Professional Documents

Culture Documents

Operating Activities, Investing Activities, Financing Activities)

Operating Activities, Investing Activities, Financing Activities)

Uploaded by

Akash RanjanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Operating Activities, Investing Activities, Financing Activities)

Operating Activities, Investing Activities, Financing Activities)

Uploaded by

Akash RanjanCopyright:

Available Formats

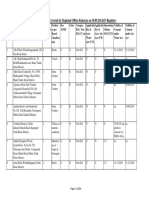

1.

Classify the following into Cash Flows from-

(operating activities, investing activities,financing activities)

1.Cash sale of goods in cash

2.Cash payment to acquire fixed assets

3.Cash payments from issuing shares at a premium

4.Payment of dividend

5.Interest received on Investment

6.Interest Paid on debentures

7.payment of income tax

8.Cash repayment of long term loans

9.Cash payment of salaries and wages to employees.

Q 2.A company had following balances

investment in the beginning = 34000

investment at the end = 28000

during the year, company sold 40% of its investments held in the beginning of the period at a profit of

8400. calculate cash flow form investing activity.

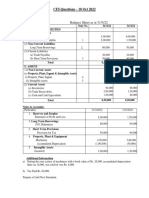

Q3.Following is the balance sheet of Rs Ltd as at 31st March, 2016.

Particulars Note No. 31st March, 2016 Amt (Rs) 31st March,2015 Amt (Rs)

1. EQUITY AND LIABILITIES

1.Shareholders’ Funds

(a) Share Capital 9,00,000 7,00,000

(b) Reserves and Surplus 1 2,50,000 1,00,000

2.Non-current Liabilities

Long-term Borrowings 2 4,50,000 3,50,000

3.Current Liabilities

(a)Short-term Borrowings 3 1,50,000 75,000

(b)Short-term Provisions 4 2,00,000 1,25,000

Total 19,50,000 13,50,000

2 ASSETS

1.Non-current Assets

(a)Fixed Assets

(i)Tangible 5 14,65,000 9,15,000

(ii)Intangible 6 1,00,000 1,50,000

(b) Non-current Investments 1,50,000 1,00,000

2.Current Assets

(a)Current Investments 40,000 70,000

(b)Inventories 7 1,22,000 72,000

(c)Cash and Cash Equivalents 73,000 43,000

Total 19,50,000 13,50,000

Note to Accounts

Note No. Particulars 31st March,2016 Amt (Rs) 31st March,2015 Amt (Rs)

1. Reserves and Surplus

(Surplus i.e., Balance in the Statement of Profit and Loss) 2,50,000 1,00,000

2,50,000 1,00,000

2. Long-term Borrowings

12% Debentures 4,50,000 3,50,000

4,50,000 3,50,000

3. Short-term borrowings

Bank Overdraft 1,50,000 75,000

1,50,000 75,000

4. Short-term Provisions

Proposed Dividend 2,00,000 1,25,000

2,00,000 1,25,000

5. Tangible Assets

Machinery 16,75,000 10,55,000

Accumulated Depreciation (2,10,000) (1,40,000)

14,65,000 9,15,000

6. Intangible Assets

Goodwill 1,00,000 1,50,000

1,00,000 1,50,000

7. Inventories

Stock in Trade 1,22,000 72,000

1,22,000 72,000

Additional Information

Rs.1,00,000, 12% debentures were issued on 31st March,2016.

During the year a piece of machinery costing Rs.80,000 on which accumulated depreciation was Rs.

40,000 was sold at a loss of Rs.10,000.

Prepare a cash flow statement.

You might also like

- Odds Enhancers' Worksheet - 20170401Document1 pageOdds Enhancers' Worksheet - 20170401Anonymous rB0wZQjxZFNo ratings yet

- Manual Vilter 440 and 450xlDocument41 pagesManual Vilter 440 and 450xlJose Antonio Yupa MedinaNo ratings yet

- Narayana HrudayalayaDocument6 pagesNarayana HrudayalayaPriyanka Bharadwaj100% (1)

- 232 FM AssignmentDocument17 pages232 FM Assignmentbhupesh joshiNo ratings yet

- EXERCISE Cashflow of The CompanyDocument41 pagesEXERCISE Cashflow of The CompanyDev lakhaniNo ratings yet

- Accounts DDocument13 pagesAccounts DRahit MitraNo ratings yet

- 12 Accountancy Notes CH12 Cash Flow Statement 02Document28 pages12 Accountancy Notes CH12 Cash Flow Statement 02Gourab GoraiNo ratings yet

- Solution:: Equity and LiabilitiesDocument4 pagesSolution:: Equity and LiabilitiesNIMROD MOCHAHARINo ratings yet

- Unit IIIDocument9 pagesUnit IIIkuselvNo ratings yet

- CASH FLOW 2024 SPCCDocument54 pagesCASH FLOW 2024 SPCCTCPS UNFILTEREDNo ratings yet

- PART-B Analysis Test YtDocument8 pagesPART-B Analysis Test YtRiddhi GuptaNo ratings yet

- Xii Acc Worksheetss-30-55Document26 pagesXii Acc Worksheetss-30-55Unknown patelNo ratings yet

- Cash Flow Statement - 2Document9 pagesCash Flow Statement - 2Midhun PerozhiNo ratings yet

- Que PaperDocument7 pagesQue PaperaditikaushikNo ratings yet

- Valuation of GoodwillDocument15 pagesValuation of Goodwillbtsa1262013No ratings yet

- Accounts AIP FINALDocument14 pagesAccounts AIP FINALManthanNo ratings yet

- General Instructions: All The Questions Are CompulsoryDocument2 pagesGeneral Instructions: All The Questions Are CompulsoryJatin ChaudharyNo ratings yet

- Management Accouting Assignment4 Manish Chauhan (09-1128) .Document17 pagesManagement Accouting Assignment4 Manish Chauhan (09-1128) .manishNo ratings yet

- Additional Questions 5Document13 pagesAdditional Questions 5Sanjay SiddharthNo ratings yet

- Assignment For AccountancyDocument3 pagesAssignment For AccountancyKamlesh PandeyNo ratings yet

- Preparation of Financial Statements - QBDocument26 pagesPreparation of Financial Statements - QBHindutav arya100% (1)

- Class 12 Accountancy CBSE Cash Flow StatementDocument7 pagesClass 12 Accountancy CBSE Cash Flow StatementSarvesh SreedharNo ratings yet

- Mam2eDocument4 pagesMam2epriyanehasahaNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- Sums On Cash Flow StatementDocument5 pagesSums On Cash Flow StatementAstha ParmanandkaNo ratings yet

- RatioanalysisanswersDocument5 pagesRatioanalysisanswersAnu PriyaNo ratings yet

- Cash Flow ENDDocument11 pagesCash Flow ENDinstant uploaderNo ratings yet

- Problem Set of Cash Flow StatementDocument1 pageProblem Set of Cash Flow StatementpriyankaNo ratings yet

- Consolidation TutorialDocument8 pagesConsolidation TutorialPrageeth Roshan WeerathungaNo ratings yet

- Crash MysoreDocument40 pagesCrash MysoreyashbhardwajNo ratings yet

- CFS Questions - 18 - OCT - 2022Document5 pagesCFS Questions - 18 - OCT - 2022Kartik SujanNo ratings yet

- Managenet AC - Question Bank SSDocument18 pagesManagenet AC - Question Bank SSDharshanNo ratings yet

- Paper18 Solution PDFDocument24 pagesPaper18 Solution PDFI'm Just FunnyNo ratings yet

- University of Mauritius: Faculty of Law and ManagementDocument9 pagesUniversity of Mauritius: Faculty of Law and ManagementMîñåk ŞhïïNo ratings yet

- Accounts Important Questions by Rajat Jain SirDocument31 pagesAccounts Important Questions by Rajat Jain SirRajiv JhaNo ratings yet

- RatioDocument24 pagesRatioSadika KhanNo ratings yet

- Proposed DividebdDocument34 pagesProposed DividebdPiyush SrivastavaNo ratings yet

- Management Accounting BankDocument23 pagesManagement Accounting BankVaishnavi ChoudharyNo ratings yet

- Holding Company ProblemsDocument22 pagesHolding Company ProblemsYashodhan MithareNo ratings yet

- Question Bank - Management AccountingDocument7 pagesQuestion Bank - Management Accountingprahalakash Reg 113No ratings yet

- Accountancy Board Practical Paper - 2020-2021 Class - Xii Time: 1 Hour Max. Marks: 12Document3 pagesAccountancy Board Practical Paper - 2020-2021 Class - Xii Time: 1 Hour Max. Marks: 12Kairav KhuranaNo ratings yet

- Cashflowstatement 150402074118 Conversion Gate01Document30 pagesCashflowstatement 150402074118 Conversion Gate01vini2710No ratings yet

- Business ProjectDocument16 pagesBusiness Projectlaiba khanNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- UntitledDocument1 pageUntitledBinoy TrevadiaNo ratings yet

- CMA Final CFR MarathonDocument30 pagesCMA Final CFR MarathonRamanpreet KaurNo ratings yet

- Cash Flow Statement Activity Wise 05-02-24Document7 pagesCash Flow Statement Activity Wise 05-02-24navyabindra28No ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- JKN - Acc - 13 - Question Paper - 131020Document10 pagesJKN - Acc - 13 - Question Paper - 131020adityatiwari122006No ratings yet

- Accounting Assignment (100) : A. B. C. The Journal EntryDocument2 pagesAccounting Assignment (100) : A. B. C. The Journal EntryFaiaz ShahreearNo ratings yet

- MMS 2022-24 QP Financial AccountingDocument6 pagesMMS 2022-24 QP Financial AccountingnimeshnarnaNo ratings yet

- Ma 2020Document8 pagesMa 2020Hamsa PNo ratings yet

- Cash Flow StatementDocument10 pagesCash Flow Statementvsy9926No ratings yet

- 12 Acs (S) - Set A 19.7.2021Document3 pages12 Acs (S) - Set A 19.7.2021Sakshi NagotkarNo ratings yet

- Problems On Cash Flow StatementsDocument12 pagesProblems On Cash Flow StatementsAnjali Mehta100% (1)

- Bca 304 Financial Statement AnalysisDocument5 pagesBca 304 Financial Statement Analysiskennymugo39No ratings yet

- End Term On 24.09.2019 FR MBA 2019-21 Term IDocument10 pagesEnd Term On 24.09.2019 FR MBA 2019-21 Term Ideliciousfood463No ratings yet

- Class Xii Ut I Ws I AnswerkeyDocument9 pagesClass Xii Ut I Ws I Answerkeybabitagupta962No ratings yet

- Financial Reporting & Financial Statement Analysis: Time - 3 Hours Group - ADocument6 pagesFinancial Reporting & Financial Statement Analysis: Time - 3 Hours Group - Atanmoy sardarNo ratings yet

- Previous Year Question Paper (FSA)Document16 pagesPrevious Year Question Paper (FSA)Alisha ShawNo ratings yet

- Gujarat Technological UniversityDocument4 pagesGujarat Technological UniversityAniket PatelNo ratings yet

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportFrom EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Abhishek Sharma 19BSP0100 SM & RSMDocument2 pagesAbhishek Sharma 19BSP0100 SM & RSMAkash RanjanNo ratings yet

- C1 BECG AssignmentsDocument1 pageC1 BECG AssignmentsAkash RanjanNo ratings yet

- PM-AB3-Understanding The Nature of Markets N Products ( Perceptual Mapping..)Document45 pagesPM-AB3-Understanding The Nature of Markets N Products ( Perceptual Mapping..)Akash RanjanNo ratings yet

- 4.market Potential Sales ForecastingDocument10 pages4.market Potential Sales ForecastingAkash RanjanNo ratings yet

- Chapter 6 - History and CultureDocument57 pagesChapter 6 - History and CultureAkash RanjanNo ratings yet

- STD - RETAILING OVERVIEWDocument10 pagesSTD - RETAILING OVERVIEWAkash RanjanNo ratings yet

- Consumer Behaviour - Unit3F PDFDocument79 pagesConsumer Behaviour - Unit3F PDFAkash RanjanNo ratings yet

- MCQ S 306hr Performance Management - CompressDocument33 pagesMCQ S 306hr Performance Management - CompressAkash RanjanNo ratings yet

- Methods of Redemption-2Document11 pagesMethods of Redemption-2Akash RanjanNo ratings yet

- Future Plans of ToyotaDocument1 pageFuture Plans of ToyotaAkash RanjanNo ratings yet

- Daily Expense Sheet: DetailsDocument8 pagesDaily Expense Sheet: DetailsAkash RanjanNo ratings yet

- Data Entry Form: NameDocument2 pagesData Entry Form: NameAkash RanjanNo ratings yet

- Chap019.Third-Party Approaches To Managing Difficult NegotiationsDocument34 pagesChap019.Third-Party Approaches To Managing Difficult NegotiationsAkash RanjanNo ratings yet

- Online Downloaded ProjectDocument11 pagesOnline Downloaded ProjectAkash RanjanNo ratings yet

- Marketing TrendsDocument51 pagesMarketing TrendsAkash RanjanNo ratings yet

- List of Organisations Covered by Regional Office-Kolar (As On 30.09.2014) (F-Register)Document284 pagesList of Organisations Covered by Regional Office-Kolar (As On 30.09.2014) (F-Register)mutton moonswamiNo ratings yet

- South Bend SB1002 Lathe Owners ManualDocument84 pagesSouth Bend SB1002 Lathe Owners ManualRendab100% (2)

- CSRDocument16 pagesCSRAnkit YadavNo ratings yet

- Rain Water OutletsDocument36 pagesRain Water OutletsIshan RanganathNo ratings yet

- Unit 1 Rates of Change Assessment of Learning 1 PDFDocument11 pagesUnit 1 Rates of Change Assessment of Learning 1 PDFaubweeNo ratings yet

- KPI FormulaDocument3 pagesKPI FormulaSrikant GuptaNo ratings yet

- BlazeVideo HDTV Player v6.0R User's Manual DTR8101Document16 pagesBlazeVideo HDTV Player v6.0R User's Manual DTR8101Oscar Dario NIño GonzalezNo ratings yet

- 2.1.c.ii. Theory of Liming and UnhairingDocument5 pages2.1.c.ii. Theory of Liming and UnhairingAnanthNo ratings yet

- CE PROJECT MidtermDocument5 pagesCE PROJECT MidtermAndrea A. IgupNo ratings yet

- Branches of Medicine & Wards and Departements - EditkuDocument31 pagesBranches of Medicine & Wards and Departements - EditkuGigih Sanjaya PutraNo ratings yet

- Alter IndexDocument64 pagesAlter IndexPiyush MandalNo ratings yet

- When Caring Hurts: The Silence Burnout of SonographersDocument5 pagesWhen Caring Hurts: The Silence Burnout of SonographersCarlos BarradasNo ratings yet

- Results For Sri Lakshmi Chennakesava Tirupatham - Rajahmundry - Zonalinfo2Document2 pagesResults For Sri Lakshmi Chennakesava Tirupatham - Rajahmundry - Zonalinfo2SRINIVASARAO JONNALANo ratings yet

- ELMS Project ReportDocument42 pagesELMS Project ReportLuckinsi Samuel100% (1)

- Sop - L&od R&RDocument14 pagesSop - L&od R&RJeewan PawarNo ratings yet

- About JK TyreDocument10 pagesAbout JK TyreAshish Adholiya0% (1)

- Customizar Modulo HEIDocument33 pagesCustomizar Modulo HEIJose TejedaNo ratings yet

- Adult PSG Guidelines 2014Document49 pagesAdult PSG Guidelines 2014mohanNo ratings yet

- Personal Style ScaleDocument3 pagesPersonal Style ScalesomaNo ratings yet

- FullereneDocument12 pagesFullereneapi-249970885No ratings yet

- CH 2 - Guide To Physics PracticalsDocument20 pagesCH 2 - Guide To Physics PracticalsNong Hm100% (2)

- Renal Vegetarian NutritionDocument2 pagesRenal Vegetarian NutritionSg Balaji100% (1)

- NCERT Solutions For Class 12 Physics Chapter 3 Current ElectricityDocument24 pagesNCERT Solutions For Class 12 Physics Chapter 3 Current ElectricityDileep GNo ratings yet

- Musician VC YGO IV 2021Document1 pageMusician VC YGO IV 2021Ari J PalawiNo ratings yet

- CPL EbrochureDocument4 pagesCPL EbrochureAnuj_WNo ratings yet

- VLAN Tricks With NICs - Teaming & Hyper-V in Windows Server 2012Document10 pagesVLAN Tricks With NICs - Teaming & Hyper-V in Windows Server 2012Shashank MahadevNo ratings yet