Professional Documents

Culture Documents

Generation-Skipping Transfer Tax Return For Distributions: General Information

Generation-Skipping Transfer Tax Return For Distributions: General Information

Uploaded by

douglas jonesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Generation-Skipping Transfer Tax Return For Distributions: General Information

Generation-Skipping Transfer Tax Return For Distributions: General Information

Uploaded by

douglas jonesCopyright:

Available Formats

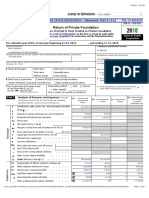

Form 706-GS(D) Generation-Skipping Transfer Tax Return For Distributions

▶ Use for distributions made after December 31, 2010.

(Rev. June 2019) OMB No. 1545-1144

For calendar year .

Department of the Treasury

Internal Revenue Service ▶ Go to www.irs.gov/Form706GSD for instructions and the latest information.

Attach a copy of all Forms 706-GS(D-1) to this return.

Part I General Information

1a Name of skip person distributee 1b Social security number of individual distributee (see instructions)

2a Name and title of person filing return (if different from 1a, see instructions) 1c Employer identification number of trust distributee (see instructions)

2b Address of distributee or person filing return (see instructions) (number and street or P.O. box; city, town, or post office; state; and ZIP code). If you have a foreign

address, also complete the spaces below.

Foreign country name Foreign province/county Foreign postal code

Part II Distributions

a b c

Trust EIN (from Form 706-GS(D-1), Item no. (from Form 706-GS(D-1), Amount of transfer (from Form 706-GS(D-1),

line 2a) line 3, column a) line 3, column f (Tentative transfer))

3 Total transfers (add amounts in column c) . . . . . . . . . . . . . . . . . . 3

Part III Tax Computation

4 Adjusted allowable expenses (see instructions) . . . . . . . . . . . . . . . . 4

5 Taxable amount (subtract line 4 from line 3) . . . . . . . . . . . . . . . . . . 5

6 Maximum federal estate tax rate (see instructions) . . . . . . . . . . . . . . . 6 %

7 Generation-skipping transfer tax (multiply line 5 by line 6) . . . . . . . . . . . . . 7

8 Payment, if any, made with Form 7004 . . . . . . . . . . . . . . . . . . . 8

9 Tax due . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶ 9

10 Overpayment. If line 8 is larger than line 7, enter amount to be refunded . . . . . . . ▶ 10

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Here

▲

Signature of taxpayer or person filing on behalf of taxpayer Date

Print/Type preparer’s name Preparer’s signature Date PTIN

Paid Check if

self-employed

Preparer

Use Only Firm’s name ▶ Firm’s EIN ▶

Firm’s address ▶ Phone no.

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 10327Q Form 706-GS(D) (Rev. 6-2019)

You might also like

- Color of Law Form PDF-2Document1 pageColor of Law Form PDF-2douglas jones100% (1)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Engineering Economy 8th Edition Blank Solutions ManualDocument21 pagesEngineering Economy 8th Edition Blank Solutions ManualDanielThomasxjfoq100% (16)

- Multibit Register Synthesis PDFDocument90 pagesMultibit Register Synthesis PDFPudi SriharshaNo ratings yet

- Sally S. Smith: Professional SummaryDocument2 pagesSally S. Smith: Professional SummaryJustine ManoosNo ratings yet

- 2020 Proteus Offshore, LLC Form 1065 Partnerships Tax Return - FilingDocument17 pages2020 Proteus Offshore, LLC Form 1065 Partnerships Tax Return - FilingPeter Kitchen100% (2)

- Color of Law Form PDF-2Document1 pageColor of Law Form PDF-2douglas jonesNo ratings yet

- Affidavit of Denial of US CitizenshipDocument1 pageAffidavit of Denial of US Citizenshipdouglas jones100% (3)

- C L P L: Ommon AW Roperty IENDocument5 pagesC L P L: Ommon AW Roperty IENdouglas jones100% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Reserve Bank and Serial Number Relationship Table 2 PDFDocument1 pageReserve Bank and Serial Number Relationship Table 2 PDFdouglas jonesNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09JIMOH100% (1)

- 1120s PDFDocument5 pages1120s PDFBreann MorrisNo ratings yet

- Consent by Birth Parent: Superior Court of California, County of Imperial 939 W. Main Street El Centro, Ca 92243Document1 pageConsent by Birth Parent: Superior Court of California, County of Imperial 939 W. Main Street El Centro, Ca 92243douglas jonesNo ratings yet

- Why You Are A "National", "State National", and Constitutional But Not Statutory Citizen, Form #05.006Document682 pagesWhy You Are A "National", "State National", and Constitutional But Not Statutory Citizen, Form #05.006Sovereignty Education and Defense Ministry (SEDM)100% (9)

- Private Surety BondDocument1 pagePrivate Surety BondJulie Hatcher-Julie Munoz Jackson100% (9)

- CH 4 - Project Integration Management - ExamDocument2 pagesCH 4 - Project Integration Management - ExamEng Thiru100% (2)

- Tax Form Template 21 Page1 0001Document1 pageTax Form Template 21 Page1 0001ayesha mihiraniNo ratings yet

- Remic Tax FormDocument4 pagesRemic Tax Formnutech18No ratings yet

- United States Estate (And Generation-Skipping Transfer) Tax ReturnDocument2 pagesUnited States Estate (And Generation-Skipping Transfer) Tax Returndouglas jonesNo ratings yet

- Amended U.S. Corporation Income Tax Return: Fill in Applicable Items and Use Part II On The Back To Explain Any ChangesDocument4 pagesAmended U.S. Corporation Income Tax Return: Fill in Applicable Items and Use Part II On The Back To Explain Any ChangesMoose112No ratings yet

- Form 7200 (2021) - PDF Reader ProDocument1 pageForm 7200 (2021) - PDF Reader Proahmed.hany817818No ratings yet

- Exempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )Document2 pagesExempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )lp101goldNo ratings yet

- US Internal Revenue Service: f8404 - 2003Document2 pagesUS Internal Revenue Service: f8404 - 2003IRSNo ratings yet

- U.S. Income Tax Return For Estates and Trusts: For Calendar Year 2018 or Fiscal Year Beginning, 2018, and Ending, 20Document2 pagesU.S. Income Tax Return For Estates and Trusts: For Calendar Year 2018 or Fiscal Year Beginning, 2018, and Ending, 20Lauren100% (2)

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDocument2 pagesInterest Charge On DISC-Related Deferred Tax Liability: Sign HereIRSNo ratings yet

- US Internal Revenue Service: f8404 - 2000Document2 pagesUS Internal Revenue Service: f8404 - 2000IRSNo ratings yet

- Resolve 990 Federal Financial Disclosure - 2009Document13 pagesResolve 990 Federal Financial Disclosure - 2009ResolveNo ratings yet

- 2010 Blank IRS Form 1065Document5 pages2010 Blank IRS Form 1065Nick PechaNo ratings yet

- Form 7200-PDF Reader ProDocument1 pageForm 7200-PDF Reader ProEdward FederisoNo ratings yet

- Form 3520-A (Rev. December 2023)Document5 pagesForm 3520-A (Rev. December 2023)Jeff LouisNo ratings yet

- US Internal Revenue Service: f8404 - 2001Document2 pagesUS Internal Revenue Service: f8404 - 2001IRSNo ratings yet

- United States Additional Estate Tax Return: General InformationDocument4 pagesUnited States Additional Estate Tax Return: General Informationdouglas jonesNo ratings yet

- 2018 NoVo 990Document80 pages2018 NoVo 990Noam Blum100% (1)

- Application For Extension of Time To File A Return And/or Pay U.S. Estate (And Generation-Skipping Transfer) TaxesDocument1 pageApplication For Extension of Time To File A Return And/or Pay U.S. Estate (And Generation-Skipping Transfer) TaxesJerry MandorNo ratings yet

- US Internal Revenue Service: f5500sb - 1993Document3 pagesUS Internal Revenue Service: f5500sb - 1993IRSNo ratings yet

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument6 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax Returnapi-252942620No ratings yet

- American College of Lifestyle Medicine, IRS 990s 2008 + 2011-PresentDocument41 pagesAmerican College of Lifestyle Medicine, IRS 990s 2008 + 2011-PresentPeter M. HeimlichNo ratings yet

- Formulario 1028Document6 pagesFormulario 1028Renatto reyesNo ratings yet

- J1 WCIJ Form990 Tax Return 2009Document14 pagesJ1 WCIJ Form990 Tax Return 2009jlabinternNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040)Document4 pagesProfit or Loss From Business: Schedule C (Form 1040)adam burd100% (1)

- 2018 Nys Ct3a Comb FormDocument13 pages2018 Nys Ct3a Comb FormMatt MuellerNo ratings yet

- This Is The Trial Version. Click Here To Get The Full Calc VersionDocument16 pagesThis Is The Trial Version. Click Here To Get The Full Calc VersionMounesh KumarNo ratings yet

- F1040nre 2012 PDFDocument2 pagesF1040nre 2012 PDFJohanna AriasNo ratings yet

- f1120s AccessibleDocument5 pagesf1120s AccessiblebhanuprakashbadriNo ratings yet

- TDS Form 16 & 16ADocument14 pagesTDS Form 16 & 16AVaibhav NagoriNo ratings yet

- Military Family Advisory Network Tax Return 2015-12-31Document17 pagesMilitary Family Advisory Network Tax Return 2015-12-31Military Family Advisory NetworkNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument6 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetAshutosh Singh ParmarNo ratings yet

- US Internal Revenue Service: f8860 - 2003Document2 pagesUS Internal Revenue Service: f8860 - 2003IRSNo ratings yet

- 01 Multiple DocumentsDocument8 pages01 Multiple DocumentsChandrasekhara Reddy TNo ratings yet

- Form 5472Document3 pagesForm 5472A.F. GRANADANo ratings yet

- Certificate of Payment of Foreign Death TaxDocument3 pagesCertificate of Payment of Foreign Death Taxdouglas jonesNo ratings yet

- File PDFDocument18 pagesFile PDFAmanda CoffeyNo ratings yet

- Turning Point USA - FY 2016 990Document36 pagesTurning Point USA - FY 2016 990Lachlan MarkayNo ratings yet

- Amended U.S. Individual Income Tax ReturnDocument2 pagesAmended U.S. Individual Income Tax ReturnJohnNo ratings yet

- 2012 Building Intl Bridges (03!28!2013)Document17 pages2012 Building Intl Bridges (03!28!2013)Jk McCreaNo ratings yet

- Employee's Withholding Certificate: Step 1: Enter Personal InformationDocument4 pagesEmployee's Withholding Certificate: Step 1: Enter Personal InformationcstaknysNo ratings yet

- Employee's Withholding Certificate 2020Document4 pagesEmployee's Withholding Certificate 2020CNBC.comNo ratings yet

- 2020 W-4 FormDocument4 pages2020 W-4 FormFOX Business100% (8)

- F 706Document31 pagesF 706Bogdan PraščevićNo ratings yet

- F 709Document5 pagesF 709Bogdan PraščevićNo ratings yet

- F 8868Document4 pagesF 8868IRSNo ratings yet

- US Internal Revenue Service: f8860 - 2002Document2 pagesUS Internal Revenue Service: f8860 - 2002IRSNo ratings yet

- US Internal Revenue Service: f8404 - 2004Document2 pagesUS Internal Revenue Service: f8404 - 2004IRSNo ratings yet

- Courtyard of Honor Inc Full Filing Nonprofit Explorer PropublicaDocument11 pagesCourtyard of Honor Inc Full Filing Nonprofit Explorer PropublicaPennLiveNo ratings yet

- Employer's Annual Federal Tax Return For Agricultural EmployeesDocument3 pagesEmployer's Annual Federal Tax Return For Agricultural EmployeesHotfootballmomNo ratings yet

- Notice Concerning Fiduciary Relationship: IdentificationDocument2 pagesNotice Concerning Fiduciary Relationship: IdentificationRenn DallahNo ratings yet

- U.S. Return of Partnership Income: Sign HereDocument5 pagesU.S. Return of Partnership Income: Sign HereMarie CaragNo ratings yet

- US Internal Revenue Service: I706gsdDocument3 pagesUS Internal Revenue Service: I706gsdIRSNo ratings yet

- Claim For Refund and Request For Abatement: See Separate InstructionsDocument1 pageClaim For Refund and Request For Abatement: See Separate InstructionsYang JeanNo ratings yet

- 1120S Case StudyDocument5 pages1120S Case StudyHimani SachdevNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Envelope TemplateDocument1 pageEnvelope Templatedouglas jones100% (1)

- Expatriation & Divorse From U.S.: Emancipation From The GovernmentDocument1 pageExpatriation & Divorse From U.S.: Emancipation From The Governmentdouglas jonesNo ratings yet

- GN 03325 Verification of SSNDocument8 pagesGN 03325 Verification of SSNTheplaymaker508No ratings yet

- Constitutional Passport RulingDocument42 pagesConstitutional Passport Rulingdouglas jones100% (1)

- Superior Court of California, County of Imperial 939 W. Main Street El Centro, CA 92243Document2 pagesSuperior Court of California, County of Imperial 939 W. Main Street El Centro, CA 92243douglas jonesNo ratings yet

- Superior Court of California, County of Imperial 939 W. Main Street El Centro, Ca 92243Document1 pageSuperior Court of California, County of Imperial 939 W. Main Street El Centro, Ca 92243douglas jonesNo ratings yet

- PROBABLE CAUSE Updated EnabledDocument1 pagePROBABLE CAUSE Updated Enableddouglas jones100% (2)

- Stepparent Adoption, Family. Code Section 9001Document1 pageStepparent Adoption, Family. Code Section 9001douglas jonesNo ratings yet

- Appoint Fiduciary Eric ThorsonDocument2 pagesAppoint Fiduciary Eric Thorsondouglas jones50% (2)

- Reserve Bank and Serial Number Relationship Table 2 PDFDocument1 pageReserve Bank and Serial Number Relationship Table 2 PDFdouglas jonesNo ratings yet

- Ssa-Withdrawal-521 FormDocument2 pagesSsa-Withdrawal-521 Formdouglas jonesNo ratings yet

- Documents For Proof of Ownership For FundsDocument2 pagesDocuments For Proof of Ownership For Fundsdouglas jones100% (1)

- Certificated SecurityDocument1 pageCertificated Securitydouglas jonesNo ratings yet

- Recording Cover PageDocument1 pageRecording Cover Pagedouglas jonesNo ratings yet

- ACH SETTLEMENT Processing: Set Up For Reoccurring Payments To Douglas Charles Bey D/b/a For Fiduciary Duties $25K / MoDocument1 pageACH SETTLEMENT Processing: Set Up For Reoccurring Payments To Douglas Charles Bey D/b/a For Fiduciary Duties $25K / Modouglas jones100% (1)

- Football Recruit LetterDocument1 pageFootball Recruit Letterdouglas jonesNo ratings yet

- List of CollateralDocument5 pagesList of Collateraldouglas jonesNo ratings yet

- 1 Anonymous Auto RegistrationDocument1 page1 Anonymous Auto Registrationdouglas jonesNo ratings yet

- OPPT Invoice US Letter 6p00Document1 pageOPPT Invoice US Letter 6p00douglas jonesNo ratings yet

- Wadhwani OpportunityDocument6 pagesWadhwani Opportunity2310115075100% (1)

- Project Proposal Sustainable PPP ProcurementDocument4 pagesProject Proposal Sustainable PPP ProcurementChristo InnocentNo ratings yet

- Agrekon 25 03 012Document10 pagesAgrekon 25 03 012ronalynNo ratings yet

- Case 7 MGT 214 StudyDocument2 pagesCase 7 MGT 214 StudyViolets n' DaisiesNo ratings yet

- Dharma Bhoomi: Business PlanDocument18 pagesDharma Bhoomi: Business PlanHashitha ArunNo ratings yet

- Mobile Money Note 2019Document8 pagesMobile Money Note 2019Hunter killersNo ratings yet

- Pual Wander Resume First DraftDocument2 pagesPual Wander Resume First Draftarslan muzammilNo ratings yet

- Genres Across Domains - Genre ColoniesDocument24 pagesGenres Across Domains - Genre ColoniesfusumNo ratings yet

- SOP MBA Deepika UpdatedDocument2 pagesSOP MBA Deepika Updatedkrish rawatNo ratings yet

- Steps For Obtaining Cfo StickerDocument4 pagesSteps For Obtaining Cfo StickertagulaolysseteNo ratings yet

- Chapter 13 To Chapter 16: CorrectDocument12 pagesChapter 13 To Chapter 16: CorrectChaiz MineNo ratings yet

- 20 Things You Need To Know About The East Africa ExchangeDocument6 pages20 Things You Need To Know About The East Africa ExchangeAugustine KwingaNo ratings yet

- Atheniac Solutions Brand IdentityDocument16 pagesAtheniac Solutions Brand Identityv89wytwpynNo ratings yet

- Uncommon ServiceDocument3 pagesUncommon ServiceEmanuel Gomez TapiaNo ratings yet

- Kano's Model of Customer Satisfaction: Nikhil Kandwal 19020841022 Neeraj Garg 19020841021Document13 pagesKano's Model of Customer Satisfaction: Nikhil Kandwal 19020841022 Neeraj Garg 19020841021Neeraj GargNo ratings yet

- Nitish at Solutions Unlimited Case AnalyDocument7 pagesNitish at Solutions Unlimited Case AnalyGangadhar BituNo ratings yet

- ElectronicSources ComponentsDocument130 pagesElectronicSources ComponentsHenry ChanNo ratings yet

- Neacsa Matei Stefan AndreiDocument10 pagesNeacsa Matei Stefan AndreiMatei NeacsaNo ratings yet

- Rectification of ErrorsDocument6 pagesRectification of ErrorsJuhi JadhavNo ratings yet

- A Quick Guide To Credit Linked Notes, (CLN)Document2 pagesA Quick Guide To Credit Linked Notes, (CLN)Keval ShahNo ratings yet

- Entrep Activity 2Document1 pageEntrep Activity 2Abraham BojosNo ratings yet

- Invoice AttDocument3 pagesInvoice AttcedricNo ratings yet

- Companies ActDocument45 pagesCompanies ActJanavi KalekarNo ratings yet

- FOR GRADE 11 SourceDocument189 pagesFOR GRADE 11 Sourcechadskie20No ratings yet

- Definitive Guide To Ethics and Compliance Programs USDocument20 pagesDefinitive Guide To Ethics and Compliance Programs USPaul Vincent Ramirez ValbuenaNo ratings yet

- Ca Past PapersDocument248 pagesCa Past PapersDixie CheeloNo ratings yet