Professional Documents

Culture Documents

ASSESSMENT - Franchise Accounting (ACCSPEC)

ASSESSMENT - Franchise Accounting (ACCSPEC)

Uploaded by

Ryan CapistranoCopyright:

Available Formats

You might also like

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Mock Exam QuestionsDocument43 pagesMock Exam QuestionsFerran Mola ReverteNo ratings yet

- Compiled QuizzesDocument13 pagesCompiled QuizzesJymldy Encln50% (2)

- Buss. Combi PrelimDocument8 pagesBuss. Combi PrelimPhia TeoNo ratings yet

- Franchise AccountingDocument2 pagesFranchise AccountingChristopher NogotNo ratings yet

- Working capital-HALDocument62 pagesWorking capital-HALManaswini Hotta100% (1)

- Module 5 Franchise Sales Assignments 2bac May 2023Document6 pagesModule 5 Franchise Sales Assignments 2bac May 2023Aaron OsmaNo ratings yet

- Advance Financial Accounting and Reporting: Franchise IAS 18Document4 pagesAdvance Financial Accounting and Reporting: Franchise IAS 18Roxell CaibogNo ratings yet

- Cpa Review School of The Philippines ManilaDocument4 pagesCpa Review School of The Philippines Manilaxara mizpahNo ratings yet

- Franchise (Applied Auditing)Document4 pagesFranchise (Applied Auditing)Abraham Jr. Manansala100% (3)

- Franchise Applied AuditingDocument4 pagesFranchise Applied AuditingMariel RascoNo ratings yet

- Activity 6 - Accounting For Franchise OperationsDocument3 pagesActivity 6 - Accounting For Franchise OperationsSharon AnchetaNo ratings yet

- Franchise Problems For DiscussionDocument4 pagesFranchise Problems For DiscussionRAGASA, John Carlo R.No ratings yet

- Final Quiz and SeatworkDocument3 pagesFinal Quiz and SeatworkMikaela SungaNo ratings yet

- Franchise AccountingDocument5 pagesFranchise AccountingJose SasNo ratings yet

- Quiz No. 3Document4 pagesQuiz No. 3abbyNo ratings yet

- Revenue From Contracts With CustomersDocument3 pagesRevenue From Contracts With Customerscaloy cagzNo ratings yet

- Afar IcpaDocument6 pagesAfar IcpaAndrea Lyn Salonga CacayNo ratings yet

- This Study Resource Was: National College of Business and ArtsDocument8 pagesThis Study Resource Was: National College of Business and ArtsGinoong OsoNo ratings yet

- Revenue Recognition: FranchiseDocument4 pagesRevenue Recognition: FranchiseJoeNo ratings yet

- Module 5 Franchise Accounting WADocument4 pagesModule 5 Franchise Accounting WAMadielyn Santarin MirandaNo ratings yet

- FRANCHISEDocument2 pagesFRANCHISELayla SimNo ratings yet

- Afar Franchise Accounting PDFDocument6 pagesAfar Franchise Accounting PDFArah OpalecNo ratings yet

- Lesson 08. Franchising - A.TDocument6 pagesLesson 08. Franchising - A.THayes HareNo ratings yet

- 07 Franchise AccountingDocument5 pages07 Franchise AccountingAllegria AlamoNo ratings yet

- Quiz On FranchiseDocument4 pagesQuiz On FranchiseTin BulaoNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument3 pagesCpa Review School of The Philippines Mani LaKristelleNo ratings yet

- Advanced Financial Accounting and ReportingDocument18 pagesAdvanced Financial Accounting and Reportingedrick LouiseNo ratings yet

- AFARicpaDocument23 pagesAFARicpaRegine YbañezNo ratings yet

- Ifrs 15Document3 pagesIfrs 15Cha EsguerraNo ratings yet

- FranchiseDocument3 pagesFranchiseDJ ULRICHNo ratings yet

- National College of Business and Arts: Name: Date: Professor: SubjectDocument8 pagesNational College of Business and Arts: Name: Date: Professor: SubjectAngelica CerioNo ratings yet

- Buss. Combi PrelimDocument8 pagesBuss. Combi PrelimPhia TeoNo ratings yet

- Quiz 2 - Acctng For FranchiseDocument2 pagesQuiz 2 - Acctng For FranchiseSarah Jane SeñidoNo ratings yet

- Quizzer 1 - OverallDocument25 pagesQuizzer 1 - OverallJan Elaine CalderonNo ratings yet

- FdggseeDocument2 pagesFdggseefghhnnnjmlNo ratings yet

- Accounting For Franchise Quiz QuizDocument3 pagesAccounting For Franchise Quiz QuizAliah CyrilNo ratings yet

- Franchise AccountingDocument8 pagesFranchise AccountingJason McLaren100% (1)

- FRANCHISEDocument2 pagesFRANCHISEadieNo ratings yet

- 5 Franchise Accounting - PPTMDocument17 pages5 Franchise Accounting - PPTMClarisse PelayoNo ratings yet

- Afar302 A - FranchisingDocument3 pagesAfar302 A - FranchisingNicole TeruelNo ratings yet

- PFRS-15-LTCC Franchise ConsignmentDocument2 pagesPFRS-15-LTCC Franchise ConsignmentArlyn A. Zuniega0% (1)

- Tutorial 3 WHT DiscussDocument6 pagesTutorial 3 WHT DiscussAqila Syakirah IVNo ratings yet

- 7Document7 pages7Lyza Molina ParadoNo ratings yet

- Afar 3603 Franchise-AccountingDocument3 pagesAfar 3603 Franchise-AccountingDenise RamilNo ratings yet

- FA ExercisesDocument1 pageFA Exercisesjemmaserrano1220No ratings yet

- FA2Document2 pagesFA2Jomar VillenaNo ratings yet

- Franchise Accounting (Franchisor) Problems: CMPC 131 Franchise Accounting Notes (CC 1331) Sy 2019-2020 First Sem RLFDocument1 pageFranchise Accounting (Franchisor) Problems: CMPC 131 Franchise Accounting Notes (CC 1331) Sy 2019-2020 First Sem RLFAllyssa ThalliaNo ratings yet

- Revenue From Contracts With Customers Application of Basic ConceptsDocument6 pagesRevenue From Contracts With Customers Application of Basic ConceptsSharon AnchetaNo ratings yet

- Quiz 2 With Correct AnswersDocument7 pagesQuiz 2 With Correct AnswersmarietorianoNo ratings yet

- HO4 Franchise and ConsignmentDocument5 pagesHO4 Franchise and ConsignmentKatrina Peralta FabianNo ratings yet

- PFRS 15 HandoutDocument4 pagesPFRS 15 HandoutNye NyeNo ratings yet

- FranchiseDocument4 pagesFranchiseAivan De LeonNo ratings yet

- CE On FranchiseDocument2 pagesCE On FranchisealyssaNo ratings yet

- AP 2001 - Students PDFDocument15 pagesAP 2001 - Students PDFdave excelleNo ratings yet

- FranchisingDocument10 pagesFranchisingKRABBYPATTY PHNo ratings yet

- Franchise AccountingDocument4 pagesFranchise AccountingCatherine AncananNo ratings yet

- 118.2 - Illustrative Examples - IFRS15 Part 2Document2 pages118.2 - Illustrative Examples - IFRS15 Part 2Ian De DiosNo ratings yet

- AFAR FinalMockBoard ADocument11 pagesAFAR FinalMockBoard ACattleyaNo ratings yet

- UntitledDocument9 pagesUntitledJanna Mari FriasNo ratings yet

- Accounting For Special Transaction Final ReviewerDocument73 pagesAccounting For Special Transaction Final ReviewerLunaNo ratings yet

- Chapter 15 Multiple Choices: PROB. 15-1 (AICPA)Document5 pagesChapter 15 Multiple Choices: PROB. 15-1 (AICPA)Celen OchocoNo ratings yet

- Relebus MIDTERM Answer KeyDocument2 pagesRelebus MIDTERM Answer KeyRyan CapistranoNo ratings yet

- Essay On Real Estate Mortgage and Intellectual PropertyDocument4 pagesEssay On Real Estate Mortgage and Intellectual PropertyRyan CapistranoNo ratings yet

- Ryan Capistrano AC181 Mid-Term Examination RelebusDocument3 pagesRyan Capistrano AC181 Mid-Term Examination RelebusRyan CapistranoNo ratings yet

- Personal Experience On Unethical Business PracticesDocument2 pagesPersonal Experience On Unethical Business PracticesRyan CapistranoNo ratings yet

- Katutubong SayawDocument6 pagesKatutubong SayawRyan CapistranoNo ratings yet

- A Coming of OneDocument7 pagesA Coming of OneRyan CapistranoNo ratings yet

- Minority DiscriminationDocument4 pagesMinority DiscriminationRyan CapistranoNo ratings yet

- Personal Data Name: (Optional)Document2 pagesPersonal Data Name: (Optional)Ryan CapistranoNo ratings yet

- Term Sheet - Convertible Note - SkillDzireDocument5 pagesTerm Sheet - Convertible Note - SkillDzireMAツVIcKYツNo ratings yet

- All Banking Related Questions PDF - Exampundit - SatishDocument49 pagesAll Banking Related Questions PDF - Exampundit - SatishRaj DubeyNo ratings yet

- Final Report - BhoomitDocument70 pagesFinal Report - BhoomitShubham SuryavanshiNo ratings yet

- Purchase Order 159442926387958500Document4 pagesPurchase Order 159442926387958500Toka Barisovi BarisoviNo ratings yet

- SAR Audit MemoDocument19 pagesSAR Audit MemoAshish SharmaNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia Part 1aDocument16 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia Part 1aMiguel AmihanNo ratings yet

- 03 - Intermediate - Technical Analysis - Ochilators & Momentum Ver 2.0 - Geby BiancaDocument59 pages03 - Intermediate - Technical Analysis - Ochilators & Momentum Ver 2.0 - Geby BiancaVandana DNo ratings yet

- Financial Analysis NotesDocument24 pagesFinancial Analysis Noteshamnah lateefNo ratings yet

- Chapter 9 - Financial AnalysisDocument13 pagesChapter 9 - Financial AnalysisNicole Feliz InfanteNo ratings yet

- Canara BankDocument52 pagesCanara BankSandipto BanerjeeNo ratings yet

- o CQWyh NZa PVQK 8 WDocument4 pageso CQWyh NZa PVQK 8 WHimanshuNo ratings yet

- GGCADocument2 pagesGGCAPrakash BaldaniyaNo ratings yet

- Chapter 7-The Revenue/Receivables/Cash Cycle: Multiple ChoiceDocument33 pagesChapter 7-The Revenue/Receivables/Cash Cycle: Multiple Choicemisssunshine112No ratings yet

- About Visa Fact SheetDocument1 pageAbout Visa Fact SheetdaveNo ratings yet

- Quiz Cash and ReceivablesDocument4 pagesQuiz Cash and Receivableserica insiongNo ratings yet

- Investment BankingDocument85 pagesInvestment BankingJoshuva DanielNo ratings yet

- Wealth Management PCX - ReportDocument36 pagesWealth Management PCX - Reportaurorashiva1No ratings yet

- Trading HoursDocument7 pagesTrading Hourspaparock34No ratings yet

- Key Skill Sets: Rakesh Kumar DasDocument3 pagesKey Skill Sets: Rakesh Kumar DasNIBOX MEDIA CENTERNo ratings yet

- Chapter 22 Investment PropertyDocument5 pagesChapter 22 Investment PropertyEllen MaskariñoNo ratings yet

- ACCA-Advance Audit & Assurance (AAA/P7) - MCQ's - Questions: A Passive Duty An Active DutyDocument8 pagesACCA-Advance Audit & Assurance (AAA/P7) - MCQ's - Questions: A Passive Duty An Active Dutybuls eyeNo ratings yet

- Perspektif Pendirian Bank PertanianDocument16 pagesPerspektif Pendirian Bank PertanianRafli AdiansyahNo ratings yet

- Questions CompleteDocument100 pagesQuestions CompleteBooks100% (1)

- IHRM - My ExplnationDocument2 pagesIHRM - My ExplnationNishan ShettyNo ratings yet

- Intro To Cost AccountingDocument4 pagesIntro To Cost AccountingdollymbaikaNo ratings yet

- GENEROSO PCDocument5 pagesGENEROSO PCJar Jorquia100% (1)

- Datasheet Financial Management SeDocument6 pagesDatasheet Financial Management SeALHNo ratings yet

- Pre-Hispanic Period: Evolution of Philippine TaxationDocument8 pagesPre-Hispanic Period: Evolution of Philippine TaxationAlias SimounNo ratings yet

ASSESSMENT - Franchise Accounting (ACCSPEC)

ASSESSMENT - Franchise Accounting (ACCSPEC)

Uploaded by

Ryan CapistranoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ASSESSMENT - Franchise Accounting (ACCSPEC)

ASSESSMENT - Franchise Accounting (ACCSPEC)

Uploaded by

Ryan CapistranoCopyright:

Available Formats

MODULE 3 – ASSESSMENT -Franchise Accounting (ACCSPEC)

Solve the following problems:

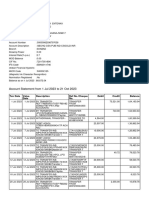

1. On January 1, 2020, ABC Co. enters into a franchise contract with a customer to grant the right to open a store in

a specified location. The store will bear ABC Co.’s trade name and the franchisee will have the right to sell ABC’s

products for 7 years, starting on the commencement of operations of the new store. The contract requires the

franchisee to pay a P1,400,000 non-refundable up-front fee (initial franchise fee). The franchise contract requires

ABC Co. to maintain the brand through product improvements, marketing campaigns, research and development,

and other activities that would strengthen the brand’s marketing position. The franchisee’s new store started

operations in July 1, 2020.

Required: Apply “Steps 2 to 5” of PFRS 15 to identify the following:

a. The performance obligation(s) in the contract. State how the performance obligation(s) are satisfied.

b. The transaction price.

c. Allocation of the transaction price.

d. The recognition of revenue from the contract.

e. Provide all the necessary journal entries in 2020.

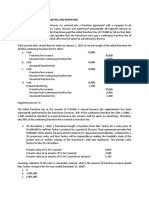

2. Warren Co. charges an initial franchise fee of P1,840,000, with P400,000 paid when the agreement is signed and

the balance in five annual payments. The present value of the future payments, discounted at 10%, is P1,091,744.

The franchisee has the option to purchase P240,000 of equipment for P192,000. Warren has substantially

provided all initial services required and collectability of the payments is reasonably assured.

Question: What is the amount of revenue from franchise fees?

Items 3 to 9 are based on the following information:

Superlicious Burgers charges an initial fee of P70,000. Upon the signing of the agreement (which covers 3 years),

a payment of P28,000 is due. Thereafter, three annual payments of P14,000 are required. The credit rating of the

franchisee is such that it would have to pay interest at 10% to borrow money. The franchise agreement signed on

May 1, 2020, and the franchise commences operation on July 1, 2020.

3. What is the amount of franchise revenue on May 1, 2020 assuming no future services are required by the

franchisor once the franchise starts operations?

4. What is the amount of franchise revenue on July 1, 2020?

5. Compute the amount of franchise revenue on May 1, 2020 assuming that the franchisor has substantial services

to perform, once the franchise begins operations, to maintain the value of the franchise.

6. Refer to #5, how much is the amount of franchise revenue on December 31, 2020?

7. What is the amount of franchise revenue on May 1, 2020 assuming that the total franchise fee includes training

services (with value of P2,400) for the period leading up to the franchise opening and for two (2) months following

the opening?

8. Refer to #7, what is the amount of franchise revenue on July1, 2020?

9. Refer to items #7 and #8, what is the amount of service revenue on September 1, 2020?

Due date: May 29

Note: No penalty on late submission for meritorious cases.

You might also like

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Mock Exam QuestionsDocument43 pagesMock Exam QuestionsFerran Mola ReverteNo ratings yet

- Compiled QuizzesDocument13 pagesCompiled QuizzesJymldy Encln50% (2)

- Buss. Combi PrelimDocument8 pagesBuss. Combi PrelimPhia TeoNo ratings yet

- Franchise AccountingDocument2 pagesFranchise AccountingChristopher NogotNo ratings yet

- Working capital-HALDocument62 pagesWorking capital-HALManaswini Hotta100% (1)

- Module 5 Franchise Sales Assignments 2bac May 2023Document6 pagesModule 5 Franchise Sales Assignments 2bac May 2023Aaron OsmaNo ratings yet

- Advance Financial Accounting and Reporting: Franchise IAS 18Document4 pagesAdvance Financial Accounting and Reporting: Franchise IAS 18Roxell CaibogNo ratings yet

- Cpa Review School of The Philippines ManilaDocument4 pagesCpa Review School of The Philippines Manilaxara mizpahNo ratings yet

- Franchise (Applied Auditing)Document4 pagesFranchise (Applied Auditing)Abraham Jr. Manansala100% (3)

- Franchise Applied AuditingDocument4 pagesFranchise Applied AuditingMariel RascoNo ratings yet

- Activity 6 - Accounting For Franchise OperationsDocument3 pagesActivity 6 - Accounting For Franchise OperationsSharon AnchetaNo ratings yet

- Franchise Problems For DiscussionDocument4 pagesFranchise Problems For DiscussionRAGASA, John Carlo R.No ratings yet

- Final Quiz and SeatworkDocument3 pagesFinal Quiz and SeatworkMikaela SungaNo ratings yet

- Franchise AccountingDocument5 pagesFranchise AccountingJose SasNo ratings yet

- Quiz No. 3Document4 pagesQuiz No. 3abbyNo ratings yet

- Revenue From Contracts With CustomersDocument3 pagesRevenue From Contracts With Customerscaloy cagzNo ratings yet

- Afar IcpaDocument6 pagesAfar IcpaAndrea Lyn Salonga CacayNo ratings yet

- This Study Resource Was: National College of Business and ArtsDocument8 pagesThis Study Resource Was: National College of Business and ArtsGinoong OsoNo ratings yet

- Revenue Recognition: FranchiseDocument4 pagesRevenue Recognition: FranchiseJoeNo ratings yet

- Module 5 Franchise Accounting WADocument4 pagesModule 5 Franchise Accounting WAMadielyn Santarin MirandaNo ratings yet

- FRANCHISEDocument2 pagesFRANCHISELayla SimNo ratings yet

- Afar Franchise Accounting PDFDocument6 pagesAfar Franchise Accounting PDFArah OpalecNo ratings yet

- Lesson 08. Franchising - A.TDocument6 pagesLesson 08. Franchising - A.THayes HareNo ratings yet

- 07 Franchise AccountingDocument5 pages07 Franchise AccountingAllegria AlamoNo ratings yet

- Quiz On FranchiseDocument4 pagesQuiz On FranchiseTin BulaoNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument3 pagesCpa Review School of The Philippines Mani LaKristelleNo ratings yet

- Advanced Financial Accounting and ReportingDocument18 pagesAdvanced Financial Accounting and Reportingedrick LouiseNo ratings yet

- AFARicpaDocument23 pagesAFARicpaRegine YbañezNo ratings yet

- Ifrs 15Document3 pagesIfrs 15Cha EsguerraNo ratings yet

- FranchiseDocument3 pagesFranchiseDJ ULRICHNo ratings yet

- National College of Business and Arts: Name: Date: Professor: SubjectDocument8 pagesNational College of Business and Arts: Name: Date: Professor: SubjectAngelica CerioNo ratings yet

- Buss. Combi PrelimDocument8 pagesBuss. Combi PrelimPhia TeoNo ratings yet

- Quiz 2 - Acctng For FranchiseDocument2 pagesQuiz 2 - Acctng For FranchiseSarah Jane SeñidoNo ratings yet

- Quizzer 1 - OverallDocument25 pagesQuizzer 1 - OverallJan Elaine CalderonNo ratings yet

- FdggseeDocument2 pagesFdggseefghhnnnjmlNo ratings yet

- Accounting For Franchise Quiz QuizDocument3 pagesAccounting For Franchise Quiz QuizAliah CyrilNo ratings yet

- Franchise AccountingDocument8 pagesFranchise AccountingJason McLaren100% (1)

- FRANCHISEDocument2 pagesFRANCHISEadieNo ratings yet

- 5 Franchise Accounting - PPTMDocument17 pages5 Franchise Accounting - PPTMClarisse PelayoNo ratings yet

- Afar302 A - FranchisingDocument3 pagesAfar302 A - FranchisingNicole TeruelNo ratings yet

- PFRS-15-LTCC Franchise ConsignmentDocument2 pagesPFRS-15-LTCC Franchise ConsignmentArlyn A. Zuniega0% (1)

- Tutorial 3 WHT DiscussDocument6 pagesTutorial 3 WHT DiscussAqila Syakirah IVNo ratings yet

- 7Document7 pages7Lyza Molina ParadoNo ratings yet

- Afar 3603 Franchise-AccountingDocument3 pagesAfar 3603 Franchise-AccountingDenise RamilNo ratings yet

- FA ExercisesDocument1 pageFA Exercisesjemmaserrano1220No ratings yet

- FA2Document2 pagesFA2Jomar VillenaNo ratings yet

- Franchise Accounting (Franchisor) Problems: CMPC 131 Franchise Accounting Notes (CC 1331) Sy 2019-2020 First Sem RLFDocument1 pageFranchise Accounting (Franchisor) Problems: CMPC 131 Franchise Accounting Notes (CC 1331) Sy 2019-2020 First Sem RLFAllyssa ThalliaNo ratings yet

- Revenue From Contracts With Customers Application of Basic ConceptsDocument6 pagesRevenue From Contracts With Customers Application of Basic ConceptsSharon AnchetaNo ratings yet

- Quiz 2 With Correct AnswersDocument7 pagesQuiz 2 With Correct AnswersmarietorianoNo ratings yet

- HO4 Franchise and ConsignmentDocument5 pagesHO4 Franchise and ConsignmentKatrina Peralta FabianNo ratings yet

- PFRS 15 HandoutDocument4 pagesPFRS 15 HandoutNye NyeNo ratings yet

- FranchiseDocument4 pagesFranchiseAivan De LeonNo ratings yet

- CE On FranchiseDocument2 pagesCE On FranchisealyssaNo ratings yet

- AP 2001 - Students PDFDocument15 pagesAP 2001 - Students PDFdave excelleNo ratings yet

- FranchisingDocument10 pagesFranchisingKRABBYPATTY PHNo ratings yet

- Franchise AccountingDocument4 pagesFranchise AccountingCatherine AncananNo ratings yet

- 118.2 - Illustrative Examples - IFRS15 Part 2Document2 pages118.2 - Illustrative Examples - IFRS15 Part 2Ian De DiosNo ratings yet

- AFAR FinalMockBoard ADocument11 pagesAFAR FinalMockBoard ACattleyaNo ratings yet

- UntitledDocument9 pagesUntitledJanna Mari FriasNo ratings yet

- Accounting For Special Transaction Final ReviewerDocument73 pagesAccounting For Special Transaction Final ReviewerLunaNo ratings yet

- Chapter 15 Multiple Choices: PROB. 15-1 (AICPA)Document5 pagesChapter 15 Multiple Choices: PROB. 15-1 (AICPA)Celen OchocoNo ratings yet

- Relebus MIDTERM Answer KeyDocument2 pagesRelebus MIDTERM Answer KeyRyan CapistranoNo ratings yet

- Essay On Real Estate Mortgage and Intellectual PropertyDocument4 pagesEssay On Real Estate Mortgage and Intellectual PropertyRyan CapistranoNo ratings yet

- Ryan Capistrano AC181 Mid-Term Examination RelebusDocument3 pagesRyan Capistrano AC181 Mid-Term Examination RelebusRyan CapistranoNo ratings yet

- Personal Experience On Unethical Business PracticesDocument2 pagesPersonal Experience On Unethical Business PracticesRyan CapistranoNo ratings yet

- Katutubong SayawDocument6 pagesKatutubong SayawRyan CapistranoNo ratings yet

- A Coming of OneDocument7 pagesA Coming of OneRyan CapistranoNo ratings yet

- Minority DiscriminationDocument4 pagesMinority DiscriminationRyan CapistranoNo ratings yet

- Personal Data Name: (Optional)Document2 pagesPersonal Data Name: (Optional)Ryan CapistranoNo ratings yet

- Term Sheet - Convertible Note - SkillDzireDocument5 pagesTerm Sheet - Convertible Note - SkillDzireMAツVIcKYツNo ratings yet

- All Banking Related Questions PDF - Exampundit - SatishDocument49 pagesAll Banking Related Questions PDF - Exampundit - SatishRaj DubeyNo ratings yet

- Final Report - BhoomitDocument70 pagesFinal Report - BhoomitShubham SuryavanshiNo ratings yet

- Purchase Order 159442926387958500Document4 pagesPurchase Order 159442926387958500Toka Barisovi BarisoviNo ratings yet

- SAR Audit MemoDocument19 pagesSAR Audit MemoAshish SharmaNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia Part 1aDocument16 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia Part 1aMiguel AmihanNo ratings yet

- 03 - Intermediate - Technical Analysis - Ochilators & Momentum Ver 2.0 - Geby BiancaDocument59 pages03 - Intermediate - Technical Analysis - Ochilators & Momentum Ver 2.0 - Geby BiancaVandana DNo ratings yet

- Financial Analysis NotesDocument24 pagesFinancial Analysis Noteshamnah lateefNo ratings yet

- Chapter 9 - Financial AnalysisDocument13 pagesChapter 9 - Financial AnalysisNicole Feliz InfanteNo ratings yet

- Canara BankDocument52 pagesCanara BankSandipto BanerjeeNo ratings yet

- o CQWyh NZa PVQK 8 WDocument4 pageso CQWyh NZa PVQK 8 WHimanshuNo ratings yet

- GGCADocument2 pagesGGCAPrakash BaldaniyaNo ratings yet

- Chapter 7-The Revenue/Receivables/Cash Cycle: Multiple ChoiceDocument33 pagesChapter 7-The Revenue/Receivables/Cash Cycle: Multiple Choicemisssunshine112No ratings yet

- About Visa Fact SheetDocument1 pageAbout Visa Fact SheetdaveNo ratings yet

- Quiz Cash and ReceivablesDocument4 pagesQuiz Cash and Receivableserica insiongNo ratings yet

- Investment BankingDocument85 pagesInvestment BankingJoshuva DanielNo ratings yet

- Wealth Management PCX - ReportDocument36 pagesWealth Management PCX - Reportaurorashiva1No ratings yet

- Trading HoursDocument7 pagesTrading Hourspaparock34No ratings yet

- Key Skill Sets: Rakesh Kumar DasDocument3 pagesKey Skill Sets: Rakesh Kumar DasNIBOX MEDIA CENTERNo ratings yet

- Chapter 22 Investment PropertyDocument5 pagesChapter 22 Investment PropertyEllen MaskariñoNo ratings yet

- ACCA-Advance Audit & Assurance (AAA/P7) - MCQ's - Questions: A Passive Duty An Active DutyDocument8 pagesACCA-Advance Audit & Assurance (AAA/P7) - MCQ's - Questions: A Passive Duty An Active Dutybuls eyeNo ratings yet

- Perspektif Pendirian Bank PertanianDocument16 pagesPerspektif Pendirian Bank PertanianRafli AdiansyahNo ratings yet

- Questions CompleteDocument100 pagesQuestions CompleteBooks100% (1)

- IHRM - My ExplnationDocument2 pagesIHRM - My ExplnationNishan ShettyNo ratings yet

- Intro To Cost AccountingDocument4 pagesIntro To Cost AccountingdollymbaikaNo ratings yet

- GENEROSO PCDocument5 pagesGENEROSO PCJar Jorquia100% (1)

- Datasheet Financial Management SeDocument6 pagesDatasheet Financial Management SeALHNo ratings yet

- Pre-Hispanic Period: Evolution of Philippine TaxationDocument8 pagesPre-Hispanic Period: Evolution of Philippine TaxationAlias SimounNo ratings yet