Professional Documents

Culture Documents

124.caltex (Phils.) Inc. v. PNOC Shipping and Transport Corp

124.caltex (Phils.) Inc. v. PNOC Shipping and Transport Corp

Uploaded by

Michelle CosicoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

124.caltex (Phils.) Inc. v. PNOC Shipping and Transport Corp

124.caltex (Phils.) Inc. v. PNOC Shipping and Transport Corp

Uploaded by

Michelle CosicoCopyright:

Available Formats

Topic Power to Sell or Dispose of Corporate Assets

Case Name Caltex (Phils.) Inc. v. PNOC Shipping and Transport Corp.

Case No. & Date G.R. No. 150711 August 10, 2006

Ponente Carpio, J.

Petitioners CALTEX (PHILIPPINES), INC.

Respondents PNOC SHIPPING AND TRANSPORT CORPORATION

Summary PSTC and Luzon Stevedoring Corporation ("LUSTEVECO") entered into an Agreement of Assumption of

Obligations ("Agreement"). The Agreement provides that for a valuable consideration, LUSTEVECO (the

assignor) will transfer, convey, and assign unto PSTC (the assignee), all of LUSTEVECO’s business, properties

and assets. In addition, PSTC shall also assume all the obligations of LUSTEVECO with respect to the claims

enumerated in the Agreement. Among the actions enumerated is Caltex (Phils.), Inc. v. Luzon Stevedoring

Corporation wherein the IAC affirmed CFI’s ruling which directed LUSTEVECO to pay Caltex a sum of money.

When the decision became final and executory, RTC Manila issued a writ of execution in favor of Caltex.

However, the judgment was not satisfied because of the prior foreclosure of LUSTEVECO’s properties.

Caltex subsequently learned of the Agreement between PSTC and LUSTEVECO. Caltex sent successive

demands to PSTC asking for the satisfaction of the judgment rendered by the CFI. PSTC informed Caltex that

it was not a party to the civil case and thus, PSTC would not pay LUSTEVECO’s judgment debt. Thereafter,

Caltex filed a complaint for sum of money against PSTC. The RTC ruled in favor of Caltex and ordered PSTC to

pay the sums due Caltex. However, the CA reversed and ruled that Caltex has no personality to sue PSTC. It

ruled that LUSTEVECO and PSTC are the only parties who can file an action to enforce the Agreement.

The SC ruled that PSTC is liable to Caltex. Caltex may recover from PSTC under the terms of the Agreement.

When PSTC assumed all the properties, business and assets of LUSTEVECO pertaining to LUSTEVECO’s tanker

and bulk business, PSTC also assumed all of LUSTEVECO’s obligations pertaining to such business. The

Agreement specifically mentions the case between LUSTEVECO and Caltex. PSTC cannot accept the benefits

without assuming the obligations under the same Agreement. Even without the agreement, PSTC is still liable

to Caltex. The disposition of all or substantially all of the assets of a corporation is allowe d. However, the

transfer should not prejudice the creditors of the assignor. Here, all of LUSTEVECO’s business, properties and

assets pertaining to its tanker and bulk business had been assigned to PSTC without the knowledge of its

creditors. Caltex now has no other means of enforcing the judgment debt except against PSTC. If PSTC

refuses to honor its written commitment to assume the obligations of LUSTEVECO, there will be fraud on the

creditors of LUSTEVECO.

Doctrine/s The disposition of all or substantially all of the assets of a corporation is allowed under Section 40 of the

Corporation Code (Section 39, RCC). However, the transfer should not prejudice the creditors of the assignor.

The only way the transfer can proceed without prejudice to the creditors is to hold the assignee liable for the

obligations of the assignor. The acquisition by the assignee of all or substantially all of the assets of the

assignor necessarily includes the assumption of the assignor’s liabilities, unless the creditors who did not

consent to the transfer choose to rescind the transfer on the ground of fraud. To allow an assignor to transfer

all its business, properties and assets without the consent of its creditors and without requiring the assignee

to assume the assignor’s obligations will defraud the creditors. The assignment will place the assignor’s assets

beyond the reach of its creditors.

You might also like

- People Vs PetralbaDocument3 pagesPeople Vs PetralbaRaymart SalamidaNo ratings yet

- Reaction Paper To The Conjugal DictatorsDocument5 pagesReaction Paper To The Conjugal DictatorsJohn Paul PaculanNo ratings yet

- Transpo Cd-Go Chan & Co VS AboitizDocument1 pageTranspo Cd-Go Chan & Co VS AboitizDaniel M. GalzoteNo ratings yet

- PCSC vs. SandiganbayanDocument2 pagesPCSC vs. Sandiganbayanronald100% (4)

- CALTEX v. PNOC SHIPPING, GR NO. 150711, 2006-08-10Document3 pagesCALTEX v. PNOC SHIPPING, GR NO. 150711, 2006-08-10Jha NizNo ratings yet

- Caltex vs. Pnoc Shipping and Transport CorporationDocument2 pagesCaltex vs. Pnoc Shipping and Transport CorporationGela Bea BarriosNo ratings yet

- Caltex V PNOCDocument2 pagesCaltex V PNOCDick ButtkissNo ratings yet

- 38 - Forest Hills Golf Country Club V Fil-Estate PropertiesDocument2 pages38 - Forest Hills Golf Country Club V Fil-Estate PropertiesJoseph Lorenz AsuncionNo ratings yet

- Kho Vs MagbanuaDocument1 pageKho Vs MagbanuaLyka Bucalen DalanaoNo ratings yet

- 5 PLDT Vs National Telecommunications CouncilDocument4 pages5 PLDT Vs National Telecommunications CouncilMichelle CatadmanNo ratings yet

- Filipinas Port Vs Go - DigestDocument2 pagesFilipinas Port Vs Go - DigestArmand Patiño Alforque100% (2)

- Saverio vs. PuyatDocument2 pagesSaverio vs. PuyatHARing iBONNo ratings yet

- 82 Andaya Vs Rural Bank of Cabadbaran IncDocument1 page82 Andaya Vs Rural Bank of Cabadbaran IncKim Cajucom100% (1)

- Stockholders of F. Guanzon and Sons, Inc. Vs Register of Deeds of ManilaDocument2 pagesStockholders of F. Guanzon and Sons, Inc. Vs Register of Deeds of ManilaReah Shyne RefilNo ratings yet

- Grace Christian High School Vs CADocument1 pageGrace Christian High School Vs CAIan Jala Calmares0% (1)

- Grace Christian High School vs. CaDocument2 pagesGrace Christian High School vs. CaPaola Escobar100% (1)

- 8 Bernas Vs Cinco DigestDocument1 page8 Bernas Vs Cinco DigestPatricia TaduranNo ratings yet

- Digest. Sci-Nacusip vs. NWPC 269 Scra 173 (1997)Document2 pagesDigest. Sci-Nacusip vs. NWPC 269 Scra 173 (1997)IamIvy Donna PondocNo ratings yet

- Metroplex Berhad and Paxell Investment v. Sinophil CorpDocument2 pagesMetroplex Berhad and Paxell Investment v. Sinophil CorpAmina Dipantar AcmaliNo ratings yet

- Ong Yong DigestDocument6 pagesOng Yong DigestRay SantosNo ratings yet

- 146 - Nell v. Pacific Farms Inc.Document2 pages146 - Nell v. Pacific Farms Inc.MariaHannahKristenRamirezNo ratings yet

- GR 172885Document1 pageGR 172885Karen Gina DupraNo ratings yet

- San Juan Structural v. CA - G.R. No. 129459 (Case DIGEST)Document2 pagesSan Juan Structural v. CA - G.R. No. 129459 (Case DIGEST)Jezen Esther Pati50% (2)

- 13 Okol vs. Slimmer's World InternationalDocument2 pages13 Okol vs. Slimmer's World Internationaljed_sindaNo ratings yet

- Salenga V CA Facts: in A Case For Illegal Dismissal and Money Claims Against Clark Development Corporation (CDC), The LaborDocument1 pageSalenga V CA Facts: in A Case For Illegal Dismissal and Money Claims Against Clark Development Corporation (CDC), The LaborAshley CandiceNo ratings yet

- CIR Vs Manning, GR L-28398, Aug. 6, 1975Document8 pagesCIR Vs Manning, GR L-28398, Aug. 6, 1975Dario G. TorresNo ratings yet

- Wee v. Wee G.R 169345 25aug2010Document1 pageWee v. Wee G.R 169345 25aug2010Bennet BalberiaNo ratings yet

- GCC Vs AlsonsDocument2 pagesGCC Vs AlsonsLindsay MillsNo ratings yet

- Global Business Holdings, Inc. v. Surecomp Software, B.V.Document1 pageGlobal Business Holdings, Inc. v. Surecomp Software, B.V.CheCheNo ratings yet

- Iglesia Evangelica v. Bishop LazaroDocument3 pagesIglesia Evangelica v. Bishop LazaroAnonymous XvwKtnSrMR100% (1)

- Digest PNB V RitrattoDocument1 pageDigest PNB V RitrattoGRNo ratings yet

- Tan v. Sycip - G.R. No. 153468 (Case Digest)Document2 pagesTan v. Sycip - G.R. No. 153468 (Case Digest)Jezen Esther Pati100% (1)

- Banate Vs Phil Country SideDocument2 pagesBanate Vs Phil Country SideAnonymous TCXV3yTgqb80% (5)

- Long VsDocument4 pagesLong VsJaniceNo ratings yet

- Lao VS lAODocument2 pagesLao VS lAOJuris Renier MendozaNo ratings yet

- Calubad Vs Ricarcen Development Corp. GR. No. 202364, August 30, 2017Document3 pagesCalubad Vs Ricarcen Development Corp. GR. No. 202364, August 30, 2017Maryluz Cabalonga100% (1)

- Lopez Realty vs. FontechaDocument3 pagesLopez Realty vs. FontechaLincy Jane AgustinNo ratings yet

- 394 Roque V PeopleDocument1 page394 Roque V PeopleNat DuganNo ratings yet

- San Juan Structural and Steel Fabricators v. CADocument4 pagesSan Juan Structural and Steel Fabricators v. CAJustin MoretoNo ratings yet

- Reynoso Vs CA DIgestDocument3 pagesReynoso Vs CA DIgestoabeljeanmoniqueNo ratings yet

- Pse VS CaDocument1 pagePse VS CaMyrnaJoyPajoJaposNo ratings yet

- Concept Builders, Inc. Vs NLRC: G.R. No. 108734Document2 pagesConcept Builders, Inc. Vs NLRC: G.R. No. 108734Michelle Gay PalasanNo ratings yet

- Bank of Commerce v. RPN DIGESTDocument3 pagesBank of Commerce v. RPN DIGESTkathrynmaydeveza100% (1)

- Y-I Leisure Vs YuDocument3 pagesY-I Leisure Vs YuAstrid Gopo BrissonNo ratings yet

- #European V Ingenieuburo BirkhahnDocument2 pages#European V Ingenieuburo BirkhahnKareen BaucanNo ratings yet

- (COMREV) Concept Builders Vs NLRCDocument3 pages(COMREV) Concept Builders Vs NLRCWilfred MartinezNo ratings yet

- Riosa v. Tabaco La Suerte CorporationDocument3 pagesRiosa v. Tabaco La Suerte CorporationJay jogs100% (1)

- PDF 6 Case Republic Planters Bank Vs Agana Corporation LawDocument2 pagesPDF 6 Case Republic Planters Bank Vs Agana Corporation LawPatatas SayoteNo ratings yet

- Albang Development Vs Alabang Hills - DigestDocument2 pagesAlbang Development Vs Alabang Hills - DigestGladys VirandaNo ratings yet

- IameDocument1 pageIameAngel Pagaran Amar100% (2)

- Global vs. SurecompDocument3 pagesGlobal vs. SurecompButch Sui GenerisNo ratings yet

- Alabang Development Corporation v. Alabang Hills Village Association and TinioDocument1 pageAlabang Development Corporation v. Alabang Hills Village Association and TinioCheCheNo ratings yet

- 51 Bank of Commerce Vs RPNDocument5 pages51 Bank of Commerce Vs RPNDavid Antonio A. EscuetaNo ratings yet

- Leo Y. Querobin Et Al vs. COMELEC GR 218787Document4 pagesLeo Y. Querobin Et Al vs. COMELEC GR 218787Johren A. Ejan86% (7)

- Aguirre v. FQB+7, IncDocument2 pagesAguirre v. FQB+7, IncAlyanna JingcoNo ratings yet

- 4-CORPO-MISSIONARY SISTERS v. ALZONADocument1 page4-CORPO-MISSIONARY SISTERS v. ALZONACzarina Lynne YeclaNo ratings yet

- Garcia vs. Lim Chu Sing, 59 PHIL. 562, NO. 39427 FEBRUARY 24, 1934Document1 pageGarcia vs. Lim Chu Sing, 59 PHIL. 562, NO. 39427 FEBRUARY 24, 1934mark gil alpasNo ratings yet

- 172 CIR v. ManningDocument5 pages172 CIR v. ManningPio MathayNo ratings yet

- Concept Builders, Inc. Vs NLRCDocument2 pagesConcept Builders, Inc. Vs NLRCDon AmboyNo ratings yet

- Digested CaseDocument1 pageDigested CaseEhem DrpNo ratings yet

- Caltex V PNOCDocument2 pagesCaltex V PNOCI.G. Mingo MulaNo ratings yet

- CALTEX v. Luzon Stevedoring CorporationDocument1 pageCALTEX v. Luzon Stevedoring Corporationshookt panboiNo ratings yet

- Commissioner of Internal Revenue vs. PinedaDocument2 pagesCommissioner of Internal Revenue vs. PinedaMichelle CosicoNo ratings yet

- Herman D. Coloma For Petitioner. Glicerio S. Ferrer For Private RespondentsDocument5 pagesHerman D. Coloma For Petitioner. Glicerio S. Ferrer For Private RespondentsMichelle CosicoNo ratings yet

- Nicolas P. Nonato For Appellant. Gellada, Mirasol and Ravena For AppelleesDocument2 pagesNicolas P. Nonato For Appellant. Gellada, Mirasol and Ravena For AppelleesMichelle CosicoNo ratings yet

- First DivisionDocument13 pagesFirst DivisionMichelle CosicoNo ratings yet

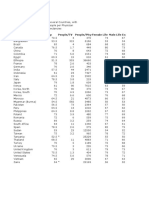

- Table 6 - 16Document52 pagesTable 6 - 16Michelle CosicoNo ratings yet

- Ross, Selph, Carrascoso and Janda For The Respondents. Bernabe Africa, Etc. For The PetitionersDocument5 pagesRoss, Selph, Carrascoso and Janda For The Respondents. Bernabe Africa, Etc. For The PetitionersMichelle CosicoNo ratings yet

- Source: International Economic ConditionsDocument1 pageSource: International Economic ConditionsMichelle CosicoNo ratings yet

- Country Life Exp People/Tv People/Physfemale Life Male Life ExpDocument2 pagesCountry Life Exp People/Tv People/Physfemale Life Male Life ExpMichelle CosicoNo ratings yet

- Actual, Forecast and Seasonally Adjusted Refrigerator Sales, UNITED STATES, 1978-1985Document4 pagesActual, Forecast and Seasonally Adjusted Refrigerator Sales, UNITED STATES, 1978-1985Michelle CosicoNo ratings yet

- Table 6 - 16Document52 pagesTable 6 - 16Michelle CosicoNo ratings yet

- Table 5 - 1Document1 pageTable 5 - 1Michelle CosicoNo ratings yet

- Table 6 - 16Document52 pagesTable 6 - 16Michelle CosicoNo ratings yet

- Capin-Cadiz Vs Brent Hospital and Colleges Inc. GR No. 187417. DigestDocument3 pagesCapin-Cadiz Vs Brent Hospital and Colleges Inc. GR No. 187417. DigestMichelle Cosico100% (2)

- TABLE 5-6 Year-To-Year Percentage Change in The Index of Hourly Earnings (Y) and The Unemployment Rate (%) (X), United States, 1958-1969Document1 pageTABLE 5-6 Year-To-Year Percentage Change in The Index of Hourly Earnings (Y) and The Unemployment Rate (%) (X), United States, 1958-1969Michelle CosicoNo ratings yet

- Source: Victor J. Elias, Sources of Growth: A Study of Seven Latin American Economies, International Center ForDocument1 pageSource: Victor J. Elias, Sources of Growth: A Study of Seven Latin American Economies, International Center ForMichelle CosicoNo ratings yet

- Restaurant Food Décor Service PriceDocument25 pagesRestaurant Food Décor Service PriceMichelle CosicoNo ratings yet

- Birla Corporation Limited and Ors Vs Adventz InvesSC201913051917184317COM857448Document26 pagesBirla Corporation Limited and Ors Vs Adventz InvesSC201913051917184317COM857448Jai VermaNo ratings yet

- (Day 31) (Final) The Inflammable Substances Act, 1952Document2 pages(Day 31) (Final) The Inflammable Substances Act, 1952Deb DasNo ratings yet

- Sections of IBC CA Final Law by CA Swapnil PatniDocument5 pagesSections of IBC CA Final Law by CA Swapnil PatniPrice JainNo ratings yet

- EsP MPS For DistrictDocument4 pagesEsP MPS For DistrictJEVIN MAE PE�ARANDANo ratings yet

- Ethics ReviewerDocument6 pagesEthics ReviewerMarianne MontefalcoNo ratings yet

- Gotesco Investment Corporation vs. ChattoDocument12 pagesGotesco Investment Corporation vs. Chattopaul esparagozaNo ratings yet

- DPWH Daang Harii - Slex Road Link Project - Mcex DTD 12-17-19 R-3234 PDFDocument143 pagesDPWH Daang Harii - Slex Road Link Project - Mcex DTD 12-17-19 R-3234 PDFbucor legalNo ratings yet

- Block 1 Lecture 1Document3 pagesBlock 1 Lecture 1ChoudhristNo ratings yet

- Deed of Absolute Sale Bod OnDocument4 pagesDeed of Absolute Sale Bod OnNeil John FelicianoNo ratings yet

- Form A - Instruction Information To Bidders - 0284 PDFDocument10 pagesForm A - Instruction Information To Bidders - 0284 PDFAl Taakhe CompanyNo ratings yet

- Capacity Building Programme For Candidates Preparing For Main Written Examination of District JudgeDocument4 pagesCapacity Building Programme For Candidates Preparing For Main Written Examination of District Judgedivyamahajan2761997No ratings yet

- ContinueDocument2 pagesContinuePrakash MishraNo ratings yet

- Civil Procedure Notes by Dean Ferdinand TanDocument51 pagesCivil Procedure Notes by Dean Ferdinand TanYannie EsparteroNo ratings yet

- The Twelve Tables PDFDocument2 pagesThe Twelve Tables PDFHelen100% (1)

- Notice: Sl. No. Roll No. Name of The CandidateDocument3 pagesNotice: Sl. No. Roll No. Name of The CandidateDipayan ChakrabortyNo ratings yet

- Extrajudicial Settlement Miguel MaligDocument4 pagesExtrajudicial Settlement Miguel MaligLance RafaelNo ratings yet

- Case Analysis of Mohd Hanif Qureshi V. State of Bihar (1958)Document9 pagesCase Analysis of Mohd Hanif Qureshi V. State of Bihar (1958)ARCHITHA SURESHNo ratings yet

- 637042146702650063ZODocument5 pages637042146702650063ZOAnna LisovskayaNo ratings yet

- Petition For Correction of Clerical Error in The Certificate of Live BirthDocument2 pagesPetition For Correction of Clerical Error in The Certificate of Live BirthWreigh ParisNo ratings yet

- Bid Evaluation Report Project Flood Control Holsa Maliana Final Feb 17Document49 pagesBid Evaluation Report Project Flood Control Holsa Maliana Final Feb 17Alex PrabowoNo ratings yet

- Learning Activity No. 2 CriminologyDocument3 pagesLearning Activity No. 2 CriminologyMichael Jan BajenNo ratings yet

- HDFC ERGO General Insurance Company Limited: Claim Form - Part ADocument7 pagesHDFC ERGO General Insurance Company Limited: Claim Form - Part AchakshuNo ratings yet

- Tsi Ope Amoc Safety of LoadDocument9 pagesTsi Ope Amoc Safety of LoadAntónioAlvesNo ratings yet

- Car Insurance Terms and Conditions BDOInsureDocument9 pagesCar Insurance Terms and Conditions BDOInsureAhben BulugagaoNo ratings yet

- Bioethics 1.02 Professional Secrecy - Dr. YapDocument1 pageBioethics 1.02 Professional Secrecy - Dr. YapJennifer Pisco LiracNo ratings yet

- JijinjDocument1 pageJijinjUmang GadaraNo ratings yet

- Memorial - Appellant (SP Rai)Document16 pagesMemorial - Appellant (SP Rai)Subhendu RaiNo ratings yet

- LegionnaireDocument6 pagesLegionnaireaventurii3453No ratings yet