Professional Documents

Culture Documents

ASE20104 Examiner Report - March 2018

ASE20104 Examiner Report - March 2018

Uploaded by

Aung Zaw HtweOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ASE20104 Examiner Report - March 2018

ASE20104 Examiner Report - March 2018

Uploaded by

Aung Zaw HtweCopyright:

Available Formats

Pearson LCCI

Certificate in Accounting

(VRQ)

Level 3

(ASE20104)

Examiners’ Report

March 2018

1 LCCI Certificate in Accounting ASE20104

LCCI Qualifications

LCCI qualifications come from Pearson, the world’s leading learning company.

We provide a wide range of qualifications including academic, vocational,

occupational and specific programmes for employers. For further information,

please visit our website at www.lcci.org.uk.

Pearson: helping people progress, everywhere

Pearson aspires to be the world’s leading learning company. Our aim is to help

everyone progress in their lives through education. We believe in every kind of

learning, for all kinds of people, wherever they are in the world. We’ve been

involved in education for over 150 years, and by working across 70 countries, in

100 languages, we have built an international reputation for our commitment to

high standards and raising achievement through innovation in education. Find

out more about how we can help you and your students at:

www.pearson.com/uk.

March 2018

Publication code: ER57511A

All the material in this publication is copyright

© Pearson Education Ltd 2018

1 LCCI Certificate in Accounting ASE20104 Level 3

Introduction

Pearson (LCCI) redeveloped the Level 3 Certificate in Accounting (VRQ)

(ASE20104) specification as a part of a Finance and Quantitative suite of

qualifications from Level 1 to Level 4.

The Pearson LCCI Level 3 Certificate in Accounting (VRQ) gives candidates

an overview of the fundamental accounting principles and concepts that

underlie all financial accounting. Candidates are introduced to topic areas

they are likely to encounter in their working lives in practical, scenario-

based situations.

The qualification has been revised to allow candidates to progress to the

Pearson LCCI Level 4 Certificate in Financial Accounting (VRQ), which

extends and introduces new advanced topic areas in this field.

The assessment is out of 100 marks comprising a total of five compulsory

questions.

This assessment covers these topics:

Accounting concepts and framework

Recording financial transactions

Preparation of an extended trial balance

Preparation of financial statements

Interpretation of financial statements

Budgetary control

Introduction to decision making.

Candidates performed very well on numerical questions such as preparation

of the statement of financial position for a limited company, budgeted

statement of profit or loss and budgeted statement of financial position,

adjustment columns of the extended trial balance, statement of cash flows,

and calculation of the accounting rate of return and net present value for

capital investment appraisal. The performance on written questions was

very poor in this series.

To progress to higher levels and score higher grades, candidates must

demonstrate underpinning knowledge and understanding of fundamentals

by preparing for the exams according to the specification and by combining

the theory and practice. This will help them to answer explain, discuss and

evaluate question expected at this level.

2 LCCI Certificate in Accounting ASE20104

Question 1

The majority of candidates scored above average marks for this question.

Part (a) Candidates were able to state two stakeholders interested in the

financial statements of a business.

See below an example of (a).

Part (b) Candidates were able to state the two ratios used to measure the

liquidity of a business.

See below an example of (b).

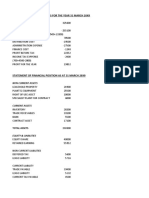

Part (c) The majority of candidates were able to prepare the statement of

financial position as expected for a company format. Candidates

experienced difficulties when dealing with the calculation of the retained

earnings, revaluation reserve and general reserve.

See below an example of (c.)

3 LCCI Certificate in Accounting ASE20104

4 LCCI Certificate in Accounting ASE20104

Examiner Comments

The financial statements of a company must be prepared in a

company format.

Candidates must show the figures in detail and subtotals should

be included in the financial statements with labels, as

appropriate, using the IAS terminology.

All calculations must be supported by workings/notes.

Examiner Tip

For a company statement of financial position, the trade and

other receivables or trade and other payables must be shown

as one figure with the workings in the notes/workings.

Visit the LCCI website link shown in the paper summary for

the correct formats for the statements.

Question 2

The majority of candidates scored above average marks on this question.

Part (a) The majority of candidates were able to prepare the budgeted

statement of profit or loss for the period requested. Main mistakes related

to the rent, general expenses and depreciation expenses. Some candidates

from a few centres recorded the wrong figures for the revenue and

purchases despite the fact that these were provided.

See below an example of (a).

5 LCCI Certificate in Accounting ASE20104

Part (b) The majority of candidates were able to identify the correct

accounting concept for the treatment of the rent charge for the period

provided in the question. Most candidates were unable to provide an

explanation of the concept by relating this to the scenario of rent charge

that had been provided; where this had been attempted, the explanation

was generic, relating to the concept only and not the scenario.

Part (c) Candidates were unable to prepare the budgeted statement of the

financial position as expected. Main mistakes related to not accounting the

accumulated depreciation, drawings and trade payables correctly.

See below an example of (c).

6 LCCI Certificate in Accounting ASE20104

Part (d)(i) The majority of candidates were unable to explain the purpose

of preparing a cash budget; where candidates attempted this question their

response was to identify the purpose but they did not develop it further.

See below an example of (d)(i).

Part (d)(ii) The majority of candidates were able to state the name of the

two other budgets.

See below an example of (d)(ii).

7 LCCI Certificate in Accounting ASE20104

Examiner Comments

Expenses for budgeted profit or loss must be recorded on an

accrual basis, hence expenses need to be adjusted for the

prepayments etc.

Examiner Tip

Budgeted financial statements are prepared for the period

rather than according to each month in the period until stated

otherwise, but the budgets are prepared for each month in

columnar format.

Question 3

The majority of candidates scored below average marks on this question.

Part (a) The majority of candidates struggled to calculate the depreciation

charge for the year. Main mistakes were not accounting correctly for the

cost and accumulated depreciation of the delivery vehicle disposed of,

hence calculating the carrying value incorrectly to calculate the depreciation

charge for the year.

See below an example of (a).

8 LCCI Certificate in Accounting ASE20104

Part (b) The majority of candidates were unable to complete the adjustment

columns of the extended trial balance for the adjustments provided,

including the depreciation charge and the delivery vehicle disposed of, as

some transactions relating to disposal were already recorded.

See below an example of (b).

Part (c) The majority of candidates were unable to calculate the difference

in the loss on the motor vehicle disposed of; this was meant to be

completed by changing the method of depreciation from the reducing

balance method to the straight line method. The main mistake was either

calculating the revised carrying value for all the vehicles, or simply

calculating the loss by using only one method, which demonstrated a lack

of understanding of the requirement of the question.

See below an example of (c).

9 LCCI Certificate in Accounting ASE20104

Part (d) The majority of candidates were unable to identify and explain the

relevant principle of professional ethics by applying their response to the

scenario provided.

See below an example of (d).

Part (e) The majority of candidates were able to state only one

disadvantage of trading as a private limited company. Some candidates

from a few centres stated the advantages rather than the disadvantage.

Examiner Comments

The financial statements of a company must be prepared in

a company format.

Financial statements must have subtotals with labels.

Examiner Tip

The figures in financial statements must have the labels

and all the figures must be supported with the

accompanying notes/workings with labels.

Visit the LCCI website link shown in the paper summary

for the correct formats for the statements.

10 LCCI Certificate in Accounting ASE20104

Question 4

The majority of candidates scored average marks on this question.

Part (a) The majority of candidates were able to calculate the profit for the

year. The main mistake was missing out the depreciation charge as it was

excluded from the fixed overheads for the year provided.

See below an example of (a).

Part (b) The majority of candidates were able to calculate the accounting

rate of return (ARR) correctly by using the correct formula for ARR. Some

candidates had problems calculating the average investment because they

did not consider the residual value after three years.

See below an example of (b).

11 LCCI Certificate in Accounting ASE20104

Part (c) The majority of candidates were able to calculate the net present

value by using the correct cash inflows. Some candidates from a few

centres added the present value of the net inflows to the initial investment

to calculate the net present value.

See below an example of (c).

Part (d) The majority of candidates were unable to calculate the payback

period correctly as they either did not account the cash inflows correctly or

because they rounded down the figure for months, which demonstrated

lack of understanding.

Part (e) The majority of candidates were unable to evaluate the results of

the three different methods of the capital investment appraisal obtained to

form a decision.

Part (f) The majority of candidates were unable to calculate the number of

the additional units to be sold to earn the required profit as most candidates

just calculated the number of the units required to sell to earn the required

/target profit.

See below examples of (f).

12 LCCI Certificate in Accounting ASE20104

Examiner Comments

Payback period can be expressed either in years or

months/days but must be rounded up to the whole month

or day. It is incorrect to round down because this means

that the investment would not be fully recovered during

that period.

Candidates must express the accounting rate of return as a

percentage.

Examiner Tip

For payback period, the net cash flows are used.

For accounting rate of return, average profit and average

investment are used in the formula. For average

investment, if the residual value is provided it must be

added to the initial investment to find out the average.

Question 5

The majority of candidates scored average marks on this question.

Part (a) The majority of candidates were able to state the qualitative

characteristics of the financial reporting under the International

Accounting Standards Board (IASB) framework.

See below an example of (a).

13 LCCI Certificate in Accounting ASE20104

Part (b) The majority of candidates were able to calculate the value of the

plant and machinery purchased. The main mistake was not accounting the

value of the disposal correctly to calculate the purchase of plant and

machinery as the values provided for the opening and closing balances were

carrying values.

See below an example of (b).

Part (c) The majority of candidates were able to prepare the statement of

the cash flows as expected by showing the figures with correct labels and

subtotals with labels. Candidates from some centres did not record the

opening and closing balances of the cash and cash equivalents with the net

increase or decrease provided correctly, despite the fact that the opening

and closing balances were provided and net increase and decrease for the

year could be calculated.

See below an example of (c).

14 LCCI Certificate in Accounting ASE20104

15 LCCI Certificate in Accounting ASE20104

Part (d) The majority of candidates were unable to identify the name of the

financial statement to record the dividend paid, other than the statement

of cash flows.

See below an example of (d).

Part (e) The majority of candidates were unable to discuss the information

provided to form a decision as to whether the business will be able to

receive the loan or not.

Examiner Comments

To get full marks on discussion/evaluation/ written

questions, check the marks and have the same number of

points/arguments/justification to make the decision.

Do not just state the fact but state the impact on the

business from the information provided.

Examiner Tip

Cash and cash equivalents include the cash in hand and

cash at bank (bank overdraft). It also includes short-term

investments.

Cash and cash equivalents at the beginning and at the end

are always provided in the question and must be correct.

Net increase and decrease can be worked out from the

cash and cash equivalents at the beginning and at the end

and must be correct. If the net increase or decrease,

working through the statement, does not balance, then

you must go back and check your figures but do not

change the figures in investing or financing activities just

to balance this figure.

Visit the LCCI website link shown in the paper summary

for the correct formats for the statements.

16 LCCI Certificate in Accounting ASE20104

Paper Summary

Candidates performed very well on numerical question such as preparation

of the statement of financial position for a limited company, budgeted

statement of profit or loss and budgeted statement of financial position,

adjustment columns of extended trial balance, statement of cash flows, and

calculation of accounting rate of return and net present value for capital

investment appraisal.

Candidates need to practise explain, discuss and evaluate questions.

Candidates will benefit from the following:

Candidates must learn and practise using the International

Accounting Standards (IAS) terminology and formats to show

subtotal and totals including the labels for financial statements.

Candidates must show their workings/notes with reference number

such as W1/Note1, W2/Note 2 etc

Candidates must use the labels for the figures used in the workings.

Candidates must learn and prastice preparation of ledger accounts

with full details.

Candidates must learn and practise preparation of all financial

statements with full details and in the proper format for the

company accounts.

Candidates must learn and practise preparation of all budgets with

full details.

Do not just practise numerical questions but also understand the

theory to be able to answer the explain questions.

Practise discuss question by providing the comparative statements

for both sides.

Practise how to analyse the results from the information provided to

consider reasons or the potential impact the results will have on the

business currently or in future.

Visit Pearson website for various resources to support candidates

learning

17 LCCI Certificate in Accounting ASE20104

https://qualifications.pearson.com/en/qualifications/lcci/financial-

and-quantitative/accounting-2015.coursematerials.html

18 LCCI Certificate in Accounting ASE20104

Grade Boundaries

Grade boundaries for this, and all other papers, can be found on the

website on this link:

http://qualifications.pearson.com/en/support/support-topics/results-

certification/grade-boundaries.html

19 LCCI Certificate in Accounting ASE20104

You might also like

- Tax Advisor Confirmation LetterDocument1 pageTax Advisor Confirmation LetterAung Zaw Htwe100% (1)

- Advanced Business Calculations/Series-3-2011 (Code3003)Document15 pagesAdvanced Business Calculations/Series-3-2011 (Code3003)Hein Linn Kyaw86% (21)

- Answers Series 3 2015Document12 pagesAnswers Series 3 2015Penny Pun80% (5)

- ASE20097 Examiner Report December 2018 PDFDocument11 pagesASE20097 Examiner Report December 2018 PDFPhyu Phyu MoeNo ratings yet

- Week 8 (Prior To Tutorial) QsDocument10 pagesWeek 8 (Prior To Tutorial) Qsalexandra0% (1)

- 2010 LCCI Level 3 Series 2 Model Answers (Code 3012)Document9 pages2010 LCCI Level 3 Series 2 Model Answers (Code 3012)mappymappymappyNo ratings yet

- Accounting Level 3: LCCI International QualificationsDocument17 pagesAccounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (4)

- 2006 LCCI Cost Accounting Level 2 Series 4 Model AnswersDocument15 pages2006 LCCI Cost Accounting Level 2 Series 4 Model AnswersHon Loon SeumNo ratings yet

- LCCI Certificate in Advance Business Calculations ASE3003 June 2016Document12 pagesLCCI Certificate in Advance Business Calculations ASE3003 June 2016Aung Zaw Htwe50% (2)

- LCCI Level 3 Certificate in Accounting ASE20104 Jun-2018 PDFDocument20 pagesLCCI Level 3 Certificate in Accounting ASE20104 Jun-2018 PDFAung Zaw HtweNo ratings yet

- 2011 LCCI Accounting IAS Level-3 Series 2 (Code 3902)Document17 pages2011 LCCI Accounting IAS Level-3 Series 2 (Code 3902)Hon Loon Seum100% (6)

- Cost Accounting Level 3/series 4 2008 (3017)Document17 pagesCost Accounting Level 3/series 4 2008 (3017)Hein Linn Kyaw100% (1)

- MS Ase3003Document13 pagesMS Ase3003Aung Zaw HtweNo ratings yet

- Code 2007 Accounting Level 2 2010 Series 4Document15 pagesCode 2007 Accounting Level 2 2010 Series 4apple_syih100% (1)

- Book Keeping and Accounts Model Answer Series 3 2014Document13 pagesBook Keeping and Accounts Model Answer Series 3 2014cheah_chinNo ratings yet

- ABC L3 Past Paper Series 3 2013Document7 pagesABC L3 Past Paper Series 3 2013b3nzyNo ratings yet

- Answers Series 3 2013Document8 pagesAnswers Series 3 2013Penny Pun100% (1)

- ASE3003209MADocument11 pagesASE3003209MAHein Linn Kyaw100% (1)

- Accounting (IAS) Level 3/series 2 2008 (Code 3902)Document17 pagesAccounting (IAS) Level 3/series 2 2008 (Code 3902)Hein Linn Kyaw100% (6)

- Cost Accounting Level 3/series 2-2009Document17 pagesCost Accounting Level 3/series 2-2009Hein Linn Kyaw100% (5)

- Cost Accounting Level 3: LCCI International QualificationsDocument20 pagesCost Accounting Level 3: LCCI International QualificationsHein Linn Kyaw33% (3)

- Management Accounting Level 3/series 4 2008 (3024)Document14 pagesManagement Accounting Level 3/series 4 2008 (3024)Hein Linn Kyaw50% (2)

- Advanced Business Calculations Level 3 - April 2016 Question PaperDocument12 pagesAdvanced Business Calculations Level 3 - April 2016 Question PaperAung Zaw Htwe100% (1)

- Certificate in Advanced Business Calculations Level 3/series 3-2009Document18 pagesCertificate in Advanced Business Calculations Level 3/series 3-2009Hein Linn Kyaw100% (10)

- Cost Accounting Level 3/series 3-2009Document19 pagesCost Accounting Level 3/series 3-2009Hein Linn Kyaw100% (2)

- Mark Scheme April 2016: ResultsDocument12 pagesMark Scheme April 2016: ResultsAung Zaw HtweNo ratings yet

- LCCI Level 3 - Advanced Business Calculations (Exam Kit)Document332 pagesLCCI Level 3 - Advanced Business Calculations (Exam Kit)BethanyNo ratings yet

- LCCI L3 Advanced Business Calculations Nov 2016 - MSDocument12 pagesLCCI L3 Advanced Business Calculations Nov 2016 - MSchee pin wongNo ratings yet

- Mark Scheme - SERIES 2-2015 Results - ASE3003 Level 3Document12 pagesMark Scheme - SERIES 2-2015 Results - ASE3003 Level 3Aung Zaw Htwe0% (1)

- LCCI L3 Advanced Business Calculations Nov 2016 - MSDocument19 pagesLCCI L3 Advanced Business Calculations Nov 2016 - MSchee pin wongNo ratings yet

- Cost Accounting/Series-3-2007 (Code3016)Document18 pagesCost Accounting/Series-3-2007 (Code3016)Hein Linn Kyaw50% (6)

- Advanced Business Calculation/Series-4-2007 (Code3003)Document13 pagesAdvanced Business Calculation/Series-4-2007 (Code3003)Hein Linn Kyaw100% (6)

- LCCI Level 3 Certificate in Accounting ASE20104 ASE20104 Dec-2017Document16 pagesLCCI Level 3 Certificate in Accounting ASE20104 ASE20104 Dec-2017Aung Zaw HtweNo ratings yet

- Cost Accounting/Series-4-2011 (Code3017)Document17 pagesCost Accounting/Series-4-2011 (Code3017)Hein Linn Kyaw100% (2)

- LCCI Level 3 Certificate in Accounting ASE20104 Sep-2018 PDFDocument16 pagesLCCI Level 3 Certificate in Accounting ASE20104 Sep-2018 PDFAung Zaw HtweNo ratings yet

- Mark Scheme July 2022: Pearson LCCI Certificate in Cost & Management Accounting Level 3 (ASE 20111)Document11 pagesMark Scheme July 2022: Pearson LCCI Certificate in Cost & Management Accounting Level 3 (ASE 20111)Yin Minn ThuNo ratings yet

- AQR L3 Advanced Business Calculations 2010 (3003)Document19 pagesAQR L3 Advanced Business Calculations 2010 (3003)Roshini Kannayah67% (3)

- Cost Accounting Level 3/series 4 2008 (3016)Document20 pagesCost Accounting Level 3/series 4 2008 (3016)Hein Linn Kyaw0% (1)

- Management Accounting/Series-4-2011 (Code3024)Document18 pagesManagement Accounting/Series-4-2011 (Code3024)Hein Linn Kyaw100% (2)

- Accounting Level 3/series 4 2008 (3012)Document13 pagesAccounting Level 3/series 4 2008 (3012)Hein Linn Kyaw100% (1)

- Advanced Business Calculations Level 3/series 4-2009Document11 pagesAdvanced Business Calculations Level 3/series 4-2009Hein Linn Kyaw75% (4)

- Pearson LCCI: Certificate in Bookkeeping and Accounting (VRQ)Document20 pagesPearson LCCI: Certificate in Bookkeeping and Accounting (VRQ)Aung Zaw Htwe100% (2)

- Pearson LCCI Certificate in Accounting (VRQ) Level 3Document19 pagesPearson LCCI Certificate in Accounting (VRQ) Level 3Aung Zaw HtweNo ratings yet

- Pearson LCCI Certificate in Accounting (VRQ) Level 3Document22 pagesPearson LCCI Certificate in Accounting (VRQ) Level 3Aung Zaw HtweNo ratings yet

- Examiner Report ASE20104 January 2018Document22 pagesExaminer Report ASE20104 January 2018Aung Zaw HtweNo ratings yet

- Examiner Report ASE20104 Sept 18Document18 pagesExaminer Report ASE20104 Sept 18Aung Zaw HtweNo ratings yet

- Examiner Report ASE20104 July 2018Document22 pagesExaminer Report ASE20104 July 2018Aung Zaw HtweNo ratings yet

- Pearson LCCI Certificate in Accounting (VRQ) Level 3Document19 pagesPearson LCCI Certificate in Accounting (VRQ) Level 3Aung Zaw HtweNo ratings yet

- Pearson LCCI Certificate in Accounting (VRQ) Level 3Document20 pagesPearson LCCI Certificate in Accounting (VRQ) Level 3Aung Zaw HtweNo ratings yet

- ASE20104 - Examiner Report - November 2018Document14 pagesASE20104 - Examiner Report - November 2018Aung Zaw HtweNo ratings yet

- Pearson LCCI Certificate in Accounting (VRQ) Level 3Document24 pagesPearson LCCI Certificate in Accounting (VRQ) Level 3Aung Zaw HtweNo ratings yet

- Pearson LCCI Certificate in Accounting (VRQ) Level 3Document25 pagesPearson LCCI Certificate in Accounting (VRQ) Level 3Aung Zaw HtweNo ratings yet

- Examiner Report - ASE20104 - January 2019Document13 pagesExaminer Report - ASE20104 - January 2019Aung Zaw Htwe100% (1)

- ASE20104 - Examiner Report - March 2019 PDFDocument14 pagesASE20104 - Examiner Report - March 2019 PDFAung Zaw HtweNo ratings yet

- er-ASE20091Document10 pageser-ASE20091ringotgNo ratings yet

- Examiners' Report Principal Examiner Feedback January 2020Document5 pagesExaminers' Report Principal Examiner Feedback January 2020DURAIMURUGAN MIS 17-18 MYP ACCOUNTS STAFFNo ratings yet

- f7 Examreport d17Document7 pagesf7 Examreport d17rashad surxayNo ratings yet

- AccountingDocument8 pagesAccountingBilal MustafaNo ratings yet

- Examiner's Report: Financial Reporting (FR) June 2019Document10 pagesExaminer's Report: Financial Reporting (FR) June 2019saad aliNo ratings yet

- Clep Financial AccountingDocument5 pagesClep Financial AccountingAlexandraSammyDlodloNo ratings yet

- ASE20091 Examiner Report November 2019Document14 pagesASE20091 Examiner Report November 2019ringotgNo ratings yet

- 2010 Aicpa Newly Released Questions - Auditing: © 2010 Devry/Becker Educational Development Corp. All Rights ReservedDocument56 pages2010 Aicpa Newly Released Questions - Auditing: © 2010 Devry/Becker Educational Development Corp. All Rights Reservedjklein2588No ratings yet

- ASE20102 - Examiner Report - November 2018Document13 pagesASE20102 - Examiner Report - November 2018Aung Zaw HtweNo ratings yet

- E-AP-1 - Short Term Deposits Prepayments and Other ReceivablesDocument6 pagesE-AP-1 - Short Term Deposits Prepayments and Other ReceivablesAung Zaw HtweNo ratings yet

- F-Ap-3 - Inventory Held For Capital ExpenditureDocument5 pagesF-Ap-3 - Inventory Held For Capital ExpenditureAung Zaw HtweNo ratings yet

- F AP 1 Stock in TradeDocument10 pagesF AP 1 Stock in TradeAung Zaw HtweNo ratings yet

- E-AP-6 - Bills Discounted and PurchasedDocument3 pagesE-AP-6 - Bills Discounted and PurchasedAung Zaw HtweNo ratings yet

- N-AP-1 - Accrued MarkupDocument2 pagesN-AP-1 - Accrued MarkupAung Zaw HtweNo ratings yet

- D AP InvestmentDocument8 pagesD AP InvestmentAung Zaw HtweNo ratings yet

- E-AP-2 - Short-Term Loans and AdvancesDocument7 pagesE-AP-2 - Short-Term Loans and AdvancesAung Zaw HtweNo ratings yet

- C-AP - Cash and Bank BalancesDocument7 pagesC-AP - Cash and Bank BalancesAung Zaw HtweNo ratings yet

- Cash and Bank BalancesDocument4 pagesCash and Bank BalancesAung Zaw HtweNo ratings yet

- Cash and Bank BalancesDocument4 pagesCash and Bank BalancesAung Zaw HtweNo ratings yet

- The Double Entry System For Expenses and RevenuesDocument2 pagesThe Double Entry System For Expenses and RevenuesAung Zaw HtweNo ratings yet

- The Balance Sheet VerticalDocument4 pagesThe Balance Sheet VerticalAung Zaw HtweNo ratings yet

- The Double Entry System For Asset of StockDocument4 pagesThe Double Entry System For Asset of StockAung Zaw HtweNo ratings yet

- Sales Day BookDocument3 pagesSales Day BookAung Zaw HtweNo ratings yet

- The Double Entry System For Assets, Capital and LiabilitiesDocument2 pagesThe Double Entry System For Assets, Capital and LiabilitiesAung Zaw HtweNo ratings yet

- Sales Purchases Returns Day BookDocument8 pagesSales Purchases Returns Day BookAung Zaw HtweNo ratings yet

- Summative Test Q1 Week 5-6Document2 pagesSummative Test Q1 Week 5-6erlita credoNo ratings yet

- Ifrs 10: Consolidated Financial InstrumentDocument5 pagesIfrs 10: Consolidated Financial InstrumentAira Nhaira Mecate100% (1)

- Shinsegae (004170 KS - Buy)Document7 pagesShinsegae (004170 KS - Buy)PENo ratings yet

- Enabling Assessment 4Document7 pagesEnabling Assessment 4Nicole BatoyNo ratings yet

- SIMP Bilingual 092020-FinalDocument134 pagesSIMP Bilingual 092020-FinalMarhaindra GaryNo ratings yet

- Nirmal Multiple CampusDocument2 pagesNirmal Multiple CampusSabitaNo ratings yet

- Chin Figura - Unit IV Learning ActivitiesDocument7 pagesChin Figura - Unit IV Learning ActivitiesChin FiguraNo ratings yet

- Acc 566Document18 pagesAcc 566Happy MountainsNo ratings yet

- Which of The Activity Variances Should Be of Concern ToDocument2 pagesWhich of The Activity Variances Should Be of Concern ToDoreenNo ratings yet

- Auditing 4 Chapter 1Document19 pagesAuditing 4 Chapter 1Mohamed Diab100% (1)

- CE On Quasi-ReorganizationDocument1 pageCE On Quasi-ReorganizationalyssaNo ratings yet

- 會計科目中英對照表Document4 pages會計科目中英對照表yuxuan1228.yxwNo ratings yet

- EFY Bussiness BudgetDocument4 pagesEFY Bussiness BudgetFinance Dental JayaNo ratings yet

- 01 Activity 2Document4 pages01 Activity 2Laisan SantosNo ratings yet

- FIN 201 Chapter 02 TheoryDocument24 pagesFIN 201 Chapter 02 TheoryAhmed ShantoNo ratings yet

- 2019 TANGLAW WP A011-V2Document95 pages2019 TANGLAW WP A011-V2Isaac Dominic MacaranasNo ratings yet

- Latihan Lab 3 - General Ledger and Adjusting EntriesDocument3 pagesLatihan Lab 3 - General Ledger and Adjusting EntriesErwin MainsteinNo ratings yet

- Major Assignment Comparative Financial Statement Analysis of Kabul Based Corporations MBA Non-BusinessDocument2 pagesMajor Assignment Comparative Financial Statement Analysis of Kabul Based Corporations MBA Non-BusinessMasoud AfzaliNo ratings yet

- Deposit Mobilization by IBsDocument17 pagesDeposit Mobilization by IBsAAM26No ratings yet

- Financial Analysis of Hòa Phát Group Joint Stock CompanyDocument36 pagesFinancial Analysis of Hòa Phát Group Joint Stock CompanySang NguyễnNo ratings yet

- PT - Zalia Nofi Nurlaila (23) Neraca LajurDocument6 pagesPT - Zalia Nofi Nurlaila (23) Neraca LajurNofi Nurlaila100% (1)

- Income Tax Payment Challan: PSID #: 41614961Document1 pageIncome Tax Payment Challan: PSID #: 41614961Zubair KhanNo ratings yet

- S K Enterprise BLDocument4 pagesS K Enterprise BLVinay ChawlaNo ratings yet

- Visu SonDocument14 pagesVisu SonHHHHHHEAMAYNo ratings yet

- Financial Accounting Q&aDocument4 pagesFinancial Accounting Q&aGlen JavellanaNo ratings yet

- Intermediate Examination: Suggested Answers To QuestionsDocument20 pagesIntermediate Examination: Suggested Answers To QuestionsMOHAMMED IRFANUDDINNo ratings yet

- FIN 004 Module #3 SASDocument8 pagesFIN 004 Module #3 SASPD MagsanocNo ratings yet

- CRQS Final AccountsDocument54 pagesCRQS Final AccountsAtka FahimNo ratings yet

- Assignment 3 - Guide To WorkDocument33 pagesAssignment 3 - Guide To WorkChristopher KipsangNo ratings yet