Professional Documents

Culture Documents

Summarize Methodology

Summarize Methodology

Uploaded by

ThạchThảooCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Quick Cash Flow FormatDocument1 pageQuick Cash Flow FormatThạchThảooNo ratings yet

- MIS Chap 6Document1 pageMIS Chap 6ThạchThảoo100% (1)

- 5.13. What Are The Advantages and Disadvantages of Allowing Employees To Use Their Personal Smartphones For Work?Document3 pages5.13. What Are The Advantages and Disadvantages of Allowing Employees To Use Their Personal Smartphones For Work?ThạchThảooNo ratings yet

- Dean of School of Business LecturerDocument7 pagesDean of School of Business LecturerThạchThảooNo ratings yet

- International Finance Bonus Foward ExDocument2 pagesInternational Finance Bonus Foward ExThạchThảooNo ratings yet

- Auditing - Assignment Lecture 1Document2 pagesAuditing - Assignment Lecture 1ThạchThảooNo ratings yet

- Biases Due To The Retrievability of Instances. When The Size of A Class Is Judged by TheDocument6 pagesBiases Due To The Retrievability of Instances. When The Size of A Class Is Judged by TheThạchThảooNo ratings yet

- Literature ReviewDocument5 pagesLiterature ReviewThạchThảooNo ratings yet

- Methodology SummaryDocument6 pagesMethodology SummaryThạchThảooNo ratings yet

- Econometrics Group5 SummarizePaperDocument8 pagesEconometrics Group5 SummarizePaperThạchThảooNo ratings yet

- Biases Due To The Retrievability of Instances. When The Size of A Class Is Judged by TheDocument6 pagesBiases Due To The Retrievability of Instances. When The Size of A Class Is Judged by TheThạchThảooNo ratings yet

Summarize Methodology

Summarize Methodology

Uploaded by

ThạchThảooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Summarize Methodology

Summarize Methodology

Uploaded by

ThạchThảooCopyright:

Available Formats

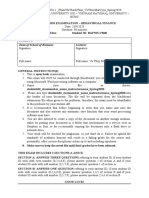

Data collects from the Global Vantage database for 1998 which contains financial

information for 16,157 companies across 80 countries. Combining with the shareholder

rights measurement of LLSV (1998), Dittmar, Mahrt-Smith and Servaes use the sample of

11,591 companies of 45 countries for this analysis. The cash ratio for the study is defined as

the cash and equivalents divided by net assets, where net assets exclude cash and cash

equivalents. The dependent variable of all models in this analysis is the logarithm of that

cash ratio as Opler et al (1999) work.

According the summary statistics table, countries are divided into two groups as the LLSV’s

shareholder rights variable was built. If the shareholder rights variable equal to 3, 4, 5 then

that country belongs to high shareholder rights group, and that variable equal to 0, 1, 2 then

that country in low shareholder rights group. Dittmar, Mahrt-Smith and Servaes also use

book value of assets variable instead for firm size. As you know, both transaction costs and

precautionary motive involve investment opportunities and the market-to-book ratio

substitute for investment opportunities. Dittmar, Mahrt-Smith and Servaes work with net

working capital to net assets ratio as a control variable and they use that ratio to investigate

with more liquidity assets held by the company can be complement or substitute for cash

level.

In term of Pooled cross-country regression table which use the reduced form model, Dittmar,

Mahrt-Smith and Servaes explain firm cash level. All regression in this table contains

industry (two-digit SIC code main classifications) dummy variables and the numbers in

brackets are p-values based on robust standard errors. Models in this table provides

regression models with the level of shareholder rights variable, common law dummy, the

external capital to GNP ratio and the private credit to GDP ratio, respectively.

Moreover, Dittmar, Mahrt-Smith and Servaes concentrate on 4 issues to conduct some

additional tests which estimates random effects model with random affects for country or

industry pair and on countries’ means.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Quick Cash Flow FormatDocument1 pageQuick Cash Flow FormatThạchThảooNo ratings yet

- MIS Chap 6Document1 pageMIS Chap 6ThạchThảoo100% (1)

- 5.13. What Are The Advantages and Disadvantages of Allowing Employees To Use Their Personal Smartphones For Work?Document3 pages5.13. What Are The Advantages and Disadvantages of Allowing Employees To Use Their Personal Smartphones For Work?ThạchThảooNo ratings yet

- Dean of School of Business LecturerDocument7 pagesDean of School of Business LecturerThạchThảooNo ratings yet

- International Finance Bonus Foward ExDocument2 pagesInternational Finance Bonus Foward ExThạchThảooNo ratings yet

- Auditing - Assignment Lecture 1Document2 pagesAuditing - Assignment Lecture 1ThạchThảooNo ratings yet

- Biases Due To The Retrievability of Instances. When The Size of A Class Is Judged by TheDocument6 pagesBiases Due To The Retrievability of Instances. When The Size of A Class Is Judged by TheThạchThảooNo ratings yet

- Literature ReviewDocument5 pagesLiterature ReviewThạchThảooNo ratings yet

- Methodology SummaryDocument6 pagesMethodology SummaryThạchThảooNo ratings yet

- Econometrics Group5 SummarizePaperDocument8 pagesEconometrics Group5 SummarizePaperThạchThảooNo ratings yet

- Biases Due To The Retrievability of Instances. When The Size of A Class Is Judged by TheDocument6 pagesBiases Due To The Retrievability of Instances. When The Size of A Class Is Judged by TheThạchThảooNo ratings yet