Professional Documents

Culture Documents

Pcib VS Ca

Pcib VS Ca

Uploaded by

Markus Tran MoraldeCopyright:

Available Formats

You might also like

- HILTI PROFIS Anchor Design GuideDocument362 pagesHILTI PROFIS Anchor Design Guidearun_angshu100% (2)

- Case Brown EnglishDocument11 pagesCase Brown EnglishPierre SquiresNo ratings yet

- Syllabus - Final PDFDocument14 pagesSyllabus - Final PDFERICANo ratings yet

- Case Digests in SalesDocument8 pagesCase Digests in SalesVictor SarmientoNo ratings yet

- Defenses of A Common Carrier Reading Guide and AssignmentDocument7 pagesDefenses of A Common Carrier Reading Guide and AssignmentVanessa Evans CruzNo ratings yet

- Maria Antonia Siguan V LimDocument6 pagesMaria Antonia Siguan V LimMicah Clark-MalinaoNo ratings yet

- Yap v. BuriDocument2 pagesYap v. BuriBienvenido RiveraNo ratings yet

- RCPI vs. CA, 143 Scra 657 (FCD)Document1 pageRCPI vs. CA, 143 Scra 657 (FCD)Rizchelle Sampang-ManaogNo ratings yet

- FGU Insurance Corp. vs. GP Sarmiento Trucking Corp. and Lambert M. ErolesDocument1 pageFGU Insurance Corp. vs. GP Sarmiento Trucking Corp. and Lambert M. ErolesJennifer OceñaNo ratings yet

- People v. Nurfrashir HashimDocument1 pagePeople v. Nurfrashir HashimIkangApostolNo ratings yet

- Oblicon Cases Fourth and Fifth Assignment (Lim To Alipio)Document275 pagesOblicon Cases Fourth and Fifth Assignment (Lim To Alipio)Eins BalagtasNo ratings yet

- Second Div Navrez Vs Abrogar III 2015Document5 pagesSecond Div Navrez Vs Abrogar III 2015Jan Veah CaabayNo ratings yet

- CANON 1 - Judicial ConductDocument3 pagesCANON 1 - Judicial ConductInnah Agito-RamosNo ratings yet

- Maceda CaseDocument7 pagesMaceda CaseDANICA FLORES100% (1)

- FLORES Vs MALLARE PHILIPPSDocument3 pagesFLORES Vs MALLARE PHILIPPSValerie Kaye BinayasNo ratings yet

- Classification of Philippine CourtsDocument1 pageClassification of Philippine CourtsMiguel Anas Jr.No ratings yet

- 13) People v. Dijan, 383 SCRA 15Document5 pages13) People v. Dijan, 383 SCRA 15Nurlailah AliNo ratings yet

- Tiongson v. Public Service Comission - GR L-24701 Dec. 16, 1970Document6 pagesTiongson v. Public Service Comission - GR L-24701 Dec. 16, 1970Lawrence EsioNo ratings yet

- Ylarde v. Aquino - Torts DigestDocument2 pagesYlarde v. Aquino - Torts DigestAlter NateNo ratings yet

- Sales (Required Syllabus)Document8 pagesSales (Required Syllabus)Janine Blaize Oplay CaniwNo ratings yet

- Constitutional Law 2 OutlineDocument15 pagesConstitutional Law 2 OutlineShane Ivy Antivo GarciaNo ratings yet

- Special Penal Laws Reviewer 2Document17 pagesSpecial Penal Laws Reviewer 2Aya BeltranNo ratings yet

- Que vs. People DigestDocument1 pageQue vs. People DigestMark PolvoraNo ratings yet

- Philip Morris vs. CA, 224 SCRA 576 (1993)Document14 pagesPhilip Morris vs. CA, 224 SCRA 576 (1993)Terry FordNo ratings yet

- Diaz vs. Encanto GR No. 171303Document15 pagesDiaz vs. Encanto GR No. 171303Therese ElleNo ratings yet

- La Mallorca vs. Court of Appeals, Et Al.Document6 pagesLa Mallorca vs. Court of Appeals, Et Al.Lance Christian ZoletaNo ratings yet

- Mareja Aña G. Arellano Engreso V Dela Cruz G.R. No. 148727 Bar QuestionDocument1 pageMareja Aña G. Arellano Engreso V Dela Cruz G.R. No. 148727 Bar QuestionMareja ArellanoNo ratings yet

- TortsDocument19 pagesTortsMaFatimaP.Lee100% (1)

- Inestate Estate of The Lete Ricardo Presbitero, Sr. Vs CA, 217 SCRA 372Document2 pagesInestate Estate of The Lete Ricardo Presbitero, Sr. Vs CA, 217 SCRA 372Gilda P. OstolNo ratings yet

- Easterm Shipping Lines Vs CA 234 SCRA 781 (1994)Document2 pagesEasterm Shipping Lines Vs CA 234 SCRA 781 (1994)Benitez GheroldNo ratings yet

- People vs. Sotelo, ManingasDocument2 pagesPeople vs. Sotelo, ManingasAngelie ManingasNo ratings yet

- Cebu Oxygen & Acetylene Co., Inc. vs. BercillesDocument6 pagesCebu Oxygen & Acetylene Co., Inc. vs. BercillesellaNo ratings yet

- Ouano vs. Court of Appeals and Francisco B. EchavezDocument3 pagesOuano vs. Court of Appeals and Francisco B. EchavezJoyce VillanuevaNo ratings yet

- Civil Code (Art 1999-2003 & 1755-1763)Document2 pagesCivil Code (Art 1999-2003 & 1755-1763)Ric SaysonNo ratings yet

- 3 Republic v. DomingoDocument6 pages3 Republic v. DomingoMarione Mae Bernadette ThiamNo ratings yet

- International Hotel Corp Vs JoaquinDocument6 pagesInternational Hotel Corp Vs JoaquinmonjekatreenaNo ratings yet

- PNB Vs CA G.R. No. 88880Document3 pagesPNB Vs CA G.R. No. 88880Rizchelle Sampang-ManaogNo ratings yet

- Bautista vs. BorromeoDocument2 pagesBautista vs. BorromeoAndré BragaNo ratings yet

- 21 06 20 SCDocument22 pages21 06 20 SCHoneybeez TvNo ratings yet

- TRANSPORTATION LAW Sulpicio Lines Inc. v. CA GR No. 106279 July 14 1995Document2 pagesTRANSPORTATION LAW Sulpicio Lines Inc. v. CA GR No. 106279 July 14 1995genel marquezNo ratings yet

- Legal Ethics Bar QuestionsDocument6 pagesLegal Ethics Bar QuestionsAce GonzalesNo ratings yet

- Macalalag vs. OmbudsmanDocument2 pagesMacalalag vs. OmbudsmanJL A H-DimaculanganNo ratings yet

- Tan V CA PDFDocument14 pagesTan V CA PDFral cbNo ratings yet

- MADRIA V RIVERADocument3 pagesMADRIA V RIVERAJumel John H. Valero100% (1)

- Atty. Fe Q. Palmiano-Salvador, Petitioner, vs. Constantino Angeles, Substituted by Luz G. Angeles, Respondent.Document3 pagesAtty. Fe Q. Palmiano-Salvador, Petitioner, vs. Constantino Angeles, Substituted by Luz G. Angeles, Respondent.engrgigikayeNo ratings yet

- Case DigestDocument4 pagesCase DigestEugene Albert Olarte JavillonarNo ratings yet

- Edding V ComelecDocument6 pagesEdding V ComelecVienna Mantiza - PortillanoNo ratings yet

- Rules On Validity of WillsDocument2 pagesRules On Validity of WillsManu SalaNo ratings yet

- Aggabao Vs Comelec, 449 Scra 400Document4 pagesAggabao Vs Comelec, 449 Scra 400AddAllNo ratings yet

- GR No 11538Document1 pageGR No 11538Kat JolejoleNo ratings yet

- Toribio, Et Al. vs. Bidin, G.R. No. L-57821Document2 pagesToribio, Et Al. vs. Bidin, G.R. No. L-57821Angelo Karl DoceoNo ratings yet

- LG Foods Vs AgraviadorDocument2 pagesLG Foods Vs AgraviadorPaula GasparNo ratings yet

- Lao Chit V Security Bank & Trust Co. and Consolidated Investment, Inc. (17 April 1959)Document4 pagesLao Chit V Security Bank & Trust Co. and Consolidated Investment, Inc. (17 April 1959)Alelie BatinoNo ratings yet

- Estacion Vs BernardoDocument20 pagesEstacion Vs BernardoMelissa AdajarNo ratings yet

- MAGUAN V COURT OF APPEALSDocument2 pagesMAGUAN V COURT OF APPEALSCedricNo ratings yet

- Dizon Vs Dizon CaseDocument3 pagesDizon Vs Dizon CaseM Azeneth JJ100% (1)

- Week 2 CasesDocument10 pagesWeek 2 CasesAisaia Jay ToralNo ratings yet

- Yu Biao Sontua vs. OssorioDocument3 pagesYu Biao Sontua vs. OssorioLou Ann AncaoNo ratings yet

- PHILIPPINE COMMERCIAL INTERNATIONAL BANK v. CADocument2 pagesPHILIPPINE COMMERCIAL INTERNATIONAL BANK v. CAAngelNo ratings yet

- Case Digest Ni JommelDocument1 pageCase Digest Ni Jommel21-55654No ratings yet

- (Phil. Commercial International Bank vs. Court of Appeals, 255 SCRA 299 (1996) )Document12 pages(Phil. Commercial International Bank vs. Court of Appeals, 255 SCRA 299 (1996) )Jillian BatacNo ratings yet

- In The Matter of Proceedings For Disciplinary Action Against AttyDocument1 pageIn The Matter of Proceedings For Disciplinary Action Against AttyMarkus Tran MoraldeNo ratings yet

- SANTOS vs. PAGUIO A.M. No. MTJ-93-781 November 16, 1993Document1 pageSANTOS vs. PAGUIO A.M. No. MTJ-93-781 November 16, 1993Markus Tran MoraldeNo ratings yet

- AMATORIO vs. YAP A.C. No. 5914 March 11, 2015Document1 pageAMATORIO vs. YAP A.C. No. 5914 March 11, 2015Markus Tran MoraldeNo ratings yet

- Castillo vs. Padilla, JR., 127 SCRA 743, February 24, 1984Document1 pageCastillo vs. Padilla, JR., 127 SCRA 743, February 24, 1984Markus Tran Moralde100% (2)

- IN RE MUNESES, BM No 2112, July 24, 2012Document1 pageIN RE MUNESES, BM No 2112, July 24, 2012Markus Tran MoraldeNo ratings yet

- SPS CONCEPTION Vs DELA ROSA, AC No 10681, February 3, 2015Document1 pageSPS CONCEPTION Vs DELA ROSA, AC No 10681, February 3, 2015Markus Tran MoraldeNo ratings yet

- BANSIG VS CELERA A.C. No. 5581, January 14, 2014Document1 pageBANSIG VS CELERA A.C. No. 5581, January 14, 2014Markus Tran MoraldeNo ratings yet

- Tadlip Vs Borres nOV.11, 2005Document1 pageTadlip Vs Borres nOV.11, 2005Markus Tran MoraldeNo ratings yet

- PAGCOR vs. CARANDANG, AC No 5700, January 30, 2006Document1 pagePAGCOR vs. CARANDANG, AC No 5700, January 30, 2006Markus Tran MoraldeNo ratings yet

- LIKONG vs. LIM, AC No. 3149, August 17, 1994Document1 pageLIKONG vs. LIM, AC No. 3149, August 17, 1994Markus Tran MoraldeNo ratings yet

- LEDA vs. TABANG, AC No 2505, February 21, 1992Document1 pageLEDA vs. TABANG, AC No 2505, February 21, 1992Markus Tran MoraldeNo ratings yet

- BARANDON JR vs. FERRER SR, AC No 5678, March 26, 2010Document1 pageBARANDON JR vs. FERRER SR, AC No 5678, March 26, 2010Markus Tran MoraldeNo ratings yet

- Catu vs. Rellosa (A.C. No. 5738. February 19, 2008Document1 pageCatu vs. Rellosa (A.C. No. 5738. February 19, 2008Markus Tran MoraldeNo ratings yet

- GACIAS vs. BULAUITAN, AC No. 7280, November 16, 2006Document1 pageGACIAS vs. BULAUITAN, AC No. 7280, November 16, 2006Markus Tran MoraldeNo ratings yet

- DE MIJARES vs. VILLALUZDocument1 pageDE MIJARES vs. VILLALUZMarkus Tran MoraldeNo ratings yet

- DANTES vs. DANTES, AC No 6486, September 22, 2004Document1 pageDANTES vs. DANTES, AC No 6486, September 22, 2004Markus Tran Moralde100% (1)

- PITCHER vs. GAGATE A.C. No. 9532 October 08, 2013Document1 pagePITCHER vs. GAGATE A.C. No. 9532 October 08, 2013Markus Tran MoraldeNo ratings yet

- DEL MUNDO vs. CAPISTRANO, AC No 6903, April 16, 2012Document1 pageDEL MUNDO vs. CAPISTRANO, AC No 6903, April 16, 2012Markus Tran MoraldeNo ratings yet

- DALISAY vs. MAURICIO JR, AC No 5655, April 22, 2005Document1 pageDALISAY vs. MAURICIO JR, AC No 5655, April 22, 2005Markus Tran MoraldeNo ratings yet

- TOLOSA vs. CARGODocument1 pageTOLOSA vs. CARGOMarkus Tran MoraldeNo ratings yet

- Alex B. Cueto, Complainant, v. Atty. Jose B. Jimenez, JR., RespondentDocument1 pageAlex B. Cueto, Complainant, v. Atty. Jose B. Jimenez, JR., RespondentMarkus Tran MoraldeNo ratings yet

- CO vs. BERNARDINODocument1 pageCO vs. BERNARDINOMarkus Tran MoraldeNo ratings yet

- ANDRADA vs. CERADocument1 pageANDRADA vs. CERAMarkus Tran MoraldeNo ratings yet

- ENRIQUEZ vs. DE VERADocument1 pageENRIQUEZ vs. DE VERAMarkus Tran MoraldeNo ratings yet

- Zoriano VS DizonDocument1 pageZoriano VS DizonMarkus Tran MoraldeNo ratings yet

- Foodsphere VS MauricioDocument1 pageFoodsphere VS MauricioMarkus Tran Moralde100% (1)

- CASTANEDA vs. AGODocument1 pageCASTANEDA vs. AGOMarkus Tran MoraldeNo ratings yet

- Spouses Lopez vs. Limos A.C. No. 7618 February 02, 2016Document1 pageSpouses Lopez vs. Limos A.C. No. 7618 February 02, 2016Markus Tran MoraldeNo ratings yet

- CORONEL Vs CUNANANDocument2 pagesCORONEL Vs CUNANANMarkus Tran MoraldeNo ratings yet

- Facts:: YSASI III vs. NLRC, GR No. 104599, 3/11/1994Document1 pageFacts:: YSASI III vs. NLRC, GR No. 104599, 3/11/1994Markus Tran MoraldeNo ratings yet

- Admission CriteriaDocument2 pagesAdmission CriteriaDr Vikas GuptaNo ratings yet

- Modal Adverb Lesson PlanDocument4 pagesModal Adverb Lesson Planapi-587326479100% (1)

- The Problem of Increasing Human Energy - Nikola Tesla PDFDocument27 pagesThe Problem of Increasing Human Energy - Nikola Tesla PDFKarhys100% (2)

- Apache Kafka Quick Start GuideDocument180 pagesApache Kafka Quick Start GuidesleepercodeNo ratings yet

- Application of IntegralsDocument14 pagesApplication of IntegralsSanjayNo ratings yet

- LPP - orDocument12 pagesLPP - orbharat_v79No ratings yet

- Stat Fax 3300 Chemistry AnalyzerDocument2 pagesStat Fax 3300 Chemistry AnalyzermohamedNo ratings yet

- JAMB English Language Past Questions and Answers 2010 - 2018Document84 pagesJAMB English Language Past Questions and Answers 2010 - 2018Joel Adams100% (6)

- Risk Management in Islamic BankingDocument17 pagesRisk Management in Islamic BankingEdi SusiloNo ratings yet

- DC20D MKII Genset Controller Upgrade Version For Diesel - Gasoline Engine - EbayDocument2 pagesDC20D MKII Genset Controller Upgrade Version For Diesel - Gasoline Engine - EbayAliNo ratings yet

- Tamil Inscriptions in ChinaDocument38 pagesTamil Inscriptions in Chinasubiksha100% (1)

- PreviewpdfDocument136 pagesPreviewpdfDayana Suarez RamosNo ratings yet

- OET SpeakingDocument92 pagesOET SpeakingAnwaarNo ratings yet

- SAP Security QuestionsDocument24 pagesSAP Security Questionschakri406k67% (3)

- Loksabha AccomodationDocument2 pagesLoksabha Accomodationabdul956No ratings yet

- Assignment Name: Identifying Characteristics of Some Family With 5 ExamplesDocument4 pagesAssignment Name: Identifying Characteristics of Some Family With 5 ExamplesAbdullah Al MamunNo ratings yet

- Competitive Intelligence: Guest EditorialDocument14 pagesCompetitive Intelligence: Guest EditorialIoana AlexandraNo ratings yet

- Lenovo Tab-M10-Plus-3Gen Folio Case Datasheet ENDocument1 pageLenovo Tab-M10-Plus-3Gen Folio Case Datasheet ENSavoNo ratings yet

- Management Theories-1Document5 pagesManagement Theories-1veera kaurNo ratings yet

- Accomplishment of ElectricianDocument17 pagesAccomplishment of ElectricianRichard Tañada RosalesNo ratings yet

- 14.3 Study GuideDocument3 pages14.3 Study Guide4b00d1No ratings yet

- Classification of HotelsDocument14 pagesClassification of HotelsJeevesh ViswambharanNo ratings yet

- FRB13089887411Document4 pagesFRB13089887411MAHA KAALNo ratings yet

- Bus FestoDocument82 pagesBus FestoraphvalonNo ratings yet

- Fenomenele Postvulcanice Utóvulkáni Mûködések Post Volcanic PhenomenaDocument1 pageFenomenele Postvulcanice Utóvulkáni Mûködések Post Volcanic PhenomenaCosmin FlorinNo ratings yet

- Expt. No: 1111: Determination of Total Hardness of Water by Complexometric Titration (EDTA Method)Document3 pagesExpt. No: 1111: Determination of Total Hardness of Water by Complexometric Titration (EDTA Method)Nael NomanNo ratings yet

- 4life Distributor New Prices-1Document3 pages4life Distributor New Prices-1Hermosa BellisimaNo ratings yet

- NY CREATES IBM Board PacketDocument2 pagesNY CREATES IBM Board PacketSean MickeyNo ratings yet

- Research Lifecycle DiagramDocument1 pageResearch Lifecycle DiagramAlexandre Caixeta UmbertiNo ratings yet

Pcib VS Ca

Pcib VS Ca

Uploaded by

Markus Tran MoraldeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pcib VS Ca

Pcib VS Ca

Uploaded by

Markus Tran MoraldeCopyright:

Available Formats

PCT

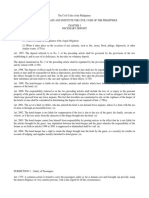

2. PCIB vs. CA GR No. 97785 March 29, 1996

FACTS:

On March 13, 1986, private respondent Rory Lim delivered to his cousin Lim Ong Tian PCIB

Check amounting to P200,000.00 for the purpose of obtaining a telegraphic transfer from petitioner

PCIB. Upon purchase of the telegraphic transfer, petitioner issued the a receipt which relieves it of

any liability resulting from loss caused by errors or delays in the course of the discharge of its

services. After its purchase, petitioner in turn issued and delivered eight (8) Equitable bank checks to

his supplier in different amounts as payment for the merchandise that he obtained from them.

However, these checks was dishonored for insufficiency of funds. Petitioner PCIB made the

corresponding transfer of funds only on April 3, 1986, twenty one (21) days after the purchase of the

telegraphic transfer on march 13, 1986.

Private respondent demanded from petitioner PCIB that he be compensated for the

resulting damage that he suffered due to petitioner’s failure to make the timely transfer of funds

which led to the dishonor of his checks. Petitioner, however, refuse to heed private respondent’s

demand and pointed out that private respondent is nevertheless bound by the stipulation in the

telegraphic transfer application/form receipt which exempts the petitioner from liability.

Both the RTC and CA held that petitioner is liable for breach of contract.

ISSUE:

Whether or not petitioner PCIB is liable for damages.

HELD:

YES. The petitioner is liable. In Geraldez vs. CA, it was unequivocally declared that

notwithstanding the enforceability of a contractual limitation, responsibility arising from a

fraudulent act cannot be exculpated because the same is contrary to public policy. Further, Article

21 of the Civil code provides that:

“any person who willfully causes loss or injury to another in a manner that is contrary to morals,

good customs or public policy shall compensate the latter for the damage.

Freedom of contract is subject to the limitation that the agreement must not be against

public policy and any agreement or contract made in violation of this rule is not binding and will not

be enforced. Undoubtedly, the services being offered by a banking institution like petitioner are

imbue with public interest. Any attempt to completely exempt one of the contracting parties from

any liability in case of loss notwithstanding its bad faith, fault or negligence cannot be sanctioned for

being inimical to public interest and therefore contrary to public policy. There being no dispute that

petitioner acted fraudulently and in bad faith, the award of moral and exemplary damages were

proper.

You might also like

- HILTI PROFIS Anchor Design GuideDocument362 pagesHILTI PROFIS Anchor Design Guidearun_angshu100% (2)

- Case Brown EnglishDocument11 pagesCase Brown EnglishPierre SquiresNo ratings yet

- Syllabus - Final PDFDocument14 pagesSyllabus - Final PDFERICANo ratings yet

- Case Digests in SalesDocument8 pagesCase Digests in SalesVictor SarmientoNo ratings yet

- Defenses of A Common Carrier Reading Guide and AssignmentDocument7 pagesDefenses of A Common Carrier Reading Guide and AssignmentVanessa Evans CruzNo ratings yet

- Maria Antonia Siguan V LimDocument6 pagesMaria Antonia Siguan V LimMicah Clark-MalinaoNo ratings yet

- Yap v. BuriDocument2 pagesYap v. BuriBienvenido RiveraNo ratings yet

- RCPI vs. CA, 143 Scra 657 (FCD)Document1 pageRCPI vs. CA, 143 Scra 657 (FCD)Rizchelle Sampang-ManaogNo ratings yet

- FGU Insurance Corp. vs. GP Sarmiento Trucking Corp. and Lambert M. ErolesDocument1 pageFGU Insurance Corp. vs. GP Sarmiento Trucking Corp. and Lambert M. ErolesJennifer OceñaNo ratings yet

- People v. Nurfrashir HashimDocument1 pagePeople v. Nurfrashir HashimIkangApostolNo ratings yet

- Oblicon Cases Fourth and Fifth Assignment (Lim To Alipio)Document275 pagesOblicon Cases Fourth and Fifth Assignment (Lim To Alipio)Eins BalagtasNo ratings yet

- Second Div Navrez Vs Abrogar III 2015Document5 pagesSecond Div Navrez Vs Abrogar III 2015Jan Veah CaabayNo ratings yet

- CANON 1 - Judicial ConductDocument3 pagesCANON 1 - Judicial ConductInnah Agito-RamosNo ratings yet

- Maceda CaseDocument7 pagesMaceda CaseDANICA FLORES100% (1)

- FLORES Vs MALLARE PHILIPPSDocument3 pagesFLORES Vs MALLARE PHILIPPSValerie Kaye BinayasNo ratings yet

- Classification of Philippine CourtsDocument1 pageClassification of Philippine CourtsMiguel Anas Jr.No ratings yet

- 13) People v. Dijan, 383 SCRA 15Document5 pages13) People v. Dijan, 383 SCRA 15Nurlailah AliNo ratings yet

- Tiongson v. Public Service Comission - GR L-24701 Dec. 16, 1970Document6 pagesTiongson v. Public Service Comission - GR L-24701 Dec. 16, 1970Lawrence EsioNo ratings yet

- Ylarde v. Aquino - Torts DigestDocument2 pagesYlarde v. Aquino - Torts DigestAlter NateNo ratings yet

- Sales (Required Syllabus)Document8 pagesSales (Required Syllabus)Janine Blaize Oplay CaniwNo ratings yet

- Constitutional Law 2 OutlineDocument15 pagesConstitutional Law 2 OutlineShane Ivy Antivo GarciaNo ratings yet

- Special Penal Laws Reviewer 2Document17 pagesSpecial Penal Laws Reviewer 2Aya BeltranNo ratings yet

- Que vs. People DigestDocument1 pageQue vs. People DigestMark PolvoraNo ratings yet

- Philip Morris vs. CA, 224 SCRA 576 (1993)Document14 pagesPhilip Morris vs. CA, 224 SCRA 576 (1993)Terry FordNo ratings yet

- Diaz vs. Encanto GR No. 171303Document15 pagesDiaz vs. Encanto GR No. 171303Therese ElleNo ratings yet

- La Mallorca vs. Court of Appeals, Et Al.Document6 pagesLa Mallorca vs. Court of Appeals, Et Al.Lance Christian ZoletaNo ratings yet

- Mareja Aña G. Arellano Engreso V Dela Cruz G.R. No. 148727 Bar QuestionDocument1 pageMareja Aña G. Arellano Engreso V Dela Cruz G.R. No. 148727 Bar QuestionMareja ArellanoNo ratings yet

- TortsDocument19 pagesTortsMaFatimaP.Lee100% (1)

- Inestate Estate of The Lete Ricardo Presbitero, Sr. Vs CA, 217 SCRA 372Document2 pagesInestate Estate of The Lete Ricardo Presbitero, Sr. Vs CA, 217 SCRA 372Gilda P. OstolNo ratings yet

- Easterm Shipping Lines Vs CA 234 SCRA 781 (1994)Document2 pagesEasterm Shipping Lines Vs CA 234 SCRA 781 (1994)Benitez GheroldNo ratings yet

- People vs. Sotelo, ManingasDocument2 pagesPeople vs. Sotelo, ManingasAngelie ManingasNo ratings yet

- Cebu Oxygen & Acetylene Co., Inc. vs. BercillesDocument6 pagesCebu Oxygen & Acetylene Co., Inc. vs. BercillesellaNo ratings yet

- Ouano vs. Court of Appeals and Francisco B. EchavezDocument3 pagesOuano vs. Court of Appeals and Francisco B. EchavezJoyce VillanuevaNo ratings yet

- Civil Code (Art 1999-2003 & 1755-1763)Document2 pagesCivil Code (Art 1999-2003 & 1755-1763)Ric SaysonNo ratings yet

- 3 Republic v. DomingoDocument6 pages3 Republic v. DomingoMarione Mae Bernadette ThiamNo ratings yet

- International Hotel Corp Vs JoaquinDocument6 pagesInternational Hotel Corp Vs JoaquinmonjekatreenaNo ratings yet

- PNB Vs CA G.R. No. 88880Document3 pagesPNB Vs CA G.R. No. 88880Rizchelle Sampang-ManaogNo ratings yet

- Bautista vs. BorromeoDocument2 pagesBautista vs. BorromeoAndré BragaNo ratings yet

- 21 06 20 SCDocument22 pages21 06 20 SCHoneybeez TvNo ratings yet

- TRANSPORTATION LAW Sulpicio Lines Inc. v. CA GR No. 106279 July 14 1995Document2 pagesTRANSPORTATION LAW Sulpicio Lines Inc. v. CA GR No. 106279 July 14 1995genel marquezNo ratings yet

- Legal Ethics Bar QuestionsDocument6 pagesLegal Ethics Bar QuestionsAce GonzalesNo ratings yet

- Macalalag vs. OmbudsmanDocument2 pagesMacalalag vs. OmbudsmanJL A H-DimaculanganNo ratings yet

- Tan V CA PDFDocument14 pagesTan V CA PDFral cbNo ratings yet

- MADRIA V RIVERADocument3 pagesMADRIA V RIVERAJumel John H. Valero100% (1)

- Atty. Fe Q. Palmiano-Salvador, Petitioner, vs. Constantino Angeles, Substituted by Luz G. Angeles, Respondent.Document3 pagesAtty. Fe Q. Palmiano-Salvador, Petitioner, vs. Constantino Angeles, Substituted by Luz G. Angeles, Respondent.engrgigikayeNo ratings yet

- Case DigestDocument4 pagesCase DigestEugene Albert Olarte JavillonarNo ratings yet

- Edding V ComelecDocument6 pagesEdding V ComelecVienna Mantiza - PortillanoNo ratings yet

- Rules On Validity of WillsDocument2 pagesRules On Validity of WillsManu SalaNo ratings yet

- Aggabao Vs Comelec, 449 Scra 400Document4 pagesAggabao Vs Comelec, 449 Scra 400AddAllNo ratings yet

- GR No 11538Document1 pageGR No 11538Kat JolejoleNo ratings yet

- Toribio, Et Al. vs. Bidin, G.R. No. L-57821Document2 pagesToribio, Et Al. vs. Bidin, G.R. No. L-57821Angelo Karl DoceoNo ratings yet

- LG Foods Vs AgraviadorDocument2 pagesLG Foods Vs AgraviadorPaula GasparNo ratings yet

- Lao Chit V Security Bank & Trust Co. and Consolidated Investment, Inc. (17 April 1959)Document4 pagesLao Chit V Security Bank & Trust Co. and Consolidated Investment, Inc. (17 April 1959)Alelie BatinoNo ratings yet

- Estacion Vs BernardoDocument20 pagesEstacion Vs BernardoMelissa AdajarNo ratings yet

- MAGUAN V COURT OF APPEALSDocument2 pagesMAGUAN V COURT OF APPEALSCedricNo ratings yet

- Dizon Vs Dizon CaseDocument3 pagesDizon Vs Dizon CaseM Azeneth JJ100% (1)

- Week 2 CasesDocument10 pagesWeek 2 CasesAisaia Jay ToralNo ratings yet

- Yu Biao Sontua vs. OssorioDocument3 pagesYu Biao Sontua vs. OssorioLou Ann AncaoNo ratings yet

- PHILIPPINE COMMERCIAL INTERNATIONAL BANK v. CADocument2 pagesPHILIPPINE COMMERCIAL INTERNATIONAL BANK v. CAAngelNo ratings yet

- Case Digest Ni JommelDocument1 pageCase Digest Ni Jommel21-55654No ratings yet

- (Phil. Commercial International Bank vs. Court of Appeals, 255 SCRA 299 (1996) )Document12 pages(Phil. Commercial International Bank vs. Court of Appeals, 255 SCRA 299 (1996) )Jillian BatacNo ratings yet

- In The Matter of Proceedings For Disciplinary Action Against AttyDocument1 pageIn The Matter of Proceedings For Disciplinary Action Against AttyMarkus Tran MoraldeNo ratings yet

- SANTOS vs. PAGUIO A.M. No. MTJ-93-781 November 16, 1993Document1 pageSANTOS vs. PAGUIO A.M. No. MTJ-93-781 November 16, 1993Markus Tran MoraldeNo ratings yet

- AMATORIO vs. YAP A.C. No. 5914 March 11, 2015Document1 pageAMATORIO vs. YAP A.C. No. 5914 March 11, 2015Markus Tran MoraldeNo ratings yet

- Castillo vs. Padilla, JR., 127 SCRA 743, February 24, 1984Document1 pageCastillo vs. Padilla, JR., 127 SCRA 743, February 24, 1984Markus Tran Moralde100% (2)

- IN RE MUNESES, BM No 2112, July 24, 2012Document1 pageIN RE MUNESES, BM No 2112, July 24, 2012Markus Tran MoraldeNo ratings yet

- SPS CONCEPTION Vs DELA ROSA, AC No 10681, February 3, 2015Document1 pageSPS CONCEPTION Vs DELA ROSA, AC No 10681, February 3, 2015Markus Tran MoraldeNo ratings yet

- BANSIG VS CELERA A.C. No. 5581, January 14, 2014Document1 pageBANSIG VS CELERA A.C. No. 5581, January 14, 2014Markus Tran MoraldeNo ratings yet

- Tadlip Vs Borres nOV.11, 2005Document1 pageTadlip Vs Borres nOV.11, 2005Markus Tran MoraldeNo ratings yet

- PAGCOR vs. CARANDANG, AC No 5700, January 30, 2006Document1 pagePAGCOR vs. CARANDANG, AC No 5700, January 30, 2006Markus Tran MoraldeNo ratings yet

- LIKONG vs. LIM, AC No. 3149, August 17, 1994Document1 pageLIKONG vs. LIM, AC No. 3149, August 17, 1994Markus Tran MoraldeNo ratings yet

- LEDA vs. TABANG, AC No 2505, February 21, 1992Document1 pageLEDA vs. TABANG, AC No 2505, February 21, 1992Markus Tran MoraldeNo ratings yet

- BARANDON JR vs. FERRER SR, AC No 5678, March 26, 2010Document1 pageBARANDON JR vs. FERRER SR, AC No 5678, March 26, 2010Markus Tran MoraldeNo ratings yet

- Catu vs. Rellosa (A.C. No. 5738. February 19, 2008Document1 pageCatu vs. Rellosa (A.C. No. 5738. February 19, 2008Markus Tran MoraldeNo ratings yet

- GACIAS vs. BULAUITAN, AC No. 7280, November 16, 2006Document1 pageGACIAS vs. BULAUITAN, AC No. 7280, November 16, 2006Markus Tran MoraldeNo ratings yet

- DE MIJARES vs. VILLALUZDocument1 pageDE MIJARES vs. VILLALUZMarkus Tran MoraldeNo ratings yet

- DANTES vs. DANTES, AC No 6486, September 22, 2004Document1 pageDANTES vs. DANTES, AC No 6486, September 22, 2004Markus Tran Moralde100% (1)

- PITCHER vs. GAGATE A.C. No. 9532 October 08, 2013Document1 pagePITCHER vs. GAGATE A.C. No. 9532 October 08, 2013Markus Tran MoraldeNo ratings yet

- DEL MUNDO vs. CAPISTRANO, AC No 6903, April 16, 2012Document1 pageDEL MUNDO vs. CAPISTRANO, AC No 6903, April 16, 2012Markus Tran MoraldeNo ratings yet

- DALISAY vs. MAURICIO JR, AC No 5655, April 22, 2005Document1 pageDALISAY vs. MAURICIO JR, AC No 5655, April 22, 2005Markus Tran MoraldeNo ratings yet

- TOLOSA vs. CARGODocument1 pageTOLOSA vs. CARGOMarkus Tran MoraldeNo ratings yet

- Alex B. Cueto, Complainant, v. Atty. Jose B. Jimenez, JR., RespondentDocument1 pageAlex B. Cueto, Complainant, v. Atty. Jose B. Jimenez, JR., RespondentMarkus Tran MoraldeNo ratings yet

- CO vs. BERNARDINODocument1 pageCO vs. BERNARDINOMarkus Tran MoraldeNo ratings yet

- ANDRADA vs. CERADocument1 pageANDRADA vs. CERAMarkus Tran MoraldeNo ratings yet

- ENRIQUEZ vs. DE VERADocument1 pageENRIQUEZ vs. DE VERAMarkus Tran MoraldeNo ratings yet

- Zoriano VS DizonDocument1 pageZoriano VS DizonMarkus Tran MoraldeNo ratings yet

- Foodsphere VS MauricioDocument1 pageFoodsphere VS MauricioMarkus Tran Moralde100% (1)

- CASTANEDA vs. AGODocument1 pageCASTANEDA vs. AGOMarkus Tran MoraldeNo ratings yet

- Spouses Lopez vs. Limos A.C. No. 7618 February 02, 2016Document1 pageSpouses Lopez vs. Limos A.C. No. 7618 February 02, 2016Markus Tran MoraldeNo ratings yet

- CORONEL Vs CUNANANDocument2 pagesCORONEL Vs CUNANANMarkus Tran MoraldeNo ratings yet

- Facts:: YSASI III vs. NLRC, GR No. 104599, 3/11/1994Document1 pageFacts:: YSASI III vs. NLRC, GR No. 104599, 3/11/1994Markus Tran MoraldeNo ratings yet

- Admission CriteriaDocument2 pagesAdmission CriteriaDr Vikas GuptaNo ratings yet

- Modal Adverb Lesson PlanDocument4 pagesModal Adverb Lesson Planapi-587326479100% (1)

- The Problem of Increasing Human Energy - Nikola Tesla PDFDocument27 pagesThe Problem of Increasing Human Energy - Nikola Tesla PDFKarhys100% (2)

- Apache Kafka Quick Start GuideDocument180 pagesApache Kafka Quick Start GuidesleepercodeNo ratings yet

- Application of IntegralsDocument14 pagesApplication of IntegralsSanjayNo ratings yet

- LPP - orDocument12 pagesLPP - orbharat_v79No ratings yet

- Stat Fax 3300 Chemistry AnalyzerDocument2 pagesStat Fax 3300 Chemistry AnalyzermohamedNo ratings yet

- JAMB English Language Past Questions and Answers 2010 - 2018Document84 pagesJAMB English Language Past Questions and Answers 2010 - 2018Joel Adams100% (6)

- Risk Management in Islamic BankingDocument17 pagesRisk Management in Islamic BankingEdi SusiloNo ratings yet

- DC20D MKII Genset Controller Upgrade Version For Diesel - Gasoline Engine - EbayDocument2 pagesDC20D MKII Genset Controller Upgrade Version For Diesel - Gasoline Engine - EbayAliNo ratings yet

- Tamil Inscriptions in ChinaDocument38 pagesTamil Inscriptions in Chinasubiksha100% (1)

- PreviewpdfDocument136 pagesPreviewpdfDayana Suarez RamosNo ratings yet

- OET SpeakingDocument92 pagesOET SpeakingAnwaarNo ratings yet

- SAP Security QuestionsDocument24 pagesSAP Security Questionschakri406k67% (3)

- Loksabha AccomodationDocument2 pagesLoksabha Accomodationabdul956No ratings yet

- Assignment Name: Identifying Characteristics of Some Family With 5 ExamplesDocument4 pagesAssignment Name: Identifying Characteristics of Some Family With 5 ExamplesAbdullah Al MamunNo ratings yet

- Competitive Intelligence: Guest EditorialDocument14 pagesCompetitive Intelligence: Guest EditorialIoana AlexandraNo ratings yet

- Lenovo Tab-M10-Plus-3Gen Folio Case Datasheet ENDocument1 pageLenovo Tab-M10-Plus-3Gen Folio Case Datasheet ENSavoNo ratings yet

- Management Theories-1Document5 pagesManagement Theories-1veera kaurNo ratings yet

- Accomplishment of ElectricianDocument17 pagesAccomplishment of ElectricianRichard Tañada RosalesNo ratings yet

- 14.3 Study GuideDocument3 pages14.3 Study Guide4b00d1No ratings yet

- Classification of HotelsDocument14 pagesClassification of HotelsJeevesh ViswambharanNo ratings yet

- FRB13089887411Document4 pagesFRB13089887411MAHA KAALNo ratings yet

- Bus FestoDocument82 pagesBus FestoraphvalonNo ratings yet

- Fenomenele Postvulcanice Utóvulkáni Mûködések Post Volcanic PhenomenaDocument1 pageFenomenele Postvulcanice Utóvulkáni Mûködések Post Volcanic PhenomenaCosmin FlorinNo ratings yet

- Expt. No: 1111: Determination of Total Hardness of Water by Complexometric Titration (EDTA Method)Document3 pagesExpt. No: 1111: Determination of Total Hardness of Water by Complexometric Titration (EDTA Method)Nael NomanNo ratings yet

- 4life Distributor New Prices-1Document3 pages4life Distributor New Prices-1Hermosa BellisimaNo ratings yet

- NY CREATES IBM Board PacketDocument2 pagesNY CREATES IBM Board PacketSean MickeyNo ratings yet

- Research Lifecycle DiagramDocument1 pageResearch Lifecycle DiagramAlexandre Caixeta UmbertiNo ratings yet