Professional Documents

Culture Documents

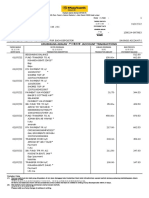

Loans Receivable: Effective Rate

Loans Receivable: Effective Rate

Uploaded by

Jonathan NavalloOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Loans Receivable: Effective Rate

Loans Receivable: Effective Rate

Uploaded by

Jonathan NavalloCopyright:

Available Formats

CHAPTER 12:

LOANS RECEIVABLE

Financial asset arising from a loan granted by a

bank or other financial institution to a borrower EFFECTIVE RATE

or client

computed through the "trial and error"

May be short term; in most cases, the and "interpolation approach"

repayment periods cover several years In practice, IT is easily determined

through the use of financial calculator.

INITIAL MEASUREMENT

Fair value (+) transaction costs that are directly EFFECTIVE INTEREST METHOD

attributable to the acquisition of financial asset

Interest received = principal x nominal

Transaction price – amount of the loan rate

granted Interest income = carrying amount x

effective rate

Direct organization cost – included in initial

measurement of the loan receivable

Indirect organization cost – treated as STATEMENT PRESENTATION

outright expense

Carrying amount = amortized cost

SUBSEQUENT MEASUREMENT

IMPAIRMENT OF LOAN

Amortized cost – amount at which the loan

receivable is measured initially: Credit losses - present value of all cash

shortfalls

a) (-) principle repayment

b) (+,-) cumulative amortization of any Expected credit losses - estimate of credit

difference between initial carrying losses over the life of the financial instrument

amount and principal maturity amount

c) (-) reduction for impairment or

uncollectibility MEASUREMENT OF IMPAIRMENT

If the initial amount recognized is… When measuring expected losses, the entity

lower than the principal amount, should consider:

amortization of the difference is added 1. Probability-weighted outcome

to the carrying amount 2. Time value of money

higher than the principal amount, 3. Reasonable and supportable information

amortization of the difference is

deducted to the carrying amount *PFRS does not prescribe a particular method;

the carrying amount of the loan receivable shall

be reduced either directly or through the use of

an allowance account

ORIGINATION FEES – charged by the bank

against borrower; recognized as unearned

interest income & amortized over the term of

loan CREDIT RISK – risk that one party to a

financial instrument will cause a financial loss

Direct origination costs – not chargeable or the other party by failing to discharge an

against borrower; offset directly against any obligation

unearned origination fees received

*The organization fees received and the direct

origination cost are included in the

measurement of the loan receivable

You might also like

- Chapter 1 - A Framework For Financial Accounting: Click On LinksDocument14 pagesChapter 1 - A Framework For Financial Accounting: Click On LinksABDULLAH ALSHEHRINo ratings yet

- Bulk Mro Industrial Supply Private Limited: Detailed ReportDocument10 pagesBulk Mro Industrial Supply Private Limited: Detailed ReportAnishNo ratings yet

- Banking DictionaryDocument188 pagesBanking DictionaryRanjan Shetty100% (1)

- Week 09 - Inventory EstimationsDocument3 pagesWeek 09 - Inventory EstimationsPj ManezNo ratings yet

- GEN 010 For BSA INVESTMENTS IN DEBT SECURITIESDocument7 pagesGEN 010 For BSA INVESTMENTS IN DEBT SECURITIESJoy RadaNo ratings yet

- Aud. Prob.Document16 pagesAud. Prob.Ria Alanis CastilloNo ratings yet

- 6809 Accounts ReceivableDocument2 pages6809 Accounts ReceivableEsse Valdez0% (1)

- Pas 1 - Presentation of Financial StatementsDocument30 pagesPas 1 - Presentation of Financial StatementsClint Baring Arranchado100% (1)

- INSTRUCTION: Prepare The Income Statement Using The Following Accounts. Use The Format BelowDocument4 pagesINSTRUCTION: Prepare The Income Statement Using The Following Accounts. Use The Format Belowmila dacarNo ratings yet

- Accounting 21 Financial Accounting and Reporting Part 1Document5 pagesAccounting 21 Financial Accounting and Reporting Part 1Faith BariasNo ratings yet

- Isabela State University: MA 112 - Conceptual Framework & Accounting Standards - Chapter 1Document18 pagesIsabela State University: MA 112 - Conceptual Framework & Accounting Standards - Chapter 1Chraze GBNo ratings yet

- Exercise No. 1: Balanced Transportation ProblemDocument7 pagesExercise No. 1: Balanced Transportation ProblemDarlyn DadulaNo ratings yet

- Prequalifying Exam Level 2 3 Set B FSUU AccountingDocument9 pagesPrequalifying Exam Level 2 3 Set B FSUU AccountingRobert CastilloNo ratings yet

- Oblicon 2 PDFDocument25 pagesOblicon 2 PDFKristine PerezNo ratings yet

- Essentials of Financial Management - CH 3 BHDocument7 pagesEssentials of Financial Management - CH 3 BHMuhtar RasyidNo ratings yet

- Shareholder's EquityDocument10 pagesShareholder's EquityNicole Gole CruzNo ratings yet

- Bond Investment - FVOCI: Subject Intermediate Accounting Teacher Dessa Dianna MadridDocument23 pagesBond Investment - FVOCI: Subject Intermediate Accounting Teacher Dessa Dianna MadridJohn Warren MestiolaNo ratings yet

- If Silent As To Date of Acquisition, Assume As Current: Cash and Cash Equivalents 1. CashDocument3 pagesIf Silent As To Date of Acquisition, Assume As Current: Cash and Cash Equivalents 1. CashKent Raysil PamaongNo ratings yet

- CFAS - Lec. 12 PAS 29, 32Document31 pagesCFAS - Lec. 12 PAS 29, 32latte aeriNo ratings yet

- Chapter 8 Receivable FinancingDocument14 pagesChapter 8 Receivable FinancingBukhani Macabangan100% (2)

- Perpetual Vs Periodic V 1.0 PDFDocument1 pagePerpetual Vs Periodic V 1.0 PDFKJ YvonNo ratings yet

- Chapter 1 Partnerships Part 1Document12 pagesChapter 1 Partnerships Part 1kevin royNo ratings yet

- 1 Partnership SolutionsDocument34 pages1 Partnership SolutionsLuna SanNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document15 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- AEC 210 FinalRequirementDocument9 pagesAEC 210 FinalRequirementALMA MORENANo ratings yet

- Washington Sycip Reaction Paper (Santos - 3A7)Document3 pagesWashington Sycip Reaction Paper (Santos - 3A7)The Brain Dump PHNo ratings yet

- Performance Task 2 Project Scheduling PERT CPM Summer 2022 Bus Math 43 Management Science II PDFDocument17 pagesPerformance Task 2 Project Scheduling PERT CPM Summer 2022 Bus Math 43 Management Science II PDFVanessa PuaNo ratings yet

- Notes and Quiz Acctg 21 Bme 21 Review PDFDocument55 pagesNotes and Quiz Acctg 21 Bme 21 Review PDFano ano hajimemashiteNo ratings yet

- Partnership Dissolution ProblemsDocument9 pagesPartnership Dissolution ProblemsKristel DayritNo ratings yet

- ABM003 N5 CaneteDocument17 pagesABM003 N5 CaneteCriscel EstrellaNo ratings yet

- Law On Oblicon NotesDocument4 pagesLaw On Oblicon NotesaiswiftNo ratings yet

- Cash & Cash Equivalents, Lecture &exercisesDocument16 pagesCash & Cash Equivalents, Lecture &exercisesNMCartNo ratings yet

- Financial AccountingDocument72 pagesFinancial AccountingChitta LeeNo ratings yet

- Bonds ReviewerDocument7 pagesBonds ReviewerDM MontefalcoNo ratings yet

- First Time Adoption of PFRSDocument5 pagesFirst Time Adoption of PFRSPia ArellanoNo ratings yet

- 6726 Revised Conceptual FrameworkDocument7 pages6726 Revised Conceptual FrameworkJane ValenciaNo ratings yet

- Unit III Partnership LiquidationDocument20 pagesUnit III Partnership LiquidationLeslie Mae Vargas ZafeNo ratings yet

- Fundamentals of Accounting I Conceptual FrameworkDocument12 pagesFundamentals of Accounting I Conceptual FrameworkericacadagoNo ratings yet

- RFBT EditDocument22 pagesRFBT Editrodell pabloNo ratings yet

- A-Standards of Ethical Conduct For Management AccountantsDocument4 pagesA-Standards of Ethical Conduct For Management AccountantsChhun Mony RathNo ratings yet

- Excel - Professional Services Inc.: Management Firm of Professional Review and Training Center (PRTC)Document7 pagesExcel - Professional Services Inc.: Management Firm of Professional Review and Training Center (PRTC)Phoeza Espinosa VillanuevaNo ratings yet

- CF FS and Reporting EntityDocument2 pagesCF FS and Reporting Entitypanda 1No ratings yet

- Solution:: Answer: The Cost of The Preferred Stock Is 12.24%Document1 pageSolution:: Answer: The Cost of The Preferred Stock Is 12.24%Unknowingly AnonymousNo ratings yet

- PAS 24 Related Party Disclosures: Learning ObjectivesDocument4 pagesPAS 24 Related Party Disclosures: Learning ObjectivesFhrince Carl Calaquian100% (1)

- Chapter 46 - Cash Basis To Accrual Basis of AccountingDocument7 pagesChapter 46 - Cash Basis To Accrual Basis of AccountingRoxan PacsayNo ratings yet

- Ia1 ReviewerDocument10 pagesIa1 ReviewerVeronica SarmientoNo ratings yet

- Finacc 3 Question Set BDocument9 pagesFinacc 3 Question Set BEza Joy ClaveriasNo ratings yet

- Finmar Final Quiz Answer KeysDocument15 pagesFinmar Final Quiz Answer KeysGailee VinNo ratings yet

- Chapter 11 Other Long Term InvestmentsDocument10 pagesChapter 11 Other Long Term InvestmentsChristian Jade Lumasag NavaNo ratings yet

- Risks and Rates of ReturnDocument2 pagesRisks and Rates of Returnjonathan_stewart0983No ratings yet

- (Studocu) Int Acc Chapter 3 - Valix, Robles, Empleo, MillanDocument4 pages(Studocu) Int Acc Chapter 3 - Valix, Robles, Empleo, MillanHufana, Shelley100% (1)

- Finals Conceptual Framework and Accounting Standards AnswerkeyDocument7 pagesFinals Conceptual Framework and Accounting Standards AnswerkeyMay Anne MenesesNo ratings yet

- Investment in Equity SecuritiesDocument4 pagesInvestment in Equity SecuritiesElaineJrV-IgotNo ratings yet

- Notes - FAR - InvestmentDocument7 pagesNotes - FAR - InvestmentElaineJrV-IgotNo ratings yet

- The Law On Sales, Agency and Credit Transactions Sales Summary ReportDocument4 pagesThe Law On Sales, Agency and Credit Transactions Sales Summary ReportchiwaNo ratings yet

- MS 02 - Management Accounting and Basic ConceptsDocument6 pagesMS 02 - Management Accounting and Basic ConceptsGeoff MacarateNo ratings yet

- Loan Receivable: If Origination Fees Are Received From The Borrower, Record It As Unearned Interest IncomeDocument1 pageLoan Receivable: If Origination Fees Are Received From The Borrower, Record It As Unearned Interest IncomeAiya LumbanNo ratings yet

- Chapter 2 Cash and Cash EquivalentsDocument13 pagesChapter 2 Cash and Cash EquivalentsRazel De DiosNo ratings yet

- 118.2 - Illustrative Example - Hedge Accounting: FV HedgeDocument2 pages118.2 - Illustrative Example - Hedge Accounting: FV HedgeStephen GarciaNo ratings yet

- Chapter 9 2019 EditionDocument26 pagesChapter 9 2019 EditionAngelica Faye DuroNo ratings yet

- PrelimsDocument24 pagesPrelimsRhea BadanaNo ratings yet

- Measurement: Impairment of LoanDocument3 pagesMeasurement: Impairment of LoanClar AgramonNo ratings yet

- Loan ReceivablesDocument4 pagesLoan ReceivablesEyra MercadejasNo ratings yet

- Cta 2D CV 06177 D 2008jun30 AssDocument72 pagesCta 2D CV 06177 D 2008jun30 AssJonathan NavalloNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon City First DivisionDocument54 pagesRepublic of The Philippines Court of Tax Appeals Quezon City First DivisionJonathan NavalloNo ratings yet

- Notes Receivable: PresentationDocument2 pagesNotes Receivable: PresentationJonathan NavalloNo ratings yet

- Court of Tax Appeals: First DivisioDocument12 pagesCourt of Tax Appeals: First DivisioJonathan NavalloNo ratings yet

- Inventories: Classes of Inventories ConsignmentDocument3 pagesInventories: Classes of Inventories ConsignmentJonathan NavalloNo ratings yet

- RMC 64-2015 Required Information On Receipts and InvoicesDocument1 pageRMC 64-2015 Required Information On Receipts and InvoicesJonathan NavalloNo ratings yet

- Receivable Financing: 1. Pledge of Accounts ReceivableDocument1 pageReceivable Financing: 1. Pledge of Accounts ReceivableJonathan NavalloNo ratings yet

- C6 Lecture NotesDocument2 pagesC6 Lecture NotesJonathan NavalloNo ratings yet

- Receivable Financing: 3. Factoring of Accounts Receivable 4. Discounting of Notes ReceivableDocument2 pagesReceivable Financing: 3. Factoring of Accounts Receivable 4. Discounting of Notes ReceivableJonathan NavalloNo ratings yet

- C6 Lecture NotesDocument2 pagesC6 Lecture NotesJonathan NavalloNo ratings yet

- C6 Lecture NotesDocument2 pagesC6 Lecture NotesJonathan NavalloNo ratings yet

- Two-Date Bank Reconciliation Proof of Cash: 1. Book BalanceDocument1 pageTwo-Date Bank Reconciliation Proof of Cash: 1. Book BalanceJonathan NavalloNo ratings yet

- C6 Lecture NotesDocument2 pagesC6 Lecture NotesJonathan NavalloNo ratings yet

- Fraud Tree Focus InventorycompressedDocument64 pagesFraud Tree Focus InventorycompressedJonathan Navallo100% (1)

- C10 Lecture NotesDocument3 pagesC10 Lecture NotesJonathan NavalloNo ratings yet

- The Accountancy Profession: American Accounting AssociationDocument2 pagesThe Accountancy Profession: American Accounting AssociationJonathan NavalloNo ratings yet

- Fundamental Qualitative CharacteristicsDocument2 pagesFundamental Qualitative CharacteristicsJonathan NavalloNo ratings yet

- C7 Lecture NotesDocument3 pagesC7 Lecture NotesJonathan NavalloNo ratings yet

- Two-Date Bank Reconciliation Proof of Cash: 1. Book BalanceDocument1 pageTwo-Date Bank Reconciliation Proof of Cash: 1. Book BalanceJonathan NavalloNo ratings yet

- Elements of Financial StatementsDocument2 pagesElements of Financial StatementsJonathan NavalloNo ratings yet

- Assumptions Scope of Conceptual Framework: 1. Going ConcernDocument2 pagesAssumptions Scope of Conceptual Framework: 1. Going ConcernJonathan NavalloNo ratings yet

- Accounts Module - 1Document486 pagesAccounts Module - 1Patanjal kumar100% (1)

- Hedge FundsDocument265 pagesHedge FundsMatt EbrahimiNo ratings yet

- Online Payment SystemDocument1 pageOnline Payment SystemAnonymous 6KWNHZPVINo ratings yet

- Accounting For Franchise ContractsDocument7 pagesAccounting For Franchise ContractsRoi Martin A. De VeyraNo ratings yet

- Difference Between Central Bank and Commercial BankDocument2 pagesDifference Between Central Bank and Commercial BankSumit SethiNo ratings yet

- Basel III Important SectionsDocument22 pagesBasel III Important SectionsGeorge Lekatis100% (1)

- CFAB Accounting Chapter 15. Sole Trader and Partnership Financial Statement Under UK GAAPDocument18 pagesCFAB Accounting Chapter 15. Sole Trader and Partnership Financial Statement Under UK GAAPHuy NguyenNo ratings yet

- Model 2 CMDMDocument11 pagesModel 2 CMDMAshish SinghNo ratings yet

- Loan Policies Cdfi Fund FinalDocument61 pagesLoan Policies Cdfi Fund FinalURBANHIJAUNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document30 pagesIndividual Account Opening Form: (Demat + Trading)ONE STEP for othersNo ratings yet

- SOLUTIONS - Practice Final ExamDocument12 pagesSOLUTIONS - Practice Final ExamsebmccabeeNo ratings yet

- Presentation On Life and Entrepreneur Of: Prof - DR. Muhammed YunusDocument12 pagesPresentation On Life and Entrepreneur Of: Prof - DR. Muhammed YunusNazrul IslamNo ratings yet

- Adjusting Entries With AnswersDocument7 pagesAdjusting Entries With AnswersMichael Magdaog100% (1)

- Email Id of CEO's Life Insurance - IBAI ORGDocument3 pagesEmail Id of CEO's Life Insurance - IBAI ORGdheerajdb99No ratings yet

- Chapter 1-Financial MarketsDocument18 pagesChapter 1-Financial Marketskim che100% (1)

- Module 3: Nominal and Effective Interest Rates: SI-4151 Ekonomi TeknikDocument21 pagesModule 3: Nominal and Effective Interest Rates: SI-4151 Ekonomi TeknikSanjika IlhamNo ratings yet

- AnnexDocument10 pagesAnnexapi-3810664No ratings yet

- Yitay ElemaDocument127 pagesYitay Elemacourse heroNo ratings yet

- CAMEL Ratings - Key RatiosDocument2 pagesCAMEL Ratings - Key Ratiossrinath121No ratings yet

- Fiori ListsDocument1,220 pagesFiori ListsAnonymous idAkaGNo ratings yet

- HHH1Document24 pagesHHH1Sitan Kumar SahooNo ratings yet

- Page 226 236 - Lyka Mae AdluzDocument9 pagesPage 226 236 - Lyka Mae AdluzWendell Maverick MasuhayNo ratings yet

- Ais255 Case StudyDocument4 pagesAis255 Case StudyNoor SyazaniNo ratings yet

- Ibs Ipoh Main, Jsis 1 31/07/22Document6 pagesIbs Ipoh Main, Jsis 1 31/07/22azman ab wahabNo ratings yet

- Black Book Project With CorrectionDocument80 pagesBlack Book Project With CorrectionAbhishek BandalNo ratings yet

- Nism Series III A Securities Intermediaries Compliance Non Fund Exam Workbook in PDFDocument416 pagesNism Series III A Securities Intermediaries Compliance Non Fund Exam Workbook in PDFManiesh MahajanNo ratings yet

- Document 42Document3 pagesDocument 42Marian Augelio PolancoNo ratings yet