Professional Documents

Culture Documents

ROI Exercise 2 Solution

ROI Exercise 2 Solution

Uploaded by

Ahmed El Khateeb0 ratings0% found this document useful (0 votes)

25 views2 pagesThe document summarizes financial information for Dark Shadows Inc. for 2014, including sales, expenses, assets, and required rate of return. It then calculates margin, turnover, return on investment, and residual income. Finally, it considers a proposed investment to increase assets by $600,000, recalculating sales, expenses, income, and ROI. The recalculated ROI of 14.86% is below the required 20%, so the investment is not recommended.

Original Description:

thanks

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes financial information for Dark Shadows Inc. for 2014, including sales, expenses, assets, and required rate of return. It then calculates margin, turnover, return on investment, and residual income. Finally, it considers a proposed investment to increase assets by $600,000, recalculating sales, expenses, income, and ROI. The recalculated ROI of 14.86% is below the required 20%, so the investment is not recommended.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

25 views2 pagesROI Exercise 2 Solution

ROI Exercise 2 Solution

Uploaded by

Ahmed El KhateebThe document summarizes financial information for Dark Shadows Inc. for 2014, including sales, expenses, assets, and required rate of return. It then calculates margin, turnover, return on investment, and residual income. Finally, it considers a proposed investment to increase assets by $600,000, recalculating sales, expenses, income, and ROI. The recalculated ROI of 14.86% is below the required 20%, so the investment is not recommended.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

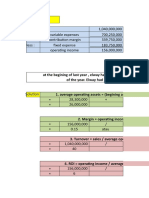

The following information provided by Dark Shadows Inc on Dec.31 2014.

Sales 2,640,000

Operating expenses 1,960,000

Average Operating assets 4,000,000

Required Rate of Return 20%

Instructions:

1. Calculate Margin, Turnover and Return on Investment.

2. Calculate Residual Income.

3. Dark Shadows Inc. planning to increase Average Operating Assets $600,000 during

2015. The estimations of managerial accountant that this investment will increase Net

Sales by 15% and Operating Expenses 20%. Do you recommend this investment? Show

your calculations.

1. Margin = net operating income/sales

= (2,640,000 – 1,960,000)/2,640,000 = 25.76% rounded

Turnover= Sales/average operating assets

= 2,640,000/4,000,000 = 66%

ROI = Margin x turnover = 0.2576 x 0.66 = 17.0016%

Or

680,000/4,000,000 = 17%

2. Residual income = net operating income – (A.O.A x R.R.R)

)x 0.20 4,000,000( – 680,000 =

( = 800,000 – 680,000 =

)120,000

3. New figures

New A.O.A = 4,000,000 + 600,000 = 4,600,000

New sales = (2,640,000 x 15%) + 2,640,000 = 3,036,000

New operating expenses = (1,960,000 x 20%) + 1,960,000 = 2,352,000

New operating income = 3,036,000 – 2,352,000 = 684,000

ROI = 684,000/ 4,600,000 = 14.86% we should reject the new investment

You might also like

- Activity - Penury CompanyDocument1 pageActivity - Penury CompanyLydevia Kigangan DiwanNo ratings yet

- M3 Activity 1Document6 pagesM3 Activity 1Ruffa May GonzalesNo ratings yet

- Kelompok 6 - Tugas Week 11 - Akuntansi Manajemen - LDocument4 pagesKelompok 6 - Tugas Week 11 - Akuntansi Manajemen - LRictu SempakNo ratings yet

- Responsibility AccountingDocument10 pagesResponsibility AccountingCheny MabiniNo ratings yet

- 8a. Responsibility and Segment Accounting CRDocument20 pages8a. Responsibility and Segment Accounting CRAngelica Gaspay EstalillaNo ratings yet

- DocxDocument6 pagesDocxLeo Sandy Ambe CuisNo ratings yet

- Some Solved Problems and Statement From Tabular AnalysisDocument9 pagesSome Solved Problems and Statement From Tabular AnalysisSubrata RoyNo ratings yet

- Man ConDocument24 pagesMan ConCho Andrea100% (1)

- Presentacion CapitalDocument11 pagesPresentacion CapitalLiliana Martínez LiraNo ratings yet

- This Study Resource Was: Tutorial 1Document4 pagesThis Study Resource Was: Tutorial 1Ahmed El KhateebNo ratings yet

- Risk Assessment and Pooling - Book 2Document21 pagesRisk Assessment and Pooling - Book 2Ahmed El KhateebNo ratings yet

- Tutorial Solutions Week 5Document9 pagesTutorial Solutions Week 5Mangala PrasetiaNo ratings yet

- Seminar in Management AccountingDocument6 pagesSeminar in Management AccountinglolaNo ratings yet

- Exercise 1Document4 pagesExercise 1Nyster Ann RebenitoNo ratings yet

- Exercise Topic 4Document10 pagesExercise Topic 4TEIK LOONG KHORNo ratings yet

- Sample ProblemDocument4 pagesSample ProblemLealyn CuestaNo ratings yet

- 13 Roi, Ri, EvaDocument32 pages13 Roi, Ri, EvaANSuciZahra100% (1)

- BASTRCSX Module 6 Self-Test Responsibility Accounting Part 2Document8 pagesBASTRCSX Module 6 Self-Test Responsibility Accounting Part 2Alyssa CaddawanNo ratings yet

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument12 pagesSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranNo ratings yet

- Akmen CH 12 KelarDocument19 pagesAkmen CH 12 KelarFadhliyaFNo ratings yet

- Segment Reporting, Decentralization and The Balanced ScorecardDocument20 pagesSegment Reporting, Decentralization and The Balanced ScorecardSneha SureshNo ratings yet

- MUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeDocument3 pagesMUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeRismayantiNo ratings yet

- Ch04 Consolidation TechniquesDocument54 pagesCh04 Consolidation TechniquesRizqita Putri Ramadhani0% (1)

- Answer KeyDocument19 pagesAnswer KeyRenNo ratings yet

- Ratio AnalysisDocument2 pagesRatio Analysisswapnil choubeyNo ratings yet

- Akmen Chapter 12 (Putri Ramadhani)Document22 pagesAkmen Chapter 12 (Putri Ramadhani)Putri RamadhaniNo ratings yet

- 3 Chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisDocument3 pages3 Chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisShenedy Lauresta QuizanaNo ratings yet

- EXERCISE 12-2 (15 Minutes)Document9 pagesEXERCISE 12-2 (15 Minutes)Mari Louis Noriell MejiaNo ratings yet

- Business Finance Week 4: Financial Ratios Analysis and Interpretation Background Information For LearnersDocument8 pagesBusiness Finance Week 4: Financial Ratios Analysis and Interpretation Background Information For LearnersCarl Daniel DoromalNo ratings yet

- Chapter 2 Financial Statements Cash Flow and TaxesDocument7 pagesChapter 2 Financial Statements Cash Flow and TaxesM. HasanNo ratings yet

- Exercise 3. Cash Flows Statements and WorkingDocument8 pagesExercise 3. Cash Flows Statements and WorkingQuang Dũng NguyễnNo ratings yet

- Acct 3503 Test 2 Format, Instuctions and Review Section A FridayDocument22 pagesAcct 3503 Test 2 Format, Instuctions and Review Section A Fridayyahye ahmedNo ratings yet

- Accounting and Finance Tugas Kelompok #3 Chapter 6 Financial Planning and ForecastingDocument10 pagesAccounting and Finance Tugas Kelompok #3 Chapter 6 Financial Planning and Forecastingbudiman100% (1)

- Solution: Year Cash Inflows Present Value Factor Present Value $ @10% $Document10 pagesSolution: Year Cash Inflows Present Value Factor Present Value $ @10% $Waylee CheroNo ratings yet

- Responsibility Accounting and Transfer PricingDocument26 pagesResponsibility Accounting and Transfer PricingfoglaabhishekNo ratings yet

- Accounting and Financial ManagementDocument7 pagesAccounting and Financial ManagementMelokuhle MhlongoNo ratings yet

- GainersDocument17 pagesGainersborn2grow100% (1)

- Management Accounting: Segment Reporting & DecentralizationDocument20 pagesManagement Accounting: Segment Reporting & DecentralizationSamiul AzamNo ratings yet

- 124 Final Practice v2 SolutionDocument5 pages124 Final Practice v2 SolutiondrakowamNo ratings yet

- RADHA Financial ASSIGNMENTDocument4 pagesRADHA Financial ASSIGNMENTradha sharmaNo ratings yet

- Lec 3 After Mid TermDocument11 pagesLec 3 After Mid TermsherygafaarNo ratings yet

- AMA Lecture 2Document54 pagesAMA Lecture 2Mohammed FouadNo ratings yet

- Fin Strategy Ass 1Document3 pagesFin Strategy Ass 1mqondisi nkabindeNo ratings yet

- AssignmentDocument11 pagesAssignmentkireeti415No ratings yet

- Special Allowable Itemized DeductionsDocument13 pagesSpecial Allowable Itemized DeductionsSandia EspejoNo ratings yet

- Responsibilty AccountingDocument3 pagesResponsibilty AccountingRenu PoddarNo ratings yet

- Case Study Accounting Oart2Document5 pagesCase Study Accounting Oart2Vero MinaNo ratings yet

- Fundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFDocument38 pagesFundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFcolonizeverseaat100% (13)

- Business ApplicationsDocument14 pagesBusiness Applicationsrommel legaspi100% (2)

- CASE 5-33 Solution: Nabeeda ShaheenDocument4 pagesCASE 5-33 Solution: Nabeeda ShaheenhadiNo ratings yet

- PaybackDocument14 pagesPaybackHema LathaNo ratings yet

- Strategic Cost Management Practical Applications DagpilanDocument6 pagesStrategic Cost Management Practical Applications Dagpilancarol indanganNo ratings yet

- ReportDocument4 pagesReportAlly M. EulalioNo ratings yet

- Tagpuno, RIki Jonas - Decentralized OperationsDocument6 pagesTagpuno, RIki Jonas - Decentralized OperationsrikitagpunoNo ratings yet

- Capital Budgeting - Problems & SolutionsDocument7 pagesCapital Budgeting - Problems & SolutionsbonduamrutharaoNo ratings yet

- Responsibility and Segment Accounting CRDocument24 pagesResponsibility and Segment Accounting CRAshy LeeNo ratings yet

- Profitability RatiosDocument4 pagesProfitability RatiosShakthiNo ratings yet

- Work Book of Corporate Financial Accounting 23-04-2022Document33 pagesWork Book of Corporate Financial Accounting 23-04-2022SWAPNIL JADHAVNo ratings yet

- Accounting For Financial ManagementDocument42 pagesAccounting For Financial ManagementTIDURLANo ratings yet

- Practice Questions-Chap 3Document9 pagesPractice Questions-Chap 3Luvnica VermaNo ratings yet

- 2008 Acct 212 Chapter 10 Resp Accg NotesDocument6 pages2008 Acct 212 Chapter 10 Resp Accg NotesBrandon HookerNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- This Study Resource Was: AFX3355 Property InvestmentDocument6 pagesThis Study Resource Was: AFX3355 Property InvestmentAhmed El KhateebNo ratings yet

- Case Study: Crowdfunding KENYA: Aidana Koshenova Sarah Nesrala Melvin Carrasquillo Felman Antonio Ruiz RodriguezDocument13 pagesCase Study: Crowdfunding KENYA: Aidana Koshenova Sarah Nesrala Melvin Carrasquillo Felman Antonio Ruiz RodriguezAhmed El KhateebNo ratings yet

- CH 3Document56 pagesCH 3Ahmed El KhateebNo ratings yet

- Mini Case Crowdfunding KenyaDocument11 pagesMini Case Crowdfunding KenyaAhmed El KhateebNo ratings yet

- Chapter 18 - International Capital BudgetingDocument91 pagesChapter 18 - International Capital BudgetingAhmed El KhateebNo ratings yet

- Chapter 3 2ndDocument40 pagesChapter 3 2ndAhmed El KhateebNo ratings yet

- Risk and Managerial (Real) Options in Capital Budgeting Risk and Managerial (Real) Options in Capital BudgetingDocument42 pagesRisk and Managerial (Real) Options in Capital Budgeting Risk and Managerial (Real) Options in Capital BudgetingAhmed El KhateebNo ratings yet

- Cost Accounting: Sixteenth Edition, Global EditionDocument32 pagesCost Accounting: Sixteenth Edition, Global EditionAhmed El KhateebNo ratings yet

- CH 1Document33 pagesCH 1Ahmed El KhateebNo ratings yet

- Operations Management OPIM 330: Chapter 8-CDocument25 pagesOperations Management OPIM 330: Chapter 8-CAhmed El KhateebNo ratings yet

- The Theory and Practice of Corporate Finance: Evidence From The FieldDocument30 pagesThe Theory and Practice of Corporate Finance: Evidence From The FieldAhmed El KhateebNo ratings yet

- Chap 015Document21 pagesChap 015Ahmed El KhateebNo ratings yet

- Corporations: Organization and Capital Stock Transactions: Accounting Principles, Ninth EditionDocument33 pagesCorporations: Organization and Capital Stock Transactions: Accounting Principles, Ninth EditionAhmed El KhateebNo ratings yet

- Risk Handling Techniques - Book 2Document17 pagesRisk Handling Techniques - Book 2Ahmed El KhateebNo ratings yet

- Math 131 Pencastreview3!8!11Document10 pagesMath 131 Pencastreview3!8!11Ahmed El KhateebNo ratings yet

- Chapter 4 MDocument39 pagesChapter 4 MAhmed El KhateebNo ratings yet

- m07 Rend6289 10 Im c07Document16 pagesm07 Rend6289 10 Im c07Ahmed El KhateebNo ratings yet

- m04 Rend6289 10 Im c04Document7 pagesm04 Rend6289 10 Im c04Ahmed El KhateebNo ratings yet

- Government Policies and Financial Services (Commercial Banks)Document14 pagesGovernment Policies and Financial Services (Commercial Banks)Ahmed El KhateebNo ratings yet

- Financial Statements of Commercial BanksDocument24 pagesFinancial Statements of Commercial BanksAhmed El KhateebNo ratings yet

- Financial Statements of Commercial Banks IIDocument14 pagesFinancial Statements of Commercial Banks IIAhmed El KhateebNo ratings yet