Professional Documents

Culture Documents

CFA - L1 - Practice Exam Vol. 1

CFA - L1 - Practice Exam Vol. 1

Uploaded by

Tsaone FoxOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CFA - L1 - Practice Exam Vol. 1

CFA - L1 - Practice Exam Vol. 1

Uploaded by

Tsaone FoxCopyright:

Available Formats

Exam 1

Morning Session

52. Books Forever, Inc., uses short-term bank debt to buy inventory.

Assuming an initial current ratio that is greater than 1, and an initial

quick (or acid test) ratio that is less than 1, what is the effect of these

transactions on the current ratio and the quick ratio?

A. Both ratios will decrease.

B. Neither ratio will decrease.

C. Only one ratio will decrease.

53. Which of the following statements regarding the financial statement

reporting of leases is most accurate?

A. Under an operating lease, the lessee treats the entire lease payment

as a cash outflow from operations.

B. The lessee’s current ratio is the same whether a lease is treated as

an operating or finance lease.

C. At the inception of a direct financing lease, the lessor recognizes

gross profit.

54. A construction firm uses the percentage-of-completion method to

recognize revenue from long-term contracts. In its next reporting

period, the firm will adopt the converged accounting standards that

were issued in May 2014. Compared to the prior accounting standards,

in that period the firm is most likely to recognize:

A. less revenue.

B. more revenue.

C. the same revenue.

55. Which of the following accounting practices is most likely to decrease

reported earnings in the current period?

A. Using the straight-line method of depreciation instead of an

accelerated method.

B. Capitalizing advertising expenses rather than expensing them in the

current period.

C. Using LIFO inventory cost methods during a period of rising

prices.

56. Which of the following statements about dilutive securities is most

accurate?

A. A simple capital structure is one that contains only common stock

and antidilutive securities.

B. A dilutive security is one that will cause earnings per share to

decrease if it is converted into common stock.

C. Warrants are antidilutive if their exercise price is less than the

stock price at the end of the period.

57. A company that receives a cash payment for a service it will provide in

the next accounting period is least likely to recognize:

A. accrued revenue.

B. unearned revenue.

C. an accrued liability.

©2016 Kaplan, Inc. Page 15

L1_V1_PE.indb 15 6/8/2016 9:46:20 AM

Exam 1

Morning Session

58. In periods of rising prices and stable or increasing inventory quantities,

compared with companies that use LIFO inventory accounting,

companies that use the FIFO method will have:

A. higher COGS and lower taxes.

B. higher net income and higher taxes.

C. lower inventory balances and lower working capital.

59. Rowlin Corporation, which reports under IFRS, wrote down its

inventory of electronic parts last period from its original cost of

€28,000 to net realizable value of €25,000. This period, inventory at

net realizable value has increased to €30,000. Rowlin should revalue

this inventory to:

A. €28,000 and report a gain of €3,000 on the income statement.

B. €30,000 and report a gain of €3,000 on the income statement.

C. €30,000 and report a gain of €5,000 on the income statement.

60. Under IFRS, remeasurements related to defined benefit pension plans

are initially recognized in:

A. net income in the current period.

B. other comprehensive income and are not amortized to income.

C. other comprehensive income and amortized over time to income.

61. During a period when net income is unexpectedly weak, managers who

attempt to smooth earnings are most likely to:

A. capitalize an expense.

B. capitalize a new lease.

C. classify a nonrecurring gain as recurring income.

62. Which of the following definitions used in accounting for income taxes

is least accurate?

A. Income tax expense is current period taxes payable adjusted for any

changes in deferred tax assets and liabilities.

B. A valuation allowance is a reserve against deferred tax assets based

on the likelihood that those assets will not be realized.

C. A deferred tax liability is created when tax expense is less than

taxes payable and the difference is expected to reverse in future

years.

63. From the extended (5-part) DuPont equation, which of the following

components describes the equation EBT / EBIT?

A. Tax burden.

B. Interest burden.

C. Financial leverage.

Page 16 ©2016 Kaplan, Inc.

L1_V1_PE.indb 16 6/8/2016 9:46:20 AM

Exam 1

Morning Session Answers

50. C Interest income is considered an operating cash flow under U.S. GAAP. (Study

Session 7, LOS 26.a)

51. C Dilution occurs since the exercise price for the warrants ($45) is less than the average

market price for the shares ($50). The incremental number of shares outstanding is

found from:

market price − exercise price 50 − 45

×# warrants = ×120, 000 = 12, 000

market price 50

Number of shares to use in diluted EPS calculation = 500,000 + 12,000 = 512,000.

(Study Session 7, LOS 24.h, LOS 24.i)

52. A As an example, start with CA = 2, CL = 1, and Inv = 1.2. We begin with a current ratio

of 2 and a quick ratio of 0.8. If the firm increases short-term bank debt (a current

liability) by 1 to buy inventory (a current asset) of 1, both the numerator and

3 3 − 2.2

denominator increase by 1, resulting in = 1.5 (new current ratio) and = 0.4

2 2

(new quick ratio). (Study Session 7, LOS 27.b)

53. A With an operating lease, the entire lease payment is recorded as rent expense and

classified as an operating cash outflow. A finance lease results in a lower current

ratio than an operating lease because the current portion of the principal repayment

component will be added to current liabilities. The lessor does not recognize any profit

at the inception of a direct financing lease. (Study Session 8, LOS 29.p, LOS 31.h)

54. C Revenue recognition for long-term contracts under the converged accounting standards

issued in May 2014 is based on progress toward satisfying the performance obligations

in the contracts, which is comparable to the percentage-of-completion method under

the prior accounting standards. (Study Session 7, LOS 24.d)

55. C LIFO will result in lower net income than FIFO in the current period, during a period

of rising prices. The other choices will tend to increase current period earnings. (Study

Session 8, LOS 28.c, LOS 29.c, LOS 29.e)

56. B Securities that can be converted to common stock are said to be dilutive to earnings

if conversion would result in lower earnings per share. A simple capital structure has

only common stock or only common stock and nonconvertible stock. It contains no

securities that could ever become or create common stock, even antidilutive ones.

Whether warrants are antidilutive depends on the average stock price over the reporting

period, not the value at the reporting date. (Study Session 7, LOS 24.i)

57. A Accrued (unbilled) revenue is recorded at the end of an accounting period for revenue

that the company has earned but has not yet recognized. Unearned revenue results from

collecting cash in an earlier period than the goods or services will be delivered (which is

when the revenue can be recognized). Unearned revenue is an accrued liability because

the company owes goods or services to the buyers. (Study Session 6, LOS 22.e)

58. B FIFO companies have higher net income, lower COGS, higher inventory, and higher

taxes. (Study Session 8, LOS 28.k, LOS 28.l)

59. A Under IFRS, inventory values are revalued upward only to the extent they were

previously written down. In this case, that is from €25,000 back up to the original

value of €28,000. The increase is reported as gain for the period. (Study Session 8,

LOS 28.g)

©2016 Kaplan, Inc. Page 173

L1_V1_PE.indb 173 6/8/2016 9:46:34 AM

Exam 1

Morning Session Answers

60. B Remeasurements (actuarial gains and losses, difference between actual return and

expected return on plan assets) are recognized as other comprehensive income under

IFRS and are not amortized. (Study Session 8, LOS 31.j)

61. A Management may attempt to increase reported earnings in the current period by

capitalizing an expense. Capitalizing a lease would decrease earnings in the current

period compared to recording an operating lease. Classifying a nonrecurring gain

as recurring income would not increase net income because it already includes

nonrecurring gains. (Study Session 9, LOS 32.h)

62. C Deferred tax liability refers to balance sheet amounts that are created when tax expense

is greater than taxes payable. (Study Session 8, LOS 30.a)

63. B EBT / EBIT is the interest burden, the second component in the extended DuPont

equation. It shows that more leverage does not always lead to higher ROE. As leverage

rises, so does the interest burden. The positive effects of leverage can be offset by the

higher interest payments that accompany higher levels of debt. Net income / EBT

is called the tax burden and is equal to (1 – tax rate). The higher the tax rate, the

lower the ROE level. EBIT / revenue is called the EBIT margin or operating margin.

(Study Session 7, LOS 27.d)

64. C Issuing debt results in a cash inflow from financing. Payment of debt at maturity has no

effect on cash flow from operations but decreases cash flow from financing by the face

value of the debt. (Study Session 8, LOS 31.a, LOS 31.b)

65. A The liability method (SFAS 109 of U.S. GAAP) takes a balance sheet approach and

adjusts deferred tax assets and liabilities to future tax rates. An increase in the tax

rate increases the value of both deferred tax assets and deferred tax liabilities. (Study

Session 8, LOS 30.e)

66. B When a question does not specify which accounting standards apply, candidates are

instructed to assume International Financial Reporting Standards (IFRS). According to

IFRS, property held for the purpose of earning rental income is classified as investment

property. However, when a property is transferred from owner-occupied to investment

property, a firm using the fair value model must treat any increase in the property’s

value as a revaluation. That is, the firm may only recognize a gain on the income

statement to the extent that it reverses a previously recognized loss. (Study Session 8,

LOS 29.n)

67. C Under U.S. GAAP, an asset is considered impaired when its book value is greater than

the sum of the estimated undiscounted future cash flows from its use and disposal.

(Study Session 8, LOS 29.i)

68. B The four general categories are: (1) scale and diversification, (2) operational efficiency,

(3) margin stability, and (4) leverage. Larger companies and those with more different

product lines and greater geographic diversification are better credit risks. High

operating efficiency is indicative of a better credit risk. Stable profit margins indicate

a higher probability of repayment and thus, a better credit risk. Firms with greater

earnings in relation to their debt level are better credit risks. While the availability of

collateral certainly reduces lender risk, it is not one of the general categories used by

credit rating agencies to determine capacity to repay. Specifically, they would consider

(1) several specific accounting ratios and (2) business characteristics. The availability of

collateral falls into neither category. (Study Session 9, LOS 33.c)

Page 174 ©2016 Kaplan, Inc.

L1_V1_PE.indb 174 6/8/2016 9:46:34 AM

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Original PDF Financial Accounting 8th by Craig Deegan PDFDocument41 pagesOriginal PDF Financial Accounting 8th by Craig Deegan PDFmathew.robertson818100% (38)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Chapter 9 - Audit of Liabilities RoqueDocument77 pagesChapter 9 - Audit of Liabilities RoqueCristina Ramirez91% (11)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Financial Analysis ToolDocument50 pagesFinancial Analysis ToolContessa PetriniNo ratings yet

- PAS 1 Presentation of Financial StatementsDocument4 pagesPAS 1 Presentation of Financial StatementsLary Lou Ventura100% (15)

- Level I R09 Common Probability Distributions: Test Code: L1 R09 COPD Q-Bank 2020Document9 pagesLevel I R09 Common Probability Distributions: Test Code: L1 R09 COPD Q-Bank 2020Tsaone FoxNo ratings yet

- EB Swanj/: I, R C IDocument3 pagesEB Swanj/: I, R C ITsaone FoxNo ratings yet

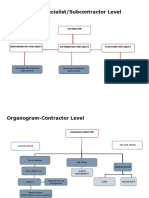

- Organogram-Specialist/Subcontractor Level: ContractorDocument4 pagesOrganogram-Specialist/Subcontractor Level: ContractorTsaone FoxNo ratings yet

- Organogram: Managing DirectorDocument3 pagesOrganogram: Managing DirectorTsaone FoxNo ratings yet

- Safety Health and Environment in Grocery BusinessDocument5 pagesSafety Health and Environment in Grocery BusinessTsaone FoxNo ratings yet

- Level I R08 Probability Concepts: Test Code: L1 R08 PRCO Q-Bank 2020Document11 pagesLevel I R08 Probability Concepts: Test Code: L1 R08 PRCO Q-Bank 2020Tsaone FoxNo ratings yet

- Level I R06 The Time Value of Money: Test Code: L1 R06 TVOM Q-Bank 2020Document9 pagesLevel I R06 The Time Value of Money: Test Code: L1 R06 TVOM Q-Bank 2020Tsaone FoxNo ratings yet

- Level I R07 Statistical Concepts and Market Returns: Test Code: L1 R07 SCMR Q-Bank 2020Document15 pagesLevel I R07 Statistical Concepts and Market Returns: Test Code: L1 R07 SCMR Q-Bank 2020Tsaone FoxNo ratings yet

- Level I R03 Guidance For Standards I-VII: Test Code: L1 R03 GUID Q-Bank 2020Document19 pagesLevel I R03 Guidance For Standards I-VII: Test Code: L1 R03 GUID Q-Bank 2020Tsaone FoxNo ratings yet

- Level I R04 Introduction To The Global Investment Performance Standards (GIPS)Document3 pagesLevel I R04 Introduction To The Global Investment Performance Standards (GIPS)Tsaone FoxNo ratings yet

- Level I R02 Code of Ethics and Standards of Professional ConductDocument5 pagesLevel I R02 Code of Ethics and Standards of Professional ConductTsaone FoxNo ratings yet

- Linear ProgrammingDocument8 pagesLinear ProgrammingTsaone FoxNo ratings yet

- Common Finance Interview QuestionsDocument10 pagesCommon Finance Interview QuestionsMd Irfan AhmadNo ratings yet

- Statement of Cash FlowsDocument12 pagesStatement of Cash FlowsDaniel PeterNo ratings yet

- Accounting FraudsDocument34 pagesAccounting Fraudsnit111No ratings yet

- Accounts and Finance Short TermsDocument59 pagesAccounts and Finance Short TermsBelalHossainNo ratings yet

- 3.3.1 Functions That Are Integral To Business: Financial Reporting SolutionDocument15 pages3.3.1 Functions That Are Integral To Business: Financial Reporting SolutionRITZ BROWNNo ratings yet

- Fac3761 106 2022 240129 234225Document21 pagesFac3761 106 2022 240129 234225lebiyacNo ratings yet

- Skol LofDocument16 pagesSkol LofvmmalviyaNo ratings yet

- Annual Report 2008-Abbott PakistanDocument76 pagesAnnual Report 2008-Abbott PakistanBassanio BrokeNo ratings yet

- Chapter 1 - Income TaxDocument30 pagesChapter 1 - Income TaxQuỳnh Anh NguyễnNo ratings yet

- Answers Acca GlobalDocument14 pagesAnswers Acca GlobalMUNKHTUUL SAMBUUDORJNo ratings yet

- FAC3764 - Assessment 10Document10 pagesFAC3764 - Assessment 10matsheporobertsNo ratings yet

- Liab, SHE, CashvsAccrual, BV & EPSDocument5 pagesLiab, SHE, CashvsAccrual, BV & EPSMimiNo ratings yet

- Intermediate Accounting Vol 2 Canadian 3rd Edition Lo Solutions ManualDocument36 pagesIntermediate Accounting Vol 2 Canadian 3rd Edition Lo Solutions Manuallegacycoupablemf2100% (35)

- IA2 Prelim ExamDocument7 pagesIA2 Prelim ExamJohn FloresNo ratings yet

- Financial Analysis of BioconDocument12 pagesFinancial Analysis of BioconNipun KothariNo ratings yet

- Updates in FRS - Midterm Exam With SolutionDocument10 pagesUpdates in FRS - Midterm Exam With Solutionchristian ReyesNo ratings yet

- Analysis of Financial StatementsDocument67 pagesAnalysis of Financial StatementsAbdul BasitNo ratings yet

- Vimal Dairy MbaDocument81 pagesVimal Dairy MbaViral Chaudhari0% (1)

- Financial Reporting: Final Course Study Material P 1Document20 pagesFinancial Reporting: Final Course Study Material P 1vandv printsNo ratings yet

- MAXIS AnnualReport2004 (1MB)Document162 pagesMAXIS AnnualReport2004 (1MB)rboxwellNo ratings yet

- Grameenphone Audited Financial Statements 2022Document60 pagesGrameenphone Audited Financial Statements 2022S.R. EMONNo ratings yet

- Financial Statements: For The Year Ended 31 December 2019Document11 pagesFinancial Statements: For The Year Ended 31 December 2019RajithWNNo ratings yet

- RTP Gr1 Nov2023Document212 pagesRTP Gr1 Nov2023bakchodikarnekliyeNo ratings yet

- Test 0 - AM - ADocument17 pagesTest 0 - AM - ADữ NguyễnNo ratings yet

- Intragroup Transaction 2Document20 pagesIntragroup Transaction 2mmNo ratings yet

- AFAR IFRS SME Quizzers Acoldnerdlion PDFDocument10 pagesAFAR IFRS SME Quizzers Acoldnerdlion PDFCarl Emerson GalaboNo ratings yet