Professional Documents

Culture Documents

Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)

Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)

Uploaded by

ignaciomannyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)

Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)

Uploaded by

ignaciomannyCopyright:

Available Formats

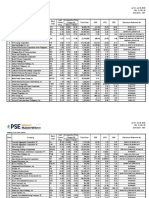

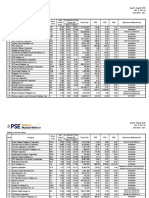

Jul 01 - Jul 05, 2019

VOL. VI NO. 27

ISSN 2013 - 1351

Weekly Top Price Gainers

Last Comparative Price

Stock

Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No.

Code

Price 1 Week 4 Weeks

1 Grand Plaza Hotel Corporation GPH 11.98 21.26 19.56 22,998 (23.29) (0.51) 0.75 No Disclosure

2 Arthaland Corporation ALCO 0.97 14.12 24.36 116,583,010 9.83 0.10 0.95 CR04074-2019, CR04205-2019

3 Marcventures Holdings, Inc. MARC 1.18 13.46 14.56 346,467,540 (9.03) (0.13) 0.93 C04759-2019, CR04271-2019

C04658-2019, CR04202-2019,

4 Philippine National Bank PNB 55.80 13.30 1.16 186,531,539 8.60 6.49 0.65 CR04252-2019, C04600-2019

5 Prime Media Holdings, Inc. PRIM 1.51 11.03 39.81 115,668,180 (43.57) (0.03) (7.45) No Disclosure

6 First Philippine Holdings Corporation FPH 91.65 10.42 19.18 283,788,050 3.88 23.63 0.47 C04758-2019

7 Oriental Petroleum and Minerals Corporation "A" OPM 0.012 9.09 - 1,161,400 46.10 0.0003 0.51 No Disclosure

8 D.M. Wenceslao & Associates, Incorporated DMW 10.58 8.51 6.33 16,352,756 18.40 0.57 1.93 CR04125-2019, C04745-2019

9 Premiere Horizon Alliance Corporation PHA 0.89 7.23 3.49 260,387,960 (6.34) (0.14) 7.23 No Disclosure

10 Cebu Landmasters, Inc. CLI 5.17 7.04 7.93 73,386,754 4.83 1.07 1.37 No Disclosure

11 Shang Properties, Inc. SHNG 3.14 6.44 5.02 9,927,950 5.15 0.61 0.46 No Disclosure

12 Aboitiz Power Corporation AP 37.00 6.32 5.41 209,570,305 12.75 2.90 2.28 C04728-2019

13 Philweb Corporation WEB 3.88 6.30 14.12 108,098,440 (93.93) (0.04) 130.18 CR04095-2019

14 MJC Investments Corporation MJIC 2.89 6.25 4.71 38,680 (13.12) (0.22) 10.14 No Disclosure

15 Cityland Development Corporation CDC 0.93 6.14 0.67 2,480,360 6.78 0.14 0.55 C04670-2019, CR04209-2019

15 Del Monte Pacific Limited DELM 6.40 6.14 16.36 5,222,988 12.98 0.49 0.42 No Disclosure

17 Universal Robina Corporation URC 176.00 6.02 4.14 636,712,730 41.76 4.22 4.87 C04756-2019

CR04092-2019, C04664-2019, C04665-2019,

18 APC Group, Inc. APC 0.53 6.00 20.45 39,930,580 (364.58) (0.001) 22.81 CR04119-2019, C04749-2019,

C04750-2019, CR04203-2019

19 Bright Kindle Resources & Investments Inc. BKR 1.26 5.88 3.28 3,153,130 (22.63) (0.06) 2.07 C04767-2019

20 Max's Group, Inc. MAXS 14.56 5.51 17.04 34,823,138 24.92 0.58 2.85 No Disclosure

21 Anglo Philippine Holdings Corporation APO 0.77 5.48 (1.28) 6,393,910 (2.91) (0.26) 0.39 No Disclosure

22 Philippine Racing Club, Inc. PRC 9.49 5.44 5.44 5,174,579 7.48 1.27 1.33 No Disclosure

23 Primex Corporation PRMX 2.24 5.16 1.82 13,108,280 49.67 0.05 3.85 No Disclosure

24 Cemex Holdings Philippines, Inc. CHP 3.07 5.14 30.08 186,579,850 (19.21) (0.16) 0.55 C04703-2019

25 Pepsi-Cola Products Philippines, Inc. PIP 1.91 4.95 55.28 128,056,360 601.05 0.003 0.77 No Disclosure

26 Paxys, Inc. PAX 3.06 4.79 0.33 1,100,260 235.18 0.01 0.91 No Disclosure

27 DFNN, Inc. DFNN 6.18 4.75 5.10 368,827 (5,085.12) (0.001) 1.85 No Disclosure

28 Metro Retail Stores Group, Inc. MRSGI 2.65 4.74 0.76 46,335,400 8.88 0.30 1.05 C04780-2019

29 PetroEnergy Resources Corporation PERC 4.75 4.63 3.94 1,988,690 5.75 0.83 0.57 No Disclosure

C04633-2019, C04674-2019, CR04132-2019,

30 A. Soriano Corporation ANS 7.00 4.48 4.48 1,138,540 8.70 0.80 0.89 CR04133-2019, C04719-2019,

C04729-2019, C04768-2019

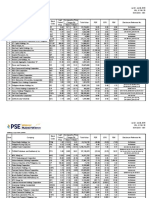

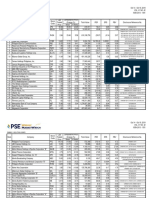

Jul 01 - Jul 05, 2019

VOL. VI NO. 27

ISSN 2013 - 1351

Weekly Top Price Losers

Last Comparative Price

Stock

Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No.

Code

Price 1 Week 4 Weeks

1 Concrete Aggregates Corporation "B" CAB 110.30 (26.47) 74.80 24,152,627 88.12 1.25 10.55 C04631-2019, CR04255-2019

2 Concrete Aggregates Corporation "A" CA 100.50 (24.61) 53.44 64,494,246 80.29 1.25 9.62 C04631-2019, CR04255-2019

3 BHI Holdings, Inc. BH 1,251.00 (15.53) - 12,510 (3,106.67) (0.40) 6.37 CR04267-2019

4 Cirtek Holdings Philippines Corporation TECH 16.50 (14.42) (33.73) 41,200,318 20.59 0.80 0.93 No Disclosure

5 Keppel Philippines Holdings, Inc. "A" KPH 4.55 (13.99) (9.00) 64,040 25.95 0.18 0.41 No Disclosure

CR04090-2019, CR04093-2019, C04678-2019,

CR04107-2019, CR04108-2019, CR04109-2019,

6 PHINMA Energy Corporation PHEN 2.20 (13.73) (12.70) 339,877,460 (22.09) (0.10) 2.02 CR04110-2019, CR04111-2019, CR04140-2019,

C04730-2019, CR04160-2019,

CR04161-2019, CR04238-2019

7 F & J Prince Holdings Corporation "A" FJP 3.91 (12.72) (13.11) 3,910 58.59 0.07 1.00 No Disclosure

8 Benguet Corporation "B" BCB 1.19 (10.53) 6.25 63,020 7.72 0.15 0.19 No Disclosure

9 Ginebra San Miguel, Inc. GSMI 57.40 (9.61) 35.22 88,002,459 11.40 5.04 2.50 No Disclosure

10 The Philodrill Corporation OV 0.010 (9.09) (9.09) 470,800 (7.34) (0.001) 0.58 No Disclosure

11 Lepanto Consolidated Mining Company "A" LC 0.110 (8.33) - 3,096,550 (10.10) (0.01) 0.98 No Disclosure

12 Victorias Milling Company, Inc. VMC 2.48 (8.15) (0.80) 697,020 7.99 0.31 1.02 C04690-2019

13 Leisure & Resorts World Corporation LR 3.80 (7.77) (11.21) 47,283,020 19.05 0.20 1.05 No Disclosure

14 Jackstones, Inc. JAS 3.00 (6.25) 2.74 429,340 (224.79) (0.01) 30.97 No Disclosure

14 Manila Mining Corporation "A" MA 0.0075 (6.25) - 414,300 (159.77) (0.00005) 0.66 No Disclosure

14 Premium Leisure Corp. PLC 0.75 (6.25) (3.85) 20,622,350 10.88 0.07 1.50 CR04219-2019, CR04247-2019

17 Lepanto Consolidated Mining Company "B" LCB 0.121 (6.20) (2.42) 680,320 (11.11) (0.01) 1.07 No Disclosure

18 PTFC Redevelopment Corporation TFC 46.00 (6.12) (6.12) 69,010 20.38 2.26 4.62 No Disclosure

19 Vulcan Industrial & Mining Corporation VUL 1.43 (5.92) 7.52 191,349,240 (2.44) (0.59) 8,459.88 CR04139-2019, C04720-2019

20 ATN Holdings, Inc. "A" ATN 1.29 (5.84) 0.78 24,753,110 18.99 0.07 2.73 CR04177-2019, CR04272-2019

21 SFA Semicon Philippines Corporation SSP 1.14 (5.79) (3.39) 4,681,490 11.55 0.10 0.42 CR04199-2019, CR04254-2019, CR04261-2019

C04704-2019, C04705-2019,

22 Asiabest Group International Inc. ABG 12.98 (5.53) (6.35) 6,401,158 (1,669.90) (0.01) 14.59 C04706-2019, C04747-2019

C04692-2019, C04693-2019,

23 Megawide Construction Corporation MWIDE 18.00 (5.36) (9.09) 216,265,904 30.42 0.59 2.57 C04694-2019, C04732-2019

24 Abra Mining and Industrial Corporation AR 0.0018 (5.26) (5.26) 901,800 (121.06) (0.00001) 0.21 No Disclosure

25 ATN Holdings, Inc. "B" ATNB 1.30 (5.11) (1.52) 7,113,270 19.14 0.07 2.75 CR04177-2019, CR04272-2019

26 Manila Mining Corporation "B" MAB 0.0076 (5.00) (1.30) 67,100 (161.90) (0.00005) 0.67 No Disclosure

C04607-2019, C04608-2019, C04609-2019,

27 Apex Mining Co., Inc. APX 1.18 (4.84) 2.61 20,272,700 37.71 0.03 1.40 C04610-2019, CR04147-2019, CR04148-2019,

CR04149-2019, CR04150-2019

28 Pacifica, Inc. PA 0.040 (4.76) 5.26 3,331,300 (608.32) (0.0001) (190.90) No Disclosure

29 Roxas Holdings, Inc. ROX 1.91 (4.50) (2.05) 163,880 (7.50) (0.25) 0.29 C04661-2019

30 IPM Holdings, Inc. IPM 5.75 (4.17) 0.88 288,045 86.66 0.07 5.26 No Disclosure

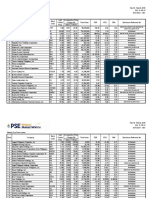

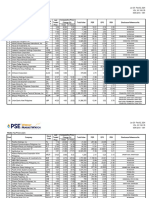

Jul 01 - Jul 05, 2019

VOL. VI NO. 27

ISSN 2013 - 1351

Weekly Market Statistics

(In pesos) June 24 - June 28 July 01 - July 05 Year-to-Date

Total Market Capitalization 17,260,000,643,933.90 17,405,023,712,051.20 17,405,023,712,051.20

Domestic Market Capitalization 14,686,913,970,799.10 14,838,378,138,097.60 14,838,378,138,097.60

Total Value Traded 51,721,224,636.13 29,410,348,238.41 962,349,297,084.86

Ave. Daily Value Traded 10,344,244,927.23 5,882,069,647.68 7,760,881,428.10

Foreign Buying 23,109,712,853.37 15,912,343,103.70 550,062,822,276.81

Foreign Selling 30,202,344,178.08 16,270,071,500.26 529,165,255,195.56

Net Foreign Buying/ (Selling) (7,092,631,324.71) (357,728,396.56) 20,897,567,081.25

% of Foreign to Total 52% 55% 56%

Number of Issues (Common shares):

123 - 103 - 24 122 - 99 - 30 151 - 100 - 6

Gainers - Losers - Unchanged

Weekly Index Performance

Comparative Change (%) YTD Change

Close PER

1 Week 4 Weeks (%)

PSEi 8,117.94 1.48 1.68 8.73 18.79

All Shares Index 4,945.68 1.06 1.12 9.47 15.36

Financials Index 1,742.01 1.27 0.30 (2.13) 13.56

Industrial Index 11,988.32 2.45 3.76 9.47 17.74

Holding Firms Index 7,797.21 1.22 1.99 6.20 16.86

Property Index 4,379.75 2.48 1.06 20.72 20.44

Services Index 1,699.04 (0.72) 1.70 17.77 18.12

Mining and Oil Index 7,439.29 (2.00) 1.96 (9.28) 13.42

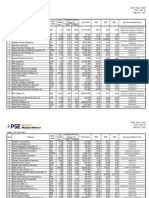

Notes:

- Top price gainers and losers only cover common shares.

- EPS (Earnings per Share) is computed as: Net Income

Outstanding Shares

PER (Price-Earnings Ratio) is computed as: Last Traded Price per Share

Earnings per Share

PBV (Price to Book Value Ratio) is computed as: Company Market Capitalization

Company Stockholders Equity (end of period)

EPS, PER and PBV use four-quarter trailing financial data.

- Total Value in Top Gainers and Losers tables refers to total value traded in the regular market.

- The disclosures cover those made from 3:31 pm, Friday of the previous week to 3:30 pm, Friday of the covered week. Information and disclosures made by the companies, as itemized in this report, may

be viewed by clicking on the links above. These may also be viewed in the “Disclosure” page of the company at the PSE website (www.pse.com.ph). To access the disclosure page, enter the stock symbol in

the symbol lookup field located at the upper right portion of the PSE website. The public is encouraged to regularly monitor subsequent developments as may be disclosed by the company in succeeding

weeks.

- Current week’s foreign transactions data are subject to amendments allowed until t+2. Previous week’s foreign transactions data have been adjusted accordingly for amendments.

- Domestic Market capitalization excludes the market capitalization of foreign domiciled companies.

The data contained in this file is collated by the Corporate Planning & Research Department of the Philippine Stock Exchange. The PSE does not make any representations or warranties, express or implied, on matters such as, but not limited to, the accuracy, timeliness, completeness, non-infringement, validity, merchantability or fitness for any particular purpose of the information and data herein contained. The PSE

assumes no liability and responsibility for any loss or damage suffered as a consequence of any errors or omissions in this file, or any decision made or action taken in reliance upon information contained herein. This document is for information purposes only, and does not constitute legal, financial or investment advice, nor intended to influence investment decisions. Independent assessment should be undertaken, and

advice from a securities professional is strongly recommended. For inquiries or suggestions on the PSE Weekly MarketWatch, you may call (632) 688-7601 to 02, send a message through fax no. (632) 688-8818 or email pirs@pse.com.ph.

You might also like

- UTIMCO Feb2023Document36 pagesUTIMCO Feb2023Manish Singh100% (3)

- Advertisement PDFDocument8 pagesAdvertisement PDFTiara Safa EarleneNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument5 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- wk35 Sep2022mktwatchDocument3 pageswk35 Sep2022mktwatchcraftersxNo ratings yet

- wk05 Jan2024mktwatchDocument3 pageswk05 Jan2024mktwatchMacxie Baldonado QuibuyenNo ratings yet

- wk38 Sep2022mktwatchDocument3 pageswk38 Sep2022mktwatchcraftersxNo ratings yet

- wk39 Sep2022mktwatchDocument3 pageswk39 Sep2022mktwatchcraftersxNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Nylinad Calubayan EstrellaNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- QuarterlyTop50 4Q 2009Document5 pagesQuarterlyTop50 4Q 2009Franz Carla NavarroNo ratings yet

- Industry Peer 2016Document13 pagesIndustry Peer 2016cherylmanapolNo ratings yet

- Investment GuideDocument2 pagesInvestment Guidegundam busterNo ratings yet

- Fundcard: Franklin India Smaller Companies FundDocument4 pagesFundcard: Franklin India Smaller Companies FundChiman RaoNo ratings yet

- QuarterlyTop50 1Q 2008Document5 pagesQuarterlyTop50 1Q 2008Franz Carla NavarroNo ratings yet

- U.S. Dividend Champions: End-Of-Month Update atDocument26 pagesU.S. Dividend Champions: End-Of-Month Update atALFONSO ARREOLANo ratings yet

- Fund Performance ActiveDocument12 pagesFund Performance ActiveFortuneNo ratings yet

- Nifty 50Document3 pagesNifty 50Arjun BhatnagarNo ratings yet

- Ark Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document1 pageArk Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)AlexHunterNo ratings yet

- Estimari Dividende 2019 22.11.2019Document4 pagesEstimari Dividende 2019 22.11.2019Bogdan BoicuNo ratings yet

- Top Story:: AEV: JERA Deal Gives AP A Competent Technical Partner, Opens Up Investment Opportunities For The GroupDocument4 pagesTop Story:: AEV: JERA Deal Gives AP A Competent Technical Partner, Opens Up Investment Opportunities For The GroupkristineNo ratings yet

- Ark Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document1 pageArk Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)minikompoNo ratings yet

- 10.05.22 ArkkDocument2 pages10.05.22 ArkkSalih GurdalNo ratings yet

- India'S Most: Valuable CompaniesDocument15 pagesIndia'S Most: Valuable CompaniesHarsh DabasNo ratings yet

- InvestmentGuide PDFDocument2 pagesInvestmentGuide PDFMon CuiNo ratings yet

- 2019 11 20 PH D PDFDocument5 pages2019 11 20 PH D PDFJNo ratings yet

- AFSADocument17 pagesAFSAshreya sarkarNo ratings yet

- The 3D Printing Etf PRNT HoldingsDocument3 pagesThe 3D Printing Etf PRNT HoldingsAlexandru SimaNo ratings yet

- 040821-SBI Press Release Q1FY22Document2 pages040821-SBI Press Release Q1FY22Prateek WadhwaniNo ratings yet

- Porfolio Rebalancing ReportDocument3 pagesPorfolio Rebalancing ReportAayushi ChandwaniNo ratings yet

- Wirdawati-B2092221017-Tugas Statistik Untuk BisnisDocument5 pagesWirdawati-B2092221017-Tugas Statistik Untuk BisnisEMI PURWANINo ratings yet

- Fintech Innovation (ARKF) HOLDINGS: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesFintech Innovation (ARKF) HOLDINGS: Company Ticker Cusip Shares Market Value ($) Weight (%)nelsonNo ratings yet

- Ark Next Generation Internet Etf Arkw HoldingsDocument2 pagesArk Next Generation Internet Etf Arkw HoldingsCheah ChenNo ratings yet

- ARK Innovation ETF: Holdings Data - ARKKDocument2 pagesARK Innovation ETF: Holdings Data - ARKKJianhua LiNo ratings yet

- Final Project For Marketing PuneetDocument21 pagesFinal Project For Marketing PuneetSankalp KayathNo ratings yet

- ARK Innovation ETF: Holdings Data - ARKKDocument2 pagesARK Innovation ETF: Holdings Data - ARKKkadaver82No ratings yet

- February 16-17, 2011 - UpdateDocument2 pagesFebruary 16-17, 2011 - UpdateJC CalaycayNo ratings yet

- Banks and Financials: As Of: 2/2/2018Document2 pagesBanks and Financials: As Of: 2/2/2018JanNo ratings yet

- AbacusShortTakes 08312022Document7 pagesAbacusShortTakes 08312022ignaciomannyNo ratings yet

- First Quarterly Report of The Keepers Holdings, Inc. Cy 2022Document73 pagesFirst Quarterly Report of The Keepers Holdings, Inc. Cy 2022ignaciomannyNo ratings yet

- LRWC-SEC 17C - Financial Highlights of Q1 2022Document4 pagesLRWC-SEC 17C - Financial Highlights of Q1 2022ignaciomannyNo ratings yet

- AbacusShortTakes 09082022Document7 pagesAbacusShortTakes 09082022ignaciomannyNo ratings yet

- Annual Report of The Keepers Holdings. Inc. For Cy 2021Document201 pagesAnnual Report of The Keepers Holdings. Inc. For Cy 2021ignaciomannyNo ratings yet

- Response To PSE Query 07 September 2022Document1 pageResponse To PSE Query 07 September 2022ignaciomannyNo ratings yet

- AbacusShortTakes 08232022Document7 pagesAbacusShortTakes 08232022ignaciomannyNo ratings yet

- Disclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)Document3 pagesDisclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)ignaciomannyNo ratings yet

- AbacusShortTakes 09212022Document5 pagesAbacusShortTakes 09212022ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- AbacusShortTakes 09092022Document6 pagesAbacusShortTakes 09092022ignaciomannyNo ratings yet

- AbacusShortTakes 10262022Document6 pagesAbacusShortTakes 10262022ignaciomannyNo ratings yet

- AbacusShortTakes 10252022Document6 pagesAbacusShortTakes 10252022ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument5 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Unit 4Document65 pagesUnit 4Rohit Kumar MahatoNo ratings yet

- Chapter 1 - Perspectives On RetailingDocument42 pagesChapter 1 - Perspectives On RetailingLoren SalanguitNo ratings yet

- I. Strategic Issues and ProblemDocument1 pageI. Strategic Issues and Problemedgaranaya13No ratings yet

- Jeunesse GlobalDocument4 pagesJeunesse GlobalJeunesse Global IndonesiaNo ratings yet

- Ch9 - Cengage 2, 4, 6, 8, 10, 12, 14Document5 pagesCh9 - Cengage 2, 4, 6, 8, 10, 12, 14Apdev OptionNo ratings yet

- Forex Reserves in IndiaDocument3 pagesForex Reserves in IndiaJohn BairstowNo ratings yet

- Beat PlanningDocument3 pagesBeat PlanningShiva Krishna PadhiNo ratings yet

- Press Release: Easypay Now Offers Credit and Debit Card Processing To E-Commerce MerchantsDocument2 pagesPress Release: Easypay Now Offers Credit and Debit Card Processing To E-Commerce MerchantsHR ExecsNo ratings yet

- SM Chapter 4Document31 pagesSM Chapter 4bekali811No ratings yet

- Finacle 10 Commands PDFDocument49 pagesFinacle 10 Commands PDFSam JebaduraiNo ratings yet

- STRAMADocument3 pagesSTRAMARosario, MarissaNo ratings yet

- Loser's Curse: Overconfidence vs. Market Efficiency in The NFL DraftDocument35 pagesLoser's Curse: Overconfidence vs. Market Efficiency in The NFL DraftDeadspinNo ratings yet

- Mishkin 6ce TB Ch08Document29 pagesMishkin 6ce TB Ch08JaeDukAndrewSeoNo ratings yet

- Investment Reviewer With Answer SolutionsDocument39 pagesInvestment Reviewer With Answer SolutionsYmmymmNo ratings yet

- Unit 6 Mutual FundDocument46 pagesUnit 6 Mutual Fundpadmakar_rajNo ratings yet

- Supply Chain Management in RetailDocument23 pagesSupply Chain Management in Retailnad_sh3192% (12)

- Foreign Currency TransactionsDocument49 pagesForeign Currency TransactionsGlenn TaduranNo ratings yet

- ProcurementDocument12 pagesProcurementHabtamuNo ratings yet

- Ch10 Installment PurchaseDocument4 pagesCh10 Installment PurchaseAqmarRahmatNo ratings yet

- Test Bank For Financial Markets and Institutions 8th Edition Anthony Saunders Marcia Cornett Otgo ErhemjamtsDocument23 pagesTest Bank For Financial Markets and Institutions 8th Edition Anthony Saunders Marcia Cornett Otgo Erhemjamtsreem.alrshoudiNo ratings yet

- Yad Utiy Asi R: Profit & Loss Ykhk VKSJ GkfuDocument6 pagesYad Utiy Asi R: Profit & Loss Ykhk VKSJ GkfuNitin DangiNo ratings yet

- 201 Final Winter 2011 v1 AnswersDocument11 pages201 Final Winter 2011 v1 AnswersJonathan Ruiz100% (2)

- CHP 9 Plant Assets and Depreciation AccountingDocument15 pagesCHP 9 Plant Assets and Depreciation AccountingRASHONNo ratings yet

- The Impact of Stock Market Performance Upon Economic GrowthDocument11 pagesThe Impact of Stock Market Performance Upon Economic GrowthboviaoNo ratings yet

- EDM - Module VI (B) - SEMDocument17 pagesEDM - Module VI (B) - SEMSandipan DawnNo ratings yet

- Nse's Certification in Financial Markets - Options Trading StrategiesDocument60 pagesNse's Certification in Financial Markets - Options Trading Strategiessachindravid100% (1)

- Bond Valuation TheoremsDocument13 pagesBond Valuation Theoremsshivbahadur71% (7)

- Financial Analysts: Introduction To Investments Prof S G Badrinath Financial AnalystsDocument3 pagesFinancial Analysts: Introduction To Investments Prof S G Badrinath Financial AnalystsIsse NvrroNo ratings yet

- Invoice 1Document1 pageInvoice 1RAJAT GARGNo ratings yet