL 2Ilham Dwi NoviantoNo ratings yet

- Kelompok 1 (Intan)Document14 pagesKelompok 1 (Intan)Amanda VeronikaNo ratings yet

- Answers To Extra QuestionsDocument8 pagesAnswers To Extra QuestionsHashani KumarasingheNo ratings yet

- AKM Week 3Document4 pagesAKM Week 3ELSA SYAFIRA ANANTANo ratings yet

- Assignment 2: Journal Entry & Ledger PostingDocument3 pagesAssignment 2: Journal Entry & Ledger PostingATBNo ratings yet

- Tabular AnalysisDocument3 pagesTabular Analysissilva yunizaNo ratings yet

- Acct 4010 Ch2-Handout-SolutionDocument4 pagesAcct 4010 Ch2-Handout-Solutionlokyee801mikiNo ratings yet

- (IFA 8) - Rendy Filiang - 1402210324Document15 pages(IFA 8) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- Lecture 8 (Chapter7) - International Arbitrage and Interest Rate ParityDocument39 pagesLecture 8 (Chapter7) - International Arbitrage and Interest Rate ParityTivinesh MorganNo ratings yet

- MCQ With AnswersDocument27 pagesMCQ With AnswersAnonymous qi4PZkNo ratings yet

- HW 7Document2 pagesHW 7Mishalm96No ratings yet

- The Role of Working Capital: Bordenk@unk - EduDocument7 pagesThe Role of Working Capital: Bordenk@unk - EduAntonio FrancoNo ratings yet

- Solution - Quiz - Partnership Formation and OperationDocument6 pagesSolution - Quiz - Partnership Formation and Operationvivien velezNo ratings yet

- 3er. SET DE EJERCICIOSDocument3 pages3er. SET DE EJERCICIOSCesar CameyNo ratings yet

- Act Stock Equity JournalDocument2 pagesAct Stock Equity Journalkevin phillipsNo ratings yet

- SOLUTION MANUAL Akm 1 PDFDocument4 pagesSOLUTION MANUAL Akm 1 PDFRizka khairunnisaNo ratings yet

- This Study Resource Was: Multiple Choice QuestionsDocument8 pagesThis Study Resource Was: Multiple Choice QuestionsPamela SantosNo ratings yet

- Hisyam Ramadhan 2201751543: 90% Parent Share 10% NCI Share 100% Total ValueDocument2 pagesHisyam Ramadhan 2201751543: 90% Parent Share 10% NCI Share 100% Total ValueYuda Fadhil CuyNo ratings yet

- Huỳnh Hiếu Hậu 2000002356 Accounting PrinciplesDocument4 pagesHuỳnh Hiếu Hậu 2000002356 Accounting PrinciplesTuấn DươngNo ratings yet

- Soal 1 A. Time Co Laporan Rekonsiliasi Bank Per 31 Januari Cash Balance Per Bank Statement $ 3,660.20Document6 pagesSoal 1 A. Time Co Laporan Rekonsiliasi Bank Per 31 Januari Cash Balance Per Bank Statement $ 3,660.20meifangNo ratings yet

- Quiz Adv Acc 2Document3 pagesQuiz Adv Acc 2georgius gabrielNo ratings yet

- TB 1 PA 2 - Meliza Angelina - 43219010134Document5 pagesTB 1 PA 2 - Meliza Angelina - 43219010134Meliza AngelinaNo ratings yet

- BUSI 2001 - Intermediate Accounting 1 Assignment 2 - Notes Receivable, Inventories Solution Problem 1Document2 pagesBUSI 2001 - Intermediate Accounting 1 Assignment 2 - Notes Receivable, Inventories Solution Problem 1Kate BNo ratings yet

- BUSI 2001 - Intermediate Accounting 1 Assignment 2 - Notes Receivable, Inventories Solution Problem 1Document2 pagesBUSI 2001 - Intermediate Accounting 1 Assignment 2 - Notes Receivable, Inventories Solution Problem 1Kate BNo ratings yet

- Tugas Bab 6 Jawaban P 6-3Document2 pagesTugas Bab 6 Jawaban P 6-3Syahirul AlimNo ratings yet

- Lat 7 Knight&lesserDocument5 pagesLat 7 Knight&lesserNadratul Hasanah LubisNo ratings yet

- Plantilla Tarea 1 1 ACCO 3150 4mjjDocument5 pagesPlantilla Tarea 1 1 ACCO 3150 4mjjcrispyy turonNo ratings yet

- Assessment Task - Tutorial Questions Assignment Unit Code: HA3011 Question 1 Answer (A It Costed $860,000 To Acquire The Machine. (B)Document7 pagesAssessment Task - Tutorial Questions Assignment Unit Code: HA3011 Question 1 Answer (A It Costed $860,000 To Acquire The Machine. (B)Jaydeep KushwahaNo ratings yet

- Akl Kelompok 4Document15 pagesAkl Kelompok 4Sry WahyuniNo ratings yet

- Solutions To ProblemsDocument4 pagesSolutions To ProblemslorraineNo ratings yet

- Feed Back Kuis Akl Praktikum (Uts)Document5 pagesFeed Back Kuis Akl Praktikum (Uts)KiwidNo ratings yet

- JAWABAN CHAPTER 17 - INVESTMENTS (Revisi)Document3 pagesJAWABAN CHAPTER 17 - INVESTMENTS (Revisi)CaratmelonaNo ratings yet

- November December 2014 $ 1.080.000 July-October 650.000 January-June 420.000 Prior To 1/1/16 150.000 $2.300.000Document4 pagesNovember December 2014 $ 1.080.000 July-October 650.000 January-June 420.000 Prior To 1/1/16 150.000 $2.300.000Yudhi MahendraNo ratings yet

- Problem 1 2 IAADocument1 pageProblem 1 2 IAAJUARE MaxineNo ratings yet

- Answers To Concepts Review and Critical Thinking QuestionsDocument6 pagesAnswers To Concepts Review and Critical Thinking QuestionsHimanshu KatheriaNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- Triangular Arbitrage ExamplesDocument1 pageTriangular Arbitrage ExamplesCarolina67% (6)

- PR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Document15 pagesPR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Satrio Saja67% (3)

- Chapter 2: Fund AccountingDocument13 pagesChapter 2: Fund AccountingPhượng TrầnNo ratings yet

- Sample Mid Term Exam QuestionsDocument15 pagesSample Mid Term Exam QuestionsThat kid 246No ratings yet

- Dwnload Full Cfin 3 3rd Edition Besley Solutions Manual PDFDocument35 pagesDwnload Full Cfin 3 3rd Edition Besley Solutions Manual PDFbrandihansenjoqll2100% (18)

- Acc 550 Week 4 HomeworkDocument7 pagesAcc 550 Week 4 Homeworkjoannapsmith33No ratings yet

- Chapter 2Document3 pagesChapter 2Ikramul HaqueNo ratings yet

- FM II Assignment 12 SolutionDocument3 pagesFM II Assignment 12 SolutionSinpaoNo ratings yet

- Modul Per 6 - Derivative and Foreign CurrencyDocument3 pagesModul Per 6 - Derivative and Foreign Currencyelisha nhataellinaNo ratings yet

- Corporate Finance Canadian 7th Edition Ross Solutions ManualDocument25 pagesCorporate Finance Canadian 7th Edition Ross Solutions ManualToniSmithmozr100% (65)

- Jawaban Soal 1: Date Keterangan DR CR Acc. Name RP Acc. Name RPDocument4 pagesJawaban Soal 1: Date Keterangan DR CR Acc. Name RP Acc. Name RPsilvia indahsariNo ratings yet

- Gulu University Private Admissions 2015/2016Document9 pagesGulu University Private Admissions 2015/2016The Campus Times100% (2)

- Theoretical Issues of Industry Structure Applied To The Building and Construction IndustryDocument10 pagesTheoretical Issues of Industry Structure Applied To The Building and Construction IndustryRonald Glenn RosadaNo ratings yet

- Literature ReviewDocument3 pagesLiterature ReviewRohan SharmaNo ratings yet

- Windows10 Commercial ComparisonDocument1 pageWindows10 Commercial ComparisoncetelecNo ratings yet

- Early History: Bacardi Is A Family-ControlledDocument13 pagesEarly History: Bacardi Is A Family-ControlledpinkiinsanNo ratings yet

- DHL Express: Money-Back Guarantee Terms and ConditionsDocument2 pagesDHL Express: Money-Back Guarantee Terms and ConditionsMopiNo ratings yet

- Industrial Engineering by S K Mondal (Marinenotes - Blogspot.com)Document318 pagesIndustrial Engineering by S K Mondal (Marinenotes - Blogspot.com)Abilasha VediappanNo ratings yet

- Kengyew ResumeDocument4 pagesKengyew ResumeKengyew ThamNo ratings yet

- Marketing Management Question Bank For MidDocument5 pagesMarketing Management Question Bank For Middynamo vjNo ratings yet

- Toyota Important TTTTDocument1 pageToyota Important TTTTArmin AmiriNo ratings yet

- 051 PELINO Secretary of Finance v. Oro MauraDocument2 pages051 PELINO Secretary of Finance v. Oro MauraIriz BelenoNo ratings yet

- (2-1) Time Value of Money - Single Cash FlowDocument19 pages(2-1) Time Value of Money - Single Cash Flowsaleemm_2No ratings yet

- Financial Statement Elements of Hotel DepartmentDocument4 pagesFinancial Statement Elements of Hotel DepartmentsarasatiwanamiNo ratings yet

- Murphy USA - Tobacco Compliance Audit: Key ObjectivesDocument2 pagesMurphy USA - Tobacco Compliance Audit: Key ObjectivesDucks TeeNo ratings yet

- Research Paper AkanshaDocument15 pagesResearch Paper AkanshaAkansha BhargavaNo ratings yet

- Bs#982371 - Antipolo City Hall Oct2021Document3 pagesBs#982371 - Antipolo City Hall Oct2021Perla EscresaNo ratings yet

- The Most Frequently Used Transaction Codes Are As FollowsDocument15 pagesThe Most Frequently Used Transaction Codes Are As FollowsJitender DalalNo ratings yet

- Mission of Pepsico BD: Transcom Beverage LTDDocument30 pagesMission of Pepsico BD: Transcom Beverage LTDBISHAASH বিশ্বাসNo ratings yet

- Gear Machine ManualDocument20 pagesGear Machine ManualRuchira Chanda Indu100% (1)

- Contract To SellDocument12 pagesContract To SellowenNo ratings yet

- UDS - Dex G 20 40 80 - 130324 Rev 04 - ENDocument1 pageUDS - Dex G 20 40 80 - 130324 Rev 04 - ENThanh Song PHANNo ratings yet

- One Time Debit Mandate Form NACH / Auto Debit: Mutual FundsDocument2 pagesOne Time Debit Mandate Form NACH / Auto Debit: Mutual FundsNothing NothingNo ratings yet

- SQM Question BankDocument25 pagesSQM Question BankkingraajaNo ratings yet

- DAR GuidelinesfortheProcessingofLandUseConversionDocument6 pagesDAR GuidelinesfortheProcessingofLandUseConversionMaricar Badiola CuervoNo ratings yet