Professional Documents

Culture Documents

Virtual Banking-SG Overview PDF

Virtual Banking-SG Overview PDF

Uploaded by

InezCopyright:

Available Formats

You might also like

- Initiate Business Checking: Important Account InformationDocument4 pagesInitiate Business Checking: Important Account InformationWeb TreamicsNo ratings yet

- Statement Nov 2021Document3 pagesStatement Nov 2021abhishek barmanNo ratings yet

- Fintech Landscape: Ashish Fafadia Kartikeya Shekhar Sujay ChoubeyDocument27 pagesFintech Landscape: Ashish Fafadia Kartikeya Shekhar Sujay ChoubeyGaurav Ahirkar100% (1)

- Credit Card StatementDocument3 pagesCredit Card StatementSaifullah Saifi0% (1)

- Accenture Digital Payments Transformation From Transaction InteractionDocument32 pagesAccenture Digital Payments Transformation From Transaction InteractionSweta AggarwallNo ratings yet

- Digital SWOT AnalysisDocument3 pagesDigital SWOT Analysisdanny lastNo ratings yet

- Digital Banking Playbook Final 1Document21 pagesDigital Banking Playbook Final 1hiteshgoel100% (2)

- 10th CRM Panayiotou PresentationDocument22 pages10th CRM Panayiotou PresentationKpessou GuihonNo ratings yet

- Global Trends in The Cards and Payments Industry 2020Document40 pagesGlobal Trends in The Cards and Payments Industry 2020Naman JainNo ratings yet

- Banking Business Model CanvasDocument1 pageBanking Business Model CanvasSetiyo BirowoNo ratings yet

- Real Time Payments Slip SheetDocument4 pagesReal Time Payments Slip SheetoctavioNo ratings yet

- Winter Internship Program: Industry Analysis To Cater The Clients' Requirements For M&A, PE/VC Fund RaisingDocument31 pagesWinter Internship Program: Industry Analysis To Cater The Clients' Requirements For M&A, PE/VC Fund RaisingAVINASH JHANo ratings yet

- Fintech Business and Paymentsstrategy PDFDocument30 pagesFintech Business and Paymentsstrategy PDFetebark h/michaleNo ratings yet

- Team2 ICLA Phase1Document3 pagesTeam2 ICLA Phase1Sweta SanganeriaNo ratings yet

- RBI Circulars March 2023Document8 pagesRBI Circulars March 2023Udya singhNo ratings yet

- Kabir-Kumar (BB Conf Pres)Document30 pagesKabir-Kumar (BB Conf Pres)akbersundraniNo ratings yet

- DCB New 2Document10 pagesDCB New 2Varad HingolikarNo ratings yet

- Sacco Growth and Profitability Through IctDocument61 pagesSacco Growth and Profitability Through IctSirengo MauriceNo ratings yet

- A Study On Retail Finance - Group4 - Section 1Document32 pagesA Study On Retail Finance - Group4 - Section 1Kitto TurtleNo ratings yet

- Axis Mission Statement:: PortfolioDocument5 pagesAxis Mission Statement:: PortfolioHimesh BhaiNo ratings yet

- In Fs Digital India Disruption NoexpDocument36 pagesIn Fs Digital India Disruption Noexpatique mohammedNo ratings yet

- Artificial Intelligence IN Financial Sector: Shantanu KrishnaDocument25 pagesArtificial Intelligence IN Financial Sector: Shantanu Krishnakuppani abhiNo ratings yet

- Payments 2025 & Beyond: Evolution To Revolution: Six Macro Trends Shaping The Future of Payments in VietnamDocument17 pagesPayments 2025 & Beyond: Evolution To Revolution: Six Macro Trends Shaping The Future of Payments in VietnamĐăng HuyNo ratings yet

- Digital Transformation For The Insurance Industry PDFDocument10 pagesDigital Transformation For The Insurance Industry PDFAsser El-FoulyNo ratings yet

- In Tax Presentation FinTax Hour Banking 13july 2022 NoexpDocument24 pagesIn Tax Presentation FinTax Hour Banking 13july 2022 NoexpSina FardiNo ratings yet

- Fin Tech 1 To 30Document428 pagesFin Tech 1 To 30Harshil MehtaNo ratings yet

- Shri Devi Institude of TechnologyDocument15 pagesShri Devi Institude of TechnologySameer MilanNo ratings yet

- Accelerate Digital Transformation: Finacle Corporate Banking SuiteDocument24 pagesAccelerate Digital Transformation: Finacle Corporate Banking SuiteManik TandonNo ratings yet

- Blume-Fintech RPRT - Aug 2020Document27 pagesBlume-Fintech RPRT - Aug 2020Rajesh DuttaNo ratings yet

- Class 2 Group 10 Project 2Document10 pagesClass 2 Group 10 Project 2Debankar MoulikNo ratings yet

- Fintech 400 PDFDocument410 pagesFintech 400 PDFHarshil MehtaNo ratings yet

- Good One 1Document21 pagesGood One 1Bhavik PrajapatiNo ratings yet

- Future of BankingDocument6 pagesFuture of BankingJanu PriyaNo ratings yet

- (ASTRA) Tantangan Digital Leadership Di Era Transformasi DigitalDocument10 pages(ASTRA) Tantangan Digital Leadership Di Era Transformasi DigitalSigit PoernomoNo ratings yet

- Next Wave BankingDocument8 pagesNext Wave BankingAbhishek CANewNo ratings yet

- Group 5: Digital Business TransformationDocument12 pagesGroup 5: Digital Business TransformationArunima SinghNo ratings yet

- Ey Fintech Compendium: Demystifying Fintech Use Cases For BankingDocument40 pagesEy Fintech Compendium: Demystifying Fintech Use Cases For BankingccmehtaNo ratings yet

- DivF Group5 ESDADocument13 pagesDivF Group5 ESDAabhinav.akr5No ratings yet

- Lending and Leasing Top 10 Trends 2017 WebDocument28 pagesLending and Leasing Top 10 Trends 2017 WebGherasim BriceagNo ratings yet

- Fintech Sessions 11 - 20Document24 pagesFintech Sessions 11 - 20Taksh DhamiNo ratings yet

- Siva PPT (Swot Analysis)Document8 pagesSiva PPT (Swot Analysis)Priya RajNo ratings yet

- Fin TechDocument32 pagesFin Techkritigupta.may1999No ratings yet

- 2019 12 Analyst DayDocument152 pages2019 12 Analyst Dayparesh shiral100% (2)

- The Changing Face of BankingDocument12 pagesThe Changing Face of BankingAsish Dash100% (1)

- Us Ai Transforming Future of BankingDocument13 pagesUs Ai Transforming Future of BankingminhNo ratings yet

- Fintech InnovationDocument20 pagesFintech InnovationGiorgioNo ratings yet

- BOB JUPITOR-combinedDocument16 pagesBOB JUPITOR-combinedharshNo ratings yet

- Impact of Digital Banks On Incumbents in SingaporeDocument20 pagesImpact of Digital Banks On Incumbents in SingaporeVarun MittalNo ratings yet

- (IBM) Ibm Banking Overview Final Version For FTUDocument18 pages(IBM) Ibm Banking Overview Final Version For FTUEcom FtuNo ratings yet

- Fintech Landscape: Ashish Fafadia Kartikeya Shekhar Sujay ChoubeyDocument27 pagesFintech Landscape: Ashish Fafadia Kartikeya Shekhar Sujay Choubeydevang bohraNo ratings yet

- Fintechresearchreport 181002173055Document6 pagesFintechresearchreport 181002173055Seth KlarmanNo ratings yet

- MACR Presentation Group 3Document8 pagesMACR Presentation Group 3anish mahtoNo ratings yet

- Case StudyDocument2 pagesCase StudySunil BaxiNo ratings yet

- Financial Services IndustryDocument17 pagesFinancial Services IndustryShrutiNo ratings yet

- Artificial Intelligen Ce in Financial Secto R: Shantanu KrishnaDocument25 pagesArtificial Intelligen Ce in Financial Secto R: Shantanu KrishnasalekingNo ratings yet

- Evolve Business Model Modern Core Platform WPDocument23 pagesEvolve Business Model Modern Core Platform WPMutaz BakriNo ratings yet

- 8-15 Sept - WeeklyDocument11 pages8-15 Sept - Weeklyshivangisingh9857No ratings yet

- Backbase Winning Strategies To Jumpstart Your Digital Transformation Microsoft EbookDocument35 pagesBackbase Winning Strategies To Jumpstart Your Digital Transformation Microsoft Ebooks4shivNo ratings yet

- School of Management & Entrepreneurship Shiv Nadar UniversityDocument21 pagesSchool of Management & Entrepreneurship Shiv Nadar UniversityPrasun SharmaNo ratings yet

- Treasury FunctionDocument4 pagesTreasury FunctionBhanu RavuriNo ratings yet

- Mobile Wallet InteroperabilityDocument8 pagesMobile Wallet InteroperabilityFred aspenNo ratings yet

- Private Equity - Micro LendingDocument32 pagesPrivate Equity - Micro LendingAtal Kishore SharmaNo ratings yet

- Pakistan National Accountability Bureau (NAB) Ordinance 1999 PDFDocument9 pagesPakistan National Accountability Bureau (NAB) Ordinance 1999 PDFNaeem IqbalNo ratings yet

- HDFCDocument21 pagesHDFCSouparna ChakrabortyNo ratings yet

- FA2 Revision Question 3Document8 pagesFA2 Revision Question 3miss ainaNo ratings yet

- Plastic Money and Paper MoneyDocument48 pagesPlastic Money and Paper MoneyAnjali PanchalNo ratings yet

- MEEZAN Bank PakistanDocument11 pagesMEEZAN Bank PakistanAli ShahidNo ratings yet

- Adventa Berhad Annual Report 2019Document7 pagesAdventa Berhad Annual Report 2019Shobee Anne Angeles BalogoNo ratings yet

- Real Bubble PDFDocument0 pagesReal Bubble PDFBhavesh KhodiyarNo ratings yet

- 1) History: Evolution of Indian Banking SectorDocument8 pages1) History: Evolution of Indian Banking SectorPuneet SharmaNo ratings yet

- Monetary Policy in India PDFDocument9 pagesMonetary Policy in India PDFNo NoNo ratings yet

- Boards and Shareholders in European Listed Companies PDFDocument454 pagesBoards and Shareholders in European Listed Companies PDFМилена СпасовскаNo ratings yet

- Prepared By: Puneet Sharma Vinay Patidar Viyappu Tharun Siddharth Khandelwal Rishu SinghDocument23 pagesPrepared By: Puneet Sharma Vinay Patidar Viyappu Tharun Siddharth Khandelwal Rishu SinghVasantha NaikNo ratings yet

- NCBA 3 Central Bank V CA Fernandez JaymeDocument6 pagesNCBA 3 Central Bank V CA Fernandez JaymeCol. McCoyNo ratings yet

- Analyst - JDDocument2 pagesAnalyst - JDShiva Kumar DunaboinaNo ratings yet

- Topic 1: & Overview of Financial SystemDocument71 pagesTopic 1: & Overview of Financial SystemSarifah SaidsaripudinNo ratings yet

- Allied Bank ProjectDocument47 pagesAllied Bank ProjectChaudry RazaNo ratings yet

- Income From Business & ProfessionDocument32 pagesIncome From Business & ProfessionauditNo ratings yet

- 3b Asyraf Wajdi DusukiDocument21 pages3b Asyraf Wajdi DusukispucilbrozNo ratings yet

- Moni GuptaDocument100 pagesMoni GuptaTasmay EnterprisesNo ratings yet

- Module 1 Week 12 Business FinanceDocument12 pagesModule 1 Week 12 Business FinanceRocelyn ManatadNo ratings yet

- HIMCOPS CCTNS-Vol 2Document88 pagesHIMCOPS CCTNS-Vol 2tarunpsm1No ratings yet

- Anatomia de Un Plan de Negocio - Linda Pinson PDFDocument282 pagesAnatomia de Un Plan de Negocio - Linda Pinson PDFJose Samuel96% (25)

- Kotter's Eight Stages: CreateDocument1 pageKotter's Eight Stages: CreateMOHAN VAMSI SANAPALANo ratings yet

- Bfs2 Evolution of Banking in IndiaDocument26 pagesBfs2 Evolution of Banking in IndiaRitesh RamanNo ratings yet

- ToyworldDocument3 pagesToyworldVinay MohanNo ratings yet

- CV - Rangga GanesatriaDocument7 pagesCV - Rangga GanesatriaAnkit LalwaniNo ratings yet

- AAF116 BuyersInformationSheet V01Document2 pagesAAF116 BuyersInformationSheet V01JP PalamNo ratings yet

- Banking & Business Review May '10Document78 pagesBanking & Business Review May '10Fa HianNo ratings yet

Virtual Banking-SG Overview PDF

Virtual Banking-SG Overview PDF

Uploaded by

InezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Virtual Banking-SG Overview PDF

Virtual Banking-SG Overview PDF

Uploaded by

InezCopyright:

Available Formats

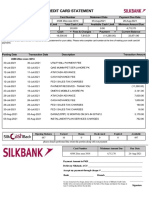

A bank which provides all its facilities… 2013-2017 Dec’14 Jul’17 May’19 Apply by Aug’19

Rise of ”challenger” Launch of China’s 2 million+ accounts 8 virtual banking for 2 full and 3

banks paving the first virtual bank within 2 weeks of licenses granted wholesale licenses.

way for virtual backed by Tencent launch, backed by (30+ applicants), Interested: Singtel,

banking ecosystem Tencent & Alibaba JVs & foreign- Grab, Razer,

backing trends Validus, InstaRem.

Through mobile/

Online tablet apps

Edge in... Concerns in…

• Offering financial services to the underbanked & • Tendency of having high loan-to-asset ratio given the

underserved segments e.g. foreign workers ease of loan application and limited capital

Typically no

• Faster transfers and loans, especially for SMEs • Lack of face-to-face identity validation increasing risk

physical

• Offering new products, quickly adapting to clients’ of identity theft, smurfing, and other financial crimes

branches

needs due to agility provided by fully online setup • Data privacy and liabilities – a digital bank is able to

• Well-designed applications and excellent user collect a lot more data; how it is used and required

experience, including 24/7 availability infrastructures to safeguard it need to be in place

“Competition and innovation has to be aimed

at serving the needs of society and the economy better.”

Senior Minister & Chairman, Monetary Authority of Singapore, Tharman Expected impacts Possible response by incumbents

Shanmugaratnam – June 2019

• Shift of SMEs, transfers and remittances, as well as a • Partnership – incumbents can render credibility and

* portion of millennial clients to the digital bank KYC resources while benefitting from data & future

7 out of 10 Singaporeans • Pressure to be felt more by smaller retail banks rather conversion once clients’ banking needs diversified

are open to new digital platforms* than the 3 major incumbents as they are generally • Establish a separate ring-fenced setup to complement

well-positioned digitally existing offerings and capture new market or perform

• Overall increase in expectations for rapid onboarding, additional client segmentation

and personalized service – fueling innovation for • Review and identify ways to migrate away from legacy

*higher than global average (Oracle 2018 The New Digital Demand report) improved profitability and user experience infrastructures and transition clients to be more nimble

You might also like

- Initiate Business Checking: Important Account InformationDocument4 pagesInitiate Business Checking: Important Account InformationWeb TreamicsNo ratings yet

- Statement Nov 2021Document3 pagesStatement Nov 2021abhishek barmanNo ratings yet

- Fintech Landscape: Ashish Fafadia Kartikeya Shekhar Sujay ChoubeyDocument27 pagesFintech Landscape: Ashish Fafadia Kartikeya Shekhar Sujay ChoubeyGaurav Ahirkar100% (1)

- Credit Card StatementDocument3 pagesCredit Card StatementSaifullah Saifi0% (1)

- Accenture Digital Payments Transformation From Transaction InteractionDocument32 pagesAccenture Digital Payments Transformation From Transaction InteractionSweta AggarwallNo ratings yet

- Digital SWOT AnalysisDocument3 pagesDigital SWOT Analysisdanny lastNo ratings yet

- Digital Banking Playbook Final 1Document21 pagesDigital Banking Playbook Final 1hiteshgoel100% (2)

- 10th CRM Panayiotou PresentationDocument22 pages10th CRM Panayiotou PresentationKpessou GuihonNo ratings yet

- Global Trends in The Cards and Payments Industry 2020Document40 pagesGlobal Trends in The Cards and Payments Industry 2020Naman JainNo ratings yet

- Banking Business Model CanvasDocument1 pageBanking Business Model CanvasSetiyo BirowoNo ratings yet

- Real Time Payments Slip SheetDocument4 pagesReal Time Payments Slip SheetoctavioNo ratings yet

- Winter Internship Program: Industry Analysis To Cater The Clients' Requirements For M&A, PE/VC Fund RaisingDocument31 pagesWinter Internship Program: Industry Analysis To Cater The Clients' Requirements For M&A, PE/VC Fund RaisingAVINASH JHANo ratings yet

- Fintech Business and Paymentsstrategy PDFDocument30 pagesFintech Business and Paymentsstrategy PDFetebark h/michaleNo ratings yet

- Team2 ICLA Phase1Document3 pagesTeam2 ICLA Phase1Sweta SanganeriaNo ratings yet

- RBI Circulars March 2023Document8 pagesRBI Circulars March 2023Udya singhNo ratings yet

- Kabir-Kumar (BB Conf Pres)Document30 pagesKabir-Kumar (BB Conf Pres)akbersundraniNo ratings yet

- DCB New 2Document10 pagesDCB New 2Varad HingolikarNo ratings yet

- Sacco Growth and Profitability Through IctDocument61 pagesSacco Growth and Profitability Through IctSirengo MauriceNo ratings yet

- A Study On Retail Finance - Group4 - Section 1Document32 pagesA Study On Retail Finance - Group4 - Section 1Kitto TurtleNo ratings yet

- Axis Mission Statement:: PortfolioDocument5 pagesAxis Mission Statement:: PortfolioHimesh BhaiNo ratings yet

- In Fs Digital India Disruption NoexpDocument36 pagesIn Fs Digital India Disruption Noexpatique mohammedNo ratings yet

- Artificial Intelligence IN Financial Sector: Shantanu KrishnaDocument25 pagesArtificial Intelligence IN Financial Sector: Shantanu Krishnakuppani abhiNo ratings yet

- Payments 2025 & Beyond: Evolution To Revolution: Six Macro Trends Shaping The Future of Payments in VietnamDocument17 pagesPayments 2025 & Beyond: Evolution To Revolution: Six Macro Trends Shaping The Future of Payments in VietnamĐăng HuyNo ratings yet

- Digital Transformation For The Insurance Industry PDFDocument10 pagesDigital Transformation For The Insurance Industry PDFAsser El-FoulyNo ratings yet

- In Tax Presentation FinTax Hour Banking 13july 2022 NoexpDocument24 pagesIn Tax Presentation FinTax Hour Banking 13july 2022 NoexpSina FardiNo ratings yet

- Fin Tech 1 To 30Document428 pagesFin Tech 1 To 30Harshil MehtaNo ratings yet

- Shri Devi Institude of TechnologyDocument15 pagesShri Devi Institude of TechnologySameer MilanNo ratings yet

- Accelerate Digital Transformation: Finacle Corporate Banking SuiteDocument24 pagesAccelerate Digital Transformation: Finacle Corporate Banking SuiteManik TandonNo ratings yet

- Blume-Fintech RPRT - Aug 2020Document27 pagesBlume-Fintech RPRT - Aug 2020Rajesh DuttaNo ratings yet

- Class 2 Group 10 Project 2Document10 pagesClass 2 Group 10 Project 2Debankar MoulikNo ratings yet

- Fintech 400 PDFDocument410 pagesFintech 400 PDFHarshil MehtaNo ratings yet

- Good One 1Document21 pagesGood One 1Bhavik PrajapatiNo ratings yet

- Future of BankingDocument6 pagesFuture of BankingJanu PriyaNo ratings yet

- (ASTRA) Tantangan Digital Leadership Di Era Transformasi DigitalDocument10 pages(ASTRA) Tantangan Digital Leadership Di Era Transformasi DigitalSigit PoernomoNo ratings yet

- Next Wave BankingDocument8 pagesNext Wave BankingAbhishek CANewNo ratings yet

- Group 5: Digital Business TransformationDocument12 pagesGroup 5: Digital Business TransformationArunima SinghNo ratings yet

- Ey Fintech Compendium: Demystifying Fintech Use Cases For BankingDocument40 pagesEy Fintech Compendium: Demystifying Fintech Use Cases For BankingccmehtaNo ratings yet

- DivF Group5 ESDADocument13 pagesDivF Group5 ESDAabhinav.akr5No ratings yet

- Lending and Leasing Top 10 Trends 2017 WebDocument28 pagesLending and Leasing Top 10 Trends 2017 WebGherasim BriceagNo ratings yet

- Fintech Sessions 11 - 20Document24 pagesFintech Sessions 11 - 20Taksh DhamiNo ratings yet

- Siva PPT (Swot Analysis)Document8 pagesSiva PPT (Swot Analysis)Priya RajNo ratings yet

- Fin TechDocument32 pagesFin Techkritigupta.may1999No ratings yet

- 2019 12 Analyst DayDocument152 pages2019 12 Analyst Dayparesh shiral100% (2)

- The Changing Face of BankingDocument12 pagesThe Changing Face of BankingAsish Dash100% (1)

- Us Ai Transforming Future of BankingDocument13 pagesUs Ai Transforming Future of BankingminhNo ratings yet

- Fintech InnovationDocument20 pagesFintech InnovationGiorgioNo ratings yet

- BOB JUPITOR-combinedDocument16 pagesBOB JUPITOR-combinedharshNo ratings yet

- Impact of Digital Banks On Incumbents in SingaporeDocument20 pagesImpact of Digital Banks On Incumbents in SingaporeVarun MittalNo ratings yet

- (IBM) Ibm Banking Overview Final Version For FTUDocument18 pages(IBM) Ibm Banking Overview Final Version For FTUEcom FtuNo ratings yet

- Fintech Landscape: Ashish Fafadia Kartikeya Shekhar Sujay ChoubeyDocument27 pagesFintech Landscape: Ashish Fafadia Kartikeya Shekhar Sujay Choubeydevang bohraNo ratings yet

- Fintechresearchreport 181002173055Document6 pagesFintechresearchreport 181002173055Seth KlarmanNo ratings yet

- MACR Presentation Group 3Document8 pagesMACR Presentation Group 3anish mahtoNo ratings yet

- Case StudyDocument2 pagesCase StudySunil BaxiNo ratings yet

- Financial Services IndustryDocument17 pagesFinancial Services IndustryShrutiNo ratings yet

- Artificial Intelligen Ce in Financial Secto R: Shantanu KrishnaDocument25 pagesArtificial Intelligen Ce in Financial Secto R: Shantanu KrishnasalekingNo ratings yet

- Evolve Business Model Modern Core Platform WPDocument23 pagesEvolve Business Model Modern Core Platform WPMutaz BakriNo ratings yet

- 8-15 Sept - WeeklyDocument11 pages8-15 Sept - Weeklyshivangisingh9857No ratings yet

- Backbase Winning Strategies To Jumpstart Your Digital Transformation Microsoft EbookDocument35 pagesBackbase Winning Strategies To Jumpstart Your Digital Transformation Microsoft Ebooks4shivNo ratings yet

- School of Management & Entrepreneurship Shiv Nadar UniversityDocument21 pagesSchool of Management & Entrepreneurship Shiv Nadar UniversityPrasun SharmaNo ratings yet

- Treasury FunctionDocument4 pagesTreasury FunctionBhanu RavuriNo ratings yet

- Mobile Wallet InteroperabilityDocument8 pagesMobile Wallet InteroperabilityFred aspenNo ratings yet

- Private Equity - Micro LendingDocument32 pagesPrivate Equity - Micro LendingAtal Kishore SharmaNo ratings yet

- Pakistan National Accountability Bureau (NAB) Ordinance 1999 PDFDocument9 pagesPakistan National Accountability Bureau (NAB) Ordinance 1999 PDFNaeem IqbalNo ratings yet

- HDFCDocument21 pagesHDFCSouparna ChakrabortyNo ratings yet

- FA2 Revision Question 3Document8 pagesFA2 Revision Question 3miss ainaNo ratings yet

- Plastic Money and Paper MoneyDocument48 pagesPlastic Money and Paper MoneyAnjali PanchalNo ratings yet

- MEEZAN Bank PakistanDocument11 pagesMEEZAN Bank PakistanAli ShahidNo ratings yet

- Adventa Berhad Annual Report 2019Document7 pagesAdventa Berhad Annual Report 2019Shobee Anne Angeles BalogoNo ratings yet

- Real Bubble PDFDocument0 pagesReal Bubble PDFBhavesh KhodiyarNo ratings yet

- 1) History: Evolution of Indian Banking SectorDocument8 pages1) History: Evolution of Indian Banking SectorPuneet SharmaNo ratings yet

- Monetary Policy in India PDFDocument9 pagesMonetary Policy in India PDFNo NoNo ratings yet

- Boards and Shareholders in European Listed Companies PDFDocument454 pagesBoards and Shareholders in European Listed Companies PDFМилена СпасовскаNo ratings yet

- Prepared By: Puneet Sharma Vinay Patidar Viyappu Tharun Siddharth Khandelwal Rishu SinghDocument23 pagesPrepared By: Puneet Sharma Vinay Patidar Viyappu Tharun Siddharth Khandelwal Rishu SinghVasantha NaikNo ratings yet

- NCBA 3 Central Bank V CA Fernandez JaymeDocument6 pagesNCBA 3 Central Bank V CA Fernandez JaymeCol. McCoyNo ratings yet

- Analyst - JDDocument2 pagesAnalyst - JDShiva Kumar DunaboinaNo ratings yet

- Topic 1: & Overview of Financial SystemDocument71 pagesTopic 1: & Overview of Financial SystemSarifah SaidsaripudinNo ratings yet

- Allied Bank ProjectDocument47 pagesAllied Bank ProjectChaudry RazaNo ratings yet

- Income From Business & ProfessionDocument32 pagesIncome From Business & ProfessionauditNo ratings yet

- 3b Asyraf Wajdi DusukiDocument21 pages3b Asyraf Wajdi DusukispucilbrozNo ratings yet

- Moni GuptaDocument100 pagesMoni GuptaTasmay EnterprisesNo ratings yet

- Module 1 Week 12 Business FinanceDocument12 pagesModule 1 Week 12 Business FinanceRocelyn ManatadNo ratings yet

- HIMCOPS CCTNS-Vol 2Document88 pagesHIMCOPS CCTNS-Vol 2tarunpsm1No ratings yet

- Anatomia de Un Plan de Negocio - Linda Pinson PDFDocument282 pagesAnatomia de Un Plan de Negocio - Linda Pinson PDFJose Samuel96% (25)

- Kotter's Eight Stages: CreateDocument1 pageKotter's Eight Stages: CreateMOHAN VAMSI SANAPALANo ratings yet

- Bfs2 Evolution of Banking in IndiaDocument26 pagesBfs2 Evolution of Banking in IndiaRitesh RamanNo ratings yet

- ToyworldDocument3 pagesToyworldVinay MohanNo ratings yet

- CV - Rangga GanesatriaDocument7 pagesCV - Rangga GanesatriaAnkit LalwaniNo ratings yet

- AAF116 BuyersInformationSheet V01Document2 pagesAAF116 BuyersInformationSheet V01JP PalamNo ratings yet

- Banking & Business Review May '10Document78 pagesBanking & Business Review May '10Fa HianNo ratings yet