Professional Documents

Culture Documents

MA FX Q Solution 1 2 3

MA FX Q Solution 1 2 3

Uploaded by

thalnay zarsoeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MA FX Q Solution 1 2 3

MA FX Q Solution 1 2 3

Uploaded by

thalnay zarsoeCopyright:

Available Formats

I.

1.

Number of Ways

200 300 400

Total Costs

Fixed Costs $ 200,000 $ 200,000 $ 200,000

Variable Costs $ 100,000 $ 150,000 $ 200,000

Total Costs

Cost per way Transport

Fixed Costs $ 1000 $ 666.67 $ 500

Variable Costs $ 500 $ 500 $ 500

Total Cost per way $ 1500 $ 1166.67 $ 1000

2. Break-even ways

Fixed Costs / (Income per way – variable cost per way)

= $ 200,000 / ($ 7000 - $ 500)

= $ 200,000 / $ 65,00

= 30.76 ways

3. Break-even ways on variable cost increase by 10 %

= Fixed Costs / (Income per way – variable cost per way)

= $ 200,000 / ($ 7000 – ($ 500 x 10%))

= $ 200,000 / ($ 7000 - $ 550)

= $ 200,000 / $ 6450

= 31 ways

###########################

II.

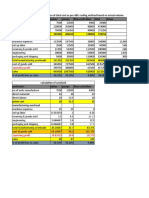

1. Planning Budget

Budget labor hours (Q) 8000

Direct Labor $ 15.8 Q $ 126,400

Indirect Labor $ 3200 + 1.5 Q $ 15,200

Utilities $ 5400 + 0.7 Q $ 11,000

Supplies $1200 + 0.5 Q $ 5,200

Equipment Depreciation $ 20,000 + 2.5 Q $ 40,000

Factory Rent $ 7500 $ 7500

Property Taxes $ 3000 $ 3000

Factory Administration $ 12,000 + 1.5 Q $ 24,000

Total Expense $ 232,300

2. Flexible Budget

Budget labor hours (Q) 8200

Direct Labor $ 15.8 Q $ 129,560

Indirect Labor $ 3200 + 1.5 Q $ 15,500

Utilities $ 5400 + 0.7 Q $ 11,140

Supplies $1200 + 0.5 Q $ 5,300

Equipment Depreciation $ 20,000 + 2.5 Q $ 40,500

Factory Rent $ 7500 $ 7500

Property Taxes $ 3000 $ 3000

Factory Administration $ 12,000 + 1.5 Q $ 24,300

Total Expense $ 236,800

3. Performance Report

Budget labor hours 8000 8200 Actual

(Q) Cost

Direct Labor $ 126,400 3160 U $ 129,560 5240 U $ 134,800

Indirect Labor $ 15,200 300 U $ 15,500 2100 U $ 17,600

Utilities $ 11,000 140 U $ 11,140 40 F $ 11,100

Supplies $ 5,200 100 U $ 5,300 300 F $ 5,000

Equipment $ 40,000 500 U $ 40,500 1800 U $ 42,300

Depreciation

Factory Rent $ 7500 0 $ 7500 500 U $ 8,000

Property Taxes $ 3000 0 $ 3000 200 F $ 2,800

Factory $ 24,000 300 U $ 24,300 700 U $ 25,000

Administration

Total Expense $ 232,300 4500 U $ 236,800 9800 U $ 246,600

###########################

III.

1. Sales Budget

Year 2 Quarters Year

1 2 3 4

Budgeted Sales Unit 10000 11000 12100 13310 46410

Selling Price per unit $ 12 $ 12 $ 12 $ 12 $ 12

Total Sales $120,000 $132,000 $145,200 $159,720 $556920

Bases on the budgeted sales above, the schedule of expected cash

collections is prepared as follow.

Year 2 Quarters Whole

1 2 3 4 Year

AR, Beginning Bal; $ 75,000 $ 75,000

1st Q sales x 75%, 25% $ 90,000 $ 30,000 $120,000

2ndQ sales x 75%, 25% $ 99,000 $ 33,000 $132,000

3rd Q sales x 75%, 25% $ 108,900 $ 36,300 $145,200

4th Q sales x 75% $ 119,790 $119,790

Total Cash collections $ 165,000 $129,000 $141,900 $156,090 $591,990

2. Production Budget is prepared as follow

Year 2 Quarters Whole Year 3

1 2 3 4 Year Q-1

Budgeted Unit Sales 10000 11000 12100 13310 46410 14641

Ending Finished Goods (+) 2200 2420 2662 2928 2928 3221

Total needs 12200 13420 14762 16238 49338 17862

Beg Finished Goods (-) 12000 2200 2420 2662 12000 2928

Required production 200 11220 12342 13576 37338 14934

3. Direct Material Budget and schedule of expected cash payment for

purchase of materials

Year 2 Quarters Whole Year 3

1 2 3 4 Year Q-1

Required production 200 11220 12342 13576 37338 14934

Raw material needs per unit (x) 5 5 5 5 5 5

Production needs 1000 56100 61710 67880 186690 74670

Ending Raw material (+) 5610 6171 6788 7467 7467

Total needs 6610 62271 68498 75347 194157

Beg Raw material (-) 24000 5610 6171 6788 24000

Raw material to be purchased 0 56661 62327 68559 170157

Based on the raw material to be purchased above, expected cash payment

are computed as follow

Year 2 Quarters Whole

1 2 3 4 Year

Raw material to be purchased 0 56661 62327 68559 170157

RM cost ($0.80 per foot) 0 $45,329 $49,862 $54,847 $150,038

AP Beginning Bal: $70,000 $70,000

1st Q purchase x 60%, 40% 0 0 0

2ndQ purchase x 60%, 40% $27,197 $18,132 $45,329

3rd Q purchase x 60%, 40% $29,917 $19,945 $49,862

4th Q purchase x 60% $32,908 $32908

Total Cash payable $70,000 $27,197 $48,049 $52,853 $198,099

###########################

You might also like

- Baldwin CompanyDocument4 pagesBaldwin CompanyShubham TetuNo ratings yet

- Wilkerson Company ABCDocument4 pagesWilkerson Company ABCrajyalakshmiNo ratings yet

- Hampton Freeze, Inc. Sales Budget For The Year Ended December 31,2015 QuarterDocument15 pagesHampton Freeze, Inc. Sales Budget For The Year Ended December 31,2015 QuarterCzarina Abigail Fortun0% (1)

- Business Plan Bolt & Nuts - Financial AspectsDocument14 pagesBusiness Plan Bolt & Nuts - Financial AspectsgboobalanNo ratings yet

- Muet 2006 To 2019 Past PapersDocument148 pagesMuet 2006 To 2019 Past PapersUmaid Ali Keerio100% (2)

- Budget InformationDocument10 pagesBudget InformationIsabella BattiataNo ratings yet

- Actual Cost Vs Plan Projection: Your Company NameDocument25 pagesActual Cost Vs Plan Projection: Your Company NameShamsNo ratings yet

- CF 19-03-21 (BudgetDocument21 pagesCF 19-03-21 (BudgetTarisya PermatasariNo ratings yet

- Cost of Goods ManufacturedDocument26 pagesCost of Goods ManufacturedAb.Rahman AfghanNo ratings yet

- Key To Corrections - LEVEL 2 MODULE 7Document9 pagesKey To Corrections - LEVEL 2 MODULE 7UFO CatcherNo ratings yet

- Forum ACC Sesi 12 - WM RevisiDocument4 pagesForum ACC Sesi 12 - WM RevisiWindy MartaputriNo ratings yet

- Jawaban Soal UAS AkmenDocument3 pagesJawaban Soal UAS AkmenElyana IrmaNo ratings yet

- Midterm Winter 2020 SolutionDocument5 pagesMidterm Winter 2020 SolutionAya Ben MohamedNo ratings yet

- Midterm Exam FALL SOLUTION Feb 27Document10 pagesMidterm Exam FALL SOLUTION Feb 27rawanelayusNo ratings yet

- FINANCIALSDocument7 pagesFINANCIALSAmmon BelyonNo ratings yet

- TUT 3 - Relevant Information&decision MakingDocument10 pagesTUT 3 - Relevant Information&decision MakingKim Chi LeNo ratings yet

- MAKSI - UI - LatihanKuis - Okt 2019Document8 pagesMAKSI - UI - LatihanKuis - Okt 2019aziezoel100% (1)

- Finch Excel ReportDocument15 pagesFinch Excel ReportshuvorajbhattaNo ratings yet

- Budget AssignmentDocument6 pagesBudget AssignmentGurveer Karen, and the PriceNo ratings yet

- 05 Wilkerson Company Solution - StudentsDocument9 pages05 Wilkerson Company Solution - StudentsVinyabhooshan Bajpai PGP 2022-24 Batch100% (1)

- Acct 2020 Excel Budget ProblemDocument6 pagesAcct 2020 Excel Budget Problemapi-307661249No ratings yet

- Making Capital Investment DecisionsDocument48 pagesMaking Capital Investment DecisionsJerico ClarosNo ratings yet

- Start-Up Capital:: Particulars Taka TakaDocument5 pagesStart-Up Capital:: Particulars Taka TakaSahriar EmonNo ratings yet

- Lesson2.1-Chapter 8-Fundamentals of Capital BudgetingDocument6 pagesLesson2.1-Chapter 8-Fundamentals of Capital BudgetingMeriam HaouesNo ratings yet

- Shri WCMDocument9 pagesShri WCMIrfan ShaikhNo ratings yet

- Assignment 7 - Fiyan Wahyu Setyandi - 2002413001 - Manufaktur Lanjutan 2ADocument11 pagesAssignment 7 - Fiyan Wahyu Setyandi - 2002413001 - Manufaktur Lanjutan 2Alucu dan kerenNo ratings yet

- James Corp. Applies Overhead On The Basis of Direct Labor HoursDocument9 pagesJames Corp. Applies Overhead On The Basis of Direct Labor Hourslaale dijaanNo ratings yet

- Additional Chapter AssignmentDocument4 pagesAdditional Chapter AssignmentM GualNo ratings yet

- 5-Year Financial Plan - Manufacturing 1Document8 pages5-Year Financial Plan - Manufacturing 1tulalit008No ratings yet

- Master BudgetDocument8 pagesMaster BudgetScribdTranslationsNo ratings yet

- Less - Cash PaymentDocument16 pagesLess - Cash PaymentEsanka FernandoNo ratings yet

- P6Document3 pagesP6Jessica HutabaratNo ratings yet

- Forecasting ToolsDocument10 pagesForecasting Toolsapi-26344229No ratings yet

- The Seabright Manufacturing Company, Inc.Document11 pagesThe Seabright Manufacturing Company, Inc.Iqbal RosyidinNo ratings yet

- David A Carrucini Assignment Chapter 22Document8 pagesDavid A Carrucini Assignment Chapter 22dcarruciniNo ratings yet

- Management AccountingDocument6 pagesManagement AccountingBornyNo ratings yet

- Engineering Economics Final QSDocument6 pagesEngineering Economics Final QSAyugma Acharya0% (1)

- Color ScopeDocument12 pagesColor Scopeprincemech2004100% (2)

- Book1 Group Act5110Document9 pagesBook1 Group Act5110SAMNo ratings yet

- Tanner McqueenDocument4 pagesTanner Mcqueenapi-242859321No ratings yet

- MGT AC - Prob-NewDocument276 pagesMGT AC - Prob-Newrandom122No ratings yet

- Expansion Project Example: Dr. C. Bulent AybarDocument10 pagesExpansion Project Example: Dr. C. Bulent AybarTricia Mae PetalverNo ratings yet

- Project2 - PRINCIPLES OF MANAGERIAL ACCOUNTINGDocument5 pagesProject2 - PRINCIPLES OF MANAGERIAL ACCOUNTINGMohammed AwadNo ratings yet

- Master Budget SolutionDocument2 pagesMaster Budget SolutionAra FloresNo ratings yet

- Chapter 12 PDFDocument11 pagesChapter 12 PDFgerNo ratings yet

- Corkford Brewing Excel With Sensitivity Analysis 1Document10 pagesCorkford Brewing Excel With Sensitivity Analysis 1Rafiah JobNo ratings yet

- CH10, Accounting Assignment Answer SheetDocument26 pagesCH10, Accounting Assignment Answer SheetTsenguun Bat-ochirNo ratings yet

- Lakeside Jawaban CaseDocument40 pagesLakeside Jawaban CaseDhenayu Tresnadya HendrikNo ratings yet

- FM11 CH 11 Mini CaseDocument16 pagesFM11 CH 11 Mini CaseDora VidevaNo ratings yet

- Bulk Purchase Depreciation Calculator 1Document7 pagesBulk Purchase Depreciation Calculator 1asianetixNo ratings yet

- Requirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Document5 pagesRequirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Md AlimNo ratings yet

- Soultions - Chapter 3Document8 pagesSoultions - Chapter 3Naudia L. TurnbullNo ratings yet

- IBF AssignmentDocument8 pagesIBF AssignmentBashir Langra TitiNo ratings yet

- PA1 Group1 Week8Document8 pagesPA1 Group1 Week8Phuong Nguyen MinhNo ratings yet

- MA hw6Document5 pagesMA hw6Caleb BuddNo ratings yet

- Chapter 2 SolutionsDocument19 pagesChapter 2 SolutionsSorken75No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- FirstYear SchoolFeeDocument1 pageFirstYear SchoolFeethalnay zarsoeNo ratings yet

- GM NatrualGasDocument2 pagesGM NatrualGasthalnay zarsoeNo ratings yet

- E Pass PDFDocument5 pagesE Pass PDFthalnay zarsoeNo ratings yet

- MCDC EGovernment ProcessDocument12 pagesMCDC EGovernment Processthalnay zarsoeNo ratings yet

- D5F-F5 (Draft Aug2021)Document6 pagesD5F-F5 (Draft Aug2021)Lame GamerNo ratings yet

- Qsi540-600Document74 pagesQsi540-600Lorenzo RossiNo ratings yet

- Testbank: Applying Ifrs Standards 4eDocument11 pagesTestbank: Applying Ifrs Standards 4eSyed Bilal AliNo ratings yet

- Understanding Nuances and Commonalities of Job DesDocument10 pagesUnderstanding Nuances and Commonalities of Job DesAmrezaa IskandarNo ratings yet

- 9th Biology NotesDocument12 pages9th Biology Notesramaiz darNo ratings yet

- 1231.322 323 MSDS Sabroe 1507-100 MSDSDocument6 pages1231.322 323 MSDS Sabroe 1507-100 MSDSzhyhhNo ratings yet

- LC1D32M7: Product Data SheetDocument7 pagesLC1D32M7: Product Data SheetCHAHRHLHOHSNo ratings yet

- 10 Science NcertSolutions Chapter 8 ExercisesDocument4 pages10 Science NcertSolutions Chapter 8 ExercisesAnita GargNo ratings yet

- Suhas S R: Email-ID: Mobile: 9535610175 / 7019470710Document2 pagesSuhas S R: Email-ID: Mobile: 9535610175 / 7019470710Sachin S KukkalliNo ratings yet

- EN Subiecte Locala 19-20 GIMNAZIU 5-8 A-BDocument16 pagesEN Subiecte Locala 19-20 GIMNAZIU 5-8 A-BSpiridon AndreeaNo ratings yet

- HD Consumer Behavior AssignmentDocument9 pagesHD Consumer Behavior AssignmentAishwaryaNo ratings yet

- Characterising Roof Ventilators: P 2 A Q CDocument4 pagesCharacterising Roof Ventilators: P 2 A Q CDhirendra Singh RathoreNo ratings yet

- HITACHI 850, 850LC, 870H, 870LCH Components Parts Catalog (151-419) Page RecognitionDocument138 pagesHITACHI 850, 850LC, 870H, 870LCH Components Parts Catalog (151-419) Page RecognitionGeorge Zormpas100% (1)

- Philippine Statistics Authority: Date (2021)Document9 pagesPhilippine Statistics Authority: Date (2021)Nah ReeNo ratings yet

- Channel DecisionsDocument30 pagesChannel Decisionsuzmatabassum1996No ratings yet

- Design of Stair CaseDocument2 pagesDesign of Stair Casepathan is khanNo ratings yet

- PR m1Document15 pagesPR m1Jazmyn BulusanNo ratings yet

- Christmas Vigil MassDocument106 pagesChristmas Vigil MassMary JosephNo ratings yet

- Glumac Shanghai Office Fall 2016Document4 pagesGlumac Shanghai Office Fall 2016NagaraniNo ratings yet

- Jyotish - Hindu Panchangam & MuhurtasDocument40 pagesJyotish - Hindu Panchangam & MuhurtasSamir Kadiya100% (1)

- Quisumbing Vs MERALCODocument1 pageQuisumbing Vs MERALCORiss GammadNo ratings yet

- ADM Marketing Module 4 Lesson 4 Promotional ToolsDocument20 pagesADM Marketing Module 4 Lesson 4 Promotional ToolsMariel Santos75% (8)

- Quick Reference Guide: 65 Degree 1800 MHZ Dual Polarized 90 Degree 1800 MHZ Dual PolarizedDocument20 pagesQuick Reference Guide: 65 Degree 1800 MHZ Dual Polarized 90 Degree 1800 MHZ Dual PolarizedРоманКочневNo ratings yet

- 3I Grading Rubric For Output PresentationDocument2 pages3I Grading Rubric For Output PresentationBinibining Michelle CenizaNo ratings yet

- UntitledDocument5 pagesUntitledGerard Phoenix MaximoNo ratings yet

- Astm A 1011 2005Document8 pagesAstm A 1011 2005gao yanminNo ratings yet

- City Center Unifier Deployment PDFDocument35 pagesCity Center Unifier Deployment PDFSachin PatilNo ratings yet

- Agile TestingDocument5 pagesAgile TestingAman YadavNo ratings yet

- The Laws On Local Governments SyllabusDocument4 pagesThe Laws On Local Governments SyllabusJohn Kevin ArtuzNo ratings yet