Professional Documents

Culture Documents

Custom Duties Calculated by FBR Details ہدﺮﮐ ﻦﻴﻌﺘﻣ ﯽﮐ رآ ﯽﺑ ﻒﯾا ﯽﮐ ﺲﮑﯿﭨ/ﯽﭨﻮﯾڈ ﻢﭩﺴﮐ تﻼﯿﺼﻔﺗ

Custom Duties Calculated by FBR Details ہدﺮﮐ ﻦﻴﻌﺘﻣ ﯽﮐ رآ ﯽﺑ ﻒﯾا ﯽﮐ ﺲﮑﯿﭨ/ﯽﭨﻮﯾڈ ﻢﭩﺴﮐ تﻼﯿﺼﻔﺗ

Uploaded by

Kassam Hussnain RizviCopyright:

Available Formats

You might also like

- Proceeds Realization Certificate (FORM A) - MEEZAN-2023-GRD-FT23341GXMQZDocument1 pageProceeds Realization Certificate (FORM A) - MEEZAN-2023-GRD-FT23341GXMQZmutahir344No ratings yet

- Pta - DRSDocument1 pagePta - DRSbilalakNo ratings yet

- ICICI Bank - FitmentProof Reciept21621170636201905211616172Document1 pageICICI Bank - FitmentProof Reciept21621170636201905211616172ssssdevendragulveNo ratings yet

- Pta - DRS PDFDocument1 pagePta - DRS PDFMajid ManzoorNo ratings yet

- Pta - DRSDocument1 pagePta - DRSOmer SaeedNo ratings yet

- PTA DRS - Coc Details 6842786 PDFDocument1 pagePTA DRS - Coc Details 6842786 PDFateeq ansariNo ratings yet

- ParticularesDocument1 pageParticularesmry65842No ratings yet

- Pta - DRSDocument1 pagePta - DRSmaqsoodstore.comNo ratings yet

- PTA DRS - Coc Details 15637087Document1 pagePTA DRS - Coc Details 156370877wdbmzqcb2No ratings yet

- PTA DRS - Coc Details 15637115Document1 pagePTA DRS - Coc Details 156371157wdbmzqcb2No ratings yet

- PTA DRS - Coc Details 15637099Document1 pagePTA DRS - Coc Details 156370997wdbmzqcb2No ratings yet

- Untitled 7Document1 pageUntitled 7abdul ahad jawedNo ratings yet

- 1ms - Mecon LTD (DNS) - blr-Sl22-23113Document1 page1ms - Mecon LTD (DNS) - blr-Sl22-23113Dipan DasNo ratings yet

- UntitledDocument7 pagesUntitledSamikhya SharmaNo ratings yet

- Application ID 64895A00238 Do Id 64895A002381: Customer Name Usha Roshan Mahale Beneficiary Name Beneficiary RelationDocument2 pagesApplication ID 64895A00238 Do Id 64895A002381: Customer Name Usha Roshan Mahale Beneficiary Name Beneficiary RelationSiddarthNo ratings yet

- Aaecc2134l 2023 PDFDocument4 pagesAaecc2134l 2023 PDFVineet KhuranaNo ratings yet

- Pov 5509783Document3 pagesPov 5509783Sameer MahajanNo ratings yet

- Jeetu RDocument2 pagesJeetu Rdivyamanglani99No ratings yet

- Charge Slip - 1708417916997Document21 pagesCharge Slip - 1708417916997masid.nbpNo ratings yet

- 221120221702-Interior Works Tender For SirgapurDocument76 pages221120221702-Interior Works Tender For Sirgapurshubham kumarNo ratings yet

- IDFCFIRSTBankstatement 10105940033 213530664Document2 pagesIDFCFIRSTBankstatement 10105940033 213530664manishbishnoi8032No ratings yet

- OmniOMS Output GenerationDocument2 pagesOmniOMS Output GenerationKaran ThapaNo ratings yet

- Gem Contract 311793Document2 pagesGem Contract 311793P.MannaNo ratings yet

- 221120221702-Interior Works Tender For EddumailaramDocument77 pages221120221702-Interior Works Tender For Eddumailaramshubham kumarNo ratings yet

- NIET No. 16 of 2018-2019 WBSIDC LTDDocument52 pagesNIET No. 16 of 2018-2019 WBSIDC LTDgoutammandNo ratings yet

- Freshtel Form For Admiral Residence v6.0 051223Document3 pagesFreshtel Form For Admiral Residence v6.0 051223IanNo ratings yet

- Payment Confirmation: Your Request For Recharge Has Been Submitted SuccessfullyDocument2 pagesPayment Confirmation: Your Request For Recharge Has Been Submitted Successfullysoubhadra nagNo ratings yet

- Loan Term Sheet - 1714661775963Document10 pagesLoan Term Sheet - 1714661775963bheliya1994No ratings yet

- CRVPOReportDocument3 pagesCRVPOReportasifriazzNo ratings yet

- Bid Notice Abstract: Request For Quotation (RFQ)Document3 pagesBid Notice Abstract: Request For Quotation (RFQ)Kevin MoraldeNo ratings yet

- E-Payment Form 2022-Steven GordonDocument2 pagesE-Payment Form 2022-Steven GordonfootprintscgNo ratings yet

- KiaDocument7 pagesKiaHimanshu DhanukaNo ratings yet

- Nirottam Shilpi - Policy #: 1-2LY7EMZNP400 Policy # MS032262Document4 pagesNirottam Shilpi - Policy #: 1-2LY7EMZNP400 Policy # MS032262nirottam88No ratings yet

- Vinod Kumar PiDocument2 pagesVinod Kumar Pitheultimate.kapildevNo ratings yet

- MicroTel-UltraSky BW Signup FormDocument1 pageMicroTel-UltraSky BW Signup FormKhan KhanNo ratings yet

- Fusionnet Web Services Private Limited COF Number: 1033727: Customer InformationDocument3 pagesFusionnet Web Services Private Limited COF Number: 1033727: Customer InformationBishnu KumarNo ratings yet

- 24 - 38221544103291 SCR GuntupalliDocument3 pages24 - 38221544103291 SCR GuntupalliAbhishek DahiyaNo ratings yet

- LOI Letter 16Document2 pagesLOI Letter 16Rajesh KumarNo ratings yet

- Sajalni 350783324985693Document1 pageSajalni 350783324985693haythem saafiNo ratings yet

- Over The Counter Through Idbi-Prakash Mhatre-Kalamboli Steel ComplexDocument2 pagesOver The Counter Through Idbi-Prakash Mhatre-Kalamboli Steel Complexraj bhoirNo ratings yet

- Tendernotice 1Document4 pagesTendernotice 1VANAJA KNo ratings yet

- RFM Corporation 2022 Definitive Information Statement (SEC Form 20-Is)Document260 pagesRFM Corporation 2022 Definitive Information Statement (SEC Form 20-Is)Carissa May Maloloy-onNo ratings yet

- Annappa S Prabhu:::::::::::::: Summary of Investments As On 09-May-2022Document2 pagesAnnappa S Prabhu:::::::::::::: Summary of Investments As On 09-May-2022soumodipmondal.1212No ratings yet

- Bakreswar Thermal Power Plant P.O. - BKTPP, District - Birbhum Pin - 731104, WB, India Telephone: 03462-220346/8336903916Document14 pagesBakreswar Thermal Power Plant P.O. - BKTPP, District - Birbhum Pin - 731104, WB, India Telephone: 03462-220346/8336903916Shakthi VelNo ratings yet

- FM-DIV03-MPD-0002-New Vendor Registration Form-KSA and OverseasDocument3 pagesFM-DIV03-MPD-0002-New Vendor Registration Form-KSA and OverseasShakeer PttrNo ratings yet

- KIA SONET BookingDocketDocument10 pagesKIA SONET BookingDocketvsrshakthiNo ratings yet

- Rameshwar LalDocument1 pageRameshwar Lalmrprajapat75No ratings yet

- Automatic Scratch Hardness Tester Khushboo 35225107100308Document3 pagesAutomatic Scratch Hardness Tester Khushboo 35225107100308Ashutosh KumarNo ratings yet

- Hotlink Order and Contract Form: Customer InformationDocument9 pagesHotlink Order and Contract Form: Customer InformationAsyraf JagungNo ratings yet

- Service: ContractDocument4 pagesService: ContractAgustaNo ratings yet

- Tax Invoice: This Invoice Is Not A Valid Travel DocumentDocument2 pagesTax Invoice: This Invoice Is Not A Valid Travel DocumentRinku M SamalNo ratings yet

- This Is An Auto-Generated Purchase Order Based On Online Tender Decision - and No Vetting Is Needed Being A Tender Committee CaseDocument4 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender Decision - and No Vetting Is Needed Being A Tender Committee CasedycmmgncrNo ratings yet

- Account StatementDocument132 pagesAccount StatementBASHA SHAFIQNo ratings yet

- UntitledDocument8 pagesUntitledPreet BamrahNo ratings yet

- Rail NR7200215503428093Document1 pageRail NR7200215503428093AbhijeetNo ratings yet

- Charge Slip - 1701298996402Document20 pagesCharge Slip - 1701298996402kabikha467No ratings yet

- ScorphioDocument3 pagesScorphiobapan mondalNo ratings yet

- GeM Bidding 3956256Document9 pagesGeM Bidding 3956256ANIMESH JAINNo ratings yet

- Telecommunications Reseller Revenues World Summary: Market Values & Financials by CountryFrom EverandTelecommunications Reseller Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

Custom Duties Calculated by FBR Details ہدﺮﮐ ﻦﻴﻌﺘﻣ ﯽﮐ رآ ﯽﺑ ﻒﯾا ﯽﮐ ﺲﮑﯿﭨ/ﯽﭨﻮﯾڈ ﻢﭩﺴﮐ تﻼﯿﺼﻔﺗ

Custom Duties Calculated by FBR Details ہدﺮﮐ ﻦﻴﻌﺘﻣ ﯽﮐ رآ ﯽﺑ ﻒﯾا ﯽﮐ ﺲﮑﯿﭨ/ﯽﭨﻮﯾڈ ﻢﭩﺴﮐ تﻼﯿﺼﻔﺗ

Uploaded by

Kassam Hussnain RizviOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Custom Duties Calculated by FBR Details ہدﺮﮐ ﻦﻴﻌﺘﻣ ﯽﮐ رآ ﯽﺑ ﻒﯾا ﯽﮐ ﺲﮑﯿﭨ/ﯽﭨﻮﯾڈ ﻢﭩﺴﮐ تﻼﯿﺼﻔﺗ

Custom Duties Calculated by FBR Details ہدﺮﮐ ﻦﻴﻌﺘﻣ ﯽﮐ رآ ﯽﺑ ﻒﯾا ﯽﮐ ﺲﮑﯿﭨ/ﯽﭨﻮﯾڈ ﻢﭩﺴﮐ تﻼﯿﺼﻔﺗ

Uploaded by

Kassam Hussnain RizviCopyright:

Available Formats

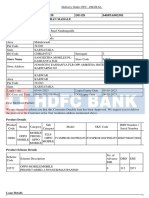

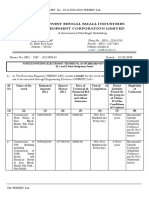

Pakistan Telecommunication Authority

# Application Date Contact Person CNIC Tracking ID Last updated Time Status

1. 2020-05-11 user from ussd 3520216840335 NzA3MzkyMw 2020-05-11 12:56:31.182274 Pending

Custom Duties اﯾﻒ ﺑﯽ آر ﮐﯽ ﻣﺘﻌﻴﻦ ﮐﺮدہ

Calculated by FBR ﭨﯿﮑﺲ ﮐﯽ/ﮐﺴﭩﻢ ڈﯾﻮﭨﯽ

Details ﺗﻔﺼﯿﻼت

Customs Process Description: Success

Applicant Contact No: 03206060035

FBR PSID code for Custom:(Use this ID for payment) 20004551884200511

Customs Process Code: 1

Customs Duties/Taxes Amount calculated by FBR: 7865.0000 PKR

(The said amount is custom duty for FBR)

Disclaimer

a. To process registration, present your PSID code details at any Bank branch, online banking, ATM or mobile banking location for payments of FBR duties or taxes.

b. Application/PSID validity is 7 days, same shall be auto deleted by system in case of non-payment of custom duties.

c. For complaint/query regarding tax amount generated by FBR, please contact nearest FBR House or Custom collectorate.

d. Reprograming of IMEI is criminal offence and such devices will be blocked when identified. Please compare IMEI programmed in your device with the IMEI printed

on the box. In case of reprogrammed IMEI PTA and FBR are not liable.

e. To check your IMEI registration status send SMS to 8484.

Device Details

Sr # Type Brand Model Application Date IMEI

1 Mobile samsung sm-g925f sm-g925f 11-05-2020

354304082393701

You might also like

- Proceeds Realization Certificate (FORM A) - MEEZAN-2023-GRD-FT23341GXMQZDocument1 pageProceeds Realization Certificate (FORM A) - MEEZAN-2023-GRD-FT23341GXMQZmutahir344No ratings yet

- Pta - DRSDocument1 pagePta - DRSbilalakNo ratings yet

- ICICI Bank - FitmentProof Reciept21621170636201905211616172Document1 pageICICI Bank - FitmentProof Reciept21621170636201905211616172ssssdevendragulveNo ratings yet

- Pta - DRS PDFDocument1 pagePta - DRS PDFMajid ManzoorNo ratings yet

- Pta - DRSDocument1 pagePta - DRSOmer SaeedNo ratings yet

- PTA DRS - Coc Details 6842786 PDFDocument1 pagePTA DRS - Coc Details 6842786 PDFateeq ansariNo ratings yet

- ParticularesDocument1 pageParticularesmry65842No ratings yet

- Pta - DRSDocument1 pagePta - DRSmaqsoodstore.comNo ratings yet

- PTA DRS - Coc Details 15637087Document1 pagePTA DRS - Coc Details 156370877wdbmzqcb2No ratings yet

- PTA DRS - Coc Details 15637115Document1 pagePTA DRS - Coc Details 156371157wdbmzqcb2No ratings yet

- PTA DRS - Coc Details 15637099Document1 pagePTA DRS - Coc Details 156370997wdbmzqcb2No ratings yet

- Untitled 7Document1 pageUntitled 7abdul ahad jawedNo ratings yet

- 1ms - Mecon LTD (DNS) - blr-Sl22-23113Document1 page1ms - Mecon LTD (DNS) - blr-Sl22-23113Dipan DasNo ratings yet

- UntitledDocument7 pagesUntitledSamikhya SharmaNo ratings yet

- Application ID 64895A00238 Do Id 64895A002381: Customer Name Usha Roshan Mahale Beneficiary Name Beneficiary RelationDocument2 pagesApplication ID 64895A00238 Do Id 64895A002381: Customer Name Usha Roshan Mahale Beneficiary Name Beneficiary RelationSiddarthNo ratings yet

- Aaecc2134l 2023 PDFDocument4 pagesAaecc2134l 2023 PDFVineet KhuranaNo ratings yet

- Pov 5509783Document3 pagesPov 5509783Sameer MahajanNo ratings yet

- Jeetu RDocument2 pagesJeetu Rdivyamanglani99No ratings yet

- Charge Slip - 1708417916997Document21 pagesCharge Slip - 1708417916997masid.nbpNo ratings yet

- 221120221702-Interior Works Tender For SirgapurDocument76 pages221120221702-Interior Works Tender For Sirgapurshubham kumarNo ratings yet

- IDFCFIRSTBankstatement 10105940033 213530664Document2 pagesIDFCFIRSTBankstatement 10105940033 213530664manishbishnoi8032No ratings yet

- OmniOMS Output GenerationDocument2 pagesOmniOMS Output GenerationKaran ThapaNo ratings yet

- Gem Contract 311793Document2 pagesGem Contract 311793P.MannaNo ratings yet

- 221120221702-Interior Works Tender For EddumailaramDocument77 pages221120221702-Interior Works Tender For Eddumailaramshubham kumarNo ratings yet

- NIET No. 16 of 2018-2019 WBSIDC LTDDocument52 pagesNIET No. 16 of 2018-2019 WBSIDC LTDgoutammandNo ratings yet

- Freshtel Form For Admiral Residence v6.0 051223Document3 pagesFreshtel Form For Admiral Residence v6.0 051223IanNo ratings yet

- Payment Confirmation: Your Request For Recharge Has Been Submitted SuccessfullyDocument2 pagesPayment Confirmation: Your Request For Recharge Has Been Submitted Successfullysoubhadra nagNo ratings yet

- Loan Term Sheet - 1714661775963Document10 pagesLoan Term Sheet - 1714661775963bheliya1994No ratings yet

- CRVPOReportDocument3 pagesCRVPOReportasifriazzNo ratings yet

- Bid Notice Abstract: Request For Quotation (RFQ)Document3 pagesBid Notice Abstract: Request For Quotation (RFQ)Kevin MoraldeNo ratings yet

- E-Payment Form 2022-Steven GordonDocument2 pagesE-Payment Form 2022-Steven GordonfootprintscgNo ratings yet

- KiaDocument7 pagesKiaHimanshu DhanukaNo ratings yet

- Nirottam Shilpi - Policy #: 1-2LY7EMZNP400 Policy # MS032262Document4 pagesNirottam Shilpi - Policy #: 1-2LY7EMZNP400 Policy # MS032262nirottam88No ratings yet

- Vinod Kumar PiDocument2 pagesVinod Kumar Pitheultimate.kapildevNo ratings yet

- MicroTel-UltraSky BW Signup FormDocument1 pageMicroTel-UltraSky BW Signup FormKhan KhanNo ratings yet

- Fusionnet Web Services Private Limited COF Number: 1033727: Customer InformationDocument3 pagesFusionnet Web Services Private Limited COF Number: 1033727: Customer InformationBishnu KumarNo ratings yet

- 24 - 38221544103291 SCR GuntupalliDocument3 pages24 - 38221544103291 SCR GuntupalliAbhishek DahiyaNo ratings yet

- LOI Letter 16Document2 pagesLOI Letter 16Rajesh KumarNo ratings yet

- Sajalni 350783324985693Document1 pageSajalni 350783324985693haythem saafiNo ratings yet

- Over The Counter Through Idbi-Prakash Mhatre-Kalamboli Steel ComplexDocument2 pagesOver The Counter Through Idbi-Prakash Mhatre-Kalamboli Steel Complexraj bhoirNo ratings yet

- Tendernotice 1Document4 pagesTendernotice 1VANAJA KNo ratings yet

- RFM Corporation 2022 Definitive Information Statement (SEC Form 20-Is)Document260 pagesRFM Corporation 2022 Definitive Information Statement (SEC Form 20-Is)Carissa May Maloloy-onNo ratings yet

- Annappa S Prabhu:::::::::::::: Summary of Investments As On 09-May-2022Document2 pagesAnnappa S Prabhu:::::::::::::: Summary of Investments As On 09-May-2022soumodipmondal.1212No ratings yet

- Bakreswar Thermal Power Plant P.O. - BKTPP, District - Birbhum Pin - 731104, WB, India Telephone: 03462-220346/8336903916Document14 pagesBakreswar Thermal Power Plant P.O. - BKTPP, District - Birbhum Pin - 731104, WB, India Telephone: 03462-220346/8336903916Shakthi VelNo ratings yet

- FM-DIV03-MPD-0002-New Vendor Registration Form-KSA and OverseasDocument3 pagesFM-DIV03-MPD-0002-New Vendor Registration Form-KSA and OverseasShakeer PttrNo ratings yet

- KIA SONET BookingDocketDocument10 pagesKIA SONET BookingDocketvsrshakthiNo ratings yet

- Rameshwar LalDocument1 pageRameshwar Lalmrprajapat75No ratings yet

- Automatic Scratch Hardness Tester Khushboo 35225107100308Document3 pagesAutomatic Scratch Hardness Tester Khushboo 35225107100308Ashutosh KumarNo ratings yet

- Hotlink Order and Contract Form: Customer InformationDocument9 pagesHotlink Order and Contract Form: Customer InformationAsyraf JagungNo ratings yet

- Service: ContractDocument4 pagesService: ContractAgustaNo ratings yet

- Tax Invoice: This Invoice Is Not A Valid Travel DocumentDocument2 pagesTax Invoice: This Invoice Is Not A Valid Travel DocumentRinku M SamalNo ratings yet

- This Is An Auto-Generated Purchase Order Based On Online Tender Decision - and No Vetting Is Needed Being A Tender Committee CaseDocument4 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender Decision - and No Vetting Is Needed Being A Tender Committee CasedycmmgncrNo ratings yet

- Account StatementDocument132 pagesAccount StatementBASHA SHAFIQNo ratings yet

- UntitledDocument8 pagesUntitledPreet BamrahNo ratings yet

- Rail NR7200215503428093Document1 pageRail NR7200215503428093AbhijeetNo ratings yet

- Charge Slip - 1701298996402Document20 pagesCharge Slip - 1701298996402kabikha467No ratings yet

- ScorphioDocument3 pagesScorphiobapan mondalNo ratings yet

- GeM Bidding 3956256Document9 pagesGeM Bidding 3956256ANIMESH JAINNo ratings yet

- Telecommunications Reseller Revenues World Summary: Market Values & Financials by CountryFrom EverandTelecommunications Reseller Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet