Professional Documents

Culture Documents

Ra 6971 PDF

Ra 6971 PDF

Uploaded by

MonicaMoscosoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ra 6971 PDF

Ra 6971 PDF

Uploaded by

MonicaMoscosoCopyright:

Available Formats

November 22, 1990

REPUBLIC ACT NO. 6971

AN ACT TO ENCOURAGE PRODUCTIVITY AND MAINTAIN INDUSTRIAL PEACE BY

PROVIDING INCENTIVES TO BOTH LABOR AND CAPITAL

SECTION 1. Short Title. — This Act shall be known as the "Productivity

Incentives Act of 1990". cdasia

SECTION 2. Declaration of Policy. — It is the declared policy of the State to

encourage higher levels of productivity, maintain industrial peace and harmony and

promote the principle of shared responsibility in the relations between workers and

employers, recognizing the right of labor to its just share in the fruits of production and

the right of business enterprises to reasonable returns on investments and to

expansion and growth, and accordingly to provide corresponding incentives to both

labor and capital for undertaking voluntary programs to ensure greater sharing by the

workers in the fruits of their labor.

SECTION 3. Coverage. — This Act shall apply to all business enterprises with

or without existing and duly recognized or certi ed labor organizations, including

government-owned and controlled corporations performing proprietary functions. It

shall cover all employees and workers including casual, regular, supervisory and

managerial employees. cd i

SECTION 4. Definition of Terms. — As used in this Act:

a) "Business Enterprise" refers to industrial, agricultural, or agro-

industrial establishments engaged in the production, manufacturing,

processing, repacking, or assembly of goods, including service-

oriented enterprises, duly certified as such by appropriate

government agencies.

b) "Labor-Management Committee" refers to a negotiating body in a

business enterprise composed of the representatives of labor and

management created to establish a productivity incentives program,

and to settle disputes arising therefrom in accordance with Section 9

hereof.

c) "Productivity Incentives Program" refers to a formal agreement

established by the labor-management committee containing a

process that will promote gainful employment, improve working

conditions and result in increased productivity, including cost savings,

whereby the employees are granted salary bonuses proportionate to

increases in current productivity over the average for the preceding

three (3) consecutive years. The agreement shall be ratified by at

least a majority of the employees who have rendered at least six (6)

months of continuous service.

SECTION 5. Labor-Management Committee. — a) A business enterprise or its

employees, through their authorized representatives, may initiate the formation of a

labor-management committee that shall be composed of an equal number of

representatives from the management and from the rank-and- le employees: Provided,

CD Technologies Asia, Inc. © 2016 cdasiaonline.com

That both management and labor shall have equal voting rights: Provided, further, That

at the request of any party to the negotiation, the National Wages and Productivity

Commission of the Department of Labor and Employment shall provide the necessary

studies, technical information and assistance, and expert advice to enable the parties to

conclude productivity agreements. cd i

b) In business enterprises with duly recognized or certi ed labor

organizations, the representatives of labor shall be those designated by the collective

bargaining agent(s) of the bargaining unit(s).

c) In business enterprises without duly recognized or certi ed labor

organizations, the representatives of labor shall be elected by at least a majority of all

rank-and- le employees who have rendered at least six (6) months of continuous

service.

SECTION 6. Productivity Incentives Program. —

a) The productivity incentives program shall contain provisions for the

manner of sharing and the factors in determining productivity bonuses: Provided, That

the productivity bonuses granted to labor under this program shall not be less than half

of the percentage increase in the productivity of the business enterprise.

b) Productivity agreements reached by the parties as provided in this Act

supplement existing collective bargaining agreements.

c) If, during the existence of the productivity incentives program or

agreement, the employees will join or form a union, such program or agreement may, in

addition to the terms and conditions agreed upon by labor and management, be

integrated in the collective bargaining agreement that may be entered into between

them.

SECTION 7. Bene ts and Tax Incentives . — (a) Subject to the provisions of

Section 6 hereof, a business enterprise which adopts a productivity incentives program,

duly and mutually agreed upon by parties to the labor-management committee, shall be

granted a special deduction from gross income equivalent to fty percent (50%) of the

total productivity bonuses given to employees under the program over and above the

total allowable ordinary and necessary business deductions for said bonuses under the

National Internal Revenue Code, as amended. casia

b) Grants for manpower training and special studies given to rank-and- le

employees pursuant to a program prepared by the labor-management committee for

the development of skills identi ed as necessary by the appropriate government

agencies shall also entitle the business enterprise to a special deduction from gross

income equivalent to fty per cent (50%) of the total grants over and above the

allowable ordinary and necessary business deductions for said grants under the

National Internal Revenue Code, as amended.

c) Any strike or lockout arising from any violation of the productivity

incentives program shall suspend the effectivity thereof pending settlement of such

strike or lockout: Provided, That the business enterprise shall not be deemed to have

forfeited any tax incentives accrued prior to the date of occurrence of such strike or

lockout, and the workers shall not be required to reimburse the productivity bonuses

already granted to them under the productivity incentives program. Likewise, bonuses

which have already accrued before the strike or lockout shall be paid the workers within

six (6) months from their accrual.aisa dc

d) Bonuses provided for under the productivity incentives program shall be

given to the employees not later than every six (6) months from the start of such

CD Technologies Asia, Inc. © 2016 cdasiaonline.com

program over and above existing bonuses granted by the business enterprise and by

law: Provided, That the said bonuses shall not be deemed as salary increases due the

employees and workers.

e) The special deductions from gross income provided for herein shall be

allowed starting the next taxable year after the effectivity of this Act.

SECTION 8. Notification. — A business enterprise which adopts a

productivity incentives program shall submit copies of the same to the National Wages

and Productivity Commission and to the Bureau of Internal Revenue for their

information and record.

SECTION 9. Disputes and Grievances. — Whenever disputes, grievances, or

other matters arise from the interpretation or implementation of the productivity

incentives program, the labor-management committee shall meet to resolve the

dispute, and may seek the assistance of the National Conciliation and Mediation Board

of the Department of Labor and Employment for such purpose. Any dispute which

remains unresolved within twenty (20) days from the time of its submission to the

labor-management committee shall be submitted for voluntary arbitration in line with

the pertinent of the Labor Code, as amended.

The productivity incentives program shall include the name(s) of the voluntary

arbitrator or panel of voluntary arbitrators previously chosen and agreed upon by the

labor-management committee. cdasia

SECTION 10. Rule Making Power. — The Secretary of Labor and Employment

and the Secretary of Finance, after due notice and hearing, shall jointly promulgate and

issue within six (6) months from the effectivity of this Act such rules and regulations as

are necessary to carry out the provisions hereof.

SECTION 11. Penalty. — Any person who shall make any fraudulent claim

under this Act, regardless of whether or not a tax bene t has been granted, shall upon

conviction be punished with imprisonment of not less than six (6) months but not more

than one (1) year or a ne of not less than two thousand pesos (P2,000.00) but not

more than six thousand pesos (P6,000.00), or both, at the discretion of the Court,

without prejudice to prosecution for any other acts punishable under existing laws.

In case of partnerships or corporations, the penalty shall be imposed upon the

of cer(s) or employee(s) who knowingly approved, authorized or rati ed the ling of

the fraudulent claim, and other persons responsible therefor. cdt

SECTION 12. Non-Diminution of Bene ts . — Nothing in this Act shall be

construed to diminish or reduced any bene ts and other privileges enjoyed by the

workers under existing laws, decrees, executive orders, company policy or practice, or

any agreement or contract between the employer and employees.

SECTION 13. Separability Clause. — If any provision of this Act is held invalid,

any other provision not so affected shall continue to be valid and effective.

SECTION 14. Repealing Clause. — Any law, presidential decree, executive

order, and letter of instruction, or any part thereof, which is inconsistent with any of the

provisions of this Act is hereby repealed or amended accordingly.

SECTION 15. Effectivity Clause. — This Act shall take effect fteen (15) days

after its publication in the Official Gazette or in at least two (2) national newspapers of

general circulation. cdtai

Approved: November 22, 1990

CD Technologies Asia, Inc. © 2016 cdasiaonline.com

Published in the Philippine Star and the Philippine Times Journal on November 24, 1990.

Published in the Official Gazette, Vol. 87 No. 2 page 205 on January 14, 1991.

CD Technologies Asia, Inc. © 2016 cdasiaonline.com

You might also like

- Latest Certified Fraud Examiner Exam Questions and Answera CfeDocument10 pagesLatest Certified Fraud Examiner Exam Questions and Answera Cfe20212111047 TEUKU MAULANA ARDIANSYAHNo ratings yet

- RevenueRegulations1 83Document4 pagesRevenueRegulations1 83Ansherina Francisco100% (1)

- ISO 22301: 2019 - An introduction to a business continuity management system (BCMS)From EverandISO 22301: 2019 - An introduction to a business continuity management system (BCMS)Rating: 4 out of 5 stars4/5 (1)

- Contrato Maurice J. Spagnoletti y Doral BankDocument33 pagesContrato Maurice J. Spagnoletti y Doral BankElcoLaoNo ratings yet

- RMC 36-99Document3 pagesRMC 36-99Rieland CuevasNo ratings yet

- PBT v. Register of DeedsDocument1 pagePBT v. Register of Deedsblu_deviantNo ratings yet

- Ra 6971Document3 pagesRa 6971Yasmin RasumanNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument3 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledEs ClaroNo ratings yet

- Compendium of Right To Food Laws in The Philippines - Vol. II - Part 2Document301 pagesCompendium of Right To Food Laws in The Philippines - Vol. II - Part 2Peoples Development InstituteNo ratings yet

- RA 6971-Productivity Incentives Act of 1990Document5 pagesRA 6971-Productivity Incentives Act of 1990Rosa GamaroNo ratings yet

- VBVBVBVBVBVBVBDocument6 pagesVBVBVBVBVBVBVBheherson juanNo ratings yet

- The Industrial Relations Code, 2020Document27 pagesThe Industrial Relations Code, 2020Hardik ShettyNo ratings yet

- Notes Ra 6971Document4 pagesNotes Ra 6971Howard ChanNo ratings yet

- Addendum LaborDocument17 pagesAddendum LaborCarlyle Esquivias ChuaNo ratings yet

- Employment AgreementDocument9 pagesEmployment AgreementAsmat Ullah AchakzaiNo ratings yet

- First Meeting LabstanDocument13 pagesFirst Meeting LabstanAinah KingNo ratings yet

- Contract Sample by Hasib H. BaigDocument10 pagesContract Sample by Hasib H. BaigMavia ZahidNo ratings yet

- Collective Bargaining AgreementDocument10 pagesCollective Bargaining AgreementdenvergamlosenNo ratings yet

- Virginia Agreement With AmazonDocument25 pagesVirginia Agreement With AmazonFOX 5 NewsNo ratings yet

- Payment of BonusDocument19 pagesPayment of Bonuskhyati.212496No ratings yet

- S. 80 IacDocument2 pagesS. 80 IacPratim MajumderNo ratings yet

- Revenue Regulations No. 10-96: August 7, 1996Document10 pagesRevenue Regulations No. 10-96: August 7, 1996APRIL ANN BIGAYNo ratings yet

- Fundamental Principles and Policies Underlying Labor LawsDocument13 pagesFundamental Principles and Policies Underlying Labor LawsemilysantiagoblogNo ratings yet

- Labor Act, 2006Document10 pagesLabor Act, 2006Subarna BiswasNo ratings yet

- UnionbkDocument37 pagesUnionbkjacima1962No ratings yet

- 2nd NLC ReportDocument6 pages2nd NLC ReportMy gamesNo ratings yet

- Roll No.R760218115 SAP ID 500071424: Online - Through Blackboard Learning Management SystemDocument7 pagesRoll No.R760218115 SAP ID 500071424: Online - Through Blackboard Learning Management Systemamritam yadavNo ratings yet

- Intern AGREEMENTDocument6 pagesIntern AGREEMENTwanepushkarNo ratings yet

- Payment of Bonus Act1965Document5 pagesPayment of Bonus Act1965kumar_2089No ratings yet

- IRR of PD 851-1Document3 pagesIRR of PD 851-1Jansen OuanoNo ratings yet

- Contract of Employment (With NDA and Non-Compete Clauses)Document11 pagesContract of Employment (With NDA and Non-Compete Clauses)Rashi ChoudharyNo ratings yet

- Institute of Management Studies (DAVV)Document14 pagesInstitute of Management Studies (DAVV)Anukrati BagherwalNo ratings yet

- Labour Law-II (115-B)Document7 pagesLabour Law-II (115-B)Harshil VadodariaNo ratings yet

- ESOP and Sweat EquityDocument7 pagesESOP and Sweat EquityShehana RenjuNo ratings yet

- Voluntary Retirement SchemeDocument4 pagesVoluntary Retirement SchemeDillip Kumar MahapatraNo ratings yet

- Minimum Wage Law (RA 602)Document12 pagesMinimum Wage Law (RA 602)Herbert GongonNo ratings yet

- Payment of Bonus Act 19651.ppsxDocument29 pagesPayment of Bonus Act 19651.ppsxshraddhaNo ratings yet

- Bonus ActDocument6 pagesBonus ActRamniwash SinghNo ratings yet

- NEW CLOTH MARKET: TAI Conference in AhmedabadDocument15 pagesNEW CLOTH MARKET: TAI Conference in AhmedabadganariNo ratings yet

- Republic Act No. 602, April 6, 1951Document10 pagesRepublic Act No. 602, April 6, 1951izzy_bañaderaNo ratings yet

- Bonus ActDocument6 pagesBonus ActRavi GuptaNo ratings yet

- 2nd NLC ReportDocument13 pages2nd NLC ReportsujithchandrasekharaNo ratings yet

- The Employees Provident FUND ACT, 1952Document63 pagesThe Employees Provident FUND ACT, 1952sheetal2001No ratings yet

- Notes - Tax I - Create Law - Nov 26Document8 pagesNotes - Tax I - Create Law - Nov 26thebeautyinsideNo ratings yet

- The Payment of The Bonus Act 1965Document28 pagesThe Payment of The Bonus Act 1965Arpita Acharjya100% (1)

- Department Order No.10 Series of 1997Document13 pagesDepartment Order No.10 Series of 1997Mike E DmNo ratings yet

- Labor 1 - Laws - 091015Document8 pagesLabor 1 - Laws - 091015Karla BeeNo ratings yet

- Voluntary Retirement SchemeDocument32 pagesVoluntary Retirement SchemeParas FuriaNo ratings yet

- Wage Order NCR-11Document4 pagesWage Order NCR-11pbasisterNo ratings yet

- Voluntary Retirement SchemeDocument32 pagesVoluntary Retirement Schemeudbhav786No ratings yet

- Labour LawDocument16 pagesLabour LawSarthac SharmaNo ratings yet

- Payment of Bonus ActDocument22 pagesPayment of Bonus ActpoohshahNo ratings yet

- Section (Oo) RetrenchmentDocument1 pageSection (Oo) RetrenchmentkairadigitalservicesNo ratings yet

- Supplement Professional Programme: For December, 2021 ExaminationDocument12 pagesSupplement Professional Programme: For December, 2021 ExaminationMeghana BalgiNo ratings yet

- Meaning of Payment of Bonus ActDocument16 pagesMeaning of Payment of Bonus ActDaljeet KaurNo ratings yet

- Economic Laws NotesDocument28 pagesEconomic Laws NotesshubhamNo ratings yet

- Employment Agreement: by and BetweenDocument11 pagesEmployment Agreement: by and BetweenPrashant GaurNo ratings yet

- Floor Wage Method Involves The Fixing of Determinate Amount That Would Be Added To The Prevailing Statutory Minimum WageDocument41 pagesFloor Wage Method Involves The Fixing of Determinate Amount That Would Be Added To The Prevailing Statutory Minimum WageElvin BauiNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)From EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)No ratings yet

- 170714-2015-Paje v. Casi o PDFDocument79 pages170714-2015-Paje v. Casi o PDFMonicaMoscosoNo ratings yet

- Criminal ProcedureDocument4 pagesCriminal ProcedureMonicaMoscosoNo ratings yet

- DAR vs. CarriedoDocument2 pagesDAR vs. CarriedoMonicaMoscosoNo ratings yet

- CONSTI 2 ReviewerDocument18 pagesCONSTI 2 ReviewerMonicaMoscosoNo ratings yet

- Pollo Vs Constantino-DavidDocument15 pagesPollo Vs Constantino-DavidMonicaMoscoso100% (1)

- The Case of The Child and The Neighbors Dog - RAC - MoscosoDocument2 pagesThe Case of The Child and The Neighbors Dog - RAC - MoscosoMonicaMoscoso100% (1)

- Yap vs. SiaoDocument3 pagesYap vs. SiaoDarwin ArguezaNo ratings yet

- Encrypted 18308 Taavs 01Document8 pagesEncrypted 18308 Taavs 01v.a.sivamuruganNo ratings yet

- Colombo Port City Economic CommissionDocument62 pagesColombo Port City Economic CommissionNuwani Ruwinika VitharanaNo ratings yet

- Rajasthan Apartment Ownership Act SDocument44 pagesRajasthan Apartment Ownership Act SPrashant KaushikNo ratings yet

- Borchard 1940Document13 pagesBorchard 1940Xylem SalvatoreNo ratings yet

- Bill Hamilton's Summons and Complaint (W0238403)Document161 pagesBill Hamilton's Summons and Complaint (W0238403)Neighbors WestNo ratings yet

- Timpco v. Implementations Services (S.D. Ind. Sept. 29, 2010)Document18 pagesTimpco v. Implementations Services (S.D. Ind. Sept. 29, 2010)Andrew PequignotNo ratings yet

- NPC Administrative Order - Muntinlupa EmployeesDocument3 pagesNPC Administrative Order - Muntinlupa EmployeesMariel MallongaNo ratings yet

- Rule 115 Emergency Recit PDFDocument9 pagesRule 115 Emergency Recit PDFPre PacionelaNo ratings yet

- Segovia vs. Climate Change Commission, GR No. 211010, March 17, 2017Document9 pagesSegovia vs. Climate Change Commission, GR No. 211010, March 17, 2017Jacquilou Gier MacaseroNo ratings yet

- The Universal Declaration of Human Rights: Objective The United Nations: Ensuring Peace and Avoiding Harm ToDocument11 pagesThe Universal Declaration of Human Rights: Objective The United Nations: Ensuring Peace and Avoiding Harm ToLeticia Palma González100% (2)

- Non-Leasehold CovenantsDocument1 pageNon-Leasehold CovenantssrvshNo ratings yet

- Fonacier V CADocument17 pagesFonacier V CAAlex Viray Lucinario100% (1)

- Wolk v. Green Legal Malpractice Plaintiff's Memo CompelDocument21 pagesWolk v. Green Legal Malpractice Plaintiff's Memo CompelGloria Grening Wolk100% (1)

- Heirs of Jose Amunategui V. Director of ForestryDocument2 pagesHeirs of Jose Amunategui V. Director of ForestryBing Kidkid Calya-enNo ratings yet

- Juris Doctor (J.D.) Program: University of Toronto Faculty of Law 2011-2012Document28 pagesJuris Doctor (J.D.) Program: University of Toronto Faculty of Law 2011-2012ShubhamSindhwaniNo ratings yet

- Asset Privatization Trust vs. T.J. Enterprise G.R. No. 167195 May 8, 2009 FactsDocument4 pagesAsset Privatization Trust vs. T.J. Enterprise G.R. No. 167195 May 8, 2009 FactsAlexander DruceNo ratings yet

- Locsin Case DigestDocument6 pagesLocsin Case DigestOwen BuenaventuraNo ratings yet

- Case DigestDocument5 pagesCase Digestrose OneubNo ratings yet

- LegRes Notes 2 PDFDocument15 pagesLegRes Notes 2 PDFMonica SalvadorNo ratings yet

- Prevention of Sexual Harassment at Workplace PDFDocument43 pagesPrevention of Sexual Harassment at Workplace PDFok123No ratings yet

- Document PDFDocument28 pagesDocument PDFLakshay DhaliaNo ratings yet

- Heavy Equipment Rental - DraftDocument2 pagesHeavy Equipment Rental - DraftcarlomaderazoNo ratings yet

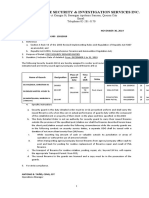

- Golden Gate Security & Investigation Services IncDocument1 pageGolden Gate Security & Investigation Services IncJojo PincaNo ratings yet

- Q11 - FamDocument3 pagesQ11 - FamBeanka PaulNo ratings yet

- Fine As A PunishmentDocument23 pagesFine As A PunishmentagzyNo ratings yet

- Tarot Advice MajorsDocument14 pagesTarot Advice Majorsshilpa shahNo ratings yet

- Standard Oil Co. vs. Jaranillo 44 Phil. 631Document4 pagesStandard Oil Co. vs. Jaranillo 44 Phil. 631Virgil SawNo ratings yet