Professional Documents

Culture Documents

Aljabar Method

Aljabar Method

Uploaded by

NuurLaelaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aljabar Method

Aljabar Method

Uploaded by

NuurLaelaCopyright:

Available Formats

3.

Algebraic Method

Allocation of overhead costs according to this method is the allocation based on the

principle of the use of service department facilities. The service department that uses other

service department facilities even though the overhead costs have been allocated will be

allocated from the other assistant departments. This method is used if the services produced

by the service department are not only enjoyed by one department, but are also used by other

service departments. For example, the service section consists of the power plant department

and the repair department. The Department of Electric Power uses a portion of the services

provided by the repair department to repair diesel engines. On the other hand, the reparations

department also uses some of the services provided by the power plant to drive repair

equipment.

Example

PT AXA has two production departments and two service departments. The company plans

Factory Overhead Costs during 2017 (before allocation) as follows

Departement Amount of Factory Overhead Cost before being allocated

Production I Rp400.000

Production II Rp500.000

Service X Rp100.0000

Service Y Rp120.0000

While the usage data of the facility is

Departement Usage of facilities

X Y

I 40% 45%

II 40% 45%

X 15% 5%

Y 5% 5%

From these data, we are asked to calculate production department overhead costs after the

allocation of service department overhead costs.

To answer the case the steps are

1. Make the equation of the case

X = Rp100.000 + 5/95 Y

Y = Rp120.000 + 5/85 X

Where

X = Cost of Service Department ‘X" after Allocation

Y = Service Department Fee ‘Y" after Allocation

2. From the equation, the allocator is calculated

X = Rp100.000 + 5/95 (Rp120.000 + 5/85 X)

X = Rp100.000 + Rp6.315,79 + 0,00309X

0,99691 X = Rp106.315,79

X = Rp106.645,32

Y = Rp1200.000 + 5/85(Rp106.645,32)

Y = Rp126.273,25

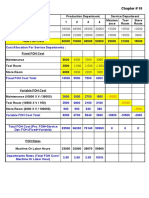

3. Make a table after allocation

Information Production Departemnet Service Departement

I II X Y

BOP 400.000 500.000 100.000 120.000

Allocation X 50.186,03 50.186,04 (106.645,32) 6.273,25

Allocation Y 59.813,97 59.813,96 6.645,32 (126.273,25)

Total 510.000 610.000 - -

You might also like

- DocxDocument8 pagesDocxMburu J. Irungu100% (1)

- Manufacturing of Phthalic AnhydrideDocument16 pagesManufacturing of Phthalic AnhydrideAnkit Mistry100% (2)

- Chapter 5 ExercisesDocument12 pagesChapter 5 ExercisesIsaiah BatucanNo ratings yet

- 21st - OCTOBER - 2022-TODAY CLASS - DotDocument23 pages21st - OCTOBER - 2022-TODAY CLASS - DotPalesaNo ratings yet

- Case: XY Pvt. LTD: Management Accounting & Control AssignmentDocument5 pagesCase: XY Pvt. LTD: Management Accounting & Control AssignmentSwati DasNo ratings yet

- OVERHEAD Control ProblemDocument7 pagesOVERHEAD Control Problemmuttakin106No ratings yet

- Process CostingDocument44 pagesProcess CostingSteven LimNo ratings yet

- Manegerial EconomicsDocument15 pagesManegerial EconomicsAmar GolleNo ratings yet

- Cost Accounting 2003Document12 pagesCost Accounting 2003Ok HqNo ratings yet

- Learning Guide No. 3 - AnswersDocument10 pagesLearning Guide No. 3 - AnswersXaivri Ylaina VrieseNo ratings yet

- Process Costing - Max CorporationDocument7 pagesProcess Costing - Max CorporationNikki GarciaNo ratings yet

- 13 OhDocument12 pages13 OhLakshay SharmaNo ratings yet

- AE 22 - MOH - DepartmentalizationDocument4 pagesAE 22 - MOH - DepartmentalizationJake BorinagaNo ratings yet

- Latihan Soal Akuntansi BiayaDocument5 pagesLatihan Soal Akuntansi Biayaaufa alfayedhaNo ratings yet

- Replacement AnalysisDocument15 pagesReplacement AnalysisVishal Soni100% (2)

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 21Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 21Roshan RamkhalawonNo ratings yet

- Department AccountsDocument14 pagesDepartment Accountsjashveer rekhiNo ratings yet

- Using The Equation Method:: Distribution Summary Particulars Ratios Production Dept. Service DeptDocument3 pagesUsing The Equation Method:: Distribution Summary Particulars Ratios Production Dept. Service DeptRomjan HusainNo ratings yet

- Ch05 Traditional Overheads Versus Activity-Based CostingDocument15 pagesCh05 Traditional Overheads Versus Activity-Based CostingAndrew ChongNo ratings yet

- Chapter 4 Overhead ProblemsDocument5 pagesChapter 4 Overhead Problemsthiluvnddi100% (2)

- Accounting For OverheadsDocument14 pagesAccounting For OverheadsSaad Khan YTNo ratings yet

- Assignment 1556954208 SmsDocument59 pagesAssignment 1556954208 SmsentertainmentqurryNo ratings yet

- S02 Joint and by Product ABC Backflush and Service Department Cost AllocationDocument5 pagesS02 Joint and by Product ABC Backflush and Service Department Cost AllocationRic John Naquila CabilanNo ratings yet

- SolutionDocument22 pagesSolutionAkira Marantal ValdezNo ratings yet

- 2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Document5 pages2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Navira MirajkarNo ratings yet

- Cost and Revenue Analysis: Names of Sub-UnitsDocument14 pagesCost and Revenue Analysis: Names of Sub-UnitssarthaksenNo ratings yet

- OverheadApportionment 7Document5 pagesOverheadApportionment 7mitsob27No ratings yet

- TYBCOM - Cost - OverheadsDocument8 pagesTYBCOM - Cost - Overheadsmkbooks4uNo ratings yet

- Manufacturing OverheadDocument21 pagesManufacturing OverheadErlinda NavalloNo ratings yet

- Cost AllocationDocument13 pagesCost AllocationErijee ParasNo ratings yet

- Chapter 6 OverheadsDocument3 pagesChapter 6 OverheadsDevender SinghNo ratings yet

- Problems in Relevant CostingDocument20 pagesProblems in Relevant CostingJem ValmonteNo ratings yet

- Chapter 15 Amended With AnswersDocument6 pagesChapter 15 Amended With AnswersIbn FaridNo ratings yet

- CAF 3 Spring 2024Document8 pagesCAF 3 Spring 2024ar7461764No ratings yet

- The Other: Cost AccowntingDocument7 pagesThe Other: Cost AccowntingLakshmi SNo ratings yet

- Advacc 3 Answer Key Set A 165pcsDocument3 pagesAdvacc 3 Answer Key Set A 165pcsPearl Mae De VeasNo ratings yet

- Cost Estimation & CVP Suggested SolutionDocument15 pagesCost Estimation & CVP Suggested SolutionNguyên Văn NhậtNo ratings yet

- Overheads - CW - Sums - Part 1Document6 pagesOverheads - CW - Sums - Part 1kushgarg627No ratings yet

- Chapter # 10Document2 pagesChapter # 10kqandeelNo ratings yet

- Caso 04Document17 pagesCaso 04ENMANUELPANDUROPELAEZNo ratings yet

- Type Answers On This Side of The Page OnlyDocument40 pagesType Answers On This Side of The Page Only嘉慧No ratings yet

- MAS Cost Behavior - Answer KeyDocument6 pagesMAS Cost Behavior - Answer KeyDonna Zandueta-TumalaNo ratings yet

- Cost Charged To Department II Total in Process Added Unit Cost 1-Oct This Month EUP CostDocument7 pagesCost Charged To Department II Total in Process Added Unit Cost 1-Oct This Month EUP CostCristel BautistaNo ratings yet

- Notes On Responsibility Accounting and Transfer PriceDocument13 pagesNotes On Responsibility Accounting and Transfer PriceJames Ryan AlzonaNo ratings yet

- BudgetingDocument11 pagesBudgetingTanuj LalchandaniNo ratings yet

- Overheads Part 1 SolutionsDocument25 pagesOverheads Part 1 Solutionsdoshiviraj77No ratings yet

- DownloadDocument18 pagesDownloadGaurav MandotNo ratings yet

- 1 2021 FAR FinalsDocument6 pages1 2021 FAR FinalsZatsumono YamamotoNo ratings yet

- Cost and Managment ADocument2 pagesCost and Managment AMartin TallaNo ratings yet

- Questions & Problems 2Document9 pagesQuestions & Problems 2Suman MahmoodNo ratings yet

- Management Accounting: Support-Department Cost AllocationDocument29 pagesManagement Accounting: Support-Department Cost AllocationbelalangkupukupukupuNo ratings yet

- Preventive Maintenance Q6.Document10 pagesPreventive Maintenance Q6.marathakiara06No ratings yet

- Service Department Cost Allocation: Solutions To Exercises and ProblemsDocument27 pagesService Department Cost Allocation: Solutions To Exercises and ProblemsMafi De LeonNo ratings yet

- Temporarily Shut Down Operations or ContinueDocument2 pagesTemporarily Shut Down Operations or ContinueAira Jaimee GonzalesNo ratings yet

- Temporarily Shut Down Operations or ContinueDocument2 pagesTemporarily Shut Down Operations or ContinueAira Jaimee GonzalesNo ratings yet

- Reviewer in Departmentalization of Factory OverheadDocument6 pagesReviewer in Departmentalization of Factory OverheadMirasolNo ratings yet

- Q1. Cadila Co. Has Three Production Departments A, B and C and Two ServiceDocument5 pagesQ1. Cadila Co. Has Three Production Departments A, B and C and Two Servicemedha surNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Calculo de Consumos Electricos de Equipos en AmbulanciasDocument4 pagesCalculo de Consumos Electricos de Equipos en AmbulanciasCarlos CastilloNo ratings yet

- 84876283Document4 pages84876283homaNo ratings yet

- Modeling of Two-Dimensional Random Fields: R. JankowskiDocument7 pagesModeling of Two-Dimensional Random Fields: R. Jankowskiaman guptaNo ratings yet

- Brosur PipaDocument58 pagesBrosur PipaBagusPrambudiNo ratings yet

- ZI 01 InterfaceDocument4 pagesZI 01 InterfaceAdrian Oprisan100% (1)

- IndexDocument1,018 pagesIndexAjay BansalNo ratings yet

- Holiday Assignment-Grade 7Document3 pagesHoliday Assignment-Grade 7aryan10No ratings yet

- FOGT - Subsea Flanges, Comparison Between Conventional API 6A & SPO CF DesignsDocument14 pagesFOGT - Subsea Flanges, Comparison Between Conventional API 6A & SPO CF DesignsEDWIN M.PNo ratings yet

- Venus School, CollegeDocument2 pagesVenus School, Collegethaxina548No ratings yet

- Request For Proposal RFP Provision of Regional Energy Strategy Individual ConsultantDocument70 pagesRequest For Proposal RFP Provision of Regional Energy Strategy Individual ConsultanttariNo ratings yet

- F 35 Sar 2018 PDFDocument100 pagesF 35 Sar 2018 PDFVietVetSteveNo ratings yet

- Oxidation ReactionDocument32 pagesOxidation ReactionDeepak PradhanNo ratings yet

- Urcea Bioc0mposite Wood Adhesive Artocarpus BlancoiDocument16 pagesUrcea Bioc0mposite Wood Adhesive Artocarpus BlancoiVincent Ronin SerratoNo ratings yet

- ML C 650 c65mm716Document8 pagesML C 650 c65mm716operacionesNo ratings yet

- Assignment ElectrostaticsDocument11 pagesAssignment ElectrostaticsAdarsh DhawanNo ratings yet

- CCP603Document15 pagesCCP603api-3849444No ratings yet

- 7.power System Stability1Document20 pages7.power System Stability1Maneesha ManuNo ratings yet

- Manual StackerDocument4 pagesManual StackerLevente BiroNo ratings yet

- Samyung SafetyEquipment SAR9 ServiceManualDocument19 pagesSamyung SafetyEquipment SAR9 ServiceManualGấu BéoNo ratings yet

- Tadano Faun GT 550E-2 Truck Crane Operator's & Maintenance Manual PDF-84-85Document2 pagesTadano Faun GT 550E-2 Truck Crane Operator's & Maintenance Manual PDF-84-85Ahmed El-FayoumyNo ratings yet

- Design Recommendation For Turned ProductsDocument14 pagesDesign Recommendation For Turned ProductsHarrisAntonyNo ratings yet

- BC Aqualator BR 0321Document16 pagesBC Aqualator BR 0321qoreysoe19No ratings yet

- Moisture-Dielectric Meter Method: ObjectiveDocument2 pagesMoisture-Dielectric Meter Method: Objectivefood tecknologistNo ratings yet

- SPEC Carbopol 940Document1 pageSPEC Carbopol 940Juan Flores OlguinNo ratings yet

- TNAU ScheduleDocument17 pagesTNAU ScheduleMadhan KumarNo ratings yet

- NetecoDocument59 pagesNetecoMN Titas Titas50% (2)

- Pixel Aspect Ratio, Part 2Document3 pagesPixel Aspect Ratio, Part 2Thomas GrantNo ratings yet

- PS-203 Rev B LO Range ManualDocument16 pagesPS-203 Rev B LO Range ManualRussbelth OrtegaNo ratings yet

- QC RegisterDocument29 pagesQC RegisterBilal Ahmed BarbhuiyaNo ratings yet