Professional Documents

Culture Documents

Assgmt 2 B

Assgmt 2 B

Uploaded by

saad bin sadaqatOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assgmt 2 B

Assgmt 2 B

Uploaded by

saad bin sadaqatCopyright:

Available Formats

Problem Set B 281

e. The store reports sales taxes payable of $5,000 in its adjusted trial balance. Explain why it

does not report any sales taxes expense.

f. What is meant by the term “operating cycle” and which accounts in the trial balance comprise

Harry’s Haberdashery’s operating cycle?

LO8 PROBLEM 6.3B

P Shown below is information from the financial reports of Jill’s Department Stores for the past few

Trend Analysis

T years.

2011 2010 2009

Net sales (in millions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $9,240 $8,810 $8,140

Number of stores . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 133 122 115

Square feet of selling space (in millions) . . . . . . . . . . . . . . . . . . 6.0 5.7 5.1

Average net sales of comparable stores (in millions) . . . . . . . . . $ 70.2 $ 72.3 $ 75.0

Instructions

a. Calculate the following statistics for Jill’s Department Stores (round all computations to one

decimal place):

1. The percentage change in net sales from 2009 to 2010 and 2010 to 2011. Hint: The per-

centage change is computed by dividing the dollar amount of the change between years

by the amount of the base year. For example, the percentage change in net sales from

2009 to 2010 is computed by dividing the difference between 2010 and 2009 net sales by

the amount of 2009 net sales, or ($8,810 ⫺ $8,140) ⫼ $8,140 ⫽ 8.2% increase.

2. The percentage change in net sales per square foot of selling space from 2009 to 2010

and 2010 to 2011.

3. The percentage change in comparable store sales from 2009 to 2010 and 2010 to 2011.

b. Evaluate the sales performance of Jill’s Department Stores.

LO3 PROBLEM 6.4B

P Mary’s TV uses a perpetual inventory system. The following are three recent merchandising trans-

Comparison of Net

C actions:

Cost and Gross Price

C

LO6 Mar. 6 Purchased eight TVs from Whosa Industries on account. Invoice price, $350 per unit,

Methods

M

for a total of $2,800. The terms of purchase were 2/10, n/30.

Mar. 11 Sold two of these televisions for $600 cash.

Mar. 16 Paid the account payable to Whosa Industries within the discount period.

Instructions

a. Prepare journal entries to record these transactions assuming that Mary’s records purchases of

merchandise at:

1. Net cost

2. Gross invoice price

b. Assume that Mary’s did not pay Whosa Industries within the discount period but instead paid

the full invoice price on April 6. Prepare journal entries to record this payment assuming that

the original liability had been recorded at:

1. Net cost

2. Gross invoice price

c. Assume that you are evaluating the efficiency of Mary’s bill-paying procedures. Which

accounting method—net cost or gross invoice price—provides you with the most useful infor-

mation? Explain.

LO3 PROBLEM 6.5B

P The following is a series of related transactions between Hip Pants and Sleek, a chain of retail

M

Merchandising clothing stores:

LO6 Transactions

T

Oct. 12 Hip Pants sold Sleek 300 pairs of pants on account, terms 1/10, n/30. The cost of these

pants to Hip Pants was $20 per pair, and the sales price was $60 per pair.

Oct. 15 Wings Express charged $50 for delivering this merchandise to Sleek. These charges

were split evenly between the buyer and the seller and were paid immediately in cash.

282 Chapter 6 Merchandising Activities

Oct. 16 Sleek returned four pairs of pants to Hip Pants because they were the wrong size. Hip

Pants allowed Sleek full credit for this return.

Oct. 22 Sleek paid the remaining balance due to Hip Pants within the discount period.

Both companies use a perpetual inventory system.

Instructions

a. Record this series of transactions in the general journal of Hip Pants. (The company records

sales at gross sales price.)

b. Record this series of transactions in the general journal of Sleek. (The company records pur-

chases of merchandise at net cost and uses a Transportation-in account to record transporta-

tion charges on inbound shipments.)

c. Sleek does not always have enough cash on hand to pay for purchases within the discount

period. However, it has a line of credit with its bank, which enables Sleek to easily borrow

money for short periods of time at an annual interest rate of 12 percent. (The bank charges

interest only for the number of days until Sleek repays the loan.) As a matter of general policy,

should Sleek take advantage of 1/10, n/30 cash discounts even if it must borrow the money to do

so at an annual rate of 12 percent? Explain fully—and illustrate any supporting computations.

LO2 PROBLEM 6.6B

P Queen Enterprises is a furniture wholesaler. Queen hired a new accounting clerk on January 1 of

Correcting Errors—

C the current year. The new clerk does not understand accrual accounting and recorded the transac-

Recording of

R tions below based on when cash receipts and disbursements changed hands rather than when the

LO3 transaction occurred. Queen uses a perpetual inventory system, and its accounting policy calls for

Merchandising

M

Transactions

T inventory purchases to be recorded net of any discounts offered.

LO6 Jan. 7 Paid Hardwoods Forever Inc. $4,900 for furniture that it received on December 20.

(This purchase was recorded as a debit to Inventory and a credit to Accounts Payable

on December 20 of last year, but the accounting clerk ignores that fact.)

Dec. 23 Received furniture from Koos Hoffwan Co. for $10,000; terms 2/10, n/30.

Dec. 26 Sold furniture to Beige Chipmunk Inc. for $15,000; terms 1/10, n/30. The cost of the

furniture to Queen was $12,250.

Instructions

a. As a result of the accounting clerk’s errors, compute the amount by which the following

accounts are overstated or understated:

1. Accounts Receivable

2. Inventory

3. Accounts Payable

4. Sales

5. Cost of Goods Sold

b. Compute the amount by which net income is overstated or understated.

c. Prepare a single journal entry to correct the errors that the accounting clerk has made. (Assume

that Queen has yet to close its books for the current year.)

d. Assume that Queen has already closed its books for the current year. Make a single journal

entry to correct the errors that the accounting clerk has made.

e. Assume that the ending inventory balance is correctly stated based on adjustments resulting

from a physical inventory count. (Cost of Goods Sold was debited or credited based on the

inventory adjustment.) Assume that Queen has already closed its books for the current year,

and make a single journal entry to correct the errors that the accounting clerk has made.

LO1 PROBLEM 6.7B

P Computer Resources Inc. is a computer retailer. Computer Resources began operations in Decem-

A

Accrual Accounting, ber of the current year and engaged in the following transactions during that month. Computer

Cash Flow, and Fair

C Resources uses a perpetual inventory system.

LO3

Value

V

Dec. 5 Purchased $100,000 of computer equipment, terms n/30.

LO6 Dec. 12 Sold $100,000 of computer equipment, terms n/30. The cost of the equipment sold is

$50,000.

Dec. 26 Purchased $200,000 of computer equipment, terms n/30.

You might also like

- Final Blackbook On Role of AdvertisingDocument62 pagesFinal Blackbook On Role of AdvertisingArjun Choudhary50% (6)

- Accounting Assignment 06A 207Document12 pagesAccounting Assignment 06A 207Aniyah's RanticsNo ratings yet

- Inventories:: True or FalseDocument8 pagesInventories:: True or FalseXiena0% (1)

- Acc. QuestionsDocument5 pagesAcc. QuestionsFaryal MughalNo ratings yet

- Soal Ujian Akhir: Intermediate Financial Management Kelas: Magister Ilmu Management /feb Usu 1Document4 pagesSoal Ujian Akhir: Intermediate Financial Management Kelas: Magister Ilmu Management /feb Usu 1ninaNo ratings yet

- Case 07-53: #REF! #REF! #REF! #REF! #REF!Document6 pagesCase 07-53: #REF! #REF! #REF! #REF! #REF!saad bin sadaqatNo ratings yet

- Assgmt Cost Flow AssumptionDocument3 pagesAssgmt Cost Flow Assumptionsaad bin sadaqatNo ratings yet

- MC DonaldsDocument4 pagesMC Donaldsmunish05No ratings yet

- Comm 457 Practice MidtermDocument9 pagesComm 457 Practice MidtermJason SNo ratings yet

- Walgreen Company Rite Aid Corporation: G RoughDocument1 pageWalgreen Company Rite Aid Corporation: G Roughsaad bin sadaqat100% (1)

- IPPTChap 006 Williams 17 eDocument70 pagesIPPTChap 006 Williams 17 eRida ChamiNo ratings yet

- Intro To Financial Analysis AssignmentDocument4 pagesIntro To Financial Analysis AssignmentAshar AlamNo ratings yet

- Achievement Test 3.chapters 5&6Document9 pagesAchievement Test 3.chapters 5&6Quỳnh Vũ100% (1)

- Forum ACC WM - Sesi 3 (REV)Document9 pagesForum ACC WM - Sesi 3 (REV)Windy Martaputri100% (2)

- For CDEEDocument7 pagesFor CDEEmikiyas zeyedeNo ratings yet

- AccountingDocument3 pagesAccountingVirginia Concepcion JobliNo ratings yet

- Books of Accounts and Double-Entry SystemDocument5 pagesBooks of Accounts and Double-Entry SystemMc Clent CervantesNo ratings yet

- ACCT 3331 Exam 2 Review Chapter 18 - Revenue RecognitionDocument14 pagesACCT 3331 Exam 2 Review Chapter 18 - Revenue RecognitionXiaoying XuNo ratings yet

- FDNACCT Review Exam-AnsKey-SetADocument7 pagesFDNACCT Review Exam-AnsKey-SetAChyle Sagun100% (1)

- FA 2 Practice Test Set 1Document14 pagesFA 2 Practice Test Set 1Chhour ThalikaNo ratings yet

- Intermediate Accounting IFRS 3rd Edition-574-576Document3 pagesIntermediate Accounting IFRS 3rd Edition-574-576dindaNo ratings yet

- Accounting For Merchandising OperationsDocument7 pagesAccounting For Merchandising OperationsRakibul HasanNo ratings yet

- Finals 2019Document4 pagesFinals 2019GargiNo ratings yet

- 605 Chapter 6Document26 pages605 Chapter 6阿锭No ratings yet

- POA1-Assignment - Chapter 5 - QDocument5 pagesPOA1-Assignment - Chapter 5 - QAuora Bianca100% (1)

- Financial Accounting Study Guide Ch5 AnswersDocument7 pagesFinancial Accounting Study Guide Ch5 AnswersSummerNo ratings yet

- Accounts Receivables: TheoriesDocument5 pagesAccounts Receivables: TheoriesshellacregenciaNo ratings yet

- Review For ExamDocument4 pagesReview For ExamJohnrich Mar PlacioNo ratings yet

- Discontinued Operations Acctg. Test BankDocument12 pagesDiscontinued Operations Acctg. Test BankDalrymple CasballedoNo ratings yet

- INVENTORIESDocument5 pagesINVENTORIESEdrick Devilla Dimayuga100% (2)

- Wiley - Practice Exam 2 With SolutionsDocument11 pagesWiley - Practice Exam 2 With SolutionsIvan BliminseNo ratings yet

- School of Accounting & FinanceDocument10 pagesSchool of Accounting & FinanceŁøuiša ŅøinñøiNo ratings yet

- Unit 2 TestDocument7 pagesUnit 2 TestThetMon HanNo ratings yet

- Intacc Q2Document4 pagesIntacc Q2Juliana Reign RuedaNo ratings yet

- Q2euxhyim - Activity - Chapter 10 - Acctg Cycle of A Merchandising BusinessDocument8 pagesQ2euxhyim - Activity - Chapter 10 - Acctg Cycle of A Merchandising BusinessLyra Mae De BotonNo ratings yet

- FAR Material 1Document31 pagesFAR Material 1Blessy Zedlav LacbainNo ratings yet

- Module 9 Accounting For A Merchandiser Dec 2021 (20231122130953)Document34 pagesModule 9 Accounting For A Merchandiser Dec 2021 (20231122130953)Antonette LaurioNo ratings yet

- Practice Quiz 07 - ACTG240 - Q2202122Document11 pagesPractice Quiz 07 - ACTG240 - Q2202122Đinh Ngọc Minh ChâuNo ratings yet

- Chapter 5 ExercisesDocument8 pagesChapter 5 ExercisesRaihan Rohadatul 'AisyNo ratings yet

- Acc Eng Chap5Document45 pagesAcc Eng Chap5李少珠 AnanchaNo ratings yet

- AIS 301 701 Practice Exam 3 Final VersionDocument16 pagesAIS 301 701 Practice Exam 3 Final VersionRafaelAlexandrianNo ratings yet

- Test SamplesDocument18 pagesTest SamplesDen NgNo ratings yet

- Chapter 5 Question Review 11th EditionDocument10 pagesChapter 5 Question Review 11th EditionEmiraslan MhrrovNo ratings yet

- Final Exam All Problem Solving Revision 2 1Document28 pagesFinal Exam All Problem Solving Revision 2 131231023949No ratings yet

- ACCT CH.2 HomeworkDocument13 pagesACCT CH.2 Homeworkj8noelNo ratings yet

- Prevalidation MASDocument9 pagesPrevalidation MASJon Dumagil Inocentes, CPANo ratings yet

- Accountancy TestDocument9 pagesAccountancy TestGaurav PitaliyaNo ratings yet

- ACCT 210 - Introductory Financial Accounting I Assignment #3Document17 pagesACCT 210 - Introductory Financial Accounting I Assignment #3dleverNo ratings yet

- Practice Exercises Additional AccountingDocument2 pagesPractice Exercises Additional AccountingNurul AisyahNo ratings yet

- Far Quiz Nov. 20, 2020Document7 pagesFar Quiz Nov. 20, 2020Yanna AlquisolaNo ratings yet

- 05 Accounting For Merchandising OperationsDocument33 pages05 Accounting For Merchandising OperationsoriboiNo ratings yet

- Accounting FirstDocument24 pagesAccounting Firstmagdy kamelNo ratings yet

- Chapter 7 Review AnswersDocument3 pagesChapter 7 Review AnswersShane Khezia BaclayonNo ratings yet

- AF101 Final Exam S1 2018Document16 pagesAF101 Final Exam S1 2018StaygoldNo ratings yet

- Chapter 7Document46 pagesChapter 7Awrangzeb AwrangNo ratings yet

- IFRS 15 Maths PDFDocument4 pagesIFRS 15 Maths PDFFeruz Sha RakinNo ratings yet

- Midterm Exam FADocument7 pagesMidterm Exam FARes GosanNo ratings yet

- Asignacioìn 1 AISDocument5 pagesAsignacioìn 1 AISElia SantanaNo ratings yet

- Comm 457 Solutions To Practice MidtermDocument9 pagesComm 457 Solutions To Practice MidtermJason SNo ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisAprile Margareth HidalgoNo ratings yet

- Chapter 8 InventoryDocument11 pagesChapter 8 Inventorymarwan2004acctNo ratings yet

- 2014 MCQ Part 1-76Document27 pages2014 MCQ Part 1-76amitsinghslideshareNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Tahir Kamal Hassan Assignment 1 09052020 013936amDocument2 pagesTahir Kamal Hassan Assignment 1 09052020 013936amsaad bin sadaqatNo ratings yet

- ADocument36 pagesAsaad bin sadaqatNo ratings yet

- Rework Tread & S/W Summary Compound Sizes QTY KG T-209 T-752Document3 pagesRework Tread & S/W Summary Compound Sizes QTY KG T-209 T-752saad bin sadaqatNo ratings yet

- Irfan Akber: Career ObjectiveDocument2 pagesIrfan Akber: Career Objectivesaad bin sadaqatNo ratings yet

- Maintenance Follow Up Report: M/C Fault Down Time Reason RemarksDocument4 pagesMaintenance Follow Up Report: M/C Fault Down Time Reason Remarkssaad bin sadaqatNo ratings yet

- 7 DAY SCHEDULE May-19 PermenentDocument12 pages7 DAY SCHEDULE May-19 Permenentsaad bin sadaqatNo ratings yet

- Imran ZafarDocument1 pageImran Zafarsaad bin sadaqatNo ratings yet

- TR Inc Format AlishahDocument164 pagesTR Inc Format Alishahsaad bin sadaqatNo ratings yet

- TestDocument3 pagesTestsaad bin sadaqatNo ratings yet

- Professional Aim: Karakoram Motors (PVT) LTDDocument2 pagesProfessional Aim: Karakoram Motors (PVT) LTDsaad bin sadaqatNo ratings yet

- 04-09-2020 Special StatusDocument9 pages04-09-2020 Special Statussaad bin sadaqatNo ratings yet

- Standard Rate AUG-20Document18 pagesStandard Rate AUG-20saad bin sadaqatNo ratings yet

- Case 09-48: #REF! #REF!Document20 pagesCase 09-48: #REF! #REF!saad bin sadaqatNo ratings yet

- Size SAP Code 1 Ply 2 Ply 3 Ply 4 Ply 5 PlyDocument2 pagesSize SAP Code 1 Ply 2 Ply 3 Ply 4 Ply 5 Plysaad bin sadaqatNo ratings yet

- Standard Rate AUG-20Document1,536 pagesStandard Rate AUG-20saad bin sadaqatNo ratings yet

- Strategies in Action: Strategic Management: Concepts & Cases 13 Edition Fred DavidDocument17 pagesStrategies in Action: Strategic Management: Concepts & Cases 13 Edition Fred Davidsaad bin sadaqatNo ratings yet

- Monthly Shift Schedule Tyre Building: The General Tyre & Rubber Company of Pakistan LTDDocument16 pagesMonthly Shift Schedule Tyre Building: The General Tyre & Rubber Company of Pakistan LTDsaad bin sadaqatNo ratings yet

- Total Available Minutes Total Downtime Minutes Total Productive TimeDocument3 pagesTotal Available Minutes Total Downtime Minutes Total Productive Timesaad bin sadaqatNo ratings yet

- Downtime Report 10 09 2020Document9 pagesDowntime Report 10 09 2020saad bin sadaqatNo ratings yet

- Implementing Strategies: Marketing, Finance/Accounting, R&D, and MIS IssuesDocument31 pagesImplementing Strategies: Marketing, Finance/Accounting, R&D, and MIS Issuessaad bin sadaqatNo ratings yet

- Walgreen Company Rite Aid Corporation: G RoughDocument1 pageWalgreen Company Rite Aid Corporation: G Roughsaad bin sadaqat100% (1)

- Saad O T File 14 AugDocument6 pagesSaad O T File 14 Augsaad bin sadaqatNo ratings yet

- The Key To Effective SWOT Analysis - Include AQCD Factors: ActionableDocument10 pagesThe Key To Effective SWOT Analysis - Include AQCD Factors: Actionablesaad bin sadaqatNo ratings yet

- Strategy Analysis & Choice: Strategic Management: Concepts & Cases 13 Edition Fred DavidDocument41 pagesStrategy Analysis & Choice: Strategic Management: Concepts & Cases 13 Edition Fred Davidsaad bin sadaqatNo ratings yet

- Case 05-68Document10 pagesCase 05-68saad bin sadaqatNo ratings yet

- Case 03-62: #REF! #REF! #REF!Document8 pagesCase 03-62: #REF! #REF! #REF!saad bin sadaqatNo ratings yet

- Case 08-31Document8 pagesCase 08-31saad bin sadaqatNo ratings yet

- Role of Communication in Conflict ManagementDocument11 pagesRole of Communication in Conflict Managementsaad bin sadaqatNo ratings yet

- Good Luck and God Bless!: College of AccountancyDocument1 pageGood Luck and God Bless!: College of AccountancyALMA MORENANo ratings yet

- Uzezi Edeha (Yah)Document4 pagesUzezi Edeha (Yah)Samson OlubodeNo ratings yet

- Assignment 01Document3 pagesAssignment 01Hasan ShahrierNo ratings yet

- Consumer Buying Pattern Through ZomatoDocument98 pagesConsumer Buying Pattern Through ZomatoHari Krishna Chalwadi0% (1)

- Project Appraisal - Investment Appraisal - 2023Document40 pagesProject Appraisal - Investment Appraisal - 2023ThaboNo ratings yet

- Chapter-3 Marketing FunctionsDocument32 pagesChapter-3 Marketing FunctionsHem Raj GurungNo ratings yet

- Why Do Financial Crises Occur and Why Are They So Damaging To The Economy?Document67 pagesWhy Do Financial Crises Occur and Why Are They So Damaging To The Economy?Irakli SaliaNo ratings yet

- Practical Accounting 1Document6 pagesPractical Accounting 1Myiel AngelNo ratings yet

- Chapter3 - Concurrent Engineering PDFDocument15 pagesChapter3 - Concurrent Engineering PDFSandeep GogadiNo ratings yet

- Business ProposalsDocument9 pagesBusiness ProposalsHusnul KhatimahNo ratings yet

- 06 Guide To Tender EvaluationDocument9 pages06 Guide To Tender Evaluationromelramarack1858No ratings yet

- Important Points To Remember For Retail AccountingDocument7 pagesImportant Points To Remember For Retail AccountingAida Tadal GalamayNo ratings yet

- Quality Assurance ProcedureDocument6 pagesQuality Assurance ProcedureTrivesh Sharma100% (1)

- Ch-4 Internal ControlDocument12 pagesCh-4 Internal ControlAyana Giragn AÿøNo ratings yet

- Working Capital Management FinalDocument22 pagesWorking Capital Management FinalmithileshagrawalNo ratings yet

- Distribution Management ReviewerDocument19 pagesDistribution Management Reviewerelsa unknownNo ratings yet

- Money Placed in A BankDocument3 pagesMoney Placed in A BankZacharie GarciaNo ratings yet

- NSA 320 (Revised) "Materiality in Planning and Performing An Audit"Document1 pageNSA 320 (Revised) "Materiality in Planning and Performing An Audit"Roshan AddhikariNo ratings yet

- Strategy Analysis & Choice: Strategic Management: Concepts & Cases 11 Edition Fred DavidDocument50 pagesStrategy Analysis & Choice: Strategic Management: Concepts & Cases 11 Edition Fred Davidliza shahNo ratings yet

- Strategic Capacity ManagementDocument25 pagesStrategic Capacity Managementjohnj345No ratings yet

- Managing Innovation Chapter 1Document72 pagesManaging Innovation Chapter 1Manuel uY100% (1)

- Resume Ibm San Storage EngineerDocument43 pagesResume Ibm San Storage Engineerakbisoi1No ratings yet

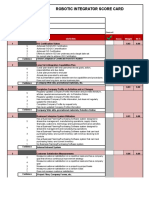

- Robotic Integrator Score Card: Item Rating Criteria Score Weight W+SDocument5 pagesRobotic Integrator Score Card: Item Rating Criteria Score Weight W+SdNo ratings yet

- MidtermDocument9 pagesMidtermSohfia Jesse VergaraNo ratings yet

- IL Digital July2017Document266 pagesIL Digital July2017SanbzNo ratings yet

- Ebook An Introduction To Management Consultancy 2Nd Edition Marc G Baaij Online PDF All ChapterDocument69 pagesEbook An Introduction To Management Consultancy 2Nd Edition Marc G Baaij Online PDF All Chaptersusan.freeman422100% (11)

- Pipavav Rail Corporation-Ppp Case Study 2008Document25 pagesPipavav Rail Corporation-Ppp Case Study 2008kaushalmehta100% (1)

- SloexportDocument10 pagesSloexportmaxNo ratings yet