Professional Documents

Culture Documents

Notice of Demand Under Section 137 (2) of The Income Tax Ordinance, 2001

Notice of Demand Under Section 137 (2) of The Income Tax Ordinance, 2001

Uploaded by

brohihassanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notice of Demand Under Section 137 (2) of The Income Tax Ordinance, 2001

Notice of Demand Under Section 137 (2) of The Income Tax Ordinance, 2001

Uploaded by

brohihassanCopyright:

Available Formats

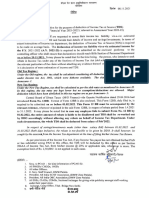

The Taxpayer is an Individual engaged in the business of educational activities as per

taxpayer’s registration profile. Taxpayer has not filed mandatory return of income for the tax

year 2015. Since default stands established, th e re fo re , penalty of Rs. /- u/s. 182(1)(s # 1) of

the Income Tax Ordinance, 2001 is here by imposed accordingly.

Issues order & demand notice accordingly.

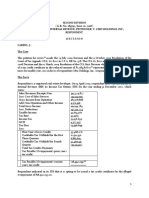

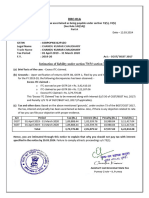

NOTICE OF DEMAND UNDER SECTION 137(2) OF THE INCOME TAX ORDINANCE, 2001

As a result of order passed u/s 182(1) of the Income Tax Ordinance, 2001 in your case for

the Tax Year 2014, penalty worked out at Rs. /-.

a) Income Tax =

b) Additional tax u/s =

c) Penalty u/s 182(1) Rs. /-

d) WWF =

e) Minimum tax u/s 113 =

TOTAL Rs. /-

2. You are required to make the payment of the above amount not later than 30 days from the

date of issue of the order in the National Bank of Pakistan /State Bank of Pakistan / Sub-Treasury

Office.

3. If you intend to appeal against the assessment, you file;

a) Appeal under section

b) Revision Petition under section122A of the said Ordinance before the Commissioner

of Income Tax within 90 days of the receipt of this notice.

4. Copy of the order on which demand / refund is based is enclosed.

ASSISTANT COMMISSIONER-IR

You might also like

- GST APL-01 Veeba FoodsDocument14 pagesGST APL-01 Veeba FoodsUtkarsh Khandelwal100% (2)

- Islam Its Meaning & Message (Khurshid Ahmad) PDFDocument285 pagesIslam Its Meaning & Message (Khurshid Ahmad) PDFbrohihassan80% (5)

- ORDER U/S. 182 (1) (1) OF THE Income TAX Ordinance, 2001Document1 pageORDER U/S. 182 (1) (1) OF THE Income TAX Ordinance, 2001brohihassanNo ratings yet

- PenaltiesDocument21 pagesPenaltiesSivaji MotorsNo ratings yet

- Atx Acca Grand RevisionDocument35 pagesAtx Acca Grand Revisioncontact.xinanneNo ratings yet

- Circularno 24 CGSTDocument4 pagesCircularno 24 CGSTHr legaladviserNo ratings yet

- PenaltiesDocument21 pagesPenaltiesJyoti VidhaniNo ratings yet

- Penalties PDFDocument19 pagesPenalties PDFpavankumarNo ratings yet

- Tds ProvisionsDocument38 pagesTds Provisionsglobalfreedom4No ratings yet

- Income Tax Divyastra CH 15 Advance Tax R 1Document7 pagesIncome Tax Divyastra CH 15 Advance Tax R 1wareva7754No ratings yet

- Penalty 3Document10 pagesPenalty 3jennyjackNo ratings yet

- TLP Supplement DT June 2020-OSDocument105 pagesTLP Supplement DT June 2020-OSZamr GNo ratings yet

- RR 22-2020 (Notice of Discrepancy) PDFDocument3 pagesRR 22-2020 (Notice of Discrepancy) PDFilovelawschoolNo ratings yet

- 2023 152 Taxmann Com 312 Bombay 14 07 2023 Bombay Dyeing Manufacturing Co LTD VsDocument1 page2023 152 Taxmann Com 312 Bombay 14 07 2023 Bombay Dyeing Manufacturing Co LTD VsSricharan RNo ratings yet

- ShowfileDocument4 pagesShowfileMkNo ratings yet

- DownloadDocument6 pagesDownloadpankhewalegNo ratings yet

- L1 - Tax Evasion and Avoidance 1Document61 pagesL1 - Tax Evasion and Avoidance 1Izaac PovanesNo ratings yet

- Income Taxation Reviewer: SolutionsDocument5 pagesIncome Taxation Reviewer: SolutionsRoselen DoloritoNo ratings yet

- PenaltiesDocument21 pagesPenaltiesRavi PrakashNo ratings yet

- GST APL-01 Siddhi Vinayak ExtrusionDocument14 pagesGST APL-01 Siddhi Vinayak ExtrusionUtkarsh KhandelwalNo ratings yet

- Consequences of Tds FailureDocument2 pagesConsequences of Tds FailureMahaveer DhelariyaNo ratings yet

- 2002 83 ITD 151 Delhi SB 2002 77 TTJ 387 Delhi SB 01 08 2002highlightedDocument12 pages2002 83 ITD 151 Delhi SB 2002 77 TTJ 387 Delhi SB 01 08 2002highlightedSnigdha MazumdarNo ratings yet

- Tax Form-22.Document27 pagesTax Form-22.Masroor RasoolNo ratings yet

- Bank of America NT & Sa, The Commissioner of Internal RevenueDocument4 pagesBank of America NT & Sa, The Commissioner of Internal RevenueHADTUGINo ratings yet

- GST APL-01 VandanDocument14 pagesGST APL-01 VandanUtkarsh KhandelwalNo ratings yet

- 3.G.R. No. 103092Document5 pages3.G.R. No. 103092Lord AumarNo ratings yet

- G Vittal 16 BackDocument1 pageG Vittal 16 BackSRINIVAS MNo ratings yet

- 2020 P T D 1908Document2 pages2020 P T D 1908haseeb AhsanNo ratings yet

- Act, 1964Document9 pagesAct, 1964syed shabbirNo ratings yet

- Tax LawDocument535 pagesTax LawPrem MahalaNo ratings yet

- Incometax 29 09 2022Document3 pagesIncometax 29 09 2022nitishbhaskaran4No ratings yet

- GST APL-01 Speedway Surgical CoDocument14 pagesGST APL-01 Speedway Surgical CoUtkarsh KhandelwalNo ratings yet

- TXHKG 2022 Dec ADocument8 pagesTXHKG 2022 Dec AmyheartfallsinnewyorkNo ratings yet

- 94-15 Filing, Penalties, Remedies - QuestionnaireDocument8 pages94-15 Filing, Penalties, Remedies - QuestionnaireSilver LilyNo ratings yet

- AAACP7770R - Issue Letter - 1038164359 (1) - 28122021Document2 pagesAAACP7770R - Issue Letter - 1038164359 (1) - 28122021lovish tyagiNo ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- TLP Supplement DT Dec, 2019 - Old SyllabusDocument94 pagesTLP Supplement DT Dec, 2019 - Old Syllabusjanardhan CA,CSNo ratings yet

- 9) CIR Vs CEBU HOLDINGS - J. CarpioDocument11 pages9) CIR Vs CEBU HOLDINGS - J. CarpioKlausNo ratings yet

- Drc-01a 10bpopk6312p1zo Chandu Kumar Chaudhary 2019-20Document1 pageDrc-01a 10bpopk6312p1zo Chandu Kumar Chaudhary 2019-20Rahul KumarNo ratings yet

- For Tds On Non SalaryDocument39 pagesFor Tds On Non SalaryicahimanshumehtaNo ratings yet

- PenaltiesDocument19 pagesPenaltiesGokul AkrishnanNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- E Newsletter September 2013Document13 pagesE Newsletter September 2013sd naikNo ratings yet

- BANK OF AMERICA Vs CADocument6 pagesBANK OF AMERICA Vs CAJason Brian E. AvelinoNo ratings yet

- Shree Karthik Papers Ltdvs Deputy Commissionerof Income TDocument4 pagesShree Karthik Papers Ltdvs Deputy Commissionerof Income TKaran GannaNo ratings yet

- Income Tax J2019Document50 pagesIncome Tax J2019Avinash ShettyNo ratings yet

- Taxation Class Test 2Document5 pagesTaxation Class Test 2ap.quatrroNo ratings yet

- 2021 Budget HighlightDocument20 pages2021 Budget HighlightNashville MuwaikaNo ratings yet

- Income Tax 2017 Edazdb1013Document50 pagesIncome Tax 2017 Edazdb1013Pradeep PatilNo ratings yet

- Cta Eb CV 01767 D 2019aug09 AssDocument18 pagesCta Eb CV 01767 D 2019aug09 AssChristel BravoNo ratings yet

- AADCD7676H - Notice Us 142 (1) - 1031169046 (1) - 03032021Document3 pagesAADCD7676H - Notice Us 142 (1) - 1031169046 (1) - 03032021D R B INFRASTRUCTURE PRIVATE LIMITED D.Ramesh NaiduNo ratings yet

- Cta Eb CV 02562 D 2023apr27 RefDocument20 pagesCta Eb CV 02562 D 2023apr27 RefFirenze PHNo ratings yet

- Tax Law BookDocument582 pagesTax Law BookSasmit PatilNo ratings yet

- Commissioner of Internal Revenue, INCORPORATED, RespondentDocument10 pagesCommissioner of Internal Revenue, INCORPORATED, RespondentRufino Gerard Moreno IIINo ratings yet

- BAM 103 - Week 3 - DOUBLE ENTRY SYSTEM - PART 2Document26 pagesBAM 103 - Week 3 - DOUBLE ENTRY SYSTEM - PART 2Trixy013No ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- Tax Laws and Practice Direct Tax June 2021Document98 pagesTax Laws and Practice Direct Tax June 2021niraliparekh27No ratings yet

- FNJ 7382 Direct Tax Question PaperDocument12 pagesFNJ 7382 Direct Tax Question PaperAnkit GuptaNo ratings yet

- 1a. Refund Formats17052017 Revised3 28Document28 pages1a. Refund Formats17052017 Revised3 28Ravi Kiran KandimallaNo ratings yet

- Bureau of Internal Revenue: Chief, Litigation DivisionDocument4 pagesBureau of Internal Revenue: Chief, Litigation DivisionGregorio de LimaNo ratings yet

- ORDER U/S. 182 (1) (1) OF THE Income TAX Ordinance, 2001Document1 pageORDER U/S. 182 (1) (1) OF THE Income TAX Ordinance, 2001brohihassanNo ratings yet

- Point of Sale (Pos) : A) Intended Audience: B) ObjectivesDocument1 pagePoint of Sale (Pos) : A) Intended Audience: B) ObjectivesbrohihassanNo ratings yet

- Class Width Max Value - Min Value No. of IntervalsDocument2 pagesClass Width Max Value - Min Value No. of IntervalsbrohihassanNo ratings yet