Professional Documents

Culture Documents

STMC Dealings in Property

STMC Dealings in Property

Uploaded by

juennaguecoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

STMC Dealings in Property

STMC Dealings in Property

Uploaded by

juennaguecoCopyright:

Available Formats

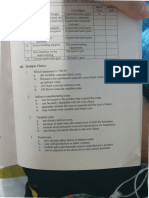

PROBLEMS

Problem 1: (Classify the following into Capital

Asset or Ordinary Asset)

Classification

1. Accounts receivable

2. Securities held as investment

3. Interest of a partner in a partnership

4. Apartment house

5. Inventories of raw materials, work in process and finished

goods

6. Office equipment

7. Land used in business

8. Land for sale by a real estate dealer

9. Residential house and lot

10. Car for personal use

Problem 2: The following data are available from the records of ABC Corporation:

Year Year Year Year Year

Business 4

P300,0 5

P400,0 6

P500,0 7

P600,0 8

P700,0

Income

Business 00

340,00 00

380,00 00

450,00 00

570,00 00

650,00

Expensegain

Capital 0 0 0 0 0

(loss)

Short-term 50,00 (40,00 30,00 30,00 (40,00

Long-term 0

(40,00 0)10,00 0

(100,00 0

10,00 0)70,00

0) 0 0) 0 0

Required: Compute the taxable income

Problem 3 A single taxpayer has the following income, expenses and transactions in 20X9

Gross income P750,0

Business expenses 00

225,00

Health insurance premium paid 0 2,00

Selling price, partnership interest (investment in 0

180,00

20X4 on

Gain was P60,000)

sale of personal car held for 3 years 030,00

Loss on sale of Jewelry for personal use held for 6 0

15,00

months

Loss on account of failure to exercise two-month 0

12,00

option to buy

Liquidating dividend (investment in 20X6, 0

240,00

P300,000)

Gain on short sales 0 6,00

0

Required:

1. How much is the net capital gain (loss)?

2. How much is taxable net income?

Page 1 of 4

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Solution Manual For Managerial Economics Business Strategy 10th Edition Michael Baye Jeff Prince DownloadDocument6 pagesSolution Manual For Managerial Economics Business Strategy 10th Edition Michael Baye Jeff Prince DownloadStephenWolfpdiz100% (47)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- Transaction List B SUADocument5 pagesTransaction List B SUAPhuong Tran100% (24)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Mci Takeover Battle AnalysisDocument13 pagesMci Takeover Battle AnalysisAastha Swaroop50% (2)

- E11 - Lyons Corporation PDFDocument5 pagesE11 - Lyons Corporation PDFShadab HussainNo ratings yet

- Govetric M7-M9 PPTDocument88 pagesGovetric M7-M9 PPTjuennaguecoNo ratings yet

- Govetric M7-M9Document33 pagesGovetric M7-M9juennaguecoNo ratings yet

- General MathematicsDocument9 pagesGeneral MathematicsjuennaguecoNo ratings yet

- Statistics and ProbabilityDocument9 pagesStatistics and ProbabilityjuennaguecoNo ratings yet

- NSTP Guidelines Policies FinalDocument1 pageNSTP Guidelines Policies FinaljuennaguecoNo ratings yet

- 2ND Sunday of Advent Dec. 7Document169 pages2ND Sunday of Advent Dec. 7juennaguecoNo ratings yet

- Third Sunday of AdventDocument124 pagesThird Sunday of AdventjuennaguecoNo ratings yet

- 3RD Sunday of Advent Dec. 14Document163 pages3RD Sunday of Advent Dec. 14juennaguecoNo ratings yet

- 1ST Sunday of Advent Nov. 30Document153 pages1ST Sunday of Advent Nov. 30juennagueco100% (1)

- TheoriesDocument25 pagesTheoriesjuennaguecoNo ratings yet

- The Practice of AccountancyDocument2 pagesThe Practice of AccountancyjuennaguecoNo ratings yet

- CPAR B86 1st PB - MASDocument12 pagesCPAR B86 1st PB - MAScrookshanksNo ratings yet

- Assurance EngagementsDocument4 pagesAssurance EngagementsjuennaguecoNo ratings yet

- ho.br.docxDocument16 pagesho.br.docxjuennaguecoNo ratings yet

- Internship Report - FinalDocument32 pagesInternship Report - FinalMd M H TanxilNo ratings yet

- CRM2-ratings Based ModelsDocument48 pagesCRM2-ratings Based ModelsRohan JainNo ratings yet

- Week 8Document4 pagesWeek 8William LinNo ratings yet

- Project Report On Currency MarketDocument54 pagesProject Report On Currency MarketSurbhi Aery63% (8)

- FIN524A Options and FuturesDocument260 pagesFIN524A Options and FuturesgzsdjyNo ratings yet

- Jaiib Caiib Exams LEGAL ASPECTS OF BANKINGDocument16 pagesJaiib Caiib Exams LEGAL ASPECTS OF BANKINGRaghvendra SinghNo ratings yet

- Analisis Ekonomi Lingkungan Terhadap Tempat Pemrosesan Akhir Sampah (Tpa) Jatibarang Kota SemarangDocument12 pagesAnalisis Ekonomi Lingkungan Terhadap Tempat Pemrosesan Akhir Sampah (Tpa) Jatibarang Kota Semarangferdin sitinjakNo ratings yet

- Sail Annual Report - 2022.inddDocument11 pagesSail Annual Report - 2022.inddSandeep SharmaNo ratings yet

- NU LFA W1 GEENT01X The Entrepreneurial Mind (Autosaved)Document45 pagesNU LFA W1 GEENT01X The Entrepreneurial Mind (Autosaved)UnknownymousNo ratings yet

- The Capital Asset Pricing Model - : The Cost of EquityDocument8 pagesThe Capital Asset Pricing Model - : The Cost of EquityMuhammad YahyaNo ratings yet

- Room Clean : Room The Thesa FDocument6 pagesRoom Clean : Room The Thesa FDRLNNo ratings yet

- NRDC Investment Agreement SF 2020Document79 pagesNRDC Investment Agreement SF 2020Balakrishna GopinathNo ratings yet

- Company Law ProjectDocument24 pagesCompany Law ProjectAnonymous qFWInco8cNo ratings yet

- Trident The U S Based Company Discussed in This Chapter Has Concluded Another LargeDocument1 pageTrident The U S Based Company Discussed in This Chapter Has Concluded Another Largetrilocksp SinghNo ratings yet

- DW FMAAContentSpecificationOutlinesDocument7 pagesDW FMAAContentSpecificationOutlinesbahaasaffarino9No ratings yet

- Credit Admin and Support FinalDocument9 pagesCredit Admin and Support FinalJohn Mark CabrejasNo ratings yet

- PR 17-4BDocument6 pagesPR 17-4BDiệu Linh Phan ThịNo ratings yet

- 13633921Document3 pages13633921Ika Zuliani NofitaNo ratings yet

- Kamatna StopaDocument16 pagesKamatna StopaMarina VasicNo ratings yet

- Cambridge O Level: Accounting 7707/12Document12 pagesCambridge O Level: Accounting 7707/12Geerish BissessurNo ratings yet

- Maturity ZCYC (%) FWD RateDocument4 pagesMaturity ZCYC (%) FWD RateGaurav SharmaNo ratings yet

- Financial ManagementDocument24 pagesFinancial Managementአረጋዊ ሐይለማርያምNo ratings yet

- 12 Macro Economics Key Notes CH 03 Money and BankingDocument5 pages12 Macro Economics Key Notes CH 03 Money and BankingKarsin ManochaNo ratings yet

- Regulation 33 of SebiDocument4 pagesRegulation 33 of SebirqpNo ratings yet

- 12 - Advanced Corporate Reporting For Strategic BusinessDocument3 pages12 - Advanced Corporate Reporting For Strategic BusinessFatima FXNo ratings yet

- Minimalist Business Report-WPS OfficeDocument21 pagesMinimalist Business Report-WPS Officewilhelmina romanNo ratings yet