Professional Documents

Culture Documents

Portfolio Management - Advanced (May 21, 2020)

Portfolio Management - Advanced (May 21, 2020)

Uploaded by

Via Commerce Sdn BhdOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Portfolio Management - Advanced (May 21, 2020)

Portfolio Management - Advanced (May 21, 2020)

Uploaded by

Via Commerce Sdn BhdCopyright:

Available Formats

Portfolio Management

(Advanced)

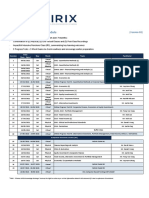

DATE: 5

May 21, 2020 (Thursday) TIME:

2.00 p.m. to 4.30 p.m.

▪ Explain the underlying concepts and theories of portfolio management.

▪ Construct a model portfolio for clients based on pre-determined return

and risk objectives

▪ Discuss the major asset allocation strategies – strategic, tactical and

COURSE OBJECTIVES dynamic.

▪ Discuss the monitoring of investor circumstances, market/economic

conditions, and portfolio holdings and explain the effects that changes

in each of these areas can have on the investor’s portfolio.

▪ Research Analyst

▪ Equity Analyst

TARGET AUDIENCE ▪ Investment Banking Personnel

▪ Institutional Investors Representatives

▪ Relationship Manager

Session 1: Key Concepts of An Efficient Portfolio and Asset

Allocation Strategies

▪ Measures of returns and risks, covariances and correlations

▪ Modern Portfolio Theory and the optimal level of diversification.

▪ Portfolio Building

▪ Strategic Asset Allocation – the rationale for passive investments

▪ Tactical Asset Allocation – the construction of a portfolio seeking active

returns

COURSE OUTLINE ▪ Investment styles – Value, Growth, Market, and Small-cap

Session 2: Rebalancing Strategies

▪ Dynamic Asset Allocation

▪ Calendar rebalancing to percentage-of-portfolio rebalancing

▪ The key determinants of the optimal corridor width of an asset class in

a percentage-of-portfolio rebalancing program

▪ The benefits of rebalancing an asset class to its target portfolio weight

versus rebalancing the asset class to stay within its allowed range

Trainer Profile

Mr. David Meow

• Chartered Financial Analyst (CFA)

• Master of Laws (University of London)

• Financial Risk Manager (FRM)

• Chartered Accountant (M)

• Master of Business Administration

(Heriot-Watt University)

• Certificate of Data Science

(John Hopkins University)

David has more than 26 years of experience in areas including financial risk

management, business valuation, financial markets, and financial reporting. His

exposures in diverse areas in the capital markets as well as being a Financial Risk

Manager (FRM) holder, Chartered Financial Analyst (CFA) holder and qualified as

a Chartered Accountant (Malaysia), allow him to offer training and consultancy

services in areas including risk management, investment management and

securities valuation. During the past years, he has received increasing

engagement in relation to capital markets projects using data science

applications.

He has provided training and consultancy services to government-related

regulatory bodies including Bank Negara Malaysia, Permodalan Nasional

Berhad, Securities Commission, Kumpulan Wang Simpanan Pekerja, Jabatan

Perdana Menteri, as well as financial institutions, including Maybank, CIMB,

OCBC and RHB.

He is currently associated with Securities Commission for several development

projects and in several programmes initiated by Permodalan Nasional Berhad

Institute. He is also the Lead Moderator for the Capital Markets with the Financial

Accreditation Agency (FAA).

You might also like

- Hierarchical Clustering-Based Asset Allocation: Homas AffinotDocument11 pagesHierarchical Clustering-Based Asset Allocation: Homas AffinotsomrupNo ratings yet

- Quantitative Asset Management: Factor Investing and Machine Learning for Institutional InvestingFrom EverandQuantitative Asset Management: Factor Investing and Machine Learning for Institutional InvestingNo ratings yet

- Chapter Six: Capital Allocation To Risky AssetsDocument34 pagesChapter Six: Capital Allocation To Risky AssetsAreej AlGhamdi100% (2)

- CFA Level III Mock Exam 3 - Questions (PM)Document36 pagesCFA Level III Mock Exam 3 - Questions (PM)Munkhbaatar SanjaasurenNo ratings yet

- Credit Suisse IWM Summer Associate ProgramDocument1 pageCredit Suisse IWM Summer Associate ProgramWilson Guillaume ZhouNo ratings yet

- Bienville Capital Managment - Presentation (December 2010)Document52 pagesBienville Capital Managment - Presentation (December 2010)bienvillecapNo ratings yet

- Portfolio Management and Investment DecisionDocument49 pagesPortfolio Management and Investment Decisionuditasinha85% (13)

- Practice Manual FTFM Akansha 2015 PDFDocument375 pagesPractice Manual FTFM Akansha 2015 PDFSriraman T100% (1)

- Vacancies: Kenya Reinsurance Corporation LimitedDocument2 pagesVacancies: Kenya Reinsurance Corporation LimitedmautidavisNo ratings yet

- Investment Strategies and Portfolio ManagementDocument9 pagesInvestment Strategies and Portfolio ManagementRubi ZimmermanNo ratings yet

- Strategic Finance Syllabus 2017Document9 pagesStrategic Finance Syllabus 2017Alifya ZahranaNo ratings yet

- 2017 Asset ManagementDocument5 pages2017 Asset ManagementMax smithNo ratings yet

- FINF315 FinManDocument4 pagesFINF315 FinManYash BhardwajNo ratings yet

- BlackRock 2023-2024 Finance Job DescriptionDocument2 pagesBlackRock 2023-2024 Finance Job Descriptionharikevadiya4No ratings yet

- Master of Management in Finance & Investment: NasdaqDocument8 pagesMaster of Management in Finance & Investment: NasdaqTino MatsvayiNo ratings yet

- Scope & Objective of The Course: Analysis of Cost and Key Factors To Optimize ReturnDocument4 pagesScope & Objective of The Course: Analysis of Cost and Key Factors To Optimize ReturnPrabhjeet KalsiNo ratings yet

- BA 185 Strategic Business Analysis ClassDocument10 pagesBA 185 Strategic Business Analysis ClassJohn Vincent CruzNo ratings yet

- Business Finance II B Lecture 1 March 01, 2021Document16 pagesBusiness Finance II B Lecture 1 March 01, 2021AhsanNo ratings yet

- IIM Calcutta Brochure 30 DecDocument13 pagesIIM Calcutta Brochure 30 DecSandeep SinghNo ratings yet

- Finance - For Non-Finance - ExecutivesDocument4 pagesFinance - For Non-Finance - Executivesabhimani5472No ratings yet

- S5 SFMDocument3 pagesS5 SFMWaqas AnjumNo ratings yet

- Auditing The TreasuryDocument3 pagesAuditing The TreasurykaashifhassanNo ratings yet

- Course Outline Financial Management-2018-19Document4 pagesCourse Outline Financial Management-2018-19Jayesh MahajanNo ratings yet

- Axis Mutual Fund - Karthik Kumar - ScrabbleDocument2 pagesAxis Mutual Fund - Karthik Kumar - ScrabbleNaman VasalNo ratings yet

- Investment Banking CertificationDocument9 pagesInvestment Banking Certificationvictor andrésNo ratings yet

- CBS-VC Due Diligence - Brochure - 13-09-22 - V16Document11 pagesCBS-VC Due Diligence - Brochure - 13-09-22 - V16Ataer ArgüderNo ratings yet

- MM ZG 523 / QMJ ZG 523 Project ManagementDocument54 pagesMM ZG 523 / QMJ ZG 523 Project ManagementArun PrasadNo ratings yet

- Corporate Finance Course OutlineDocument6 pagesCorporate Finance Course OutlineHaroon Z. ChoudhryNo ratings yet

- Wealth Management - D&B Program OutlineDocument4 pagesWealth Management - D&B Program OutlineParijat ChoudhuryNo ratings yet

- Internal Audit FileDocument6 pagesInternal Audit FileAsherah SedilloNo ratings yet

- Campus 22 - Finance JDDocument2 pagesCampus 22 - Finance JDAryan MaheshwariNo ratings yet

- Financial Statement Analysis: Standard Course OutlineDocument6 pagesFinancial Statement Analysis: Standard Course OutlineMahmoud ZizoNo ratings yet

- MGT406 - CF - Course OutlineDocument4 pagesMGT406 - CF - Course OutlinekishoreNo ratings yet

- Chief Financial Officer ProgrammeDocument16 pagesChief Financial Officer ProgrammeEnes BandaNo ratings yet

- Behavioral Finance - Brochure (June 13, 2020 - 9am)Document2 pagesBehavioral Finance - Brochure (June 13, 2020 - 9am)Via Commerce Sdn BhdNo ratings yet

- Turki Alghamdi ResumeDocument2 pagesTurki Alghamdi Resumeturki gNo ratings yet

- Research of Portfolio AvenueDocument6 pagesResearch of Portfolio AvenueaNo ratings yet

- PMO Playbook Section8Document26 pagesPMO Playbook Section8Pre MANo ratings yet

- Course Syllabus: Fall 2021Document7 pagesCourse Syllabus: Fall 2021Karim GhaddarNo ratings yet

- UT Dallas Syllabus For Sysm6312.0u1.11u Taught by David Springate (Spring8)Document6 pagesUT Dallas Syllabus For Sysm6312.0u1.11u Taught by David Springate (Spring8)UT Dallas Provost's Technology GroupNo ratings yet

- MBA 1.5 Outlines PDFDocument148 pagesMBA 1.5 Outlines PDFMaQsud AhMad SaNdhuNo ratings yet

- Investment Analysis & Portfolio ManagementDocument23 pagesInvestment Analysis & Portfolio ManagementUmair Khan Niazi75% (4)

- Investment Manager - Spider ManagementDocument2 pagesInvestment Manager - Spider ManagementMarshay HallNo ratings yet

- Financial PlanningDocument15 pagesFinancial PlanningAshwani SinghNo ratings yet

- JD - FS Risk Management (SR - Con-AM) PDFDocument3 pagesJD - FS Risk Management (SR - Con-AM) PDFAASIM AlamNo ratings yet

- Chapter 6 - 12: Strategic Management & Business PolicyDocument25 pagesChapter 6 - 12: Strategic Management & Business PolicyNuri Mayang SariNo ratings yet

- Syllabus Treasury ManagementDocument11 pagesSyllabus Treasury Managementreymarkgotis1997No ratings yet

- Ram Kumar Lakhani - ResumeDocument3 pagesRam Kumar Lakhani - Resume6g2nu4xeNo ratings yet

- BSS056-6 23-24 Unit Information Form UCIF - 4470Document8 pagesBSS056-6 23-24 Unit Information Form UCIF - 4470angelogobNo ratings yet

- BPS FinDocument11 pagesBPS FinABHITESH MANGOTRANo ratings yet

- NTU-WMI MAWM BrochureDocument7 pagesNTU-WMI MAWM BrochureSourajyoti SardarNo ratings yet

- Iimk PcpafDocument20 pagesIimk Pcpafisita adhikaryNo ratings yet

- Ee Course Descriptions Lead 2017Document6 pagesEe Course Descriptions Lead 2017cfd13No ratings yet

- BlackRock 2023-2024 Business Management Job DescriptionDocument2 pagesBlackRock 2023-2024 Business Management Job Descriptionbluelion638No ratings yet

- Brochure - Columbia - Private - Equity - 25 - August - 2020 - V10 2Document11 pagesBrochure - Columbia - Private - Equity - 25 - August - 2020 - V10 2sam_schwartz_7No ratings yet

- Required Curriculum - MBA - Harvard Business SchoolDocument4 pagesRequired Curriculum - MBA - Harvard Business SchoolJerryJoshuaDiazNo ratings yet

- DBA 5005 Strategic Investment and Financing DecisionsDocument263 pagesDBA 5005 Strategic Investment and Financing DecisionsShrividhyaNo ratings yet

- CTA Program DetailsDocument3 pagesCTA Program DetailsJennylyn BNo ratings yet

- Peranggaran - Materi 2Document42 pagesPeranggaran - Materi 2citra kurniaNo ratings yet

- Master of Business Administration: Unitar - MyDocument2 pagesMaster of Business Administration: Unitar - MyParvinder McCartneyNo ratings yet

- Investment BankingDocument5 pagesInvestment BankingShubham DoifodeNo ratings yet

- CFA Brochure (2021 & 2022)Document8 pagesCFA Brochure (2021 & 2022)Via Commerce Sdn Bhd100% (1)

- MSYA Series 1 - Personal Financial Management (Final, Distribution, Grey)Document53 pagesMSYA Series 1 - Personal Financial Management (Final, Distribution, Grey)Via Commerce Sdn BhdNo ratings yet

- VCSB - LMS Access Guidelines - PNB CFA L3 IRC ProgramDocument13 pagesVCSB - LMS Access Guidelines - PNB CFA L3 IRC ProgramVia Commerce Sdn BhdNo ratings yet

- VCSB LMS Access Guidelines - PNB CFA L1 IRC ProgramDocument13 pagesVCSB LMS Access Guidelines - PNB CFA L1 IRC ProgramVia Commerce Sdn BhdNo ratings yet

- VCSB LMS Access Guidelines - PNB CFA L2 IRC ProgramDocument13 pagesVCSB LMS Access Guidelines - PNB CFA L2 IRC ProgramVia Commerce Sdn BhdNo ratings yet

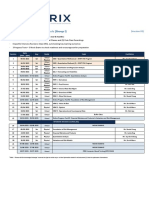

- VCSB - Financial Modelling Series (Apr & May 2021)Document9 pagesVCSB - Financial Modelling Series (Apr & May 2021)Via Commerce Sdn BhdNo ratings yet

- LMS System Guidelines (FIRIX) - CFA Program ME & VideosDocument7 pagesLMS System Guidelines (FIRIX) - CFA Program ME & VideosVia Commerce Sdn BhdNo ratings yet

- LMS Enrollment Guidelines (FIRIX) - CFA & FRM ProgramDocument16 pagesLMS Enrollment Guidelines (FIRIX) - CFA & FRM ProgramVia Commerce Sdn BhdNo ratings yet

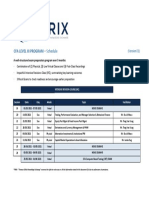

- FIRIX - CFA Level III - IRC (May 2021 Exam)Document1 pageFIRIX - CFA Level III - IRC (May 2021 Exam)Via Commerce Sdn BhdNo ratings yet

- FIRIX - FRM Brochure (2021)Document8 pagesFIRIX - FRM Brochure (2021)Via Commerce Sdn BhdNo ratings yet

- FIRIX - CFA Brochure (2021)Document8 pagesFIRIX - CFA Brochure (2021)Via Commerce Sdn Bhd100% (1)

- FIRIX - CFA Level II - IRC (May 2021 Exam)Document1 pageFIRIX - CFA Level II - IRC (May 2021 Exam)Via Commerce Sdn BhdNo ratings yet

- LMS System Access Guidelines (VCSB) - CFA Program ME & VideosDocument7 pagesLMS System Access Guidelines (VCSB) - CFA Program ME & VideosVia Commerce Sdn BhdNo ratings yet

- FRM PI (Group I & II) - Timetable (July 2021 Exam) (V2)Document2 pagesFRM PI (Group I & II) - Timetable (July 2021 Exam) (V2)Via Commerce Sdn BhdNo ratings yet

- FIRIX - LMS Access Guidelines - CFA ProgramDocument13 pagesFIRIX - LMS Access Guidelines - CFA ProgramVia Commerce Sdn BhdNo ratings yet

- FIRIX - LMS Access Guidelines - FRM ProgramDocument12 pagesFIRIX - LMS Access Guidelines - FRM ProgramVia Commerce Sdn BhdNo ratings yet

- CFA Level I - Timetable (August 2021 Exam)Document1 pageCFA Level I - Timetable (August 2021 Exam)Via Commerce Sdn BhdNo ratings yet

- CFA Level I - Timetable (August 2021 Exam) (V2)Document1 pageCFA Level I - Timetable (August 2021 Exam) (V2)Via Commerce Sdn BhdNo ratings yet

- FRM PI (G1&G2) - Timetable (July 2021 Exam)Document2 pagesFRM PI (G1&G2) - Timetable (July 2021 Exam)Via Commerce Sdn BhdNo ratings yet

- FIRIX - FRM Brochure (2021)Document8 pagesFIRIX - FRM Brochure (2021)Via Commerce Sdn BhdNo ratings yet

- Behavioral Finance - Brochure (June 13, 2020 - 9am)Document2 pagesBehavioral Finance - Brochure (June 13, 2020 - 9am)Via Commerce Sdn BhdNo ratings yet

- FIRIX - CFA Brochure (2021)Document8 pagesFIRIX - CFA Brochure (2021)Via Commerce Sdn Bhd100% (1)

- Detecting Creative Accounting and Fraud (June 6, 2020 - 9am)Document2 pagesDetecting Creative Accounting and Fraud (June 6, 2020 - 9am)Via Commerce Sdn BhdNo ratings yet

- Anti-Money Laundering (AML) - Cases Involving Capital Market ParticipantsDocument3 pagesAnti-Money Laundering (AML) - Cases Involving Capital Market ParticipantsVia Commerce Sdn BhdNo ratings yet

- Behavioral Finance - Brochure (June 13, 2020 - 9am)Document2 pagesBehavioral Finance - Brochure (June 13, 2020 - 9am)Via Commerce Sdn BhdNo ratings yet

- Business Administration 2020 Eng PDFDocument29 pagesBusiness Administration 2020 Eng PDFNiNi TsiklauriNo ratings yet

- TheoryDocument15 pagesTheoryVivek BansalNo ratings yet

- CEFA Examination Syllabus 2021Document30 pagesCEFA Examination Syllabus 2021Erico Cortez Fioravante AgnelloNo ratings yet

- Financial Plan by Anshu DalmiaDocument10 pagesFinancial Plan by Anshu DalmiaAnshu DalmiaNo ratings yet

- February 2017Document64 pagesFebruary 2017Eric Santiago100% (1)

- Biitm-IFSS-Mutual Funds - ZoomDocument55 pagesBiitm-IFSS-Mutual Funds - ZoomBikash Kumar DashNo ratings yet

- FMR June 2018Document22 pagesFMR June 2018Salman ArshadNo ratings yet

- OSAM - The Big Picture 10-8-13 - Jim OShaughnessy - UNLINKEDDocument27 pagesOSAM - The Big Picture 10-8-13 - Jim OShaughnessy - UNLINKEDcaitlynharveyNo ratings yet

- Vivint Solar 401 (K) Enrollment Workbook - 528946Document62 pagesVivint Solar 401 (K) Enrollment Workbook - 528946KieraNo ratings yet

- Financial Markets and Institutions: Abridged 10 EditionDocument41 pagesFinancial Markets and Institutions: Abridged 10 EditionNajmul Joy100% (1)

- JaneStreet Inst ETF Trading Survey 2021Document16 pagesJaneStreet Inst ETF Trading Survey 2021Alan AnggaraNo ratings yet

- Investors Policy Statement For Mr. Avinash TopnoDocument2 pagesInvestors Policy Statement For Mr. Avinash TopnoRanjith KumarNo ratings yet

- BlackRock 2020-2021 Investments Job DescriptionDocument13 pagesBlackRock 2020-2021 Investments Job DescriptionNora PetruțaNo ratings yet

- Valuation, Hedging and The Risk Management of Insurance Contracts (Doctoral Thesis) - by Jérôme Barbarin, Université Catholique de Louvain, 2008Document284 pagesValuation, Hedging and The Risk Management of Insurance Contracts (Doctoral Thesis) - by Jérôme Barbarin, Université Catholique de Louvain, 2008azizNo ratings yet

- MCXAX Presentation - 2015 Q3Document22 pagesMCXAX Presentation - 2015 Q3ZerohedgeNo ratings yet

- Eti 03 EngineTestingOverviewDocument1 pageEti 03 EngineTestingOverviewJames JosephNo ratings yet

- Efficient FrontiersDocument7 pagesEfficient FrontiersintercontiNo ratings yet

- Interview With Andrejs LandsmanisDocument2 pagesInterview With Andrejs LandsmanisForsta AP-fondenNo ratings yet

- 2023 CFA LIII MockExamA-Answer KeyDocument46 pages2023 CFA LIII MockExamA-Answer KeyHugo VALERIONo ratings yet

- Portable Alpha - Philosophy, Process & PerformanceDocument14 pagesPortable Alpha - Philosophy, Process & PerformanceChDarwinNo ratings yet

- c3 Capital Allocation of Risky AssetsDocument39 pagesc3 Capital Allocation of Risky AssetsfelipeNo ratings yet

- Roll No. 15 TYBAF Project FileDocument68 pagesRoll No. 15 TYBAF Project FileNehaNo ratings yet

- Retirement Planning With AnnuitiesDocument11 pagesRetirement Planning With Annuitiesapi-246909910No ratings yet

- Mutual FundsDocument68 pagesMutual FundsShivamitra ChiruthaniNo ratings yet

- Rudy Wong Investment AdvisorDocument21 pagesRudy Wong Investment AdvisorAzlina Zaine100% (2)

- Montgomery County Public Schools Trustee Candidate - Selection Process 2021Document1 pageMontgomery County Public Schools Trustee Candidate - Selection Process 2021Marshay HallNo ratings yet

- Al Ameen FundsDocument20 pagesAl Ameen FundsSaad Liaquat DojkiNo ratings yet