Professional Documents

Culture Documents

Leverage and Excess Risk Acivity Based Costing: Business

Leverage and Excess Risk Acivity Based Costing: Business

Uploaded by

javier apodacaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Leverage and Excess Risk Acivity Based Costing: Business

Leverage and Excess Risk Acivity Based Costing: Business

Uploaded by

javier apodacaCopyright:

Available Formats

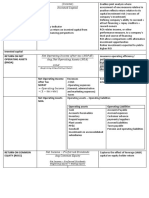

Needs to manage its finances

well enough to avoid

UNIT 2 FINANCES

Business EX: + construction companies

+farmers buying livestock

Periods of negative cash flows

Concept based on matching costs to the revenues

Profit generated within a period of trading Working capital and investment funds

LEVERAGE AND EXCESS Cash Flow

cash flow FIRST and profit LATER

RISK ACIVITY BASED Profit

COSTING Return on equity

ROE --------------------------------- X 100

Average shareholders

Equity

In reality not all of the company´s liabilities

appear in the balance sheet

Off Balance Sheet Risk Unconsolidated losses Do not have to appear in the

Short-Term

annual account

Performance

unacceptable

Theory indicates that forces managers to perform

Private Equity Leverage- Buy- Out (LBO) Focus on just one area

better

Practice by which a

Model based on debt

company is acquired Favors Short- Term

using a high percentage Profits

of borrowed funds

You might also like

- Financial Reporting and AnalysisDocument50 pagesFinancial Reporting and AnalysisGeorge Shevtsov83% (6)

- Financial Statements Cheat SheetDocument1 pageFinancial Statements Cheat SheetjmbaezfNo ratings yet

- Money Management Strategies For Future TradersDocument137 pagesMoney Management Strategies For Future TradersFarhan100% (1)

- Risk Management at Wellfleet Bank: "Megadeals"Document18 pagesRisk Management at Wellfleet Bank: "Megadeals"Rishi Bajaj100% (4)

- P5 - Chapter 9 DIVISIONAL PERFORMANCE APPRAISAL AND TRANSFER PRICINGDocument10 pagesP5 - Chapter 9 DIVISIONAL PERFORMANCE APPRAISAL AND TRANSFER PRICINGDhruvi AgarwalNo ratings yet

- FM Revision Notes-CS ExeDocument39 pagesFM Revision Notes-CS ExeAman Gutta100% (1)

- Earnings Per Share (EPS) : Accounting Topics CPA Exam QuizzesDocument6 pagesEarnings Per Share (EPS) : Accounting Topics CPA Exam QuizzesHassleBustNo ratings yet

- 2019 Quarter One Report: Presented by You ExecDocument21 pages2019 Quarter One Report: Presented by You ExecdayanaNo ratings yet

- Caie Igcse Business Studies 0450 Formula Sheet 650c7e106352f31b2630655f 074Document3 pagesCaie Igcse Business Studies 0450 Formula Sheet 650c7e106352f31b2630655f 074rudra chauhanNo ratings yet

- Hbf121 LTF CM 3p Respicio ChristineDocument1 pageHbf121 LTF CM 3p Respicio ChristineChristine RespicioNo ratings yet

- Accounting BasicsDocument10 pagesAccounting BasicsMitanshi ShahNo ratings yet

- CH Analisis Aktivitas InvestasiDocument29 pagesCH Analisis Aktivitas Investasiannis sakinahNo ratings yet

- 2018 Quarter 4 Report: Presented by You ExecDocument20 pages2018 Quarter 4 Report: Presented by You ExecLohith t rNo ratings yet

- Financial Statement Analysis RatiosDocument4 pagesFinancial Statement Analysis RatiosAmelieNo ratings yet

- Analyzing Investing Activities Chapter 5Document29 pagesAnalyzing Investing Activities Chapter 5Anggita LianiNo ratings yet

- 2018 Quarter 4 Report: Presented by You ExecDocument20 pages2018 Quarter 4 Report: Presented by You ExecLohith t rNo ratings yet

- ROIROEROADocument1 pageROIROEROARahul MalikNo ratings yet

- The Accounting Cycle: Preparing An Annual Report: Ahmed Raza MBA (Finance)Document36 pagesThe Accounting Cycle: Preparing An Annual Report: Ahmed Raza MBA (Finance)ahmedbloshiNo ratings yet

- Liquidity Ratio: Analysis - Overview, Uses, Categories of Financial Ratios, 2022)Document3 pagesLiquidity Ratio: Analysis - Overview, Uses, Categories of Financial Ratios, 2022)Akinola WinfulNo ratings yet

- Company ValuationDocument10 pagesCompany ValuationJia MakhijaNo ratings yet

- Financial Accounting Analysis Cheat SheetDocument1 pageFinancial Accounting Analysis Cheat SheetMinyu LvNo ratings yet

- Financial Ratio AnalysisDocument18 pagesFinancial Ratio Analysissarangpethe100% (4)

- Accounting KPIs LkdInDocument10 pagesAccounting KPIs LkdInGeorge BerberiNo ratings yet

- DCF Valuation Course Notes 365 Financial AnalystDocument12 pagesDCF Valuation Course Notes 365 Financial AnalystArice BertrandNo ratings yet

- Ratios Analysis Notes AND ONE SOLVED QUIZDocument6 pagesRatios Analysis Notes AND ONE SOLVED QUIZDaisy Wangui100% (1)

- Company Valuation - Course NotesDocument10 pagesCompany Valuation - Course NotesAfonsoNo ratings yet

- Interpretation of Financial Statements & Ratio AnalysisDocument35 pagesInterpretation of Financial Statements & Ratio Analysisamitsinghslideshare50% (2)

- Financial RatiosDocument12 pagesFinancial RatiosRussia CortesNo ratings yet

- LLH9e Ch03 SolutionsManual FINALDocument68 pagesLLH9e Ch03 SolutionsManual FINALIgnjat100% (1)

- Performance Measurement: OutlineDocument17 pagesPerformance Measurement: OutlineLưu Hồng Hạnh 4KT-20ACNNo ratings yet

- Analysis of Financial Statements: Made Gitanadya, Se., MSMDocument18 pagesAnalysis of Financial Statements: Made Gitanadya, Se., MSMLilia LiaNo ratings yet

- Socf With IllustrationDocument10 pagesSocf With IllustrationamirahNo ratings yet

- KCBL DD and Val Scope 221222Document13 pagesKCBL DD and Val Scope 221222mamur.mustaphaNo ratings yet

- Group 6 - Management Control System of Measurement and Control of Managed AssetsDocument25 pagesGroup 6 - Management Control System of Measurement and Control of Managed AssetsHernawatiNo ratings yet

- Fcffginzu - Xls Using The Valuation SpreadsheetDocument13 pagesFcffginzu - Xls Using The Valuation SpreadsheetMuhammad Zeeshan SaleemNo ratings yet

- Basics of AccountingDocument43 pagesBasics of Accounting6pdqqsf59rNo ratings yet

- Basic Accounting RatiosDocument47 pagesBasic Accounting RatiosSUNYYRNo ratings yet

- Difference Between Accounts & FinanceDocument4 pagesDifference Between Accounts & Financesameer amjadNo ratings yet

- Example:: Basis Assets LiabilitiesDocument23 pagesExample:: Basis Assets LiabilitiesAmbika Prasad ChandaNo ratings yet

- Analysis of Reformulated Financial StatementsDocument46 pagesAnalysis of Reformulated Financial StatementsAkib Mahbub KhanNo ratings yet

- Prudential PLC Ar 2020Document404 pagesPrudential PLC Ar 2020Lim KaixianNo ratings yet

- Joint Venture: Jointly Controlled Operations Jointly Controlled Assets Jointly Controlled EntitiesDocument6 pagesJoint Venture: Jointly Controlled Operations Jointly Controlled Assets Jointly Controlled EntitiesJoanne TolentinoNo ratings yet

- 8 Financial RatiosDocument3 pages8 Financial Ratios- fridaNo ratings yet

- Dividends Are Payments Made by A: Corporation ShareholderDocument6 pagesDividends Are Payments Made by A: Corporation ShareholderPavan RajeshNo ratings yet

- Provision and ReserveDocument4 pagesProvision and ReservePrabhakar TripathiNo ratings yet

- Intercorporate Investments - Study Session 5, Reading 14Document18 pagesIntercorporate Investments - Study Session 5, Reading 14Analyst832No ratings yet

- Finc8019 S12Document27 pagesFinc8019 S12mcahya82No ratings yet

- Leadership Retreat 10012024Document44 pagesLeadership Retreat 10012024Mshelia M.No ratings yet

- Ratio Analysis Q&a MAFDocument23 pagesRatio Analysis Q&a MAFmohedNo ratings yet

- Project of Financial Reporting AnalysisDocument29 pagesProject of Financial Reporting AnalysisAhmad Mujtaba PhambraNo ratings yet

- Apex Cash Flow 1Document16 pagesApex Cash Flow 1livinnitchNo ratings yet

- Accounting Principles and Business Transactions Cheat Sheet: by ViaDocument1 pageAccounting Principles and Business Transactions Cheat Sheet: by Viaheehan6No ratings yet

- Financial Ratios SDocument1 pageFinancial Ratios SchechotenisNo ratings yet

- Financial_RatiosDocument8 pagesFinancial_Ratiostrangsjnk123No ratings yet

- 15 FINANCIAL Performance MeasurementDocument8 pages15 FINANCIAL Performance MeasurementJack PayneNo ratings yet

- Creditors: FoundationsDocument17 pagesCreditors: FoundationseragornNo ratings yet

- You Exec - 2019 MidYear Report FreeDocument11 pagesYou Exec - 2019 MidYear Report FreePradeep ChandranNo ratings yet

- Chapter 5Document6 pagesChapter 5Azi LheyNo ratings yet

- Financial Management - San Miguel Foods and Beverage Inc.Document124 pagesFinancial Management - San Miguel Foods and Beverage Inc.Rechelle R. ValerioNo ratings yet

- Javier Apodaca Aguirre PDFDocument1 pageJavier Apodaca Aguirre PDFjavier apodacaNo ratings yet

- Leverage and Excess Risk Acivity Based Costing: Frederick TaylorDocument1 pageLeverage and Excess Risk Acivity Based Costing: Frederick Taylorjavier apodacaNo ratings yet

- MRKTNG ModelDocument1 pageMRKTNG Modeljavier apodacaNo ratings yet

- Leadership PDFDocument1 pageLeadership PDFjavier apodacaNo ratings yet

- Kaizen: Continue ImprovementDocument1 pageKaizen: Continue Improvementjavier apodacaNo ratings yet

- Play by The Rules: Business Acountants RolesDocument1 pagePlay by The Rules: Business Acountants Rolesjavier apodacaNo ratings yet

- Waste: Cost Do Not Exist To Be Calculated Exist To Be Reduced Japanese Production AproachDocument1 pageWaste: Cost Do Not Exist To Be Calculated Exist To Be Reduced Japanese Production Aproachjavier apodacaNo ratings yet

- Profits Before Perks: in A Large Public CompanyDocument1 pageProfits Before Perks: in A Large Public Companyjavier apodacaNo ratings yet

- LEADERSHIPDocument1 pageLEADERSHIPjavier apodacaNo ratings yet

- LeaderrDocument1 pageLeaderrjavier apodacaNo ratings yet

- Capital Budgeting ReviewerDocument50 pagesCapital Budgeting ReviewerPines MacapagalNo ratings yet

- Compak Question BookletDocument6 pagesCompak Question Bookletknprop134No ratings yet

- Management Accounting Assignment 1Document3 pagesManagement Accounting Assignment 1saurabhma23.pumbaNo ratings yet

- 2.1 ExamplesDocument4 pages2.1 ExamplesDM Buenconsejo100% (2)

- CH 1. Understanding of InvestmentDocument21 pagesCH 1. Understanding of InvestmentReka HendrayaniNo ratings yet

- India Infoline Company ProfileDocument12 pagesIndia Infoline Company ProfileGowri MbaNo ratings yet

- PDFDocument15 pagesPDFHina Sahar100% (1)

- Chapter 13 - Managing Nondeposit LiabilitiesDocument16 pagesChapter 13 - Managing Nondeposit LiabilitiesAhmed El KhateebNo ratings yet

- TT10 QuestionDocument1 pageTT10 QuestionUyển Nhi TrầnNo ratings yet

- MIRAE - YGe Aug22Document6 pagesMIRAE - YGe Aug22Quy Cuong BuiNo ratings yet

- StudentDocument30 pagesStudentAnh Lý100% (1)

- MAS Compilation of QuestionsDocument10 pagesMAS Compilation of QuestionsArianne LlorenteNo ratings yet

- SMC Reflection PaperDocument2 pagesSMC Reflection PaperAaron HuangNo ratings yet

- Assets and Liability Management: A Project Report ONDocument12 pagesAssets and Liability Management: A Project Report ONMohmmedKhayyumNo ratings yet

- ChakulawordpdfDocument3 pagesChakulawordpdfMishhal Hamza P.KNo ratings yet

- 1 Case Studies. 2nd SemDocument20 pages1 Case Studies. 2nd SemNeha SinglaNo ratings yet

- Financial Markets and Institutions Test Bank (051 060)Document10 pagesFinancial Markets and Institutions Test Bank (051 060)Thị Ba PhạmNo ratings yet

- Bujji Paper Plates & CupsDocument15 pagesBujji Paper Plates & CupsarunNo ratings yet

- WSGR Entrepreneurs Report Winter 2007Document13 pagesWSGR Entrepreneurs Report Winter 2007YokumNo ratings yet

- Assignemnt 1 - Baring and Lehman Brother's BankDocument7 pagesAssignemnt 1 - Baring and Lehman Brother's BankBrow SimonNo ratings yet

- CFP SDL UK Buffettology Fund: Factsheet - March 2021Document2 pagesCFP SDL UK Buffettology Fund: Factsheet - March 2021sky22blueNo ratings yet

- Bull Call SpreadDocument3 pagesBull Call SpreadpkkothariNo ratings yet

- I - Spent - Over - 100 - Thread - by - Adityatodmal - Dec 25, 22 - From - RattibhaDocument11 pagesI - Spent - Over - 100 - Thread - by - Adityatodmal - Dec 25, 22 - From - RattibhamusiboyinaNo ratings yet

- C2-Org StrategyProj select-ISB-elDocument23 pagesC2-Org StrategyProj select-ISB-elNgoc Nguyen Thi MinhNo ratings yet

- Cap TableDocument1 pageCap TabledarescribdNo ratings yet

- Overview of Quantitative Finance and Risk Management 0710Document38 pagesOverview of Quantitative Finance and Risk Management 0710pharssNo ratings yet

- MCK Q1FY24 Earnings Call TranscriptDocument18 pagesMCK Q1FY24 Earnings Call TranscriptSebastian PVNo ratings yet

- What Is An "Event Driven" Hedge Strategy?: Hypothetical Example: An Educated Bet On A Deal Getting DoneDocument2 pagesWhat Is An "Event Driven" Hedge Strategy?: Hypothetical Example: An Educated Bet On A Deal Getting Doneเสกสรรค์ จันทร์สุขปลูกNo ratings yet