Professional Documents

Culture Documents

Warren Buffett's Latest Annual Letter 2018

Warren Buffett's Latest Annual Letter 2018

Uploaded by

maheshtech76Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Warren Buffett's Latest Annual Letter 2018

Warren Buffett's Latest Annual Letter 2018

Uploaded by

maheshtech76Copyright:

Available Formats

WORDS WORTH

WISDOM

Warren

Buffett’s

latest

annual

letter

W

arrren Buffett, the all-time star investor, all deals we reviewed in 2017, as prices for decent, but

whom numerous investors around the world far from spectacular, businesses hit an all-time high.

follow has never written a book. What we Indeed, price seemed almost irrelevant to an army of

know about him and about his investment approach optimistic purchasers.

comes down to us through this annual letter to Why the purchasing frenzy? In part, it’s because

Bekshire Hathaway’s shareholders. The 2017 letter of the CEO job self-selects for “can-do” types. If

Berkshire also is full of investment wisdom. Here are Wall Street analysts or board members urge

the most insightful excerpts. that brand of CEO to consider possible acquisi-

tions, it’s a bit like telling your ripening teen-

The folly of corporate acquisitions ager to be sure to have a normal sex life.

In our search for new stand-alone businesses, the key Once a CEO hungers for a deal, he or she will

qualities we seek are durable competitive strengths; never lack for forecasts that justify the purchase.

able and high-grade management; good returns on the Subordinates will be cheering, envisioning enlarged

net tangible assets required to operate the business; domains and the compensation levels that typically

opportunities for internal growth at attractive increase with corporate size. Investment bankers,

returns; and, finally, a sensible purchase price. smelling huge fees, will be applauding as well. (Don’t

That last requirement proved a barrier to virtually ask the barber whether you need a haircut.) If the his-

10 Wealth Insight April 2018

Subscription copy of [pankaj_ca@yahoo.com]. Redistribution prohibited.

WORDS WORTH

WISDOM

torical performance of the target falls short of vali- There is simply no telling how far stocks can

dating its acquisition, large “synergies” will be fore- fall in a short period. Even if your borrowings

cast. Spreadsheets never disappoint. are small and your positions aren’t immediate-

The ample availability of extraordinarily cheap ly threatened by the plunging market, your

debt in 2017 further fueled purchase activity. After all, mind may well become rattled by scary head-

even a high-priced deal will usually boost per-share lines and breathless commentary. And an

earnings if it is debt-financed. At Berkshire, in con- unsettled mind will not make good decisions.

trast, we evaluate acquisitions on an all-equity basis, ...

knowing that our taste for overall debt is very low and When major declines occur, however, they offer

that to assign a large portion of our debt to any indi- extraordinary opportunities to those who are not

vidual business would generally be fallacious... We handicapped by debt. That’s the time to heed these

also never factor in, nor do we often find, synergies. lines from Kipling’s If:

Our aversion to leverage has dampened our “If you can keep your head when all about you are los-

returns over the years. But Charlie and I sleep well. ing theirs . . .

Both of us believe it is insane to risk what you If you can wait and not be tired by waiting . . .

have and need in order to obtain what you If you can think – and not make thoughts your aim . . .

don’t need. We held this view 50 years ago when we If you can trust yourself when all men doubt you . . .

each ran an investment partnership, funded by a few Yours is the Earth and everything that’s in it.”

friends and relatives who trusted us. We also hold it

today after a million or so “partners” have joined us The bet

at Berkshire. [Note: This excerpt is about Buffett’s $1 million dol-

...In the meantime, we will stick with our simple lar with Protégé Partners. Buffett bet that over a

guideline: The less the prudence with which others decade, the stock index would outperform a basket

conduct their affairs, the greater the prudence with of hedge funds. At the end of the 10-year period in

which we must conduct our own. 2016, the S&P 500 had returned 7.1 per cent annual-

ly. The basket of hedge funds had returned just 2.2

Investments per cent annualised. Initially, both Buffett and

Charlie and I view the marketable common Protégé put $320,000 each in Treasury bonds. They

stocks that Berkshire owns as interests in busi- estimated that the amount would be $1 million by

nesses, not as ticker symbols to be bought or 2018. Later, however, they moved the money to

sold based on their “chart” patterns, the “tar- Berkshire’s Class B shares.]

get” prices of analysts or the opinions of I made the bet for two reasons: (1) to leverage my

media pundits. Instead, we simply believe that outlay of $318,250 into a disproportionately larger sum

if the businesses of the investees are success- that – if things turned out as I expected – would be

ful (as we believe most will be) our investments distributed in early 2018 to Girls Inc. of Omaha; and

will be successful as well. Sometimes the payoffs (2) to publicize my conviction that my pick – a virtual-

to us will be modest; occasionally the cash register ly cost-free investment in an unmanaged S&P 500

will ring loudly. And sometimes I will make expensive index fund – would, over time, deliver better results

mistakes. Overall – and over time – we should get than those achieved by most investment professionals,

decent results. In America, equity investors have the however well-regarded and incentivized those “help-

wind at their back. ers” may be.

... Addressing this question is of enormous impor-

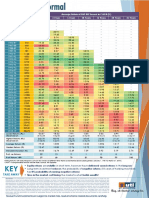

...Berkshire shares have suffered four truly major tance. American investors pay staggering sums annu-

dips. Here are the gory details: ally to advisors, often incurring several layers of con-

Percentage

sequential costs. In the aggregate, do these investors

Period High Low Decrease get their money’s worth? Indeed, again in the aggre-

March 1973-January 1975 93 38 (59.1%) gate, do investors get anything for their outlays?

Protégé Partners, my counterparty to the bet,

10/2/87-10/27/87 4,250 2,675 (37.1%)

picked five “funds-of-funds” that it expected to over-

6/19/98-3/10/2000 80,900 41,300 (48.9%) perform the S&P 500. That was not a small sample.

9/19/08-3/5/09 147,000 72,400 (50.7%) Those five funds-of-funds in turn owned interests in

more than 200 hedge funds.

This table offers the strongest argument I can mus- Essentially, Protégé, an advisory firm that knew its

ter against ever using borrowed money to own stocks. way around Wall Street, selected five investment

April 2018 Wealth Insight 11

Subscription copy of [pankaj_ca@yahoo.com]. Redistribution prohibited.

WORDS WORTH

WISDOM

experts who, in turn, employed several hundred other The five funds-of-funds got off to a fast start, each

investment experts, each managing his or her own beating the index fund in 2008. Then the roof fell in. In

hedge fund. This assemblage was an elite crew, loaded every one of the nine years that followed, the funds-of-

with brains, adrenaline and confidence. funds as a whole trailed the index fund.

The managers of the five funds-of-funds pos- Let me emphasize that there was nothing aberra-

sessed a further advantage: They could – and did – tional about stock-market behavior over the ten-year

rearrange their portfolios of hedge funds during the stretch. If a poll of investment “experts” had been

ten years, investing with new “stars” while exiting asked late in 2007 for a forecast of long-term com-

their positions in hedge funds whose managers had mon-stock returns, their guesses would have likely

lost their touch. averaged close to the 8.5% actually delivered by the

Every actor on Protégé’s side was highly incentiv- S&P 500. Making money in that environment should

ized: Both the fund-of-funds managers and the hedge- have been easy. Indeed, Wall Street “helpers” earned

fund managers they selected significantly shared in staggering sums. While this group prospered, however,

gains, even those achieved simply because the market many of their investors experienced a lost decade.

generally moves upwards. (In 100% of the 43 ten-year Performance comes, performance goes. Fees

periods since we took control of Berkshire, years with never falter.

gains by the S&P 500 exceeded loss years.) The bet illuminated another important investment

Those performance incentives, it should be empha- lesson: Though markets are generally rational, they

sized, were frosting on a huge and tasty cake: Even if occasionally do crazy things. Seizing the opportuni-

the funds lost money for their investors during the ties then offered does not require great intelli-

decade, their managers could grow very rich. That gence, a degree in economics or a familiarity

would occur because fixed fees averaging a staggering with Wall Street jargon such as alpha and beta.

2½% of assets or so were paid every year by the fund- What investors then need instead is an ability to

of-funds’ investors, with part of these fees going to the both disregard mob fears or enthusiasms and to

managers at the five funds-of-funds and the balance focus on a few simple fundamentals. A willing-

going to the 200-plus managers of the underlying ness to look unimaginative for a sustained peri-

hedge funds. od – or even to look foolish – is also essential.

12 Wealth Insight April 2018

Subscription copy of [pankaj_ca@yahoo.com]. Redistribution prohibited.

WORDS WORTH

WISDOM

Stocks over bonds Investing is an activity in which con-

Originally, Protégé and I each funded our portion of sumption today is foregone in an attempt to

the ultimate $1 million prize by purchasing $500,000 allow greater consumption at a later date.

face amount of zero-coupon U.S. Treasury bonds “Risk” is the possibility that this objective

(sometimes called “strips”). These bonds cost each won’t be attained.

of us $318,250 – a bit less than 64¢ on the dollar – By that standard, purportedly “risk-free” long-

with the $500,000 payable in ten years. term bonds in 2012 were a far riskier investment than

As the name implies, the bonds we acquired paid a longterm investment in common stocks. At that

no interest, but (because of the discount at which time, even a 1% annual rate of inflation between 2012

they were purchased) delivered a 4.56% annual and 2017 would have decreased the purchasing-power

return if held to maturity. Protégé and I originally of the government bond that Protégé and I sold.

intended to do no more than tally the annual returns I want to quickly acknowledge that in any

and distribute $1 million to the winning charity upcoming day, week or even year, stocks will be

when the bonds matured late in 2017. riskier – far riskier – than short-term U.S.

After our purchase, however, some very strange bonds. As an investor’s investment horizon

things took place in the bond market. By November lengthens, however, a diversified portfolio of

2012, our bonds – now with about five years to go U.S. equities becomes progressively less risky

before they matured – were selling for 95.7% of their than bonds, assuming that the stocks are pur-

face value. At that price, their annual yield to matu- chased at a sensible multiple of earnings rela-

rity was less than 1%. Or, to be precise, .88%. tive to then-prevailing interest rates.

Given that pathetic return, our bonds had It is a terrible mistake for investors with long-

become a dumb – a really dumb – investment com- term horizons – among them, pension funds, college

pared to American equities. Over time, the S&P 500 endowments and savings-minded individuals – to

– which mirrors a huge cross-section of American measure their investment “risk” by their portfolio’s

business, appropriately weighted by market value – ratio of bonds to stocks. Often, high-grade bonds in

has earned far more than 10% annually on share- an investment portfolio increase its risk.

holders’ equity (net worth).

In November 2012, as we were considering all The need to be patient

this, the cash return from dividends on the S&P A final lesson from our bet: Stick with big, “easy”

500 was 2½% annually, about triple the yield on decisions and eschew activity. During the ten-

our U.S. Treasury bond. These dividend payments year bet, the 200-plus hedge-fund managers that were

were almost certain to grow. Beyond that, huge involved almost certainly made tens of thousands of

sums were being retained by the companies com- buy and sell decisions. Most of those managers

prising the 500. These businesses would use their undoubtedly thought hard about their decisions,

retained earnings to expand their operations and, each of which they believed would prove advanta-

frequently, to repurchase their shares as well. geous. In the process of investing, they studied

Either course would, over time, substantially 10-Ks, interviewed managements, read trade jour-

increase earnings-per-share. And – as has been nals and conferred with Wall Street analysts.

the case since 1776 – whatever its problems of the Protégé and I, meanwhile, leaning neither on

minute, the American economy was going to research, insights nor brilliance, made only one

move forward. investment decision during the ten years. We simply

Presented late in 2012 with the extraordinary val- decided to sell our bond investment at a price of

uation mismatch between bonds and equities, more than 100 times earnings (95.7 sale price/.88

Protégé and I agreed to sell the bonds we had bought yield), those being “earnings” that could not

five years earlier and use the proceeds to buy 11,200 increase during the ensuing five years.

Berkshire “B” shares. The result: Girls Inc. of We made the sale in order to move our money

Omaha found itself receiving $2,222,279 last month into a single security – Berkshire – that, in turn,

rather than the $1 million it had originally hoped for. owned a diversified group of solid businesses.

Berkshire, it should be emphasized, has not per- Fueled by retained earnings, Berkshire’s growth in

formed brilliantly since the 2012 substitution. But value was unlikely to be less than 8% annually, even

brilliance wasn’t needed: After all, Berkshire’s gain if we were to experience a so-so economy.

only had to beat that annual .88% bond bogey – hard- After that kindergarten-like analysis, Protégé and

ly a Herculean achievement. I made the switch and relaxed, confident that, over

... time, 8% was certain to beat .88%. By a lot. WI

April 2018 Wealth Insight 13

Subscription copy of [pankaj_ca@yahoo.com]. Redistribution prohibited.

You might also like

- MGMT 702 Fall 2021 Research and Case Analysis No. 1 (10%) Part B (Warren Buffett and Berkshire Hathaway Inc.) - QuestionsDocument5 pagesMGMT 702 Fall 2021 Research and Case Analysis No. 1 (10%) Part B (Warren Buffett and Berkshire Hathaway Inc.) - QuestionsJesus D. RiosNo ratings yet

- C38Fm Financial Markets Theory Tutorial Problem Set 1Document3 pagesC38Fm Financial Markets Theory Tutorial Problem Set 1Xiang Chin NGNo ratings yet

- 2009 Annual LetterDocument5 pages2009 Annual Letterppate100% (1)

- Billionaires SecretsDocument28 pagesBillionaires SecretsSaša Lović50% (2)

- THE 12% SOLUTION Earn A 12% Average Annual Return On Your Money, Beating The S&P 500Document80 pagesTHE 12% SOLUTION Earn A 12% Average Annual Return On Your Money, Beating The S&P 500Ngan Trinh100% (6)

- Only the Best Will Do: The compelling case for investing in quality growth businessesFrom EverandOnly the Best Will Do: The compelling case for investing in quality growth businessesRating: 3.5 out of 5 stars3.5/5 (6)

- YTC Traders-Checklist PDFDocument17 pagesYTC Traders-Checklist PDFelamurugan07No ratings yet

- Tirstrup BioMechanics (Denmark)Document2 pagesTirstrup BioMechanics (Denmark)Ioana PunctNo ratings yet

- Dividends Stocks Tend To Outperform 1.19Document2 pagesDividends Stocks Tend To Outperform 1.19paul farcasNo ratings yet

- How To Measure Mutual FundDocument5 pagesHow To Measure Mutual FundAmresh SinhaNo ratings yet

- Steven Romick September 30, 2010Document13 pagesSteven Romick September 30, 2010eric695No ratings yet

- Maran Partners Fund LP 2017 4Q LetterDocument10 pagesMaran Partners Fund LP 2017 4Q LetterTimmyNo ratings yet

- Del Principe - O'Brien Financial Advisors LLC: Capital Allocation: 5 MethodsDocument6 pagesDel Principe - O'Brien Financial Advisors LLC: Capital Allocation: 5 MethodsDel Principe O'BrienNo ratings yet

- How To Make Money in Dividend StocksDocument85 pagesHow To Make Money in Dividend Stockssiva_mmNo ratings yet

- Coho Capital 2020 Q4 LetterDocument11 pagesCoho Capital 2020 Q4 LetterEast CoastNo ratings yet

- Market at Much Less Than Book Value. The Weighted Average Stock Price in Relation To Book Value ForDocument10 pagesMarket at Much Less Than Book Value. The Weighted Average Stock Price in Relation To Book Value ForT Anil KumarNo ratings yet

- Investment Theory #16 - Berkshire Hathaway's 1977 Letter - Wiser DailyDocument7 pagesInvestment Theory #16 - Berkshire Hathaway's 1977 Letter - Wiser DailyVladimir OlefirenkoNo ratings yet

- Greenhaven 2018 Q4 FINALDocument11 pagesGreenhaven 2018 Q4 FINALl chanNo ratings yet

- Contrarian-Investing-09 30 10Document5 pagesContrarian-Investing-09 30 10Nahsan YıldızNo ratings yet

- Where To Invest 2011Document32 pagesWhere To Invest 2011Talgat VanderbiltNo ratings yet

- Mera Funds Newsletter October 2022Document11 pagesMera Funds Newsletter October 2022Prasanna ShenoyNo ratings yet

- The+Incredible+Shrinking+Stock+Market - Dec2015Document8 pagesThe+Incredible+Shrinking+Stock+Market - Dec2015jacekNo ratings yet

- Pericles: 15 East 67th Street, 6th Floor, New York, NY 10065Document6 pagesPericles: 15 East 67th Street, 6th Floor, New York, NY 10065Camille ManuelNo ratings yet

- Print Save Email Write To EditorDocument2 pagesPrint Save Email Write To EditornitasampatNo ratings yet

- How To Read Financial Statements, Part 1 (Risk Over Reward)Document9 pagesHow To Read Financial Statements, Part 1 (Risk Over Reward)Arun Rao0% (2)

- The Investor's Dilemma - Mutual Funds or Stocks?: by Mohnish PabraiDocument4 pagesThe Investor's Dilemma - Mutual Funds or Stocks?: by Mohnish PabraiBruno Pinto RibeiroNo ratings yet

- Artko Capital 2018 Q2 LetterDocument9 pagesArtko Capital 2018 Q2 LetterSmitty WNo ratings yet

- The Evidence Against Actively Managed Investment Funds Is StaggeringDocument2 pagesThe Evidence Against Actively Managed Investment Funds Is StaggeringjcarlosdNo ratings yet

- Why Stocks Are Safer Than Cash - Harris AssociatesDocument4 pagesWhy Stocks Are Safer Than Cash - Harris AssociatesceojiNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- The Case for Dividend Growth: Investing in a Post-Crisis WorldFrom EverandThe Case for Dividend Growth: Investing in a Post-Crisis WorldRating: 4.5 out of 5 stars4.5/5 (4)

- Letter To Investors, Q4 2020 PerformanceDocument6 pagesLetter To Investors, Q4 2020 PerformanceKan ZhouNo ratings yet

- Market-Speak: Parag ParikhDocument1 pageMarket-Speak: Parag ParikhAmith.yeshwanthNo ratings yet

- Lessons From Warren Buffett 510Document85 pagesLessons From Warren Buffett 510Mohan GhilleyNo ratings yet

- Billionaires Secrets PDFDocument28 pagesBillionaires Secrets PDFrammon raymond100% (1)

- Warren Buffet LessonsDocument79 pagesWarren Buffet Lessonspai_ganes8002No ratings yet

- 7 Hedge Fund Manager Startup TipsDocument6 pages7 Hedge Fund Manager Startup Tipsjdchandi123No ratings yet

- Demystifying Venture Capital Economics Part 1Document6 pagesDemystifying Venture Capital Economics Part 1Tarek FahimNo ratings yet

- Billionaires Secrets PDFDocument28 pagesBillionaires Secrets PDFgeorgio valentino rayalaNo ratings yet

- Warren Buffet Letters To ShareholdersDocument44 pagesWarren Buffet Letters To Shareholdersvr211480% (5)

- The Little Black Book of Billionaire Sec PDFDocument30 pagesThe Little Black Book of Billionaire Sec PDFCharlie Bob Piñeirua ColumboNo ratings yet

- Buffets Active Vs Passive Investing BetDocument10 pagesBuffets Active Vs Passive Investing BetUmair UsmanNo ratings yet

- 4 Questions and Answers About Value InvestingDocument3 pages4 Questions and Answers About Value Investingambasyapare1No ratings yet

- Invesco Endeavor 2019 Year-End LetterDocument5 pagesInvesco Endeavor 2019 Year-End LetterKan ZhouNo ratings yet

- Q4 2015 Market CommentaryDocument5 pagesQ4 2015 Market CommentaryNorthstar Financial Companies, IncNo ratings yet

- Mutual FundDocument7 pagesMutual FundSuharthi SriramNo ratings yet

- Greenhaven+Q1 2015 FINALDocument15 pagesGreenhaven+Q1 2015 FINALPradeep RaghunathanNo ratings yet

- Mutual FundsDocument35 pagesMutual FundsDovilė Purickaitė - Koncienė100% (1)

- Del Principe O'Brien March 2018, 4th Quarter 2017 LetterDocument5 pagesDel Principe O'Brien March 2018, 4th Quarter 2017 LetterJoseph Del PrincipeNo ratings yet

- Buffett On Valuation PDFDocument7 pagesBuffett On Valuation PDFvinaymathew100% (1)

- Best Dividend Fund Managers and Their Top Holdings: January 2020Document17 pagesBest Dividend Fund Managers and Their Top Holdings: January 2020muhjaerNo ratings yet

- 3 Questions For A Solid Dividend PortfolioDocument9 pages3 Questions For A Solid Dividend Portfolioambasyapare1No ratings yet

- Bruce Berkowitz On WFC 90sDocument4 pagesBruce Berkowitz On WFC 90sVu Latticework PoetNo ratings yet

- Book of Billionaire SecretsDocument28 pagesBook of Billionaire SecretsSimpliciusNo ratings yet

- Think Fundsindia August UpdatedDocument6 pagesThink Fundsindia August UpdatedAkshay PandeyNo ratings yet

- Thesis On Hedge FundsDocument7 pagesThesis On Hedge FundsKelly Taylor100% (2)

- Aquamarine Fund February 2012 LetterDocument7 pagesAquamarine Fund February 2012 LetterBrajesh MishraNo ratings yet

- Finite Article AprilDocument5 pagesFinite Article Aprilapi-606320471No ratings yet

- Buffett On ValuationDocument7 pagesBuffett On ValuationAyush AggarwalNo ratings yet

- Stock-Picking Strategies: Value InvestingDocument3 pagesStock-Picking Strategies: Value InvestingNarin PhetthongNo ratings yet

- Week 1-4 - The Private Equity IndustryDocument5 pagesWeek 1-4 - The Private Equity IndustryVirgilio Jay CervantesNo ratings yet

- A Guide To Seed FundraisingDocument15 pagesA Guide To Seed FundraisingMridul UpadhyayNo ratings yet

- Business Finance: Prepared By: Mark Vincent B. Bantog, LPTDocument34 pagesBusiness Finance: Prepared By: Mark Vincent B. Bantog, LPTLilyfhel VenturaNo ratings yet

- Digging Deep Into Debt: High Debt Doesn't Always Mean TroubleDocument1 pageDigging Deep Into Debt: High Debt Doesn't Always Mean Troublemaheshtech76No ratings yet

- Pms Performance 30 JUNE 2019: Large Cap OrientedDocument3 pagesPms Performance 30 JUNE 2019: Large Cap Orientedmaheshtech76No ratings yet

- The Watch List: Being Near-Monopolies, These Companies Have High Chances of Delivering Consistent ReturnsDocument2 pagesThe Watch List: Being Near-Monopolies, These Companies Have High Chances of Delivering Consistent Returnsmaheshtech76No ratings yet

- Power FinanceDocument132 pagesPower Financemaheshtech76No ratings yet

- March-PMS-Performance-Newsletter (PMS AIF World)Document5 pagesMarch-PMS-Performance-Newsletter (PMS AIF World)maheshtech76No ratings yet

- Investing in 2020 & Beyond: Global Strategy PaperDocument28 pagesInvesting in 2020 & Beyond: Global Strategy Papermaheshtech76100% (1)

- Sensex Rolling ReturnsDocument1 pageSensex Rolling Returnsmaheshtech76No ratings yet

- Economy: A Turnaround' Appears DistantDocument18 pagesEconomy: A Turnaround' Appears Distantmaheshtech76No ratings yet

- Derivatives QuizDocument5 pagesDerivatives QuizAllyssa Kassandra Luces0% (1)

- ImpliedvolDocument47 pagesImpliedvolFrancis ZhouNo ratings yet

- Date Sales Rep Shift Cost Price Selling Price Profit Profit %Document16 pagesDate Sales Rep Shift Cost Price Selling Price Profit Profit %Akash Watar0% (1)

- 18 Common K-LinesDocument9 pages18 Common K-Linesvishi6234No ratings yet

- Carousell Infographic PDFDocument6 pagesCarousell Infographic PDFshi unlockNo ratings yet

- Notes To Consolidation Immediately After BusComDocument4 pagesNotes To Consolidation Immediately After BusComMelisa DomingoNo ratings yet

- Forward Start OptionsDocument2 pagesForward Start OptionsOscar JoelNo ratings yet

- Shipment OrderDocument296 pagesShipment OrderWarehouse Leader WH-TGR37 TangerangNo ratings yet

- 05 Euro Aggregate Corporate Index FactsheetDocument2 pages05 Euro Aggregate Corporate Index FactsheetRoberto PerezNo ratings yet

- Capital StructureDocument6 pagesCapital StructureHasan Zahoor100% (1)

- Cfa Level III Errata 2020augDocument12 pagesCfa Level III Errata 2020augjohn doeNo ratings yet

- ManipulationDocument13 pagesManipulationKevin Smith100% (2)

- Quiz FARDocument5 pagesQuiz FARGlen JavellanaNo ratings yet

- Skripsi - Adm. Bisnis (Taat Sutriono - 0616051051)Document120 pagesSkripsi - Adm. Bisnis (Taat Sutriono - 0616051051)Latifah HanumNo ratings yet

- Butterfly Option StrategyDocument14 pagesButterfly Option StrategyMohammad JoharNo ratings yet

- LEGAL CASES-#136740-v1-Board Review - Bates Stamped TALF Loans AugustDocument108 pagesLEGAL CASES-#136740-v1-Board Review - Bates Stamped TALF Loans AugustreutersdotcomNo ratings yet

- NCFM Model Test PaperDocument8 pagesNCFM Model Test PapersplfriendsNo ratings yet

- Outlook Money November 2017Document86 pagesOutlook Money November 201719rrsikhliNo ratings yet

- Trigonometry and Investments QuizDocument6 pagesTrigonometry and Investments QuizTimNo ratings yet

- Astra Otoparts TBK.: Company Report: January 2018 As of 31 January 2018Document3 pagesAstra Otoparts TBK.: Company Report: January 2018 As of 31 January 2018adjipramNo ratings yet

- Sumitomo Chemicals: CRAMS Offers Strong Visibility AheadDocument7 pagesSumitomo Chemicals: CRAMS Offers Strong Visibility AheadhamsNo ratings yet

- MutualfundsDocument26 pagesMutualfundsrohith surukutlaNo ratings yet

- Chapter 8 - Sources of Business FinanceDocument10 pagesChapter 8 - Sources of Business Financerudransh singhNo ratings yet

- Multi-Curve Framework For SwapsDocument10 pagesMulti-Curve Framework For SwapsSubrat VermaNo ratings yet

- FIN20016 AS1 Sample 2Document13 pagesFIN20016 AS1 Sample 2Nguyễn Hà PhươngNo ratings yet

- Mirae Asset Sekuritas Indonesia ACES August SSSG 10c7c19cd3Document11 pagesMirae Asset Sekuritas Indonesia ACES August SSSG 10c7c19cd3Cindy MartinNo ratings yet

- Unit 2 Money Market 2Document9 pagesUnit 2 Money Market 2mkmahesh813No ratings yet