Professional Documents

Culture Documents

Suggested Answer CAP II June 2018

Suggested Answer CAP II June 2018

Uploaded by

Pradeep BhattaraiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Suggested Answer CAP II June 2018

Suggested Answer CAP II June 2018

Uploaded by

Pradeep BhattaraiCopyright:

Available Formats

CAP II Paper 1: Advanced Accounting

CHARTERED ACCOUNTANCY PROFESSIONAL II

(CAP-II)

Suggested Answer

June 2018

The Institute of Chartered Accountants of Nepal

The Institute of Chartered Accountants of Nepal 1

Suggested Answer - June 2018

Paper 1: Advanced Accounting

The Institute of Chartered Accountants of Nepal 2

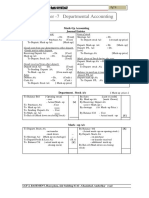

CAP II Paper 1: Advanced Accounting

Maximum Marks - 100

Total No. of Questions - 6 Total No. of Printed Pages -14

Time Allowed - 3 Hours

Marks

Attempt all questions. Working notes should form part of the answer.

1. A and B were carrying on business sharing profits and losses equally.

The firm's Balance Sheet as at 31.03.2074 was:

Liabilities Rs. Assets Rs.

Capital Accounts: Plant 1,60,000

A 1,50,000

B 1,30,000 2,80,000

Sundry Creditors 80,000 Building 48,000

Bank Overdraft 45,000 Debtors 75,000

Stock 70,000

Joint Life Policy 6,000

Profit & Loss A/c 30,000

Drawing Account: 16,000

A 9,000

B 7,000

Total 4,05,000 Total 4,05,000

The operations of the business were carried on till 30.09.2074. A and B both withdrew in

equal amount half the amount of profit made during the current period of six months

after charging depreciation at 10% per annum on plant and after writing off 5% on

building . During the current period of six months, creditors were reduced by Rs. 20,000

and bank overdraft by Rs. 5,000.

The life policy was surrendered for Rs. 6,000 before 30th Poush, 2074. Stock was valued

at Rs. 84,000 and debtors at Rs. 68,000 on 30th Poush, 2074. The other items remained

the same as 31.03.2074.

On 30.09.2074, the firm sold its business to AB Ltd. The value of goodwill was estimated

at Rs. 1,30,000 and the remaining assets were valued on the basis of the balance sheet as

on 30.09.2074.

AB Ltd. paid the purchase consideration in equity shares of Rs. 10 each.

You are required to prepare; 20

a) Balance Sheet of the firm as at 30.09.2074,

b) Realization account,

c) Partners' Capital Accounts showing the final settlement between them.

Answer:

a) Balance Sheet of the firm as at 30.09.2074

Liabilities Rs. Assets Rs.

The Institute of Chartered Accountants of Nepal 3

Suggested Answer - June 2018

Capital Account : Plant :

A's Capital 1,33,800 Opening Balance 1,60,000

B's Capital 1,15,800 Less: Depreciation @ 10% 8,000 1,52,000

Creditors 60,000 Building :

Bank Overdraft 40,000 Opening Balance 48,000

Less: Written-off @ 5% 2,400 45,600

Debtors 68,000

Stock 84,000

Total 3,49,600 Total 3,49,600

b) Realisation Account

Dr.

Cr.

Particular Amount Particular Amount

To Sundry Assets: By Creditors 60,000

Plant 1,52,000 By Bank Overdraft 40,000

Building 45,600

Stock 84,000 By AB Ltd A/c 3,79,600

Debtors 68,000 (working note 2 )

To Profit:

A's Capital A/c 65,000

B's Capital A/c 65,000

------------- ---------------

4,79,600 4,79,600

c) Partner's Capital Accounts

Date Particular A (Rs.) B (Rs.) Date Particular A (Rs.) B (Rs.)

01.04.74 To Profit & 01.04.74 By balance b/d 1,50,000 1,30,000

Loss A/c 15,000 15,000

01.04.74 To Drawing A/c 9,000 7,000 30.09.74 By Profit 15,600 15600

30.09.74 To Drawing A/c 7,800 7,800 (W.N.1)

(W. N.1)

30.09.74 To Balance c/d 1,33,800 1,15,800 ---------- ----------

- --

Total 1,65,600 1,45,600 Total 1,65,000 1,45,600

30.09.74 By Balance b/d 1,33,800 1,15800

30.09.74 To shares in AB 1,98,800 1,80,800 30.09.74 By Realisation 65,000 65,000

Ltd. A/c (Profit)

1,98,800 1,80,000 1,98,800 1,80,000

Working Notes:

(1) Ascertainment of profit for the period of 6 Months ended 30.09.2074

Amount (Rs)

Closing Assets :

The Institute of Chartered Accountants of Nepal 4

CAP II Paper 1: Advanced Accounting

Stock 84,000

Debtors 68,000

Plants less Depreciation 1,52,000

Building Less Written off 45,600

Total 3,49,600

Less: Closing Liabilities :

Creditors 60,000

Bank Overdraft 40,000 1,00,000

Closing Net Assets 2,49,600

Less: Opening adjusted Capitals

A(Rs. 1,50,000 - Rs. 15,000 - Rs. 9,000) 1,26,000

B(Rs. 1,30,000 - Rs. 15,000 - Rs. 7,000) 1,08,000 2,34,000

Profit Net of drawings 15,600

Actual Profit for six months before drawings (half of profit )=15,600x2 31,200

Combined Drawing during six months (half of profit) 15,600

(2) Ascertainment of purchase consideration

Rs.

Closing Net Assets (As above) 2,49,600

Add: Goodwill 1,30,000

Total Purchase consideration 3,79,600

2.

a) The following is the Balance Sheet of a concern on 31st Ashadh, 2073:

Liabilities Rs. Assets Rs.

Capital 10,00,000 Fixed Assets 4,00,000

Creditors (Trade) 1,40,000 Stock 3,00,000

Profit & Loss A\c 60,000 Debtors 1,50,000

Cash & Bank 3,50,000

12,00,000 12,00,000

The management estimates the purchases and sales for the year ended 31st Ashadh,

2074 as under:

Particulars Upto 32.2.2074 (Rs.) Ashadh 2074 (Rs.)

Purchases 14,10,000 1,10,000

Sales 19,20,000 2,00,000

It was decided to invest Rs. 1,00,000 in purchases of fixed assets, which are

depreciated @ 10% on cost.

The time lag for payment to Trade Creditors for purchase and receipt from Sales is

one month. The business earns a gross profit of 30% on turnover. The entire sales and

purchases are taken on credit basis. The expenses against gross profit amount to 10%

of the turnover. The amount of depreciation is not included in these expenses.

Draft a Balance Sheet as of 31st Ashadh, 2074 assuming that creditors are all Trade

Creditors for purchases and debtors for sales and there is no other item of current

assets and liabilities apart from stock and cash and bank balances. 10

The Institute of Chartered Accountants of Nepal 5

Suggested Answer - June 2018

b) From the following Balance Sheets of Mr. Ram, prepare a Cash Flow Statement as per

NAS 3 for the year ended 31.03.2074:

Balance Sheet of Mr. Ram

As on 1.4.2073 As on 31.03.2074

Liabilities:

Ram‘s Capital Account 5,00,000 6,12,000

Sundry creditors 1,60,000 1,76,000

Mrs. Ram‘s loan 1,00,000 -

Long term loan from bank 1,60,000 2,00,000

9,20,000 9,88,000

Assets:

Land 3,00,000 4,40,000

Plant & Machinery 3,20,000 2,20,000

Stock 1,40,000 1,00,000

Debtors 1,20,000 2,00,000

Cash 40,000 28,000

9,20,000 9,88,000

Additional information:

A machine costing Rs. 40,000 (accumulated depreciation there on Rs. 12,000) was

sold for Rs. 20,000. The provision for depreciation on 1.4.2073 was Rs. 1,00,000 and

on 31.03.2074 was Rs. 1,60,000. The net profit for the year ended on 31.03.2074 was

Rs. 1,80,000. 10

Answer:

a)

Projected Balance Sheet of

As on 31st Ashadh, 2074

Liabilities Rs Assets Rs

Capital 10,00,000 Fixed Assets 4,00,000

Profit & Loss Additions 1,00,000

Account as on

1st Shrawan, 60,000 5,00,000

2073

Add: Profit for 3,74,000 4,34,000 Less: Depreciation (50,000) 4,50,000

the year

Creditors 1,10,000 Stock in trade 3,36,000

(Trade)

Sundry Debtors 2,00,000

Cash & Bank Balances 5,58,000

15,44,000 15,44,000

Working Notes:

Projected Trading and Profit and Loss Account

The Institute of Chartered Accountants of Nepal 6

CAP II Paper 1: Advanced Accounting

For the year ended 31st Ashadh, 2074

Particulars Rs Particulars Rs

To Opening Stock 3,00,000 By Sales 21,20,000

To Purchases 15,20,000 By Closing Stock 3,36,000

(balancing figure)

To Gross Profit c\d (30% on 6,36,000

sales)

24,56,000 24,56,000

To Sundry Expenses (10% on 2,12,000 By Gross Profit b\d 6,36,000

sales)

To Depreciation 50,000

To Net Profit 3,74,000

6,36,000 6,36,000

Cash and Bank Account

1st Shrawan, 2073 to 31st Ashadh, 2074

Rs. Rs

.

To Balance b/d 3,50,000 By Sundry Creditors 15,50,000

To Sundry Debtors 20,70,000 (Rs1,40,000+Rs 14,10,000)

(Rs 1,50,000 + Rs By Expenses 2,12,000

19,20,000)

By Fixed Assets 1,00,000

By Balance c/d 5,58,000

24,20,000 24,20,000

b) Cash Flow Statement of Mr. Ram for the year ended 31.03.2074

Rs.

(i)Cash flow from operation activities

Net Profit (given) 1,80,000

Adjustment for Depreciation on Plant & Machinery 72,000

(W.N.2) 8,000 80,000

Loss on sale of Machinery (W.N.1) 2,60,000

Operating profit before working capital changes 40,000

Decrease in Stock (80,000)

Increase in Debtors 16,000 ( 24,000)

Increase in Creditors 2,36,000

Net cash from operating activities

(ii) Cash flow from investing activities: 20,000

Sale of Machinery (1,40,000)

Purchase of Land(4,40,000-3,00,000) (1,20,000)

Net cash used in investing activities

(iii) Cash flow from financing activities: (1,00,000)

Payment of Mrs. Ram‘s Loan (68,000)

Drawings(W.N. 3) 40,000

Loan from bank (1,28,000)

The Institute of Chartered Accountants of Nepal 7

Suggested Answer - June 2018

Net cash used in financing activities (12,000)

Net decrease in cash 40,000

Cash balance as on 1.4.2073 28,000

Cash balance as on 31.03.2074

Working Notes:

1 Plant & Machinery A/c

Rs. Rs.

To Balance b/d 4,20,000 By Bank-sales 20,000

( 3,20,000+1,00,000) By Provision for

depreciation A/c 12,000

By Profit & Loss A/c-loss

on sale(40,000-20,000- 8,000

12,000) 3,80,000

4,20,000 By balance c/d 4,20,000

(2,20,000+1,60,000)

2 Provision for depreciation on Plant & Machinery A/c

Rs. Rs.

To Plant & Machinery A/c 12,000 By Balance b/d 1,00,000

To Balance c/d 1,60,000 By Profit & Loss 72,000

1,72,000 A/c(Bal.fig) 1,72,000

3.Mr. Ram‘s Drawing

Rs.

Opening Capital 5,00,000

Add: Net profit 1,80,000

6,80,000

Less Closing Capital (6,12,000)

Drawings 68,000

3.

a) Pashupati Stores Pvt Ltd with its head office at Kathmandu, invoiced goods to its

branch at Gajuri at 20% less than the list price which is cost plus 100%, with

instruction that cash sales were to be made at invoice price and credit sales at list

price.

From the following particulars available from the branch, prepare Branch Stock

Account, Branch Adjustment A/c, Branch Profit and Loss A/c and Branch Debtors

A/c for the year ending 31st Chaitra, 2074. 10

Particulars Rs. Rs.

Stock on 1st Baishakh, 2074 ( invoice price) 6,000

Debtors on 1st Baishakh, 2074 5,000

Goods received from Head Office (invoice price) 66,000

Sales

Cash 23,000

The Institute of Chartered Accountants of Nepal 8

CAP II Paper 1: Advanced Accounting

Credit 50,000 73,000

Cash received from debtors 42,817

Expenses at branch 8,683

Debtors on 31st Chaitra, 2074 12,183

Stock on 31st Chaitra, 2074 (invoice price) 8,800

Remittance to Head Office 60,000

b) Following balances relating to loan and advances are extracted from records of a ‗A‘

class Commercial Bank.

Amount in lakhs

Categories of Loan Insured Amount Other Amount Total Amount

Pass 3,335 161,528 164,863

Restructured/Rescheduled 775 4,464 5,239

Substandard 138 706 844

Doubtful 217 1,927 2,144

Loss 662 3,539 4,201

Total 5,127 172,164 177,291

While scrutinizing the records of the bank, it was found that the bank has provided a

credit of Rs. 5,560 lakhs in excess of SOL. The bank has categorized this loan as

Pass. Find out the amount of loan loss provisions as per NRB Directives. 5

Answer:

a) In the Books of Pashupati Stores Pvt Ltd:

Dr Branch Stock Account Cr

Particulars Amount Particulars Amount

To Balance b/d 6,000 By Bank ( Cash Sales) 23,000

To Goods sent to Branch 66,000 By Branch Debtor 50,000

To Branch Adjustment( W.N-1) 10,000 By Shortage in stock (W. N-2) 200

By Balance c/d 8,800

Total 82,000 Total 82,000

In the Books of Pashupati Stores Pvt Ltd

Dr Branch Adjustment Account Cr

Particulars Amount Particulars Amount

To Shortage in stock (W.N-2) 75 By Branch Stock(W.N-1) 10,000

To Stock Reserve (W.N-5) 3,300 By Stock Reserve (W.N-3) 2,250

To Gross Profit & Loss 33,625 By Goods sent to Branch (W.N-4) 24,750

Total 37,000 Total 37,000

The Institute of Chartered Accountants of Nepal 9

Suggested Answer - June 2018

In the Books of Pashupati Stores Pvt Ltd

Dr Branch Profit and Loss Account Cr

Particulars Amount Particulars Amount

To Branch Expenses 8,683 By Gross Profit 33,625

To Shortage in sales (cost) 125

To General Profit and Loss 24,817

Total 33,625 Total 33,625

In the Books of Pashupati Stores Pvt Ltd

Dr Branch Debtors Account Cr

Particulars Amount Particulars Amount

To Balance b/d 5,000 By Bank 42,817

To Branch Stock 50,000 By Balance c/d 12,183

Total 55,000 Total 55,000

Working Notes

1) Let the Cost price= X

List price = 100% of cost price

=100 +100= Rs.200

Invoice price = 20% less than List price

=200-(20% of 200)

=Rs.160

Cash sales are made at invoice price i.e.Rs.160 and credit sales are made at list

price i.e.Rs.200

Excess amount charged on credit sales= Rs.200-Rs.160= Rs.40 i.e.

40/200*100%= 20 % of list price.

Good sold on credit= Rs.50, 000

Amount charged in excess of the invoice price = 20% of list price

= 20% of Rs.50, 000

= Rs.10, 000

2) If the cost =Rs.100 then invoice price = Rs.160

Therefore loading on invoice price = 60/160*100%=37.5%

Loading on Shortage =37.5% of Rs.200= Rs.75

= Rs.200-Rs.75= Rs.125

3) Loading of Opening stock

=37.5% of Rs.6, 000=Rs.2, 250

4) Loading on Goods sent to Branch

=37.5% of Rs.66, 000=Rs.24, 750

5) Loading on closing stock

=37.5% of Rs.8, 800=Rs.3, 300

b)

Computation of Loan Provisions Amount

(Amount in Lakhs)

The Institute of Chartered Accountants of Nepal 10

CAP II Paper 1: Advanced Accounting

Categories Insured Rate Provision Other RateProvision Total

of Loan Amount Amount Amount Provision

Amount

Pass 3,335 0.25 8 161,528 1% 1615 1624

Restructured 775 3.13 24 4,464 12.5% 558 582

/Rescheduled

Substandard 138 6.25 9 706 25% 177 185

Doubtful 217 12.5 27 1,927 50% 964 991

Loss 662 25 166 3,539 100% 3539 3705

Total 5,127 234 172,164 6852 7086

Additional 100% Provision for Credit Provided in Excess of SOL (B) =5560

Total Loan Loss Provisions (A+B) = 12646

Working Note:

Provisioning Rate for Insured Loan i.e. = 25% of prescribed rate

1×0.25=0.25%

12.5×0.25=3.125

20×0.25=6.25%

50×0.25=12.5%

100×0.25=25%

4.

a) Retirement Benefit Plan of ABC Bank Ltd. purchased preference shares of XYZ

Bank Ltd. face value of Rs. 1,000,000 at Rs. 1,037,000 on 1st Shrawan, 2069. The

coupon rate of the preference shares is 12% and maturity date of the shares is 31 st

Ashadh, 2074. You are required to prepare the investment account in the books of

retirement benefit plan up to the year ended 31st Ashadh, 2074. The effective interest

rate of the investment is 11%. 10

b) From the following information relating to M/s Genuine General Insurance find out the

revenue profit for the period ended 31.12.2074. 5

in Lakhs

Gross premium (unrealized Rs. 120) 8,000

Claim paid (including cheque issued but not collected Rs. 95) 1,680

Other administrative expenses 1,455

Unexpired risk reserve (opening) 2,450

Unexpired risk reserve (closing) 2,760

Outstanding claim liability (opening) 1,440

Outstanding claim liability (closing) 1,230

As per company's strategy 35% business is covered under reinsurance treaty,

which provides average 6.5% commission.

a)

Retirement Benefit Plan of ABC Bank Ltd.

Investment Account

Date Particulars Amount Date Particulars Amount

The Institute of Chartered Accountants of Nepal 11

Suggested Answer - June 2018

1,04.2069 To Bank A/c 10,37,000 31.03.2070 By Bank A/c 5,930

31.03.2070 By Balance C/d 10,31,070

Total 10,37,000 Total 10,37,000

1,04.2070 To Balance B/d 10,31,070 31.03.2071 By Bank A/c 6,582

31.03.2071 By Balance C/d 10,24,488

Total 10,31,070 Total 10,31,070

1,04.2071 To Balance B/d 10,24,488 31.03.2072 By Bank A/c 7,306

31.03.2072 By Balance C/d 10,17,181

Total 10,24,488 Total 10,24,488

1,04.2072 To Balance B/d 10,17,181 31.03.2073 By Bank A/c 8,110

31.03.2073 By Balance C/d 10,09,071

Total 10,17,181 Total 10,17,181

1,04.2073 To Balance B/d 10,09,071 31.03.2074 By Bank A/c 9,071

31.03.2074 By Bank A/c 10,00,000

Total 10,09,071 Total 10,09,071

Amortization Schedule

Year (A) Beginning (B) Dividend (C) Reported (D) (E) End-of-

of period and maturity dividend Amortization period

amortized cost cash inflow income of Premium amortized

[=(A)×11%] [=(C) – (B)] cost[=(A)+(D)]

2069- 10,37,000 1,20,000 1,14,070 5,930 10,31,070

70

2070- 10,31,070 1,20,000 1,13,418 6,582 10,24,488

71

2071- 10,24,488 1,20,000 1,12,694 7,306 10,17,181

72

2072- 10,17,181 1,20,000 1,11,890 8,110 10,09,071

73

2073- 10,09,071 11,20,000 1,10,929 9,071 10,00,000

74

b)

Statement of calculation of Revenue Profit

For the period ended 31.12.2074

in Lakhs

Gross premium (less unrealized Rs. 120) 7,880.00

The Institute of Chartered Accountants of Nepal 12

CAP II Paper 1: Advanced Accounting

Less: reinsurance portion (35%) (2,758.00)

Reinsurance commission (6.5% of Rs. 2,758) 179.27

Claim paid (1,680.00)

Other administrative expenses (1,455.00)

Unexpired risk reserve (opening) 2,450.00

Unexpired risk reserve (closing) (2,760.00)

Outstanding claim liability (opening) 1,440.00

Outstanding claim liability (closing) (1,230.00)

Revenue Profit for the period 2,066.27

Alternate Solution

Statement of calculation of Revenue Profit

For the period ended 31.12.2074

in Lakhs

Gross premium (less unrealized Rs. 120) 7,880.00

Less: reinsurance portion (35%) (2,758.00)

Reinsurance commission (6.5% of Rs. 2,758) 179.27

Claim paid (1,680.00)

Other administrative expenses (1,455.00)

Unexpired risk reserve (opening) 2,450.00

Unexpired risk reserve (closing) (2,760.00)

Outstanding claim liability (opening) 115% 1,656.00

Outstanding claim liability (closing) 115% (1,414.50)

Revenue Profit for the period 2,097.77

5.

a) The following information are related with Purple Nepal Ltd.

i) Goods of Rs. 60,000 were sold on 20-3-2074 but at the request of the buyer these

were delivered on 10-4-2074.

ii) On 15-3-2074 goods of Rs. 1,50,000 were sent on consignment basis of which

20% of the goods unsold are lying with the consignee as on 31-3-2074.

iii) Rs. 1,20,000 worth of goods were sold on approval basis on 1-12-2073. The

period of approval was 3 months after which they were considered sold. Buyer

sent approval for 75% goods up to 31-1-2074 and no approval or disapproval

received for the remaining goods till 31-3-2074.

iv) Apart from the above, the company has made cash sales of Rs. 7,80,000 (gross).

Trade discount of 5% was allowed on the cash sales.

You are required to advise the accountant of Purple Nepal Ltd. with valid reasons, the

amount to be recognized as revenue in above cases in the context of NAS -18 and

also determine the total revenue to be recognized for the year ending 31-3-2074. 5

b) M/s Dalima Ltd. is in a dispute with the competitor company. The dispute is

regarding the alleged infringement of copyrights. The competitor has filed a suit in

the court seeking damages of Rs. 325 lakhs.

The Institute of Chartered Accountants of Nepal 13

Suggested Answer - June 2018

Directors are of the view that the claim can be successfully resisted by the company.

How the matter be dealt in the financial statements of the company in the light of

NAS 37. Explain in brief giving reasons for your answer. 5

th

c) Gorkha Company Ltd. imported raw materials worth USD 9,000 on 24 Jestha, 2074,

when the exchange rate was Rs.104 per USD. The transaction was recorded in the

books at the above mentioned rate. The payment of the transaction was made on 10th

Shrawan, 2074, when the exchange rate was Rs.108 per USD. At the year end 31st

Ashadh, 2074, the rate of exchange was Rs.109 per USD.

The Account Officer of the company passed an entry on 31st Ashadh, 2074 adjusting

the cost of the raw material consumed for the difference between Rs.108 and Rs.104

per USD. Discuss whether this treatment is justified as per the provision of NAS-21. 5

Answer:

a) As per NAS 18 "Revenue" is a transaction involving the sale of goods, performance

should be regarded as being achieved when the following conditions are fulfilled:

(a) The seller of goods has transferred to the buyer the property in the goods for a

price or all significant risks and rewards of ownership have been transferred to the

buyer and seller retains no effective control of the goods transferred to a degree

usually associated with ownership : and

(b) no significant uncertainty exists regarding the amount of the consideration that will

be derived from the sales of the goods.

In case (i):

The sale is complete but delivery has been postponed at buyer's request. Purple Nepal

Ltd. should recognize the entire sale of Rs. 60,000 for the year ended 31 st Ashadh,

2074.

In case (ii):

20% goods lying unsold with consignee should be treated as closing inventory and

sales should be recognized for Rs. 1,20,000 (80% of Rs. 1.50,000). In case of

consignment sale revenue should not be recognized until the goods are sold to a third

party.

In case (iii):

In case of goods sold on approval basis, revenue should not be recognized until the

goods have been formally accepted by the buyer or the buyer has done an act

adopting the transaction or the time period for rejection has elapsed or where no time

has been fixed, a reasonable time has elapsed. Therefore in case (iii) revenue should

be recognized for the total sales amounting Rs.1,20,000 as the time period for

rejecting the goods had expired.

In case (iv):

Trade discounts given should be deducted in determining revenue. Thus Rs. 39,000

should be deducted from the amount of turnover of Rs.7,80,000 for the purpose of

recognition of revenue. Thus, revenue should be Rs. 7,41,000.

Thus total revenue amounting Rs. 10,41,000 (60,000+1,20,000+1,20,000+7,41,000)

will be recognized for the year ended 31st Ashadh, 2074 in the books of Purple Nepal

Ltd.

b) As per NAS 37 "Provisions, Contingent liabilities and Contingent assets" a provision

The Institute of Chartered Accountants of Nepal 14

CAP II Paper 1: Advanced Accounting

should be recognized when

a) an entity has a present obligation as a result of a past event.

b) it is probable that the outflow of resources embodying economic benefits will be

required to settle the obligation and

c) a reliable estimate can be made of the amount of obligation.

if these conditions are not met, no provision should be recognized.

In the given situation, since the directors of the company are of the opinion that the

claim can be successfully resisted by the company, therefore there will be no outflow

of resources. Hence no provision is required. The company can disclose the same as

contingent liability by way of following note.

Litigation is in the process against the company relating to dispute with the

competitor who alleged that the company has infringed copyrights and seeking

damages of Rs. 325 lakhs. However the director are of the opinion that the claim can

be successfully resisted by the company.

c) As per NAS-21, ―The effects of changes in foreign exchange rates‖,

(i) Initial recognition of a foreign currency transaction is done in the functional

currency, by applying the spot exchange rate between the functional currency and

foreign currency at the date of the transaction.

(ii) At the end of each reporting period, foreign currency monetary items shall be

translated using the closing rate.

(iii)Exchange difference arising on settlement of monetary items or on translating

monetary items at rates different from those at which they were translated on initial

recognition during the period or in previous financial statement shall be recognized

in profit and loss in the period in which they arise.

In the given case, at the date of transaction the raw material purchased and its

creditors will be recorded at USD 9,000×Rs.104= Rs. 936, 000.

At Balance Sheet date such transaction is reported at closing rate of exchange,

hence it will be valued at the closing rate i.e. Rs.109 per USD (USD

9,000×Rs.109=Rs.981, 000)

The difference of exchange rate between the closing date and transaction date is

Rs.5 per USD (i.e. Rs. 109-Rs.104). The difference of Rs.45,000 (USD 9,000×5)

will be shown as an exchange loss in the profit and loss account for the year ended

31st Ashadh, 2074 and will not be adjusted against the cost of raw materials.

At the settlement date, the company would recognize or provide in the profit and

loss account an exchange gain of Rs. 9,000 (i.e. at the rate Rs. 1 per USD, the

difference of exchange rate between the balance sheet date and the date of

settlement, i.e. Rs.109 and Rs.108 per USD).

Hence the accounting treatment adopted by the Account officer is not as per NAS

21.

6. Write short notes on: (5×3=15)

a) Life Insurance Fund

b) PEARLS System of Monitoring the Cooperative.

c) ‗Other Comprehensive Incomes‘ as per NFRS.

The Institute of Chartered Accountants of Nepal 15

Suggested Answer - June 2018

d) When can a company change its accounting policy?

e) Calculation of Profit from the Notional profit.

Answer:

a) Life Insurance Fund

As per section 22 of the Insurance Act, 2049, every Insurer shall maintain a reserve fund

as specified by the Insurance Board for the liability relating to its Insurance Business

within the state of Nepal. Further, section 21 of the Act states that an Insurer shall

maintain separate fund for each category of Insurance Business and amount to be

received from each Insurance Business shall be deposited in the concerned fund. The

fund maintained for one category of Insurance Business shall not be utilized to bear the

liabilities relating to other category of Insurance Business.

The following amount shall be transferred to the Life Insurance Fund:

An amount not less than the total liability as specified by the Actuary on the basis of the

Insurance Policies published by the Insurer of the Life Insurance Business within the

state of Nepal.

In case of fiscal year where no Actuary Valuation is done, the whole surplus amount of

Revenue Account; and

Amount specified by Insurance Board for Solvency Margin from time to time.

The amount kept under Life Insurance Fund shall be distributed as per Actuary

Valuation Report following the directives of the Insurance Board on this regard.

b) PEARLS System of Monitoring the Cooperative

PEARLS is defined as a set of financial ratios to monitor the financial stability of the

credit unions within World Council of Credit Union's developing movement projects.

These ratios provide credit unions, project staff, national federations and regulators

with essential tools for monitoring, planning, standardizing, ranking and facilitating

supervisory control in credit unions. Each letter in the word PEARLS measures the

key areas of credit union operations: Protection, Effective financial structure, Asset

quality, Rate of return and Costs and Liquidity and Sign of growth. PEARLS system

is designed as a management tool that goes beyond the simple identification of

problems. It helps managers find meaningful solutions to serious institutional

deficiencies. Use of the system permits managers quickly and accurately pinpoint

troubled areas, and to make the necessary adjustments before problems become

serious. In essence, PEARLS is an "early warning system" that generates invaluable

management information.

c) ‗Other Comprehensive Incomes‘ as per NFRS

Other comprehensive income comprises items of income and expenses (including

reclassification adjustments) that are not recognized in profit and loss as required or

permitted by other NFRSs.

The components of other comprehensive income include;

1. Changes in revaluation surplus

2. Re-measurements of defined benefit plans

3. Gains and losses arising from translating the financial statements of a foreign operation

4. Gains and losses from investments in equity instruments measured at fair value through

other comprehensive income in accordance NFRS related with financial instruments

The Institute of Chartered Accountants of Nepal 16

CAP II Paper 1: Advanced Accounting

5. The effective portion of gains and losses on hedging instruments in a cash flow hedge

For particular liabilities designed as at fair value through profit or loss, the amount of the

change in the fair value that is attributable to changes in the liability‘s credit risk.

d) A change in accounting policy should be made in the following conditions:

(i) If the change is required by some statute or for compliance with an Accounting

Standard.

(ii) Change would result in more appropriate presentation of the financial statement.

Change in accounting policy may have a material effect on the items of financial

statements. For example, if cost formula used for inventory valuation is changed from

weighted average to FIFO, or if interest is capitalized which was earlier not in practice,

or if proportionate amount of interest is changed to inventory which was earlier not the

practice, all these may increase or decrease the net profit. Unless the effect of such

change in accounting policy is quantified, the financial statements may not help the

users of accounts. Therefore, it is necessary to quantify and disclose the effect of

change on financial statement items like assets, liabilities, profit/loss.

e) Calculation of Profit from the Notional profit

If the contract account shows a loss, such loss must be fully provided. However, when

the contract account discloses a profit, all such profit cannot be deemed as profit since,

in a subsequent accounting period there may be escalation of costs and such other

contingencies. Therefore, only a proportion of the notional profit is deemed to be

profit and balance is credited to work in progress account. There are certain rules of

thumb regarding the portion of profit to be provided for contingencies. They are given

below:-

Completion stage Profits to be provided for contingencies

Below 25% Full

25% to less than 50% Two –Thirds

50% to less than 95% One- Third

95% and above Nil

The profits to be taken, as earned for the accounting period, must further be reduced

on what is called ‗cash basis‘. Cash basis is the proportion of cash received to work

certified. For example, if 40% of contract is completed, Rs. 60,000 is the notional

profit and 80% of work certified is received in cash from the contractee, profit earned

would be calculated as shown below:

Profit earned = Notional profit X 1/3 X80%

= Rs. 60,000 X 1/3 X80%

= Rs. 16,000

In the above example, out of the notional profit of Rs. 60,000, a sum of Rs. 16,000 will

be deemed to be the profit for the accounting period and the balance of Rs. 44,000 will

be carried forward towards contingencies.

Alternate Solution

If the contract account shows a loss, such loss must be fully provided. However, when

The Institute of Chartered Accountants of Nepal 17

Suggested Answer - June 2018

the contract account discloses a profit, all such profit cannot be deemed as profit since,

in a subsequent accounting period there may be escalation of costs and such other

contingencies. Therefore, only a proportion of the notional profit is deemed to be

profit.

As per the provision of NAS 11, profit to be recognized during a particular year will

be calculated as follows:

Total Contract Revenue xxx

Total Estimated Cost xxx

Total Estimated or Notional Profit xxx

Profit to be recognized during a particular year= Total Estimated Profit* Stage of

completion- Profit recognized up to previous year

Where, Stage of completion can be calculated by any of the following method

i. the proportion of contract costs incurred for work performed to date bear to the

estimated total contract costs;

ii. surveys of work performed; or

iii. completion of a physical proportion of the contract work

The Institute of Chartered Accountants of Nepal 18

CAP II Paper 1: Advanced Accounting

Specific Comments on the performance of the students

Batch: - June 2018

Level: - CAP-II

Subject: Advanced Accounting

Question No. 1

Calculation of Partners' capital and depreciation on Building is not done well.

Calculation of profit is also not done by majority of students. Generally, students had

problem in determining purchase consideration and showing profit made during

period. Most of the students randomly attempted the question; however, none could

solve it well. Some brought different way than model answer. Almost all students

confused in calculating 6 months profit. Few were confused on written off and

depreciation of Building, computation of purchase consideration. Students were not

able to calculate profit and drawing.

Question No. 2

(a) Calculation of Debtors and Creditors is wrong in some cases. Most of the students

confused on one month credit policy.

(b) Majority of students are lack of knowledge while preparing CFS. Cash flow

Statement was correctly answered by few students only. Most of the students were

confused on drawing depreciation.

Question No. 3

(a) Loading on stocks not accurate in some cases and also calculation of shortage of

stock is not done by majority of students. Most of the students confused on

calculation profit on debtor amount and shortage/loss of stock.

(b) Knowledge of provisioning is lacking. Few are confused to apply rate on insured

and SOL.

Question No. 4

(a) Majority of students fails to understand the question. Almost nil students

answered Investment account. Students failed to compute the amortizing schedule

Calculation of reinsurance portion is not done right by majority of students.

Question No. 5

(a) Goods on approval basis are not calculated by majority students. Few confused on

delivery concept, consignment, and sales by approval.

(b) Difference between provision and contingent liability is not clear.

(c) Calculation of Ex. Gain/Loss is not done due to lack of concept.

Question No. 6

(a) Majority of students fails to define life insurance fund.

(b) Almost none of the students fails to attempt the question.

(c) Majority of students did not have knowledge about OCI.

(d) Lack of concept.

The Institute of Chartered Accountants of Nepal 19

Suggested Answer - June 2018

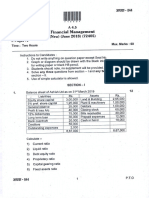

Paper 2:

Audit & Assurance

The Institute of Chartered Accountants of Nepal 20

CAP II Paper 2: Audit & Assurance

Maximum Marks - 100

Total No. of Questions- 7 Total No. of Printed Pages- 10

Time Allowed - 3 Hours

Marks

Attempt all questions.

As an auditor, give your opinion with explanations on the following cases: (45=20)

a) AJ Limited has an investment worth NPR 1,000,000 in its financial statements at 31st

Ashadh 2074. Due to the continuing recession, the investment reduced in value to NPR

900,000 by 15th Shrawan 2074.

b) MNS Ltd. (The Company) is engaged in manufacturing business. The book value of

plant & machinery of the company was Rs. 900 million as on Ashadh end 2073

(purchased at Rs. 1,000 million on 1st Shrawan 2072). It provided depreciation on

straight line basis at 10% per annum based on useful life of the plant & machinery.

Imported asset of Rs. 100 million, the component of above plant & machinery was

acquired on 1st Shrawan 2073 that would be obsolete in 2 years. The company wants to

write off this asset over 2 years. Can the company do so?

c) X Ltd. entered into an agreement with Y Ltd. to dispatch goods valuing Rs. one lakh

every month for six months upon receipt of entire payments. Y Ltd. accordingly made

the payment. In third month due to a natural calamity Y Ltd. requested X Ltd. not to

dispatch until further notice.

d) During the financial year 2073/74, Y & R Private Limited, a service providing company

purchased generator of Rs. 2 million for smooth functioning of its office. The accountant

claims that there is no necessity to provide for depreciation in respect of generator as it

was kept standby but not used at all during the financial year.

Answer:

a) NAS 10 Events after the Reporting Period provides guidance whether an entity should

adjust its financial statements or shall disclose for the events after reporting period.

Since reduction in investment value occurred only after the reporting period, it is

indicative of condition that arose after the reporting period which is a non-adjusting event

as per para 3 of NAS 10. An entity shall not adjust the amounts recognised in financial

statement to reflect non-adjusting events after the reporting period. The decline in fair

value does not normally relate to the condition of the investments at the end of the

reporting period, but reflects circumstances that have arisen subsequently.

Therefore, the entity does not update the amounts disclosed for the investments as at the

end of the reporting period, however it may need to give additional disclosure about the

The Institute of Chartered Accountants of Nepal 21

Suggested Answer - June 2018

nature of event and an estimate of its financial effect , or a statement that such an estimate

cannot be made.

b) As per Nepal Accounting Standard 16 (Property, Plant and Equipment), each part of an

item of property, plant and equipment with a cost that is significant in relation to the total

cost of the item shall be depreciated separately.

An entity shall allocate the amount initially recognised in respect of an item of property,

plant and equipment to its significant parts and depreciate separately each such part. To

the extent that an entity depreciates separately some parts of an item of PPE it also can

depreciate separately the remainder of the item. As it appears that imported assets of Rs.

100 million, which is component of plant and machinery, is having independent useful

life.

Therefore, the company can choose to depreciate the significant parts at 10% p.a. and

remainder imported assets over two years.

c) NAS 18 ―Revenue‖ specifies that revenue from sale of goods should be recognized when

following conditions have been fulfilled:

i) The seller of the goods has transferred all significant risks and rewards of ownership

to the buyer.

ii) the seller retain no effective control of the goods sold usually associated with

ownership;

iii) The amount of revenue can be measured reliably.

iv) It is probable that the economic benefits associated with the transaction will flow to

the entity and

v) The cost in respect of the transaction can be measured reliably.

In this case X Ltd had transferred the significant risk and rewards of the property at an

agreed price. As such sale has been fully completed because upon receipt of the entire

payment. X Ltd was required to dispatch goods valuing Rs 100,000 for six month out of

its inventory. However, in the third month, Y Ltd requested to stop dispatch until further

intimation due to a natural calamity. X Ltd had transferred the goods at an agreed price

and all significant risks and rewards. The delivery was to be effected as per the schedules

indicated by Y Ltd. As per NAS 18, Revenue, mere postponement of delivery at buyers

request does not alter the period in which revenue should be recognized. Accordingly X

Ltd should recognize the entire 600,000 as Sales.

d) As per para 55 of NAS 16 "Property, Plant and Equipment", depreciation of an assets

begin when it is available for use, i.e. when it is in the location and condition necessary

for it to be capable of operating in the manner intended by the management.

Depreciation is a measure of the wearing out, consumption or other loss of value of a

depreciable asset arising from use, efflux of time or obsolescence through technology and

The Institute of Chartered Accountants of Nepal 22

CAP II Paper 2: Audit & Assurance

market changes. Thus, depreciation has to be charged even in case of these assets which

are not used at all during the year but by mere efflux of time provided such assets qualify

as depreciable assets.

When the generator was kept ready for use as stand-by, it means it was intended to be

used for the purpose of business. Depreciation in respect of this generator would have

been provided in the accounts for the year ended 31st Ashadh 2074. If there is an

intention to use an asset, though it may not have actually been used, it is a 'constructive'

or 'passive' use and eligible for charging depreciation.

2. Give your comments on the following cases: (45=20)

a) Mr. KC, Partner of CA firm involved in Audit of X Limited was offered with luxury

car by X Limited for his personal use till financial statements is approved in AGM.

b) Your firm has been appointed as the statutory auditor of Super Express Bank Ltd. for

the financial year 2074/75. You, as the engagement partner, are in the process of

drafting audit plan of the said audit. When obtaining an understanding and

performing a preliminary assessment of the internal audit function for drafting your

audit plan, what are the important criteria to be considered.

c) While auditing accounts of a public limited company for the year ended 31st Ashadh

2074, an auditor found out an error in the valuation of inventory, which affects the

financial statement materially.

d) Auditor of Maya Limited was unable to confirm the existence and valuation of

imported inventory lying with the transporter and accepted a certificate from the

management without obtaining audit evidence. The inventory lying with the

transporter is material to the financial statements.

Answer:

a) A professional accountant in public practice or an immediate or close family member may

be offered gifts and hospitality from a client that may create threats to compliance with

the fundamental principles of code of ethics.

When a professional accountant in public practice or an immediate or close family

member is offered gift and hospitality, the situation shall be evaluated. In the instant case,

an offer of using luxury car for personal use may influence the opinion of professional

accountant in public practicee. Self-interest threats to objectivity or confidentiality are

created when gifts and hospitality is made to unduly influence actions or decisions,

encourage illegal or dishonest behavior, or obtain confidential information. Intimidation

threats to objectivity or confidentiality are created if such gifts & hospitality is accepted

by the professional accountant in public practice or an immediate or close family

member.

A professional accountant in public practice shall evaluate the significance of such

threats and apply safeguards when necessary to eliminate the threats or reduce them to an

The Institute of Chartered Accountants of Nepal 23

Suggested Answer - June 2018

acceptable level. Accordingly, when the threats cannot be eliminated or reduced to an

acceptable level through the application of safeguards, such offer shall not be accepted. .

b) As per NSA 610; "Using the work of internal auditors" the statutory auditor should

consider the activities of internal auditors and their effect, if any, on statutory audit

procedures. In the light of aforesaid provision of NSA, the following aspects should be

considered for drafting the audit plan of Super Express Bank Ltd. for the financial year

2074/75:

1. Organizational Status: specific status of internal auditing in the entity and the effect

this has on its ability to be objective. In the ideal situation, internal auditing will

report to the highest level of management and be free of any other operating

responsibility. Any constraints or restrictions placed on internal auditing by

management would need to be carefully considered. In particular, the internal auditors

should be free to communicate fully with the external auditor.

2. Scope of Function: the nature and extent of internal auditing assignments performed.

The external auditor would also need to consider whether management acts on

internal audit recommendations and how this is evidenced.

3. Technical Competence: whether internal auditing is performed by persons having

adequate technical training and proficiency as internal auditors. The external auditor

may, for example, review the policies for hiring and training the internal auditing staff

and their experience and professional qualifications.

4. Due Professional Care: whether internal auditing is properly planned, supervised,

reviewed and documented. The existence of adequate audit manuals, work programs

and working papers would be considered.

c) NSA 450 ―Evaluation of Misstatements identified during the audit‖ deals with the

auditor‘s responsibility to evaluate the effect of identified misstatements on the audit and

of uncorrected misstatements, if any, on the financial statements. The auditor should

consider requesting the management to adjust the financial information or consider

extending his audit procedures. If the management refuses to adjust the financial

information and the results of extended audit procedures do not enable the auditor to

conclude that the aggregate of uncorrected misstatements is not material, the auditor

should express a qualified or adverse opinion, as appropriate.

In the instant case, the auditor has detected the material errors affecting the financial

statements; the auditor should communicate his findings to the management on a timely

basis, consider the implications on true and fair view and think about modifying the

report.

d) As per NSA 580 ―Written Representations‖ auditor may rely on the representation by

the management but he should seek corroborative audit evidence. The management

The Institute of Chartered Accountants of Nepal 24

CAP II Paper 2: Audit & Assurance

representation cannot substitute other evidence that the auditor could reasonably expect

to be available to the auditors.

Also, NSA 501 ―Audit Evidence‖ Specific Consideration for Selected items‖ requires

obtaining sufficient and appropriate evidence regarding the existence and condition of

inventory lying with third party if material to the financial statement.

Supporting evidences can be obtained from inside or outside sources. The audit evidence

for verification of inventory lying with the transporter - say purchase order, invoice,

custom clearance certificate, inspection, confirmation from transporter etc. are available

evidences which auditor should verify.

Just because the management had confirmed the existence and valuation of imported

inventory lying with the transporter the auditor cannot shrink his responsibility. This is

negligence on his part.

3. Answer the following: (35=15)

a) What are the provisions on ‗Timing of Liaison and Coordination‘ amongst internal

audit and external audit in NSA 610?

b) Mr. Shyam was appointed as the auditor of M/s Himalayan Ltd. and intends to apply

the concept of materiality for the financial statements as a whole. Please guide him as

to the factors that may affect the identification of an appropriate benchmark for this

purpose.

c) Explain the concept of True and Fair View.

Answer:

a) When planning to use the work of internal auditing, the external auditor will need to

consider internal auditing‘s tentative plan for the period and discuss it at as early a stage

as possible.

Where the work of internal auditing is to be a factor in determining the nature, timing

and extent of the external auditor‘s procedures, it is desirable to agree in advance the

timing of such work, the extent of audit coverage, test levels and proposed methods of

sample selection, documentation of the work performed and review and reporting

procedures.

Liaison with internal auditing is more effective when meetings are held at appropriate

intervals during the period. The external auditor would need to be advised of and have

access to relevant internal auditing reports and be kept informed of any significant

matter that comes to the internal auditor‘s attention which may affect the work of the

external auditor. Similarly, the external auditor would ordinarily inform the internal

auditor of any significant matters which may affect internal auditing.

The Institute of Chartered Accountants of Nepal 25

Suggested Answer - June 2018

b) Use of benchmark in determining Materiality: NSA 320 Materiality in planning and

performing an audit prescribes the use of benchmarks in determining materiality for the

Financial Statements as a Whole. Accordingly determining materiality involves the

exercise of professional judgment. A percentage is often applied to a chosen benchmark

as a starting point in determining materiality for the financial statements as a whole.

Factors that may affect the identification of an appropriate benchmark include the

following:

i. The elements of the financial statements (for example, assets, liabilities, equity,

revenue, expenses);

ii. Whether there are items on which the attention of the users of the particular entity‘s

financial statements tends to be focused (for example, for the purpose of evaluating

financial performance users may tend to focus on profit, revenue or net assets);

iii. The nature of the entity, where the entity is at in its life cycle, and the industry and

economic environment in which the entity operates;

iv. The entity‘s ownership structure and the way it is financed (for example, if an entity is

financed solely by debt rather than equity, users may put more emphasis on assets,

and claims on them, than on the entity‘s earnings); and

v. The relative volatility of the benchmark.

c) 'True and fair view' is a phrase usually auditors use to express audit opinion on the

financial statements of an entity. It implies that the financial statements are presented

fairly in all materials respect; the position, performance, cash flows and changes in

equity of the entity. The auditor expresses such opinion upon assessment of the internal

control system of the entity and test checking the financial transactions carried out

during the fiscal year. The auditor's act is guided by the provisions set forth in the Nepal

Standards on Auditing together with the Code of Ethics applicable to the professional

accountants.

As per NSA 200 ―Overall Objectives of the Independent Auditor and the Conduct of an

Audit in accordance with NSA‖, the auditor‘s expression of true and fair view is

supposed to be received as only the ―reasonable assurance and not the absolute

assurance‖ of the state of the financial statements. This implies that the users are not

supposed to absolutely rely on auditor‘s judgment for making their financial decisions

relating to the entity. This is because the auditor is not expected to, and cannot, reduce

audit risk to zero and cannot therefore obtain absolute assurance that the financial

statements are free from material misstatement due to fraud or error. This is because there

are inherent limitations of an audit, which result in most of the audit evidence on which

the auditor draws conclusions and bases the auditor‘s opinion being persuasive rather than

conclusive.

Broadly speaking, the financial statements are considered as presenting to true and fair

view if:

The information contained in them are not materially misstated;

The Institute of Chartered Accountants of Nepal 26

CAP II Paper 2: Audit & Assurance

There is an appropriate application of Nepal Accounting Standards, with additional

disclosure in the case of companies registered under Companies Act. In the case of

other entities there is an appropriate application of generally accepted accounting

principles as is applicable; and

They comply with the provisions of applicable laws and regulations of the company.

4. Answer/Comment on the following: (35=15)

a) What is ‗Independence of Mind‘ and ‗Independence in Appearance‘?

b) You are the statutory auditor of PQR Ltd., while carrying out the audit you found

existence of certain threats to objectivity at significant level. What is your duty in

such situation? Give the examples of safeguards you will apply in such situation?

c) Explain the provision relating to 'Conflicts of Interest' with reference to Part B of

Code of Ethics.

Answer:

a) In case of audit engagements, it is in the public interest and, therefore, required by section

290 0f Code of ethics, that members of audit teams, firms and network firms shall be

independent of audit clients.

Independence of Mind

Independence is a state of mind and personal character and an enlightened view of the

professional duties involved. The state of mind that permits the expression of a

conclusion without being affected by influences that compromise professional judgment,

thereby allowing an individual to act with integrity and exercise objectivity and

professional skepticism.

Independence in Appearance

Independence of auditor must not only exist in fact, but should also appear to exist to all

reasonable persons. The avoidance of facts and circumstances that are so significant that a

reasonable and informed third party would be likely to conclude, weighing all the specific

facts and circumstances, that a firm‘s, or a member of the audit team‘s, integrity,

objectivity or professional skepticism has been compromised.

b) As per Section 280 (4) of ICAN Code of Ethics, I should evaluate the significance of such

threats and should apply safeguards when necessary to eliminate them or reduce them to

an acceptable level. The safeguards that should be applied are:

i. Withdrawing from the engagement team;

ii. Supervisory procedures;

iii. Terminating the financial or business relationship giving rise to the threat;

iv. Discussing the issue with higher levels of management within the firm;

v. Discussing the issue with those charged with governance of the client.

The Institute of Chartered Accountants of Nepal 27

Suggested Answer - June 2018

If safeguards cannot eliminate or reduce the threat to an acceptable level, I should decline

or terminate the audit engagement of PQR Ltd.

Section 220 of Code of Ethics contains the provision relating to Conflict of Interest. A

professional accountant in public practice may be faced with a conflict of interest when

performing a professional service. A conflict of interest creates a threat to objectivity and

may create threats to other fundamental principles.

Such threats may be created when:

The professional accountant provides a professional service related to a particular

matter for two or more clients whose interests with respect to that matter are in

conflict or

The interests of the professional accountant with respect to a particular matter and the

interests of the client for whom the professional accountant provides a professional

service related to that matter are in conflict.

A professional accountant shall not allow a conflict of interest to compromise

professional or business judgement. The professional accountant in public practice shall

apply safeguards, when necessary, to eliminate the threats to compliance or reduce them

to acceptable level.

5. Answer the following: (25=10)

a) What are the matters to be audited in view of propriety as per Audit Act,

2048 as amended in 2073?

b) Describe the functions and duties of auditors as per Companies Act, 2063.

Answer:

a) Section 5 of the Audit Act 2048 (As amended in 2073) states that ; the Auditor General

shall audit following matters considering the propriety thereof :

(i) On the propriety of any expenditure and its authorization, if in the opinion of the

Auditor General such expenditure is a reckless one or is an abuse of national property,

whether fixed or current, despite that the expenditure conforms to the authorization,

and

(ii) On the propriety of all authorizations issued in respect of any grant of national

property whether fixed or current, or underwriting of any revenue, or any contract,

license or permits relating to mining, forest, water resources, etc. and any other act of

abandoning fixed or current assets of the nation.

Though the Auditor General may not include in his report minor items of discrepancy and

other items deemed by him as insignificant in view of their propriety which were

observed during the audit of income and expenditures.

The Institute of Chartered Accountants of Nepal 28

CAP II Paper 2: Audit & Assurance

b) The function and duties of auditors as per section 115 of the Companies Act,

2063 are as follows:

(1) The auditor shall, addressing the shareholders or the appointing authority, submit to the

company his/her report, certifying the balance sheet, profit and loss account and cash

flow statement based on the books of account, records and accounts audited by

him/her.

(2) The audit report shall be prepared in accordance with the prevailing law or in

consonance with the audit standards prescribed by the competent body; and such

report shall state the matters to be set out under this Act, as per necessity.

(3) The audit report as referred to in Sub-section (2) shall also indicate the following

matters, inter alia:

(i) Whether such information and explanations have been made available as were

required for the completion of audit;

(ii) Whether the books of account as required by this Act have been properly

maintained by the company in a manner to reflect the real affairs of its business;

(iii) Whether the balance sheet, profit and loss account and cash flow statements

received have been prepared in compliance with the accounting standards

prescribed under the prevailing law and whether such statements are in agreement

with the books of account maintained by the company;

(iv) Whether, in the opinion of the auditor based on the explanations and information

made available in the course of auditing, the present balance sheet properly

reflects the financial situation of the company, and the profit and loss account and

cash flow statement for the year ended on the same date properly reflect the profit

and loss, cash flow of the company, respectively;

(v) Whether the board of directors or any representative or any employee has acted

contrary to law or misappropriated any property of the company or caused any

loss or damage to the company or not;

(vi) Whether any accounting fraud has been committed in the company

(vii) Suggestion, if any

6. Write short notes on the following: (42.5=10)

a) Audit Risk

b) Audit Committee

c) Cut Off Procedure

d) Corporate Governance

Answer:

a) Audit Risk

The risk that the auditor expresses an inappropriate audit opinion when the financial

statements are materially misstated. Audit risk is a function of the risks of material

misstatement and detection risk. Risk of material misstatement is a product of inherent

The Institute of Chartered Accountants of Nepal 29

Suggested Answer - June 2018

risk and control risk whereas detection risk is a situation where auditors audit procedures

fail to detect material misstatement. To reduce audit risk at acceptable level, the auditor

should appropriately respond to the assessed risk.

b) Audit Committee

As per Section 164 of Companies Act as amended, a listed company with paid up capital

of thirty million rupees or more or a company which is fully or partly owned by the

Government of Nepal shall form an audit committee under the Chairpersonship of a

director who is not involved in the day-to–day operations of the company and consisting

of at least three members. At least one member of the audit committee shall be an

experienced person having obtained professional certificate in accounting or a person

having gained experience in accounting and financial field after having obtained at least

bachelor’s degree in accounts, commerce, management, finance or economics. The

committee is responsible to review internal control systems of the company.

c) Cut Off Procedure

Cut-off procedures mean procedures employed to ensure the separation of transactions at

the end of one year from those in the commencement of the next year. For the cut off

procedure of inventory, the auditor should satisfy himself by examination and test check

that these procedures adequately ensure that:

Goods purchased for which property has passed to the client have in fact been

included in inventories and that the liability if any, has been provided for.

Goods sold have been excluded from the inventories and credit has been taken for

sales.

The auditor may examine a sample of documents evidencing the movement of stocks into

and out of stores, including documents pertaining to period shortly before and shortly

after the cutoff date, and check whether the stocks represented by those documents were

included or excluded, as appropriate, during the stock-taking.

d) Corporate Governance

Corporate Governance is a system by which the business organizations are directed and

controlled. It is a set of processes, customs, policies, laws, and institutions affecting the

way an organization is directed, administered or controlled. The corporate governance

structure specifies the allocation of rights and responsibilities among board, managers,

shareholders, employees, suppliers, customers, government etc. and spells out the rules

and procedures for making decisions on corporate affairs.

Corporate governance is thus 'an internal system encompassing policies, processes and

people, which serves the needs of shareholders and other stakeholders, by directing and

controlling management activities with corporate fairness, transparency, independence,

integrity and accountability. Further, it influences how the objectives of the company are

set and achieved, how risk is monitored and assessed, and how performance is optimized.

It encourages companies to create value (through entrepreneurism, innovation,

development and exploration) and provide accountability and control systems

commensurate with the risks involved

The Institute of Chartered Accountants of Nepal 30

CAP II Paper 2: Audit & Assurance

7. Distinguish between: (25=10)

a) Cost Accounting and Financial Accounting

b) Reserves and Provisions

Answer:

a) Distinction between Cost Accounting and Financial Accounting

Cost Accounting is a close follower of financial accounting. It is not independent of

financial accounting. Though there are common grounds between the two, the important

differences are given below:

(i) Reporting: The major objective of financial accounting is external reporting whereas the

focus of cost accounting has been essentially internal i.e. management.

(ii) Flexibility: Financial accounting is mostly historical or after the event while cost

accounting is much more flexible and open minded and includes in both retrospective

and anticipatory calculations.

(iii)Nature: Financial accounting classifies records, presents and interprets in terms of

money transactions whereas cost accounting classifies, records, presents and interprets

in a significant manner the material, labour and overhead costs involved in

manufacturing and selling each product.

(iv) Financial accounting uses Relevant Accounting Standards while recording, classifying

summarizing and reputing business transactions whereas cost accounting is not bound

to use such Accounting Standards and it can use any technique or practice which

generates useful information.

(v) Time Span: Financial accounting data are developed for a definite period, usually a

year, half year or a quarter, but cost accounting reports and statements can be prepared

whenever needed.

(vi) Accounting Method: Financial Accounting follows the double-entry system for

recording, classifying and summarizing business transactions.

The data under Cost Accounting can be gathered for small or large segments or activities

of an organization and monetary as well as other measures can be used for different

activities in the organization.

b) Reserves and Provisions

(i) Reserve is an appropriation of profit whereas provision is a charge against Profit.

(ii) Reserves are not intended to meet specific liability, contingency or diminution in the

value of assets. Provisions are made to provide for depreciation, renewal or a known

liability or a disputed claim.

(iii) Reserves cannot be created unless there is a profit except revaluation reserve and

capital subsidy. Provisions must be created whether or not there is profit.

(iv) Reserves are generally optional except in certain situations – Capital Redemption

reserve, Debenture Redemption Reserve, etc. Provisions are not optional and have to

The Institute of Chartered Accountants of Nepal 31

Suggested Answer - June 2018

be made as per generally accepted accounting principles.

(v) Reserves are shown on the liability side. Provisions for depreciation and provision for

doubtful debts are shown as deduction from respective assets. Provision for liability is

shown on the liability side.

The Institute of Chartered Accountants of Nepal 32

CAP II Paper 2: Audit & Assurance

Specific Comments on the performance of the students

Batch: - June 2018

Level: - CAP-II

Subject: Audit and Assurance

Question No. 1

Most of the students did not understand the question about non-adjusting event. They are

unaware about NAS PPE(16). Students are aware about the related accounting standard and

provision. However, while answering the question they are not correctly given the

justification. It seems the student has surface knowledge only. Most of the students were not

able to relate Q.no. 1 (c) with revenue recognition. Some students cannot answer in line with

NAS, other irrelevant NASs are referred. 50% answer are irrelevant, could not linked with

NAS - 18

Question No. 2

(c) part is confusing, so mostly internal audit function has been ignored only focused on audit

plan. 2(b) most of the student wrote about audit planning instead of preliminary assessment

of internal audit function. The question is not understood by student properly. 'Self- int.

threat' could not be referred by majorities. Majorities 90%, fail to link the audit plan with

"internal audit function". No student can refer NSA 450.

Question No. 3

Satisfactorily. Instead of writing about timing of liaison and coordination most student write

on using the work of internal Auditor.

Question No. 4

Students found difficulty due to generalization of question.

Question No. 5

Not referred as per audit act, attempted definition of propriety audit. It seems student does

not understand the concept of proprietary audit properly.

Question No. 6

Most of all answered satisfactorily. There is confusion regarding Audit committee for some

students. They wrote the detail of Audit committee of ICAN, instead Audit committee as per

company Act.

Question No. 7

Differences are not specific. Attempted by most of the students and answering properly.

However, some student repeated same point again and again in different language.

The Institute of Chartered Accountants of Nepal 33

Suggested Answer - June 2018

Paper 3:

Corporate & Other Law

The Institute of Chartered Accountants of Nepal 34

CAP II Paper 3: Corporate & Other Law

Roll No……………. Maximum Marks - 100

Total No. of Questions - 7 Total No. of Printed Pages -12

Time Allowed - 3 Hours

Marks

Attempt all questions.

1. Answer the following questions: (5×5=25)

a) During the course of Audit of Nepal Commercial Bank Limited, auditor of the bank

found some irregularities during the course of audit. He would like the shareholders

to know about these irregularities. Therefore, he wants to have the bank‘s extra

ordinary general meeting (EGM) convened and he approaches you for consultation

for convening EGM. Could you explain how the EGM of the bank can be convened

pursuant to the Companies Act, 2063?

b) Mr. Ramesh Mahato, a renowned businessman is planning to carry out insurance

business in Nepal by establishing a private company. Give your suggestion/opinion to

Mr. Mahato on his plan by citing the relevant provision of the Companies Act, 2063.

c) Mr. 'A' is appointed as an auditor of Prime Development Bank Ltd. in this Fiscal

Year. He is willing to continue in this company for F/Y 2076/2077. Mr. B, who had

been a partner of A before 3 years, is also willing to be an auditor in this company. In

spite of this, company is planning to substitute another auditor. In this circumstances,

is the willingness of A and B is justified? If the company has planned to remove Mr.

A then how it can be removed? Justify your answer with reference to the Companies

Act, 2063.

d) Mentions the circumstances where special resolution shall be presented in the general

meeting of a company for decision.

e) A resolution is passed by the general meeting of Alliance Insurance Ltd. to appoint

Rajan as an independent Director. After three months an action is filed against him as

he was convicted for 1 year jail imprisonment in a case of assault, hence, disqualified.

Advise the company regarding :

i) The disqualifications of an independent director?

ii) Is Rajan is disqualified in this respect?

Answer

a) As per the section 82(2) of the Companies Act 2063, if in the course of auditing the

account of the bank, it is deemed necessary to call an extra ordinary general meeting

for discussion of the irregularities at the EGM, the auditor may request the board of

directors to call such meeting; and if the board of directors fails to call the meeting

accordingly, the auditor may make an application, setting out the matter, to the

Office of Company Registrar and if an application is so made, the office may call the

extra-ordinary general meeting of the company.

b) Besides incorporation of a company as a public company certain companies can be

incorporated as a public company only. According to the section 12 of the

companies Act 2063 a company carrying on the business of banking, financial

The Institute of Chartered Accountants of Nepal 35

Suggested Answer - June 2018

transactions, insurance business related transaction, stock exchange business,

provision fund etc. as prescribed. Thus Mr. Ramesh Mahato, if interested to carryout

insurance business in Nepal, it is mandatory to be registered company as public

company only.

c) According to section 110 of the Companies Act, 2063, every company must appoint

an auditor to audit its accounts.

The companies Act, 2063, in section 111, has provided different rules as to

appointment of auditor. An auditor, from the amongst the auditors registered or

licensed under the existing law, can be appointment, in case of a public company, by

the General Meeting and in the case of a private company as provided in its

Memorandum of Association, Articles of Association and consensus agreement or by

the General Meeting in the absence of such arrangements.

The prime authority to appoint an auditor is general meeting. The company registrar

office also performs an appointing authority with reference of Board of Director due

to fail to appoint an auditor by AGM and fails to be held meeting and ceases to hold

the office for any reason.

The auditor appointed above remains in the office until next AGM is held. No auditor

or his/her partner or ex-partner or employee or ex-employee shall be appointed as

auditor for more than three consecutive terms to perform the audit of a public

company.

Both candidates are eligible in the eye of prevailing law. In regard to the willingness

of Mr. A, he can be continued up to 3 consecutive terms. However, the issue is

subject to the approval and consent of the shareholders meetings. Further, Mr. B is

also eligible to be appointed as an auditor of the said company. He has fulfilled

requirement as Mr. A has owned.

Regarding the removal process of an auditor, the companies Act, 2063, it its section

119, has mentioned, that, an auditor should be removed after completion of the audit

accounts of such F/Y. Auditor can be removed after fulfilling following conditions:

Breaching the code of conduct of auditors or does any act against the interest of

the company which has appointed him as the auditor, or commits ant act contrary

to the prevailing law.

Auditor may be removed through same process whereby he/she was appointed as

auditor.

Prior information should be given to Nepal Chartered Accountants Institute.

Approval should be taken from regulatory authority as provided by the prevailing

law.

Approval from the office in the time while failing such authority.

The auditor should be provided with a reasonable opportunity to defend

him/herself.

d) In a general meeting of the Company, it is required to submit matters to be decided

as resolution which may be either ordinary or special resolution. However Section

83 of the Companies Act prescribes the subject matter which requires to be

presented as special resolutions in the general meeting of a company for decision.

The Institute of Chartered Accountants of Nepal 36

CAP II Paper 3: Corporate & Other Law

i) Increasing the authorized capital of the company,

ii) Decreasing or altering share capital of the company,