Professional Documents

Culture Documents

The Watch List: Being Near-Monopolies, These Companies Have High Chances of Delivering Consistent Returns

The Watch List: Being Near-Monopolies, These Companies Have High Chances of Delivering Consistent Returns

Uploaded by

maheshtech76Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Watch List: Being Near-Monopolies, These Companies Have High Chances of Delivering Consistent Returns

The Watch List: Being Near-Monopolies, These Companies Have High Chances of Delivering Consistent Returns

Uploaded by

maheshtech76Copyright:

Available Formats

COMPANIES

WITH MOATS

The watch list

Being near-monopolies, these companies have high chances

of delivering consistent returns

T

he concept of moats was popularised by Warren In the 2016 anniversary issue of Wealth Insight, we

Buffett. In business, a moat means a competitive had presented the latest list of moat companies in

advantage or a barrier to entry. Companies that India. The following watch list gives moat companies

enjoy moats have a near-monopoly. They ensure with their updated numbers. Many of these companies

consistency of returns. Hence, moat investing is a have high valuations, which may not make them an

sophisticated form of fundamental investing. ideal buy currently. WI

Companies with moats

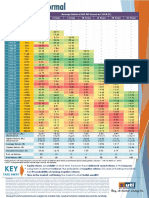

Company name Sector ROE (%) Price to book Price to earnings 5Y median P/E Price (`) 52-week high-low (`)

AIA Engineering Capital Goods 18.1 4.66 33.9 22.5 1,462 1702-1276

Amara Raja Batteries Automobile 20.3 4.75 29.6 30.3 798 955-665

Asian Paints Chemicals 27.8 12.94 53.2 51.3 1,120 1261-954

Bajaj Auto Automobile 24.0 4.56 22.3 20.4 3,012 3473-2695

Bajaj Corp FMCG 44.8 10.90 33.8 27.6 490 525-343

Bajaj Finance Finance 21.7 6.00 39.9 27.5 1,643 1989-1020

Bayer CropScience Chemicals 14.9 7.35 47.6 35.8 3,835 5050-3685

Bharat Electronics Capital Goods 17.6 4.66 23.0 21.9 153 193-135

Blue Dart Express Logistics 34.5 17.86 79.1 75.5 4,417 5422-3831

Bosch Automobile 19.0 6.25 43.1 48.2 19,447 25245-18602

Britannia Industries FMCG 37.0 18.03 59.5 41.4 4,715 4964-3052

Castrol India Automobile 115.2 18.50 27.3 32.4 191 227-172

Colgate-Palmolive FMCG 50.5 16.50 46.2 44.2 1,066 1176-886

Container Corporation Logistics 9.7 3.34 28.9 27.8 1,292 1500-922

CRISIL Ratings 36.2 13.60 46.8 44.8 1,988 2070-1752

Cummins India Automobile 17.5 5.89 33.3 31.7 848 1096-767

Dabur India FMCG 29.0 10.66 46.3 39.5 340 368-264

Divis Laboratories Healthcare 22.0 4.75 31.2 26.4 1,020 1142-533

Emami FMCG 20.2 12.69 73.1 50.3 1,064 1428-990

Essel Propack Plastic Products 19.6 3.84 26.2 15.2 285 317-226

46 Wealth Insight March 2018

Subscription copy of [pankaj_ca@yahoo.com]. Redistribution prohibited.

COMPANIES

WITH MOATS

Company name Sector ROE (%) Price to book Price to earnings 5Y median P/E Price (`) 52-week high-low (`)

Exide Industries Automobile 17.1 3.32 27.7 24.0 210 250-193

GSK Consumer Healthcare FMCG 22.2 8.37 41.1 37.7 6,495 6799-4856

HCL Technologies IT 28.5 3.66 14.2 16.0 914 1042-797

HDFC Bank Bank 18.4 4.82 29.2 24.1 1,880 2014-1360

Hero MotoCorp Automobile 33.7 5.71 20.1 20.4 3,464 4200-3074

Hindustan Unilever FMCG 67.8 37.23 57.1 42.5 1,336 1415-841

HDFC Finance 15.6 4.26 19.2 20.1 1,814 1982-1361

Indraprastha Gas Inds. Gases & Fuels 19.5 6.18 32.7 15.6 295 344-194

Infosys IT 22.0 3.19 15.5 18.1 1,130 1220-862

ITC FMCG 24.3 6.76 29.4 30.6 264 353-250

Marico Agri 37.5 13.33 49.2 42.3 306 348-266

Maruti Suzuki Automobile 21.7 6.60 35.0 28.4 8,742 10000-5804

MRF Automobile 18.7 3.24 29.0 12.3 70,649 74499-49600

Navneet Education Media & Entertainment 28.4 4.02 20.7 17.1 137 194-135

NBCC Realty 21.9 9.38 46.7 45.8 197 292-161

Nestle India FMCG 31.8 21.21 59.2 61.1 7,523 8001-6085

Oracle Fin Services Software IT 31.1 7.80 27.8 24.7 4,000 4376-3300

Pidilite Industries Chemicals 28.2 11.82 52.6 44.7 898 972-666

Power Grid Corporation Power 16.8 2.00 12.4 13.9 194 226-188

P&G Hygiene & Health Care FMCG 39.9 45.16 70.9 51.6 9,267 9900-6668

Schaeffler India Automobile 14.2 5.25 37.4 34.6 5,354 5960-3993

Siemens Capital Goods 15.7 5.64 38.3 48.7 1,251 1470-1123

SKF India Automobile 14.0 5.37 33.6 32.5 1,846 2010-1428

Sun Pharmaceutical Healthcare 22.5 3.61 64.8 38.7 561 728-433

Sundaram Finance Finance 15.0 4.40 31.7 32.4 1,628 2085-1357

TCS IT 33.6 6.90 21.9 22.2 2,924 3255-2255

Titan Company Diamond & Jewellery 18.1 14.60 65.8 42.8 802 938-421

Zee Entertainment Media & Entertainment 38.8 7.16 20.3 32.8 567 619-477

Data as on February 19, 2018

March 2018 Wealth Insight 47

Subscription copy of [pankaj_ca@yahoo.com]. Redistribution prohibited.

You might also like

- Forecasting Short-Term Financial RequirementsDocument22 pagesForecasting Short-Term Financial RequirementsArmando Robles100% (1)

- India'S Most: Valuable CompaniesDocument15 pagesIndia'S Most: Valuable CompaniesHarsh DabasNo ratings yet

- Name of The Broker-ADARSH N.P: SL No. Script Code Script Name 3/2/2020Document15 pagesName of The Broker-ADARSH N.P: SL No. Script Code Script Name 3/2/2020Adarsh JainNo ratings yet

- Performance of Select Stocks Over Last 20 Years (2000-2020)Document12 pagesPerformance of Select Stocks Over Last 20 Years (2000-2020)GANESHNo ratings yet

- RelianceTaxSaver (ELSS) Fund 2017jul25Document4 pagesRelianceTaxSaver (ELSS) Fund 2017jul25Krishnan ChockalingamNo ratings yet

- 1-25 ET 500 Company List 2022Document2 pages1-25 ET 500 Company List 20220000000000000000No ratings yet

- DiwaliPicks2022 131022Document22 pagesDiwaliPicks2022 131022tranganathanNo ratings yet

- Return On Capital EmplyedDocument7 pagesReturn On Capital EmplyedKAMAL SARINNo ratings yet

- DIVIDEND YIELD REPORT - JUNE 2023-05-June-2023-1938561564Document5 pagesDIVIDEND YIELD REPORT - JUNE 2023-05-June-2023-1938561564uma AgrawalNo ratings yet

- Ind Nifty50listDocument4 pagesInd Nifty50listSubrata PaulNo ratings yet

- Share ProjectionsDocument4 pagesShare ProjectionsPuducherryNo ratings yet

- Fundcard: Franklin India Taxshield FundDocument4 pagesFundcard: Franklin India Taxshield FundvinitNo ratings yet

- ROCE Growth Matrix - SNDocument6 pagesROCE Growth Matrix - SNFESCRIBDNo ratings yet

- Rising Net Cash Flow and Cash From Operating Activity Aug 10Document3 pagesRising Net Cash Flow and Cash From Operating Activity Aug 10KabirNo ratings yet

- Dividend Yield Stocks 210922Document3 pagesDividend Yield Stocks 210922Aaron KaleesNo ratings yet

- Fundcard: SBI Consumption Opportunities FundDocument4 pagesFundcard: SBI Consumption Opportunities FundNikit ShahNo ratings yet

- 3.monthly Tender Statistical Report March 2022Document1 page3.monthly Tender Statistical Report March 2022a.thomas67No ratings yet

- Stock Screener203544Document5 pagesStock Screener203544Sde BdrNo ratings yet

- Dividend Yield Monitor As of 3rd May 2024Document4 pagesDividend Yield Monitor As of 3rd May 202448abhinavmittalNo ratings yet

- Digging Deep Into Debt: High Debt Doesn't Always Mean TroubleDocument1 pageDigging Deep Into Debt: High Debt Doesn't Always Mean Troublemaheshtech76No ratings yet

- H Ps://Forms - Gle/Q6Pg4V5J2Pwvvwr59: Issue No. 34 Page No.: 1Document29 pagesH Ps://Forms - Gle/Q6Pg4V5J2Pwvvwr59: Issue No. 34 Page No.: 1SUJIT KUMAR GHOSHNo ratings yet

- Automobile Industry: Presented by Josh Jit Singh BaliDocument15 pagesAutomobile Industry: Presented by Josh Jit Singh BalivjsbaliNo ratings yet

- Fundcard: Tata India Tax Savings FundDocument4 pagesFundcard: Tata India Tax Savings FundKrishnan ChockalingamNo ratings yet

- List of Highest Dividend Paying Stocks in India 2019Document4 pagesList of Highest Dividend Paying Stocks in India 2019arjunNo ratings yet

- Assignment I - PGDM-IE T-1 (2022-24) - QTDocument4 pagesAssignment I - PGDM-IE T-1 (2022-24) - QTAtharv DaphaleNo ratings yet

- Tojqi Paper Technical Efficiency Affecting Factors in Indian Banking Sector An Empirical AnalysisDocument18 pagesTojqi Paper Technical Efficiency Affecting Factors in Indian Banking Sector An Empirical AnalysisDr Bhadrappa HaralayyaNo ratings yet

- Strategy: Portfolio Perspectives: Safe and SelectiveDocument15 pagesStrategy: Portfolio Perspectives: Safe and SelectiveRecrea8 EntertainmentNo ratings yet

- Impact of Liquidity On Profitability in Telecom Companies: Dr. Mohmad Mushtaq Khan Dr. K. Bhavana RajDocument11 pagesImpact of Liquidity On Profitability in Telecom Companies: Dr. Mohmad Mushtaq Khan Dr. K. Bhavana RajSavy DhillonNo ratings yet

- America'S Top Companies: Available On The IpadDocument4 pagesAmerica'S Top Companies: Available On The IpadMichele KongNo ratings yet

- Long Term SIP Picks Jan 23Document15 pagesLong Term SIP Picks Jan 23sbvaNo ratings yet

- Dalal Street - Top 1000 Companies Financial ReviewDocument19 pagesDalal Street - Top 1000 Companies Financial ReviewRoyden DSouzaNo ratings yet

- Nifty 50 Quarterly Estimates Q4FY23Document9 pagesNifty 50 Quarterly Estimates Q4FY23gann wolfNo ratings yet

- Automobile-MSU-June 2022 - 04072022 - Retail-04-July-2022-540612220Document18 pagesAutomobile-MSU-June 2022 - 04072022 - Retail-04-July-2022-540612220Himanshu GuptaNo ratings yet

- Dividend Yield StocksDocument3 pagesDividend Yield StocksSushilNo ratings yet

- Quality Dividend Yield Stocks - 301216Document5 pagesQuality Dividend Yield Stocks - 301216sumit guptaNo ratings yet

- 26-50 ET 500 Company List 2022Document2 pages26-50 ET 500 Company List 20220000000000000000No ratings yet

- Nifty 50Document3 pagesNifty 50Arjun BhatnagarNo ratings yet

- Top 17 Stocks BuyDocument13 pagesTop 17 Stocks BuySushilNo ratings yet

- Book 6Document3 pagesBook 6salvi_2079No ratings yet

- PhotoDocument8 pagesPhotoPrasad GopiNo ratings yet

- India-2023 Exports and Imports Data Sri LankaDocument6 pagesIndia-2023 Exports and Imports Data Sri LankaSnigdha RanjanNo ratings yet

- Dividend Yield StocksDocument3 pagesDividend Yield StocksDilip KumarNo ratings yet

- Apparel Sector SheetDocument3 pagesApparel Sector SheetSmriti DurehaNo ratings yet

- Fundcard: Franklin India Smaller Companies FundDocument4 pagesFundcard: Franklin India Smaller Companies FundChiman RaoNo ratings yet

- ValueResearchFundcard Kotak50RegularPlan 2018jan21Document4 pagesValueResearchFundcard Kotak50RegularPlan 2018jan21rdhNo ratings yet

- Portfolio-1 With February 2022 CE Writting OpportunityDocument5 pagesPortfolio-1 With February 2022 CE Writting OpportunityPravin SinghNo ratings yet

- ESG IndustriaDocument5 pagesESG IndustriaDiego PonceNo ratings yet

- ValueResearchFundcard DSPBlackRockMicroCapFund RegularPlan 2017mar14Document4 pagesValueResearchFundcard DSPBlackRockMicroCapFund RegularPlan 2017mar14Rahul AnandNo ratings yet

- 51-75 ET 500 Company List 2022Document2 pages51-75 ET 500 Company List 20220000000000000000No ratings yet

- ValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09Document6 pagesValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09ksrygNo ratings yet

- Fundcard: Aditya Birla Sun Life Tax Relief 96Document36 pagesFundcard: Aditya Birla Sun Life Tax Relief 96Deepak VaswaniNo ratings yet

- Fundcard: Birla Sun Life Equity FundDocument4 pagesFundcard: Birla Sun Life Equity FundSana BrahmaiahNo ratings yet

- ICICIdirect ExpectedHighDividendYieldStocksDocument2 pagesICICIdirect ExpectedHighDividendYieldStocksRamesh RajagopalanNo ratings yet

- Fund ComparisionDocument14 pagesFund ComparisionAmit PatelNo ratings yet

- Trending Value Portfolio Implementation-GoodDocument260 pagesTrending Value Portfolio Implementation-Gooddheeraj nautiyalNo ratings yet

- Fundcard: Axis Long Term Equity FundDocument4 pagesFundcard: Axis Long Term Equity FundprashokkumarNo ratings yet

- Fundcard: Axis Long Term Equity FundDocument4 pagesFundcard: Axis Long Term Equity FundARUN JACOB 1827606No ratings yet

- StocksDocument5 pagesStockstemp raoNo ratings yet

- D. SWOT AnalysisDocument5 pagesD. SWOT Analysisammu150479No ratings yet

- Portfolio As On Jun 30,2022Document6 pagesPortfolio As On Jun 30,2022rocko Akash ThakurNo ratings yet

- Warren Buffett's Latest Annual Letter 2018Document4 pagesWarren Buffett's Latest Annual Letter 2018maheshtech760% (1)

- Digging Deep Into Debt: High Debt Doesn't Always Mean TroubleDocument1 pageDigging Deep Into Debt: High Debt Doesn't Always Mean Troublemaheshtech76No ratings yet

- Pms Performance 30 JUNE 2019: Large Cap OrientedDocument3 pagesPms Performance 30 JUNE 2019: Large Cap Orientedmaheshtech76No ratings yet

- Power FinanceDocument132 pagesPower Financemaheshtech76No ratings yet

- March-PMS-Performance-Newsletter (PMS AIF World)Document5 pagesMarch-PMS-Performance-Newsletter (PMS AIF World)maheshtech76No ratings yet

- Sensex Rolling ReturnsDocument1 pageSensex Rolling Returnsmaheshtech76No ratings yet

- Economy: A Turnaround' Appears DistantDocument18 pagesEconomy: A Turnaround' Appears Distantmaheshtech76No ratings yet

- Investing in 2020 & Beyond: Global Strategy PaperDocument28 pagesInvesting in 2020 & Beyond: Global Strategy Papermaheshtech76100% (1)

- Ch3 ProvisionsDocument30 pagesCh3 ProvisionsDarrelNo ratings yet

- Pratt's: Guide To Private Equity & Venture Capital SourcesDocument9 pagesPratt's: Guide To Private Equity & Venture Capital SourcesDaodu Ladi BusuyiNo ratings yet

- Bahrain: AMB Country Risk ReportDocument4 pagesBahrain: AMB Country Risk ReportaakashblueNo ratings yet

- DedDocument23 pagesDedasdasdaNo ratings yet

- Prelim Actg5Document74 pagesPrelim Actg5klynrodriguez446No ratings yet

- BFM Module PDFDocument68 pagesBFM Module PDFBala SubramanianNo ratings yet

- Canada Business Start Up VisaDocument10 pagesCanada Business Start Up VisaWorldoverseas immigrationNo ratings yet

- IFSA Income StatementDocument2 pagesIFSA Income StatementYaesnavy ParamesvaranNo ratings yet

- HRM Practices in Private Commercial Banking Factor AIB PLCDocument82 pagesHRM Practices in Private Commercial Banking Factor AIB PLCABC Computer R.SNo ratings yet

- Gross Income Quiz With Answer KeyDocument10 pagesGross Income Quiz With Answer KeyMylene AlfantaNo ratings yet

- Crisis of MasculinityDocument7 pagesCrisis of MasculinityStevie VorceNo ratings yet

- Challenges of Modern Personnel Manager (Autosaved)Document27 pagesChallenges of Modern Personnel Manager (Autosaved)mohd_abdulmajed0% (1)

- RCBCDocument15 pagesRCBCPocari OnceNo ratings yet

- OPEC MOMR March 2023Document94 pagesOPEC MOMR March 202311: 11No ratings yet

- Feasibility Study Organic Cocoa - Togo and CameroonDocument46 pagesFeasibility Study Organic Cocoa - Togo and CamerooncobbymarkNo ratings yet

- Feasibility Study OF Gujarat International Finance Tec-City Phase IDocument12 pagesFeasibility Study OF Gujarat International Finance Tec-City Phase IAlocinNo ratings yet

- UAL Reorganization Memo 5.29 FINALDocument2 pagesUAL Reorganization Memo 5.29 FINALAnn DwyerNo ratings yet

- Caucasus Central AsiaDocument22 pagesCaucasus Central Asiazepeng wuNo ratings yet

- PAC DocumentDocument554 pagesPAC DocumentOlakachuna AdonijaNo ratings yet

- Banking and Finance For Commercial and Industrial Rooftop Solar in Vietnam PresentationsDocument44 pagesBanking and Finance For Commercial and Industrial Rooftop Solar in Vietnam PresentationsDương Thanh Thuận TrầnNo ratings yet

- Sap SD NotedocxDocument14 pagesSap SD NotedocxBCHERIF100% (1)

- 2 - Project Evaluation and Programme ManagementDocument26 pages2 - Project Evaluation and Programme ManagementDavid MunyagaNo ratings yet

- Intro To Topic: Module 2.1 ObjectivesDocument3 pagesIntro To Topic: Module 2.1 ObjectivesMeilin Denise MEDRANANo ratings yet

- Assignment 5 - EL5732Document2 pagesAssignment 5 - EL5732Sophia MorrisNo ratings yet

- DR Ahmad - Manual of Training and Advisory Requirements 2023Document5 pagesDR Ahmad - Manual of Training and Advisory Requirements 2023Ahmad TarabilsyNo ratings yet

- DI Practice Set - K.kundanDocument278 pagesDI Practice Set - K.kundanAAANNU50% (2)

- Attock Cement Ratio Analysis 2019 by RizwanDocument8 pagesAttock Cement Ratio Analysis 2019 by RizwanHayat budhoooNo ratings yet

- Post-Sanction Monitoring of Industrial Advances in Indian BankDocument127 pagesPost-Sanction Monitoring of Industrial Advances in Indian BankChiranjit Basu100% (4)

- FinTech - The Force of Creative Disruption - RBIDocument19 pagesFinTech - The Force of Creative Disruption - RBIvaishaliNo ratings yet