Professional Documents

Culture Documents

No Shortchanging Act

No Shortchanging Act

Uploaded by

Karissa TolentinoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

No Shortchanging Act

No Shortchanging Act

Uploaded by

Karissa TolentinoCopyright:

Available Formats

NO SHORTCHANGING ACT OF 2016

By: Atty. Karissa Faye Tolentino-Maxino

What is the declaration of Policy of this Act?

It is the policy of the State to protect the interest and promote the general welfare of the

consumer as well as establish standards of conduct for business and industry. Towards this end,

the State shall implement measures to achieve the following objectives:

(a) Protection of consumers against deceptive, unfair and unconscionable sales acts and

practices;

(b) Institutionalization of the industry practice of giving exact change to consumers of

goods and services;

(c) Provision of information and education to facilitate sound choice and the proper

exercise of rights by the consumer;

(d) Provision of adequate rights and means of redress for consumers; and

(e) Provision of penalties for offenders. (Sec. 2, RA No. 10909)

What are the duties of the business establishments under this Act?

It shall be the duty of the business establishment to give the exact change to the

consumer without waiting for the consumer to ask for the same.

(a) It shall be unlawful for any business establishment to shortchange a consumer, even if

such change is only of a small amount. Nothing in this Act shall be construed as a

restriction for business establishments to give an amount greater than the sufficient

change.

(b) It shall also be unlawful for any business establishment which sells goods or provides

services to give the change in any form other than the present currency or to ask the

consumers for permission to be exempted from the provisions of this Act for any reason,

including the non-availability of small bills or coins.

(c) It shall likewise be the duty of business establishments to use price tags, when

appropriate, indicating the exact retail price per unit or service which already includes the

taxes applicable to the goods or services being offered. These establishments shall also

put signs in conspicuous places within the establishments or reflect in the official receipts

issued, the taxes incorporated in the retail price per unit of goods or services. This is to

avoid misleading the consumers as to the exact price they have to pay for the goods or

services and, consequently, the exact change due them.

You might also like

- Anti-Mail Order Spouse ActDocument1 pageAnti-Mail Order Spouse ActKarissa TolentinoNo ratings yet

- Sample IRR Muffler 2-10Document4 pagesSample IRR Muffler 2-10Karissa TolentinoNo ratings yet

- The Consumer Protection Act, 1986Document5 pagesThe Consumer Protection Act, 1986Preethi neelamNo ratings yet

- Consumer Behaviour Assign 2Document7 pagesConsumer Behaviour Assign 2TENDAI MUNHAMONo ratings yet

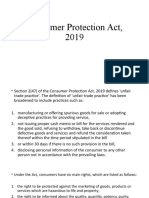

- Consumer Protection Act 2019Document5 pagesConsumer Protection Act 2019AnonymousNo ratings yet

- Consumer Protection ActDocument9 pagesConsumer Protection ActRochakNo ratings yet

- Assignment 2 - Consumer Protection ActDocument9 pagesAssignment 2 - Consumer Protection ActRochakNo ratings yet

- Copra 2019Document11 pagesCopra 2019Jatin KumarNo ratings yet

- Consumer Protection Act IC, 2019Document35 pagesConsumer Protection Act IC, 2019Debojit PalNo ratings yet

- Who Is Consumer and Objectives of Consumer Protection Act, 2019Document11 pagesWho Is Consumer and Objectives of Consumer Protection Act, 2019Kajal SinghNo ratings yet

- 1st Yr LLB - Notes The Consumer Protection ActDocument7 pages1st Yr LLB - Notes The Consumer Protection ActnamratatNo ratings yet

- 017 Aditi Pandey SEO PsdaDocument8 pages017 Aditi Pandey SEO PsdaadvocateaditipandeyNo ratings yet

- Notable Features of CpaDocument8 pagesNotable Features of Cpaan nameless artistNo ratings yet

- The New Consumer Protection Act, 2019-An AnalysisDocument11 pagesThe New Consumer Protection Act, 2019-An AnalysisAnuragNo ratings yet

- Consumer Protection Act 2019Document25 pagesConsumer Protection Act 2019ADPS PLI RO MumbaiNo ratings yet

- Differences Between 1986 Act and 2019 ActDocument11 pagesDifferences Between 1986 Act and 2019 Actproject mailNo ratings yet

- Consumer Update September October 2019Document4 pagesConsumer Update September October 2019tahasheikh822No ratings yet

- CP ActDocument3 pagesCP ActT.Gayatri Devi Guest FacultyNo ratings yet

- Consumer Protection Act 2019Document4 pagesConsumer Protection Act 2019Shubham100% (1)

- Consumer Protection Act 2019Document5 pagesConsumer Protection Act 2019mitaliNo ratings yet

- Consumer Protection Act - SimplifiedDocument4 pagesConsumer Protection Act - SimplifiedyashandwhataboutitNo ratings yet

- Consumer Protection Act 2019Document4 pagesConsumer Protection Act 2019Pranit BhagatNo ratings yet

- Consumer Protection Act, 2019Document7 pagesConsumer Protection Act, 2019roopalNo ratings yet

- New Draft Bill Consumer Protection ActDocument11 pagesNew Draft Bill Consumer Protection ActShivansh SoniNo ratings yet

- Consumer Protection Act 2019Document6 pagesConsumer Protection Act 2019Prisha BauskarNo ratings yet

- Lab Assignment 1 Ayushitiwari 20017Document4 pagesLab Assignment 1 Ayushitiwari 20017Ashmita BhartiNo ratings yet

- lcp pptDocument173 pageslcp pptYuvam GargNo ratings yet

- CONSUMER PROTECTION - 2019 - Preliminary, CouncilDocument91 pagesCONSUMER PROTECTION - 2019 - Preliminary, CouncilAmogh SanikopNo ratings yet

- Consumer Protection ActDocument15 pagesConsumer Protection ActBbbbbNo ratings yet

- Consumer Protection ActDocument16 pagesConsumer Protection ActPiyush SinglaNo ratings yet

- Importance of Consumer Protection Act - DocumentDocument14 pagesImportance of Consumer Protection Act - DocumentProf. Amit kashyap100% (9)

- Consumer Protection Act, 1986Document132 pagesConsumer Protection Act, 1986Md Enamul HasanNo ratings yet

- Session-7 CPActDocument40 pagesSession-7 CPActShivangi BhasinNo ratings yet

- Consumer Protection Act, 2019 - UPSC NotesDocument5 pagesConsumer Protection Act, 2019 - UPSC NotesBhavin KariaNo ratings yet

- Consumer Protection Act - 2019Document25 pagesConsumer Protection Act - 2019prasoon kumarNo ratings yet

- Role, Powers and Functions of Central Consumer Protection Authority: Critical AnalysisDocument5 pagesRole, Powers and Functions of Central Consumer Protection Authority: Critical AnalysisUditanshu MisraNo ratings yet

- E-Commerce in Cpa 2019Document6 pagesE-Commerce in Cpa 2019vibhu shankar kulshresthaNo ratings yet

- Nupur Gupta - Analysis of Consumer Protection ActDocument8 pagesNupur Gupta - Analysis of Consumer Protection ActNeha GuptaNo ratings yet

- Customer Protection Proclamtion AnalysisDocument7 pagesCustomer Protection Proclamtion AnalysisAbdulbasit AhmedeNo ratings yet

- Section 4, RA 10909Document1 pageSection 4, RA 10909Kenneth VillagonzaloNo ratings yet

- Business Law ..Document13 pagesBusiness Law ..Whatsapp stutsNo ratings yet

- Consumer Protection ActDocument3 pagesConsumer Protection Actvarunendra pandeyNo ratings yet

- Consumer Protection Act 2019 NotesDocument9 pagesConsumer Protection Act 2019 NotesMonuNo ratings yet

- Legal Aspect of BusinessDocument16 pagesLegal Aspect of BusinessRinki KumariNo ratings yet

- Consumer Protection Act 2019 - LMDocument10 pagesConsumer Protection Act 2019 - LMVedika SinghNo ratings yet

- Consumer Protection Act....Document5 pagesConsumer Protection Act....RISHMANo ratings yet

- Infrastructural Research Paper by Vipin Malviya B-03Document9 pagesInfrastructural Research Paper by Vipin Malviya B-03Vipin MalviyaNo ratings yet

- Consumer Protection Act, 1986Document11 pagesConsumer Protection Act, 1986Yashovardhan SinghNo ratings yet

- Consumer Protection Act, 2019Document6 pagesConsumer Protection Act, 2019Magical MakeoversNo ratings yet

- A Consumer's ConstitutionDocument2 pagesA Consumer's ConstitutionSreenidhi KrNo ratings yet

- Torts AssignmentDocument9 pagesTorts AssignmentTanya SinghNo ratings yet

- Legal Environment: Enrollment Number: NameDocument13 pagesLegal Environment: Enrollment Number: NamePRABAL BHATNo ratings yet

- Notes GSTDocument137 pagesNotes GSTKarthik VNo ratings yet

- Ope Question AnswerDocument12 pagesOpe Question AnswerSaloni ChaudharyNo ratings yet

- Economics AssignmentDocument32 pagesEconomics AssignmentSoham PatilNo ratings yet

- Consumer Protection Act 2019Document4 pagesConsumer Protection Act 2019devangNo ratings yet

- 10 Consumer Protection Act, 2019 - UPSCDocument4 pages10 Consumer Protection Act, 2019 - UPSCSatyajitSahooNo ratings yet

- Consumer Protection ActDocument3 pagesConsumer Protection Actvarunendra pandeyNo ratings yet

- Consumer P. ActDocument13 pagesConsumer P. ActrohanNo ratings yet

- I. Faculty Mr. Mohammed Azaad, Assistant Professor of Law, TNNLU. II. Rapporteur Iii. Contents of The Class A. IntroductionDocument3 pagesI. Faculty Mr. Mohammed Azaad, Assistant Professor of Law, TNNLU. II. Rapporteur Iii. Contents of The Class A. IntroductionPrakash HPNo ratings yet

- Consumer Protection in India: A brief Guide on the Subject along with the Specimen form of a ComplaintFrom EverandConsumer Protection in India: A brief Guide on the Subject along with the Specimen form of a ComplaintNo ratings yet

- SometimesDocument1 pageSometimesKarissa TolentinoNo ratings yet

- Anti-Age Discrimination in Employment ActDocument1 pageAnti-Age Discrimination in Employment ActKarissa TolentinoNo ratings yet

- June 2020 - ArsonDocument1 pageJune 2020 - ArsonKarissa TolentinoNo ratings yet

- Free Internet Access in Public Places ActDocument1 pageFree Internet Access in Public Places ActKarissa TolentinoNo ratings yet

- DAMAGESDocument1 pageDAMAGESKarissa TolentinoNo ratings yet

- Anti-Distracted Driving ActDocument1 pageAnti-Distracted Driving ActKarissa TolentinoNo ratings yet

- Property of Public DominionDocument1 pageProperty of Public DominionKarissa TolentinoNo ratings yet

- Direct AssaultDocument1 pageDirect AssaultKarissa TolentinoNo ratings yet

- What Is The Principle of Presumptive Death?Document1 pageWhat Is The Principle of Presumptive Death?Karissa TolentinoNo ratings yet

- Access To Public Spaces PDFDocument11 pagesAccess To Public Spaces PDFKarissa TolentinoNo ratings yet

- What Is Provided in The Law When It Comes To Number of Hours of Work?Document1 pageWhat Is Provided in The Law When It Comes To Number of Hours of Work?Karissa TolentinoNo ratings yet

- Exempting CircumstancesDocument1 pageExempting CircumstancesKarissa TolentinoNo ratings yet

- What Is Photo and Video Voyeurism?Document1 pageWhat Is Photo and Video Voyeurism?Karissa TolentinoNo ratings yet

- What Is Negligence?Document1 pageWhat Is Negligence?Karissa TolentinoNo ratings yet

- New SK LawDocument2 pagesNew SK LawKarissa TolentinoNo ratings yet

- Safeguards and Limitations Under The Present ConstitutionDocument1 pageSafeguards and Limitations Under The Present ConstitutionKarissa TolentinoNo ratings yet

- Affidavit of Loss Sim CardDocument1 pageAffidavit of Loss Sim CardKarissa TolentinoNo ratings yet

- Extrajudicial Settlement of Estate TemplateDocument4 pagesExtrajudicial Settlement of Estate Templateblue13_fairy100% (1)

- Sample Offer Letter - TransferDocument1 pageSample Offer Letter - TransferKarissa TolentinoNo ratings yet

- ManifestationDocument2 pagesManifestationKarissa Tolentino100% (1)

- Republic of The Philippines City of Dumaguete Office of The Sangguniang PanlungsodDocument1 pageRepublic of The Philippines City of Dumaguete Office of The Sangguniang PanlungsodKarissa TolentinoNo ratings yet