Professional Documents

Culture Documents

Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV

Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV

Uploaded by

ignaciomannyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV

Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV

Uploaded by

ignaciomannyCopyright:

Available Formats

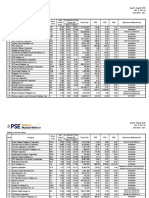

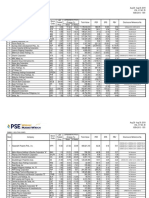

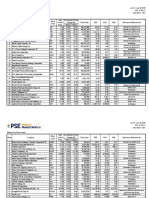

Jul 29 - Aug 02, 2019

VOL. VI NO. 31

ISSN 2013 - 1351

Weekly Top Price Gainers

Last Comparative Price

Stock

Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No.

Code

Price 1 Week 4 Weeks

1 Manila Mining Corporation "B" MAB 0.011 46.67 44.74 2,390,300 (234.33) (0.00005) 0.97 C05356-2019

2 Manila Mining Corporation "A" MA 0.010 36.99 33.33 5,767,600 (213.03) (0.00005) 0.88 C05356-2019

3 PXP Energy Corporation PXP 10.68 27.29 45.31 367,247,550 (336.27) (0.03) 7.57 C05342-2019, C05257-2019

4 Ginebra San Miguel, Inc. GSMI 68.30 15.57 18.99 157,875,515 13.56 5.04 2.98 C05347-2019

C05353-2019, C05354-2019, C05355-2019,

5 Philex Mining Corporation PX 3.90 13.37 11.11 63,486,210 37.62 0.10 0.81 C05357-2019, CR04996-2019, C05358-2019,

CR05000-2019, CR05002-2019

6 Pepsi-Cola Products Philippines, Inc. PIP 1.88 12.57 (1.57) 48,246,180 591.61 0.003 0.75 No Disclosure

7 Philippine Racing Club, Inc. PRC 9.25 12.39 (2.53) 97,067 7.29 1.27 1.29 No Disclosure

C05343-2019, CR05004-2019,

8 Vitarich Corporation VITA 1.39 12.10 8.59 76,767,090 (26.65) (0.05) 3.16 CR05019-2019, CR04945-2019

CR05005-2019, C05243-2019, C05248-2019,

9 D.M. Wenceslao & Associates, Incorporated DMW 11.40 11.76 7.75 89,002,286 19.83 0.57 2.08 C05307-2019, C05316-2019

10 Cemex Holdings Philippines, Inc. CHP 3.11 11.07 1.30 213,843,160 (19.46) (0.16) 0.56 No Disclosure

11 PHINMA Petroleum and Geothermal, Inc. PPG 6.04 10.02 24.79 34,227,512 (24.24) (0.25) 17.85 CR04983-2019

12 Chemical Industries of the Philippines, Inc. CIP 116.00 9.43 1.93 19,379 (75.79) (1.53) 1.42 No Disclosure

13 Oriental Petroleum and Minerals Corporation "A" OPM 0.013 8.33 8.33 331,300 49.94 0.0003 0.55 No Disclosure

14 Manila Broadcasting Company MBC 15.18 7.51 (1.43) 3,036 63.03 0.24 5.36 No Disclosure

15 Apex Mining Co., Inc. APX 1.28 6.67 8.47 72,620,470 40.91 0.03 1.52 No Disclosure

15 Rizal Commercial Banking Corporation RCB 30.40 6.67 11.97 63,100,280 13.10 2.32 0.71 C05267-2019, C05287-2019

17 Euro-Med Laboratories Phil., Inc. EURO 1.70 6.25 - 5,090 18.55 0.09 1.31 C05302-2019

18 Zeus Holdings, Inc. ZHI 0.295 5.36 (11.94) 3,279,850 (1,141.64) (0.0003) 3,908.74 No Disclosure

19 Bright Kindle Resources & Investments Inc. BKR 1.23 5.13 (2.38) 19,280 (22.09) (0.06) 2.02 No Disclosure

20 Jackstones, Inc. JAS 3.13 5.03 4.33 61,370 (234.53) (0.01) 32.32 No Disclosure

21 JG Summit Holdings, Inc. JGS 69.50 4.98 1.09 451,023,079 22.84 3.04 1.75 No Disclosure

22 Roxas Holdings, Inc. ROX 2.30 4.55 20.42 440,070 (9.03) (0.25) 0.34 No Disclosure

23 Easycall Communications Philippines, Inc. ECP 10.04 4.47 (0.20) 1,182,571 27.57 0.36 7.54 C05375-2019, C05376-2019

24 Millennium Global Holdings, Inc. MG 0.195 4.28 4.84 115,540 (964.12) (0.0002) 2.81 No Disclosure

25 LBC Express Holdings, Inc. LBC 14.68 3.82 4.26 204,036 25.58 0.57 6.15 C05249-2019, C05250-2019, C05291-2019

26 Sta. Lucia Land, Inc. SLI 2.20 3.77 12.24 6,586,650 15.84 0.14 1.23 No Disclosure

27 Lepanto Consolidated Mining Company "A" LC 0.112 3.70 1.82 1,603,560 (10.28) (0.01) 0.99 No Disclosure

28 Philweb Corporation WEB 4.25 3.66 9.54 110,246,730 (102.89) (0.04) 142.59 C05415-2019, CR05024-2019

29 Island Information & Technology, Inc. IS 0.116 3.57 (3.33) 717,830 (656.15) (0.0002) (5.28) No Disclosure

30 Prime Media Holdings, Inc. PRIM 1.47 3.52 (2.65) 10,244,310 (42.42) (0.03) (7.25) No Disclosure

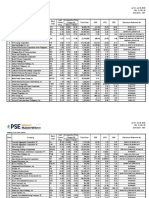

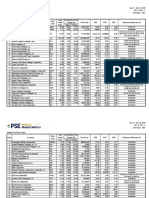

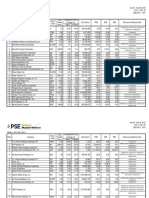

Jul 29 - Aug 02, 2019

VOL. VI NO. 31

ISSN 2013 - 1351

Weekly Top Price Losers

Last Comparative Price

Stock

Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No.

Code

Price 1 Week 4 Weeks

1 Liberty Flour Mills, Inc. LFM 29.30 (41.40) (41.40) 793 49.37 0.59 1.67 No Disclosure

2 Grand Plaza Hotel Corporation GPH 10.00 (16.53) (16.53) 13,910 (19.44) (0.51) 0.63 CR04965-2019

3 Philippine Seven Corporation SEVN 135.00 (15.63) (0.74) 13,800,745 70.26 1.92 14.21 No Disclosure

4 Omico Corporation OM 0.470 (14.55) (11.32) 211,050 (38.86) (0.01) 0.70 No Disclosure

5 National Reinsurance Corporation of the Philippines NRCP 1.01 (12.17) 3.06 9,957,710 7.52 0.13 0.42 No Disclosure

6 Cirtek Holdings Philippines Corporation TECH 14.60 (10.98) (11.52) 22,268,012 18.22 0.80 0.82 C05416-2019, C05417-2019

7 Philippine Bank of Communications PBC 20.50 (10.48) (4.21) 35,475 11.84 1.73 0.92 C05292-2019

8 Asiabest Group International Inc. ABG 15.34 (10.29) 18.18 9,494,036 (1,973.52) (0.01) 17.25 CR05008-2019

9 Premiere Horizon Alliance Corporation PHA 0.71 (10.13) (20.22) 117,994,890 (5.06) (0.14) 5.77 No Disclosure

C05268-2019, C05269-2019, C05270-2019,

10 AbaCore Capital Holdings, Inc. ABA 0.94 (9.62) (7.84) 266,855,390 0.91 1.04 0.36 C05283-2019, C05297-2019

11 Boulevard Holdings, Inc. BHI 0.060 (9.09) 5.26 3,182,110 (14.47) (0.004) 0.40 No Disclosure

12 Asian Terminals, Inc. ATI 18.16 (8.74) (15.53) 140,920 10.65 1.71 2.14 CR05009-2019

13 Harbor Star Shipping Services, Inc. TUGS 1.95 (8.02) (11.76) 25,242,870 (138.59) (0.01) 1.13 No Disclosure

14 Concrete Aggregates Corporation "A" CA 75.00 (7.86) (25.37) 1,821,296 59.92 1.25 7.18 No Disclosure

15 Seafront Resources Corporation SPM 2.48 (7.81) - 208,530 56.80 0.04 0.90 No Disclosure

16 Manila Jockey Club, Inc. MJC 3.28 (7.61) 3.80 1,072,140 (78.05) (0.04) 1.31 CR04938-2019

17 Arthaland Corporation ALCO 0.98 (7.55) 1.03 130,781,770 9.93 0.10 0.96 No Disclosure

18 Philippine Estates Corporation PHES 0.445 (7.29) (7.29) 827,750 45.71 0.01 0.59 C05311-2019

19 GEOGRACE Resources Philippines, Inc. GEO 0.209 (7.11) (5.86) 1,634,510 (27.54) (0.01) 47.31 No Disclosure

20 Waterfront Philippines, Inc. WPI 0.76 (6.17) (1.30) 16,692,750 35.45 0.02 0.35 C05361-2019

21 DFNN, Inc. DFNN 6.00 (6.10) (2.91) 2,560,310 (4,937.01) (0.001) 1.79 No Disclosure

22 Aboitiz Equity Ventures, Inc. AEV 52.60 (6.07) (5.23) 330,279,229 14.16 3.72 1.74 C05314-2019, C05331-2019

23 Benguet Corporation "A" BC 1.15 (5.74) (8.00) 17,250 7.46 0.15 0.18 No Disclosure

24 Globe Telecom, Inc. GLO 2,100.00 (5.41) (7.00) 492,771,810 13.52 155.32 3.64 C05409-2019, C05299-2019

25 Jolliville Holdings Corporation JOH 6.05 (5.32) (4.72) 26,860 4.57 1.32 0.97 C05326-2019

26 AyalaLand Logistics Holdings Corp. ALLHC 4.04 (5.16) 4.66 144,805,330 46.11 0.09 2.70 No Disclosure

C05405-2019, C05240-2019,

27 Pacific Online Systems Corporation LOTO 2.79 (5.10) (8.22) 25,179,160 20.79 0.13 1.42 CR04942-2019, C05320-2019

28 Aboitiz Power Corporation AP 34.80 (5.05) (5.95) 450,468,795 11.99 2.90 2.14 C05308-2019, C05317-2019, C05330-2019

29 Robinsons Land Corporation RLC 26.60 (5.00) (1.48) 271,669,865 16.24 1.64 1.44 C05352-2019, C05325-2019

30 Metro Alliance Holdings & Equities Corporation "A" MAH 1.43 (4.67) (7.74) 73,110 57.18 0.03 4.16 C05406-2019, CR04987-2019

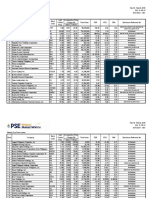

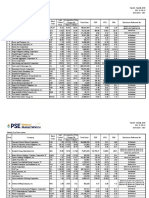

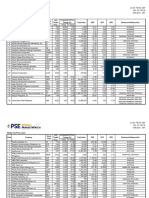

Jul 29 - Aug 02, 2019

VOL. VI NO. 31

ISSN 2013 - 1351

Weekly Market Statistics

(In pesos) July 22 - July 26 July 29 - August 02 Year-to-Date

Total Market Capitalization 17,493,460,474,050.30 17,393,094,818,975.30 17,393,094,818,975.30

Domestic Market Capitalization 14,872,131,377,061.30 14,786,955,630,522.50 14,786,955,630,522.50

Total Value Traded 33,322,324,826.44 31,502,513,793.18 1,093,665,971,078.27

Ave. Daily Value Traded 6,664,464,965.29 6,300,502,758.64 7,594,902,576.93

Foreign Buying 17,237,644,089.27 15,445,889,610.42 617,003,979,483.73

Foreign Selling 17,348,532,723.29 15,153,085,319.82 591,961,269,100.64

Net Foreign Buying/ (Selling) (110,888,634.02) 292,804,290.60 25,042,710,383.10

% of Foreign to Total 52% 49% 55%

Number of Issues (Common shares):

64 - 158 - 23 90 - 126 - 30 141 - 111 - 5

Gainers - Losers - Unchanged

Weekly Index Performance

Comparative Change (%) YTD Change

Close PER

1 Week 4 Weeks (%)

PSEi 8,129.93 (0.66) 0.15 8.89 18.75

All Shares Index 4,926.56 (0.59) (0.39) 9.05 15.35

Financials Index 1,861.40 0.70 6.85 4.58 14.41

Industrial Index 11,412.13 (0.48) (4.81) 4.21 16.98

Holding Firms Index 7,901.63 (1.22) 1.34 7.63 17.05

Property Index 4,324.00 (0.53) (1.27) 19.18 20.23

Services Index 1,613.12 (2.35) (5.06) 11.81 17.30

Mining and Oil Index 8,101.47 2.93 8.90 (1.21) 14.56

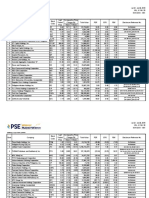

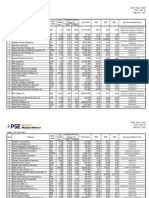

Notes:

- Top price gainers and losers only cover common shares.

- EPS (Earnings per Share) is computed as: Net Income

Outstanding Shares

PER (Price-Earnings Ratio) is computed as: Last Traded Price per Share

Earnings per Share

PBV (Price to Book Value Ratio) is computed as: Company Market Capitalization

Company Stockholders Equity (end of period)

EPS, PER and PBV use four-quarter trailing financial data.

- Total Value in Top Gainers and Losers tables refers to total value traded in the regular market.

- The disclosures cover those made from 3:31 pm, Friday of the previous week to 3:30 pm, Friday of the covered week. Information and disclosures made by the companies, as itemized in this report, may

be viewed by clicking on the links above. These may also be viewed in the “Disclosure” page of the company at the PSE website (www.pse.com.ph). To access the disclosure page, enter the stock symbol in

the symbol lookup field located at the upper right portion of the PSE website. The public is encouraged to regularly monitor subsequent developments as may be disclosed by the company in succeeding

weeks.

- Current week’s foreign transactions data are subject to amendments allowed until t+2. Previous week’s foreign transactions data have been adjusted accordingly for amendments.

- Domestic Market capitalization excludes the market capitalization of foreign domiciled companies.

The data contained in this file is collated by the Corporate Planning & Research Department of the Philippine Stock Exchange. The PSE does not make any representations or warranties, express or implied, on matters such as, but not limited to, the accuracy, timeliness, completeness, non-infringement, validity, merchantability or fitness for any particular purpose of the information and data herein contained. The PSE

assumes no liability and responsibility for any loss or damage suffered as a consequence of any errors or omissions in this file, or any decision made or action taken in reliance upon information contained herein. This document is for information purposes only, and does not constitute legal, financial or investment advice, nor intended to influence investment decisions. Independent assessment should be undertaken, and

advice from a securities professional is strongly recommended. For inquiries or suggestions on the PSE Weekly MarketWatch, you may call (632) 688-7601 to 02, send a message through fax no. (632) 688-8818 or email pirs@pse.com.ph.

You might also like

- LGA Festival and Events Eguide - Final PDFDocument85 pagesLGA Festival and Events Eguide - Final PDFFederico B. Doblado Jr.No ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument5 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- wk35 Sep2022mktwatchDocument3 pageswk35 Sep2022mktwatchcraftersxNo ratings yet

- wk05 Jan2024mktwatchDocument3 pageswk05 Jan2024mktwatchMacxie Baldonado QuibuyenNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- U.S. Dividend Champions: End-Of-Month Update atDocument26 pagesU.S. Dividend Champions: End-Of-Month Update atALFONSO ARREOLANo ratings yet

- wk39 Sep2022mktwatchDocument3 pageswk39 Sep2022mktwatchcraftersxNo ratings yet

- QuarterlyTop50 1Q 2008Document5 pagesQuarterlyTop50 1Q 2008Franz Carla NavarroNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Nylinad Calubayan EstrellaNo ratings yet

- wk38 Sep2022mktwatchDocument3 pageswk38 Sep2022mktwatchcraftersxNo ratings yet

- QuarterlyTop50 4Q 2009Document5 pagesQuarterlyTop50 4Q 2009Franz Carla NavarroNo ratings yet

- 2019 11 20 PH D PDFDocument5 pages2019 11 20 PH D PDFJNo ratings yet

- Top Story:: Ubp: Manageable Increase Npls in May Maintain HoldDocument7 pagesTop Story:: Ubp: Manageable Increase Npls in May Maintain HoldJajahinaNo ratings yet

- U S DividendchampionsDocument196 pagesU S DividendchampionsRobert RippeyNo ratings yet

- CF 01Document2 pagesCF 01John Alex SelorioNo ratings yet

- Suspense AccountDocument1 pageSuspense AccountMetricNo ratings yet

- Top Story:: AEV: JERA Deal Gives AP A Competent Technical Partner, Opens Up Investment Opportunities For The GroupDocument4 pagesTop Story:: AEV: JERA Deal Gives AP A Competent Technical Partner, Opens Up Investment Opportunities For The GroupkristineNo ratings yet

- U S DividendChampionsDocument293 pagesU S DividendChampionsmike greeneNo ratings yet

- Disclosure Date Net Profit (Losses) As of 30 June 2019Document1 pageDisclosure Date Net Profit (Losses) As of 30 June 2019right.solution.dohaNo ratings yet

- URC: Results in Line, But Downside Risks RemainDocument5 pagesURC: Results in Line, But Downside Risks RemainJNo ratings yet

- Top Stories:: TUE 05 MAR 2019Document5 pagesTop Stories:: TUE 05 MAR 2019JajahinaNo ratings yet

- Row Dividend ChampionsDocument998 pagesRow Dividend ChampionsMadcarioNo ratings yet

- Saham-Saham Berpotensi Utk Trade Mid Term - Invest Long TermDocument12 pagesSaham-Saham Berpotensi Utk Trade Mid Term - Invest Long Termhart azacNo ratings yet

- Top Story:: Banking Sector: 2Q21 Earnings Expand On Lower Provisions and Higher FeesDocument7 pagesTop Story:: Banking Sector: 2Q21 Earnings Expand On Lower Provisions and Higher FeesJajahinaNo ratings yet

- Industry Peer 2016Document13 pagesIndustry Peer 2016cherylmanapolNo ratings yet

- Investment GuideDocument2 pagesInvestment Guidegundam busterNo ratings yet

- Top Stories:: TUE 22 SEP 2020Document5 pagesTop Stories:: TUE 22 SEP 2020Elcano MirandaNo ratings yet

- Top Stories:: Economy: June Inflation Slows To 4.1% ICT: PPA Approves MICT's Tariff IncreaseDocument5 pagesTop Stories:: Economy: June Inflation Slows To 4.1% ICT: PPA Approves MICT's Tariff IncreaseJajahinaNo ratings yet

- U S DividendchampionsDocument12 pagesU S DividendchampionsElizabeth ParsonsNo ratings yet

- Other NewsDocument3 pagesOther NewsElcano MirandaNo ratings yet

- CHP: Earnings Miss But Outlook Remains Positive: Stocks in FocusDocument6 pagesCHP: Earnings Miss But Outlook Remains Positive: Stocks in FocusJajahinaNo ratings yet

- Top Stories:: WED 18 AUG 2021Document10 pagesTop Stories:: WED 18 AUG 2021Elcano MirandaNo ratings yet

- Top Story:: MON 14 JUN 2021Document4 pagesTop Story:: MON 14 JUN 2021JajahinaNo ratings yet

- Top Story:: Consumer Sector: Consumer Companies Deliver Mixed Results in 1Q21Document9 pagesTop Story:: Consumer Sector: Consumer Companies Deliver Mixed Results in 1Q21JajahinaNo ratings yet

- Top Story:: Telecom Sector: Elevated Demand For Data Shaping Bullish Narrative For Telco OperatorsDocument8 pagesTop Story:: Telecom Sector: Elevated Demand For Data Shaping Bullish Narrative For Telco OperatorsElcano MirandaNo ratings yet

- Midterm Exam GFGB 6005 003 Fall 2019 Excel Problems QuestionsDocument55 pagesMidterm Exam GFGB 6005 003 Fall 2019 Excel Problems QuestionsGel viraNo ratings yet

- Estimari Dividende 2019 22.11.2019Document4 pagesEstimari Dividende 2019 22.11.2019Bogdan BoicuNo ratings yet

- LRWC-SEC 17C - Financial Highlights of Q1 2022Document4 pagesLRWC-SEC 17C - Financial Highlights of Q1 2022ignaciomannyNo ratings yet

- First Quarterly Report of The Keepers Holdings, Inc. Cy 2022Document73 pagesFirst Quarterly Report of The Keepers Holdings, Inc. Cy 2022ignaciomannyNo ratings yet

- Annual Report of The Keepers Holdings. Inc. For Cy 2021Document201 pagesAnnual Report of The Keepers Holdings. Inc. For Cy 2021ignaciomannyNo ratings yet

- Disclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)Document3 pagesDisclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)ignaciomannyNo ratings yet

- AbacusShortTakes 08232022Document7 pagesAbacusShortTakes 08232022ignaciomannyNo ratings yet

- Response To PSE Query 07 September 2022Document1 pageResponse To PSE Query 07 September 2022ignaciomannyNo ratings yet

- AbacusShortTakes 09212022Document5 pagesAbacusShortTakes 09212022ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- AbacusShortTakes 08312022Document7 pagesAbacusShortTakes 08312022ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- AbacusShortTakes 09092022Document6 pagesAbacusShortTakes 09092022ignaciomannyNo ratings yet

- AbacusShortTakes 10252022Document6 pagesAbacusShortTakes 10252022ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- AbacusShortTakes 09082022Document7 pagesAbacusShortTakes 09082022ignaciomannyNo ratings yet

- AbacusShortTakes 10262022Document6 pagesAbacusShortTakes 10262022ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument5 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- CHAPTER 5 SolutionDocument29 pagesCHAPTER 5 SolutionAA BB MM100% (1)

- May Salary PayrollDocument610 pagesMay Salary PayrollSaurabh SinghNo ratings yet

- Annual Report 2075 76 EnglishDocument200 pagesAnnual Report 2075 76 Englishram krishnaNo ratings yet

- Company Financial StatementsDocument3 pagesCompany Financial StatementsNarasimha Jammigumpula0% (1)

- Company Isin Description in NSDLDocument183 pagesCompany Isin Description in NSDLvishalNo ratings yet

- ISIN ListDocument32 pagesISIN ListMirza Haseeb Ahsan100% (1)

- RF 1Document4 pagesRF 1sweetviolet0303No ratings yet

- Steel BazaarDocument20 pagesSteel BazaarhetalgutkaNo ratings yet

- Super-Frog Saves Tokyo by Haruki MurakamiDocument10 pagesSuper-Frog Saves Tokyo by Haruki MurakamiGustavo LaraNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961NirajNo ratings yet

- Acraiissample CCFP 201207Document6 pagesAcraiissample CCFP 201207Minh Nguyen VanNo ratings yet

- CRD of Sharon Di Stefano (1497908)Document8 pagesCRD of Sharon Di Stefano (1497908)buyersstrikewpNo ratings yet

- Assignment On Inventory-Chapter 6-Fall 23Document2 pagesAssignment On Inventory-Chapter 6-Fall 23www.kazimarzanjsbmsc570No ratings yet

- Financial Scams in IndiaDocument6 pagesFinancial Scams in IndiaShubham GuptaNo ratings yet

- E@banking Price List Private Individuals: Payment Services Used by e Banking International Outgoing Money TransfersDocument2 pagesE@banking Price List Private Individuals: Payment Services Used by e Banking International Outgoing Money TransfersToniTuliNo ratings yet

- Speaker's Lecture MaudeDocument10 pagesSpeaker's Lecture MaudeHenryNo ratings yet

- Tenancy AgreementDocument5 pagesTenancy AgreementjawaidakramNo ratings yet

- Strategic Mine Planning SurpacWhittleDocument308 pagesStrategic Mine Planning SurpacWhittleTessfaye Wolde Gebretsadik90% (10)

- Doctrine of Clog On RedemptionDocument6 pagesDoctrine of Clog On RedemptionSuvONo ratings yet

- Brazilian Sugar OfferDocument2 pagesBrazilian Sugar OfferRajnikant ChauhanNo ratings yet

- AlphabetDocument12 pagesAlphabetandre.torresNo ratings yet

- Vietnam's Derivatives MarketDocument12 pagesVietnam's Derivatives MarketNguyễn Thuỳ DungNo ratings yet

- 11ants Analytics Customer Churn Quick FactsDocument3 pages11ants Analytics Customer Churn Quick FactsAdeyemi OdeneyeNo ratings yet

- Government Accounting PunzalanDocument5 pagesGovernment Accounting PunzalanN Jo89% (18)

- 1.sangchan Et Al. (2022)Document31 pages1.sangchan Et Al. (2022)linus.koekeNo ratings yet

- MQ13 13 b-1Document13 pagesMQ13 13 b-1Jona ResuelloNo ratings yet

- Investment PlanningDocument11 pagesInvestment PlanningONESTOP PRINTINGNo ratings yet

- Solved Explain Why You Would Be More or Less Willing ToDocument1 pageSolved Explain Why You Would Be More or Less Willing ToM Bilal SaleemNo ratings yet

- ISA 700 Sample Auditors ReportDocument25 pagesISA 700 Sample Auditors ReportMuhammad HarithNo ratings yet